If you’re looking to start accepting credit and debit cards at your business, it’s likely that you’ve come across the terms merchant account and payment gateway.

Perhaps you’ve had some questions about how they differ.

What does each one do? Do I need both of them to process credit cards? What about debit cards? And is there software involved?

In this article, we’ll answer these questions and more as we demystify the difference between a merchant account and a payment gateway.

The better you understand the difference, the faster you can implement both and start processing credit cards to grow your business.

- What Is a Merchant Account?

- What Is a Payment Gateway?

- Merchant Account vs. Payment Gateway: Key Differences

- Why Do You Need a Merchant Account?

- Why Do You Need a Payment Gateway?

- Conclusion

What Is a Merchant Account?

A merchant account is a type of bank account that businesses use in order to accept cashless payments from customers, mainly debit and credit card payments.

This account is where the money is deposited when a customer uses a card to pay, and the funds are held there only for a short period while the credit card network verifies the details of the transaction.

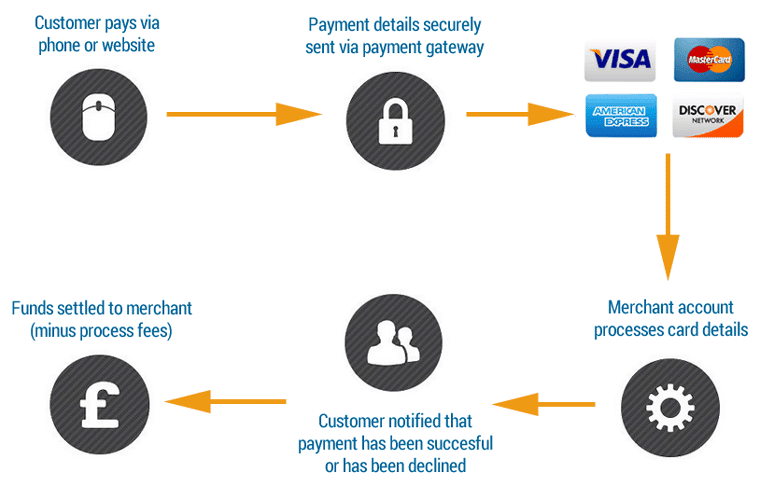

Here’s a flowchart depicting how a merchant account works.

Source: Web-Merchant

After the payment is processed successfully, the funds go to your business bank account, which you should set up before opening a merchant account.

Sometimes businesses keep a bit of money in the merchant account, which they use for various purposes such as refunding customers.

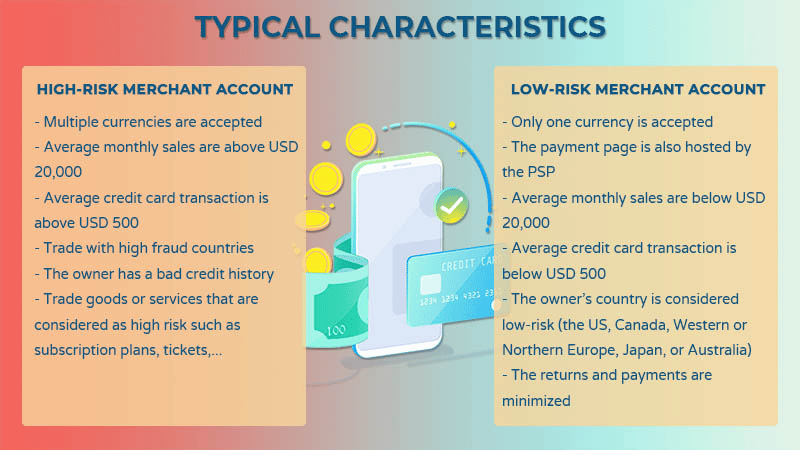

To open a merchant account, businesses partner with a merchant account services provider and fill out an application, which a merchant account provider uses to assess your level of risk. Higher-risk account owners will be charged greater fees.

Below are some characteristics of high and low-risk merchant accounts:

Source: BBCIncorp

To summarize, although there are other ways for businesses to accept cards than opening a merchant account, such as with payment service providers like PayPal, for example, e-commerce stores and other businesses that want to collect online cashless payments need to use a merchant account.

Anyway, merchant accounts provide many benefits you won’t find in a payment service provider, such as plan customization, fee negotiation, and better protection against fraud. We’ll go into more detail on the benefits later.

What Is a Payment Gateway?

A payment gateway is a technology that acts as the bridge between the customer’s payment method and your merchant account.

