Cash problems might seem like something that only happens to others, especially if your business is doing great at the moment and growing at a reasonable rate.

However, all it takes for you to face these issues is for your debts to be due before you collect your earnings. Just like that, you could be facing cash difficulties yourself.

Through this article, we’ll try to point out the eight best ways for you to increase your cash flow and avoid being stranded without enough resources to keep your business afloat.

Jump to section:

Maintain Cash Flow Forecasts

Speed up Payments

Review Your Pricing Strategy

Focus on Regular Clients

Ask for Better Deals From Suppliers

Make the Most Out of Your Assets

Scrap Your Low-Profit Services

Keep Debt Under Control

Maintain Cash Flow Forecasts

You can’t know where you stand with your finances unless you get down to business and make a note of your revenue and expenses.

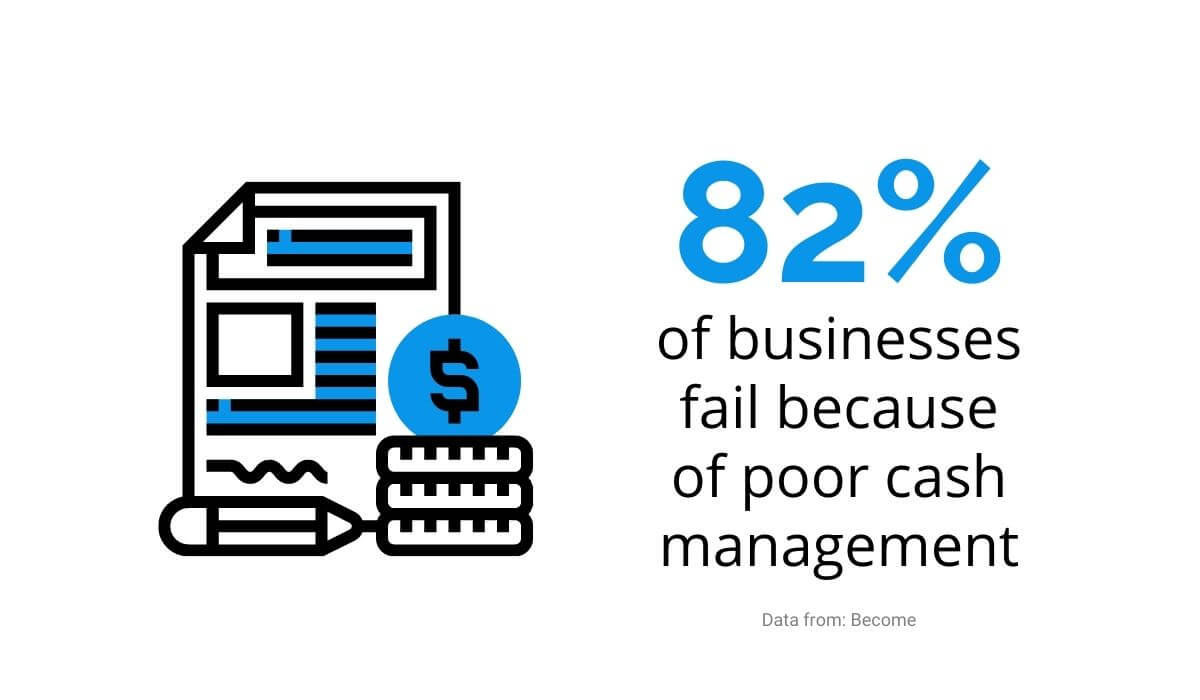

In other words, you have to manage your cash flow well and, to do this, you have to know what to expect. U.S. Bank experts confirm that 82% of businesses fail due to poor cash flow management, which only serves to prove its importance.

Source: Regpack

When you put your revenue and expenses down on paper and analyze them thoroughly, you’ll understand what to expect in the upcoming months.

This type of analysis will also help you detect where you’re spending too much money and where you’re not getting enough.

It’s advisable to do this at the beginning of every year, so you know what to expect.

