You’re aware of the importance of proper financial management for your school—or you wouldn’t have landed here. Therefore, we don’t need to overstress that point.

What does need to be stressed, however, is that effectively managing school finances can be complex and challenging, even for smaller schools.

What’s more, this process is often hampered by internal organizational shortcomings and external factors like inflation, changing demographics, and increasing competition.

That’s why we’ll focus on seven essential tips that can help you strengthen your school’s financial stability, providing your students with quality education and your staff with the resources they need to thrive.

- Prepare an Accurate School Budget

- Create a Long-Term Financial Plan

- Eliminate Any Unnecessary Expenses

- Create Detailed Financial Reports

- Review Your School’s Finances Monthly

- Use Software for Effective Financial Management

- Conclusion

Prepare an Accurate School Budget

Preparing an accurate school budget is the starting point of effective financial management.

In other words, if you and your team misjudge the revenue or expenses side of your budget, that can lead to overspending in some areas and underfunding in others.

And that can undermine staff morale and reduce enrollment numbers.

For instance, if you seriously overestimate the amount your school will earn from tuition and donations, you may be forced to cut back on employee benefits, after-school programs, or educational resources, thus lowering the quality of education your school provides.

Therefore, accurately forecasting and budgeting for revenue streams is equally important as doing the same for school expenses.

Of course, regardless of how precise your forecasts are, your school budget should have funds set aside for unexpected expenses, and month-by-month spending should be monitored.

We discuss this in later sections.

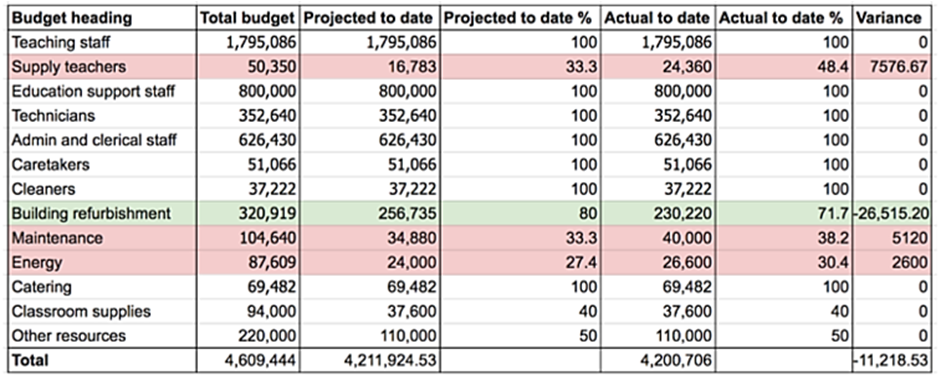

Source: The Guardian

You can read more about preparing a school budget in this article by The Guardian, and we’ll just give some pointers on how to make this process more accurate.

For starters, it goes without saying that your school’s expenditure for the upcoming year should be based on past financial records.

Moreover, last year’s amounts should be adjusted for inflation, planned investments, and other anticipated changes in the regulatory environment, staffing levels, and student enrollment numbers.

Here’s a practical example.

Reviewing past budgets, a private K-12 school sees that maintenance expenses have been increasing by about 10% each year due to the school building’s aging infrastructure and outdated equipment.

Source: Prey Project

This informs the school’s budget team that the next year’s budget allocation for maintenance should be increased accordingly, thus ensuring the funds will be sufficient to cover those higher expenses and won’t eat into funds allocated for other purposes.

As you’ll see in the next section, this also gives the budget team room for longer-term planning, such as deciding on investing in upgrading the school building and/or procuring new equipment to cut those growing upkeep costs.

For now, remember that preparing an accurate school budget is the foundation upon which your understanding of school finances is built, allowing you to make informed decisions about how to best allocate the available funds.

Don’t Limit Your Customer Pool!

Offer Multiple Payment Options Seamlessly

Create a Long-Term Financial Plan

While creating an annual budget is essential for day-to-day school operations, a long-term financial plan provides a clear direction for how your school can effectively manage its finances in the foreseeable future.

Of course, this means your school should first determine what it wants to achieve in the next 3-5 years and then create a financial plan on how to get there.

For example, let’s say that the private K-12 school we mentioned above wanted to refurbish the school building to improve its students’ and staff’s learning and working environment.

Source: Tennessean

To do that, the school must first identify what should be renovated, estimate the renovation costs, and determine the timeline.