Not only does it give customers a place to input their card information, but It also communicates card data to the merchant account and other backend parties involved in verifying the payment.

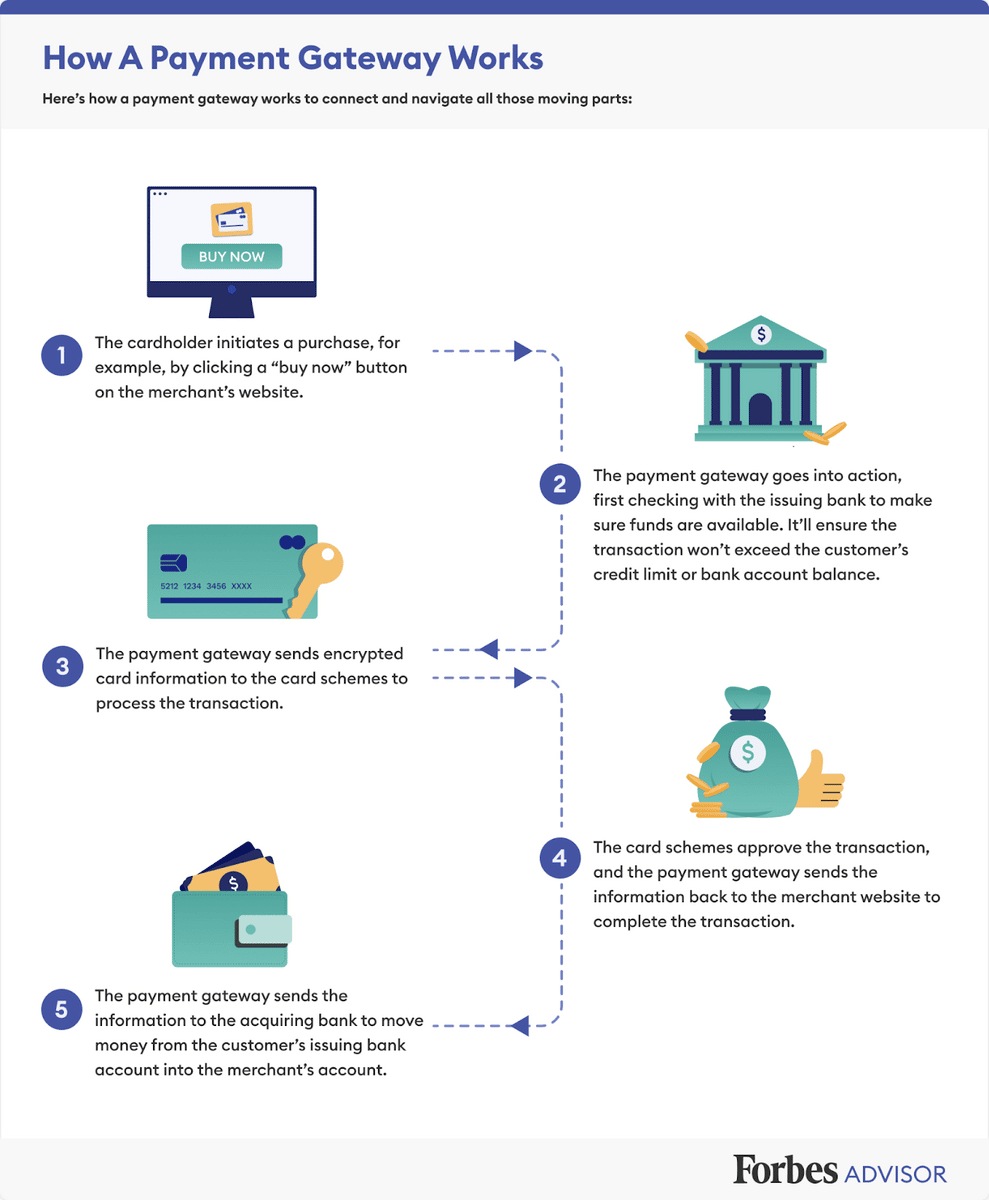

Here’s an illustration of how the payment gateway works to connect these various parties involved in cashless payment processing:

Source: Forbes

As you can see, the payment gateway facilitates the transaction of card data between the customer, the customer’s bank, the card schemes involved in card processing, and your merchant account. Without one, you cannot accept online cashless payments.

