To maintain healthy cash flow, get paid faster by your customers, and make smarter business decisions, small business owners and accountants must understand and track their accounts receivable.

In this article, we’ll cover everything you need to know about accounts receivable, including why it’s so crucial to track and manage them and how to do so effectively as a small service-based business.

- What Are Accounts Receivable?

- Why Is It Important to Track Accounts Receivable?

- Accounts Receivable Turnover

- Accounts Receivable vs. Payable

- Are Accounts Receivable an Asset

- Tips for Staying on Top of Your Accounts Receivable

- Conclusion

What Are Accounts Receivable?

The term accounts receivable (AR) refers to the total money owed to an organization by its customers for services rendered or products delivered. For most businesses, this represents the sum of unpaid invoices, and in all businesses, it’s listed as an asset.

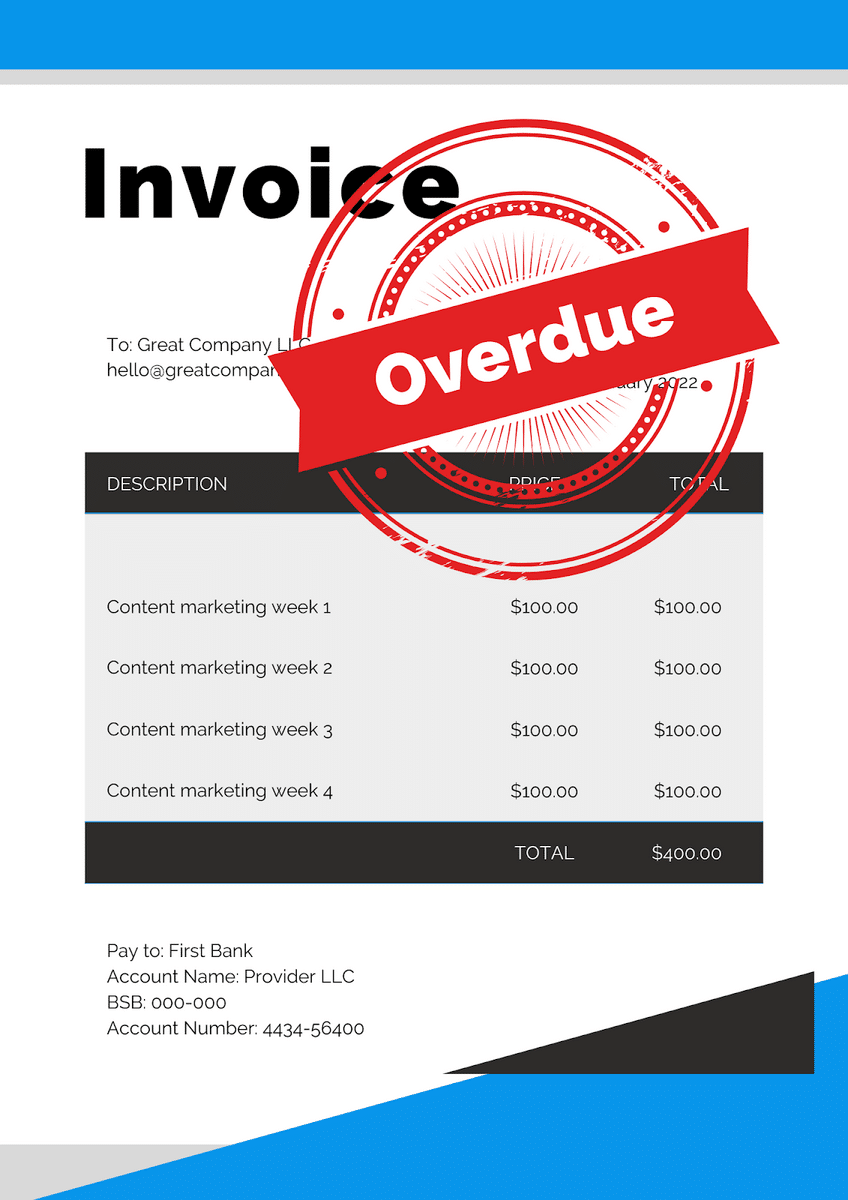

To understand how accounts receivable work, imagine if a content agency had 4 unpaid invoices, each equaling $400. Their accounts receivable would equal $1,600 total. If one of the invoices was paid, the AR would drop to $1,200.

Source: Regpack

Now, not all businesses will have to think about AR. Most B2C or product businesses are paid upfront and will therefore have no accounts receivable. B2C or B2B service businesses, on the other hand, usually have accounts receivable. They do the service before charging.

