Working with the correct data is crucial for a SaaS company, as it can uncover secrets to business growth and offer you opportunities to implement the most rewarding strategies.

You can influence your customers’ behavior to benefit your business when you know which metrics to track.

Customer retention measurement is a set of metrics that can help you document how well your retention strategy is and if you’re meeting your customer’s needs.

Everyone in your company can contribute equally to the customer journey and improve your retention rates.

To help you on your journey to understand your customer, we’ve selected key metrics to track to improve your retention rates.

Customer Churn

You should know how many customers are leaving by measuring customer churn.

The customer churn rate measures how many customers stopped doing business with you, regardless of whether their contract expired or they simply didn’t renew.

It is measured as a percentage of customers who cancel their subscription plans in a specific period.

Tracking this metric is important because it determines your performance in the market.

Investors like to use it as a valuation of your company’s profitability.

Higher churn rates will put you in jeopardy because they will signal that your business is not stable, and investors will pull money from further investments.

When should you calculate your churn rate?

It depends on the type of company and its products, but for B2B SaaS, it’s recommended to do it annually, as contracts are longer, but customers’ volume is smaller than B2C.

Another way you can use churn is to see how happy your customers are with your product. When customers stop using a product, it’s a good indicator that you’re failing to meet their needs.

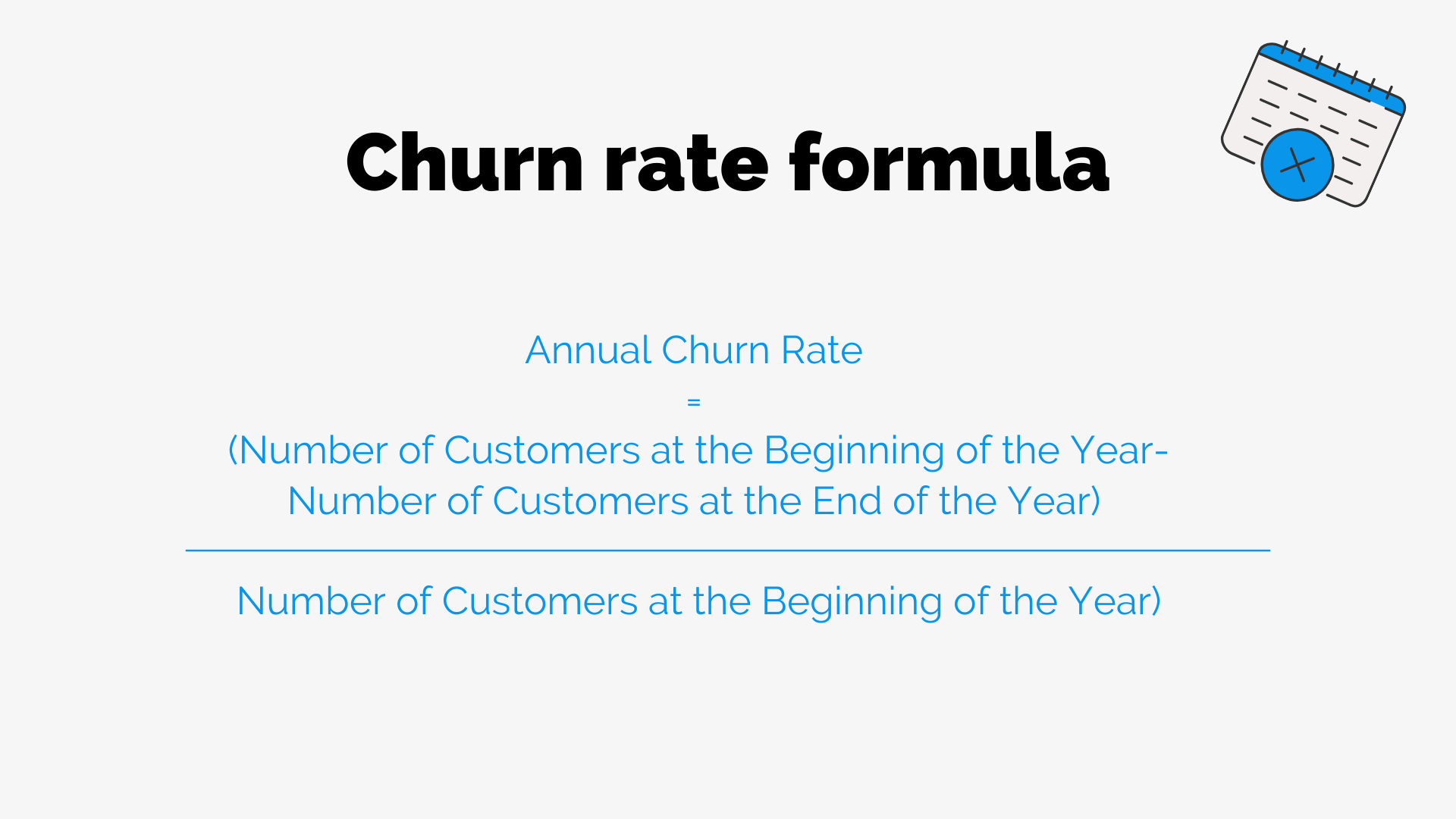

Here is a handy formula that will help you measure your customer churn:

To further explain, let’s use some numbers.

To further explain, let’s use some numbers.

For example, let’s say you have 1000 customers and lose 50 of them in a year. You will subtract the remaining 950 customers from the 1000 old ones and divide it by 1000:

(1000 – 950) / 1000 = 0.05)

This gets you a churn rate of 5%.

It’s also important to remember that you shouldn’t count new customers into your churn rate.

When it comes to customer churn, your goal is to keep it as low as possible. It’s even better if you can get to the net negative churn, which is achieved when your revenue from existing customers is higher than the revenue you lose from cancellations.

It’s a dream come true for SaaS companies, and it can happen to you too.

Customer churn is an indicator for investors about the health of your business, and it shows how happy your customers are to do business with you.

Revenue Churn

Keep track of your revenue by looking at how much you’ve lost.

The potential causes of revenue churn are numerous, from downgrades and cancellations, to customers going bankrupt or choosing another company.

The good news is that three out of four times, you can do something about it.

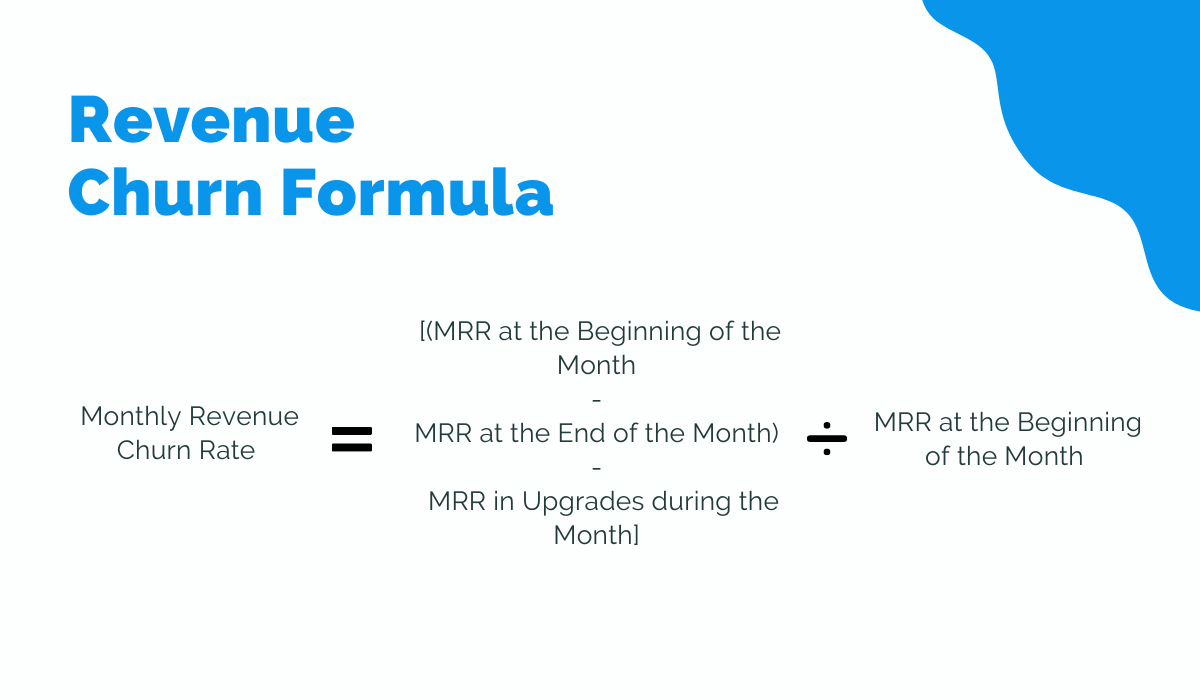

Calculate how much revenue you’ve lost by using this formula:

For example, we started the month with an MRR of $20K, lost $2K, and gained $1500 from upgrades.