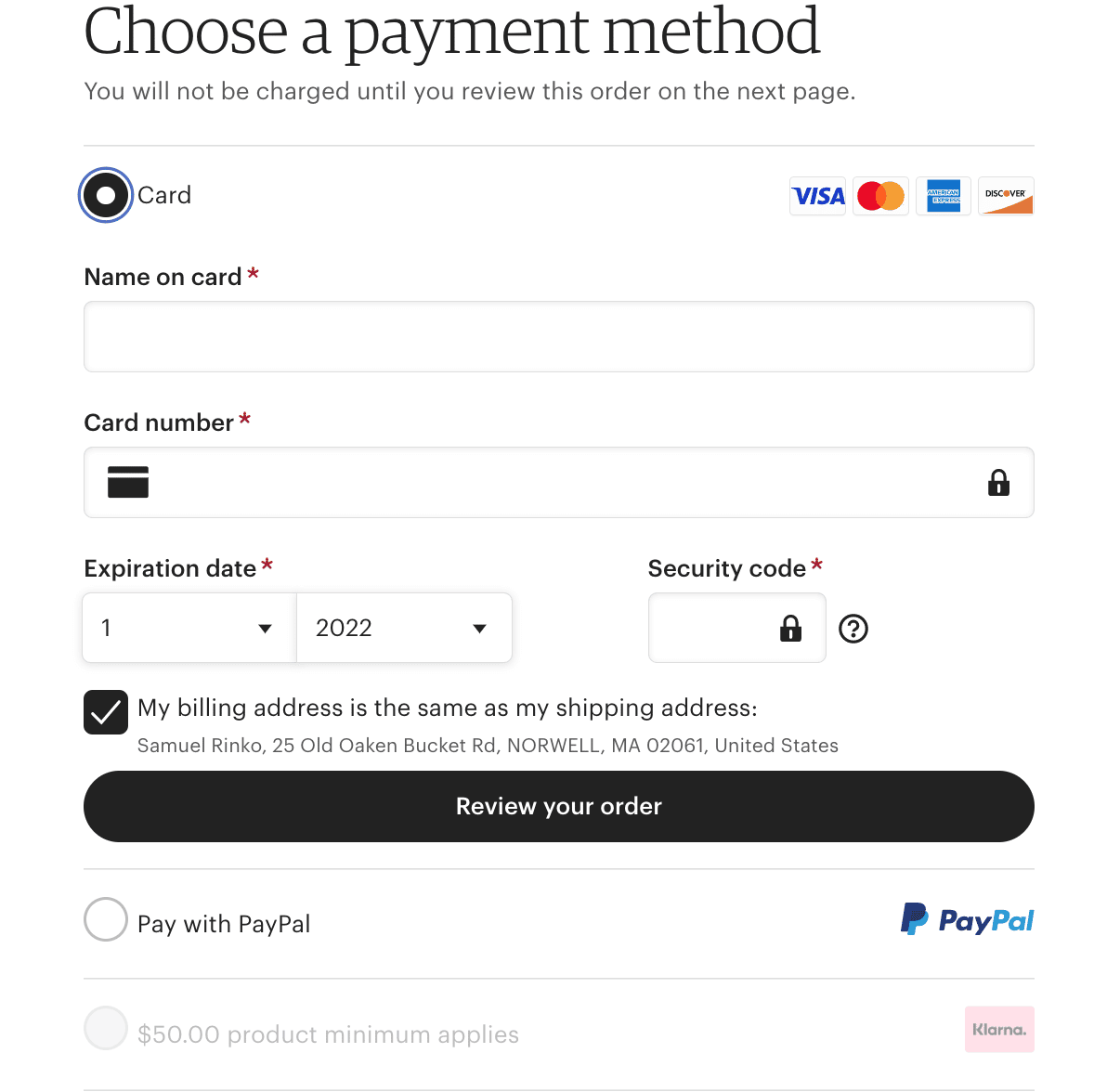

It sometimes helps to think of the customer-facing components of the gateway to get a better sense of what it is and how it works.

In a physical storefront, the payment gateway is the POS card terminal, the machine you use to swipe, tap, or insert your card.

In e-commerce, a payment gateway is the secure checkout page where debit or credit card information is entered.

It’s where you type in details like your name, address, and card information. Sometimes these fields are auto-populated if you’ve saved your card info.

Here’s an example of an online payment gateway:

Source: Etsy

It’s important to note that a payment gateway, like a merchant account, is essential for businesses that want to accept online card payments.

Merchant Account vs. Payment Gateway: Key Differences

Merchant accounts and payment gateways work together to process, verify, and collect card payments. Each plays a distinct and vital role in the online cashless payments process.

The payment gateway acts as the online customer interface and allows the seller to collect card information from customers, relaying it to the payment processor.

