Have you thought about switching to another method of accepting payments to make your business more efficient?

If online payments are among those methods you’re considering, then you’re in the right place.

There are several advantages to accepting online payments, which help businesses encourage customers to pay quickly and conveniently.

What’s more, in the past several years, online payments have become almost mandatory for companies of all sizes that wish to stay competitive and continue serving their customers.

So, if you’re looking for reasons why investing in online payments is beneficial for your business, read on to learn more.

Jump to section:

Saving Time

Avoiding Errors

Enhancing Security

Improving Payment Efficiency

Offering More Convenience for The Customer

Saving Time

Think about how much time you waste by manually processing payments in your business. From invoicing your customers, keeping track of payments, and going to the bank to cash checks–all of these tasks require time and effort.

So, wouldn’t it be better if you could spend that time on more productive tasks like engaging customers or brainstorming new product ideas?

The reduction in workload can be significant with online payments, according to the newest survey findings by Visa.

Their researchers reveal that small businesses spend 542 hours to process $100 000 manually, while businesses with online payments spend 189 hours on average to process the same amount.

By accepting online payments, you’ll simplify your payment process and access your financial data anytime and anywhere.

Your online payment service provider will handle:

- Managing transactions

- Sending billing information to customers

- Supervising the money transfer between accounts

Or, to put it differently, automation will save you from dealing with boring administrative tasks. You’ll no longer have to count the cash, prep and fill cash registers, prepare deposits, and go to the bank.

But let’s see how online payments affected two small businesses and gave them more freedom to focus on their customers.

Little Green Cyclo was founded by chefs Quynh Nguyen, Monica Wong, and Susie Pham in the Bay Area in 2010. They serve authentic Vietnamese street food using local ingredients in three food trucks, a commercial kitchen, and a bistro in Brisbane, California.

Source: Little Green Cyclo

But to be able to grow, they needed a more efficient way to handle payments. So, they turned to online payments to serve more customers, but the process also helped them with daily bookkeeping.

The software gave them insight into sales and cash flow data, which saved them two to three hours a week that they would normally have spent doing so manually.

In a year, they saved over a hundred hours on processing payments.

Another business that saw the time-saving benefit of online payments is Epic Burger in Chicago, founded by David Friedman.

Friedman has been growing his business since 2008, and today he has seven locations around the city, serving hamburgers with fresh and sustainably sourced ingredients.

Source: Epic Burger

After dealing with some problems handling cash, Friedman decided to turn to online payments.

Soon enough, his employees freed up their time from handling money to training and cleaning. It saved them two hours a day that was spent on making Epic Burger a nicer place to visit and work, according to Friedman.

After all, what you can learn from this is that dealing with fewer checks to sort out can free your time to focus on your core business tasks.

Avoiding Errors

Manual payment processing goes hand in hand with errors.

Humans are prone to making mistakes, ranging from small ones like entering the wrong credit card number to large ones like overpayments, or check tampering.

What is more, small errors in handling payments can snowball, negatively affecting your business and reputation.

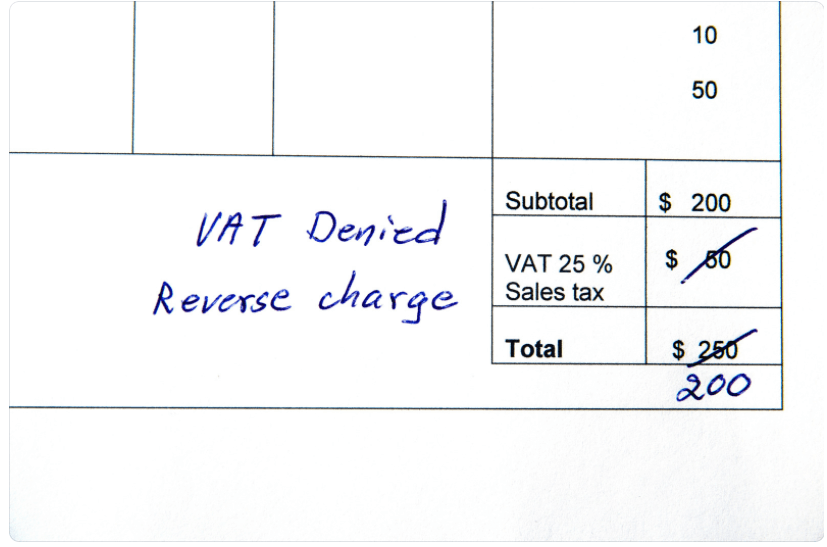

© kn1 via Canva.com

In addition to taking up valuable time, managing cash and checks manually leaves you prone to errors and losses.

