Calculate the manufacturing cost, multiply it by two, and there’s your price—if only it were so simple!

Pricing is a crucial aspect of running a business. It doesn’t only inform the customers on how much items cost; it paints a picture of your brand as a whole.

As prices greatly depend on the changes in the market and on your competitors, finding a balance in pricing can be challenging.

Luckily, you can turn the pricing changes to your advantage and even attract more customers.

To show you how, we’ve made a list of seven frequently used pricing strategies, together with real-life examples. These strategies may have originated from retail giants, but you can still adapt them to your small business with some clever planning.

Jump to section:

Penetration Pricing

Economy Pricing

Premium Pricing

Price Skimming

Competitive Pricing

Psychology Pricing

Captive Product Pricing

Penetration Pricing

When a grocery chain opens a new store in an area, how do they lure customers from competitors? By drastically lowering the prices and increasing them later when customer loyalty is gained.

That’s penetration pricing in a nutshell.

This pricing strategy is often used when a new company enters the market, hence the name. On the other hand, companies that are already up and running use it to introduce new articles or services.

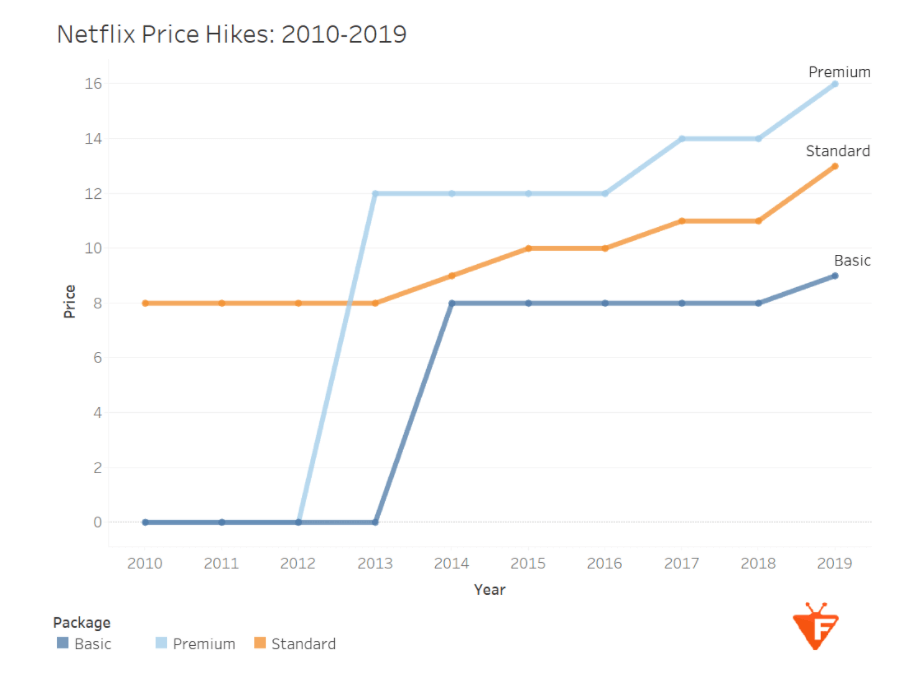

A successful example of penetration pricing is Netflix.

When the company first started offering streaming services in 2010, they sold standard subscriptions for $8. By 2019, the price rose to $13.

Source: Flixed

The reason why Netflix was able to increase the price by more than 50% is the quality of the service.

They used penetration pricing to attract customers with a low price. Once they gained their trust and proved the quality of their offer, they were able to justify the price increase.

However, penetration pricing may not be a strategy that works for all businesses, so you have to research if it would work for you before committing.

The first criterion to consider is how much loss your business can absorb.

Lowering the prices requires your business to sacrifice short-term profits.

While penetration pricing may bring you increased revenue later, your business has to be able to compensate for the initial low profits.

Therefore, before deciding on this strategy, you should calculate whether you can handle an influx of new customers with limited funds.

The next is determining how long your offer should last.

Penetration pricing only works if it’s temporary. If you keep the promotional pricing for too long, customers won’t be paying you what you’re worth.

All in all, penetration pricing is a beneficial strategy—as long as you calculate its viability for your business well.

Economy Pricing

Economy pricing is a pricing strategy in which products with low production costs are sold at low prices.

To best describe this pricing strategy, let’s once again use grocery stores as an example.

You have probably wondered how they keep the prices of their store-brand products so low.

The answer is economy pricing.

The core principle of this strategy is to identify products with low production costs, or products that require little to no advertising, and sell them at the lowest possible price while still generating a small profit.

Companies that apply economy pricing don’t aim for high revenue. On the contrary, they rely on the sum of sales with a small profit margin.

For instance, pricing store-brand cookies a dollar below Oreos will attract enough customers to make selling these cookies more profitable than selling Oreos only.

