You have undoubtedly heard a lot of talk about financial stability since the term gets thrown around frequently. But, do you know what it means?

Generally speaking, a financially stable business can survive a loss of a significant customer or team member, a considerable drop in sales, or other monetary problems that would put an end to other companies.

Such a business will, of course, feel the consequences of the issue but will be able to move forward instead of shutting down.

In other words, financial stability is what makes or breaks a business.

This article will show you six ways of getting your business to be more financially stable, which should be the goal of any business. Let’s get right into it!

Jump to section:

Build Customer Loyalty

Diligently Track Your Payments

Maintain Bulletproof Financial Records

Leverage Technology

Keep Debt Under Control

Be Prepared for Slow Seasons

Build Customer Loyalty

Having a loyal customer base is a great way to ensure you don’t go out of business despite financial difficulties.

A great way to go about it is to focus on making your customers happy because this will make them more likely to remain loyal to the brand.

Data proves this point because 78% of customers stated they keep buying from a company that offers excellent customer service, even if it makes a mistake.

Source: Regpack

Clearly, investing in your customers pays off. Clients satisfied with how you do business and treat them will not flee as soon as you’re imperfect, which will help keep your company operating even during bad times.

On top of offering excellent customer support, you can make your customers happy by providing recurring payments. This payment method allows you to repeatedly charge money directly from your customer’s account, thus doing all the work for them.

It might not seem logical, but studies show that 76% of consumers think an easy payment process is an important reason they remain loyal to a brand.

Customers don’t want to waste time or energy on payments, especially nowadays when you can do it in a couple of clicks.

So, think about offering recurring payments. They will make things easier for your customers but also guarantee that you’ll have recurring revenue.

Source: Regpack

This is how these payments work: the customer has to give you their payment information once, and you will charge them weekly or monthly from that point on as long as you are providing a product or service.

An example of a top-rated company that offers recurring payments is Netflix, with over 213 million active subscribers worldwide.

Some companies connect the payment information manually and then save it in spreadsheets or similar programs, which takes time and effort. If that just isn’t viable for your company, you should look into recurring billing software.

The software will charge your customers automatically according to the agreed timeframe, and neither you nor the customer will have to put in any manual work.

At the same time, you’ll be getting exactly what you signed up for: customers will get the product or service, and you will get paid.

The best part about it is that you know you can count on these recurring payments every week or month, depending on what you arranged with your customers.

