Payment processing software helps your business avoid data breaches, reduce late payments, enhance the customer experience, and so much more.

Equipped with the right tool, much of the work involved in payment processing and management that used to bother you and cost your business labor hours becomes automated.

Today, you’ll learn the seven biggest reasons to use payment processing software.

- Easier to Meet Business Needs

- Stronger Payment Security

- Enhanced Customer Experience

- Fewer Late and Failed Payments

- Improved Record-Keeping

- Faster Account Reconciliation

- Informed Decision-Making

- Conclusion

Easier to Meet Business Needs

Payment processing software keeps your business from falling behind when it comes to payment trends.

Using it allows you to avoid that frustrating period of scrambling and trying to figure out how to meet the new payment expectations of your customers.

You avoid it because, whenever there’s some fancy new payment method or invoicing best practice in your industry, the payment processing software provider updates its platform to accommodate it.

It’s their job to keep track of these things, not yours. Offloading this responsibility to an expert can be a real relief for your business.

Even more importantly, it’ll keep you from losing customers too.

Instead of losing a customer to a more tech-forward brand, or, for instance, accidentally collecting revealing personal data you don’t need, you’ll win a new loyal buyer.

But changes in the payment space aren’t the only changes that payment processing software helps you manage.

Another one that comes to mind is scaling your business.

When you start taking on more clients, you’ll have features that prevent this rise in customer payments from affecting your team’s workload.

If you’re using online payments with automated invoicing, for example, customers pay online without the help of your staff.

Source: Regpack

No one will have to build and send an invoice. It all happens automatically. Scaling thus becomes easier on your business. No backs are pulled trying to lift that heavier weight.

Whether you’re collecting payments from 30 or 100 people, the workload is about the same, since it’s done mostly by the software. You likely won’t have to hire new people.

In sum, it becomes easier to meet your ever-changing business needs when you use a payment processing platform that’s always improving its service in line with the changes in the market.

Stronger Payment Security

Most payment processing platforms are PCI-compliant, meaning they follow a set of security standards set out by the Payment Card Industry Security Standards Council—a much less exciting council than the Council of Elrond, but an important one nonetheless.

Source: Tolkien Gateway

They might not slay orcs or save mankind from imminent annihilation, but they do ensure that sensitive financial data is kept out of harm’s reach.

Heroes, like spiders, can be found almost anywhere if you look hard enough.

Some of the requirements to receive PCI-compliance are installing and maintaining a firewall, using updated antivirus software, and encrypting cardholder data.

When you have a software solution that’s PCI-compliant, it is a lot easier to keep your business in the good graces of the council as well.

The software handles most of the legwork when it comes to keeping in step with the 12 requirements.

