If you own a company, you know that payments keep your business running. Therefore, it’s no wonder business owners are placing such importance on making the payment process as seamless as possible.

That’s precisely what you should be doing if you want to offer your customers the best possible user experience. Otherwise, there’s a high chance they will take their business elsewhere, causing you to lose out on revenue.

Let’s explore five ways to improve your customers’ payment experience!

Jump to section:

Offer the Payment Methods Your Customers Want

Reduce the Number of Steps in the Payment Process

Create a Mobile-Friendly Payment Experience

Simplify Recurring Payments

Show Customers That You Prioritize Security

Offer the Payment Methods Your Customers Want

The more payment methods you offer, the better your chances of providing exactly the one your customers need.

You may be thinking that if someone wants to buy something, they will do it regardless of whether their preferred payment method is offered.

While that may be true, ask yourself: would the customer see it as a good experience? After all, a great customer experience starts with giving customers what they want.

So, what do your customers want? In a word: options.

Your clients should be able to choose between several different payment methods instead of being forced to pay with one they are not comfortable with or don’t normally use.

You can’t go wrong with electronic payment methods.

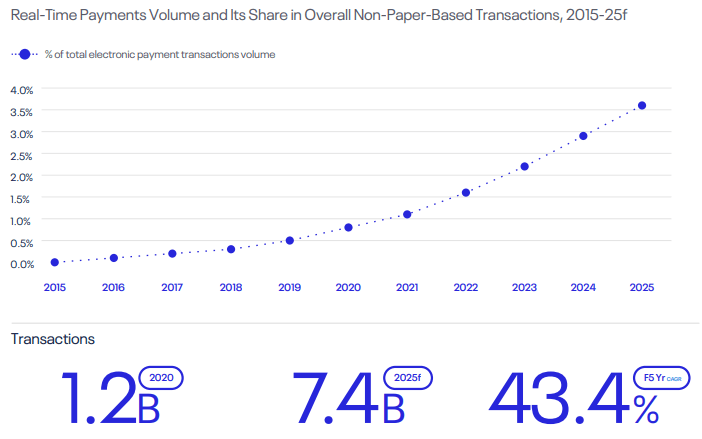

In fact, payment experts from ACI Worldwide predict that the number of electronic transactions made in the US will rise to an astonishing 7.4 billion by 2025.

Source: ACI Worldwide

It’s safe to say that electronic payments will be essential for anyone selling their products or services. Otherwise, they could be missing out on a lot of money and business.

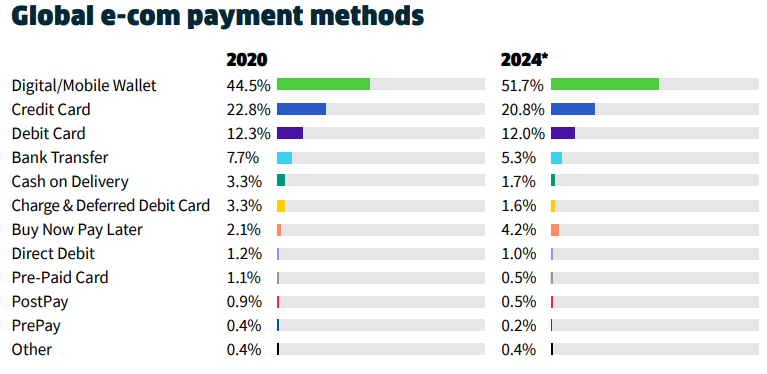

In the Global Payments Report, experts have analyzed and compiled a list of the most popular payment methods in North America in 2020.

Digital or mobile wallet payments were in the lead by a 20% margin at 44.5%. The ACI Worldwide report notes that 41% of US customers own and have used their mobile wallets for purchases, so this comes as no surprise.

Traditional credit and debit cards are still fairly popular in North America, too.

The report then used the current data and trends to predict the state of payments in 2024. It found that there would be no significant shifts, other than an increase in the number of people opting for digital/mobile wallet payments (51.7%).