Diligently Track Your Payments

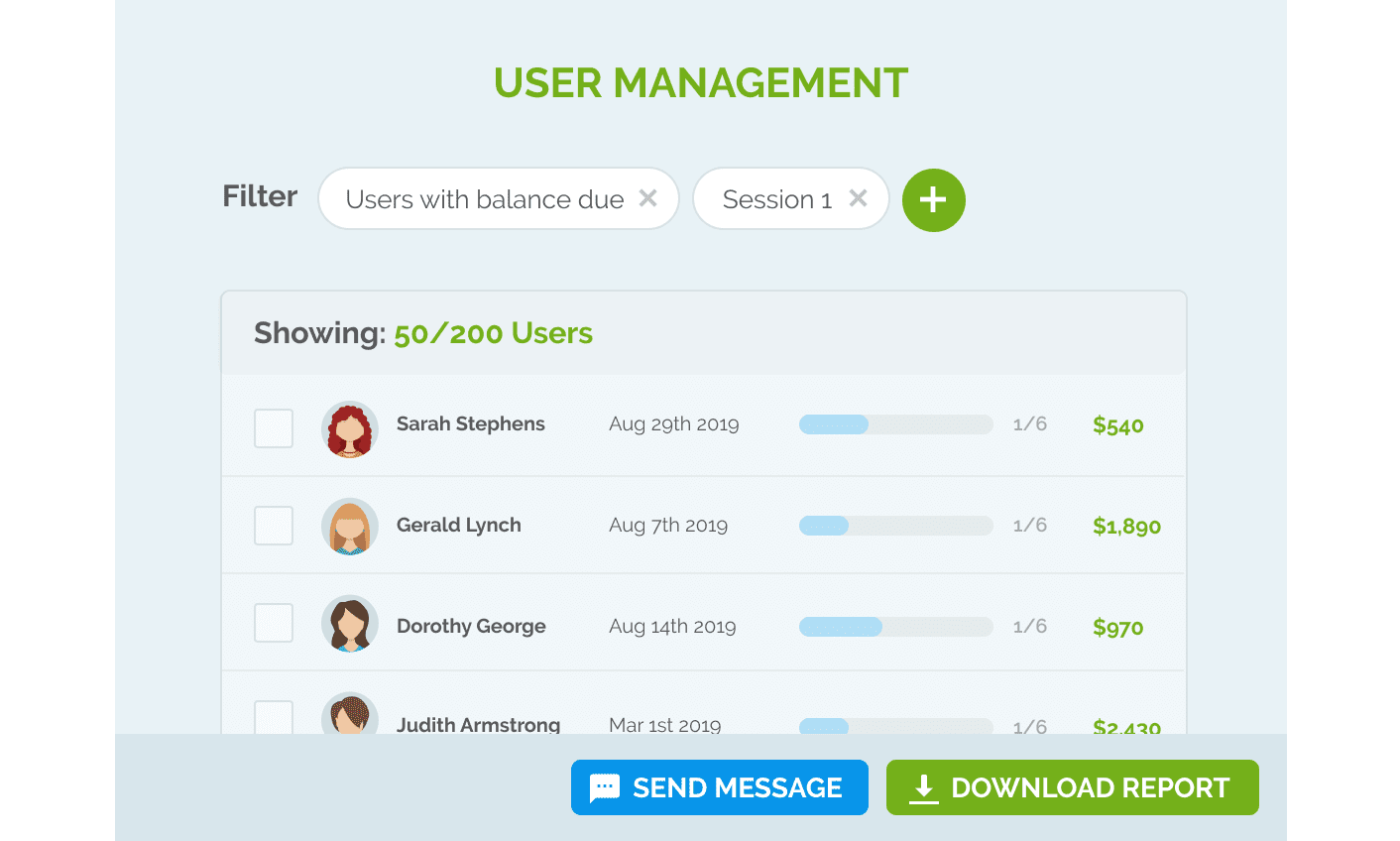

A significant aspect of being financially stable is tracking your payments.

You simply have to know who owes you money so you can charge them. Otherwise, you may be bleeding money without realizing it.

If you’re still managing your invoices manually or on paper, you will have a hard time tracking them.

Sure, you can hire people to keep track of your invoices and payments to make the process easier. However, you’ll spend a lot of time and resources hiring, training, and paying employees to do something that billing software can easily do for you.

