If you’re a small business owner, a late payment from a customer can seriously affect your cash flow, not to mention your peace of mind.

Precautions should therefore be taken to reduce the possibility of late payments, even from your most disorganized customers.

In this article, you’ll learn seven highly effective methods for preventing late payments, from building great relationships with customers to asking for payment upfront.

By implementing a few, if not all, of these strategies, you’ll be able to spend less time worrying about payments and more time providing top-notch service.

- Research Customers When Possible

- Build Great Relationships With Customers

- Consider Asking Customers to Pay Upfront

- Be Clear on Your Payment Terms

- Offer Different Payment Methods

- Automate the Payment Process

- Send Reminders for Payments That Are Due

- Conclusion

Research Customers When Possible

The first and most obvious way to avoid late payments is to avoid customers prone to making them.

You want to stack your client list with reputable customers with a history of paying their bills on time, and good standing in your space.

Therefore, before you take on a new client, it’s a good idea to do a bit of research to figure out if they’re likely to pay you on time. Do some due diligence.

It’s a bit harder to investigate an individual’s finances than a company’s, but it’s still totally doable.

Start by running a credit check on your customer to see if they have a solid credit history. This is especially important if you’re going to be dealing with large sums of money.

You don’t want to enter into an agreement with a customer who regularly neglects to pay their bills.

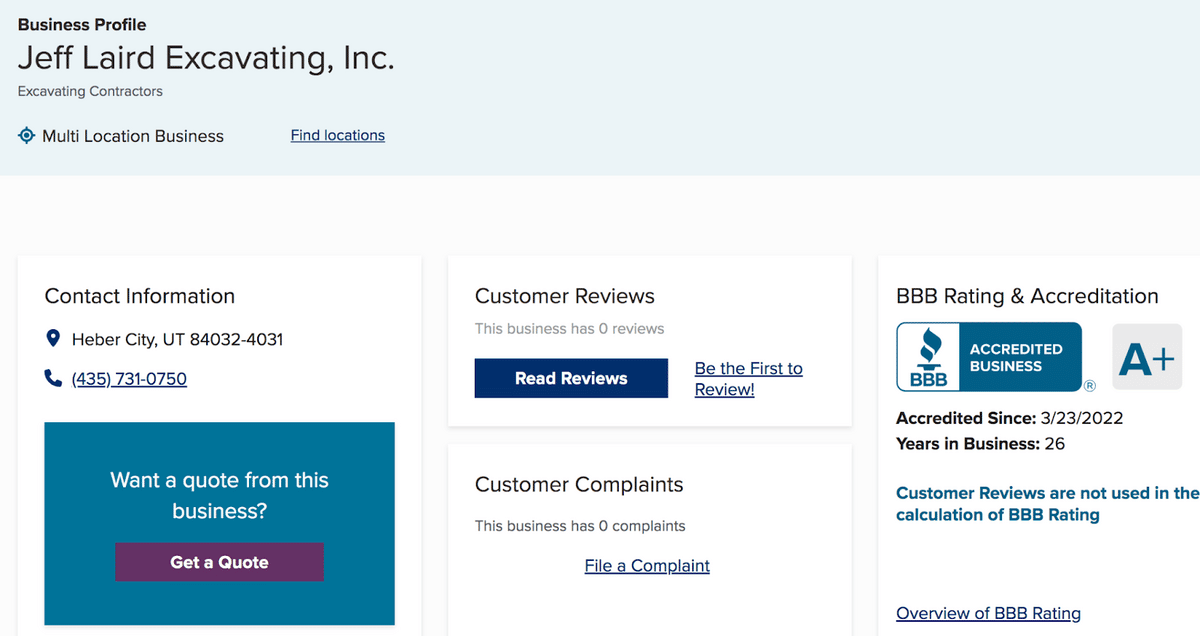

Next, find their rating on Better Business Bureau, a nonprofit that scores companies on their trustworthiness.

Here’s an example BBB rating of a construction company:

Source: BBB

The site’s purpose is mostly to protect consumers, but if a business is notoriously unfair to its customers, it’s reasonable to guess it might subject its vendors to the same treatment.

If it’s a company you’re investigating, it’s also a good idea to look at their website, social profiles, and reviews on Google, Yelp, and similar sites.

This will give you a sense of their reputation.

If you’re especially motivated to do in-depth research on an individual, use a tool like Spokeo, a people intelligence software that does background checks and reveals hard-to-find data—even wealth information.