There is, however, a notable change with the “buy now pay later” method which is expected to see a 100% increase in users.

This payment type allows the customer to buy something and pay for it in installments over the upcoming months. According to payment experts, this option will soon start gaining traction.

Source: WorldPay Global

If you’re aiming for an international audience, it is a good idea to offer the local payment options available in your desired market, as this increases your chances of someone following through with the purchase.

For example, suppose you’re thinking about selling your product in China.

In that case, you should consider offering AliPay as a payment option as Statista reports this method has 676 million active monthly users, which is 67x the number of UnionPay users, the second most popular payment option in China.

On top of offering multiple payments, you should also think about the payment channels you want to incorporate.

No matter how many payment options you implement, if you only offer them in your stores, you’re still eliminating a big part of your potential customer base who don’t shop in your stores.

You have to provide as many options as possible on as many channels as possible.

What other payment channels could you offer?

- Online store

- SMS payment

- Webchat payment

- Social media payment

- Over-the-phone payment

- App payment

These options work just like any other payment method. Your system or one of your agents sends the payment link to your customer using the client’s preferred channel.

The customer has to click on the link and fill out the payment data or, if applicable, simply choose the pre-saved data and pay with one click.

By offering different methods and channels for payment, you’re opening yourself up for more business, while making your customers’ experience more enjoyable.

Decrease Non-Payment By 75%

With Flexible Payment Plans!

Reduce the Number of Steps in the Payment Process

The simpler your payment process, the higher the chance of customers having a great shopping experience.

In other words, if your payment process includes numerous confusing steps and requires unnecessary information or even redirects customers to third-party sites, they won’t be happy by the end of it.

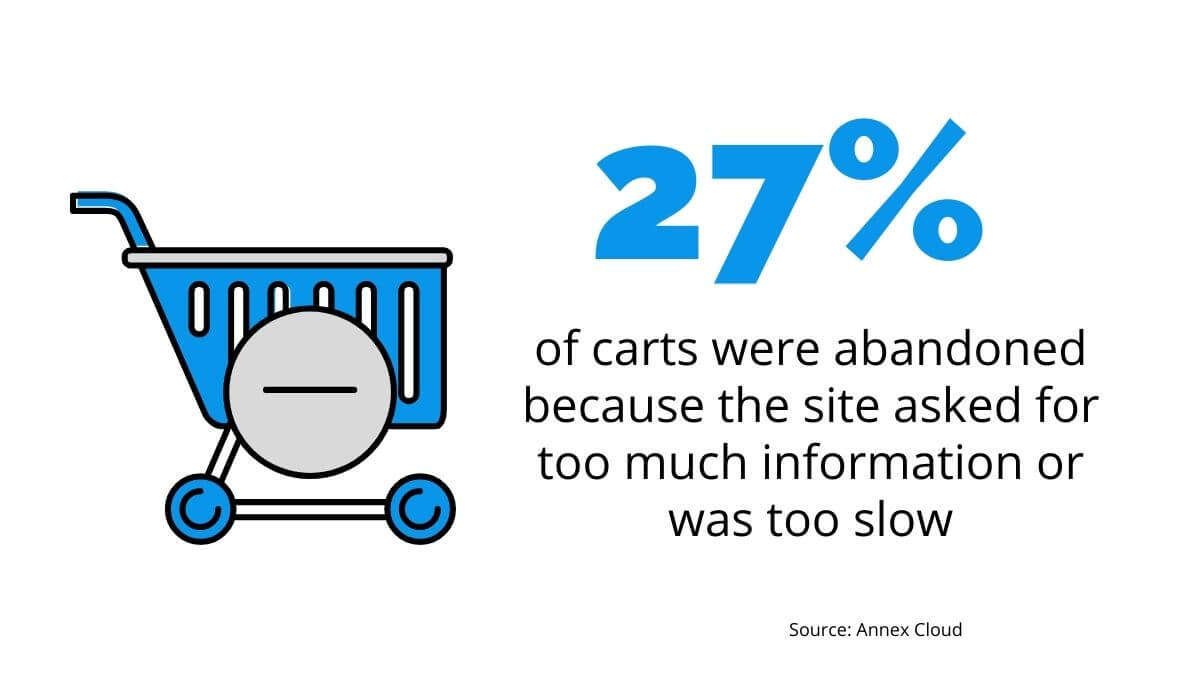

Some of your customers could also abandon their carts and take their business elsewhere, where they won’t have to offer as much personal data just to make a purchase.