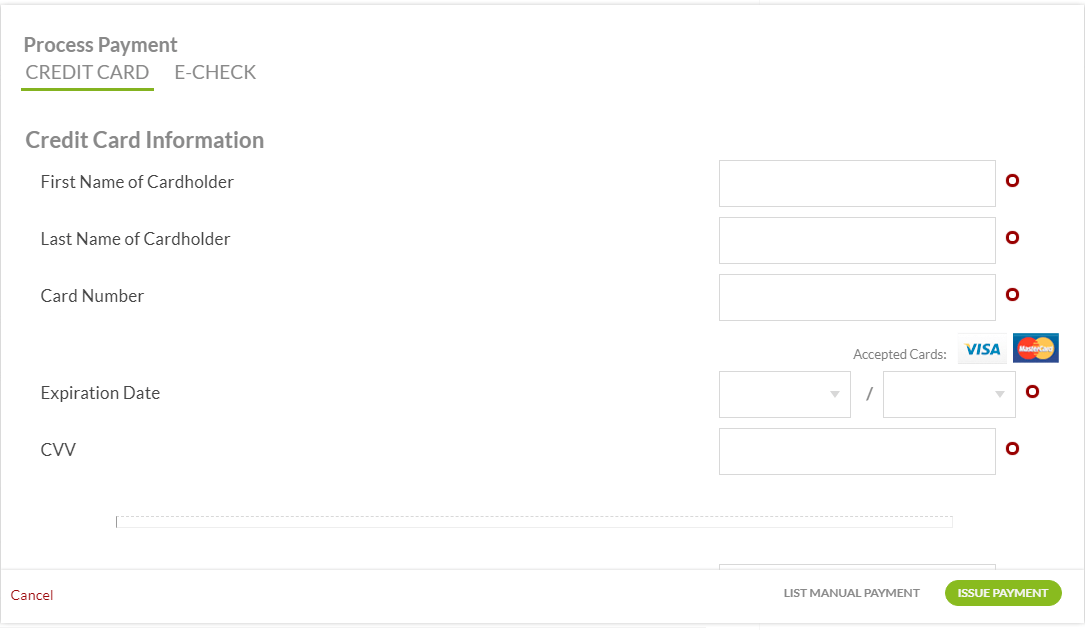

A quality payment processing provider should tell you their security protocols somewhere on their website, like here.

They shouldn’t beat around the bush when it comes to this important functionality.

Another benefit of using a secure software tool is that you can boast about it on your checkout page:

Source: Yellowstone Forever

When customers see these badges and PCI-compliance signs, they’re more likely to trust you.

They’re more likely to finish the purchase and submit their credit card details into your online payment form.

Knowing you have strong security will also keep you from having to worry about security breaches, not to mention worrying about what you’re going to do to resolve a breach that has already occurred.

These breaches can do serious damage to a small business.

They erode customer trust and hurt your brand reputation, something most CMOs think is the worst result of all:

Source: Data Privacy Manager

Of course, as a chief marketing officer, it’s probably in their best interest to say that brand reputation, something they’re paid to control, is the most important thing for a business to protect.

Despite that potential bias, we all know it’s bad to come across as unstable and insecure to customers. It’s one of the few types of bad press that isn’t actually good press.

So, get a tool that’s going to securely transmit, store, and process your customers’ financial data. This isn’t something to take a risk on.

Enhanced Customer Experience

As humans become more and more averse to speaking with other humans, payment processing software becomes more and more desirable, as it provides buyers with a delightful small-talk and eye-contact-free experience.

We hope that the statement above is a joke like we intended it to be, and not a true statement about human preferences, but, regardless, there is at least a kernel of truth in it.

Buyers have started to want more self-service payment experiences. Note the self-ordering kiosks in McDonald’s and other retailers.

Buyers these days don’t want to have to place a call or head to an office to submit their payment.

They want the freedom to choose. And they often want to do it online from the comfort of their couch.

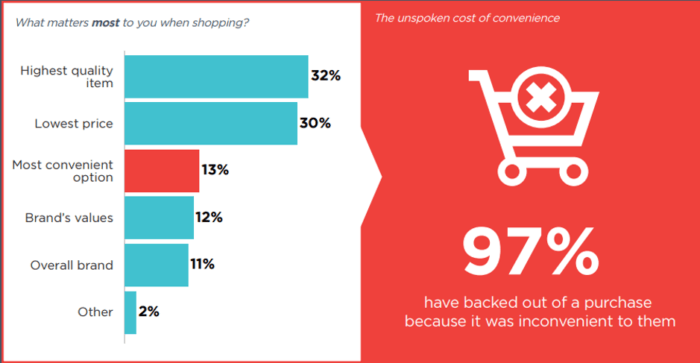

Now, this desire is probably not because they’re tired of humanity, but because it’s just more convenient. They only have so much time.

In fact, 97% of buyers have backed out of a purchase because the process was too inconvenient:

Source: Smart Insights

Payment processing software offers this convenience they crave, first and foremost by allowing them to pay online via web forms.

They can make payments and register using their mobile, tablet, or desktop devices, provided they have wifi.

But there are other convenience features aside from self-checkout offered by these software platforms.