For example, we started the month with an MRR of $20K, lost $2K, and gained $1500 from upgrades.

Putting these numbers into the formula, we get a monthly revenue churn of 2.5%.

You can measure it monthly or annually, and it’s shown in percentages. Like customer churn, it can also show you how much value your customers get from your product.

Customer success teams should focus on looking into where customers have problems with your product and keep them from downgrading their subscription plans or outright canceling.

To better grasp the situation, you should calculate your revenue churn monthly. This is important if you have multiple pricing plans to segment your users based on the amount they spend.

It will tell you where you can lose large amounts of revenue.

Then you can put in place new strategies to win back customers or even get them to upsell.

Tracking customer cancellations and downgrades should help you see which customers derive more value from your product to implement the right retention strategies.

Existing Customer Revenue Growth Rate

Contract expansion is the easiest way to grow your retention rates.

As we all know, acquisition costs have grown tremendously in the past several years, and SaaS companies have embraced the new motto: “Retention is the new acquisition.”

This is why it’s essential to look into your existing customers and see which of them are the prime candidates for upgrading their subscription plans.

When you see your expansion rates climbing, that is a good sign that your sales and marketing team are doing an excellent job by showing the customers your product’s additional value.

Increased spending is generally a good thing. You should be concerned when those rates are stagnant or falling.

Failing to cater to your existing customers means you won’t have enough funds to cover your business expenses, and the cost of acquisition will only eat more into your revenue.

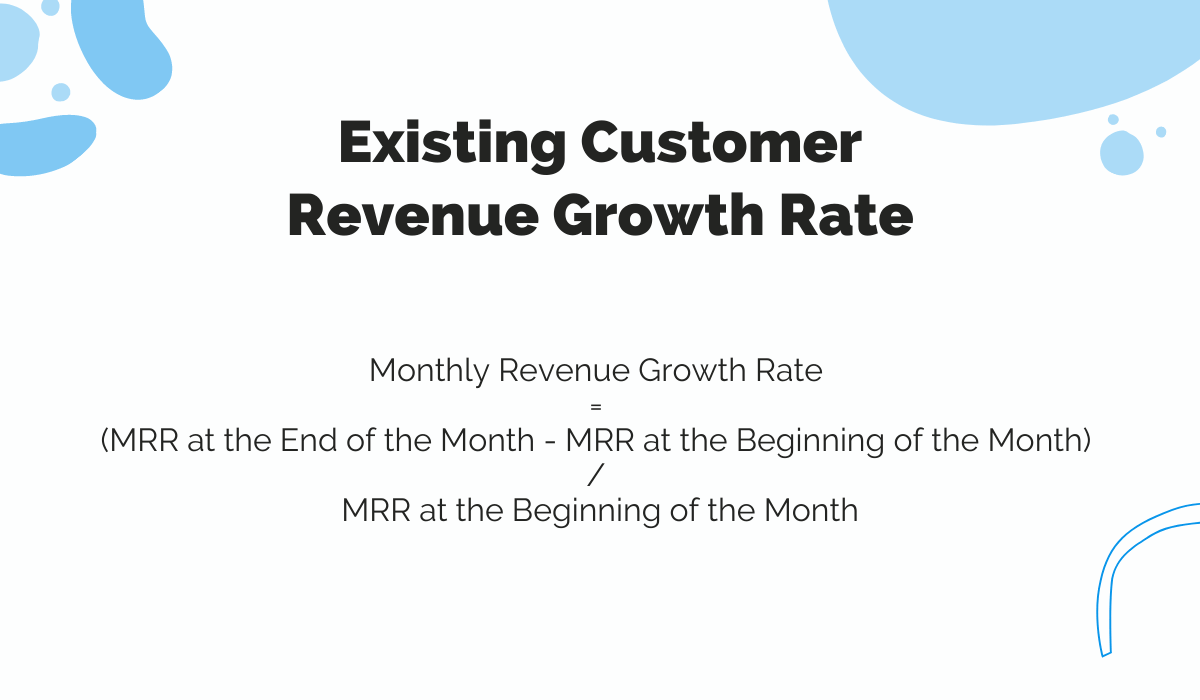

To measure expansion rates, you should only put revenue generated from existing customers. Forget about new sales for a moment.

