In the e-commerce space, managing transactions smoothly is crucial for maintaining a successful business. One challenge many merchants face is dealing with chargebacks as they can lead to lost revenue, increased operational costs, and the potential to damage a business’s reputation. Understanding what chargebacks are and how to prevent them is essential for protecting your business’s bottom line.

What are Chargebacks?

Chargebacks are reversals of credit card transactions initiated by the cardholder’s issuing bank. They occur when a customer disputes a transaction on their credit card statement, claiming it was unauthorized or fraudulent. While chargebacks are designed to protect consumers from credit card fraud, they can also pose a substantial burden on merchants, leading to increased operational costs and potential loss of revenue. Over time, chargebacks have evolved into a complex process involving multiple parties, including the cardholder, merchant, issuing bank, acquiring bank, and card networks like Visa, Mastercard, and American Express.

Common Causes of Chargebacks

Chargebacks can occur for various reasons, broadly categorized into three main types:

- Fraudulent Transactions: Fraud is a significant driver of chargebacks. These include both true fraud (where a third party uses stolen credit card information) and friendly fraud (where the cardholder disputes a legitimate charge, often to get a refund without returning the product).

- Merchant Error: Mistakes such as incorrect billing descriptors, duplicate charges, or fulfillment issues can lead to chargebacks. Ensuring accurate and clear communication with customers can mitigate these errors.

- Customer Disputes: Customers might initiate chargebacks if they are dissatisfied with the product or service, or if they feel the product did not match its description. Clear return and refund policies can help manage these expectations and limit chargeback disputes.

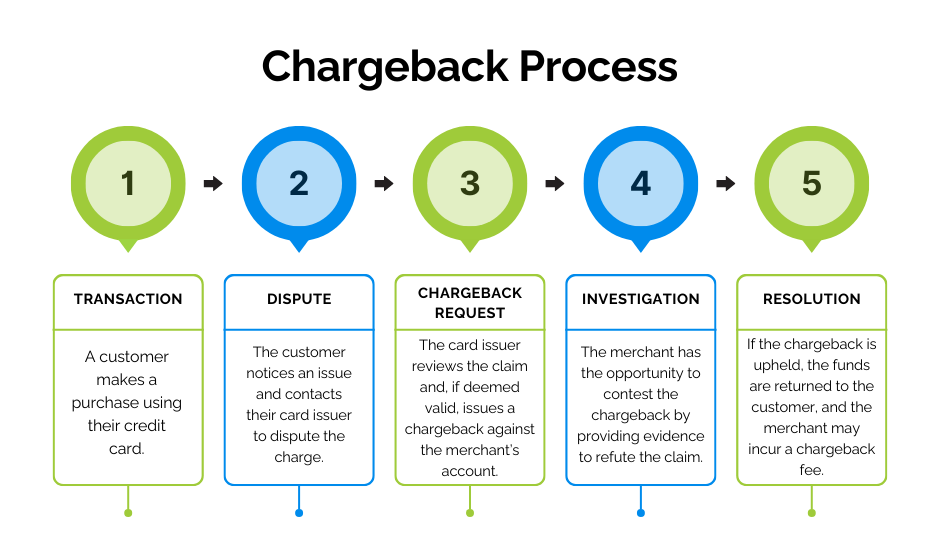

Understanding the Chargeback Process

Understanding the chargeback process can help businesses better manage and prevent them.

Here’s a step-by-step outline of how it typically works:

- Transaction: A customer makes a purchase using their credit card.

- Dispute: The customer notices an issue and contacts their card issuer to dispute the charge.

- Chargeback Request: The card issuer reviews the claim and, if deemed valid, issues a chargeback against the merchant’s account.

- Investigation: The merchant has the opportunity to contest the chargeback by providing evidence to refute the claim.

- Resolution: Based on the evidence provided, the card issuer makes a final decision. If the chargeback is upheld, the funds are returned to the customer, and the merchant may incur a chargeback fee.

The Impact of Chargebacks on Merchants

Chargebacks can significantly impact a merchant’s business in several ways:

- Financial Loss: Besides losing the transaction amount, merchants often face chargeback fees, which can add up quickly.

- Operational Costs: Managing chargebacks requires time and resources, increasing operational costs.