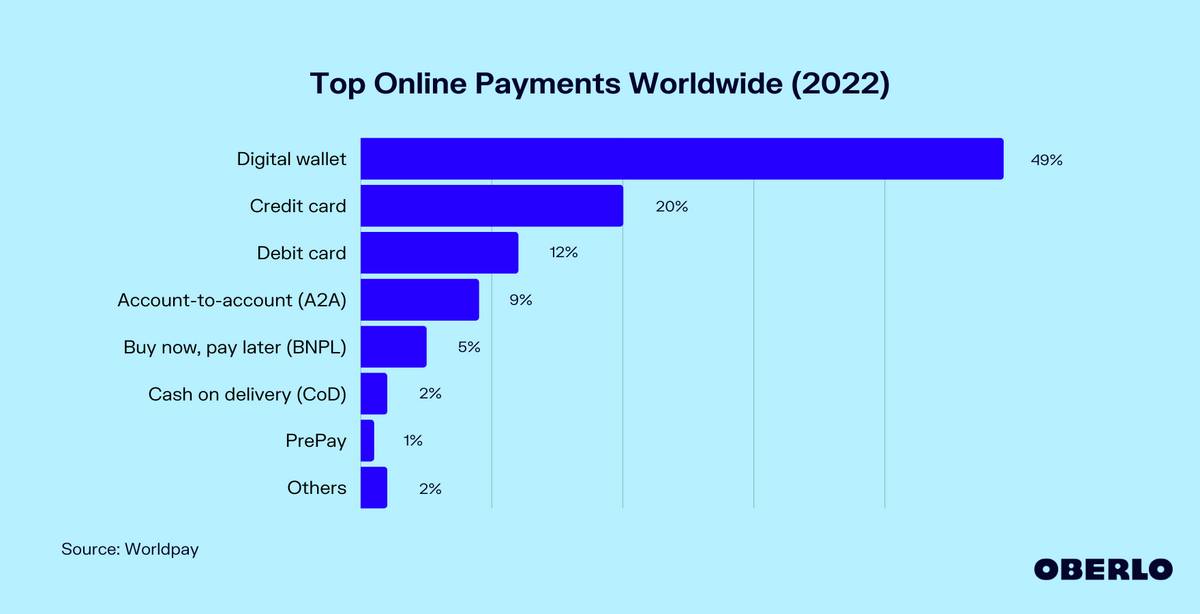

For instance, a payment processing software like Regpack enables your customers to pay using their local currency and their preferred payment method, whether it’s ACH payment, credit card, or one of the other popular methods:

Source: Oberlo

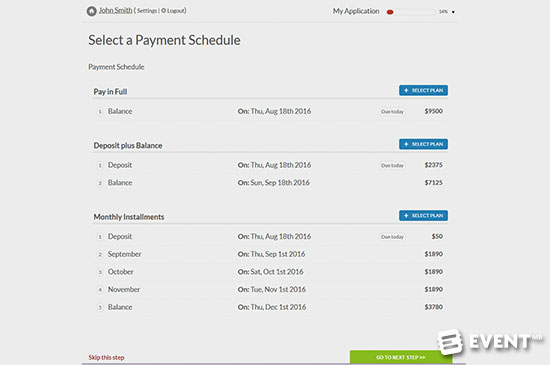

Regpack even allows you to offer them personalized payment plans.

This way, they can split up larger purchases into multiple smaller payments that they pay over several months or years.

For example, the business below offers customers three ways to pay:

Source: Regpack

When customers choose this recurring payment style, they can also sign up for autopay. This feature will make sure they’re automatically charged on the agreed upon due-dates.

When busy is the norm, people want tasks like paying for a service to be painless and quick.

Using software will help you give them this convenience, and they’ll reward you with their long term loyalty.

Fewer Late and Failed Payments

Late payments and failed payments are both a nuisance to business owners. They may disrupt cash flow or require extra work like following up with a customer.

Payment processing software helps you avoid these errors in multiple ways:

| Automated late payment emails | If a customer misses a payment, the software automatically sends them an email notifying them of this and telling them how to pay. |

| Automatic payment retries | If a payment method fails, the software automatically retries it a few times at regular intervals. |

| Automated payment reminder emails | Configure your system to send reminder emails that notify customers of upcoming payments. This improves the chances they pay. It also gives them a chance to update payment info. |

| Recurring billing and autopay | Automatically charges customers at agreed-upon dates via their chosen payment method. With this, customers can’t forget to pay. |

When you reduce late and failed payments, your operations will run more smoothly and you’ll spend less time chasing down customers for payments.

