Many small businesses are born from creativity and enthusiasm, so their founders struggle with planning a budget. However, they soon find that budgeting is essential for their survival.

This article will explain why the budgeting process is important and how it can help you successfully navigate your small business budget in these demanding times.

- Cash Flows Are Managed More Efficiently

- Financial Goals Are Reached Faster

- Debt Is Managed More Effectively

- Resources Are Better Allocated

- Financial Reporting Is More Accurate

- Potential Investors Are Better Informed

- Conclusion

Cash Flows Are Managed More Efficiently

For small business budgeting, cash flow is often their biggest weakness. With unstable revenues and late payments on one side, and both fixed and unexpected expenses on the other, even profitable businesses can run into trouble.

As budgeting gives you the power to plan and track your earnings and expenses, it also allows you to forecast cash flows, thus helping you to manage them more efficiently.

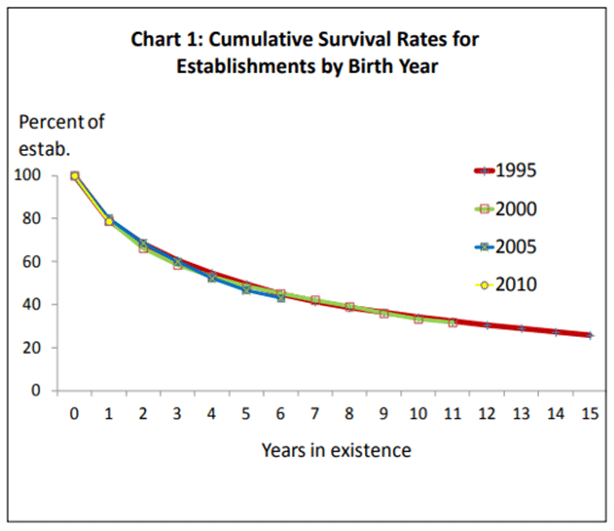

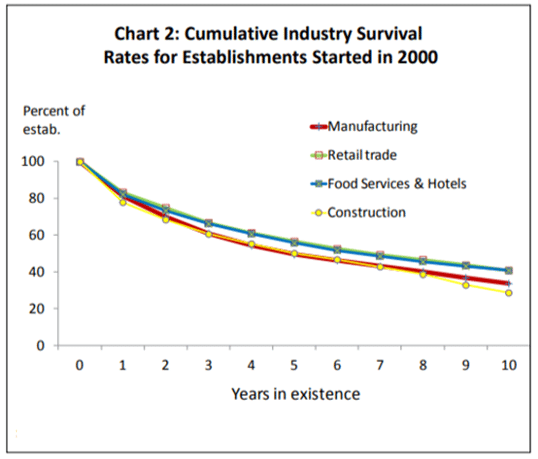

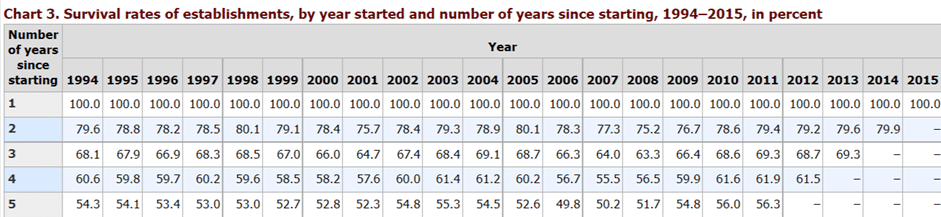

According to the U.S. Bureau of Labor Statistics (BLS), 20% of new businesses will go under within the first two years from their inception, 45% within five years, and 65% within ten years.

As you can see in the chart below, the survival rate of businesses is largely unaffected by whether they opened during a positive or negative economic cycle.

Source: sba.gov

In other words, although starting a business while the economy is booming has its advantages, that doesn’t guarantee its survival any more than opening it during an economic crisis. And while the state of the economy or the industry may not be crucial for business success, budgeting, and cash flow forecasting certainly are.

Investopedia’s research shows that reasons why businesses fail include bad business planning, lack of financial planning, and inflexibility.

