Navigating the vast world of online commerce can initially appear like an overwhelming task, particularly when it comes to understanding the complex nature of payment gateways. As the critical link in the chain of online transactions, selecting the right payment gateway for your business is a decision that should be well-thought-out and tailored to your specific needs. The purpose of this blog post is to provide you with a complete understanding of what a payment gateway is, discuss the various types of payment gateways, and help you decide which one is right for you.

At this juncture, allow us to introduce ourselves. Regpack is a leading name in providing robust, custom registration and billing software for camps, courses, events, and more. With our vast knowledge and specialized expertise, we’ve aided a myriad of businesses across the globe in making an informed choice when it comes to the integration and operation of efficient payment gateways.

This blog post serves to leverage our expansive understanding and well-rounded exposure to make the concept of payment gateways more accessible. Our aim is to provide you with valuable insights and beneficial knowledge that can significantly contribute to your business’s seamless online operations.

To ensure your understanding, we will be breaking down the topic of payment gateways. The information will range from the basic – defining a payment gateway and its role in online transactions; to the more complex – discussing the relationship between a payment gateway, a payment processor, and a merchant’s website.

We will also delve deeper into the world of plastic money and explore how credit and debit card transactions are processed through payment gateways. The goal is to empower you with the right information, thereby allowing you to make the best decision for your business.

We, at Regpack, take pride in our dynamic software solutions that have carved a niche in multiple business environments. Our role does not stop at delivering quality products – we believe in continual engagement with our clientele to ensure the best user experience at all times.

Join us as we embark on this journey to simplify the intricate world of online payment networks. After all, our mission is to equip you with the right information that can serve as a guide toward making a rewarding decision and realizing significant growth in your digital commerce experience.