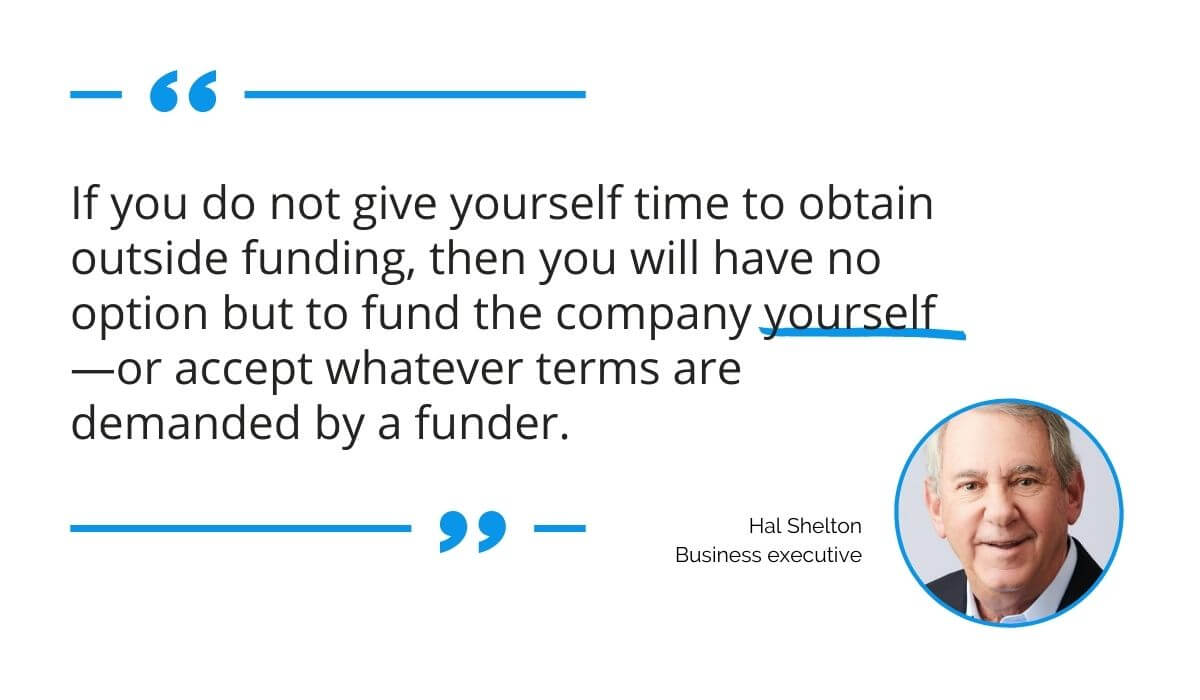

Hal Shelton, a business executive, thinks a yearly forecast is essential to see where you’re falling behind, as this gives you time to gather the necessary funds.

Shelton warns about the dangers of not staying on top of your cash flow and, therefore, not preparing for additional expenses in advance.

According to him, doing so will leave you with two options: covering the costs yourself or finding an outside funder. The latter may offer terms that could cost you a lot more than expected.

Source: Regpack

To avoid this scenario, sit with your team and write down the anticipated income for the next year on top of the everyday expenses. Be sure to make a budget for unexpected, last-minute spendings.

As the year goes on, you can check your projections and see if you’re straying too far from the original plan.

When you notice that you’re overspending, analyze why.

Is it a miscalculation, or did something unexpected happen?

Do this regularly to always stay in the loop. Not checking your accounts and cash flow averages for months can end up costing you a lot in the long run. You might catch an error months down the line, but at that point, it could be too late or too expensive to fix.

Speed up Payments

Anyone who wants to increase their cash flow should find ways of speeding up their expected payments.