Let’s look into another example.

Let’s look into another example.

We started the new month with a $50K MRR, and we lost $4500 due to churn. When we put the numbers into the formula, we get an existing revenue growth rate of -9%:

(45 500 - 50 000) / 50 000

This metric can also be applied to a single account over a long period.

Now that you’re familiar with measuring expansion rates, it’s also important to know how you can improve these numbers.

Expanding on your existing customers can happen in three common ways.

The first one is upselling. Find existing customers who will benefit from using more features for a higher price.

Then, look into those customers who might not want a full upgrade but to whom you can sell extensive additional products or services.

And finally, there could be those in your customer base who could use the basic add-ons for your existing service.

If your customers aren’t upgrading their contracts, you’re failing to provide more value and grow your revenue.

Repeat Purchase Ratio

Only the happiest customer will repeatedly do business with you.

If you want to measure success, look at how many customers keep coming back to you.

Customers who make repeat purchases have higher retention rates and are generally an excellent pool to market new products to.

What you consider a repeat purchase depends on your business model and products.

Companies typically count customers who have made at least two purchases in a given period.

For this, you’ll need to know the number of customers who made repeat purchases in a specific time and the total number of customers in that same period.

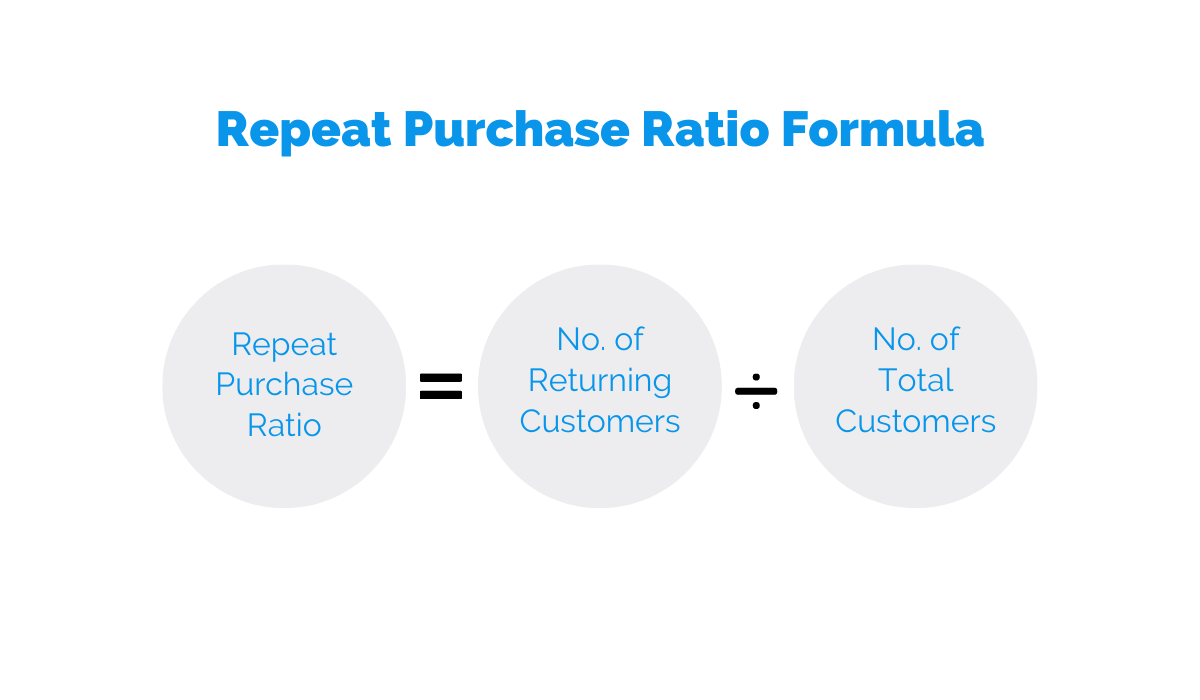

Your RPR formula is this:

If you have 4000 customers and 1500 made at least two purchases in six months, your repeat purchase ratio is 37,5%.