Based on those factors, the school can create a long-term financial plan that outlines the necessary funds and steps needed to achieve the renovation goals over a certain period.

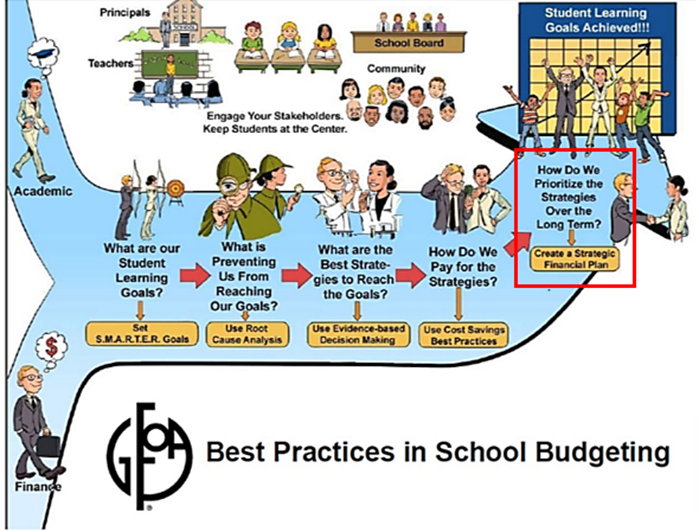

Schools can also do the same for student learning goals they want to achieve long-term and then tie those academic goals with financial plans, as highlighted in the image below.

Source: Brookline K12

Although budgeting—and particularly long-term financial planning—are complex processes with many variables to account for, here are some general tips that will make things simpler.

First, your school should set clear financial goals, such as funding the school’s renovation or improving specific student learning goals, and prioritize them according to their importance and feasibility.

This process should involve input from all relevant stakeholders (school staff, faculty, parents, etc.).

Next, the feasibility of any significant investment should be evaluated against a realistic forecast of your school’s future revenues and expenses, including enrollment projections, tuition increases, and inflation rates.

Of course, different scenarios—such as unexpected changes in enrollment, funding, or economic conditions—should be considered at that time to identify potential issues and challenges and adjust the plan accordingly.

Overall, these generalized steps will help you create a detailed 3–5-year financial plan for your school, giving it clear guidance on how to manage finances in the foreseeable future.

Eliminate Any Unnecessary Expenses

To effectively manage their finances, schools should reduce their spending by eliminating any unnecessary expenses.

Then, the money saved in this way can be put to better use, focusing on areas where expenses would most contribute to achieving the school’s long-term academic and financial goals.

For instance, a school can determine that its utility costs are higher when compared to similar-sized schools in the area.

From there, it can implement a number of measures to address this issue, such as improved facility management, switching to energy-efficient lighting and HVAC systems, or installing solar panels.

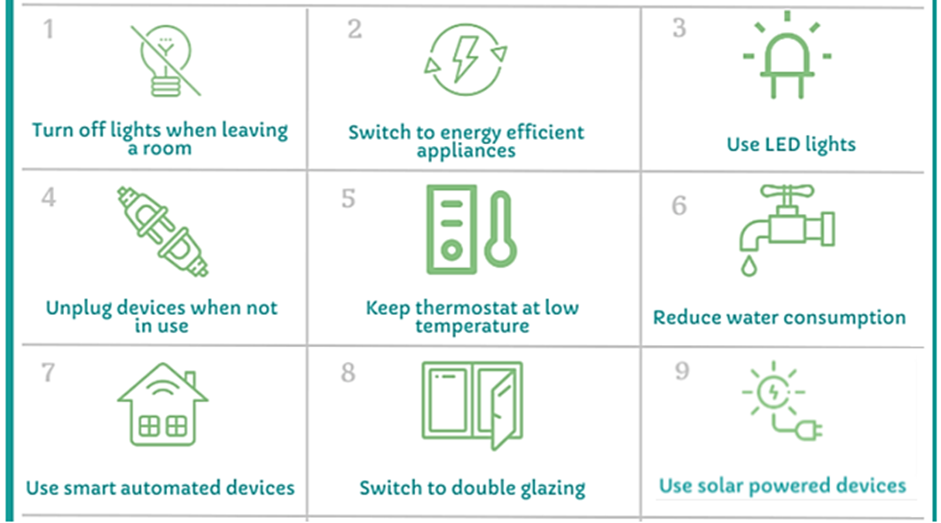

Here are some utility cost-saving measures, ranging from those that involve almost no costs (turning off lights and reducing heat) to those that require some investment (double-glazed windows or solar power).

