The habit of relying on cards or even checks may be preventing you from upgrading the way you run your business.

If your business receives many online payments, and especially if you take recurring ones, ACH (Automated Clearing House) payments may benefit you in more ways than one.

Whether you’re a small business owner or managing a larger enterprise, understanding the advantages of ACH payments can help you make informed decisions about your payment processing strategies.

What Are ACH Payments?

ACH payments are electronic payments made through the Automated Clearing House network, a centralized system that facilitates the transfer of funds between bank accounts in the United States. This network processes a variety of transactions, including direct deposits, bill payments, and business-to-business payments. ACH payments can be categorized into two main types: ACH credit and ACH debit.

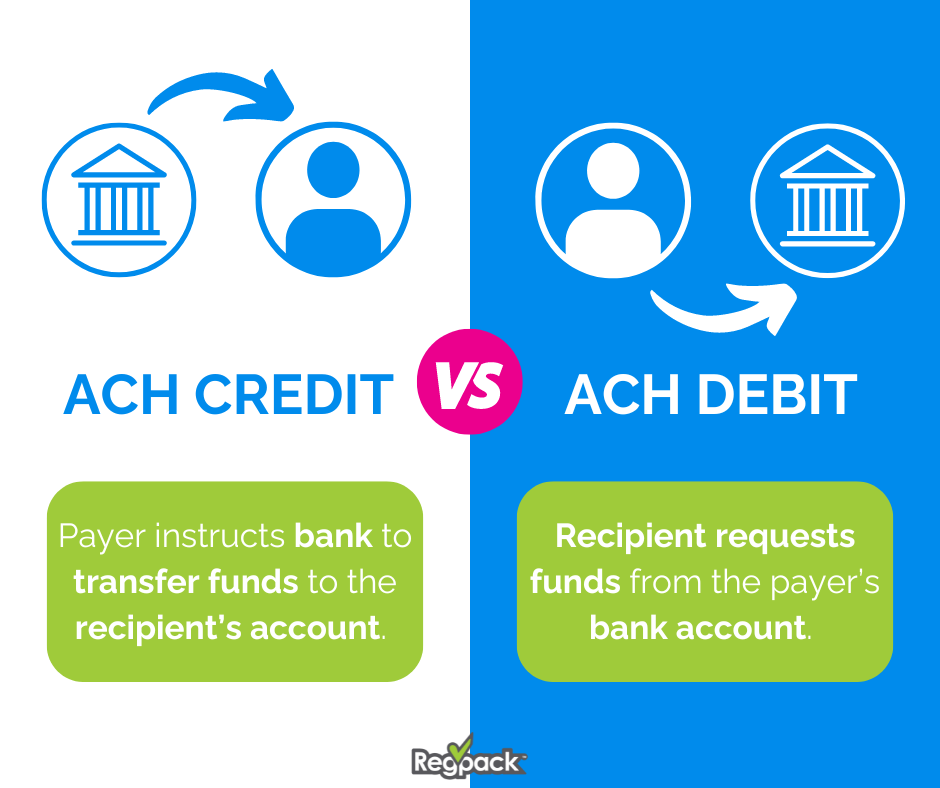

ACH Credit vs. ACH Debit

- ACH Credit: This type of transaction is initiated by the payer, who instructs their financial institution to transfer funds to the recipient’s account. Common examples include direct deposit of payroll and vendor payments.

- ACH Debit: In this case, the recipient initiates the transaction by requesting funds from the payer’s account. Examples include recurring bill payments and subscription services.

How Do ACH Payments Work?

The process of ACH payments involves several steps:

- Initiation: The payer or recipient initiates the transaction through their financial institution or payment processor.

- Batch Processing: Transactions are grouped into batches and sent to an ACH operator, such as the Federal Reserve or a private clearing house.

- Clearing and Settlement: The ACH operator processes the transactions, ensuring that funds are available and debiting/crediting the respective accounts.