Annex Cloud found that the customers didn’t finish 27% of purchases because the check-out process was too complicated or the website was too slow.

Source: Regpack

To avoid this, make the process as clear as possible. The forms your customers have to fill should be straightforward.

If you’re afraid that your customers might be uncomfortable providing certain data, don’t hesitate to add a short explanation or an example of the needed information to make things as evident as possible.

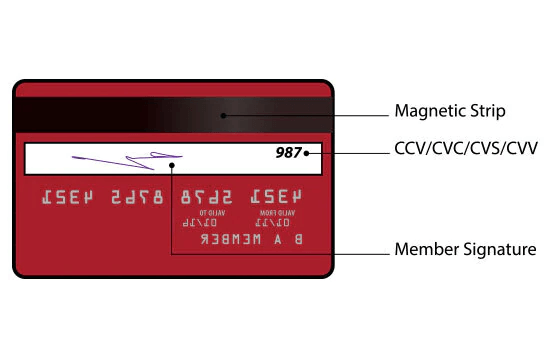

For example, you can often see this with the credit card’s verification value (CVV) number, as few people know what it stands for.

However, if you include a picture of it like the one below, your customers will know where to find it.

Source: IDFC FIRST Bank

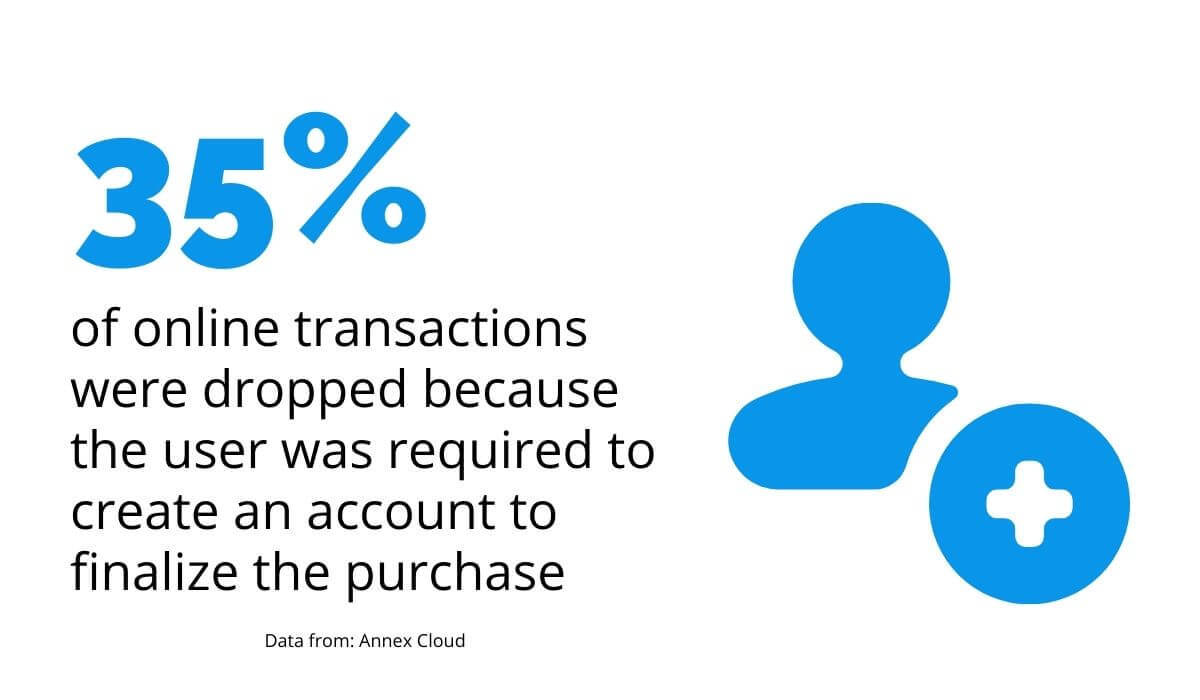

Another significant point to reconsider is forcing the customers to register if they want to shop.