After the payment is processed, the merchant account receives and holds the funds from these card transactions until transferring them to your chosen bank account.

Therefore, one could say that In the process of card payment processing, the payment gateway handles the first step and the merchant account handles the last.

In her article, Vivian Thuri describes the difference quite clearly using a simile:

“Think of it like this—the payment gateway is like the cashier and the merchant account is the cash register.”

Now, let’s go over some other key differences between merchant accounts and payment gateways.

| Merchant Account | Payment Gateway |

| Unique to the specific business. It’s your personal account. | Shared between several businesses and their customers. |

| Set up through a bank. | Provided by a third-party vendor or online payments software that processes payments on the merchant’s behalf. |

| Customers never interact with a company’s merchant account. | Customers interact with the payment gateway first thing in the payment process. |

| A holding account that connects your customer’s card payments to your personal bank. | The link between your customer’s bank and your merchant account. |

It’s a misconception that merchant accounts and payment gateways have a lot of overlap in their functions. The truth is that they serve almost completely different purposes.

That means businesses looking to accept card payments online need to use both a payment gateway and a merchant account to process these payments successfully.

Let’s go over some of the main advantages of each.

Why Do You Need a Merchant Account?

The primary reason you need a merchant account is that without one you won’t be able to accept online cashless payments. This makes it essential for e-commerce stores.

When a customer submits their card information, your merchant account checks with the card network to make sure that the customer has sufficient funds to make the purchase.

Once funds are confirmed, the merchant services provider fronts your business the money so that you don’t have to wait until the customer pays their card bills to get paid.

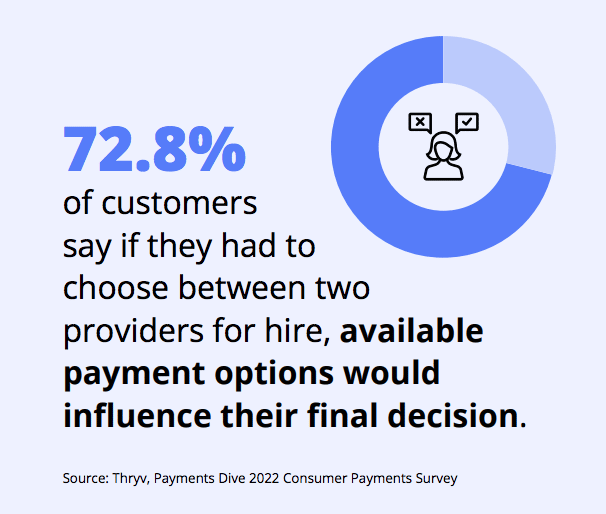

By offering cashless payments online, you’ll be able to attract more people to your business.

Customers who shop online are used to paying with a credit or debit card, and many of them will become annoyed if they don’t have that option.

They may even decide to take their business elsewhere. In fact, according to Thryv’s survey, 72.8% of customers say that they take payment options into account when choosing a provider.

Source: Thryv

Aside from this main advantage of helping you process online cashless payments, merchant accounts can also provide you with many other benefits, spanning from improved security and cash flow to greater customer satisfaction:

| Improved Cash Flow | Authorizations for card payments take only seconds, and you’ll have access to the funds in 1-2 days, a much shorter period than you’d experience invoicing your customers. |

| More Secure Online Payments | The merchant account allows for fraud checks and the flagging of suspicious payments. |

| Easier Customer Refunds | The merchant account can help manage risk around transactions. For example, customer refunds can be easily distributed from this account. |

| Improved Revenue | At $112, the average card transaction is $90 higher than the average cash transaction. If you want to set up your business to attract impulse buys, it’s smart to allow for easy cashless payment. |

| Simplified Accounting | The merchant account groups transactions into one deposit before sending them to your business bank account, thereby making your accounting less of an ordeal. |

As an online merchant, it’s best to focus on the benefits you’ll receive from a merchant account rather than the fact that you are forced to have one to accept cashless payments.

Thinking about the improvements you’ll see in your business’s security, revenue, and customer experience will make the process of searching for a merchant account provider more exciting, and you’ll be less likely to rush through the evaluation process without doing your due diligence.

Why Do You Need a Payment Gateway?

A payment gateway is crucial mainly because, without one, the money from the customer’s bank account cannot be processed and moved into the merchant account.

Therefore, you need a payment gateway to facilitate cashless payments on your website, e-commerce store, or app.

When you do, this provides benefits to both the business and the customer. The business can expand its customer base thanks to its greater range of accepted payment forms.