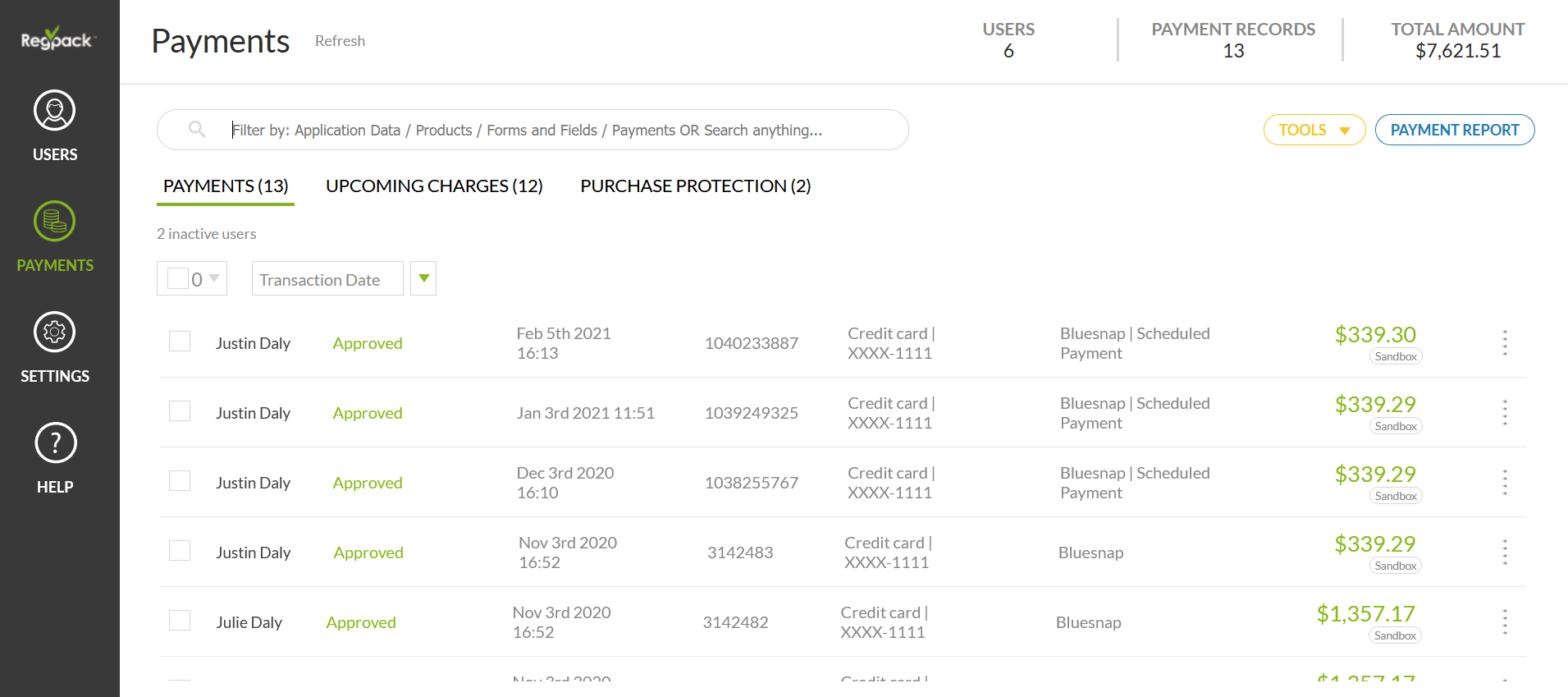

Source: Regpack

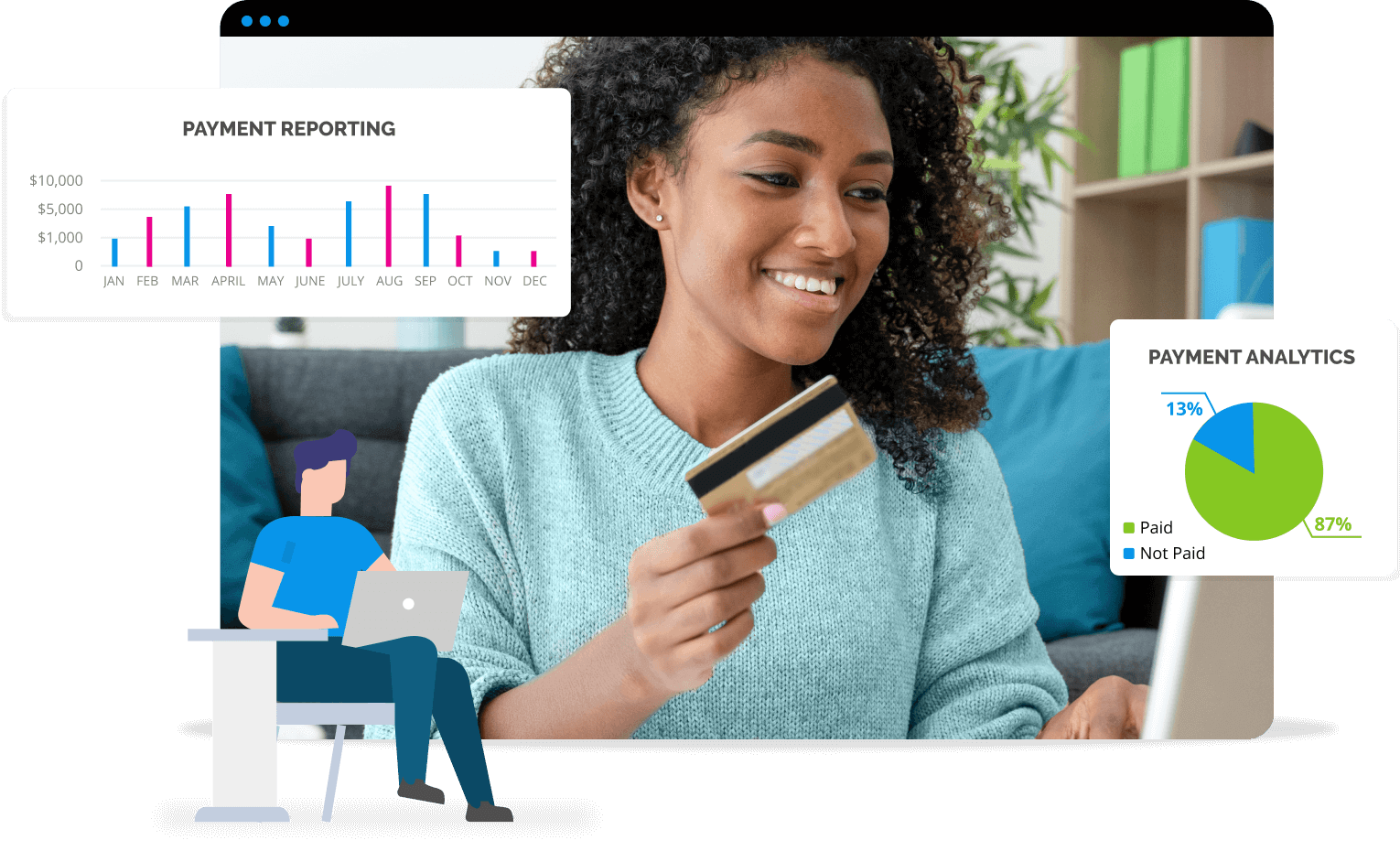

Software designed specifically for payments, like Regpack, will give you a clear overview of invoices: paid, pending, unpaid, which will help you determine your revenue.

The point of tracking your payments is understanding your cash flow. Once you have a list of unpaid invoices, you can contact those customers and try to charge them again.

Invoicing software can even send automated payment reminders until the customers pay.

Even though these reminders work, they don’t guarantee payment.