While this may get you more registered users, it could also cost you a lot. Annex Cloud reports that 35% of transactions went unfinished if the site required the customer to create an account to complete a purchase.

Source: Regpack

Nowadays, most customers offer two check-out options: for guests and for registered users. This variety allows customers to choose whether they want to go through the registration process and become members.

However, if you pressure customers into creating an account just to buy from you, you lose more than a third of potential purchases.

Create a Mobile-Friendly Payment Experience

If you make your site mobile payment friendly, your chances of providing a great customer experience skyrocket.

Being mobile-friendly with payments means allowing your users to pay online using their portable electronic devices instead of using cash.

Nowadays, every service provider should strive to offer digital payments, especially in light of the ACI worldwide report we’ve previously discussed, which shows their growing prevalence.

Source: Regpack

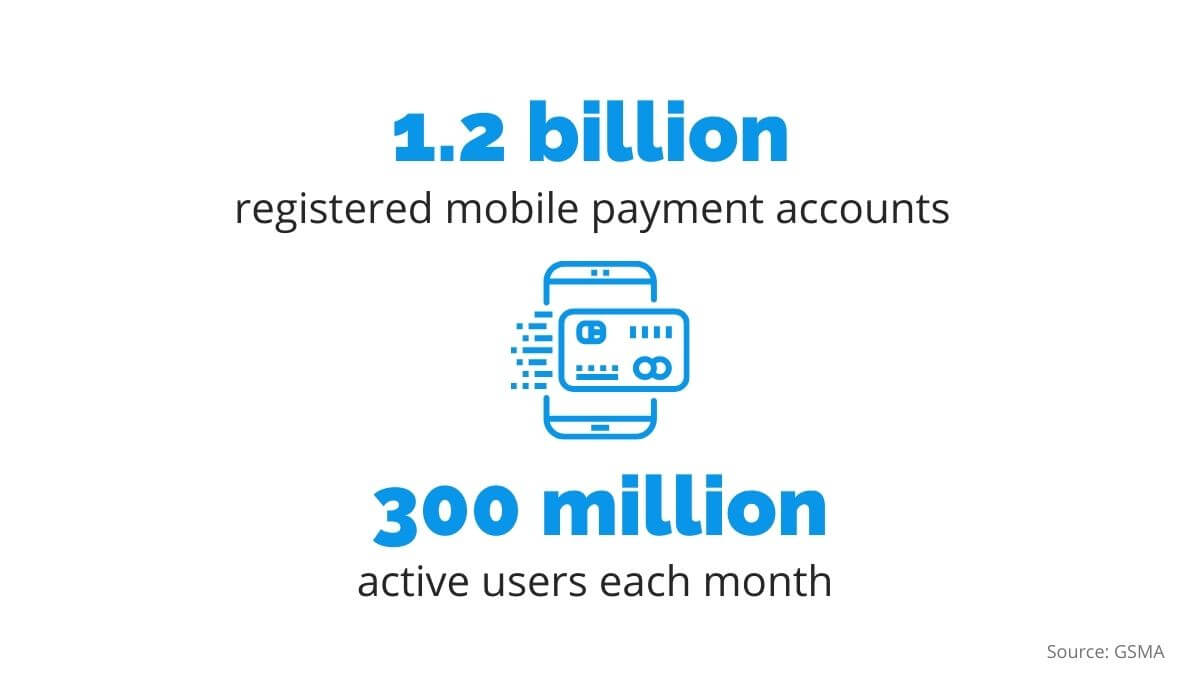

Mobile devices are also a popular means of conducting transactions. The GSMA report found that there were 1.2 billion registered mobile payment accounts in 2020, and 300 million of them were active every month.