All you need is the customer’s phone number, address, email address, or full name to run a report:

Source: Spokeo

You can either get a monthly membership for $24.95 per month or just buy a one-off report for $1.95, which is best if you infrequently sign on new clients.

Just assuming your customers are going to pay their bills on time is a fool’s gamble if large payments are involved.

Do some background investigation to ensure they’re reputable enough to enter into a financial agreement with.

Build Great Relationships With Customers

Building a great relationship with your customers is a fabulous way to both keep them around and ensure they’re paying their dues on time.

Loyal and satisfied customers who have had an amazing experience with your business are less likely to delay or miss a payment than someone who feels that you haven’t lived up to your end of the bargain.

Additionally, if a customer feels like they know you or your representatives on a personal level, they’ll feel guilty about paying for the service late.

Throughout human history, people have lived in small communities, where breaking one’s word had serious, far-reaching consequences.

The affected person might tell others in the group about the other person’s failure to meet their obligations, and then others in the community might then decide to never trade with or assist said person.

In a modern setting, when we’re close to a vendor, we feel as if they’re a part of our small community, and are therefore more hesitant to upset them.

It’s much easier to neglect to pay someone with whom we don’t share that kind of personal connection—some random faceless corporation, for example.

Therefore, it’s important that you take every opportunity you can to connect with your customers on a human level.

Make calls to check in on their experience. Send birthday emails.

When you make customers feel satisfied with your service and establish that connection, they’ll try their best to avoid making a late payment.

Consider Asking Customers to Pay Upfront

An upfront payment requires customers to make a partial, or even full payment, for the product or service before receiving it.

If you can get your customer to pay you upfront, do so. It means more money for you more quickly, and eliminates the negative effects of late payments.

Even if the customer is late, they’re only late on the amount left over after subtracting the upfront payment, so the tardiness doesn’t hurt you as badly.

Some cases when companies should ask for upfront payments include:

| When you’re working with a new and potentially unreliable customer. |

| If the business agreement is for large payments. |

| When the customer has a history of paying you late. |

| If you just want more money faster and feel that this is fair. |

The most common percentage of payment asked for in an upfront payment agreement is 25-50% of the total price. And this is usually for work that costs $1000 or more total.

For example, the customer would have to pay $500 before you even start doing any work. Once you deliver the final product or render the service, they pay you the rest.

But you can totally charge upfront deposits for work that costs less. It’s your business and you deserve financial protection.

Customers are usually pretty open to this proposal, especially if you have good reason to back it up, like their history of late payments.

The regularity of this payment structure varies from industry to industry, so ask around to see if it’s a norm in yours.

In some industries, this practice is so commonplace that the customers will likely already know about it, so you won’t have much explaining to do.

If you find that it’s an uncommon practice in your industry, you might have to put in some more effort to convince them, but, with a little bit of preparation, that’s still a conversation you can successfully have.