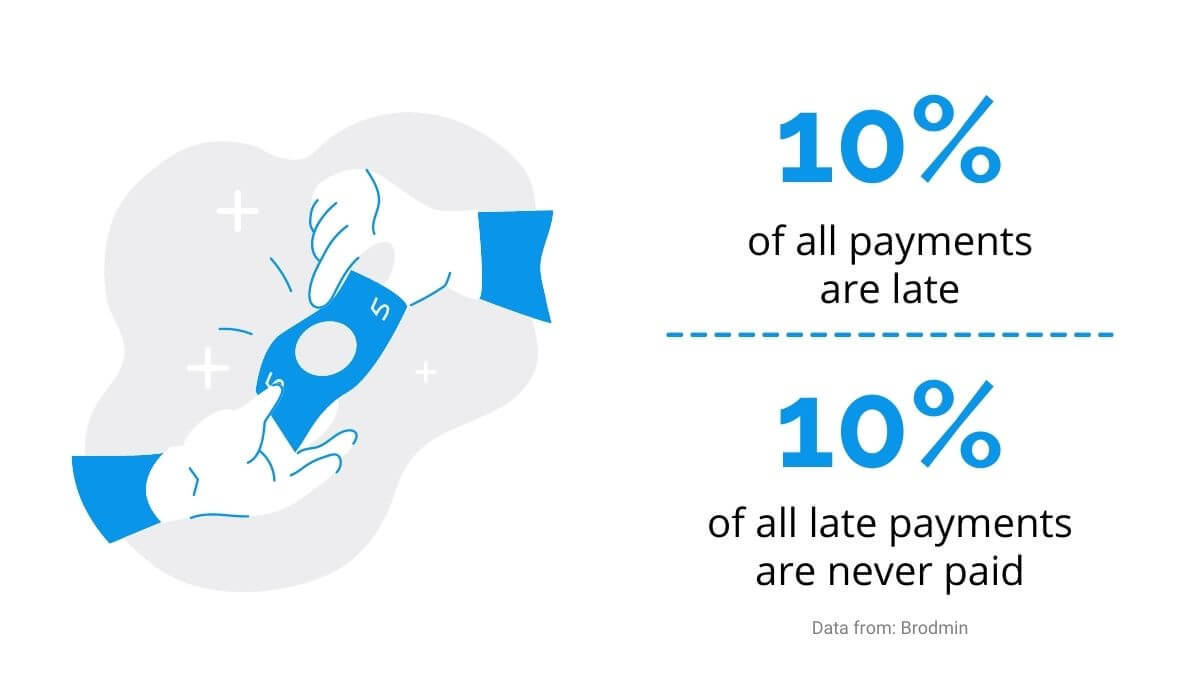

Late payments are a common struggle in the world of small businesses. More than 10% of all invoices are never paid, which means that one out of ten businesses wastes time chasing money they are owed but will never get.

Source: Regpack

However, you shouldn’t just accept these statistics as the normal state of things and expect late payments. Instead, you should do as much as you can to speed them up and incentivize your customers to pay early.

Here’s what you can do.

Start by sending invoices immediately after the sale of a product or service. To always stay up to date with your invoicing, consider using billing software that helps generate and send your invoices to customers.

Source: Regpack

When creating invoices, always make sure they state the due date, so the customers know when you’re expecting their payment.

Then, don’t forget to offer electronic payments. One of the best ways to get paid right away is to send your invoices electronically and add a click-to-pay button. That way, you’re allowing the customer to pay right away, if possible.

You may assume that only the younger generations use electronic payments. However, McKinsey states that more than four in five U.S. customers use some sort of digital payment nowadays.

Five years ago, the number was down at 72%, which shows that more and more people see the appeal of paying electronically.

Source: Regpack

Of course, if you incentivize early payments by offering discounts, your chances of getting paid faster and increasing your cash flow will rise significantly.

At the same time, you want your customers to know what will happen if they’re late fulfilling their part of the bargain, so think of introducing late payment fees.

Make it clear on the invoice or in the email you send the customers that you will charge a fee if the payment arrives after the due date.

Review Your Pricing Strategy

Setting your pricing can make or break your company.

At times, businesses get too optimistic about raising prices and earning more money for the products or services they offer. They make missteps and often end up losing customers, who turn to their competitors who offer lower pricing and similar quality instead.

Let’s take Netflix as an example. Today, they’re one of the most popular subscription services, worth $289.09 billion.

However, back in 2011, they took a big hit when they lost a whopping 800,000 subscribers due to a change in pricing.

Source: Regpack

Instead of offering one plan for $10 like before, Netflix split their service into two—DVDs and online streaming—pricing each at $8. Therefore, subscribers who wanted both services had to pay 60% more than before.

However, it’s also not a wise business decision to keep your prices below the industry average and not make the most you can for the quality you provide.

Therefore, the goal is to find that golden median—a price that won’t be too high for your customers to pay but will nevertheless help you see an increase in cash flow.

