If you’re accepting online payments for your small business, you’re going to need a payment gateway solution to facilitate these transactions.

As you explore the payment gateway marketplace and evaluate companies, there are some things you should keep in mind—how much security do they offer?

Do they allow me to offer multiple payment methods to my customers? What’s the pricing model?

To help you choose the right payment gateway for your business, we’ll explain the various factors you need to consider during your evaluation process of gateways for your business.

- Make Strong Payment Security a Priority

- Check the Pricing of the Payment Gateway

- Look for a Wider Range of Payment Methods

- Consider Accepting Multi-Currency Payments

- Think About Whether You Need Recurring Billing

- Search for Detailed Payment Analytics

- Choose a Payment Gateway With Great Customer Support

- Conclusion

Make Strong Payment Security a Priority

With credit card fraud on the rise, finding a payment gateway with strong payment security is imperative. This will keep you and your customers’ sensitive financial data safe.

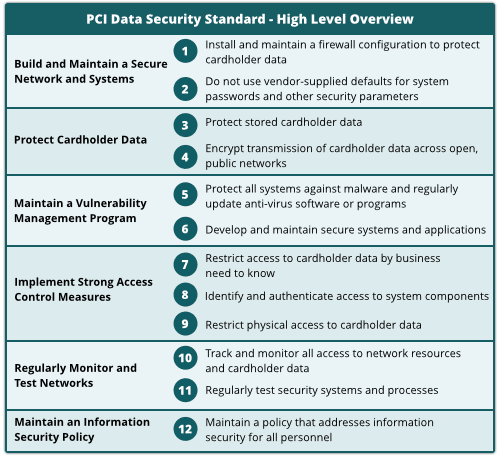

All payment gateways need to be compliant with PCI DSS (Payment Card Industry Data Security Standard).

To receive PCI DSS certification, the provider has to satisfy specific security requirements set by the Payment Card Industry to ensure the protection of consumer data.

Here are some of the major requirements:

Source: BCC Cuny

It is also advisable to look for a payment gateway that offers other safeguards like end-to-end encryption, which turns financial data into a string of nonsensical letters and numbers that can only be translated if you have the key.

Screening and fraud detection features are useful as well, as they can flag and prevent suspicious transactions.

Additionally, it’s a good idea to make sure that your payment gateway stores and processes customer data in the country where your business is situated and facilitates all communication via secure TLS and HTTPS protocols.

When searching for a payment gateway, security is the most important factor to consider. Fraud and identity theft are too big of a risk to take lightly.

Check the Pricing of the Payment Gateway

Like with any purchase, it’s crucial that you check out the pricing of each payment gateway to ensure that it fits within your budget.

The trouble is that payment gateway pricing can get slightly confusing because, unlike other products, it’s threefold:

| Set-up Fee | Some businesses will waive this fee if you have a simple setup. This is more common for enterprise businesses that need customization. |

| Transaction Fee | The competitive price is 2.9% + 30 cents per transaction, but it varies and depends on other factors. |

| Monthly Fee | Usually somewhere between $10 and $25 per month. |

When you’re calculating the potential cost for your business, make sure to account for these prices so that you don’t underestimate the total monthly cost.

Also, it’s often best to talk to a service rep at the company to get specific pricing, because the price of a payment gateway often depends on several factors, such as the volume and value of your transactions.

Some gateways will offer discounts as your business grows.

If your business’s average purchase value is relatively low, the competitive price of 2.9% + 30 cents shouldn’t be too much to bear, but if your business deals in high-value transactions, the costs will add up quickly.

So if your business has large transaction values, you should try to get a payment gateway that offers a low transaction fee and a set monthly fee.

Look for a Wider Range of Payment Methods

Find a payment gateway that will allow your customers to pay using a wide variety of payment methods, from credit and debit cards to bank transfers and e-wallets.

Offering a diverse set of payment options will help you improve your customers’ payment experience because consumers value the ability to pay how they want.