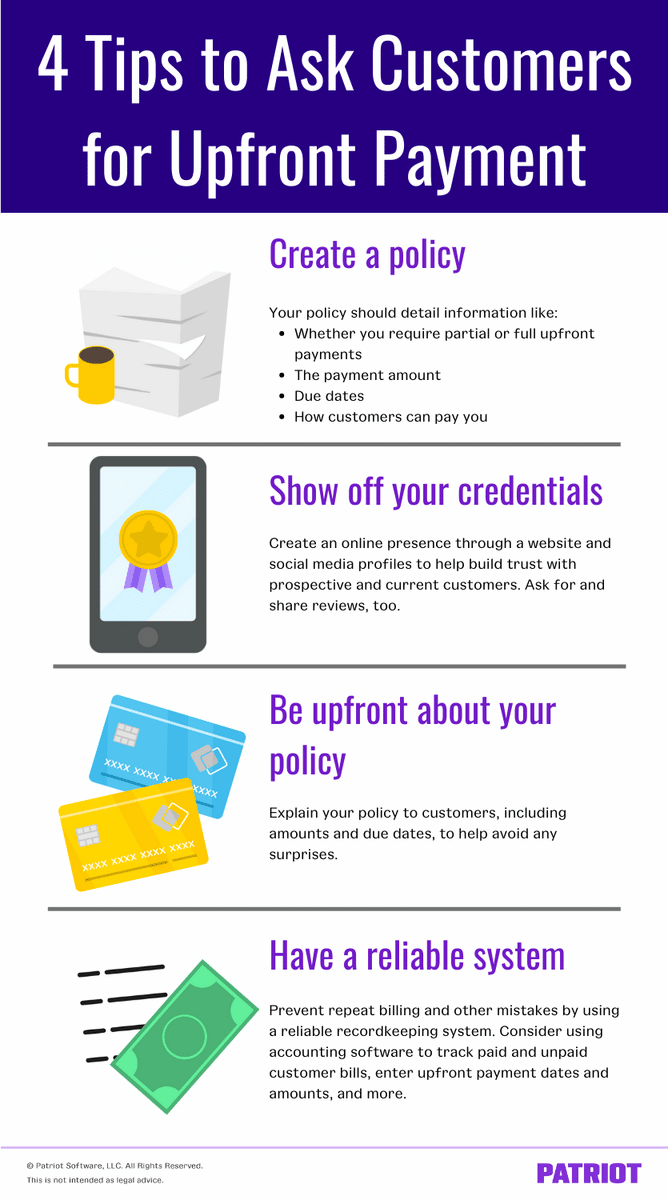

Here are some tips for asking for an upfront deposit:

Source: Patriot Software

Asking your customers for 25%, 50%, or even the entire payment upfront can seem a tad bold, but, in reality, the practice is becoming increasingly common.

It’s one of the best ways to avoid late payments and mitigate their effects on your cash flow.

Be Clear on Your Payment Terms

Payment terms state how your clients can make their payments and when their payments should be made (e.g., 30 days after receiving the service).

You should be as clear and upfront as possible when it comes to sharing your payment terms with a customer.

Sometimes customers fail to pay on time simply because they aren’t aware of the payment terms: the accepted payment methods, the due dates, etc.

Be extremely clear about what event initiates the countdown toward the due date. Does it start when you render the service completely, or at some other point in the process?

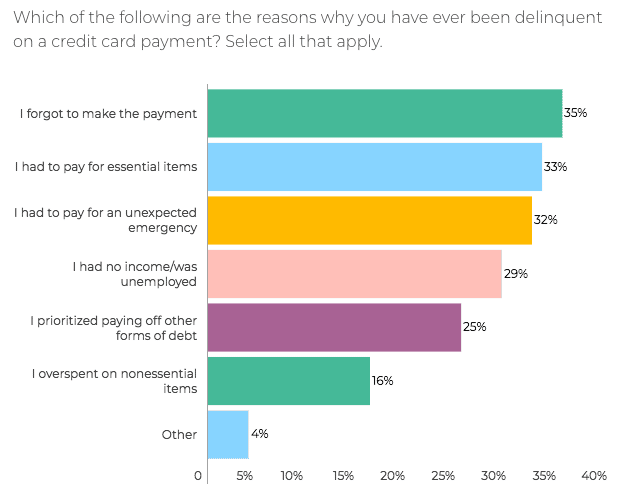

One of the most common reasons people miss a payment is that they weren’t aware of the payment’s due date, and therefore just forgot.

Source: NGPF

However, customers may also pay late because they assume you offer a certain payment method when, in fact, you don’t.

This forces them to reassess how to pay and consequently causes delays.

For example, if a customer mistakenly thought that your business accepted ACH transfers, they might use that as one of many common excuses to delay the payment.

Or they might honestly just not be able to pay immediately via the methods you accept—for example, due to insufficient funds on a credit card.

So, you should make sure that customers know exactly how to pay their invoices, when they’re due (net-10, net-30, etc.), and any fees or consequences associated with late payments.

Fees can act as an additional nudge to a customer to pay on time.

As for how to deliver the terms, do it over the phone or in-person to lend some force to what you’re saying.

But also send your customers a contract or at least a written document outlining the payment terms so they can refer to it on their own without interrupting your day.

Providing clear instructions about how and when to pay will ensure your customers never miss or delay payments because of ignorance or confusion.

Offer Different Payment Methods

Customers want options when it comes to payments. They want to pay in the way they find most convenient.

For some, that’s credit and debit cards. Others might prefer ACH transfers, and some might still want to send a physical check.

Therefore, it’s important to widen your range of accepted payment options so that the vast majority of your customers are able to pay in the easiest way for them.

When you allow them to pay how they like, they’re more likely to make the payments on time because they know it’s going to be a seamless, simple process.

Like a kid who enjoys the flavor of their toothpaste, they won’t drag their feet as much.