This is especially true if they bill by the hour because they won’t know how much to charge until after the service is complete.

Tracking your accounts receivable can help you get a more accurate picture of the financial health of your business and bring you other benefits, which we discuss next.

Why Is It Important to Track Accounts Receivable?

Staying on top of accounts receivable is important for small businesses for various reasons. Benefits can be as basic as remembering to collect your payments and as crucial as avoiding cash flow shortages that can cause business failure.

Here are some reasons why you should manage your accounts receivable.

Be More Effective at Collecting What You’re Owed

When tracking accounts receivable, you’ll be less likely to forget to collect money owed to you by a customer.

You can also uncover payment trends to figure out why clients are often missing payments, and then you can fix the issue.

Understand Your Short-Term Cash Flow

Once fulfilled, unpaid invoices result in immediate cash for your business. If you stay on top of them, you can estimate your future cash flow. As a result, you’ll be better able to determine if it is feasible for you to fund certain operations and investments.

Avoid Cash Flow Shortages

The majority of businesses that fail to fund their planned investments do so because of cash flow shortages.

In that period, they’re unable to afford their operations. And often, these shortages are caused by mismanagement of accounts receivable.

You’ll Know When to Follow Up

When you track accounts receivable, you can spot overdue payments more easily and follow up with a client accordingly.

Sometimes, a gentle nudge is all it will take to get them to pay you what you’re owed. If it isn’t, being aware of those trends will help you determine your next steps.

Spot Trouble Customers

Run reports frequently to find who’s often late on their payments so that you can prioritize spending time building customer relationships with those who pay you within the deadline and don’t hurt your cash flow.

In sum, tracking your accounts receivable will give you a clearer overview of your business’s financial situation, allowing you to make smart, number-driven business decisions.

On another note, if you’re looking for investors, including AR in your balance sheet will increase your profitability, which will help you attract and land investments. And, of course, business accountants will need it for tax purposes as well.

Accounts Receivable Turnover

Accounts receivable turnover ratio is the number of times per accounting year that a business collects its average accounts receivable.

Below is the formula:

Net Credit Sales / Average Accounts Receivable = Accounts Receivable Turnover

Small business owners calculate turnover in order to assess how efficiently they are retrieving payments owed to them by their customers. The lower the number, the more efficient their collections process.

Here’s how to calculate your accounts receivable turnover:

| Choose a Period | Typically, this will be a year for most small business accountants, but you could also do it quarterly, monthly, or any other duration. |

| Add Beginning and End Accounts Receivable | If you had $300,000 AR at the beginning of the period and $500,000 AR at the end, you’d get $800,000 as your net accounts receivable. |

| Divide the Number by 2 | To get your average accounts receivable, divide the sum of the beginning and end by 2. For this example, the average accounts receivable would be $400,000. |

| Divide Net Credit Sales by Avg. Accounts Receivable | If your net credit sales for the given period amounted to $3,000,000, you’d do the calculation: $3,000,000/$400,000 to get your accounts receivable turnover ratio of 7.5. |

Calculating your AR turnover ratio on a regular basis and comparing it to past ratios to see if it’s increased or decreased is a great way to analyze whether changes you’ve made to your accounts receivable management are paying off or not.

Accounts Receivable vs. Payable

While accounts receivable is the money owed to your business by customers, accounts payable (AP) is the money your business owes its vendors, suppliers, and other creditors.

Whereas AR appears on the asset side of a balance sheet, AP shows up on the liability side, since those are payments your business will have to make.

For example, if a business rented out a venue for an event, and has yet to pay the invoice, the amount owed would be added to their accounts payable.

The owner of the venue, however, would add that amount they’re owed to their accounts receivable.

It’s important for businesses to track both numbers so that they understand the true financial health of their business. Unless your cash flow is suffering, accounts payable are typically easier to manage since the obligation is on you to pay, not on someone else.

Are Accounts Receivable an Asset

Accounts receivable are listed as an asset on your small business’s balance sheet. It’s money that your business will most likely, pending any bad debts, have in the near future.

These unpaid invoices are actually so valuable that some companies make money from buying them from other businesses for less than the total owed and then collecting the total. This is called invoice or accounts receivable financing.

Here’s a short video to illustrate how it works:

Source: Ben Van Zee on YouTube

As you can see, accounts receivable can be a great asset to your business. If there’s a problem with your cash flow, you can turn them into funds by selling a portion or all of your AR to specialized companies that will then pursue the debt. There is a fee to consider, but this solution works well in a pinch.

