Many companies don’t realize how much they lose by ignoring customers who don’t pay on time. While focusing on customers who actively cancel is necessary, addressing failed payments can also greatly impact your bottom line.

Experts estimate that 9% of MRR loss is due to failed payments. But the good news is that you can prevent that! And here’s how: dunning emails.

Dunning is a process in which companies communicate with their customers about payment problems. In this way, they try to recover any lost revenue by asking the customer to update their billing information to process the payment quickly.

This is best done via email since it’s still the most effective way to reach customers. Hence why they’re called dunning emails.

Now, the tricky part is how to approach dunning. You don’t want to look like a loan shark, but you want to get paid to secure cash flow for your company.

Luckily, we’ve put together the best ways to manage your dunning process to ensure you get paid on time.

Let’s start!

Don’t Send Pre-dunning Emails

If you see some of your customers’ cards will expire soon, you might be tempted to inform them in advance. While that may seem nice from your side, there are many reasons for not doing it.

Sending pre-dunning emails was a standard practice years ago, but that’s not necessary anymore.

While you’re thinking of sending that pre-dunning email, the chances are that banks are already informing their clients about their soon-to-expire credit cards and resolving these issues.

Just like you, banks want to continue doing business with their clients, so you can rest assured that 70% of credit card expirations will get resolved without your intervention. That’s a massive load of work you don’t have to do if you don’t send pre-dunning emails.

Another reason why you should forget about pre-dunning emails is that they irritate your customers.

They’re probably already resolving payment issues, and you reminding them about it damages your relationship. You’re basically telling them that you only care about their money and not them as a person.

Not to mention that if you send them a pre-dunning email, you’re giving them the chance to rethink the value of your product. With each billing period, they’re already reassessing how your product contributes to their lives, and if you do it more frequently, you’re shooting yourself in the foot.

After another reminder about their upcoming payment issues, they just might decide you’re not worth the money they spend.

To sum up, pre-dunning emails belong to the past, and you should focus on customers who continue having problems with their payment after their renewal period is over.

Offer a Grace Period

Even if most payment issues will be resolved beforehand, there will always be a segment of your customers who will not pay on time.