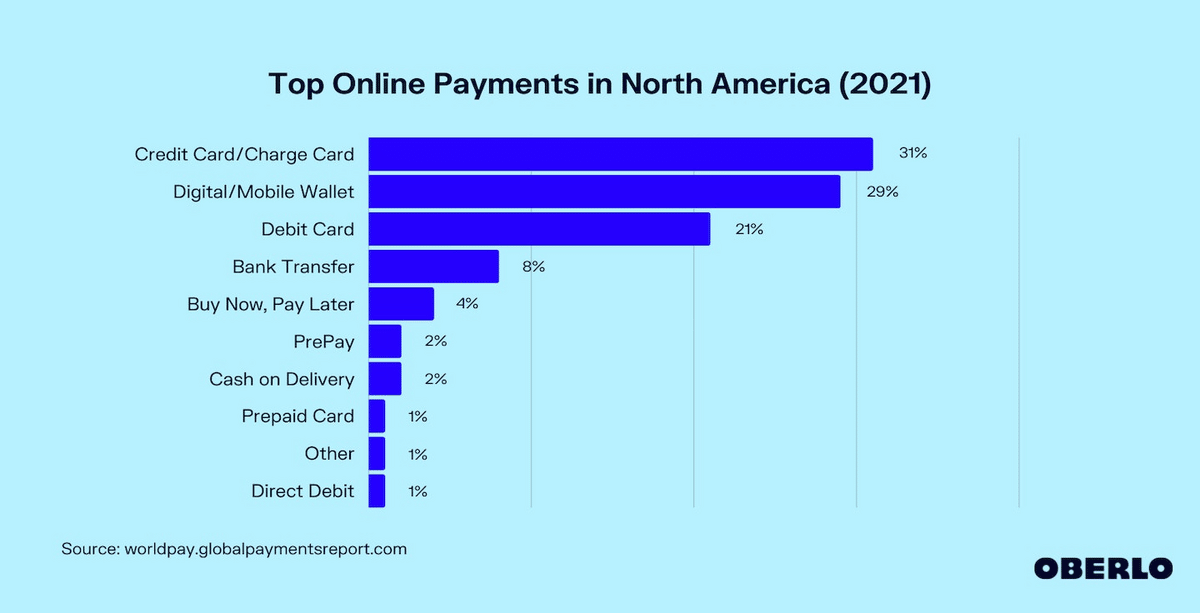

Your payment gateway should facilitate at least the four most popular payment methods in the graph below:

Source: Oberlo

When it comes to accepting credit and debit cards, focus on the ability to accept transactions from popular banks and card networks like MasterCard, Visa, and American Express.

As for mobile payments, the second most common method, globally, the most popular apps are Apple Pay, Google Pay, PayPal, and Cash App, so ensure your payment gateway supports them.

Bank transfers are most commonly done with Automated Clearing House (ACH) transfers, so ask the payment gateway provider about this as well.

When you choose a payment processor that offers a multitude of different payment methods, you make the payment process more convenient for your customers.

As a result, you’ll experience an uptick in customer retention. Providing comfort makes people stick around.