First and foremost, this means financial losses that stem from incorrect cash handling, late payment fees, and theft.

Then, it also leads to damaged relationships; for instance, if you send invoices to the wrong people, misspell the customer’s name or charge them incorrectly.

What’s worse, the mistakes often aren’t detected on time, which means businesses are paid late for their services, if at all.

It goes without saying that your bottom line is in danger if such occurrences are common in your business.

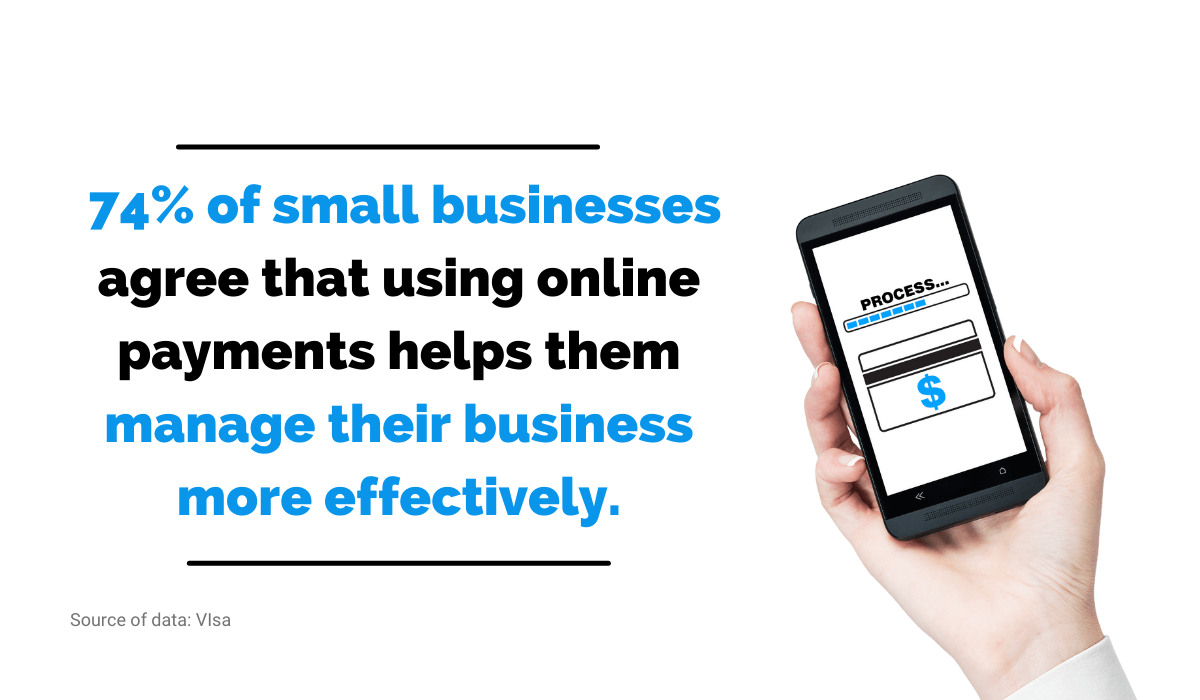

That is why the previously-cited Visa survey showed that 74% of small businesses agree that using online payments significantly helps take care of their financial tasks.

Source: RegPack

Payment processors ensure that online payments are secure and accurate.

These digital solutions will communicate between banks and card networks to verify the transaction details and the identity of the cardholder. That way, you can detect errors and problems faster.