If you have 4000 customers and 1500 made at least two purchases in six months, your repeat purchase ratio is 37,5%.

These numbers are usually calculated annually, but you can choose any period that you want.

You might wonder what the best ratio for repeat purchases is.

While every industry is different, some believe that 28% is a good benchmark. The only way to know is to look at the numbers of competing SaaS companies and similar products.

If you’re falling short with the recommended numbers, there are a few things you can do to improve:

- Identify your best-selling features and products.

- Plan targeted marketing campaigns for customers with high repurchase rates

- Retarget customers with incentives to encourage repurchasing decisions

Remember, a repeat customer is more likely to stick with you in the long run. So, you have to make more effort to impress them and provide more value.

As they continue doing business with you, it will be easier to identify their preferences, and you will better understand their purchasing behavior and motivation.

Time Between Purchases

Measure your customer’s willingness to stick with your product by looking at the time between their purchases.

The time between purchases and repeat purchase ratio might look similar on the outside since they both look into buying behavior of your customers. Yet, they measure different things that can tell you more about how to plan your retention strategy.

Repeat purchase ratio focuses on the primary value of your product. In contrast, the time between purchases can tell you more about the quality of your product and its standing when compared to your competitors.

If there is a long time between two purchases, it may tell you that your offer is not as strong as you thought it is or that your service is not that different from your competitors.

When you calculate the time between purchases, you can get an insight into your customer’s buying patterns and identify the opportunities to upsell or cross-sell.

In short, you can maximize your revenue by tracking purchase patterns.

This requires a bit more data and looking into your customer’s purchase history.

Let’s say we had five customers.

To get an average purchase rate, we have to look at the number of purchases they made in a year, then at the total number of days between purchases.

We’ll get that number by dividing 365 by the purchase frequency.

Now, when we have that number (let’s say it was 30 days for all five customers), then we use a new formula to calculate the time between purchases:

Time Between Purchases = Sum of Individual Purchase Rates / Number of Repeat Customers

So our time between purchases is:

30 / 5 = 6 days

To get the accurate numbers, you’ll need a system that will record repeated purchases for all your customers and exclude any new purchases.

Anticipate your customer’s buying patterns by looking at the right metrics.

Upselling Ratio

The upselling ratio can help you anticipate monthly renewal rates.

Having repeat customers is fantastic, and it’s even better if they expand their contracts and increase your revenue.

When you want to predict your monthly renewal rates, look into your upsell ratio.

This metric is important because, with it, you can identify and segment customer cohorts to focus on those who have not made new purchases.

The customer success team can also be more proactive in keeping your customer churn rates low.

Upselling is an essential factor in your revenue, so you must have the correct numbers to implement the right strategies in collaboration with your customer success team.

It can also help you with your budgeting because you’ll know which customer segment you can invest more into to increase their customer experience.

Spending more on marketing to enterprises will be different than spending on SMBs or startups.

Use an upsell ratio to identify upselling opportunities, increase your revenue and plan your budget.

