Digital payments have recently become the norm—and it’s easy to see why. Electronic payment methods such as credit and debit cards, ACH payments, and electronic checks (eChecks) come with many benefits.

eChecks, for instance, preserve the customer’s confidence in and familiarity with paper checks while adding speed and convenience.

And for businesses—especially service-based companies who need to manage their customers’ payments online—accepting eChecks can be more efficient and cost-effective.

Jump to section:

What Are eChecks?

How Do eChecks work?

How Secure Are eCheck Payments?

What Can eCheck Payments Be Used For?

What Are the Business Benefits of Using eChecks?

What Do You Need to Start Accepting eChecks?

What Are eChecks?

An eCheck, short for electronic check, is a digital version of a modern alternative to traditional paper checks. They are a type of electronic fund transfer (EFT) that allows money to move electronically from a payer’s bank account to a payee’s account using the Automated Clearing House (ACH) network. This method eliminates the need for physical checks, reducing the time and resources required for processing payments. eChecks are commonly used in the United States and offer a secure and efficient way to handle transactions.

Like it’s paper counterpart, an electronic check includes important information such as the account number, routing number, and digital signature of the account holder. However, instead of physically delivering the check, the information is electronically transmitted to the financial institution.

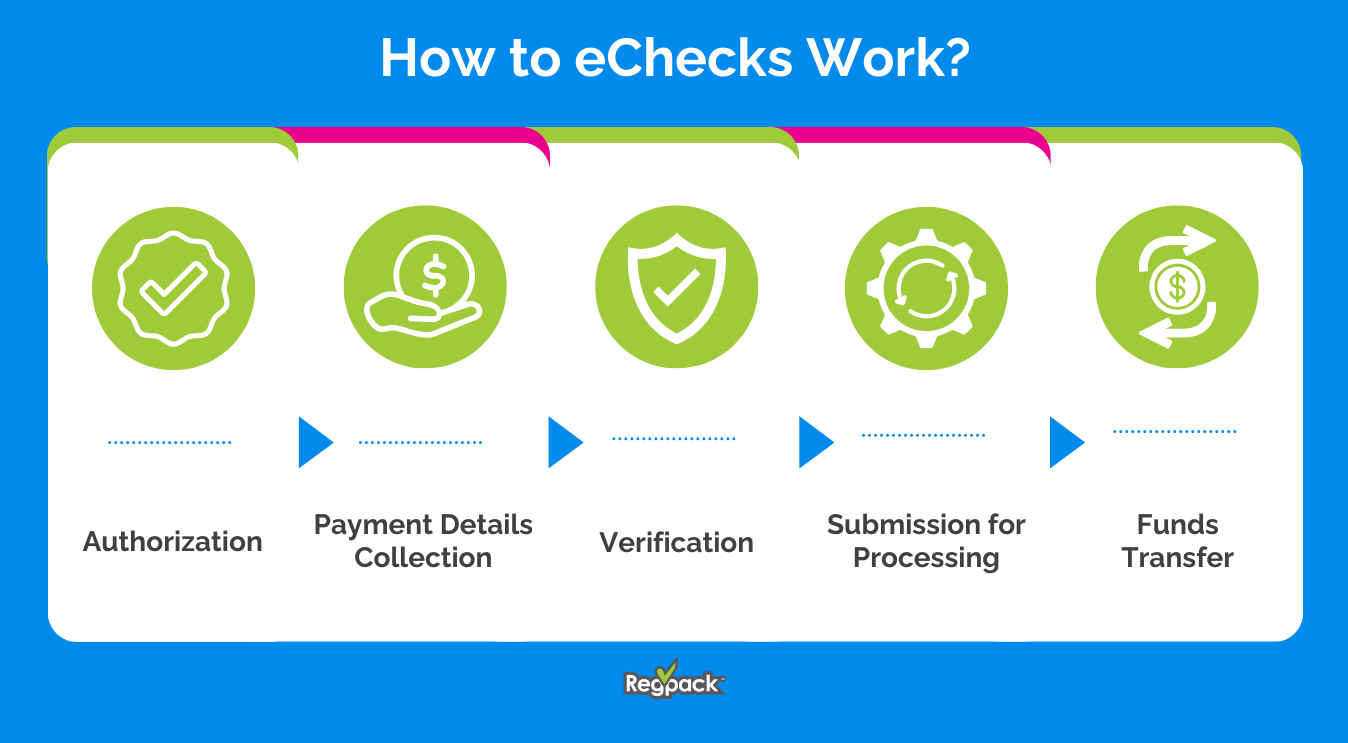

How Do eChecks Work?

Much like paper checks, eChecks notify the payer’s bank to send funds to the payee’s bank. However because everything happens digitally, the process is much faster and more convenient for all parties involved.

- Authorization: The payer authorizes the transaction by providing their bank account details and agreeing to the payment terms. This can be done through an online form, a signed contract, or a recorded phone call.

- Payment Details Collection: The merchant collects essential payment details, including the customer’s bank account number, routing number, and payment amount.