Plus, knowing your money will arrive on time is always a pleasant thing, especially if you’re a small business owner who can’t always effortlessly weather random slumps in cash flow.

Improved Record-Keeping

Organized record-keeping leads to a bunch of positive results for your business.

First off, there’s sanity. That’s usually a nice thing to have.

It also helps you prevent fraud, pay your taxes, track and predict cash flow, and comply with laws and regulations.

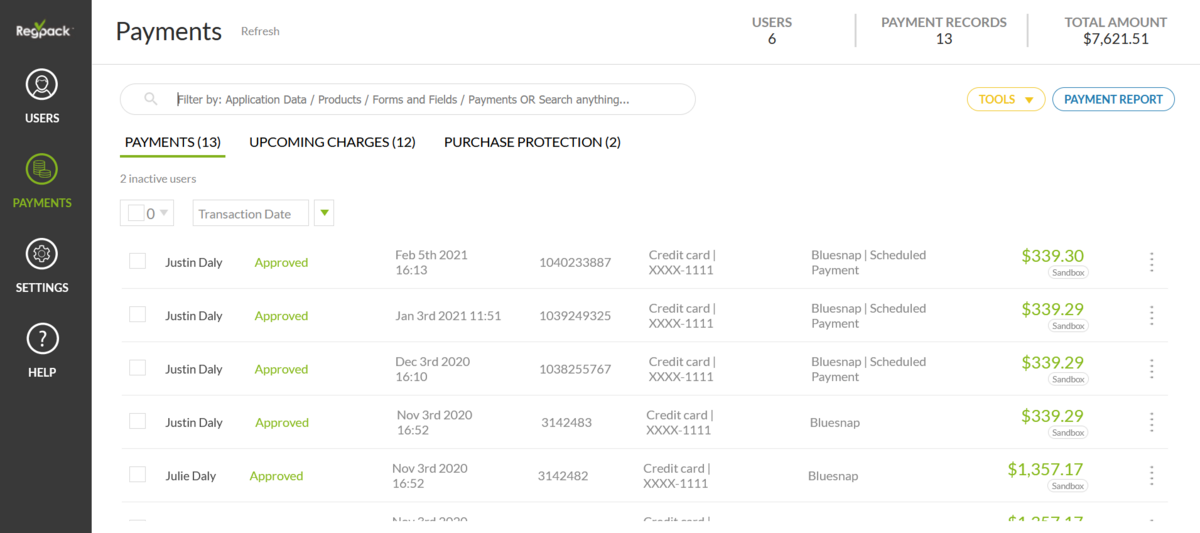

A payment processing software solution will come with features that enable you to keep track of your records without much effort.

For example, when someone makes an online payment, it’s immediately recorded and saved in the database.