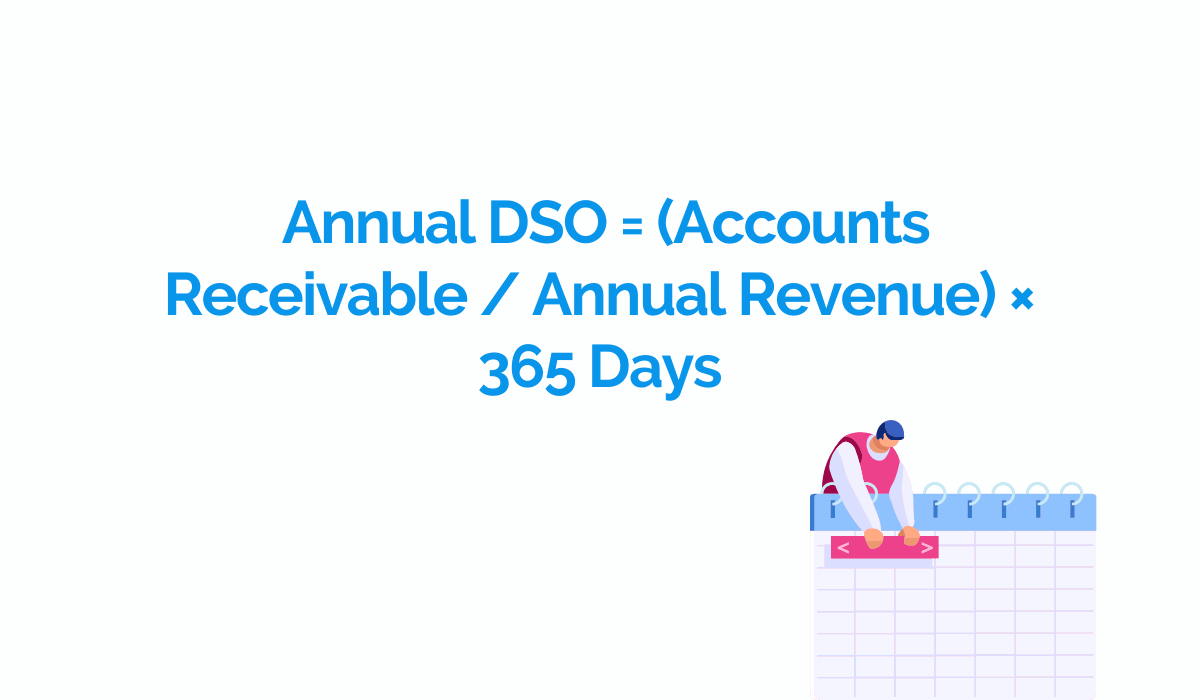

Days Sales Outstanding

Calculate how many days until you can collect your receivables.

The tricky thing with SaaS is that you don’t count your revenue until you’ve provided service and collected the money for it. Sometimes this process can take a long time.

Days sales outstanding (DSO) can help you determine the average amount of days until your customers pay their bills.

It’s beneficial for handling finances but also for maintaining a healthy relationship with your customers.

If you have a high DSO, it can signal potential problems in your acquisition process.

Your sales team could be targeting customers with cash flow problems, or your product may not be a viable solution for them.

It’s essential to know your average DSO so you can plan for paying operational expenses and investing.

A high volume of sales is no good when those same customers are late paying their invoices.

It can also happen that some of them don’t ever pay, so how will you manage to pay off your expenses?

Calculate it by following this formula:

What counts as a high DSO, and makes DSO low?

What counts as a high DSO, and makes DSO low?

Low DSO means you need fewer days to collect, which indicates higher cash flow and better liquidity. On the other hand, a high DSO means you need longer to receive payments, which can negatively impact your cash flow.

DSO benchmarks vary by industry, but the average numbers are between 30 and 90 days. Many things can impact your DSO—from the product, customer type to the industry sector.

Look at your DSO to identify customer behavior regarding payments and improve your retention strategy.