However, if an invoice seems like it will never be paid, you can write it off as a bad debt. That’s often done when a payment is long past the due date or the client is refusing to pay.

After being written off as a bad debt, it will no longer be on the balance sheet. On the other hand, when it’s paid, it will cease being an asset and become cash instead.

Tips for Staying on Top of Your Accounts Receivable

There are some best practices you can follow to ensure you’re effectively managing the accounts receivable of your small business.

These include sending invoices ASAP, confirming their receipts, avoiding extending credit, following up, and automating the accounts receivable management process. All of them are simple to implement.

Let’s go over each one.

Send Invoices Promptly

Invoicing immediately after delivery of your product or service will ensure that you rarely, if ever, forget to invoice for the hard work you’ve done.

Plus, when compared to invoicing on a specific day once a week, as many businesses do, you’ll get your money faster, thus improving your cash flow.

If you shy away from leaving anything unscheduled and instead prefer task chunking — blocking off time to do your invoicing in one sitting — consider switching from invoicing once a week to once a day.

That way you get the benefits of focused attention along with faster payment collection.

As an added benefit to this prompt invoicing, your clients will also view you as more of a professional who is keeping track of their accounts receivable.

And, respecting you as a business person, they’ll be more cognizant of paying promptly.

Confirm the Receipt of Invoices With Clients

After you send an invoice, ask your clients to confirm its receipt. You can even put this request on the invoice itself.

Not only will this ensure they have in fact seen it, but it will also force them to respond regarding the invoice, an act that will increase their awareness that they owe you money.

You could also consider setting up read receipts.

Most email programs and invoicing apps have a read receipt feature that you can easily turn on. If you’re using Gmail, follow these instructions to turn on read receipts.

Source: Google

When you know if the recipient has received and seen the invoice, you can plan your follow-ups accordingly. You’ll know whether they’re dodging the invoice or just haven’t seen it yet.

For other invoicing tips like this one, check out our article on six invoicing best practices for small businesses.

Do Not Extend Credit to Anyone

Although extending credit to customers can lead to more sales, it does have its potential downfalls, including not getting paid on time, extra effort, and reduced cash flow.

Below are the disadvantages of extending credit to your customers:

| You Risk Not Getting Paid | You’ll risk delivering services to customers who are never able to pay for it, either because they’ve run out of money themselves or because they just don’t feel your service was worth paying for. |

| You Have to Investigate Creditworthiness | To extend credit responsibly, you’d have to devote time and resources to checking each customer’s credit references and procuring business credit reports. |

| Your Cash Flow Might Be Negatively Impacted | When you start letting your customers buy on credit, your cash on hand will inevitably be lower, as you’ll have to wait for them to pay. |

| You Might Suffer Unnecessary Stress | Lastly, knowing your customers owe you money can be a bit anxiety-inducing for some people, especially those with trust issues. In that case, it’s best to avoid this avoidable stressor. |

For most small businesses, the cons of extending credit outweigh the pros.

Follow Up With Customers

If a customer has yet to pay an invoice and the due date has come and gone, it’s essential that you immediately get in touch with them to determine why they haven’t paid.

As we’ve said before, often, this will be enough to remind them of the payment and get them to fulfill their obligations. Other times they’ll give you clarity on when you can expect the payment, and then you can plan accordingly.