Source: Regpack

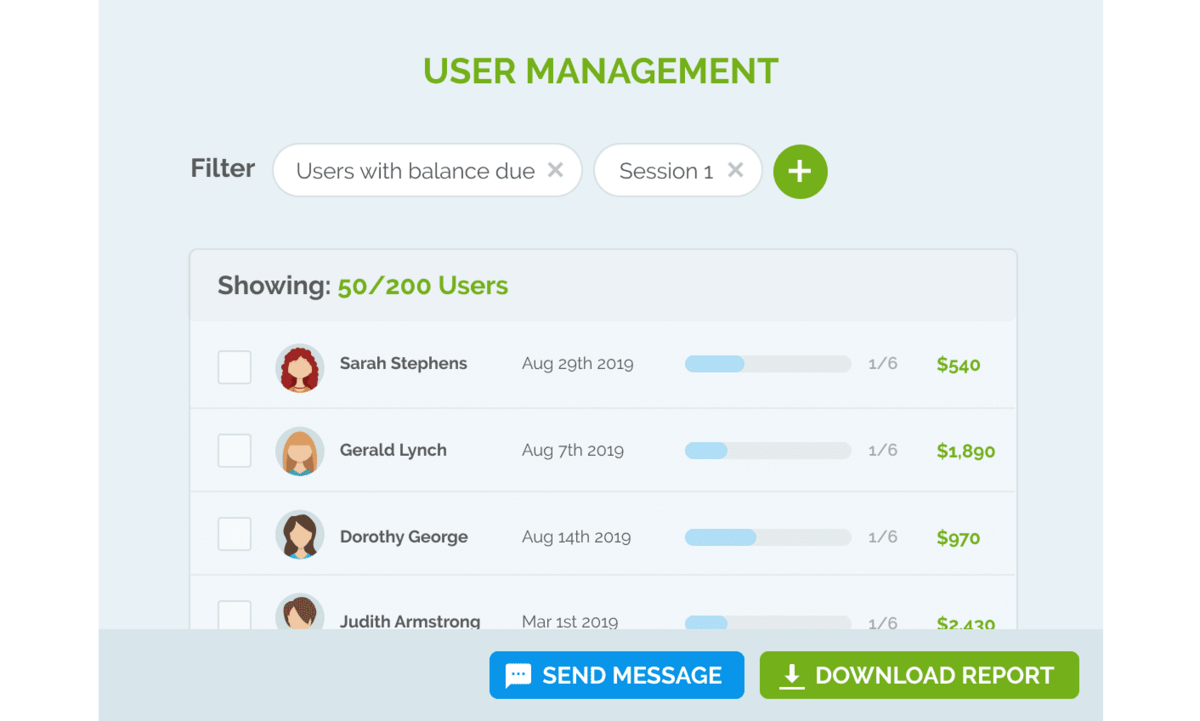

You can also filter records to pull up the information you need to see. If you want to see all outstanding unpaid invoices, you can do that in a few clicks, since all invoices, along with their status, are tracked in the system.

Here’s an example of filtering for all customers with a balance due:

Source: Regpack

Software makes record-keeping automatic, so that you can be sure that all the important data you’re collecting from buyers is always safe, right there at your fingertips.

Faster Account Reconciliation

Manually reconciling bank statements with accounting records can be time-consuming, and it tends to be error-prone.

It’s easy for a human to miss discrepancies. Computers have a better time spotting them.

The best payment processing platforms will help you automate the tedious account reconciliation process.

Source: Investopedia

When both your accounting software and your payments tool are integrated, then there’s a seamless flow of information between the two.

Whenever a payment is submitted, the system automatically matches it with your pending invoices.

Software ensures that the process is handled quickly and accurately.

This way, your accounting team can focus on more impactful and interesting ventures than one as repetitive as account reconciliation.

Plus, you’ll be happy to know that there aren’t any mistakes in your books that can lead to compliance issues down the line.

