A merchant account enables small businesses to accept multiple forms of cashless payments online, including credit and debit cards, which have become the standard for online transactions.

In fact, according to the Digital Economy Payments Report, 37% of consumers use credit cards and 33% of them use debit cards to make online purchases.

But accommodating your customers’ payment preferences is only one of many reasons to use a merchant account. They also give small businesses better protection against fraud, improved cash flow and enhanced credibility, as well as help bring in global clients.

Read on to learn how merchant accounts provide these benefits and why they’re so important for your small business’s success in today’s economy.

- Enables Accepting Cashless Payments

- Allows Payments in Different Currencies

- Helps Increase Sales

- Streamlines Cash Flow

- Processes Payments Securely

- Demonstrates Business Legitimacy

Enables Accepting Cashless Payments

The most impactful benefit of a merchant account is that it gives your business the ability to accept cashless payments online from your customers. It does so by facilitating communications between necessary parties, including the card issuer, in an electronic transaction.

This makes a merchant account essential for subscription-based businesses or eCommerce stores that want to collect money through a payment gateway on their website or mobile app.

The evidence shows that for online purchases, cashless methods reign supreme. So without a merchant account, you fall behind in the online marketplace.

According to Finances Online’s payments report, the most common methods for online payments are debit (30%), e-wallet (28%), and credit (22%).

Source: Finances Online

If you fail to offer these payment options to customers, they’re going to become frustrated during checkout. And they’ll likely leave your website for a competitor who does accept their preferred payment method, even if they love your brand.