Consider Accepting Multi-Currency Payments

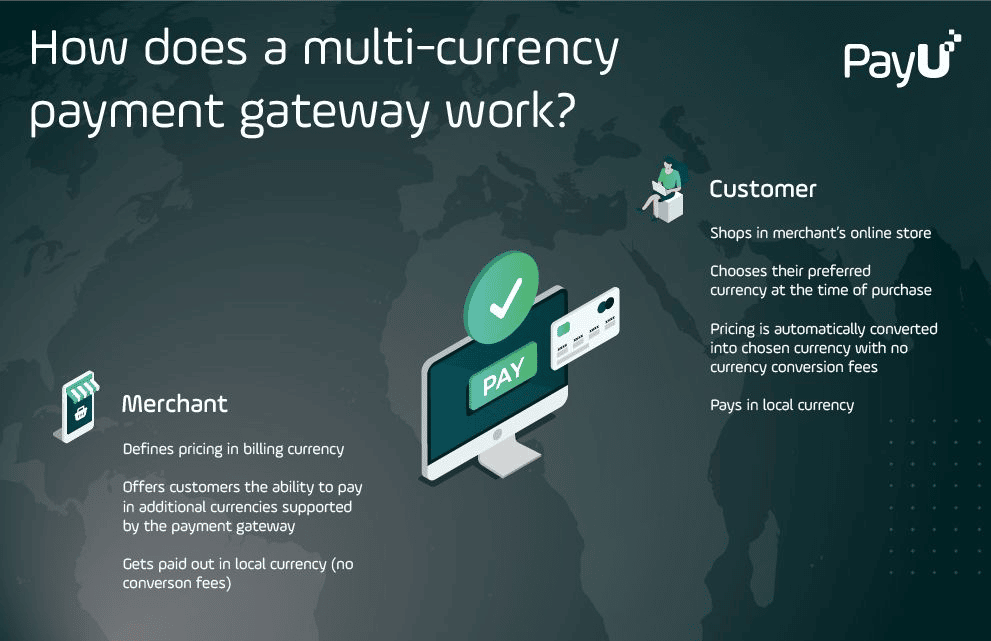

Look for a payment gateway that accepts multi-currency payments.

This gives customers the option to pay in their own local currencies and is especially important if your business has customers across the globe or intends to expand beyond your country’s borders.

Source: PayU

Accepting multi-currency payments makes it easier and more convenient for international customers to make purchases with your business, which helps you attract and hold onto international customers.

Being known as a globally friendly brand will also improve your company’s image. Our culture continues to increasingly value worldliness and the inclusion of people from all over the globe.

Also, the payment gateway makes accepting and tracking foreign currency payments easy for your business as well, since the software automatically converts it into your specified currency, be it dollars or euros, without conversion fees.

Some payment gateways may charge additional fees for multi-currency support, so be sure to check with them before following through with any purchase.

As a side note, consider offering PayPal as a payment option, as it’s one of the most popular online payment methods worldwide for making international payments.

Think About Whether You Need Recurring Billing

Subscription-based businesses need to choose a payment gateway that offers recurring billing, which automates the payment collection process and makes your life easier.

Recurring billing works by allowing you to create an automatic billing cycle that will automatically charge customers for a pre-defined amount at the end of each billing cycle.

Offering recurring billing also makes things easier on your clients because it enables them to opt-in for automatic monthly withdrawals from their chosen payment method.

That way, they don’t have to go through the payment process themselves every time an invoice is due.

Your chosen software should offer the following features for managing recurring billing:

| Customer information storage | The software should easily track, filter, and find customer data like names, location, card information, and bank account numbers within the platform. |

| Automatic withdrawals and charges | Your system should be able to automatically draw money from a customer’s bank or charge their card once you’ve received permission to do so. |

| Automatic retries | When a credit or debit card fails to process, your software will automatically retry the transaction at pre-defined intervals, limiting failed payments. |

With these features, the billing process is almost completely automated, and your team is able to focus on more impactful objectives and projects that take high-level thinking and strategy.