Understanding Payment Gateways

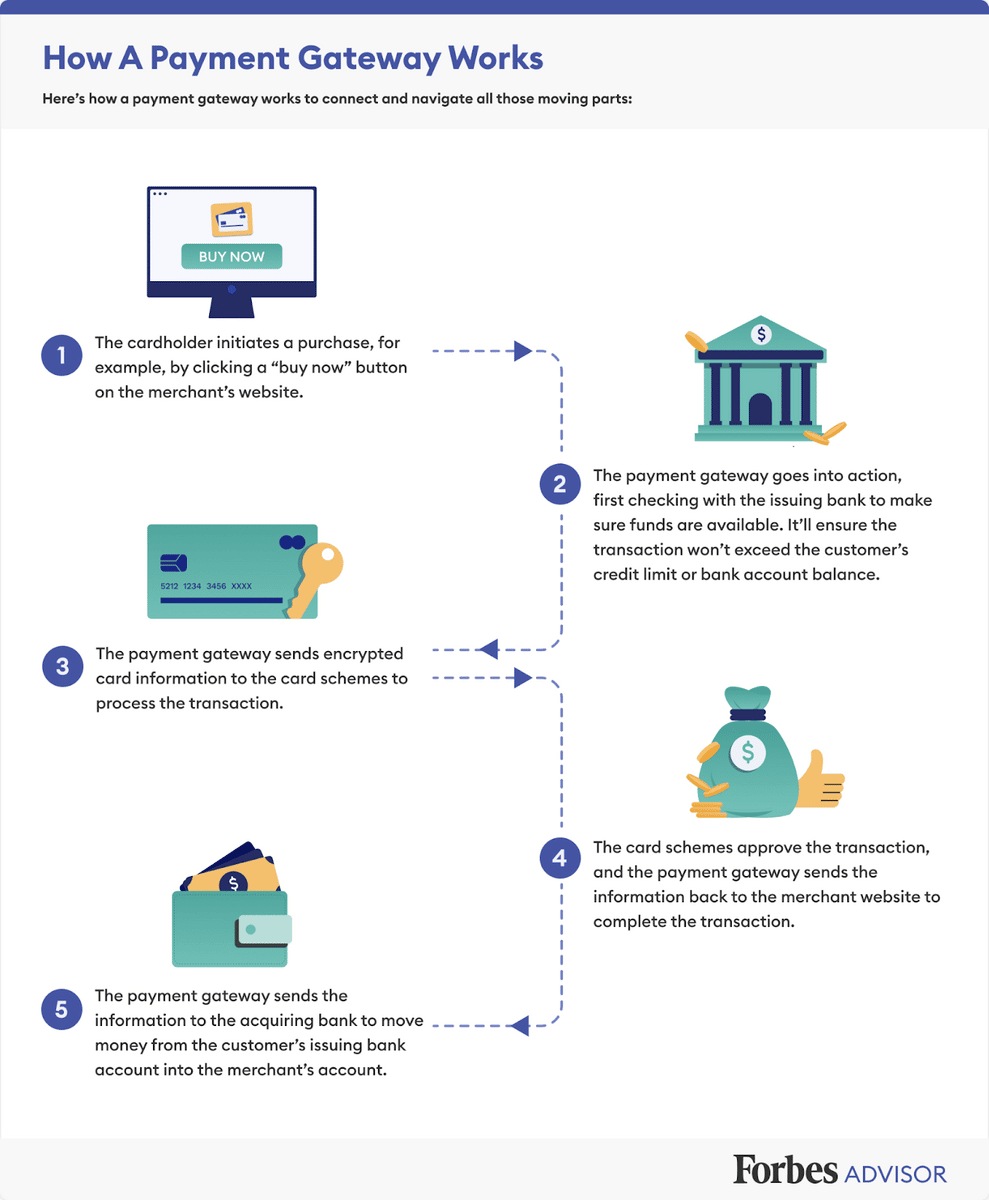

Building on the introduction we provided, let’s begin by understanding the fundamental role of a payment gateway in the digital commerce landscape. To put it in simple terms, a payment gateway is like a middleman in an online transaction. It plays an instrumental role in facilitating online payments from customers to merchants, ensuring secure, efficient, and timely transactions.

Now, you might be wondering how different a payment gateway is from a payment processor or a merchant’s website. While these three entities work synergistically to ensure a seamless payment process, they each play distinct roles. A payment processor is essentially responsible for handling credit and debit card transactions. They liaise with the banks, transfer payment details, ensure transaction approval, and facilitate the secured transfer of funds.

The merchant’s website, on the other hand, is where the transaction kicks off. It’s like a digital storefront where customers select products or services they wish to purchase. Once the customer is ready to complete the purchase, they are directed to the checkout page. Here is where the payment gateway comes into play.

In a common scenario involving a purchase via a credit card or a debit card, the customer would enter their card details at the checkout. The payment gateway then encrypts this sensitive data and securely transfers it across to the payment processor for necessary verifications and approvals. Once the transaction is approved, the payment gateway seamlessly completes the process, culminating in a successful payment for services or products desired by the customer.

The beauty of today’s state-of-the-art payment gateways lies in their capability to support a multitude of payment methods. From conventional credit and debit cards to the modern and more sophisticated forms of payment such as Google Pay, Apple Pay, and other digital wallets— payment gateways have immensely contributed to the evolution of online retail.

It’s clear that an effective payment gateway is a crucial cog in the wheel driving the machinery of online commerce. It bridges the gap between customers and merchants, enabling them to transact in a safe, swift, and secure manner. However, remember that not all payment gateways are created equal. In the coming sections, we will delve into different types of payment gateways available today, their unique characteristics, and how to choose the one that best suits your business needs.

Types of Payment Gateways

Having established a basic understanding of what payment gateways are and how they function, it’s time to explore the diverse range of payment gateways available to us. Each type of payment gateway has its own unique set of features that are suited to different kinds of business operations. So, let’s break them down:

Self-Hosted Payment Gateway

In the self-hosted gateway, the merchant’s website is responsible for collecting customer payment details. After collecting all necessary data, the information is sent to the gateway URL. Even though the data collection falls into the merchant’s domain, the actual payment process is carried out through the gateway provider. This type of gateway provides greater control over the payment process but also demands thorough SSL certification and secure transaction handling from your end.

Hosted Payment Gateway

A hosted payment gateway directs the customer away from the merchant’s website to the payment processor’s page to input their payment details. Once the transaction is complete, the customer is redirected back to the merchant’s website. This popular type, including prominent examples like PayPal, is user-friendly and takes the burden of secure data handling away from the merchant.

API-Hosted Payment Gateway

API-hosted gateways allow customers to enter their payment details directly on the merchant’s checkout page. The API then sends the payment data to the gateway for processing. This method requires significant security measures on the merchant’s end but offers a seamless user experience as customers never leave the merchant’s site.

Third-Party Payment Gateway

With the third-party payment gateway, companies such as Google Pay, Apple Pay, and American Express enter the picture. This type involves embedding the payment system of a third-party app, like those mentioned, into your site. Your customers are directed to these platforms, away from your online store, to finalize their payments. The advantage of this type of gateway is that it’s easy to set up and often involves no transaction fee.

Understanding the different types of payment gateways, along with their advantages and disadvantages, can greatly assist your decision when choosing a form that suits your specific needs, aligns with your business model, and optimizes the customer experience. However, there are several additional factors to consider, which we will delve into in our next section.

Factors to Consider When Choosing Your Payment Gateways

Choosing a payment gateway can be likened to selecting an integral part of your business’s engine. Your decision can significantly impact not just your operations but also your customer’s experience during the checkout process. Here are some of the critical aspects you should consider:

User Experience

The checkout process plays a pivotal role in defining the user’s experience. For instance, API-hosted gateways allow customers to check out without leaving your website, ensuring a seamless transaction. Similarly, offering a good variety of payment methods can enhance the user’s experience and increase their chances of completing the purchase.

Payment Methods

In today’s digital world, customers prefer having multiple payment options. Some prefer paying via credit card, while others choose digital wallets or bank transfers. And remember alternative payment methods, such as Buy Now Pay Later services, which are becoming increasingly popular with consumers. Offering this diversity can make your online store more appealing to a broader consumer base.