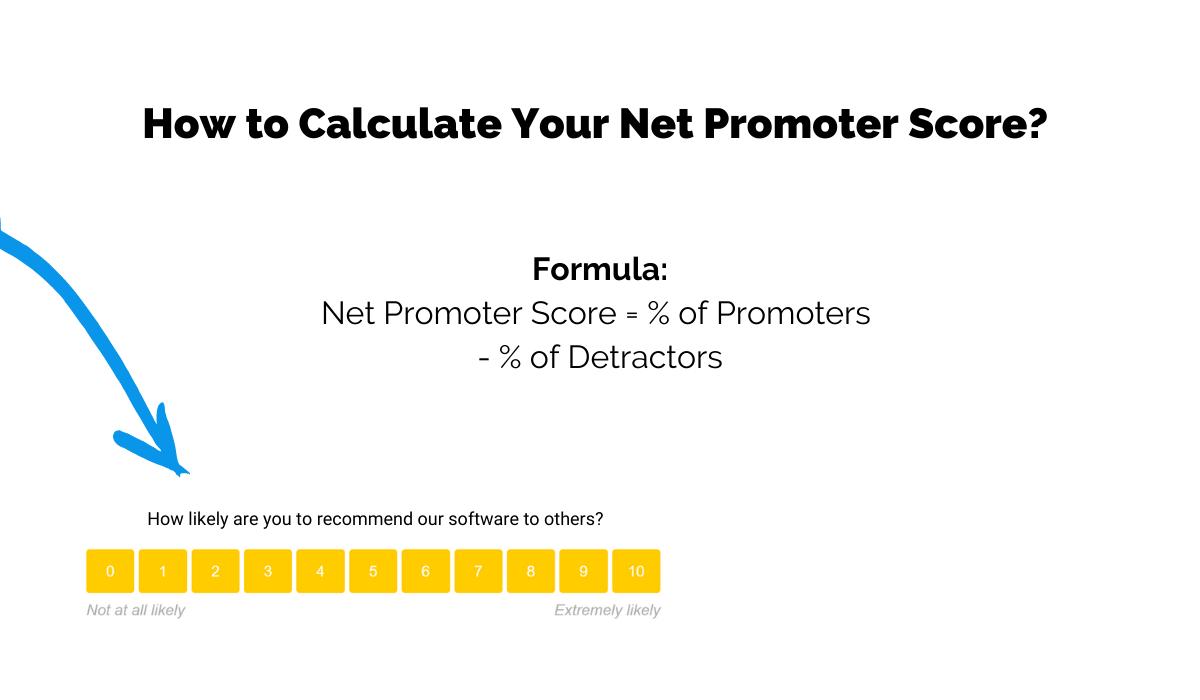

Net Promoter Score

Measure customer satisfaction by looking at your NPS.

Net Promoter Score enables you to identify the loyalty of your customers.

It can’t guarantee customer growth, but it can give you a fairly decent picture of how your product holds up in their eyes.

You can use this metric to identify potential promoters that you can include in your referral and loyalty programs to increase sales and save on CAC.

We’ve already explained NPS, but let’s recap some basics.

To measure your NPS, all you need to do is ask your customers how likely are they to promote your product and then use the data for this formula:

This is based on customer feedback, so it is not very reliable since you only ask one question.

This is based on customer feedback, so it is not very reliable since you only ask one question.

Customer retention depends on several factors, and you should use NPS with other metrics to make calculated decisions for your retention strategies.

NPS is valuable in other ways, like knowing whether you have a likable product and room for improvement.

You can use NPS as a starting point in getting more information from your customers to understand their (dis)satisfaction.

Use customer feedback to separate your promoters from your detractors.

Customer Loyalty Index (CLI)

What better way to change your retention than by looking at who your most loyal customers are?

Those users have cracked the secret to your product’s value, and they’re the best source of sharing positive reviews and referrals to those in doubt.

When you measure this metric, you’ll know what drives the most sales, and you can maximize your retention opportunities by gathering testimonials.

85% of customers trust online reviews, and they’re generally looking for positive ones.

So you should do your best to identify who your advocates are and how many you can further incentivize to spread the word about your product.

Customer Loyalty Index is an extension of NPS, and to calculate it, you should ask more questions to get a more accurate number.

Use 1-10 range for each question and then take the average numbers to calculate your CLI. This number includes both new customers and old repeat customers.

Just as with NPS, you should carefully examine these numbers because customers might not be completely honest with their answers. It shouldn’t serve as the basis for long-term acquisition and retention strategies.

Customer Lifetime Value (LTV)

Predict your growth and retention by measuring customer LTV.

Customer lifetime value is the best metric to track if you want to know how much you will spend on acquisition and when you can expect a return on your CAC.

Then you can prepare yourself for implementing the right marketing strategies.

To calculate a single customer contract, use this simplified formula:

Simple CLV: (Annual revenue per customer x Customer relationship in years) – Customer acquisition cost

For example, a customer has a $25K annual subscription, and they renewed their plan for three years.

You have to subtract that number from the CAC (let’s say you spend $15K), and you get a CLV of $60K.

However, if you want to measure the average CLV of your entire customer base, you should divide your gross annual income by the total number of customers in that year.

For example, if one year your revenue was $2 million, and you have 2000 customers, your average revenue per customer per year is $1000.

Then analyze your average customer longevity (for this example, let’s say it’s two years).

Multiply your average revenue with the number of years they do business, so you’ll get the average customer LTV of $2000.

In SaaS, pricing tiers impact your revenue in different ways, so it’s helpful to know the average numbers your customers spend to do business with you.

Conclusion

As retention becomes more and more critical for SaaS, you must have the right metrics that can help you determine the right strategies for your business growth.

Looking at different churn rates and repeat purchases will help you get an idea of your cash flow.

However, to stabilize your income, you need to measure the repeat purchase ratio and gather feedback from customers. These will enable you to improve the key features of your product.

When you know who your most loyal customers are, you can maximize your profits by recruiting them for your marketing strategies.

Retention metrics can be used for numerous things, but their core purpose is to ensure business growth.