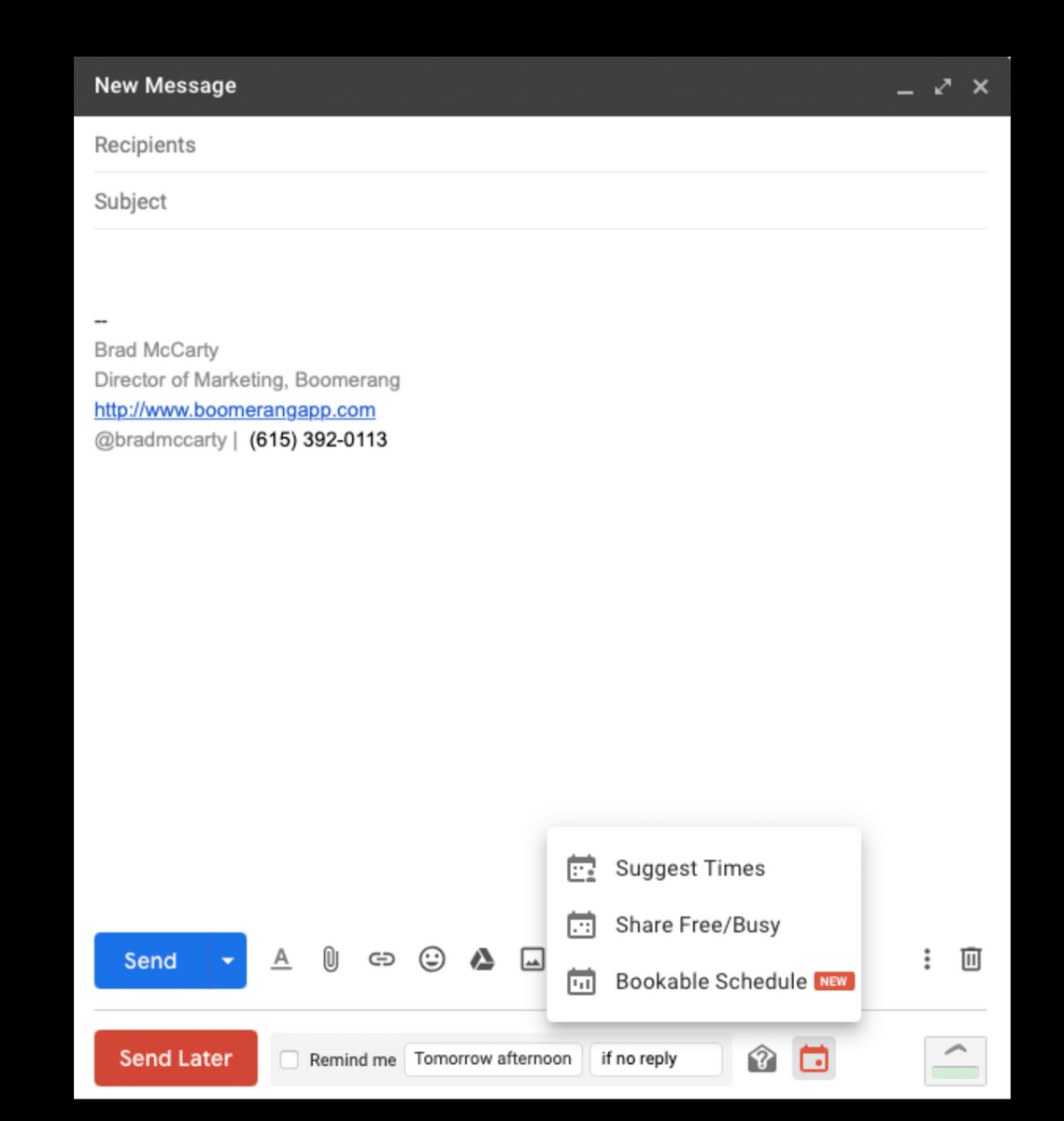

Most CRMs and some Chrome extensions like Boomerang enable you to set up automatic follow-ups that send to the customer at a certain date and time.

Taking advantage of those features can make it so you don’t have to remember to follow up with them.

Source: Facebook

The majority of email programs will also allow you to create and save email templates.

It’s a good practice to build a late payment follow-up template that you can use every time so you don’t have to start from scratch and waste your time.

If you use Gmail, you’ll find the template under the three dots in the email drafts.

If you don’t see the template option, you have to enable templates, a simple process Business Insider walks you through in their article on using Gmail templates.

Document Everything and Automate the Process

Documenting everything that’s happening in your payment collection process is an essential practice if you want to stay on top of your accounts receivable.

That way, you can track who’s paid and who hasn’t in a centralized, online location and take the right measures to collect any overdue payments.

However, doing this in an excel spreadsheet, a common practice among small business owners, can cause too much mundane administrative work and open your business up to human error that leads to bigger problems down the line.