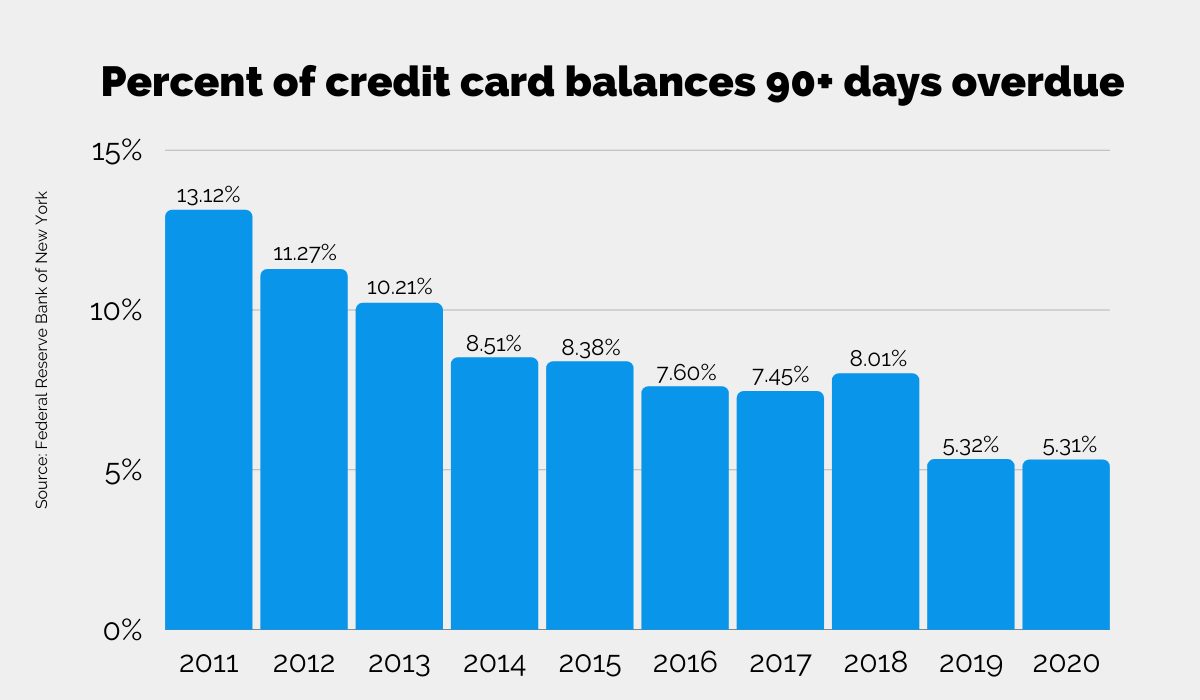

However, in the past ten years, payment issues are becoming less and less frequent.

As you can see, only 5.31% of accounts were 90 days late with their payments last year. That is good news for you because you will have to send fewer dunning emails over the years. But… failed payments will still happen.

We’ve mentioned the first common problem causing late payments, and that’s credit card expiration. Other possible reasons for failed payments are insufficient funds or errors with the payment gateway.

Whatever the reason, when a customer’s credit card gets declined, this is a sign the customer has issues that can’t be resolved without their knowledge, so you should start sending dunning emails.

Consider your first dunning email as notification of what happened. The main point is to inform the customer to give them enough time to rectify the situation independently. It’s not their fault this happened, so you should be empathetic and polite.

