Payment processors help small business owners accept various forms of cashless payment, from credit and debit cards to e-wallets.

There are numerous payment processor providers out there, so finding the right one for your small business can be tricky.

To help, we’ll call out some common mistakes people make when choosing a payment processor and inform you on what to do instead.

Hopefully, this will help you streamline the evaluation process and pick a provider that makes your life easier.

- Accepting Limited Payment Options

- Misunderstanding Contractual Obligations

- Overlooking Extra Fees

- Disregarding PCI DSS Compliance

- Assuming Security Is Guaranteed

- Undervaluing Continuous Support

- Conclusion

Accepting Limited Payment Options

Customers value convenience above all else. They’ll go to great lengths to protect it.

According to Hyken’s report, 75% of customers would actually switch to a competing company if they found out they were more convenient to do business with.

One of the worst ways to inconvenience customers is during payment.

Buyers are excited to buy, or just want to get it over with, and they feel especially frustrated when a service provider complicates the payment process by not allowing them to pay using their preferred method of payment, be it credit card, digital wallet, mobile wallet, or bank transfer.

Therefore, one of the biggest mistakes you can make while choosing a payment processor is picking one that restricts you to only a small number of payment options.

Limited payment options is one of the main reasons customers abandon their shopping cart:

Source: Regpacks

Instead, strive for a payment processor that offers the widest range of payment options possible. That way, no customers will be inconvenienced and turned off from your business.

An added benefit of doing this is that you can be pretty sure that when new payment options come into existence, the payment processor provider will update their service to incorporate that method as well.

If they’re on the cutting edge of payments now, it’s fair to assume they will be going forward as well. Of course, always ask and do your due diligence on this.

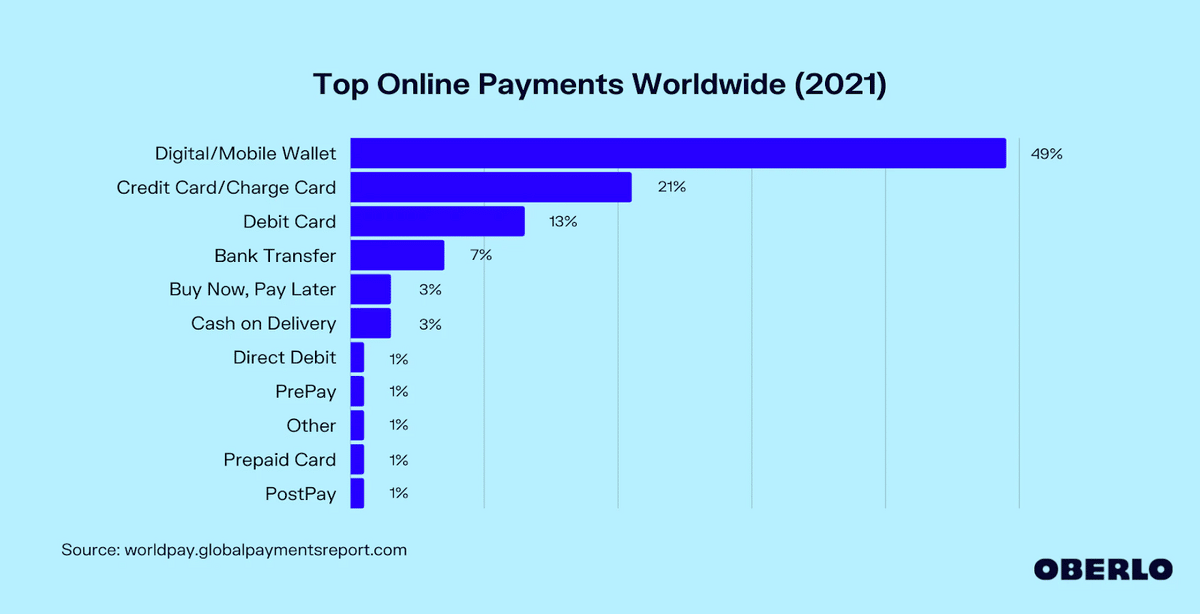

To give you some guidance about what payment options to prioritize, check out this graph from Oberlo, where they share the top online payment methods worldwide in 2021:

Source: Oberlo

According to Worldpay Global’s research, 49% of e-commerce payments were made via digital or mobile wallet. An example of this is Apple Pay.

Coming in second was credit card payment, followed by debit card, then bank transfer.

It’s ideal to look for a payment processor that allows for at least these four most popular payment options, but, the more, the better.