Security

Online transactions come with inherent risks, so demonstrating to your customers that their credit card information and other personal data will be handled safely is crucial. The use of SSL certification, ensuring PCI compliance, and maintaining a secure transaction environment are some of the ways to accomplish this.

Transaction Fees and Compliance Requirements

Every payment gateway comes with different transaction fees and compliance requirements. You should compare these factors, including PCI DSS compliance, amongst various gateways to make an informed decision. Usually, significant savings can be made by choosing the right gateway that matches your transaction volume and business model.

Integration

When selecting a payment gateway, you also need to consider how easily it can be integrated into your existing online store or business setup. Some payment gateways may require extensive programming to integrate with, while others may only involve a simple plug-and-play setup.

Weighing these factors carefully will enable you to select the appropriate payment gateway that suits your business needs. Remember, your choice will directly impact your online sales and customer satisfaction. Now, let’s see how Regpack can assist you in this process.

How Regpack Can Help

Now that we have a comprehensive grasp of payment gateways – their role, types, and the factors that should be considered while selecting one, you may wonder how Regpack can assist in this crucial process.

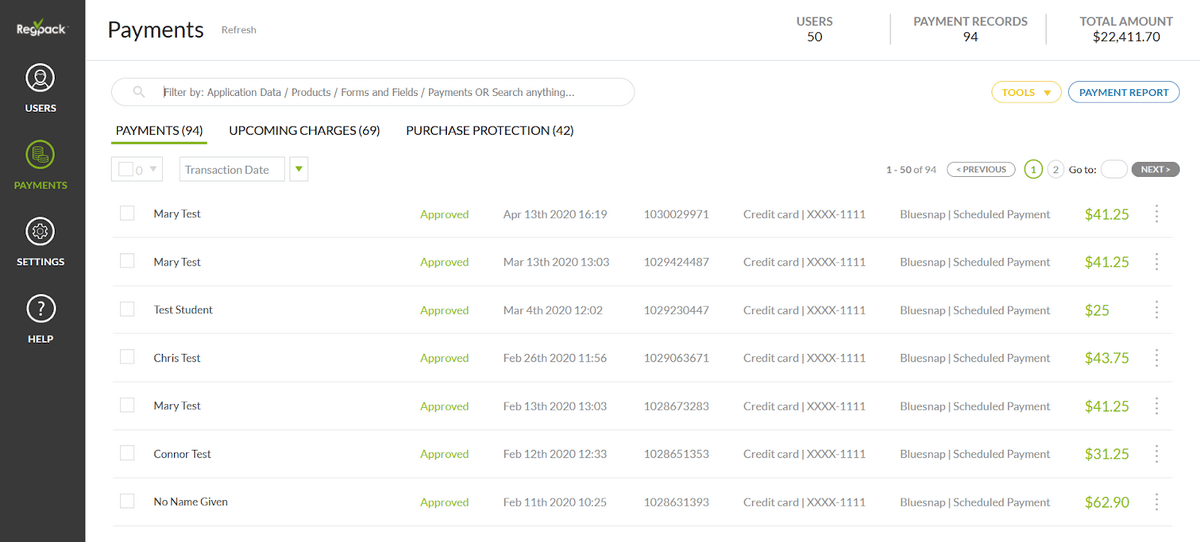

At Regpack, our focus isn’t just developing cutting-edge registration and billing software that drives success for our clients – we also provide personalized support in helping direct your payment gateway options, depending upon your specific business model and needs.

Our solution is built to be adaptable and versatile, enabling it to cater to a myriad of payment gateway integrations. This feature ensures that you can offer your customers numerous payment method options, thereby enhancing customer experience and maximizing your transaction success rate.

Furthermore, our software provides robust payment processing choices while assuring secure online transactions. We understand the importance of security and compliance, thus striving to ensure our clients meet all necessary security measures, including SSL certification and PCI DSS compliance.

Besides facilitating smooth payments via flexible gateways, the Regpack system takes pride in adding value to the checkout experience with intuitive, seamless interfaces. By ensuring a flawless checkout process, we aim to contribute significantly to increased customer satisfaction and, subsequently, higher conversion rates.

In a nutshell, Regpack works as a dynamic extension of your business, functioning seamlessly to help streamline your payment processes and offering versatile payment gateway options for your customers’ varied preferences.

In conclusion, understanding and selecting the appropriate payment gateway is a crucial aspect of your e-commerce operations. Your choice not only affects your revenue generation but is also instrumental in shaping your customers’ experience. Trust the right software partner like Regpack to help you navigate these important decisions, ensuring your business model adapts and thrives in the evolving digital commerce landscape.

We invite you to reach out to us, explore more about what we can offer, and join the multitude of businesses worldwide that have successfully enhanced their payment processes with Regpack. Your journey toward a comprehensive, secured, and customer-centric payment gateway is merely a call away.