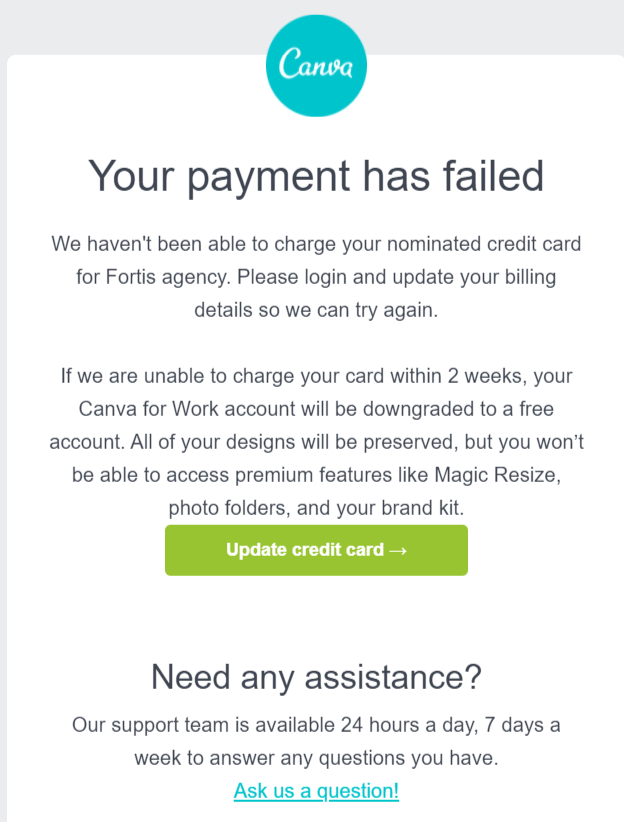

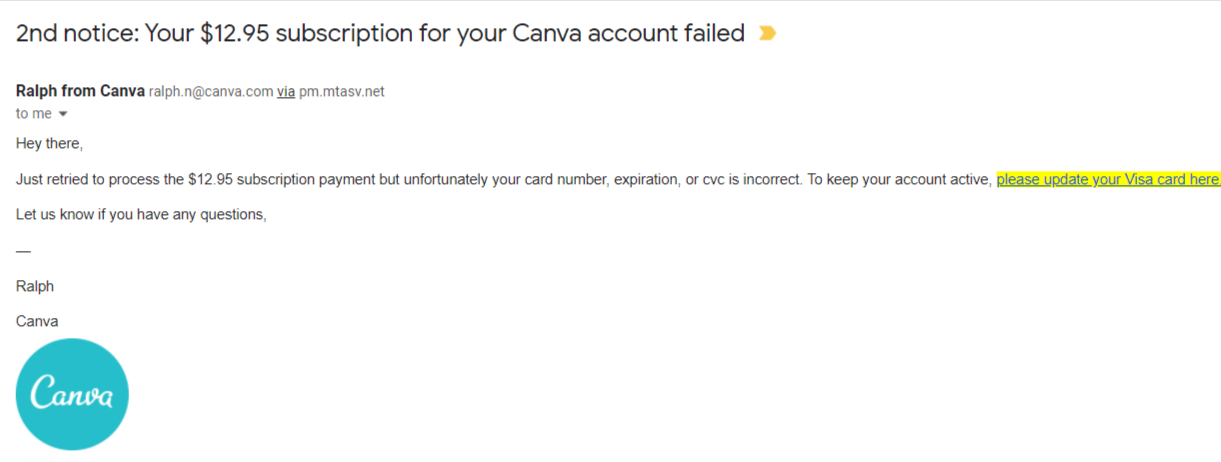

Here is how Canva did it.

Canva is informing the customer about a payment issue, and offering them a grace period of 2 weeks to update their billing information. After that, they will retry the payment process.

This way, customers have enough time to investigate further what the problem was and fix the issue. They will update their billing information or transfer funds to the credit card so the company can seamlessly process the payment.

You don’t have to follow Canva’s example and offer a two weeks grace period. Most companies offer up to a week to their customers. But you must give them enough time so they can follow up on your dunning email.

This is an essential aspect of your customer experience because you’re trying to minimize the negative impact of a dunning email. When you’re polite and understanding, the customer will be more inclined to take your advice and click-through to your payment page.

Remember that you can recover the most revenue by properly informing your customers and giving them time to resolve their payment problems.

Make Your Email Clear

How you compose your dunning email and what you say will impact the customer’s decision to update their billing information.

Are you clear and persuasive enough to get them to open your email and read it? Here, you have to look at three key areas: the subject line, email body, and closing.

Subject line

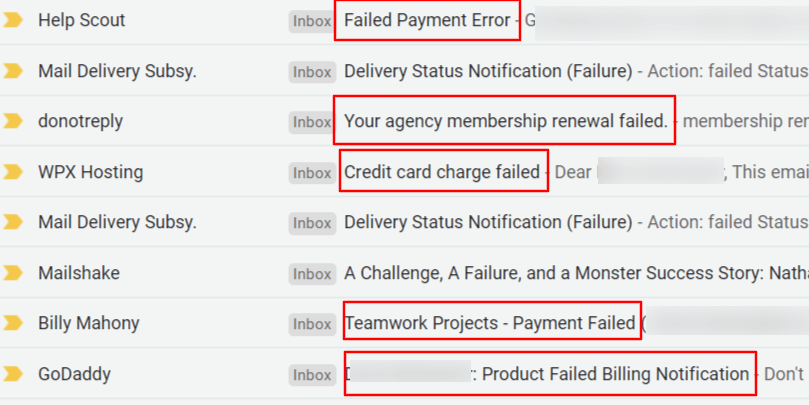

This is the first thing your customers see in their email inbox.

![]()

It’s important to have an eye-catching subject line that will make your customers open your email. Why? They might be getting 121 emails on average each day, and you can bet they’re not reading all of them.

They’re prioritizing more urgent emails, and your subject line has to communicate that urgency. You want to get paid, right? So write better subject lines.

You can stand out with strong words that will trigger emotion in your customers. Here’s an example of effective subject lines that evoke action.

See how many of them use the word ‘’failed’’. It’s a powerful word that spurs the customer into opening the email. They want to know what went wrong and fix it.