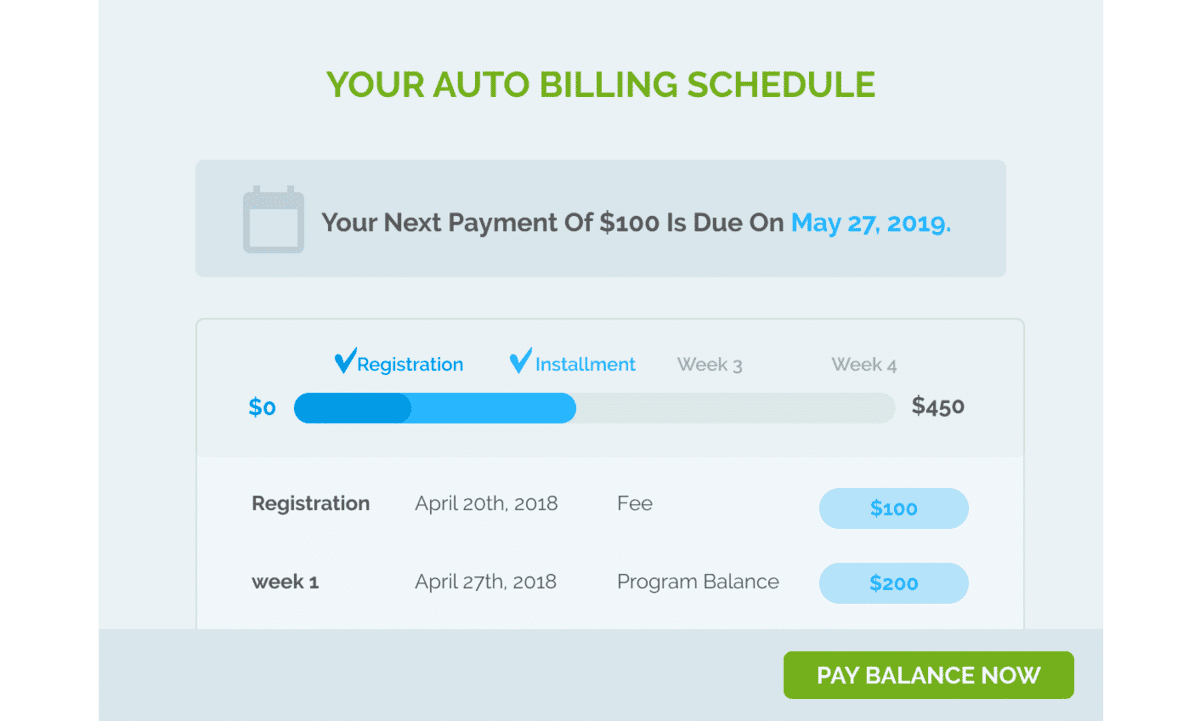

To further enhance the customer experience, consider using a payment gateway platform that also lets you create personalized auto billing schedules for your customers, like Regpack does:

Source: Regpack

These personalized payment plans allow your customers to pay in the way that works best for their financial schedule and prevents you from losing customers due to financial stress.

Search for Detailed Payment Analytics

Look for payment gateways that offer detailed payment analytics and the ability to create custom reports, as these provide you with insights into the health of your payment collection process and help you spot opportunities to improve it.

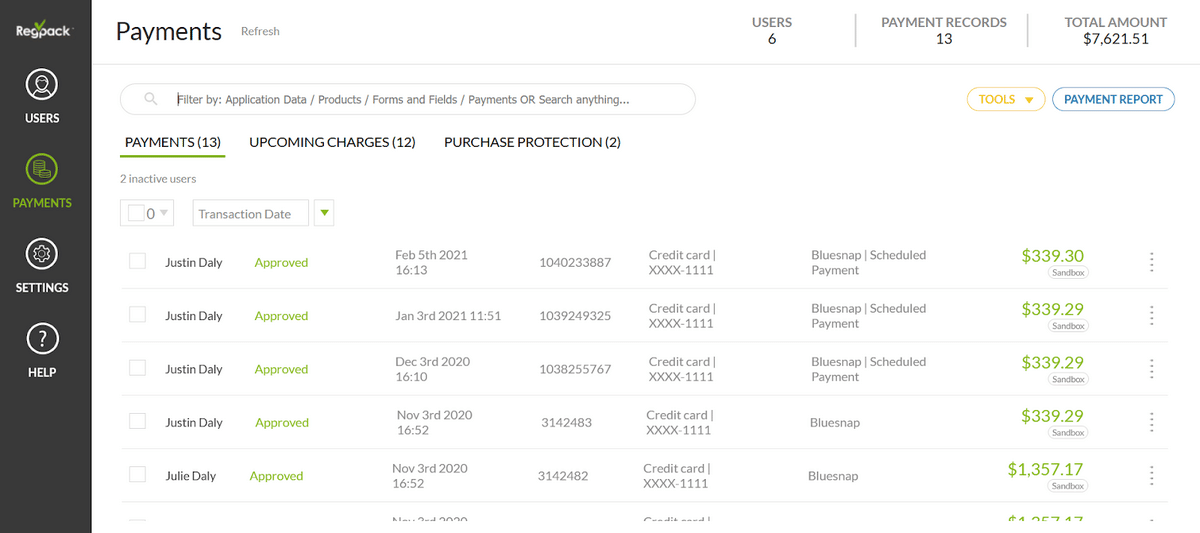

First and foremost, your payment gateway should be able to provide you with detailed records of all transactions, telling you what’s been paid, what’s outstanding, and more:

Source: Regpack

Your payment gateway should also enable you to filter this data by product, customer, payment method, and other categories, allowing you to learn about individual customers and segments of your customer base.