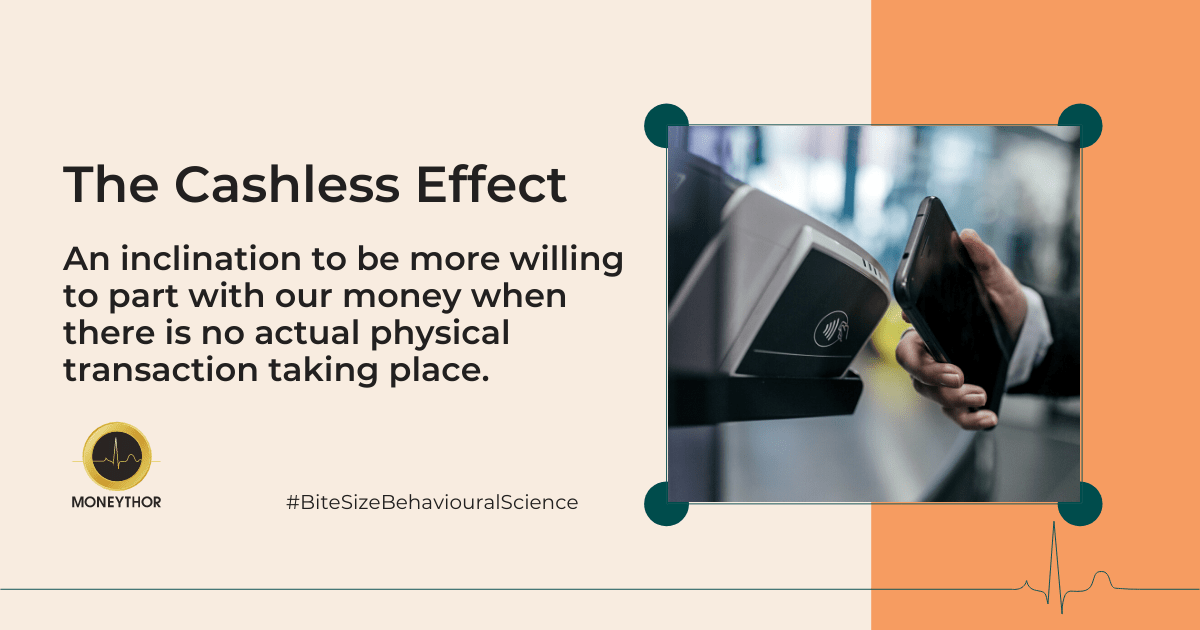

Thanks to the cashless effect, which states that people may more easily part with card money than cash, you might even win over some customers who would have otherwise saved instead of making the purchase if forced to use cash.

Source: Moneythor

As for your customers, it’s likely they are familiar with payment gateways. Almost all e-commerce stores use them.

So, they won’t have to learn anything new to pay your business online using their cards.

And when you simplify a process for the customer, their overall satisfaction with your business tends to improve.

In addition to making payments seamless, the payment gateway also adds a feeling of security to the customer experience.

When customers buy something online from your site, their data will be securely collected, transferred, and stored.