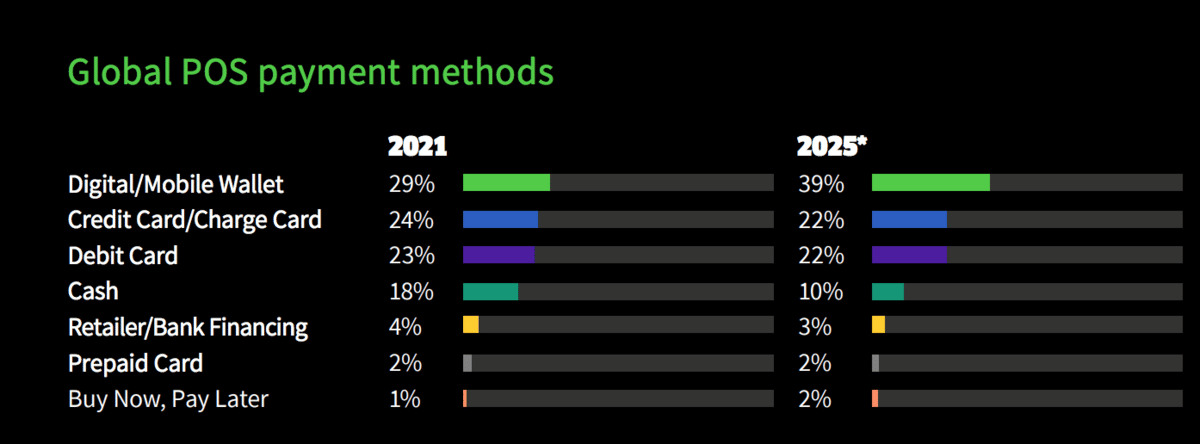

If you’re using a POS system at a brick-and-mortar store, the hierarchy of payment options is pretty much the same.

Despite receiving a smaller share of the total, digital and mobile wallets still retained the top spot, with 29%.

And, bank transfer is replaced by cash at number four, behind credit and debit cards.

Source: Worldpay Global

In both e-commerce and POS systems, Worldpay Global predicts a rise in digital and mobile wallet usage, so, again, it’s especially important to find a payment processor that accepts these types of payments.

In sum, offering your customers numerous ways to pay increases the customer experience and helps you increase customer retention, sales, and overall profits for your small business.

Do not make the mistake of selecting a payment processor that offers a limited number of options.

Misunderstanding Contractual Obligations

When evaluating a payment processor, it’s critical that you read the fine print in the contract, and ask questions about the agreement before you sign anything.

Make sure you review and understand every clause in the contract or terms of service.

The last thing you want is to lock yourself into commitments that you can’t keep or that negatively impact your business.

Of course, standard monthly payments and other types of fees are important to look over. But there are also other technicalities to examine.

For example, many payment processor providers include a volume commitment clause, which commits your company to a minimum number of monthly transactions by setting a profit goal.

If you fail to hit the established goal, the provider can charge you penalties.

Sometimes the contracts are filled with legal terminology that can be hard for the average person to interpret without the help of a legal professional.

Working with one might be a good option since misunderstanding a term can lead to unfortunate surprises down the line.

In short, by reviewing the contract, or having a lawyer do so, you ensure that the agreement with your payment processor works for your business, not just theirs.

Overlooking Extra Fees

It’s a common mistake to overlook extra or hidden fees and, as a result, assume that the payment processor with the lowest transaction rates is the most cost-effective choice.

The problem with that approach is that there’s a lot going on beneath the surface. For instance, payment processors may charge high processing fees for specific types of cards. They may also include extra fees that look small when taken alone, but together create a significant cost to your business.

Here are some fees to watch out for when selecting a payment processor:

| Statement Fees | You may have to pay for your monthly statement, regardless of whether it’s paper or digital. |

| Cancellation Fees | Some providers will charge you a fee if you cancel the agreement before the set expiration date. The cancellations usually cost between $100 and $500. |

| Batch-Processing Fees | You incur a fee, often around 10 cents per batch, every time a group of transactions is submitted for processing. Most businesses do this once a day. |

| PCI Compliance Fees | These are fees that incur if you are deemed out of compliance with payment card industry standards. To avoid it, get a PCI DSS certificate. |

To avoid signing on for any fees that seem unreasonable, ask the provider for a document that explains all the fees in-depth, and don’t be afraid to ask questions.

Sometimes you may even be able to negotiate a fee out of the agreement.

In addition to extra fees, you should also know the different types of pricing models that are commonly used by payment processor providers: flat and interchange-plus pricing.

Flat Pricing

Flat pricing is when the processor charges a fixed percentage for each transaction.