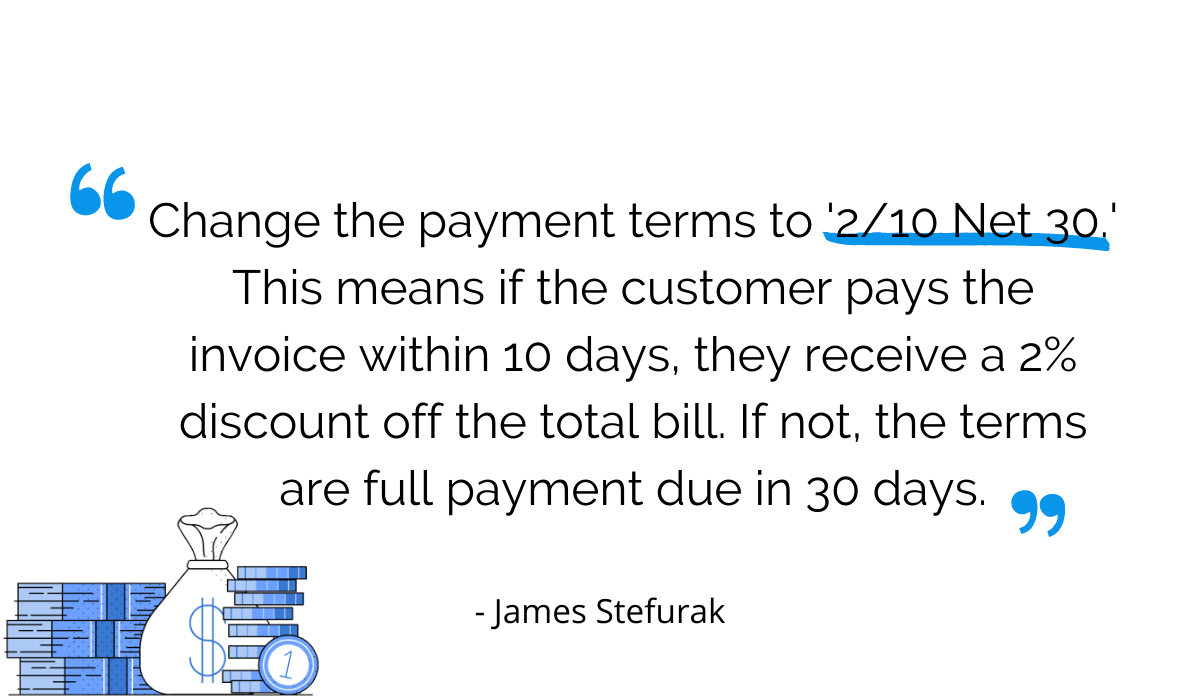

James Stefurak, the Invoice Factoring Guide’s managing editor, thinks you’re more likely to get paid on time if you offer an incentive.

Source: Regpack

In other words, you should offer some sort of a discount for your customers to motivate them to pay you early or before the due date.

The benefits of indoor tracking for businesses are clear. With this system, you’ll be able to better plan your slow seasons and take advantage when it’s time.

While most business people will understand expressions such as “2/10 Net 30”, it would be better to explain the terms and possible discounts and fines in a sentence to avoid confusion.

The goal is for your invoice to be as straightforward as possible to increase your chances of getting paid faster.

Maintain Bulletproof Financial Records

For your business to be financially stable, you have to get all your financial documents in order, not just track late payments.

When you have a clear overview of your finances, you understand where your money is coming from and where it goes.

Having a written record of all earnings and expenditures is essential to spot inconsistencies or habits you can change to maximize your earnings or lower your spending.

Besides, you want to be able to tell whether you’re making any financial progress or if you’re stuck in the same place.

Source: Regpack

Accurate financial documents will also help you calculate taxes when tax season rolls around. Without records, you’re risking incorrect tax calculations, which are heavily fined.

On top of that, if you file your taxes correctly but don’t have supporting financial documentation, you can still be fined.

The Internal Revenue Service (IRS) states that you should keep most tax documents for at least three years, which should be incentive enough to hold onto these records.

You can hire a bookkeeper to do it manually or opt for software that helps track all your payments and maintain the records. That way, you’ll quickly find and use any documents you save using such software, making tax calculation a breeze.

Leverage Technology

Technology can help you keep track of your business details and remain financially stable. Sadly, 80% of US small businesses simply aren’t making the most out of the available digital tools.

Instead of being a part of the majority, explore the tech options available and pick the ones that could improve your financial stability.

One of the ways you can improve your financial stability is to offer digital payments through new technology.

When someone pays digitally, they pay online without a physical exchange of money, using options such as mobile banking and digital wallets.

Nowadays, finance technology’s most popular segment is precisely digital payments. Their total global transaction value in 2021 is supposed to reach $6,752,388m, proving the worth such payments can bring to your company.

Since technology is so focused on digital payments, you’ll find a solution that suits your needs.