And when you get them to open your email, your job is still not done.

Email Body

There are two things you need to include in your email body. The first is to tell your customers what happened, and the second is to instruct them what to do next.

There has been a problem, and you need them to fix it right away, so don’t waste their time writing a 1,000-word essay on credit card failures. You have to be short and to the point.

Several sentences should cover the essential points of your dunning email and include a CTA button.

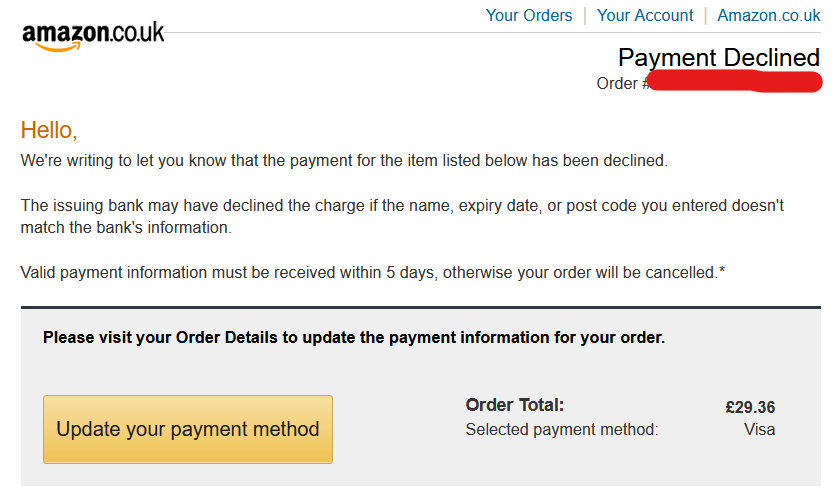

Let’s look at Amazon’s dunning email.

Their tone is formal and slightly impersonal, but they explained everything in three sentences. First, they stated that a payment has been declined, then possible reasons why this happened, and finally what to do next.

Remember that the best dunning emails are short and clearly express the problem at hand.

Closing

What do you do if customers have more questions?

The answer is to provide contact information. Sometimes things don’t always work out, or customers want to talk to a customer service agent so you want to give them an email they can reply to or a telephone number.

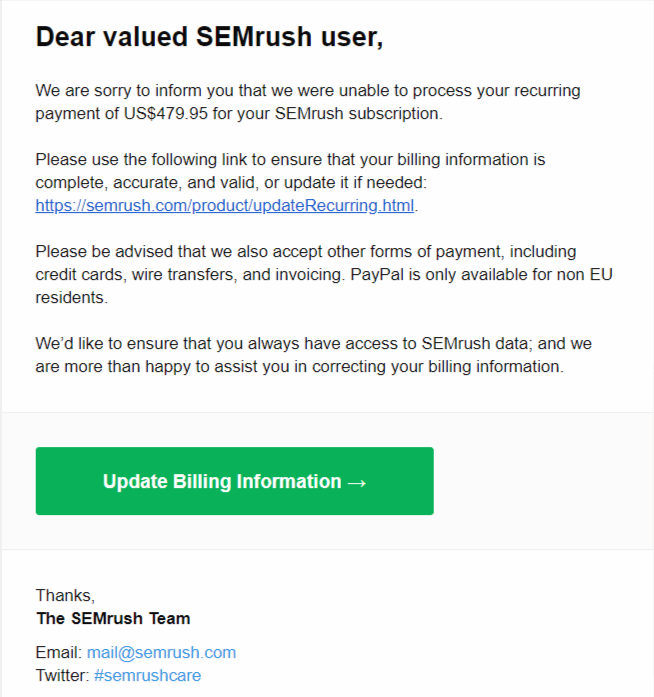

For example, look at SEMrush’s email. After the CTA button, they provide an email address and a Twitter hashtag, so the customer has different options to reach the customer service.

Like SEMrush, your closing should give your customers alternative solutions so they can get help as quickly as possible. Then you can collect your payment on time.