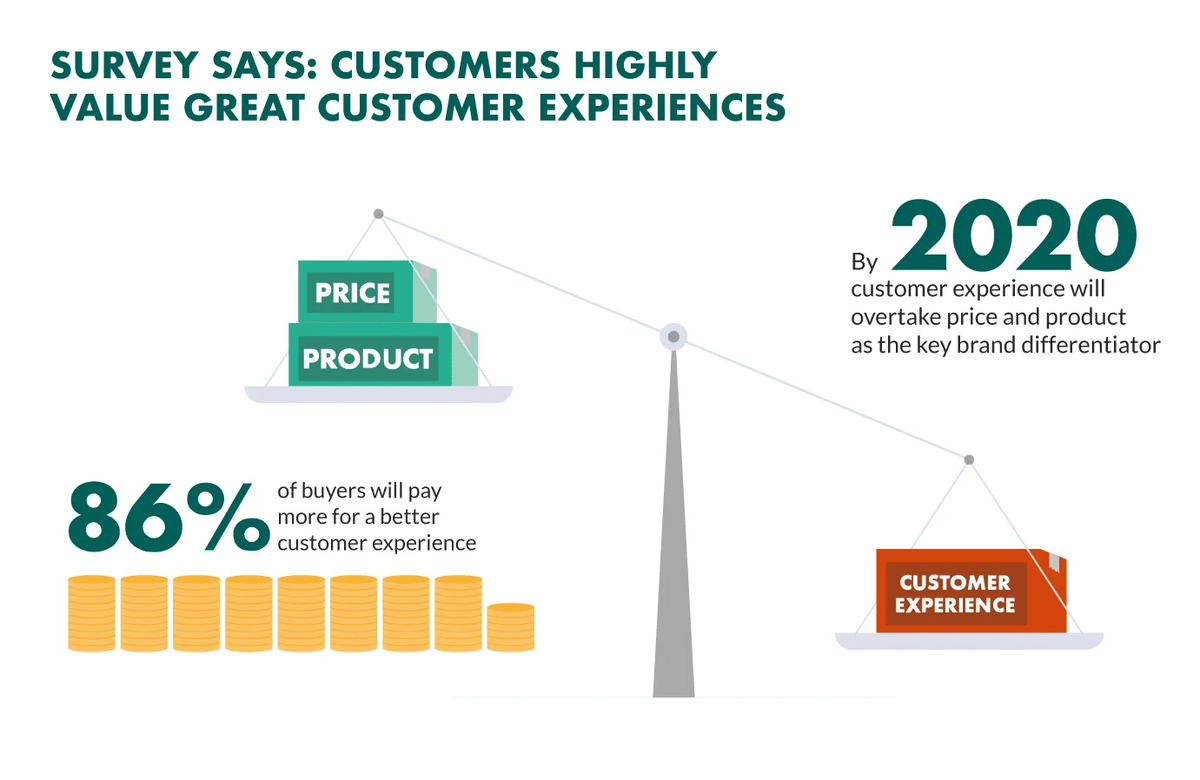

Delivering an exceptional customer experience is critical in this era when customers put such a premium on it:

Source: Super Office

Additionally, when you allow for credit and debit card payments, your business is going to benefit in many other ways as well. For starters, you’ll receive the money a lot faster than if you were to request a check or bill customers individually.

That allows you to quickly put your money to use, making investments or simply paying for operating costs on time.

In short, merchant accounts allow your business to accept online cashless payments, typically through a payment gateway. This improves the customer experience and, as a result, increases your company’s revenue.

Allows Payments in Different Currencies

In addition to allowing you to accept cashless forms of payment from customers, opening a merchant account also enables you to accept payments in different currencies. International customers can therefore pay for your service with payment methods they’re familiar with.

Magic Pay, for example, allows customers to accept over 120 different currencies.

Source: MagicPay

The positive results of accepting currencies from all around the world are numerous. First of all, you grow your potential customer base by opening up your business to people around the globe.

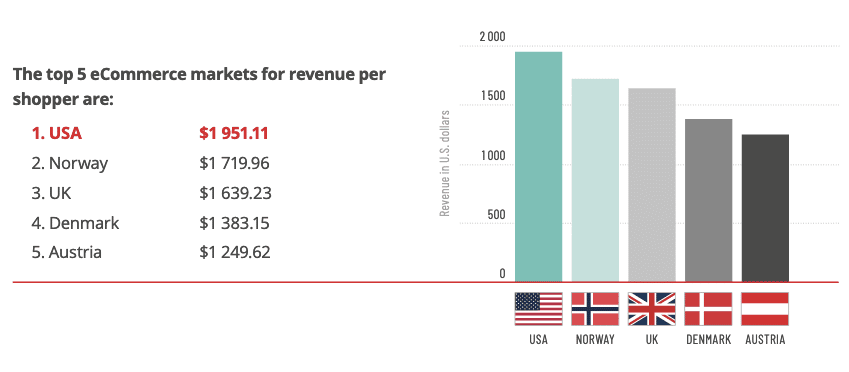

Just look at all the potential revenue there is in the global marketplace for e-commerce businesses to pick up outside of their country:

Source: SecurionPay

Second, you give those new international customers an excellent and seamless payment experience, which will make them more loyal to your brand going forward. They’ll perceive you as catering to their needs, not just to the people living in your home country.

Third, you may even experience some psychological benefits. Seeing a payment come in from another country may alter your beliefs about just how large your business can get. In other words, you start thinking globally. Expansion plans begin to transcend your country’s borders, and future revenue targets surpass what you originally thought possible.

Lastly, making the transition to accepting cashless payments can represent a major step in getting your employees to think globally too.

“The key differentiator is to actively promote a Global Mindset as a corporate value. Employees, it turns out, can easily tell the difference, and will work to align their own behavior with corporate expectations.” – Culture Wizard’s Global Mindset Index Report

Because employees see that you’re taking action to put the value into practice, they’ll start working to form a global perspective, which will help your business meet the needs of international customers.

Helps Increase Sales

The main reason that a merchant account helps you increase sales is that customers are more likely to spend money when using a cashless payment, which merchant accounts enable your business to accept.

This tendency to pay more with cashless methods is known in the behavioral science world as the cashless effect.