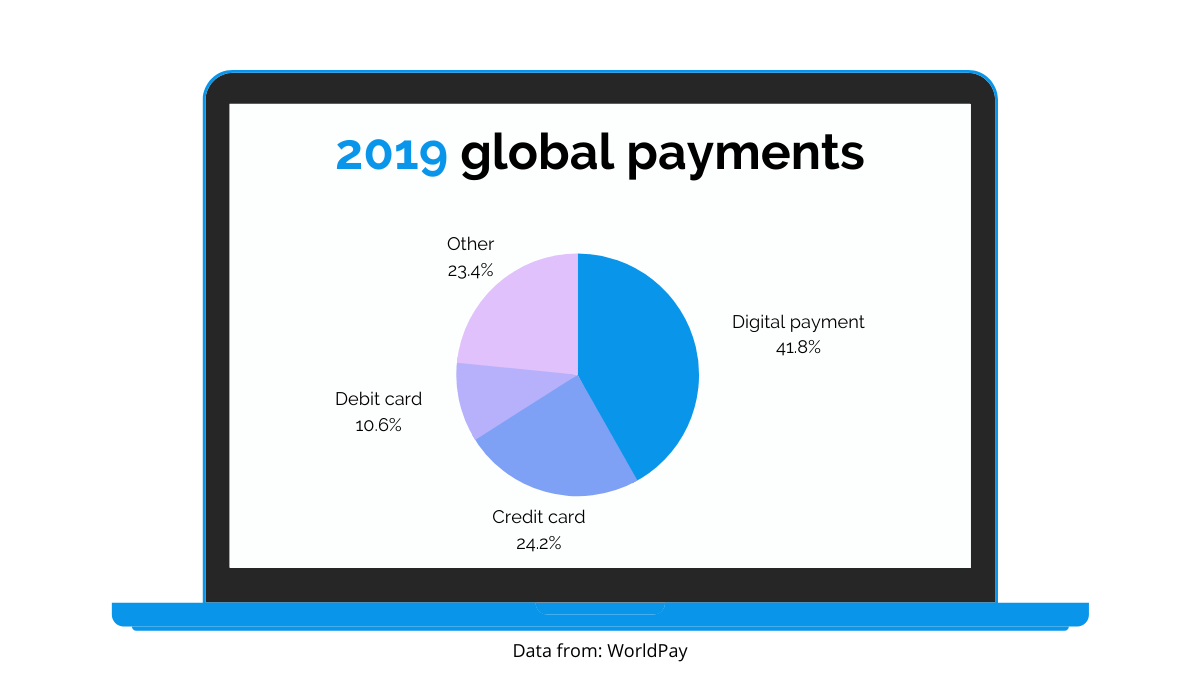

You may not think your customers would prefer this type of payment, but statistics prove otherwise. Worldpay analyzed 2019 global e-commerce payment methods and found that digital payments or mobile wallets made up for most online transactions at 41.8%.

In other words, almost half of e-commerce transactions were made using a digital payment method.

Source: Regpack

The second most popular payment option was the credit card at 24.2%, followed by the debit card at 10.6%. Therefore, the customers’ preference is clear: they prefer to pay using digital options globally.