- Completion: The funds are transferred between the bank accounts, typically within one to two business days.

Common Uses for ACH Payments

ACH payments are widely used in various real-world scenarios due to their convenience, cost-effectiveness, and security. Here are some common uses for ACH payments:

- Payroll Processing: Employers use ACH direct deposit to transfer employees’ salaries directly into their bank accounts. This is efficient and reduces the risk of lost or stolen checks.

- Bill Payments: ACH payments are commonly used for recurring bill payments, such as utilities, rent, mortgage, insurance premiums, and subscription services. Consumers can set up automatic ACH debits to ensure their bills are paid on time without manual intervention.

- Vendor Payments: Businesses often use ACH transfers to pay suppliers and vendors and is preferred for its lower cost compared to wire transfers.

- Tax Payments and Refunds: Individuals and businesses can pay their taxes electronically, and the IRS can issue refunds directly to taxpayers’ bank accounts.

- Charitable Contributions: Donors can set up recurring contributions, ensuring a steady stream of support for the organization.

- College Tuition Payments: Educational institutions use ACH payments to collect tuition fees from students, simplifying the payment process for both the institution and the students.

- Retirement and Investment Contributions: Individuals can use ACH transfers to contribute to retirement accounts, such as IRAs and 401(k)s, as well as investment accounts. This method allows for automatic, recurring contributions, helping individuals stay on track with their financial goals.

ACH Payments vs. Other Types of Payments

ACH Payments vs. Paper Checks

ACH payments are generally less expensive, costing around $0.29 per transaction, compared to $1.22 to $4.00 for paper checks. They are processed within one to two business days, whereas paper checks can take several days to clear. ACH payments are more secure as they are processed electronically, reducing the risk of checks being lost or stolen.

ACH Payments vs. Credit Card Payments

ACH payments have lower processing fees, ranging from 0.5% to 1.5%, compared to 1.5% to 3.5% for credit card payments. Credit card payments are processed faster, typically within 24 hours to three days, while ACH payments can take up to three business days. Credit card payments are guaranteed by the credit card network, whereas ACH payments can be rejected for reasons such as insufficient funds.

ACH Payments vs. Wire Transfers

ACH payments are significantly cheaper, costing between $0.20 and $1.50, compared to $25 to $50 for wire transfers. Wire transfers are faster, often completed within the same day, whereas ACH payments can take one to three business days. ACH payments can be reversed in cases of errors or fraud, while wire transfers are generally final and irreversible.