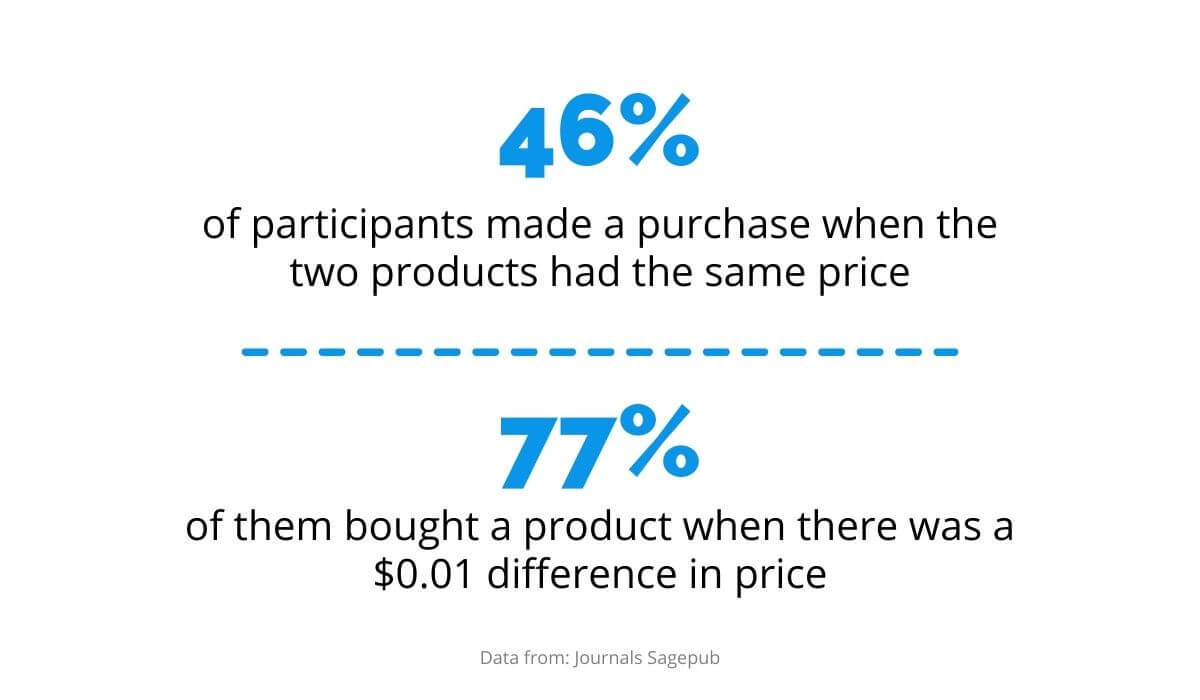

Here’s a tip for your pricing system: similar products or services shouldn’t have the same price if you want to make sales. A Yale study proved that adding a difference in price for similar products leads to more sales and profit.

Researchers gave participants money and told them they could either keep it or spend it on one of the two packs of gum.

Source: Regpack

Less than half of the participants chose to buy gum when the two packs had the same price ($0.63).

However, when the packs were priced differently ($0.62 and $0.63), the sale percentage jumped up to 77%, proving that even a minor difference in price between similar items can lead to a massive increase in sales.

When selecting the right pricing strategy, make sure to price similar products differently and not go overboard with increases.

Focus on Regular Clients

When you want to increase your cash flow, always focus on your regulars first.

After all, they provide the income you can count on each month while you can never know how many new customers you’ll acquire in the following months.

It’s also no secret that it’s easier and cheaper to retain a customer than to attract a new one.

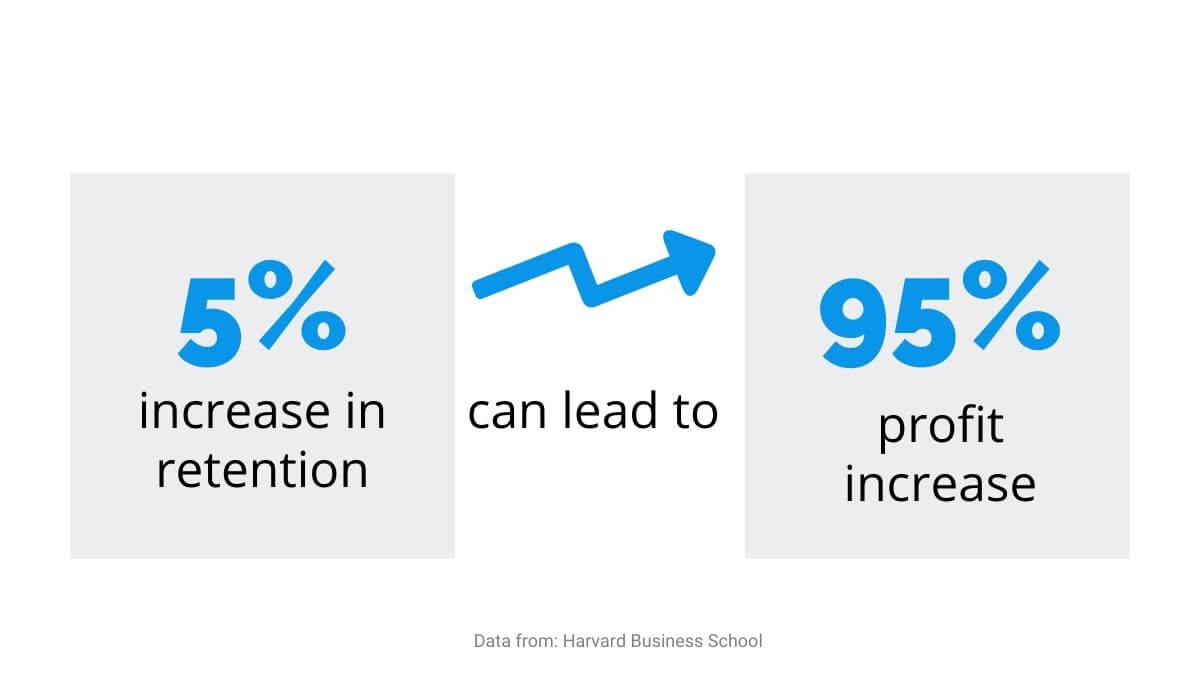

In 2000, Harvard Business School published their findings regarding this point and found that just a 5% increase in customer retention can result in a 25-95% increase in profits, making retention a wise business goal.