So, the advantages of economy pricing are:

- Attracting customers looking for cheaper alternatives

- Getting an edge over the competitors

- Spending less on advertising

On the other hand, there are ways in which it might hinder small businesses, such as:

- Reliance on small margins

- Low customer loyalty

- High risk due to narrow margins

It’s worth noting that small businesses have to slightly adjust how they implement this strategy, because they can’t rely on large-scale production to lower the costs.

Let’s say you teach courses online. The fact that you can’t churn out large numbers of courses shouldn’t stop you from trying out economy pricing.

You could create some basic video courses which wouldn’t require you to interact with students.

This method would allow you to focus your efforts on more expensive live courses (these are your Oreos), while those customers interested in getting the learning materials at the lowest price would get you income by purchasing pre-made videos or PDF documents.

Premium Pricing

Depending on the type of your business, sometimes it will make more sense to increase prices rather than lower them. This seemingly counterintuitive strategy is called premium pricing.

It all depends on how valuable your product is perceived to be by the customers.

For instance, the element that Rolex, Bentleys, and Apple products have in common is the fact that their buyers feel that they are purchasing a premium product.

There are many other watches, cars, or phones that are similar in quality, but these three brands always stand out as a display of luxury, so people don’t mind paying more for them.

In fact, people often want to spend more on premium products or services.

Source: Regpack

As opposed to penetration pricing and economy pricing, this strategy requires a considerable amount of planning and marketing.

If you want your customers to perceive your product or services as a premium, you have to convince them you’re worth their money.

You can do this by identifying the features that are considered high-end and highlighting them in advertisements and marketing materials.

Don’t forget about the authenticity of what you’re selling, either.

While it may be tempting to advertise your products by comparing them to Apple or Rolex, keep in mind that customers place a high value on authenticity.

Even if your product shares similar characteristics with other famous brands, it’s better to emphasize your uniqueness.

So, if you want to get a leg up on the competition, you can find a product or service that you do better and then increase the price to cultivate a sense of being higher in quality.

Price Skimming

When using the price skimming strategy, businesses charge a high initial price and lower it when the demand starts to decrease.

This pricing strategy works best for innovative products, especially mobile phones, game consoles, and similar gadgets.

The prime example of a company that leverages price skimming release after release is Apple.

Apple generates buzz for their devices months before they are launched, creating demand for the product.

This practice motivates the customers who want to be among the first to get their hands on the new release to spend more money than they ordinarily would.

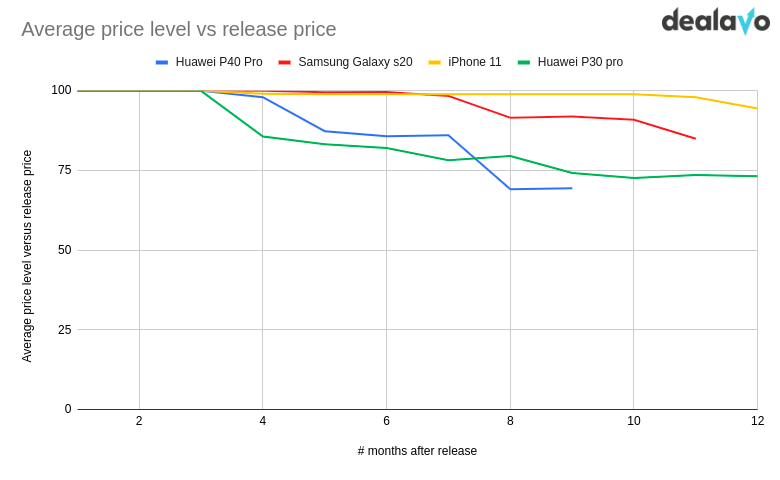

This is a common practice among tech giants, so Apple is not the only company to utilize price skimming. The graph below shows other competitors and the decrease in their prices over a year after release.

Source: Delavo

Price skimming can help you generate higher ROI because you produce merchandise at the same cost, but sell it for a higher price during the first months.

Since people like talking about exclusive purchases, skimming also allows early buyers to spread the word and attract more customers.

However, this strategy can backfire if you skim the price too soon. If you sell a product for $1000 and then reduce the price to $800 only a few months later, you may enrage the early buyers.

A good way around this problem is to incrementally lower the price or to prolong the time between price alterations.

It’s worth noting that price skimming only targets a portion of the customer base; those curious about the new products, so it isn’t advisable to start such a strategy unless you’re familiar with your customer groups.

Remember, price skimming is only beneficial if you offer a unique product or service. However, if you are in a saturated market, the customers won’t have any reason to give you more money than to your competitors.