For example, if a customer’s credit card has expired, the payment processor will send a timely notification to handle the problem, so you won’t have to chase after the customer with numerous phone calls or emails.

Following that, with online payments, there’s less room for making errors and storing incorrect information.

Generally, the payment processor will handle all the heavy lifting and update the payment information. That way, you can rest assured that most of your payments will be processed without a hitch.

In the end, no matter how careful and competent your employees are, when payments are handled manually, errors are always a possibility.

Therefore, to prevent and minimize them, you should accept online payments in your business.

Enhancing Security

Your data is not only at risk from errors in your internal processes; they’re a target for outside intruders too.

So, while your employees can make mistakes that can lead to duplicate payments, overpayments, or missed discounts, hackers can intentionally hurt your business to the point of forcing you to close your doors forever.

The most common error small business owners make is to assume data breaches won’t happen to them.

However, while we mostly hear about major instances of data loss like Yahoo (2017), Equifax (2017), Facebook (2019), or LinkedIn (2021), that doesn’t mean small businesses cannot become victims of security breaches.

When you handle sensitive customer data manually, you’re likely storing them in easily exposed devices or Excel spreadsheets.

To you, it might mean an easy overview of important data, but to the ill-intentioned people, such devices are a sitting duck.

That is why recent reports show an increase in the frequency of cyberattacks on small businesses. In fact, a third of data breaches in 2020 involved small companies.

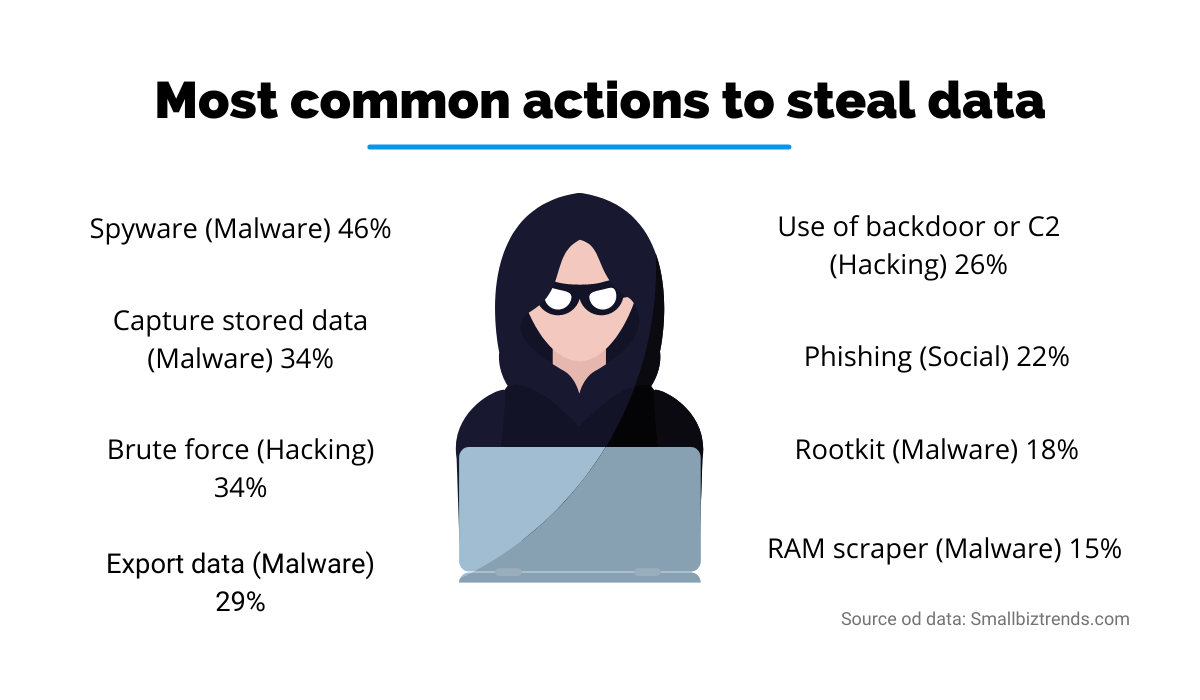

Most of the attacks were caused by external factors such as spyware, export data, the use of stolen credentials, and brute force (hacking).