Besides, getting new customers can cost 6-7X more than retaining them, which also points to the necessity of prioritizing retention.

Source: Regpack

After successfully retaining customers, it’s time to use their loyalty to maximize your cash flow.

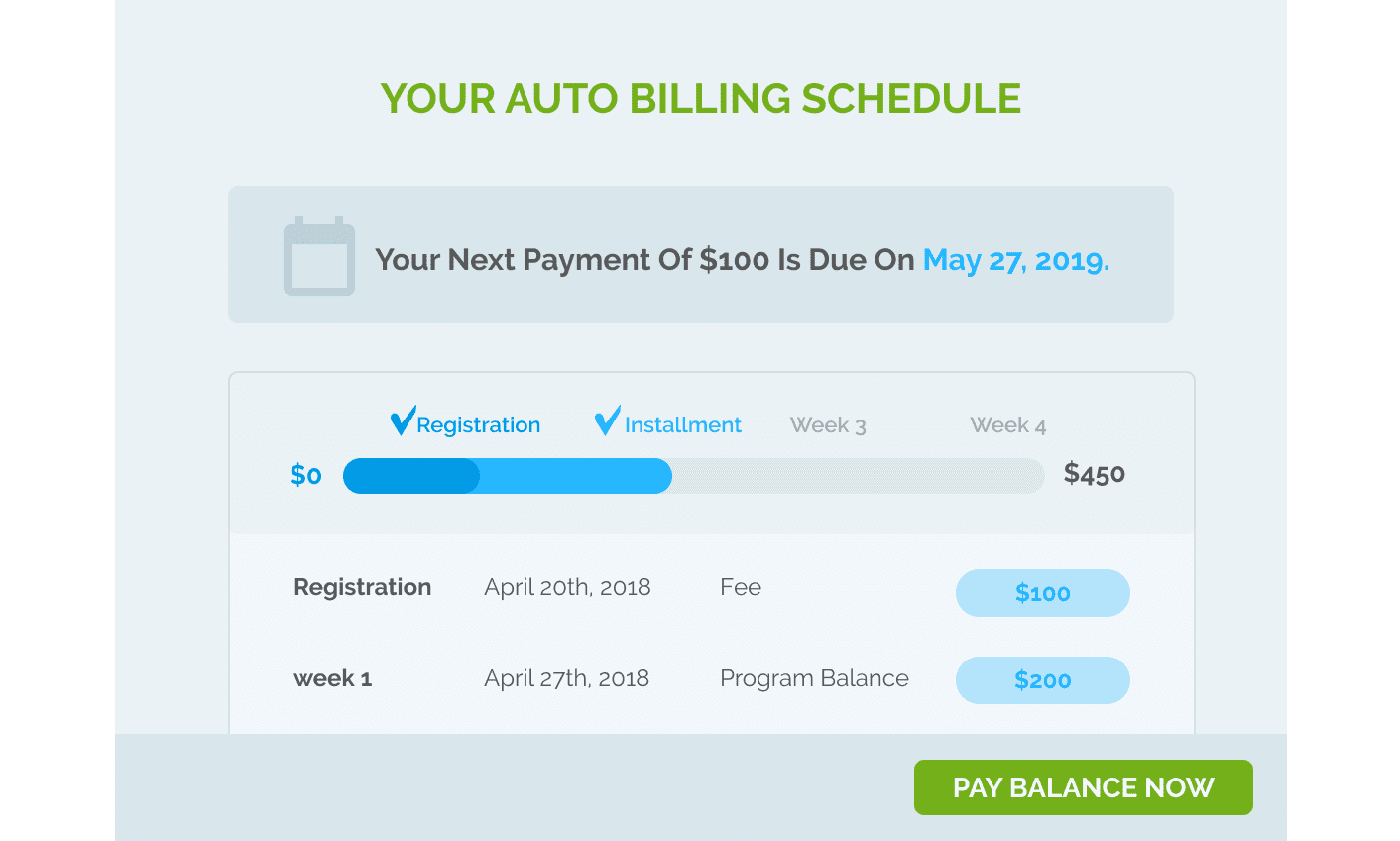

A good way of getting regular customers to pay on time is to offer recurring payments. This payment model allows your customers to send you their payment information only once, after which you charge them automatically on a regular, previously agreed-on basis.