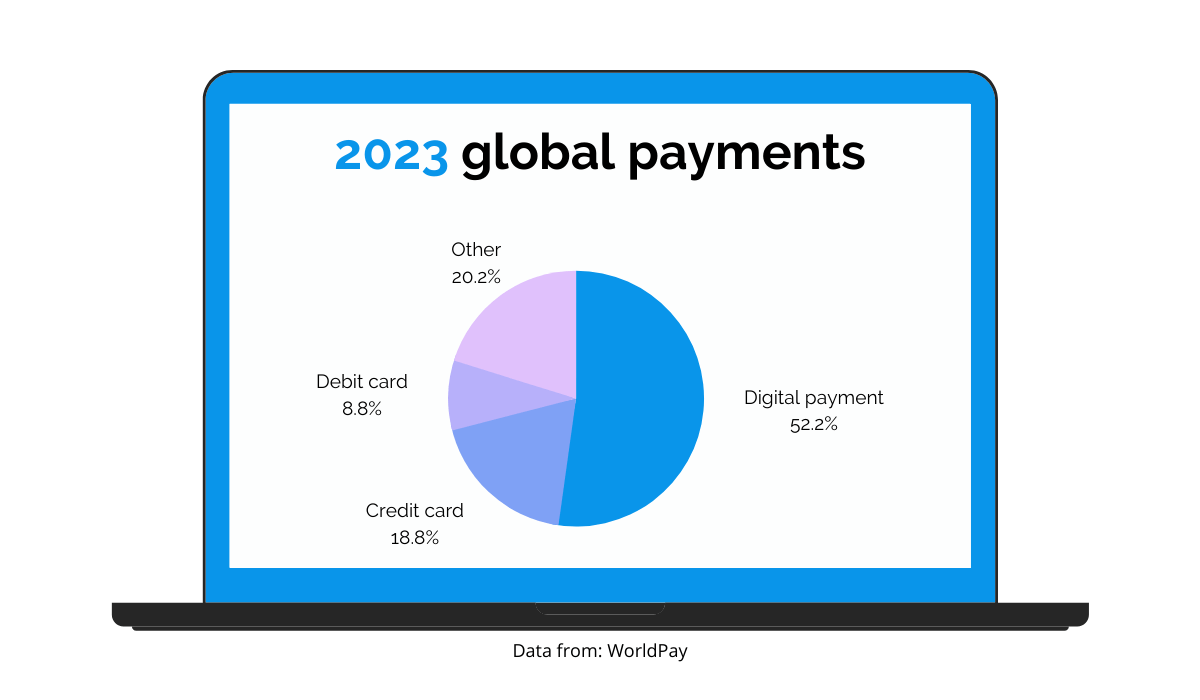

If that isn’t enough to convince you, you should know that Worldpay also shared its predictions for the year 2023.

The main takeaway is that digital payments will take over the global payments market and make up 52.2% of e-commerce payments in 2023.

Source: Regpack

The popularity of credit and debit cards is expected to go down by 5.4% and 1.8%, respectively, increasing digital payments’ advantage over other payment methods.

The point is, you should make use of technology and offer as many payment options as you can to cater to customers.

Since going digital is an expected trend in the fintech industry, why not use it to your advantage?

Keep Debt Under Control

Taking the reins of your business debt can help your business stay afloat.