If your average sale was $10, and the flat rate was 3% + 20 cents interchange fees, you’d pay 50 cents per transaction.

This cost accounts for the variation in card interchange fees, as well as the markup for the processing.

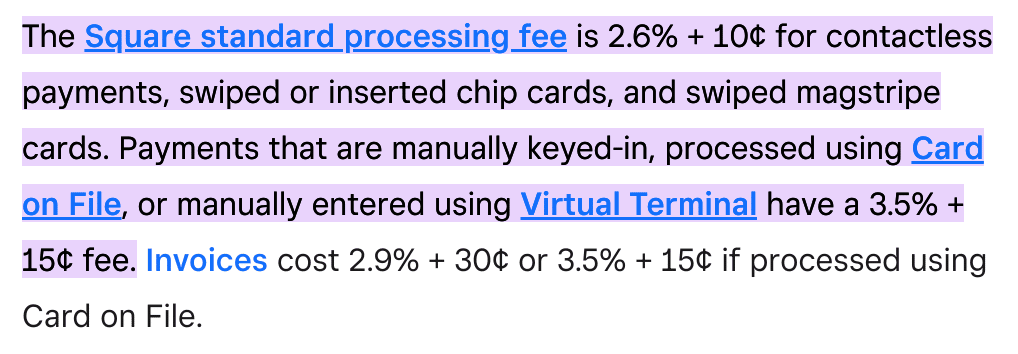

Many businesses like PayPal and Square offer this to new businesses as an entry into payment processing:

Source: Square

The benefit of this pricing model is that it is predictable and easy to understand.

But, you won’t know the actual cost each month or the margin taken by the processor, so you might be overpaying without knowing it.

Interchange-Plus Pricing

Interchange-plus pricing provides more transparency. This is when you pay the interchange fee specific to each card. You can therefore see the interchange cost of each transaction.

Although it’s a bit trickier to wrap your head around, interchange-plus pricing models can save you serious money.

For example, a debit card transaction will usually have an interchange rate under 1%. If you were paying a flat fee, the rate would still be around 2.9% (the industry average).

That’s a big difference.

In conclusion, it pays to know about extra fees and different pricing models when making your payment processor decision.

Disregarding PCI DSS Compliance

Payment Card Industry Data Security Standard (PCI DSS) compliance is a requirement of all companies that process credit card transactions.

It’s a set of standards designed to help businesses protect against identity theft and other cyberattacks.

Some of the requirements for PCI DSS include:

| Maintaining an effective firewall. |

| Using updated anti-virus software. |

| Utilizing encryption technology to securely store data. |

| Regularly reviewing a data security policy with staff. |

Instead of assuming that your provider is PCI DSS compliant, make sure to check their website or ask them directly.

If the provider is not compliant, you’ll have to get certified on your own, which is an expensive, tedious process that requires technical know-how.

To save yourself the hassle, you’re therefore better off finding a payment processor that is PCI DSS compliant and will be for a long time.

Assuming Security Is Guaranteed

It’s not enough to just ensure that you are PCI DSS certified to protect your business from fraud. And not all payment processors offer a high level of security.

You also need to look for payment processors that offer advanced tools to help you reduce the risk of payment fraud and data breaches that can hurt your relationship with customers and even paralyze your small business.

Here are some fraud prevention and data protection features to prioritize:

| Fraud Scrubbing | This technology uses software and verification techniques to analyze transactions for potential fraud and brings suspicious ones to your attention, or cancels them entirely. |

| Payer Authentication | Also known as 3-D Secure, this is a solution created by credit card issuers that helps you provide additional security against fraud. An example of this authentication is 2-factor authentication. |

| Encrypted Data Storage | Payment processors should store customer payment information like credit card details in an encrypted data format, meaning no one can read the details except those with the key (usually you and the relevant financial institutions) |

| Full EMV Compatibility | This is an acronym for Europay, Mastercard, and Visa, who pioneered a chip technology that protects consumer data. Your payment processor should be EMV-compatible, meaning their POS systems and card readers use EMV technology. |