Source: Investopedia

These reasons can stem from poor or non-existent budget planning that results in inadequate cash flow management.

With cash flow, it’s all about timing, especially for small businesses with little or no savings. This means that, although your business would normally be profitable at the year’s end, it might not last until then because, for example, a key client has failed to pay on time earlier in the year, and your responsibilities couldn’t wait that long. That’s why creating a well-thought-out cash flow budget can be crucial for the survival of your business.

Making a budget plan allows you to forecast the money that’s supposed to come in and go out from your business in the next one, three or six months, as well as prepare for any contingency.

In short, proper budget planning can shape your business decisions and ensure your cash flow covers all primary monthly expenses like payroll and supplies and other (un)planned expenditures so that your company doesn’t go belly up as almost 50% of them do in the first five years.

Financial Goals Are Reached Faster

Small businesses need to carefully plan their budget to reach their overarching strategic, operational, and financial goals. Budgeting can be a road map to achieving both short and long-term goals faster, as it helps your entire team focus on the financial priorities of your business.

A survey from Clutch shows that about 65% of small businesses didn’t have a formal, documented budget in 2020. However, it also shows that 65% of those businesses that did have one managed to stick to it. Moreover, 15% of them stayed under the budget, thus besting their own plans. This shows that the biggest advantage of budgeting comes from having a structured plan. Just the act of planning your finances forces you to think about what you want your business to achieve.

Naturally, there are different kinds of accounting software tools out there to help you plan your financial goals, like QuickBooks.

Source: QuickBooks

This software is particularly geared towards small-to-medium-sized businesses, comes in on-premises or cloud-based versions, and can handle just about anything related to setting and monitoring your financial goals. So, once you’ve determined what your business goals are, you can use such a digital solution to track their progress.

QuickBooks gives you a clear view of your business expenses and business finances, thus giving you the financial clarity to see whether the goals are being reached or not.

Source: QuickBooks

Whether you’re using software to set financial goals, you should strive to make them SMART (Specific, Measurable, Achievable, Relevant, and Timely).

There is another benefit of budgeting that can accelerate the realization of financial goals. If the budget is clearly communicated to employees, it’s easier for them to understand the strategic priorities, operational objectives, and business goals of the entire organization. This can increase productivity and prevent overspending.

Hence, budgeting helps you stay focused on your financial goals. If those goals are well-defined and monitored, you can adjust your business operations to achieve them faster. And if they are communicated across your organization, employees can prioritize acting in ways that help in reaching them, thus growing your business.

Debt Is Managed More Effectively

If your business has debts and you want to manage them efficiently, you must first gain a thorough understanding of your current financial decisions. Budgeting will help you identify the strengths and weaknesses of your business and ways to manage debt more effectively.

With 70% of small businesses having outstanding debts, debt management is a critical component of your business success.

In some cases, a certain amount of debt is a necessary step towards increasing future profitability—for example, when you take out a loan to pursue a promising opportunity or invest in equipment that will significantly reduce costs in the long run. However, debt is often the result of the inability of a business to bridge a particular financial gap due to a lack of capital.

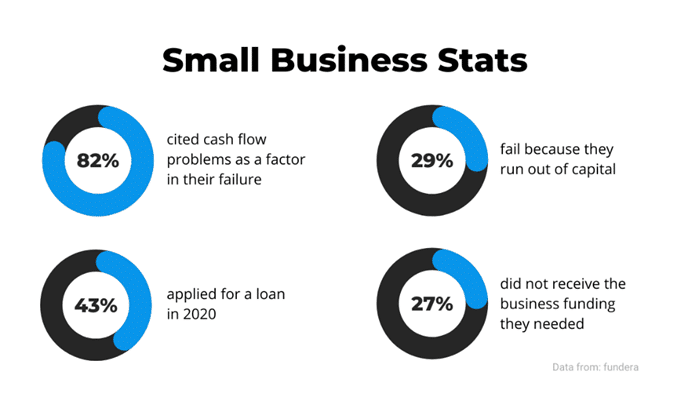

As said, this is the weakest point of many small businesses. Just consider these numbers:

Source: Regpack

You can see that 29% of small businesses failed because they ran out of money and that cash flow issues played a key role in their failure. Who knows how many of those businesses would have survived if they had access to funding at the right time?