Competitive Pricing

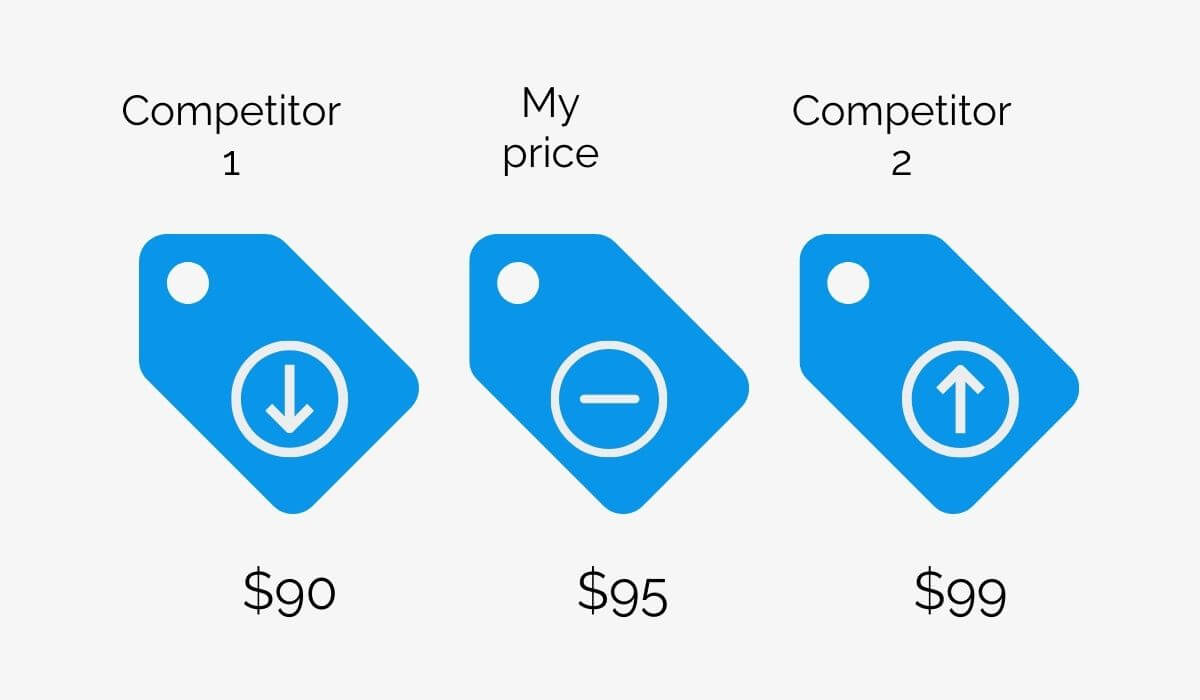

If you don’t mind an active pricing strategy, competitive pricing might be a good option to consider.

Also known as a price war, this strategy includes monitoring the prices set by your competition and adjusting yours accordingly.

It usually includes two or more competitive businesses that:

- Lower their prices

- Increase their prices

- Match their prices

Perhaps the most extreme example of competitive pricing happened in the 1990s when two American air travel companies started a pricing war that culminated in a $1.53 billion loss in 1992.

The war began when Northwest Airlines initiated a promotion that included free tickets for grown-ups flying with children. The next day, American Airlines responded with a 50% price cut on every flight.

Long story short, the reduced prices attracted so many passengers that the airlines suffered enormous losses. The demand outweighed the capacity of the competing airlines.

An edge case like this one illustrates what happens when companies push competitive pricing to extremes; the strategy normally doesn’t require such drastic price reductions.

Source: Regpack

It’s usually enough to drop your price a few dollars to lure customers away from your competitors, as Walmart and Amazon did in 2014.

Shortly before Black Friday, the yearly period of reduced prices and skyrocketing sales, Walmart announced they would price-match Amazon and other online retailers.

Instead of spending time on adjusting all the prices in their system, Walmart decided to match all prices of items that customers found at other stores for less.

Since small businesses usually don’t stock large quantities of merchandise, you should tailor this strategy to your needs.

You can do this by following Walmart’s example rather than that of American Airlines.

In other words, there’s no need to lower the prices of all the services you offer—identify the ones that are sold the most and see if you can absorb the cost of lowering those prices.

Psychology Pricing

You don’t have to have a degree in psychology to impact customer behavior. You can boost your sales with psychology pricing strategies that have already been proven functional.

Psychology pricing doesn’t require you to change your prices drastically; you change how you present the prices instead. That way, you trigger a psychological response from the customers that encourages the purchase.

This strategy also helps you convince the customers that your product meets their psychological needs, such as:

- Saving money

- Investing in a high-quality product

- Getting a good deal

One of the most prevalent psychological strategies is putting an artificial time constraint on your offer.