Make Sure Dunning Emails Get Delivered

Even after you’ve crafted the perfect dunning email, there is one major problem—delivering it to the customer. Are you sure your emails are getting delivered?

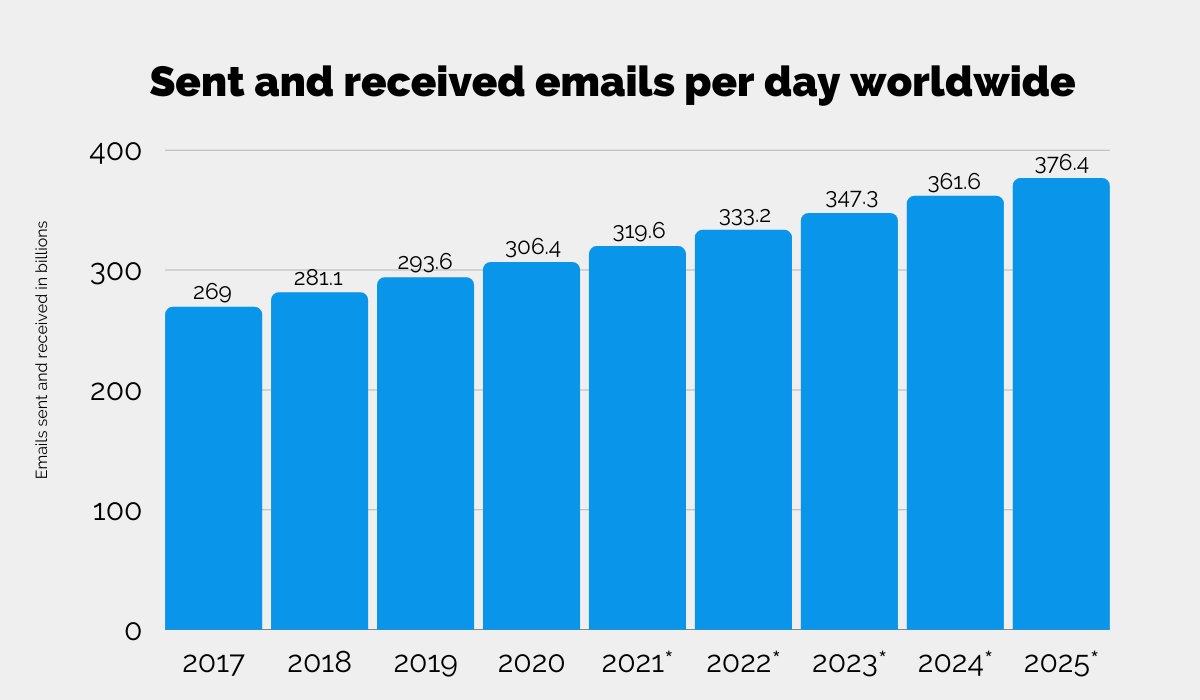

Deliverability is a growing concern overall since companies send more and more emails each year to their customers.

With this many emails being sent, it’s no wonder email providers are getting pickier over what gets into their customer’s inboxes and what they’re directing to the spam folder.

In fact, spam amounted to 50% of email traffic in 2020. Half of those billions of emails were never read by customers!

At the end of the day, where your dunning email ends up is of the utmost importance since it has a more significant impact on your bottom line than your marketing emails.

Your customers need to know that they missed a payment which they won’t be able to because your emails are in their spam folder.

You should actively prevent two things from happening: email ending up in the spam folder and bouncing.

Let’s tackle spam prevention first.

One way to ensure you don’t end up in someone’s spam folder is to have a reputable email domain. To do this, you need to set up SPF (Sender Policy Framework) and DKIM (Domain Keys Identified Mail). You should also choose your website name carefully so that you appear in domain lookup platforms as a professional.

These are email validation systems that help email providers authenticate your emails and build credibility for any future emails you send to your customers.