Restaurants are a classic example of this. Long known as a risky business, their reputation follows them in the financing world and results in banks’ reluctance to give loans for their opening, operation, or expansion. And that reputation is incorrect. As the chart below shows, businesses in different industries have similar survival rates.

Source: sba.gov

As you can see, data dispels the myth that some industries are riskier than others. However, that myth persists, and, in the case of restaurants, itself hinders the chances of success of certain business ventures. Of course, the market is responding to this as an opportunity, so now there are many alternative sources of financing for restaurants and other small businesses.

Regardless of the industry your business is in, keeping an operating budget will allow you to detect which costs can be avoided, reduced, or adjusted, so you have a little more breathing room in a fix. It will also allow you to prioritize your debts and maybe think about refinancing some of them.

All in all, effective debt management requires efficient budgeting. It gives you crucial information about your business, your debts, and ways to manage both successfully.

Resources Are Better Allocated

As said, small businesses often have slim resources. Budgeting will ensure you keep track of what resources you have, how they are allocated, and what can be done to improve their distribution. In other words, it can give businesses more freedom and flexibility to handle unexpected situations.

The initial planning stages of any business usually involve a broad resource allocation followed by a more detailed elaboration of where exactly those resources will be used.

Of course, this can be done in Google Sheets or Microsoft Excel, but nowadays, other more practical digital solutions exist, like FreeAgent.

Source: FreeAgent

This software is intended for small business owners and automates basic budgeting and accounting tasks.

You can monitor how your financial resources are allocated and gain valuable insights into how you can adjust them for better business performance or if something unexpected happens. In fact, unforeseen expenses and emergencies are often a setback for efficient resource allocation.

However, businesses that rely on a budget have a clear view of their financial performance and usually don’t overspend. As we mentioned earlier, 65% of them manage to do so, as per Clutch’s survey. When you plan your spending, you should always strive to put some funds to the side.

According to Keith McFarland, founder of RED Strategy Group, businesses should figure out the core leverage points of their business model and make sure these are adequately funded.

Then he goes on to say:

“Cut anything that is not in the 20 percent of the activities that generate 80 percent of the results.”

In other words, look where savings can be made without jeopardizing your primary revenue-generating operations, and use those savings to create a solid emergency fund. Having one has been especially important in recent times.

In conclusion, budgeting makes you focus on what exactly your money is spent on. Furthermore, this helps you create a financial “cushion” to soften the blow of unforeseen events.

Financial Reporting Is More Accurate

Financial reporting serves to show you and others whether your business was financially successful or not during a specific period.

What’s more, such reports provide invaluable insights for more accurate forecasting and better-informed decision-making. And they all stem from proper budgeting.