Source: Greenmatch

Either way, the savings generated by implementing these measures can be invested in, for example, classroom technology upgrades.

Of course, despite rising energy prices, reducing your school’s utility bills is just one example of unnecessary expenses that can be eliminated.

Other excessive costs can be tackled in different ways, which involve going paperless (using digital tools to cut paper and printing costs), reducing school waste, and improving inventory management.

You can read more about them in our article on how schools can reduce their spending.

To sum up this section, identifying and eliminating any unnecessary expenses is a near-constant process that, when properly implemented, can help your school reduce its spending and put that money to better use.

Decrease Non-Payment By 75%

With Flexible Payment Plans!

Create Detailed Financial Reports

By creating detailed financial reports, schools can easily track their income and expenses to see how well they manage their finances.

Although financial reports can be created manually, it is advisable to use a software solution that can automatically generate detailed financial reports using data stored within the software’s database.

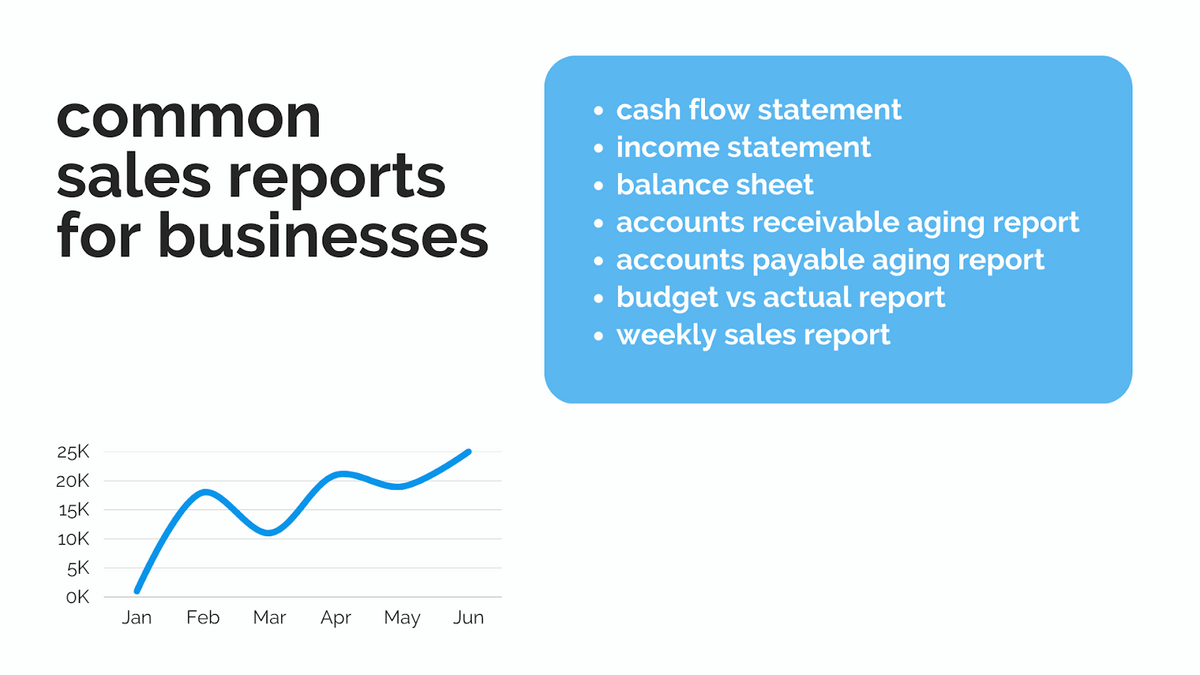

As for which financial reports schools should be able to easily generate with the help of software, they include most of the reports common to other businesses.

For example, consider the below list of typical financial reports for small businesses:

Source: Regpack

Out of the listed reports, schools usually prepare all of them except weekly sales reports, as their revenue is generally earned through tuition payments and fundraising rather than sales of products or services.

In addition to these reports, schools will usually need to generate additional financial reports, such as:

- enrollment report showing the number of enrolled students categorized by grade and other relevant parameters

- staffing report showing the number and expenditure for employed faculty and staff categorized by position and department

- fundraising/donor report showing the funds raised from different sources categorized by donor and purpose

- financial aid report showing the amount of aid awarded to students categorized by need and source

All these reports—and the need to regularly create them for tracking and compliance purposes—just underline how helpful software solutions can be for the school’s financial administration.