Informed Decision-Making

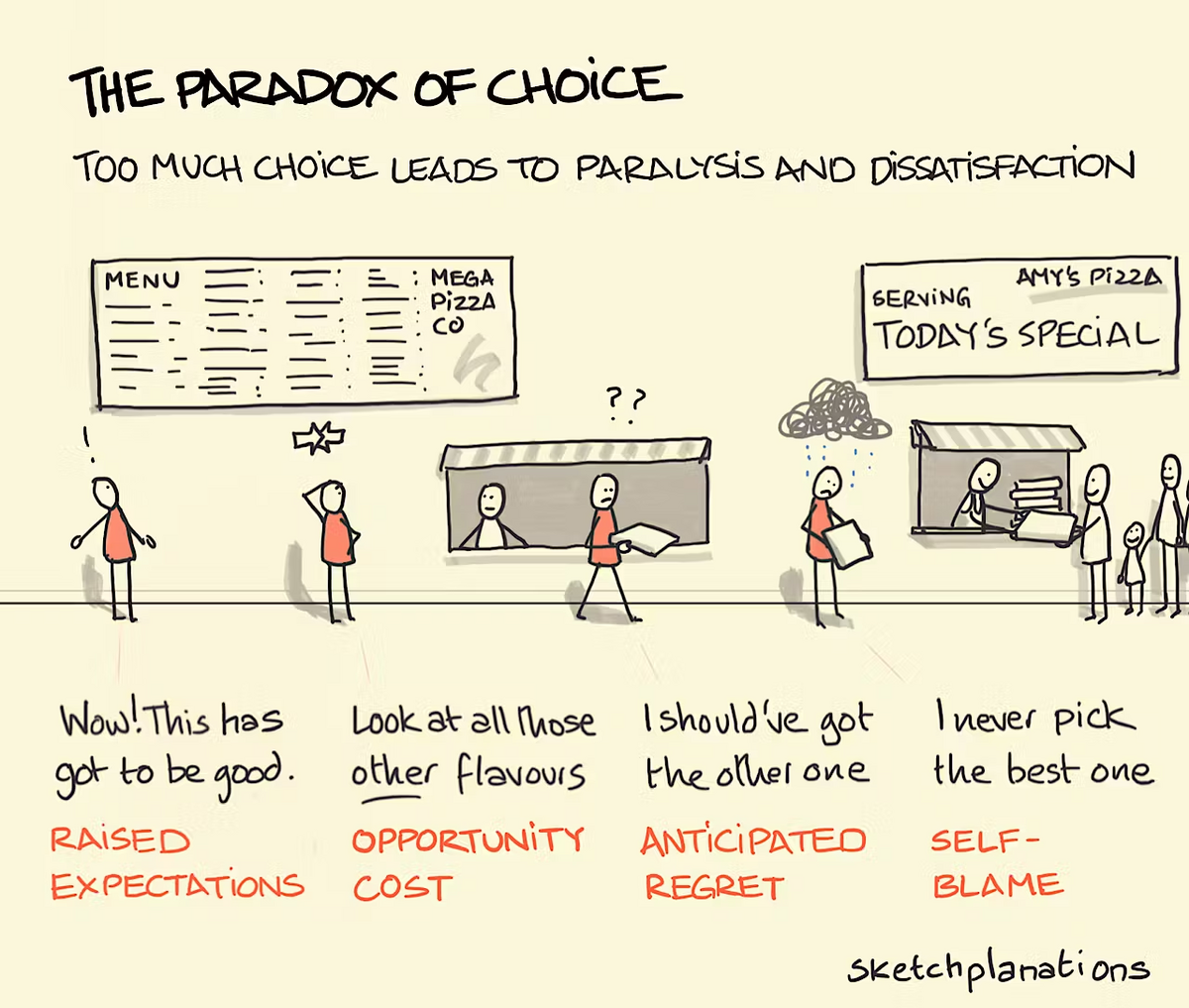

If people agonize over deciding which snack from the cabinet is going to provide the highest satisfaction to unhealthiness ratio, then business owners making big decisions, where serious money’s on the line, can feel an anxiety of choice that’s nearly debilitating.

Source: Sketch Plantations

When it comes to payment process improvement, you have to answer questions like “Which payment method should we offer” or “Is recurring billing actually working or should we discontinue it?”

Answering these things without data and analysis tools can be hard and time-consuming.

Just check out this quote from McKinsey’s study on decision-making in business:

On average, respondents spend 37 percent of their time making decisions, and more than half of this time was thought to be spent ineffectively.

So, in addition to accurate decision-making, saving time is another powerful reason why companies should use payment processing software with reporting features.

These tools help you analyze payment information to come to data-driven conclusions fast.

For example, if you wanted to know which payment methods resulted in the greatest late or incomplete payments, you could quickly run a custom payment report to find out.

You’d have an answer in minutes. Then you could go make a decision based on your findings.

If you discovered that customers without autopay were 50% more likely to miss a payment by 10 days, then you could push to get everyone signed up for autopay.

In sum, having a payment processing tool that can provide you with insights into your performance and processes will help you make stronger choices about how you run and grow your business.

Conclusion

Payment processing software can help your business improve security, scale more efficiently, make decisions, and, probably most important of all, improve the customer experience.

Not to mention, it allows you and your team to spend less time doing repetitive tasks like creating invoices and more time thinking creatively and strategically.

This improves morale and employee loyalty. When they feel they’re doing valuable and challenging work, they’re more likely to stick around.

If you’re considering investing in a payment platform to reap these advantages, check out this guide on the 8 features to look for in payment processing software.