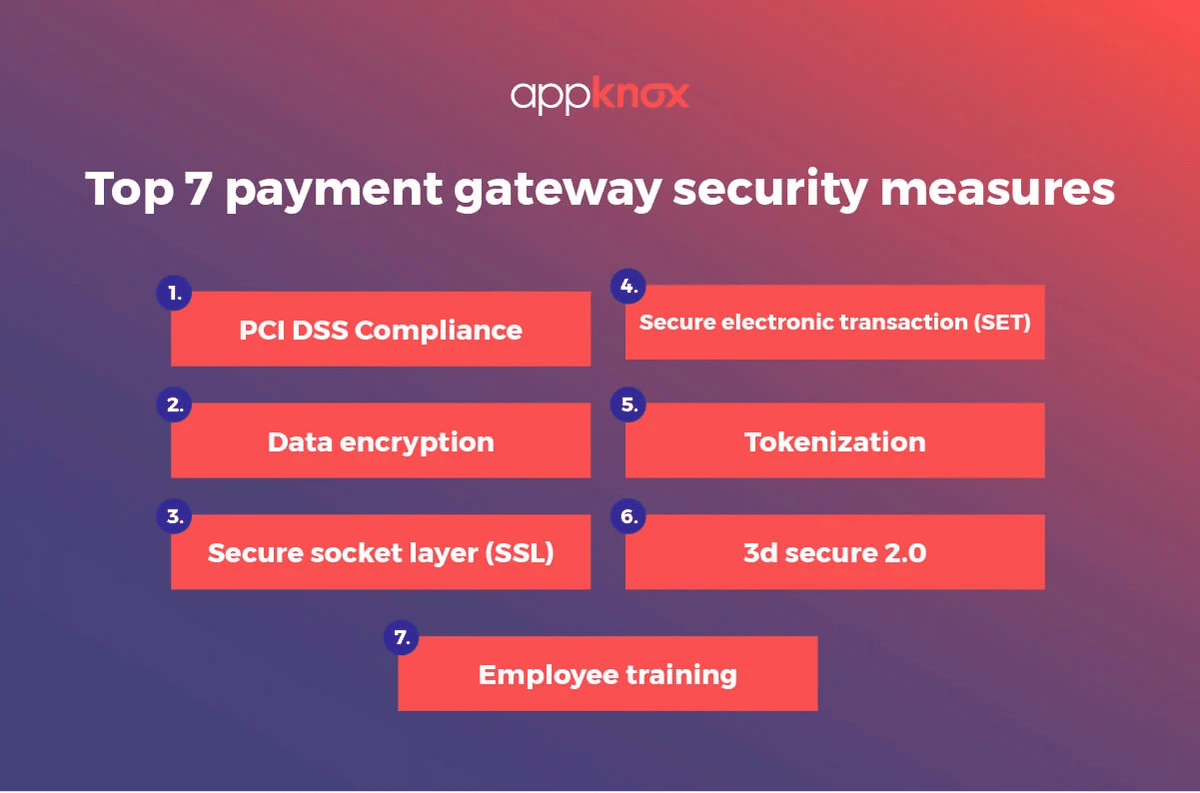

That’s because payment gateways employ various security measures that ensure that customer data doesn’t end up in the hands of some malevolent cybercriminal.

Source: Appknox

Encryption is one of the most common protection measures. This technique turns your card data into another form or code that no person can understand.

Many gateways can also detect online fraud, such as questionable card details.

When it detects something suspicious, it enables the merchant to accept or decline a payment, thereby protecting you from fraud.