More precisely, by automatically generating detailed financial reports, schools can easily monitor their revenues and expenses to evaluate the effectiveness of their financial management.

Review Your School’s Finances Monthly

Schools should make it a routine to review their finances at the end of each month.

By doing so, schools will be able to detect and resolve any financial issues on time, thus retaining control over their finances.

For example, during a regular monthly review of the school’s expenses, the financial management team may discover that a vendor has overcharged the school for supplies, be it accidentally or intentionally.

By catching this issue early on, your school can take corrective action—such as warning the supplier and arranging some kind of refund (or finding a new vendor)—before the financial impact of monthly overcharges becomes significant, as they did in this case.

Source: Auburn Pub

To avoid such issues, as well as identify and eliminate unnecessary expenses, schools should review their finances on a monthly basis.

This monthly review should be done using some of the financial reports we mentioned, such as cash flow and income statements, accounts receivable and payable, and budget vs. actual reports.

In addition, the review should also look at vendor contracts to ensure the school is not being overcharged or billed for services not provided.

Overall, making monthly reviews of your school’s finances a routine can help you detect and resolve financial issues on time, thus keeping control over—and increasing the efficiency of—your financial management.

Use Software for Effective Financial Management

It could be said that, in this day and age, there is no effective financial management without using one or more software tools.

In fact, applying all the above tips—from preparing a school budget and long-term financial plan to regularly reviewing the school’s monthly financial data—can be greatly facilitated by today’s software solutions.

That’s why schools should research different software solutions and consider which best aligns with their needs.

For example, classic accounting software can automate most of the data related to the school’s financial transactions.

However, such solutions, depending on their features, are often focused just on accurate record-keeping and financial reporting and not on the operational side of the school’s business, namely the enrollment process and related collection of student tuition fees.

Therefore, schools should look for solutions that complement their new or existing accounting software to further automate their financial management.

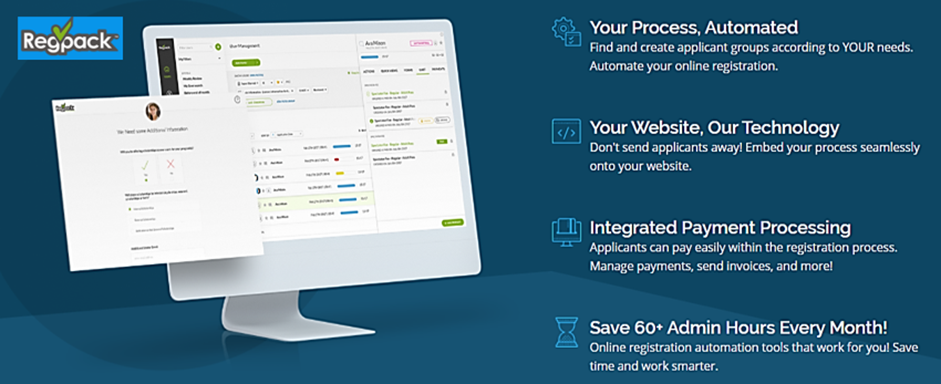

For example, Regpack allows you to digitize and automate the registration and payment processes in one solution embedded on your school’s website.

Source: Regpack

Regpack can handle everything from creating online admissions forms for students and parents to fill out, collecting fees and tuition on time, and confirming payment to sending automatic email reminders about upcoming or late tuition payments.

Schools that use Regpack see multiple benefits, such as:

- 32% more completed enrollments

- 35% increase in cash flow from registration fees

- 16% fewer program cancellations

You can also use it to create payment reports that make accounting easy.

Naturally, these reports and all other data collected by Regpack can be—through its open API and webhooks—easily connected with other software solutions you’re using.

In summary, using the right software tools to create a fully automated and integrated financial management system will allow your school to effectively manage its finances from one centralized source of accurate and up-to-date financial information.

Accept Payments Online, Right On Your Website!

Streamline your checkout process, offer payment plans, and more!

Conclusion

Simply put, you should use these seven tips as a starting point to identify your school’s financial management strengths and weaknesses, do further research, and select the best (software) tools needed to establish a robust financial management system.

This process will gradually lead to more effective management of your school’s finances.

As a result, the school’s cash flow and short- as well as long-term financial planning will improve, while regulatory compliance will be ensured.

The end result?

Higher quality of education, increased staff satisfaction, time and cost savings, and improved financial sustainability.