As for which payments to offer, consider the following:

| Bank transfers |

| Online payment services (like PayPal) |

| Mobile payment services (like Apple Pay) |

| Credit and debit cards |

Online payments are becoming increasingly preferred by customers, so it’s a good idea to allow them to pay through an online platform or app.

In fact, according to research by Mckinsey, 82% of Americans use digital payments.

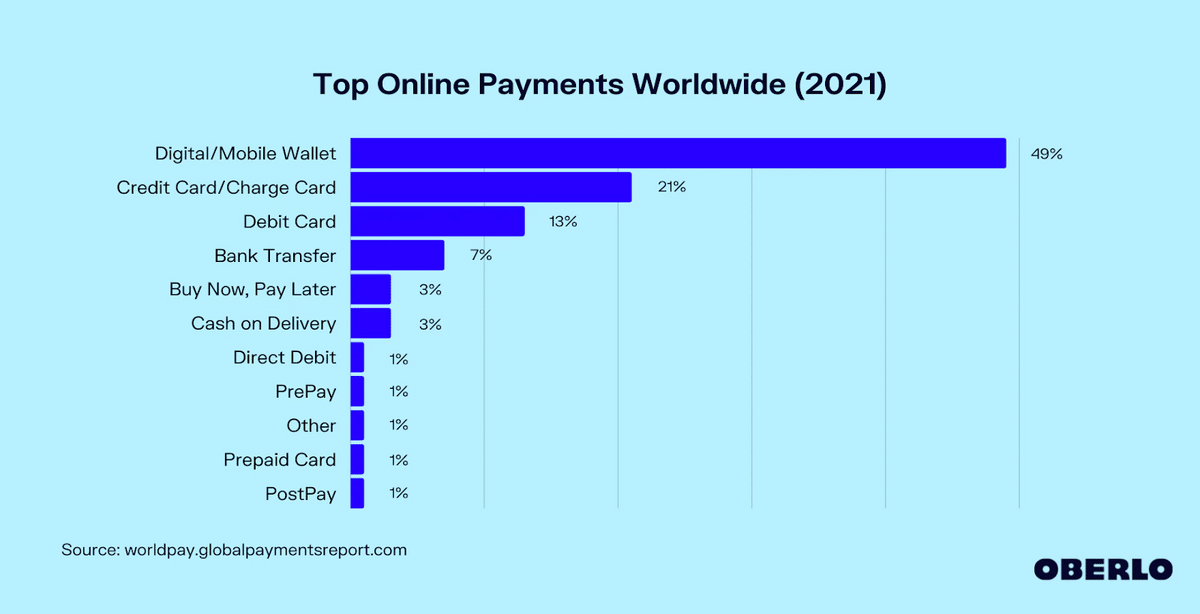

Here are the most popular online payment options:

Source: Oberlo

Digital and mobile wallet payments, like Google or Apple Pay, are also becoming more popular as time goes on, so it’s smart to consider offering them now.

When you give your customers a wide range of payment options, it’s likely they’ll find a method that suits their preferences and allows them to pay on time—every time.

Automate the Payment Process

Automating your payment process with software makes it easier for companies to receive and process payments, while also reducing the chance of human error.

For example, if one of your staff accidentally filled out an invoice incorrectly, it could delay payment because the customer would have to reach out to remedy the situation.

With an automated payment process, that kind of issue is much less likely.