Source: Regpack

There is also a growing concern among experts like Neira Jones, advisory board member for Merchant Payments Ecosystem, who says that criminals are increasingly adapting to digital transformation and taking advantage of businesses that aren’t keeping pace.

One such example is Efficient Escrow in California, where hackers gained access to the company’s bank data and transferred over $1.5 million.

The company was only able to recover a fraction of that sum ($432 215) because the bank didn’t have an obligation to recover funds associated with a commercial account.

So what happened then?

Basically, the company had no choice but to lay off their staff and face a mountain of lawyer fees. They had no way of recovering the money for their clients either.

However, there is a way to combat this problem. That is providing the highest level of payment security for your customers with online payments.

Data protection necessarily requires multiple levels of encryption and prevention tools to serve businesses.

That means finding a reliable payment processor that has effective anti-fraud protection. Any suspicious activity should be detected on time and protect sensitive data from external breaches or fraud attempts.

© guvendemir via Canva.com

Cybersecurity is a serious issue, so companies have to take a well-rounded approach to handling threats, according to Dan McNamara, chief technology and security officer at MedReview (a medical/health claims auditing firm).

As their organization grew, they experienced more cyber attacks. In just six months in 2019, there were almost 15 million breach attempts.

So how does the company continue to protect itself?

They have implemented AI-powered solutions and real-time cybersecurity tools, but they also train their employees to actively prevent online threats. In forty years of doing business, they haven’t had a single data breach.

If you want to have a similar success rate in protecting valuable customer data, then you need to accept online payments for your business.

As mentioned before, security is more regulated in online payments, so you can rest assured that your customers’ personal and banking information will stay protected.

Improving Payment Efficiency

Another great reason why online payments are better for your business is the ability to process payments faster.

Customers value efficiency, and they want to be able to settle their bills immediately. And what’s more convenient than paying their bills online? They can do that anytime and anywhere through any device with Internet access.

Obviously, this is great news for your business because you’ll have money in your account within days of it being processed electronically. This makes a great difference to your cash flow.

Basically, the faster you get paid for your services, the more money you’ll have to delegate and pay your business expenses.

What’s more, everyone in your company can reap the rewards of faster payment processing. For example, Roucet, a private wine-importing agency, has seen the benefits first-hand.

Source: Roucet

When the company installed an online payment platform, they processed payments faster. What this meant is that the company’s sales representatives collected their commissions sooner.

So, improving the payment process directly impacted their business on several fronts. Their customers settled their bills faster, and the company could pay their employees on time.

In the end, accepting online payments can improve your payment processes, create a healthy cash flow and help you grow your business.

Offering More Convenience for The Customer

Companies that opt for allowing online payments want to give their customers more convenient ways to pay for their services and products.

Since customers can have various preferences when it comes to payments, that is a sound business decision.

© Estradaanton via Canva.com

While some consumers still prefer paying in cash, many others are more comfortable with debit cards, digital wallets, or even cryptocurrencies. Logically, the more options you offer, the more customers you can serve.

That’s also what a small business from California discovered when they switched to online payments. Rachael Melin and Ice Eriste opened Caribbean Café to sell West Indian food from a food truck.

They operated on a cash-basis, thinking it would be simpler because they were stationed near festivals, but they soon moved close to a college campus in Chico, California.

They discovered that most of their customers were college students who used cards for every purchase, so most of them carried little or no cash.

Melin says they often had to turn away customers who didn’t have enough cash to pay for their services, which hurt their sales.

After they converted their phone into a card reader, they were able to serve more customers and they even sold all of their products at the end of each day.

It also eased Melin’s mind because she could just swipe a card and not worry about calculating the exact change.

Based on this example, we can conclude that online payments are convenient for both the customer and businesses. But there is another reason why online payments will be necessary for all types of businesses in the future.

Apart from being a more convenient way to pay for products, they have proven themselves to be a safer method of getting goods during the pandemic.

The fear of contracting COVID-19 made customers prefer low to no-contact interactions and avoid situations where they had to handle physical currency.