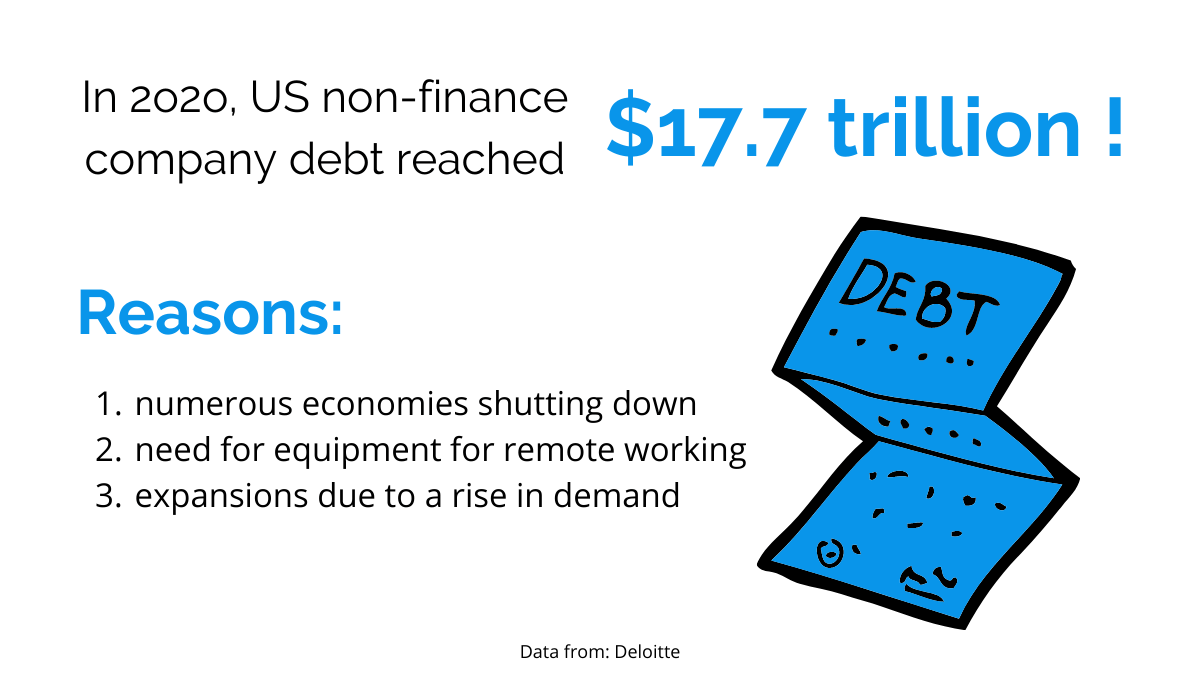

The fact that the debt of US non-financial companies reached $17.7 trillion at the end of 2020 shows that the current financial stability of US businesses is not that great.

However, the debt rose mainly because of COVID-19-related problems, such as economies shutting down, companies switching to remote work, and acquiring the necessary technology. The benefits of a pulse survey for business owners are greater financial stability. When you give feedback on your customers, it can be used in negotiations and sales pitches to help push products or services forward with their clients more effectively than ever before.

In addition, specific industries saw a high rise in demand, forcing the companies to borrow money for expansion, according to Deloitte.

Source: Regpack

If any of these things apply to your company, you’d be better off had you put some money aside for such occasions. You’re not alone in this, though. A federal report found that 40% of small businesses are in debt up to $100,000.

However, it’s never too late to start paying off that debt since you never know when a rainy day is around the corner, causing you to go into even more debt.

Dan Henry, CEO, and President of Green Dot Corporation, advises saving to create a safety net.

Having an open line of credit for just that purpose is important because your operating costs won’t disappear if your revenue does.

So, start saving now if you don’t want to get into debt the next time you go through a rocky financial period. If you keep track of all your payments and hold onto financial records, you’ll be able to tell when money is running tight.

Source: Regpack

At the same time, you’ll be able to pinpoint all unpaid invoices and start sending reminders to those customers.

Be Prepared for Slow Seasons

The key to financial stability is being able to withstand periods with little to no income.

You generally have fewer customers and earn less during such periods, even though your expenses stay the same. Therefore, those who didn’t prepare for slow seasons might have to close their business as a consequence.

Since you don’t want that to happen to you, here’s what you can do.

First, distribute your funds, so you have enough for the next few months, regardless of whether the business is going great or not.

By this, we mean not cashing out the first month you earn a lot more than expected. Instead, save this money for the slow season because it’s highly likely it will happen eventually.

Suppose your business focuses on outdoor activities. In that case, you’ll have fewer customers during the winter months due to the weather, so you can save some of the extra money you earn during the rest of the year to cover for this period.

Source: Regpack

Secondly, you can find other ways to save money during slow seasons, such as cutting back on ordering inventory and decreasing the number of working hours, if necessary.

Such business expenses don’t seem that costly, but remember that you spend money on them even during the months you don’t need these things. In other words, you’re wasting money. Budgets help!

A great way of cutting down on costs while staying just as productive, in general, is using technology to eliminate manual work, thus using your employees for activities tech solutions simply can’t handle.

Source: Regpack

For example, you can use software for invoicing your customers, which sends the customers the invoice and the reminders for late or non-payments, taking the work off your hands.

Your employees can handle other tasks, while your software will ensure that you get paid. It’s a win-win situation!

Conclusion

If you don’t want to be one of many US businesses that have to close down because of financial instability, you have to start fixing your finances before problems hit.

Businesses that control their payments and debts, keep financial records, and provide excellent customer service are on a great path. However, if you pair that with automating your processes using technology, you’re taking a shortcut to financial stability.

Work automation not only speeds up your business and helps you get more things done at once, but it also helps you cut down on costs associated with working hours and staff, thus ensuring savings.