Think of them as IDs for email providers that help verify your identity and ensure email deliverability.

Check out how to set up your SPF and DKIM if you’re using Gmail (like billions of other email users because it’s the leading email provider).

Next, we come to bounce. This term refers to emails not being delivered at all.

There can be numerous reasons why that happens, and we separate them into two categories:

- Hard bounce – happens due to typos (e.g. @gmil.com), recipient’s email addresses being deactivated or sender’s email address being blocked. This is a permanent bounce, and your emails will never get delivered.

- Soft bounce – this is a temporary bounce and you might get emails delivered after several retries. These happen because too many people marked your emails as spam, there was an error in the email server, the email account is temporarily suspended or the customer’s inbox is full.

Email delivery tools are better equipped to tackle bounce rates. They track the type of bounce and the number of bounces your emails get so they can help you understand how to manage your mailing list.

So if you repeatedly send dunning emails to hard bounce addresses, it’s time to contact those customers and ask them for a different email address.

Email deliverability can be tricky, but when you’re proactive about it, you can ensure that your dunning emails get sent to the right person and that you’re getting paid.

Send Follow up Emails

Consistency is important in dunning management. You can’t send one email and think everything will be solved.

Life happens, and emails are easily missed. Your customers might overlook them in their inboxes the first time (remember those 121 daily emails they get?), or there might be something that distracts them from acting right away.

Whatever the reason, you have to send multiple emails at regular intervals. The key is to find a balance between being annoying and communicating urgency.

The most common advice is to send at least three emails for a month to maximize your chances of recovering revenue.

But take into consideration who your customers are. Some will require more time than others.

For example, customers of B2C companies might respond much quicker, so you can send emails that are a few days apart. The best route is to send them during weekdays and weekends. You’ll have to catch people when they have free time to update their billing info.

On the other hand, B2B customers will take longer to fix payment issues. Sending them weekly emails for a month or longer might be the best option. You never know the state of their finances, so it’s not unusual to have payment follow-up of up to 90 days.

The next thing you need to consider is increasing the level of urgency with each follow-up email.

Let’s look at how Canva approached their dunning follow-up emails. Their second dunning email is more personalized and emphasizes urgency more bluntly.

They sent this email from an employee email account to push the customer to act immediately. When customers are faced with an email from an actual person, they are more likely to do as instructed. Someone is relying on them to take action, so in most cases, they will.

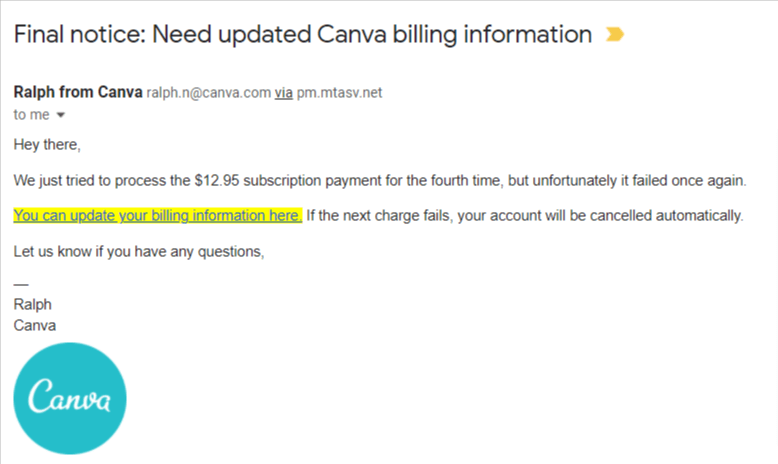

If this doesn’t work, Canva will continue to send dunning emails, and here is their fourth, and final notice:

They continued with the ‘’send from an actual person’’ strategy, but now they warn the customer what will happen if they fail to update their billing information after the final notice. Their account will be canceled, and some of the features’ access will be lost.

This is a clear incentive to the customer to act immediately; otherwise, their inaction will have real consequences.