Source: Moneythor

Because you don’t see credit or debit in your hand, it feels less like you’re parting with actual money. But when you’re handing over a wad of cash, you get that physical, sometimes painful, sensation of money leaving your hand.

This is why some people bring only cash with them when they’re shopping or out for a night on the town. They know they’re less likely to splurge when they force themself to pay with only cash.

Applying this principle, businesses can attract customers to make larger purchases when they accept cashless payments, especially when customers use credit cards which, compared to debit, feel even less like actual money, probably because the pain of payment is delayed a month.

“With credit cards, because you don’t pay for something the moment you buy it, it’s less psychologically painful to spend your future money than your present money.” – Ian Zimmerman, Ph.D., Psychology Today

Another reason that going cashless improves sales is that its convenience makes impulse buys more likely. Paying online with a card or e-wallet is just so fast and convenient.

There are fewer steps in the payment process, hence fewer opportunities for doubts or hesitations to creep into the mind. Before the customer can stress over money or come up with reasons to hold off making the purchase, the purchase has already been processed.

Finally, because merchant accounts let you accept multiple currencies and cashless payments, you’ll also have a wider reach. You’ll be able to win over customers who otherwise wouldn’t have been able to pay you for your service, no matter how badly they wanted it.

To summarize, merchant accounts allow your customers to use cashless payments to buy your service, and cashless payments are connected to increases in sales numbers.

Streamlines Cash Flow

Having a merchant account helps small businesses improve their cash flow through faster payments provided by relying on electronic payment options and streamline their cash flow management with simple-to-manage payment data.

When you have a merchant account, it takes, on average, 1-2 days for you to receive electronic payments from credit and debit card purchases. The purchases process incredibly quickly.

With electronic payments, you receive your money soon after someone purchases something on your website. You can then put this cash into action to handle your operating costs, re-invest, or increase your profits.

Meanwhile, if you invoice each customer individually, it’s likely that you won’t receive payment for around thirty days. Such a delay can cause cash flow shortages that make it difficult to keep up business operations.

Using electronic payments also makes it easier for you to manage and understand your cash flow. This is crucial when so many small businesses have gone under because of sub-par cash flow management:

Source: Regpack

Electronic payments are easier to organize than cash or check because you receive detailed monthly statements that share all the relevant transaction information. That way, you can make sure that your accounts are accurate, and this part of doing taxes becomes a breeze. Plus, there’s no need to count cash, which is a huge time-waster.

Many businesses also use online payment tools for payment gateways and other features like reporting that help them make sense of their payment data, draw useful insights, spot bottlenecks in their online payment process, and improve cash flow forecasting.

Processes Payments Securely

Using a merchant account ensures that your customers’ sensitive payment details, like a credit card number, are secure and won’t end up in the wrong hands.

Most merchant account services are PCI DSS certified, meaning they meet a certain set of strict security standards created by the PCI DSS and rely on state-of-the-art security technology like firewalls and antivirus software.

To continue using a merchant, you also have to comply with PCI DSS standards. So getting a merchant account acts as a sort of accountability mechanism for the effectiveness of your own security protocols.

When more than half of consumers don’t believe companies are doing enough to protect their online data, it’s important to work with a trustworthy merchant account provider and showcase your efforts to keep your customers’ data safe.

Some businesses will show that they’re PCI DSS certified on their checkout page, as Yellowstone Forever has done below in the bottom left corner:

Source: Yellowstone Forever

This form of credibility signaling increases the chances that any given customer will go through with their purchase on your website or app.