- Verification: The payment processor verifies the provided information, ensuring the payer’s account has sufficient funds and that the account details are accurate.

- Submission for Processing: The payment details are submitted through the ACH network, which facilitates the electronic transfer of funds between banks.

- Funds Transfer: The ACH network processes the transaction, transferring the funds from the payer’s account to the payee’s account. This process typically takes between three to five business days to complete.

This electronic system ensures that funds are transferred quickly and securely from one bank account to another. It’s important to note that like other forms of payment, eCheck payment might be subject to bank hours or business day regulations. For instance, if you make a payment late in the day, it might not be processed until the next business day. Fortunately, since everything is electronic, you can check your refund status or payment progress virtually anytime.

How Secure Are eCheck Payments?

E-Check payments are generally secure, employing multiple layers of security to protect against fraud and unauthorized transactions. Key security features include:

- Authentication: Ensures that the payer consents to the transaction by verifying their account information.

- Digital Signatures: Timestamped digital signatures help prevent fraud by verifying the authenticity of the transaction.

- Duplicate Detection: Identifies and prevents duplicate transactions.

- Encryption: Sensitive data is encrypted during transmission, ensuring that it remains secure even if intercepted.

- Certificate Authorities: Issue digital certificates to certify the ownership of public keys used in data encryption.

Security is a key aspect when handling credit card payments, eCheck transactions, and other forms of online payments. Although security measures are always in place and consistently updated, businesses and consumers must also do their part in keeping their account information and electronic transactions safe. This can be achieved by using secure networks, regularly updating passwords, and not sharing sensitive information.

What Can eCheck Payments Be Used For?

eCheck payments have wide-ranging applications thanks to their adaptability and convenience. They provide businesses of all sizes with an efficient method to securely transfer funds, regardless of whether you’re handling one-time payments or recurring transactions.

Here are some examples of when a business can utilize eChecks:

- Bill Payments: Whether it’s utility bills, insurance premiums, or monthly subscriptions, eCheck payments are an excellent way to handle recurring payments. These can easily be set up with the customer’s permission, creating a reliable and timely cash flow.

- Online Purchases: With the e-commerce boom, eChecks have become a preferred method for online purchases. As digital payments, they save customers time as there’s no need to input lengthy credit card information or sign up for third-party payment processors.

- Payment for Services: Service providers like consultants, contractors, and doctors can accept eCheck payments. It eliminates the hassle of dealing with paper checks and reduces the processing time of payments.

- B2B Transactions: eChecks can facilitate B2B transactions too. Many businesses prefer making payments via eChecks to maintain a digital trail of their transactions, something which is not possible with cash or paper checks.

- Rent Payments: eChecks can be used to pay rent, especially for commercial properties. This simplifies the transaction process for both the property owner and tenant, making rent collection and payment efficient.

- Donation and Charity: Non-profit organizations and charities could also benefit from accepting donations via eChecks. It’s a secure and straightforward way for donors to contribute, and they can even set up recurring donations.

What Are the Business Benefits of Using eChecks?

eChecks as a payment method offer a range of definitive perks that can enhance your business operations.

- Increased Efficiency: eChecks speed up the overall payment process compared to paper checks as the processing time is much shorter. This ensures faster receipt of payments, enhancing your cash flow and financial health. Often, the fee associated with eCheck processing is lower than that of credit card transactions.

- Greater Security: As discussed earlier, eChecks are encrypted and require authorization before initiating transfers, providing businesses with a secure method of handling payments.

- Versatility: eChecks can be used for a variety of transactions, such as paying utility bills, receiving donations, handling B2B transactions and more. This allows businesses to serve a wider set of customer needs and preferences.

- Lower Costs: Compared to the additional fees that come with credit card transactions, the overall fee for eChecks tends to be lower. This cost-saving aspect is an attractive point to consider for smaller businesses, which are often charged a percentage of the total transaction amount under credit card payments.

- Improved Record Keeping: The electronic nature of eCheck transactions makes it much easier for businesses to track and manage their financials. This can help simplify bookkeeping, assist with tax preparation, and enhance financial transparency for audits.

Every business is different and the benefits one can draw may vary, but there’s no denying that eChecks have the potential to simplify and secure business transactions.

What Do You Need to Start Accepting eChecks?

If your business is ready to start using electronic checks, you need to set up a few key components before you can accept eCheck payments. Here’s a step-by-step guide to help you get started:

- Merchant Account: The first step is to set up a merchant account with a bank or a financial institution. This account will allow you to accept eCheck payments.

- Payment Gateway: You need a payment gateway that can process eCheck payments. It authorizes payments for e-businesses, online retailers, and brick-and-mortar businesses. This digital portal will connect your business, your customers, and your bank while also providing encryption to secure sensitive data.

- Agreement with ACH Network: Accepting an eCheck payment necessitates a relationship with the ACH Network for processing. You will need to sign an agreement with the ACH, binding you to obey their rules and guidelines.

- Website or Platform: If you plan to accept eCheck payments online, you’ll need a website or a platform where customers can input their banking information. It should be user-friendly, secure, and equipped with the necessary technology to accept eCheck payments.