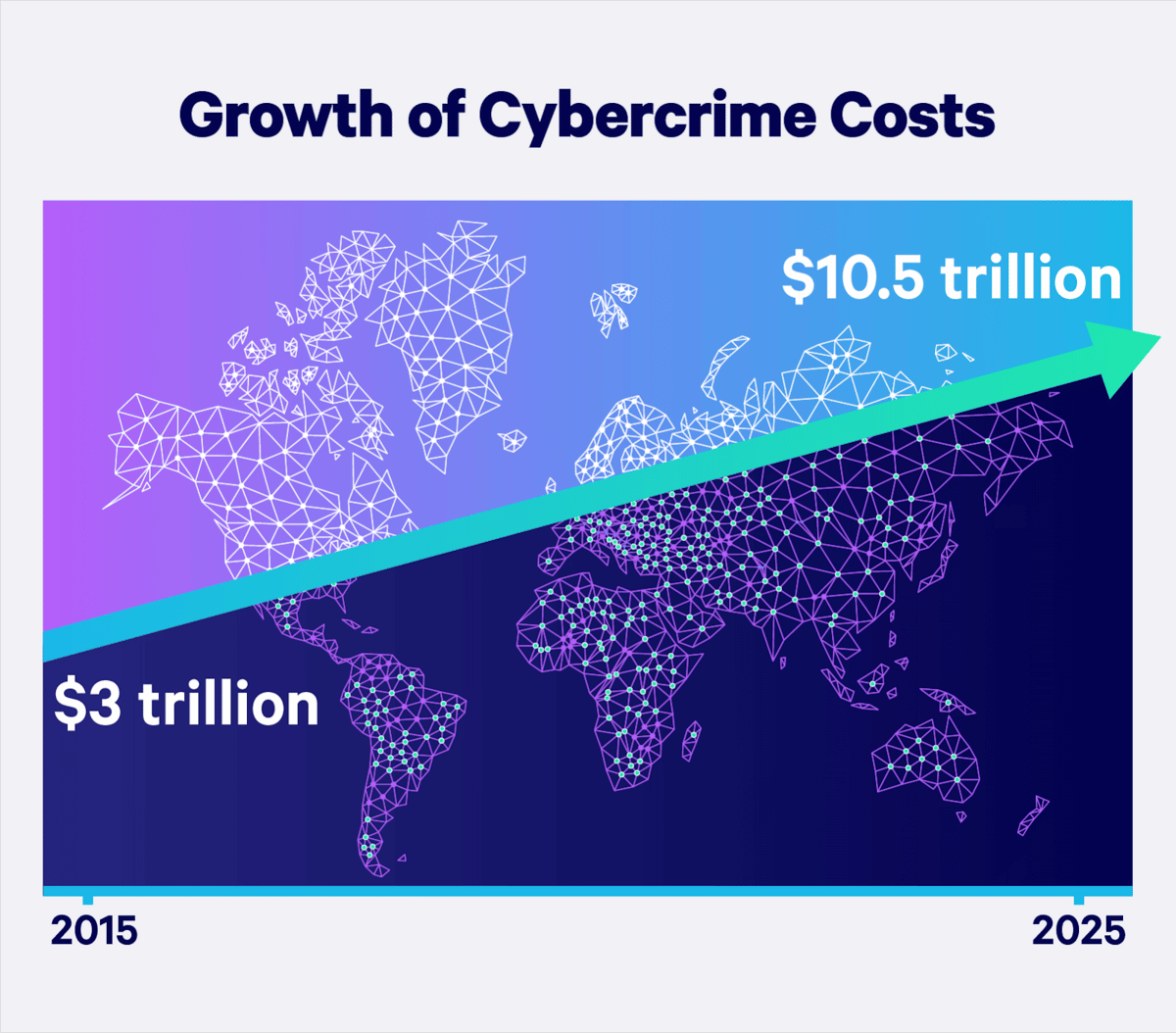

These security measures protect your business from fraud and your customers from theft, and this is essential in a time when small and medium-sized businesses are experiencing cyberattacks in record numbers.

Source: Embroker

In fact, in the State of Cybersecurity Report, 66% of the surveyed companies experienced a cyber attack in the past 12 months, and credential theft affected 30% of the small businesses.

So, next to enabling customers to pay cashless online, the second most important benefit of using a payment gateway is the security element, which leads to both peace of mind and reduced costs associated with cyber-attacks and fraud.