What this payment type does for your company is pretty obvious: you get paid on time every time, without neither you nor the customer having to put in a lot of effort.

In other words, this type of payment increases your cash flow and makes payment a hassle-free experience for your clients.

Another great tactic to increase your cash flow with the help of your existing customer base is to upsell.

You shouldn’t offer just anything and hope the customer will take you up on it simply because they’re loyal to your brand.

Instead, take the time to analyze your customers’ purchase habits and offer them a service or product complementary to one or more of their previous purchases.

But, to do this, you also have to understand what your customers need to succeed.

Which one of your products or services could take your users to the next level? If you guess it right and successfully help the customers, your relationship with them and, therefore, their loyalty to your brand will improve.

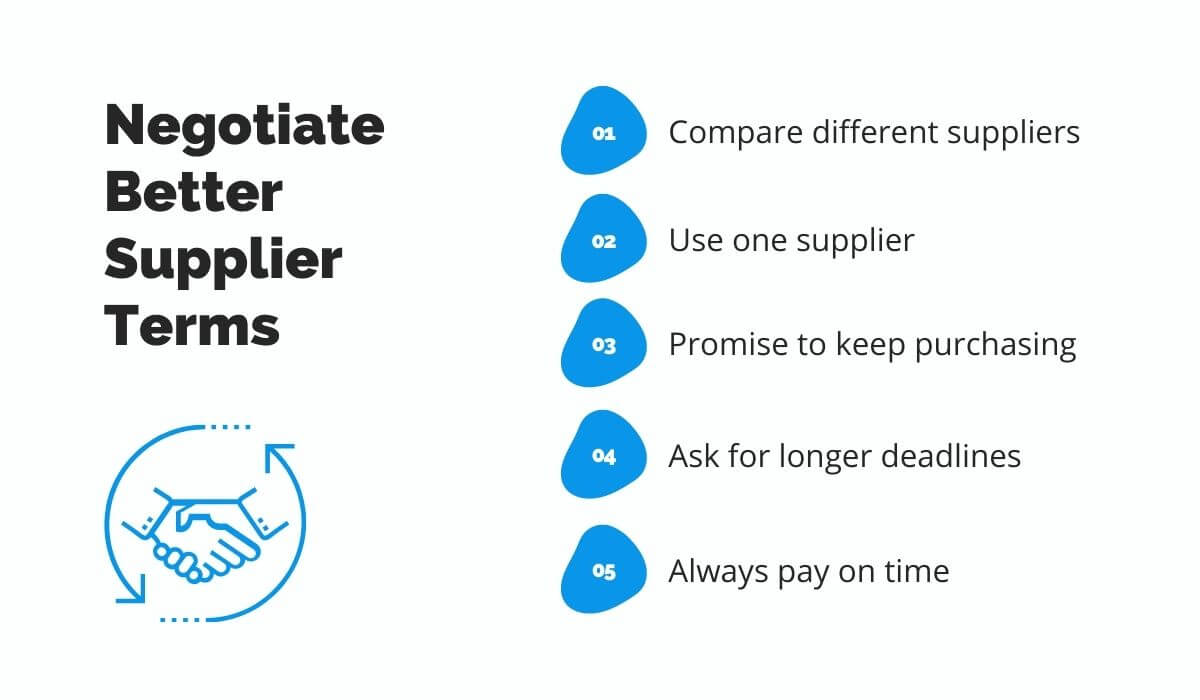

Ask for Better Deals From Suppliers

This one’s pretty straightforward: if you want to have more money, find ways to spend less.

Of course, this doesn’t mean you should only buy the cheapest materials, as this will affect your final product and service, which will reflect poorly on your business.

So, the goal is not to skimp on necessities but rather find more affordable options without sacrificing quality. One of the best ways to do this is to negotiate better terms with your suppliers.

Source: Regpack

Firstly, investigating what different suppliers have to offer so as to improve your understanding of what’s out there will allow you to negotiate better.

Go to one supplier and explain which quote you got from another to see if they can match the offer or extend a better deal.

Then, think about using the same supplier for everything you need as this can help you become a candidate for bulk discounts. In other words, buying from the same person can help you get the same merchandise for less money.

If you are happy with your supplier, you can always try to get a better deal by promising you’ll keep doing business with them for a long time.

Become a recurring customer, and you’ll become a priority—we’ve already explained just how necessary customer retention is for companies.

When you are tight with cash, always try to negotiate longer payment terms with your supplier. Instead of paying off the supplies in a month, ask for two.

The extension will help your cash flow and generally shouldn’t be a problem for the supplier if you ask for it sufficiently in advance.