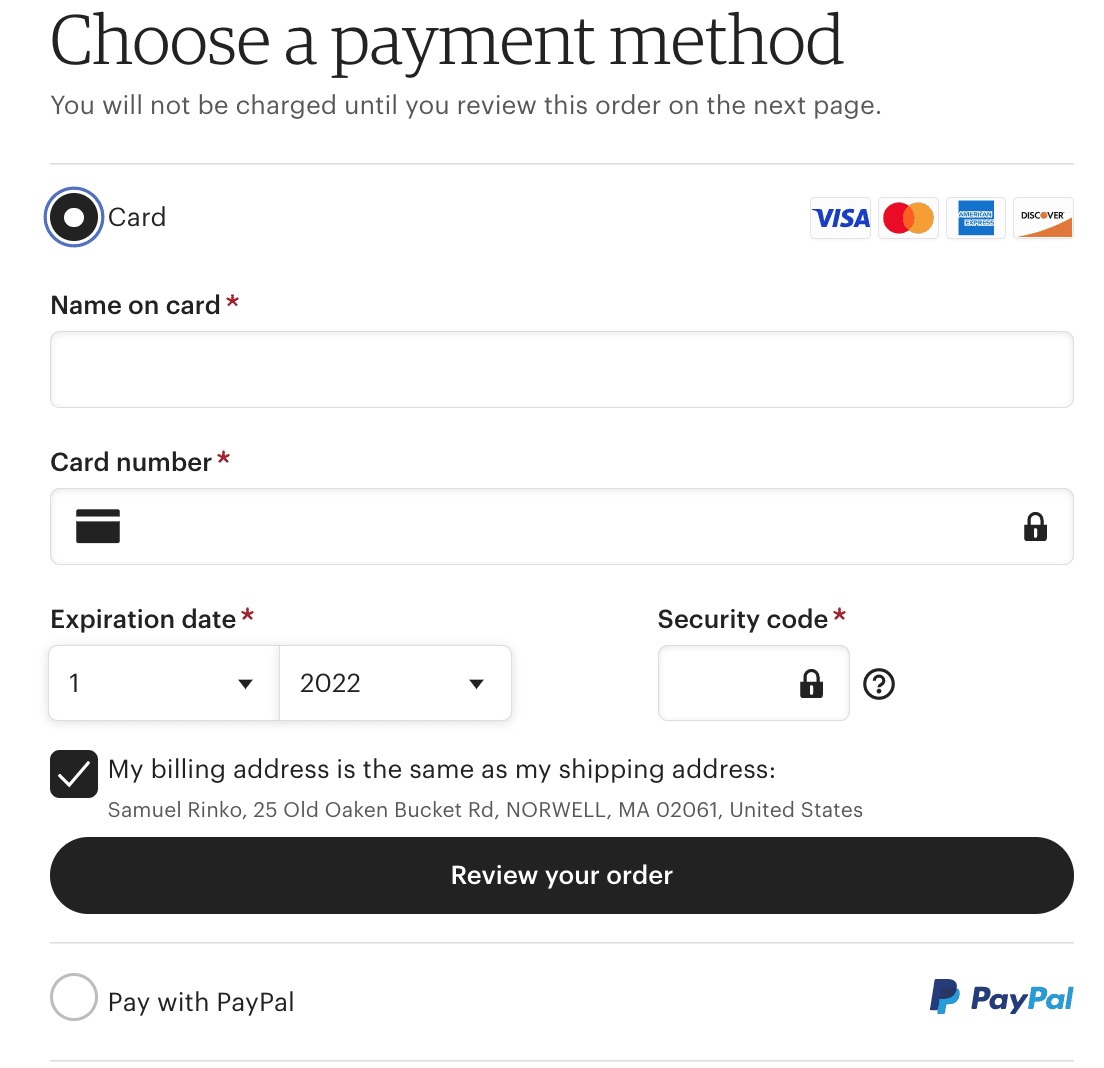

Furthermore, businesses collecting cashless payments online also need to use a payment gateway, the customer interface that, among other functions, collects payment details from customers:

Source: Etsy

This payment gateway also helps you reduce the likelihood of theft and fraud thanks to its security technologies like data encryption, which renders a customer’s payment information incomprehensible to anyone trying to steal it by turning it into a secret code. Only those with a special key can access the data.