What should you learn from this email sequence? Sending more emails is necessary to recover as much revenue as possible. Customers are forgetful, and only when they’re reminded of what they can lose will they act immediately.

However you set your dunning cycle, remember to keep emails frequent but avoid irritating your customers. Your goal is to get them to pay for their subscription, so communicate a good amount of urgency without appearing predatory.

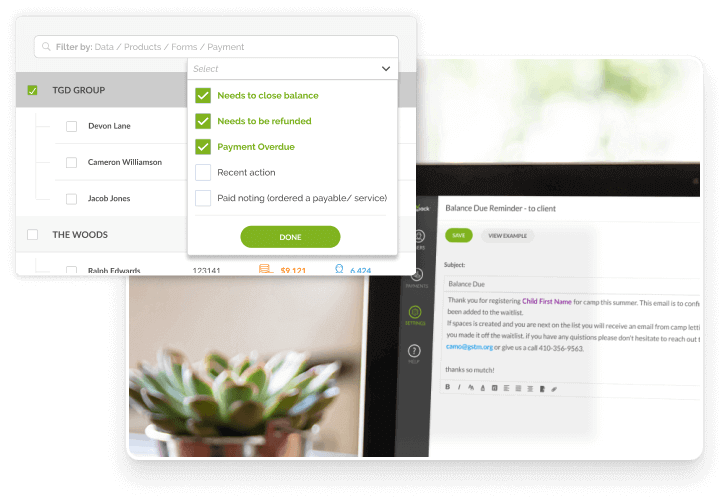

Use a Dunning Management Tool

All of our previous advice doesn’t matter if you don’t invest in good dunning management software.

Handling billing and payments gets complicated as your customer base grows. If you do it manually, you’re prone to making mistakes, letting missed payments slip through, and losing more revenue. All of these problems can be fixed with an automated solution.

In fact, Baremetrics managed to recover $30,000 in 2019 when they adopted a dunning management software.

Apart from recovering more revenue, there are other great benefits to using dunning management solutions.

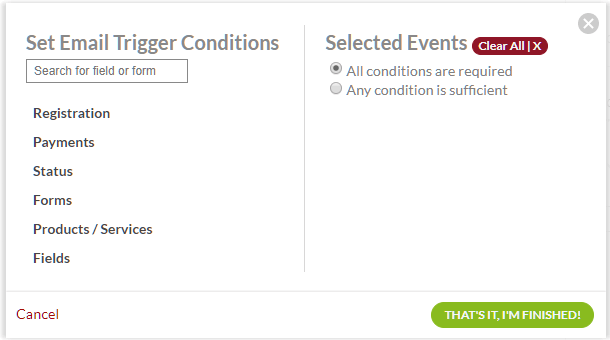

First, you save a lot more time with dunning automation. You won’t have to individually send reminders to your customers because your billing solution will automatically detect failed payments and send emails for you based on set triggers.

You can even set a dunning cycle to send multiple follow-up emails without worrying about payments being missed.

When you set these automatic retries, you can also lower your churn. Customers will be alerted on time about their payment issues, which ultimately results in increasing your revenue.