Another thing that can help immensely with supplier negotiations is reliability. When you have a history of being a good customer, the supplier is more likely to trust you and offer you better terms.

Paying early pays off too, as you could get an early-payer discount and save some money.

Make the Most Out of Your Assets

When you need to improve cash flow, consider getting rid of the inventory you simply don’t need.

Clearly, this doesn’t mean scrapping half of what you own, but it helps to examine what you’re working with and whether it’s paying off.

Research shows that most companies have 20-30% of obsolete inventory. In other words, companies are holding onto assets they have no use for.

This can be a significant drain on your resources, as simply storing such assets can be a drain on your resources.

Source: Regpack

Once you buy a piece of equipment, like, say, a forklift, it starts depreciating. In other words, the simple act of maintaining it, replenishing fuel, and keeping it in storage incurs costs for your business.

This can be particularly damaging if you don’t use it often, either because you don’t have much need for it or because it’s become dated.

In those cases, it’s a good idea to try to recoup your costs by opting for leasing or renting the equipment you don’t use regularly.

That way, the lessor is responsible for maintenance, and your company only has short-term expenses while you use the piece.

You can also rent out or even sell obsolete equipment to get an influx of cash.

Scrap Your Low-Profit Services

Not all your services will perform the same way. Some will simply be more popular with your customers, which is totally fine unless the less popular ones negatively affect your cash flow.

In fact, when you don’t get a return on investment on one of your services, you should start thinking about getting rid of it, no matter how much you like it.

Thankfully, it’s relatively easy to scrap your services. However, you should be careful about getting rid of a service prematurely, mainly if you’re basing the decision on temporary results.

Source: Regpack

For example, if your business offers organization of outdoor events, of course, you’ll sell such services more during the sunnier and warmer parts of the year.

But, if such events end up costing you more than you earn from them, you should scrap them and come up with something more profitable.

Also, don’t forget about all the service-related inventory once you decide to get rid of a service for good.

Let’s say you organize events, and your most popular ones are the educational type. Such events require materials like notebooks, pens, or tablets.

Once you cancel the service, you should try to find a purpose for these materials. If you can’t find a use for them after scraping the service, it’s time to resell or donate the related inventory.

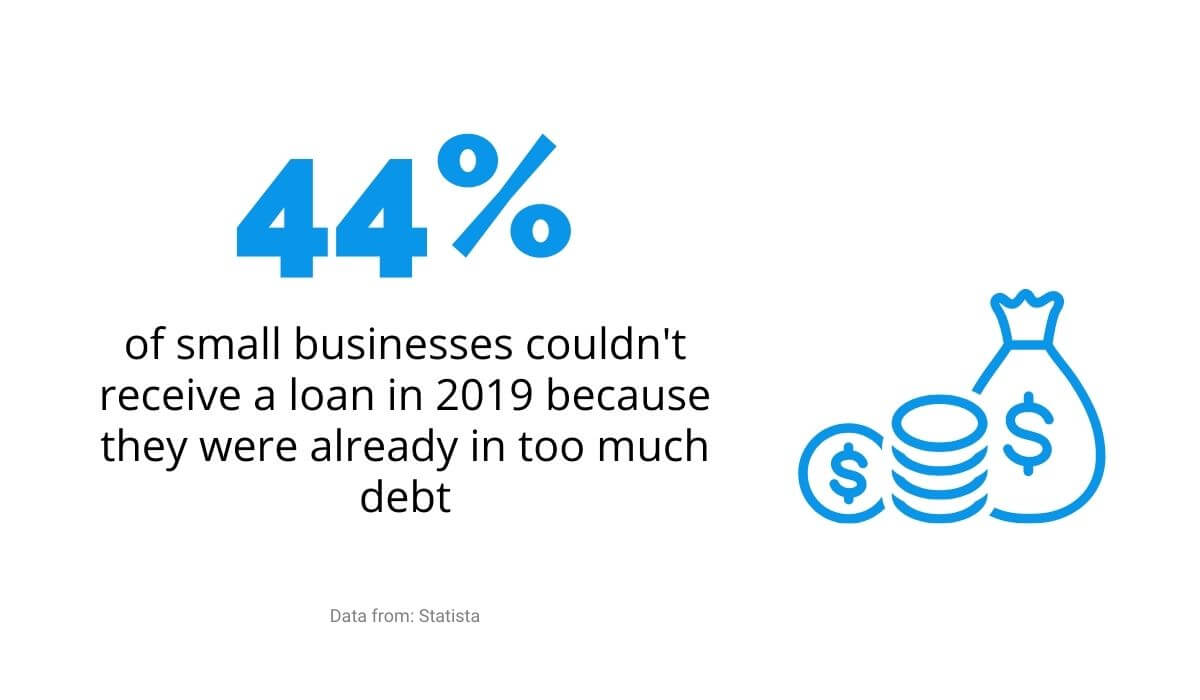

Keep Debt Under Control

The first step of increasing your cash flow is decreasing your debt or at least keeping it under control.