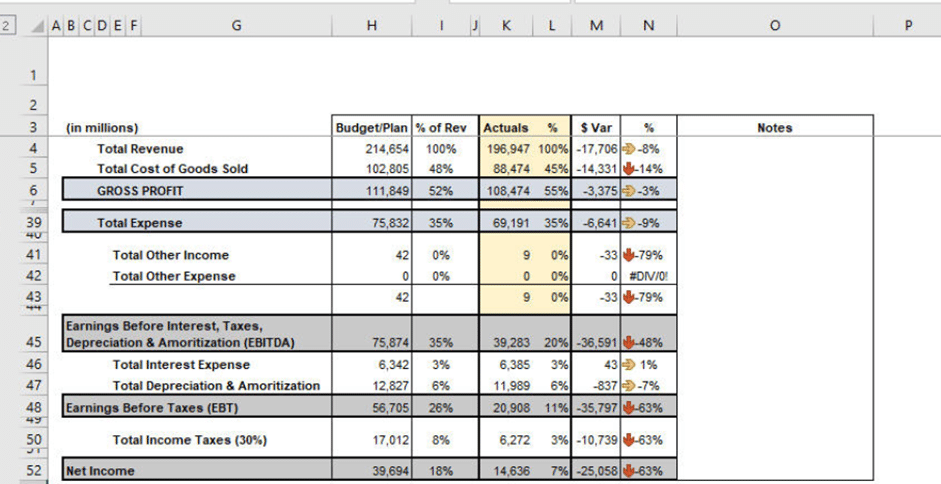

You can compare the budgeted and actual numbers your business earned and spent in a given period. This process is called budget variance analysis. In its simplest form, this analysis consists of two columns, one with the budgeted/planned results and one with actual results.

Here’s a classic example.

Source: wallstreetprep

You can see the budgeted/planned values and their percentage of revenues, followed by actual figures and their percentage. The last two columns represent a numerical and percentage variance when these values are compared. They enable you to identify where you over- or underestimated your budget items more quickly.

This is particularly useful when creating a new budget as it allows you to make more accurate projections, find room for potential cost cuts, and improve the accuracy of your financial reports.

Many software and other digital tools can help you do budgeting and financial reporting more easily and accurately, like Prophix.

Source: Prophix

This cloud-based software allows you to create standard or customized financial reports. It provides a single source of financial data, thus allowing for easier budgeting, reporting, and re-forecasting processes. This or other tools, coupled with variance analysis, enable you to make data-driven budgeting decisions.

In other words, more accurate financial information leads to more precise budget projections. And the more financial data you have, the more precise your forecasts become.

All in all, budgeting makes financial reporting easier and more accurate. Conversely, financial reports make future budgeting more precise. This allows you to make informed decisions, discover ways to cut costs, and quickly take advantage of business opportunities.

Potential Investors Are Better Informed

Finally, if you aim to attract investors and become a successful business, you must inform them of what investments you have made so far and what plans you have for the future. And to do that, you need budgeting.

In the words of Victor Butcher. a small business advisor from Memphis, Tennessee, a budget is like a roadmap for your company.

We could say that the same is true for potential investors in your business—your budget is their roadmap for understanding where your business is going. Whether you’re looking to expand your new business to other venues or have a great idea for a new app, you’ll find that investors are careful to jump aboard.

Why? Because they are aware of the BLS data we mentioned, showing that nearly half of all new businesses will fail within five years. Here it is.

Source: BLS

That’s why investors are looking for evidence of financial investments you already made or are prepared to make. Along with other signals, this shows your commitment to the idea you’re asking them to invest in.

When it comes to investors, they usually have two financial questions in mind: How much do I need to invest, and how much will I get in return? Also, when will I need to invest, and when will I start getting it back? Budgeting can answer both of these questions.

For example, if you’re starting from scratch, a budget will tell you the total startup costs for a business, hence informing potential investors about the overall project size and where their money will be used. If you’re looking to expand, it will indicate your operational costs and expected profits after the expansion.

But the full strength of budgeting arises when financial projections are concerned.

A detailed projection of the future of your business that investors want to see usually includes pro forma financial statements, underlying assumptions for the figures given in them, return-on-investment (ROI) analysis, income statements, loss statements, and future cash flow predictions, including marketing costs, labor costs, variable costs, production costs, and even unexpected costs.

Thus, it can be said no investor will give their money without seeing a budget. And the better informed they are, the more likely it is they will decide to invest in your business.

In the meantime, if you want a better overview of your revenue by managing your customers’ registration and payments online, you can try Regpack.

Source: Regpack

Our online registration software Regpack offers robust reporting and analytics features that provide insight into any aspect of your business, including its financial performance. With it, you can generate customized payment and sales reports that allow you to present this information to investors in an easily understandable way.

Conclusion

It’s evident why budgeting is essential for businesses of any size. Even the smallest operations have to plan and track their financial situation.

As we’ve seen, effective budgeting will enable more efficient cash flow and debt management, help you reach financial goals faster, and allocate resources better while also resulting in more accurate financial reports that will help you persuade potential investors of your professionalism.

We hope this article has moved you forward on your path to business success.