Therefore, it’s safe to say that neglecting to offer mobile payments could make you miss out on a lot of business.

However, this doesn’t mean you should stop at simply making payments mobile-friendly, especially not when you could upgrade the entire paying experience.

Instead, offer an interface for each type of device.

By doing this, you’ll ensure that each customer has a great experience, regardless of whether they’re on a PC, a tablet, or a smartphone. If your website looks crisp and clean on any type of device, the payment will go smoothly.

Source: Regpack

Last but not least, you should consider incorporating one-click payments on your website. This type of payment allows the customer to save their payment data after entering it on your site for the first time.

That way, next time they want to purchase something from you, the site will offer to autofill the saved data instead of the customer having to type all the information once again.

Don’t Limit Your Customer Pool!

Offer Multiple Payment Options Seamlessly

Simplify Recurring Payments

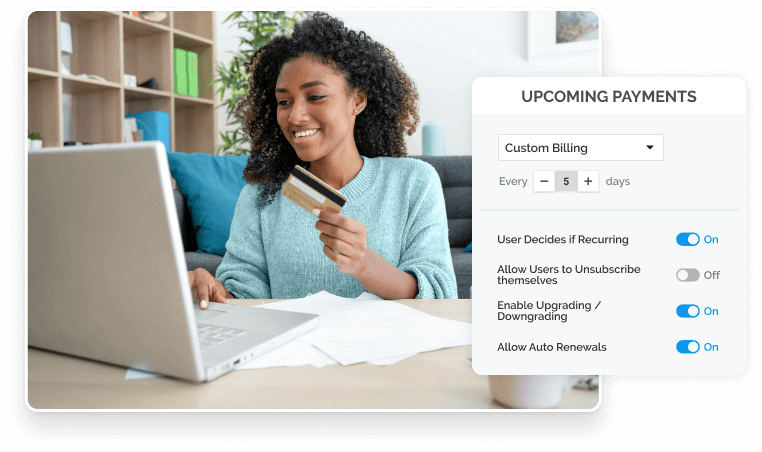

Like we said, a great way of making things easier on your customers is to ask them to enter their payment information only once and charge them automatically from that point on.

This way, the customers have to go through the hassle of checking out and paying for their items just one time.

Suppose you’ve also put in the effort to streamline the check-out process, as suggested. In that case, the process will be smooth sailing, especially because you’ll have the payment information.

Then, at the end of the following month or year, depending on the charging period chosen by the customer, you will use the saved payment data to charge the customer automatically.

Therefore, you’ll be taking that worry off their hands and ensuring that you get paid on time, every time.

Source: Regpack

A great thing about recurring payments is that they benefit the customer by simplifying payment for them, while also helping you in the long run.

Since your system will automatically charge the customers using the payment information that’s already been saved, you don’t have to worry about getting paid each month.

So, after the initial payment, you can just relax and trust the system to charge your customers as agreed. This option leaves you with a lot more time and energy for other aspects of your business, just like it makes life easier for your customers.