If you want to stimulate customers to make the purchase, you could create a sense of urgency. Nobody wants to miss a good deal, so you should emphasize that the offer is time-limited.

Here’s how Zoom applied this technique.

Source: Regpack

As you can see, the discount is the most noticeable element, occupying almost half of the image. Zoom urged the customers to get the offer before it expired and highlighted that the offer wouldn’t last long.

Nevertheless, if you decide to implement a time constraint, be careful not to dilute its message.

A time-limited offer too frequently signals that the constraint is made artificially, decreasing your trustworthiness.

Another highly effective strategy is called charm pricing. It removes one cent or dollar from the rounded price so that customers perceive the price as lower.

You can see it in grocery stores where a jar of jam is priced at $4.99, with the aim of imparting to the consumer that the cost is less than five dollars.

Upscale companies use this strategy as well. For instance, Apple laptops tend to cost $999, $1299, or $1999.

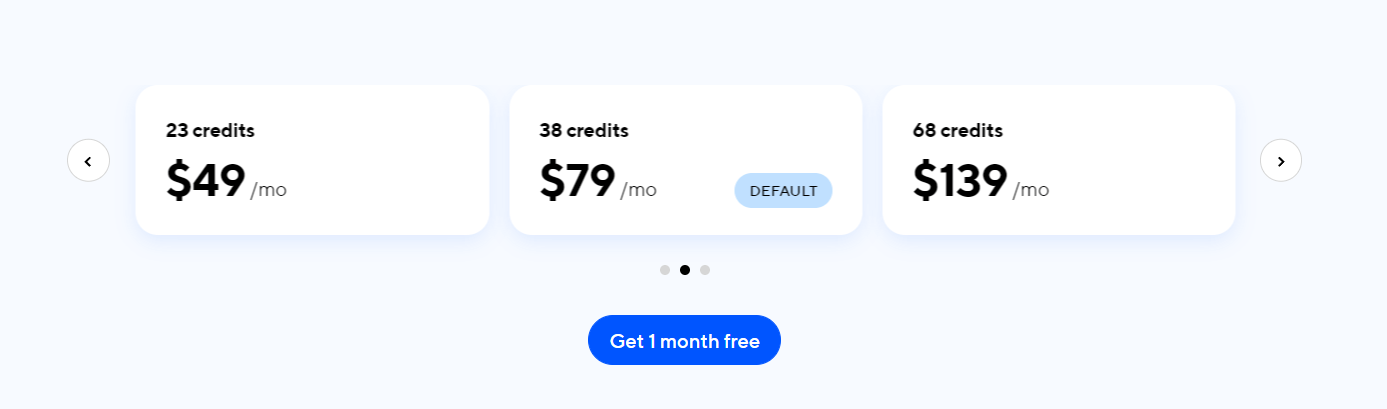

In the following picture, you can see different pricing plans on ClassPass, a fitness platform. Notice how all the plans across different price ranges end in 9.

Source: ClassPass

To sum up, psychology pricing can drive your sales. However, be sure to always implement it ethically, with no false promises.

Captive Product Pricing

If you want to attract returning customers, you should give them something to come back for.

You can do this with captive product pricing, a strategy that consists of selling a lower-priced core product, to be followed by a number of accessory products later.

Here’s a list of such products you’ve probably bought yourself.

| Core product | Accessory products |

| Coffee maker | Coffee pods |

| Game console | Video games |

| Printer | Ink cartridges |

| Smartphone | Phone plans |

Bear in mind that this strategy doesn’t work with all kinds of businesses and products. Companies selling furniture or clothes will have a hard time coming up with accessory products that make sense.

In fact, if your business sells individual products or services, it may be better to avoid this strategy. You don’t want your customers to perceive you as a money-grabber.

Keep in mind that you can apply this type of pricing to more than just physical products. What is more, recently, SaaS companies have started exploring an option similar to captive product pricing, called freemium.

Freemium is a business model where a company offers basic services for free and charges premium options additionally.

The difference between this and classic captive product pricing is that in the freemium model, you agree to give something for free.

While this may work for SaaS models, it’s not a viable option for all small businesses. This is why you could consider using the combination of the two.

Let’s say you own a gym.

You could offer the customers a regular plan, something like your core product. However, if you enabled them to upgrade to a plan that allows the use of additional amenities—similar to the freemium model—you would also have your accessory product.

Even though you could only sell the upgrade once or twice, it’s still better than charging the lowest plan month after month.

Conclusion

Before you implement any of these strategies, think about how you can best adjust them so that the strategies leave your business with a profit.

You can even work with your financial advisor to see how much you can spare in case you decide on a strategy that requires giving up short-term profits.

Regardless of the strategy you choose, remember to keep your customers’ trust a priority. So, approach pricing with transparency and never compromise the value of your products for profit.