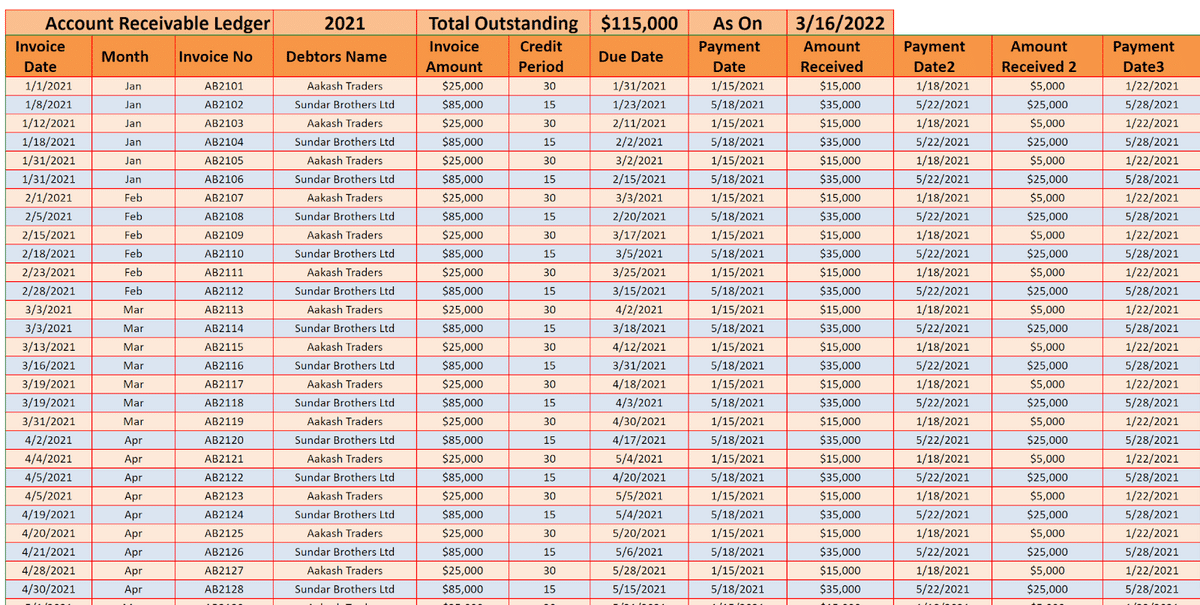

Source: MSOfficeGeek

Just look at the amount of data in the example above. This spreadsheet must have taken ages to assemble and finding errors within it would be an almost impossible task.

Instead, it’s better to automate your accounts receivable management with a software platform built for managing payments.

These usually offer features like invoicing templates, read receipts, filtering capabilities, and reporting functionality that enable you to generate lists of unpaid invoices and sort them by size or lateness.

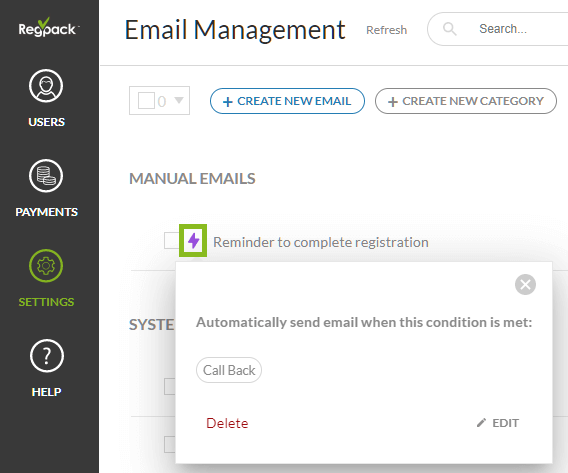

Below is an example of Regpack’s email automation feature.

Source: Regpack

One such online payment software is Regpack, which offers even more automation functionality.

With the tool’s auto-billing feature, users can set parameters to set up automatic billing and then rest easy, knowing their customers are being billed according to the business’s standards.

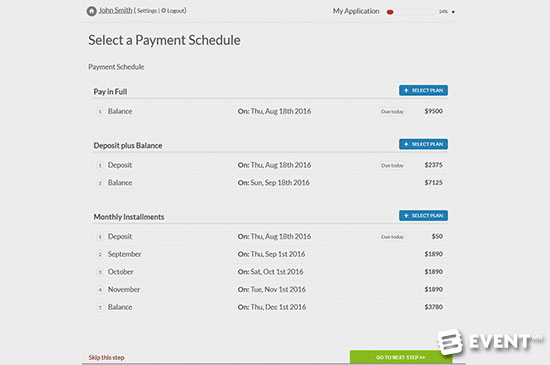

Here’s an example:

Source: Regpack

When you automate payment collection, you’ll find that late and non-payments decrease and, in turn, your cash flow increases.

All the while, you’ll spend less time worrying about and thinking about getting paid on time.

Conclusion

Running a small service-based business is difficult.

There’s a whole lot to keep track of, and many owners would argue that tracking how much money is owed to them, and who owes it, is of particular importance to their business’s financial health, not to mention their mental health.

Therefore, it’s important to implement a system for managing your accounts receivable. You’ll get paid faster, improve your cash flow, and be better informed about your business’s financial situation.