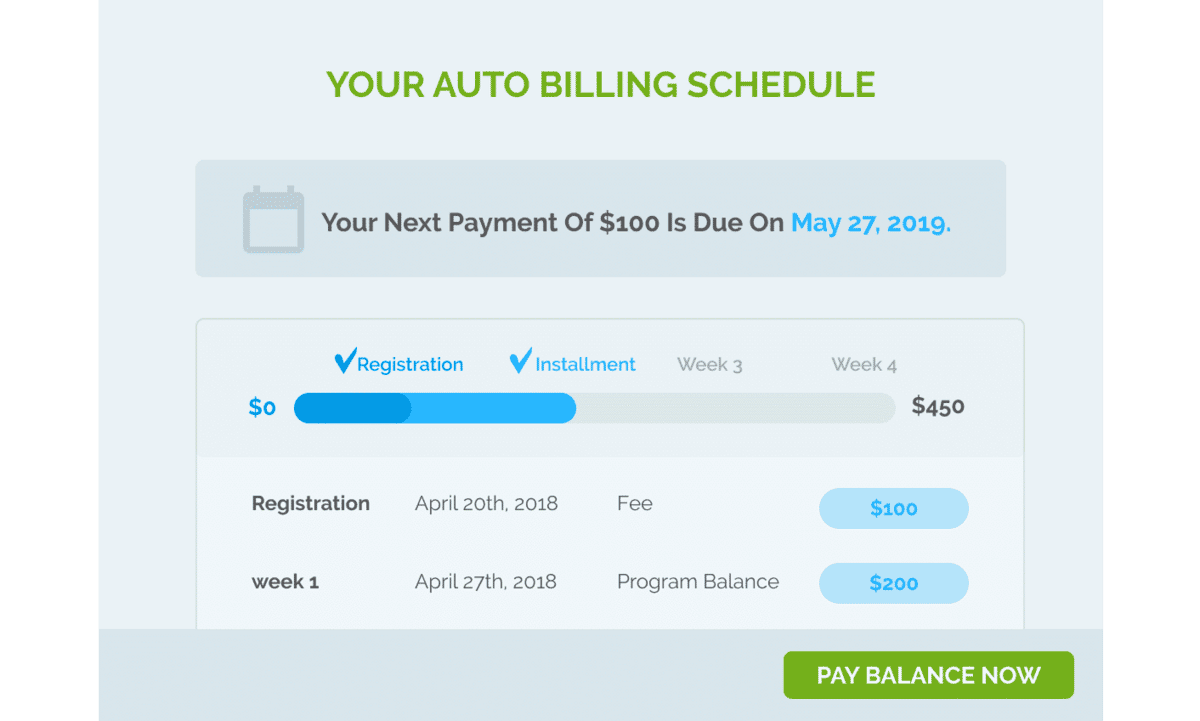

Customers can also do things like sign up for auto-pay so that their credit card or bank is charged automatically every time a payment is due.

This is probably the best way to reduce late payments.

Regpack, an online payments software, offers small business owners tools like automatic billing, integrated payments, and payment portals where customers can track their balances and register for auto-pay:

Source: Regpack

Additionally, it offers great reporting features which allow you to generate payments reports to figure out things like which customers are most likely to be late or which payment methods result in the highest number of late payments.

Armed with these insights, you can adjust your payment process accordingly. For example, you might make a certain customer who’s always late start paying upfront.

Aside from helping you avoid late payments from customers, software and payment automation also help you save valuable time and resources, so you can focus on your core functions.

Send Reminders for Payments That Are Due

Companies should send reminders to customers about upcoming payments due and payments that are already due.

Often, the best way to remind them is with emails.

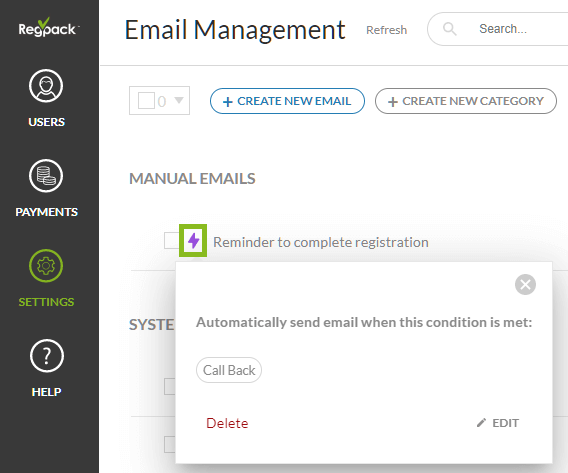

With an automated email tool, like the one found in Regpack’s online payments software, you can set up emails to automatically go out to your customers.

You could configure it so that customers receive a reminder at specified intervals.

For example, you might make it so customers get an email 2 days before the due date, on the due date, and a day after the due date if they failed to make the payment.

Conditional automated emails allow you to create email drips that respond to a customer’s behavior, so that the communications feel highly personalized:

Source: Regpack

Automating email communication saves you a substantial amount of time because you don’t have to write and send an email to every customer when the due date rolls around.

And it’s a great way to give those more busy or forgetful customers a friendly reminder about their upcoming payment.

Conclusion

Late payments from customers can seriously mess with your operations and plans, so it’s crucial that small businesses set up mechanisms that prevent them from happening.

These mechanisms include clearly written payment terms, strong relationships, an automated payment process, payment reminders, and other techniques covered in this article.

If there’s one thing to take away, it’s that late payments aren’t something you should let slide.

Start keeping track of the customers who are often late and have a conversation with them about it.

Clear communication is often the best way to solve a problem with a customer.