Here are just some of the ways you can filter payment data in Regpack:

Source: Regpack

With a filtering function, a business could do something like quickly figure out which payment methods are most popular with a certain type of customer, and then adjust their strategy accordingly.

Or, a business might want to learn about which customers tend to be late on their payments and then drill down into the data to learn why this occurs.

If their gateway allows for reporting, they might run a report that finds that the majority of people who pay late aren’t using the auto-billing option.

They can then come up with a plan to move more customers to recurring billing.

These reports can also help you learn about the effectiveness of the various payment methods you offer to your customers.

For instance, a business might create a report to see which payment methods fail most often, and then—based on the result—decide to steer customers away from using the least reliable method.

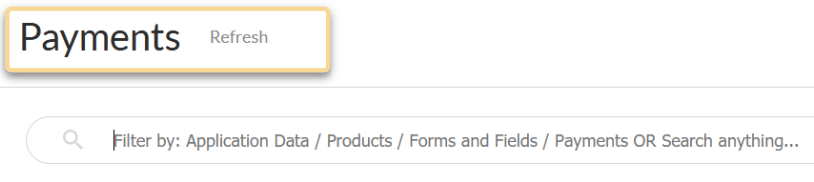

In addition to reports and filters, your payment gateway should also offer a search function that enables you to quickly pull up information about your customers and their invoices.

That way, your team will always be on top of their game and be able to answer customer or internal questions without any delay.

With every customer’s financial information and history automatically stored in a searchable database, you won’t ever have to spend hours digging through a pile of paper or email chains to find an answer.

In sum, look for a payment gateway that gives you features like payment data storage, data filtering, comprehensive reporting, and a search function.

Choose a Payment Gateway With Great Customer Support

Our last tip is to choose a payment gateway with a track record of exceptional customer service and a wide range of ways to get assistance and find answers to your questions.

While access to customer service reps over the phone, email, and live chat is important, don’t forget about self-service options as well.

The best payment gateways will have large resource centers where you can find answers to simple and even some complex problems without having to speak to an agent.

Some will have on-demand videos, articles, how-to guides, white papers, and FAQs that will help you become the master of the software, not the other way around.

Of course, some problems will be too large for you to solve, or too time-sensitive for you to spend time searching a knowledge center.

For example, unexpected downtime is a big issue that loses you customers and therefore needs to be solved as soon as possible.

In cases like these, you want a customer support team that is available and competent, providing you with fast and reliable service.

Regpack is one such payment gateway that prioritizes customer service and, consequently, receives numerous positive reviews from satisfied customers, like the one below from a user called Barbie L.:

Source: Capterra

And this review from a user going by Mark B:

Source: Getapp.com

As the first reviewer mentioned, Regpack also has a bunch of helpful online tutorials and training videos that allow you to easily learn how to use its large feature set.

For example, here’s a video teaching users how to set up one of its most useful features for event organizers—group payments:

Source: Regpack on YouTube

Whenever you invest in a new piece of software for your business, it’s critical that you have access to a knowledgeable and responsive support team who will help you make the most of your investment and solve any issues that come up.

Conclusion

Choosing a payment gateway is a big decision for small business owners and shouldn’t be rushed.

There’s a lot to consider: security measures, the range of payment methods, multi-currency functionality, and access to payment analytics.

Take the time to understand your specific needs and evaluate each software in that light, and don’t be hesitant to hop on the phone with a sales representative to ask if they have the features you want.

If you’re planning on accepting card payments from customers, you’re also going to need a merchant account alongside your payment gateway.

Read this article comparing merchant accounts and payment gateways to learn the difference between the two.