In sum, using a PCI-compliant merchant account and payment gateway to collect online cashless payments will enhance your business’s security and protect you and your customers from fraud and theft that can severely damage a business’s reputation.

Demonstrates Business Legitimacy

If you can’t accept cashless payments online, customers may think of your business as old-fashioned. And unlike their grandmother’s rules of dining etiquette or the rocking chair in the antique store, people won’t find this blast from the past endearing. They’ll just find it inconvenient and frustrating.

When you’ve taken the time to set up a merchant account and had your application accepted, it’s a sign to customers that you’re a legitimate, modern business that’s following best practices surrounding payments and security.

Entrepreneurs know how important it is to come across as reputable:

Source: Reputation Up

These thoughts of business legitimacy lead to feelings of trust. Customers feel that you’re taking the necessary precautions to keep their private payment details safe and secure.

Merchant accounts also enable you to accept cashless payments. This tells your customers that your business is keeping up with industry trends, and this implies that you’ll continue updating your service and protocols as customer preferences and cultural norms evolve.

To customers, this is a relief. They can be sure that they are working with a service provider that is constantly evolving and making use of the newest technology to improve the customer experience.

Being perceived as up-to-date is especially important for companies that sell technology, like SaaS brands, because their customers expect them to be their guides in the technology space.

The same goes for businesses with a lot of Gen Z customers, who have spent most of their lives buying with cashless methods over the internet.

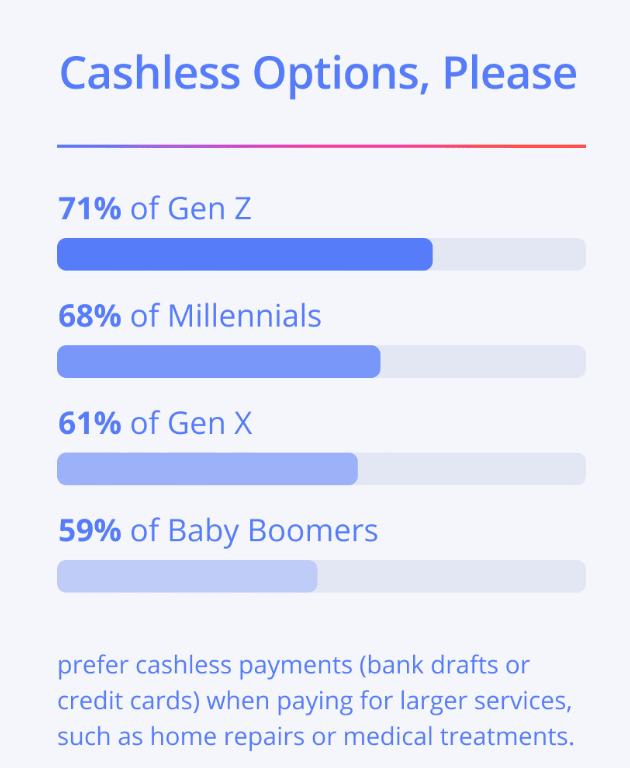

For larger, more expensive services, cashless is preferred across the board:

Source: Thryv

Have you ever been on a website that seems outdated and wondered if the business can be trusted?

You want to avoid giving your customers that uh-oh feeling, especially when something as private as payment information is involved. Offering cashless payments thanks to your merchant account is a great way to prevent just that.

Conclusion

A merchant account is a must-have for small businesses that want to collect a variety of cashless payments online from their app or e-commerce website. This transition to cashless can lead to increased sales, streamlined cash flow, and other effects that will improve your small business.

If you’re looking to start accepting cashless payments through your eCommerce site, you’re also going to need a payment gateway.

Consider checking out Regpack, an online payments platform that not only provides you with a payment gateway but also gives you other useful features like online registration and payment analytics.