Think of it like this: the less money you owe, the better your cash flow.

Besides, if you’re already in debt, you could get turned down when asking for a new loan. 44% of small businesses get turned down when applying for a loan because they already have too much debt.

You don’t want that to happen to you when you’re in need of a loan. So, what can you do about it?

Source: Regpack

To understand how to not get into even more debt, know how much you owe in the first place. Understanding the total and monthly installment amounts will help you figure out where you’re standing and what you can do to decrease your debt, if possible.

Know precisely what you’re paying each month and see if there’s a way to prioritize the spending.

For example, you may be spending money on something that’s more of a luxury than a necessity, thus putting yourself in further debt. Cut all the expenses that aren’t necessary to keep your business afloat.

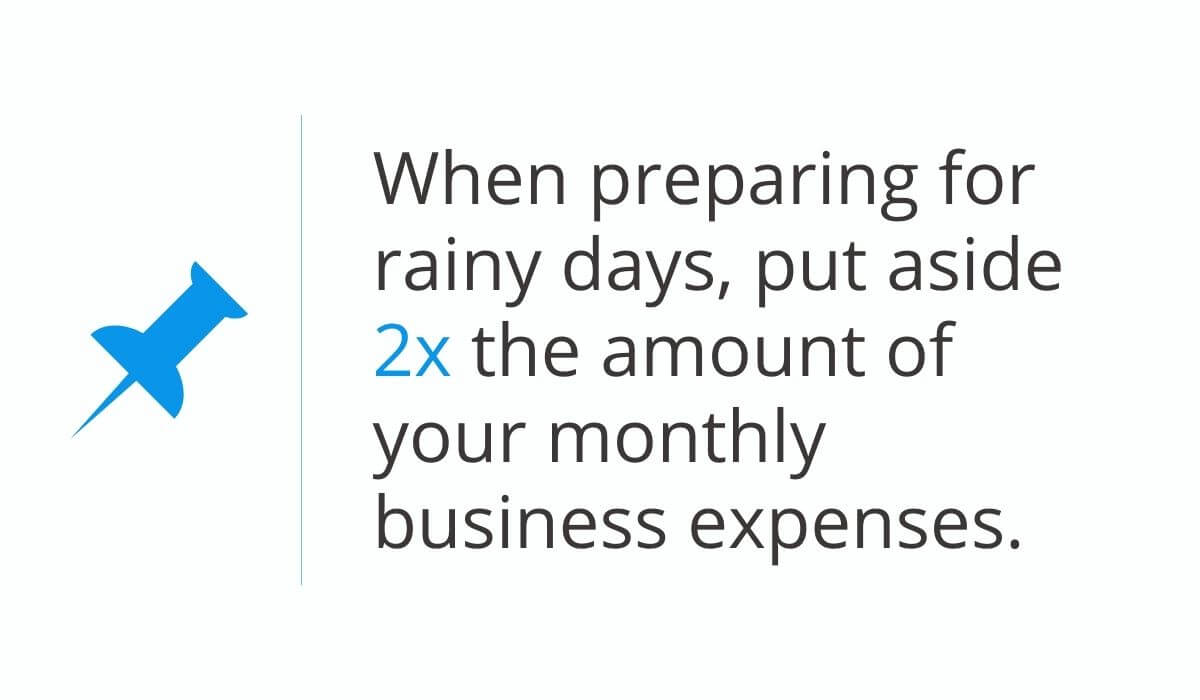

It’s essential to know how much you owe each month to prepare for the worst-case scenario. A good rule of thumb for savings is to have enough money to cover two months of debt.

Source: Regpack

In other words, if you spend $5,000 a month on your business debts, you should have at least $10,000 saved for rainy days. That way, you’ll avoid going into even more debt. It’s also very important that your business is registered as an LLC to protect your personal assets and yourself from liability should the business become overwhelmed by debt. Thankfully, there’s a helpful resource that can help you find the best LLC formation service available online.

Conclusion

The easiest and best way to never run out of cash in the business is to stay on top of your spendings and earnings by creating cash flow forecasts.

Such forecasting will let you know what to expect, and when you notice that you’re straying from the plan, you can determine the cause.

Your pricing may be off, or customers might be paying late. Moreover, you may be paying too much for your supplies or still offering services that just don’t perform as expected.

Analyzing and keeping up with your cash flow will help you spot each of these problems on time.