- Increased Chargeback Ratio: A high chargeback ratio can lead to penalties from payment processors and card networks, and in severe cases, the termination of the merchant account.

Tips for Chargeback Prevention

1. Improve Customer Service

Excellent customer service can resolve many potential disputes before they escalate to chargebacks. Make sure your team is well-trained, responsive, and equipped to handle customer concerns promptly. Provide multiple channels for support, such as phone, email, and live chat, to ensure customers can reach you easily. A proactive approach to customer service can build trust and reduce the likelihood of customers resorting to chargebacks.

2. Clear Billing Descriptors

Ensure your billing descriptor, the name that appears on the customer’s credit card statement, is clear and recognizable. This helps prevent confusion and disputes over unrecognized charges. For instance, if your business operates under a different name than your brand, ensure the billing descriptor reflects the name customers associate with their purchase. Consistency and clarity in billing descriptors can significantly reduce unnecessary chargebacks.

3. Detailed Product Descriptions

Provide accurate and comprehensive product descriptions to set clear expectations for customers. Include high-quality images, videos, and detailed information about the product’s features, dimensions, and usage. Honest and thorough descriptions help customers make informed decisions and reduce the chances of disputes over product quality or mismatches between expectation and reality.

4. Robust Fraud Detection

Utilize advanced chargeback fraud detection tools and services to identify and block suspicious transactions. Implement technologies such as machine learning algorithms that analyze transaction patterns and flag potential fraud. Services like Ethoca alerts can provide real-time notifications of fraudulent activities, allowing you to take immediate action. Strengthening your fraud detection capabilities is essential for preventing both true fraud and friendly fraud.

5. Comprehensive Return and Refund Policies

Clearly outline your return and refund policies on your website and make the process straightforward for customers. Ensure that these policies are easy to find and understand. A well-defined return policy can guide customers through the proper channels for returns and refunds, reducing the likelihood of chargebacks. Consider offering flexible return options and hassle-free refunds to enhance customer satisfaction and loyalty.

6. Secure Payment Gateway

Choose a reliable and secure payment gateway that offers fraud protection and secure transaction processing. A robust payment gateway can help minimize the risk of fraudulent transactions and provide tools for detecting and preventing suspicious activities. Features like AVS (Address Verification Service) and CVV (Card Verification Value) checks can add extra layers of security to your payment process.

7. Monitor Chargeback Ratio

Regularly monitor your chargeback ratio to stay aware of any trends or patterns in chargebacks. Analyzing chargeback data can help you identify underlying issues and implement corrective measures. Keeping your chargeback ratio low is crucial, as a high ratio can lead to penalties from payment processors and card networks, and even the termination of your merchant account. Proactively addressing chargeback issues can help maintain a healthy business relationship with your payment processor.

8. Educate Customers

Provide clear instructions and contact information for customer support to educate customers about the proper channels for addressing issues. Include FAQs, troubleshooting guides, and detailed product manuals on your website. Educated customers are less likely to initiate chargebacks and more likely to seek assistance directly from your support team when problems arise.

9. Optimize Checkout Process

Simplify and secure your checkout process to minimize errors and ensure customers understand their purchase. A streamlined checkout process reduces the risk of transaction errors and enhances the overall customer experience. Clearly display all charges, taxes, and fees, and offer multiple payment options. An optimized checkout process can lead to fewer abandoned carts and fewer chargebacks.

By implementing these strategies, you can reduce the occurrence of chargebacks and protect your business’s revenue. Through proactive measures and a commitment to excellence, merchants can navigate the complexities of chargebacks and maintain a thriving ecommerce business.

Conclusion

Chargebacks are an unavoidable part of running a business that accepts credit card payments, but they can be managed and minimized with the right strategies.

As a business owner, you want to mitigate chargebacks and the problems they cause. Often, chargebacks occur because a customer is mistaken or confused.

Therefore, the best and fastest way to reduce your chargebacks is to increase the clarity surrounding your customer support, refund and return policies, shipping details, and other areas related to the purchase.

If you’re a service-based small business that wants to see how online billing and email automation can help you solve or prevent a chargeback problem, reach out to Regpack to learn about their online payment software.