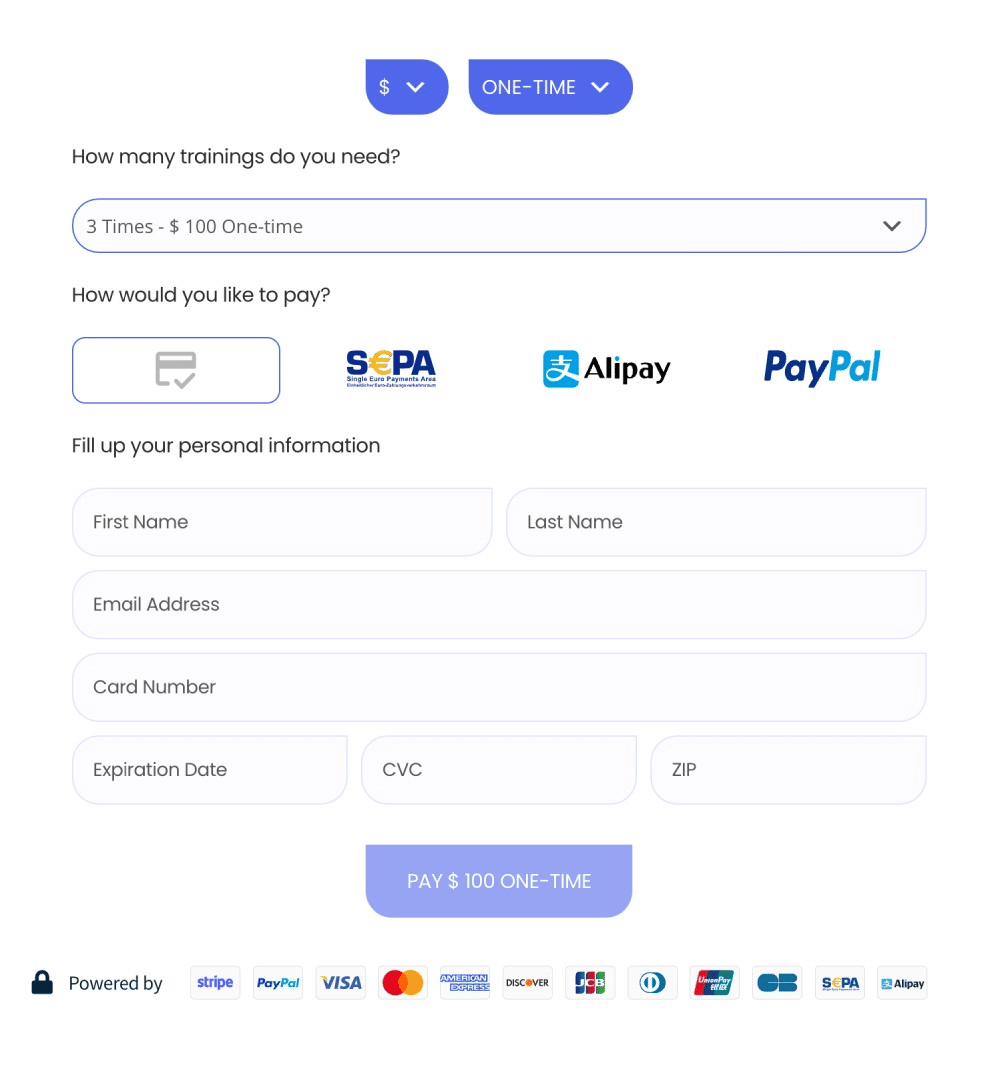

But still, those aren’t the only advantages gateways offer. In the name of personalization, payment gateway providers also typically give you the ability to customize the payment forms that you’ll embed on your business’s e-commerce site or mobile app.

That allows you to offer your customers options like recurring payments, personalized payment plans, or one-time payments, as offered in the form below:

Source: Payment Page

Also, through design best practices, you can make sure the form’s structure is as simple and clear as possible so that customers don’t get confused and drop out before paying.

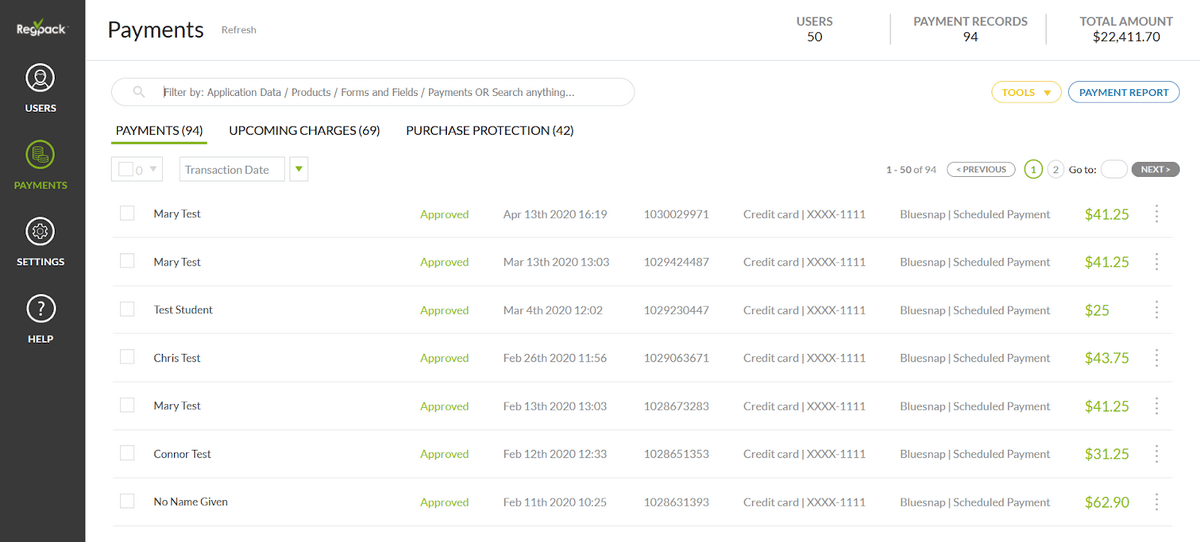

Finally, payment gateway providers also usually give you the ability to run reports so you can stay on top of your payments and find ways to improve your online payment process.

Here’s an example of a report of payments from Regpack, our own online payments platform that comes with a payment gateway:

Source:Regpack

In sum, businesses that want to collect cashless payments online need a payment gateway.

Their benefits expand to security, customer satisfaction, and visibility into your financial transactions.

Conclusion

According to a study from Business.com, 99% of customers use credit or debit to pay for something each month.

Being unable to accept these cashless payments from customers puts your business at a disadvantage.

To start accepting these payments online, such as through an e-commerce site, businesses need to get a merchant account and a payment gateway.

These tools both work together to process cashless payments in a secure and fast manner, limiting fraud while helping you get the money that’s owed to you quickly, so you can avoid cash flow disruptions.

Now, the next best step is to open up a merchant account and find some online payment software, like Regpack, that comes with a payment gateway as well as other impactful features that will take your small business to the next level.