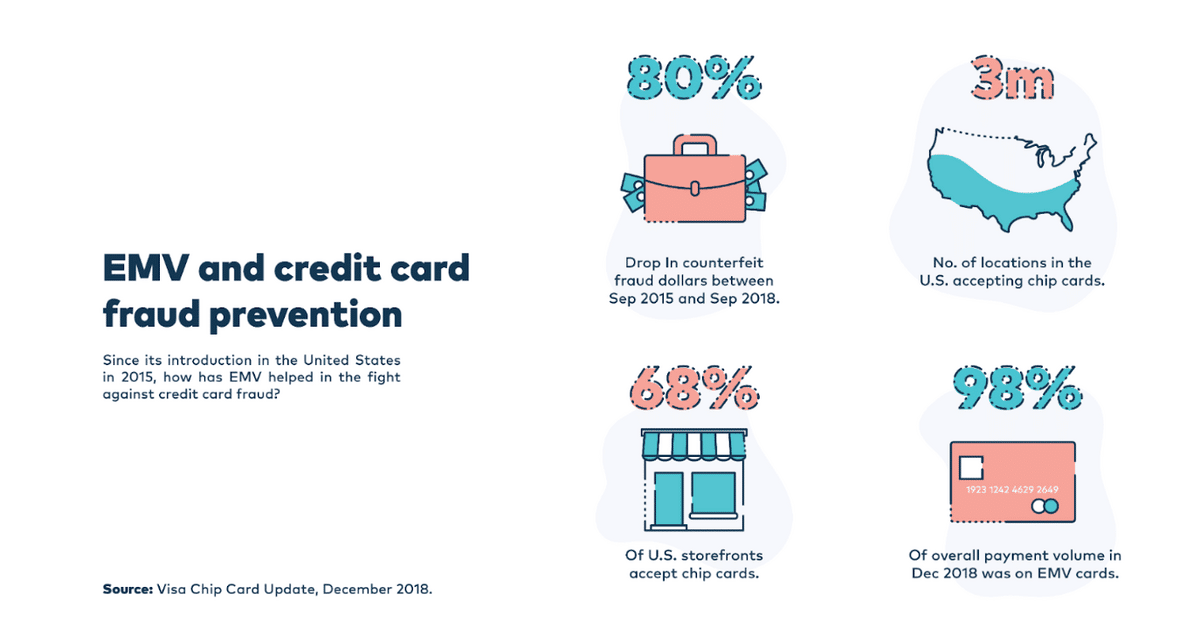

Since it was first introduced into the US in 2015, EMV has made great contributions to the fight against credit card fraud.

Among other positive outcomes, there was an 80% drop in counterfeit fraud dollars between September 2015 and September 2018:

Source: Merchant Cost Consulting

Fraud prevention and data security are essential for the long-term success of a small business: 60 percent of small businesses are forced to shut down within six months of suffering a data breach or cyber attack.

We cannot emphasize enough how prudent a strategy it is to narrow your search to payment processors that provide technology and systems that help your business and your customers remain safe from cyber criminals and fraudsters.

Undervaluing Continuous Support

Sometimes, during payment processor evaluation, businesses discount the value of customer support, thinking they’ll be fine on their own, and that the payment processor provider’s only function is to process the payments.

Then, not long after signing an agreement with a company that offers little customer support, the business realizes that they need more help than they had originally anticipated.

For example, many businesses find that setting up a new account or multiple payment options is frustrating and difficult to do on their own, even with the most intuitive, user-friendly interface.

Customer support provided by the payment processor is vital to your success.

Without it, you could spend hours troubleshooting issues that could’ve been solved in a few minutes from a live chat with a knowledgeable team member from your payment processor provider.

Also, payment processor issues aren’t the type to leave for later.

Many issues require immediate resolution, especially system downtime, which prevents customers from being able to pay for your service.

Source: PYMTS

With this in mind, save yourself the headache down the line and pick a payment processor that gives you around-the-clock support in various forms, from phone calls and live chat to self-service options like knowledge centers that offer guides and video tutorials.

For an example of such a company, check out Regpack, an online payments platform that prides itself on its customer support.

Not only do they offer you support throughout the relationship, they also give your team training.

Plus, they have an extensive knowledge base that includes helpful articles and videos which will help you quickly find the answers you need:

Source: Regpack

Best of all, you receive a dedicated project manager who builds out the online payment system for you, according to your exact needs.

In sum, a payment processor that has your back and gives you personalized, ongoing support can save you a lot of time, stress, and trouble in your effort to process online payments.

Conclusion

Investing in a payment processor is an essential step for businesses looking to accept credit cards and other forms of cashless payment from their customers to improve the customer experience.

It’s a big decision, and a fair amount of due diligence is rewarded.

Don’t make the mistake of overlooking fees, assuming PCI DSS compliance, undervaluing customer support, or any of the others outlined in this article.

Treat this initiative with the same level of respect that you treat a project in your domain of expertise and you’ll come away with a cost-effective, helpful, and trustworthy payment processor and all the amazing benefits that come with it.