- Customer Authorization: Before processing an eCheck, you must obtain the customer’s written or digital authorization confirming the payment amount and terms.

- Relevant Software: Depending on your business type and size, you may need a specific software solution to handle your eCheck processing. A robust solution will offer features like instant payment notifications, comprehensive analytics, and easy integration with other banking systems.

In general, most businesses can start accepting eChecks with these steps. However, remember that each business is unique, and the requirements may vary.

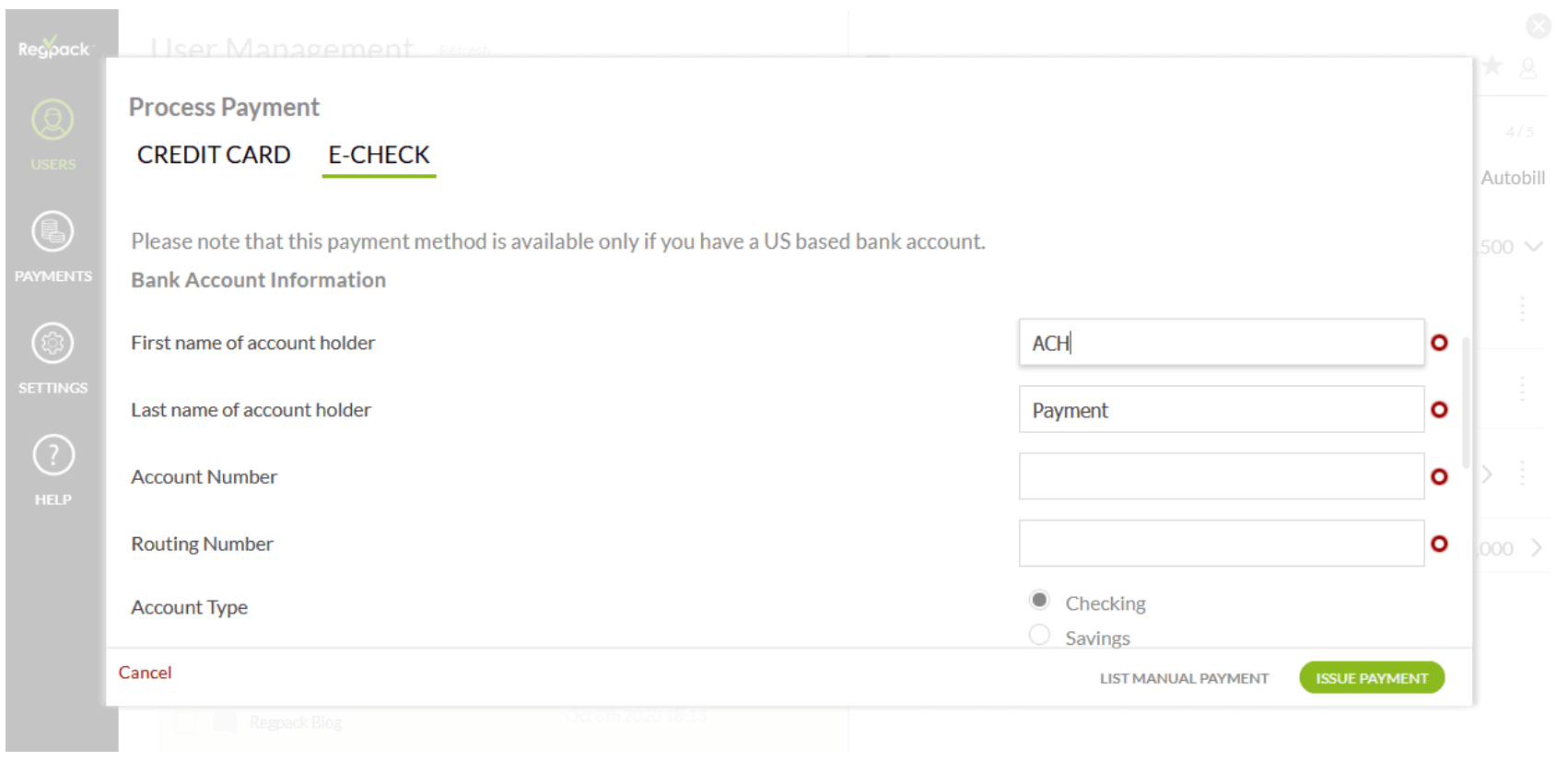

Accepting eChecks with Regpack

Accepting eChecks offers businesses a very efficient, secure, and swift method for processing online payments from credit card payments, wire transfers to international payments. It simplifies transactions, minimizes human error, and can ultimately have a positive impact on cash flow.

To harness the full potential of eCheck payments, finding the right service provider is crucial. That’s where Regpack comes in.

Regpack, an industry-leading online registration and payment software, allows businesses to receive eCheck payments while offering additional features that enhance the overall payment collection process. It integrates seamlessly with your website, simplifying registration and payment for your customers in one place.

By leveraging Regpack’s eCheck transaction capabilities, you can ensure better security, improved cash flow, and a streamlined business model.