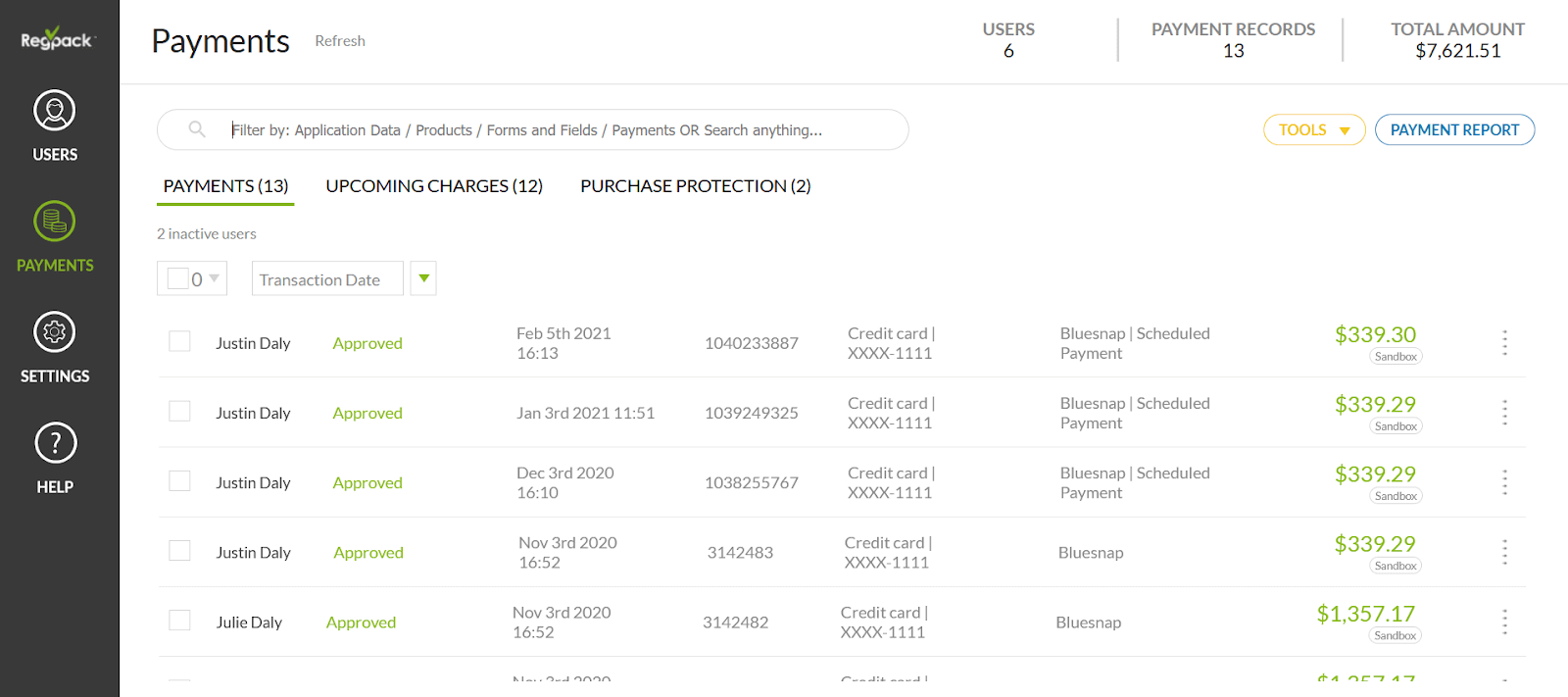

Finally, your dunning solution will store a lot of relevant data about your customer’s financial history with your company.

You will be able to see which customers have a higher number of declined charges, which type of payments are the most used, and how many retries it took to recover revenue.

This will help you uncover your most highly valued customers who are on the verge of churn.

Why is this important?

Then you can use the data and have your customer success team reach out to them. If your high-value customers experience multiple payment failures, it will be better to manually reach out to them and see why they have problems.

Anything you need to know to manage your billing can be seen with the right billing system that supports automated dunning.

When you have an in-depth overview of your billing data, you can make better decisions on managing your dunning process. Automation can help you uncover problems you might not be aware of and save you even more revenue.

Conclusion

Remember that most payment failures usually resolve themselves without your intervention. And for those that don’t, you need a smart dunning email process.

Your emails should be short but convey a sense of urgency to the customer so that you won’t get ignored. When you optimize your email format and tone, you can convince your customers to click on the CTA button to update their billing information.

Finally, remember not to send just one email and hope for the best. Even though the matter of recovering revenue is urgent, your customers might need a couple of reminders of why this is important for them too.

Make sure you’re optimizing your business operations and invest in an excellent dunning management solution. This will handle the tedious tasks of sending dunning emails so you can focus on what you’re good at—developing a great product.