Naturally, this pushed more users to abandon ATMs in favor of online payments. For example, India saw a 47% decline in ATM usage in 2020, while the UK had a monthly decline of 46% from March to July 2020.

As a consequence, this allowed more customers to see the benefits of speed, convenience, and safety of online payments, so research suggests that this trend is here to stay.

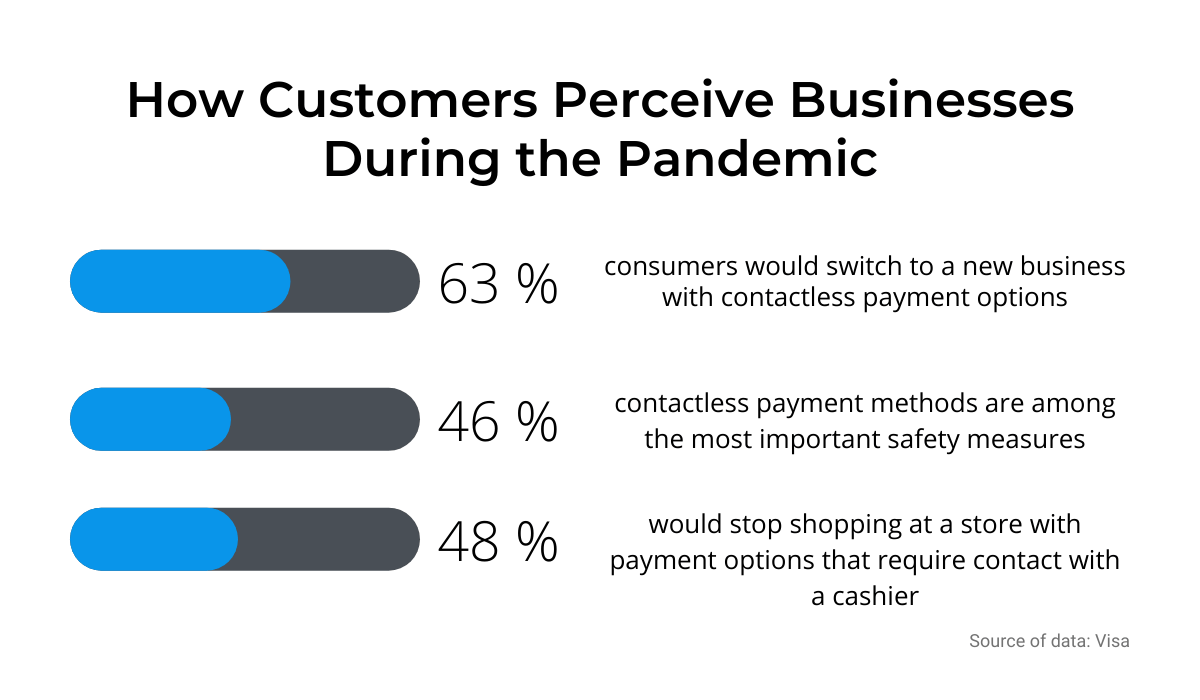

According to a recent ‘’Back to Business’’ study conducted by Visa, many customers believe that contactless payment methods are the most important way to ensure safety measures in any business.

What’s more, 48% of customers would stop doing business with a company if it didn’t offer an online or contactless payment method.

Source: RegPack

Another study by GoCardless further emphasizes the eager shift towards online payment: nearly 85% of customers are happier because they don’t have to deal with cash anymore.

In a nutshell, online payments are a convenient way for businesses to cater to their customer’s changing payment preferences. But they’re also becoming a mandatory method to ensure safety in unprecedented times when health measures are a top priority.

Conclusion

Switching to a new payment method can be daunting for small businesses. But there are far more reasons why online payments are a good idea if you want to optimize the payment process and grow your business.

More importantly, accepting online payments might become a prerequisite for staying in business. This is due to changing customer preferences and the fact that they favor contactless payment due to fear of the coronavirus.

All in all, online payments save you time, money and enhance security to offer your customers the best experience when doing business with your company.