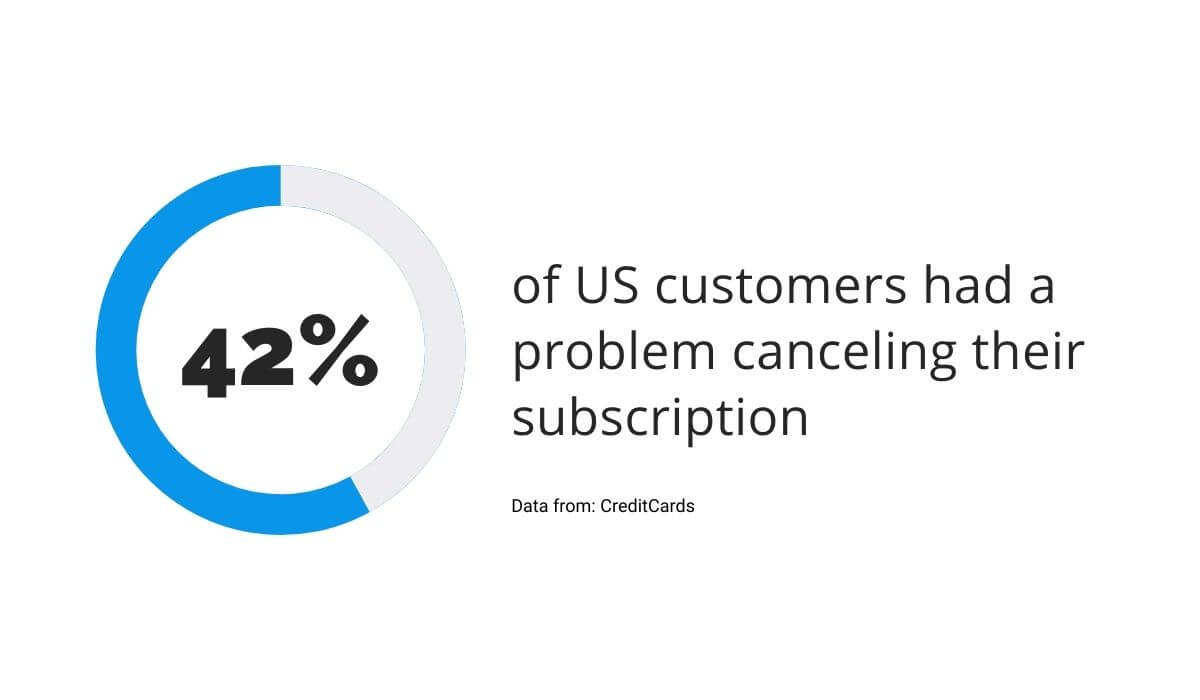

Finally, even though you don’t want your customers to leave, you have to make it easy for them to cancel their subscription.

Otherwise, you may receive bad reviews since it will seem you’re trying to trap customers into staying with your company and paying every month. Since 42% of US consumers have reported having difficulty canceling a subscription service, this is a real possibility.

Source: Regpack

Making it easy to cancel the recurring billing you offer leaves your customers with a positive impression even if they’ve decided to no longer use this payment method.

Show Customers That You Prioritize Security

The best way to ensure customer satisfaction is to show your customers you are serious about security.

The Annex Cloud survey found that customers are aware of the many threats lurking on the web today and that they care about security.

Therefore, more than a third of potential customers will leave a site if it doesn’t seem trustworthy, i.e., if it doesn’t have a security badge, usually visible in the check-out section.

Source: Regpack

An excellent way to go about this is to work only with reliable credit card processors. That way, you prove to the client base that you are invested in keeping their sensitive payment information secure.

Once you work with someone reliable, you can place their security badge somewhere on your website.

We suggest you place it in:

- your FAQ section

- the payments section

- the check-out

However, it’s not just about showing customers you are protecting their private data—it’s about actually protecting them and yourself from security breaches that could end up bankrupting your business.

Sadly, most small businesses fail at this, as 61% reported at least one cyberattack in 2020.

Source: Regpack

Of course, your customers will see the secure payment badge during check-out, but you should also offer more details for those who want to know more. Many people will look up your security details before deciding to trust you with their sensitive payment data.

Include website and payment safety information in your frequently asked questions (FAQ) section, so your customers can read up on what exactly happens behind the scenes while and after paying.

In short, working with reliable credit card processors and investing in security all around can help you stay secure and build trust with your customers.

Conclusion

When creating the perfect setting for payments, you first need to offer as many options as possible. Of course, prioritize safety for each option offered to ensure an optimal payment experience.

Since so many people use mobile payments in their day-to-day life, you should adapt and take advantage of the mobile payment market yourself, thus increasing your chances of attracting potential customers.

If you’re worried about getting paid consistently, consider offering recurring payments to ensure that the customer gets charged monthly or yearly without anyone doing extra work.

The payment process should be straightforward so that everyone can do it!

Accept Payments Online, Right On Your Website!

Streamline your checkout process, offer payment plans, and more!