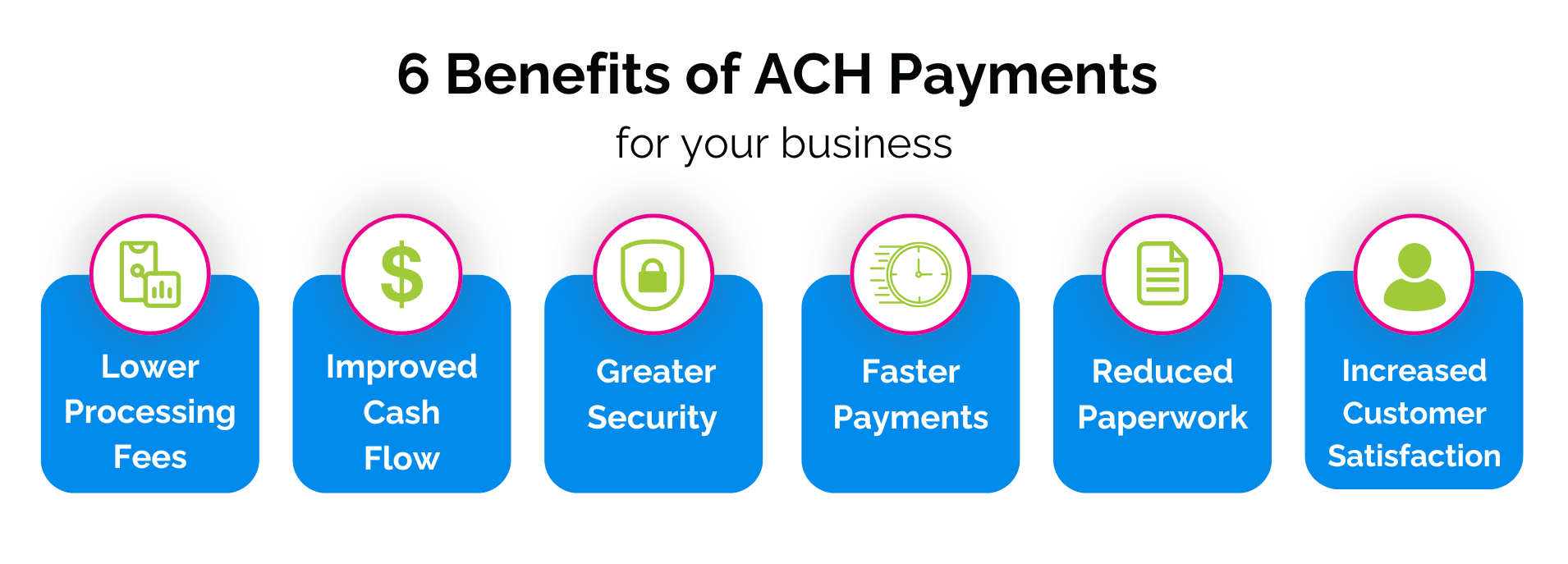

6 Benefits of ACH Payments for Your Business

1. Lower Processing Fees

When choosing methods of accepting payments, business owners should consider the fees associated with each option.

One of the most significant advantages of ACH payments is the lower processing fees. ACH transactions typically cost a fraction of what businesses pay for credit card processing fees, making it a cost-effective option for businesses of all sizes.

This reduction in fees can lead to substantial savings, especially for businesses with high transaction volumes.

2. Improved Cash Flow

ACH payments can improve cash flow by providing faster access to funds.

Unlike paper checks, which can take several days to clear, ACH transactions are processed quickly, often within one to two business days.

This speed allows businesses to manage their finances more effectively, ensuring that funds are available when needed for operational expenses, payroll, and other financial obligations.

3. Greater Security

ACH payments offer greater security compared to paper checks and other traditional payment methods.

The ACH network employs robust encryption and authentication protocols to protect sensitive payment information.

Additionally, the risk of fraud and insufficient funds is lower with ACH transactions, as they are processed electronically and can be verified in real time.

4. Faster Payments

If you want to get paid faster, accepting ACH payments is a good idea.

Recurring payments, such as subscription fees and insurance premiums, can be set up to be automatically debited from customers’ accounts, ensuring timely payments and reducing the risk of late or missed payments.

This automation can save time and resources, allowing you to focus on other aspects of your business.

5. Reduced Paperwork

ACH payments eliminate the need for associated paperwork, such as mailing, handling, and storage.

This reduction in paper transactions not only saves time and money but also contributes to a more environmentally friendly business practice.

By going paperless, businesses can streamline their payment processes and reduce their carbon footprint.

6. Increased Customer Satisfaction

Offering ACH payments as a payment method can increase customer satisfaction by providing a convenient and reliable way to make payments.

Customers appreciate the ease of setting up direct payments and the assurance that their payments will be processed on time.

This convenience can lead to increased customer loyalty and repeat business, ultimately benefiting your bottom line.

Conclusion

Incorporating ACH payments into your business’s payment processing strategy can offer numerous benefits, from lower processing fees and improved cash flow to greater security and increased customer satisfaction.

By understanding how ACH payments work and the advantages they provide, you can make informed decisions that will help streamline your operations and support your business’s growth.

Handling a new payment method may sound scary, but Regpack can help you integrate ACH into your business seamlessly. Get in touch, and we’ll take care of the rest!