We live in the digital age. Everything has been steadily transitioning online, including making purchases and paying for goods and services.

This trend was greatly enhanced by the COVID-19 pandemic when we all had to transfer most of our daily activities into the virtual world.

In fact, according to Statista, at the end of 2019, before the pandemic hit, the value of the digital payments market was US $4.70 trillion.

Since then, the digital payments market has been experiencing a surge in growth, and the total transaction value by the end of this year is projected to reach a striking US $9.46 trillion.

Naturally, this trend of going digital resulted in customers expecting easy and convenient transactions from businesses like yours.

Think about it: with so much competition out there, why would they choose you if you don’t make paying a breeze?

But embracing online payments is more than just keeping up with the trends. It can actually boost your financial well-being by increasing your cash flow.

Let’s see how.

- Attracts More Customers

- Makes It Easy for Customers to Pay

- Quicker Payment Processing

- Ability to Accept Automatic Recurring Payments

- Conclusion

Attracts More Customers

By enabling a variety of online payment options for your business, you unlock a whole new realm of potential customers drawn to the ease and simplicity of completing transactions digitally.

And what does attracting more customers bring you?

More money, and therefore, increased cash flow.

Imagine all the possibilities when your products or services are just a few clicks away from being in the hands of your customers.

For example, your business offers activity bookings online, seamlessly integrated with a user-friendly payment platform.

Customers can effortlessly browse a range of exciting experiences and securely pay for their chosen activities, all from the comfort of their homes.

It’s a convenience at its finest—a magnet for those who value time-saving solutions.

And in today’s fast-paced world, people crave convenience and efficiency more than ever.

Indeed, the fact that it saves time and money is exactly why online purchasing has skyrocketed in popularity.

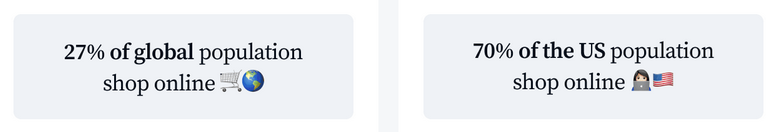

Astonishingly, 27% of the world’s population and a staggering 70% of Americans prefer the convenience of online shopping over traditional brick-and-mortar stores.

Source: Tidio

However, the allure goes beyond convenience.

Online payment erases geographical barriers that traditional payment methods struggle to overcome.

Think about it: customers from different countries and time zones can easily access your website or online store and make purchases at any hour that suits them.

Suddenly, your business has the potential to reach a vast market of customers who may have been out of your reach in the past.

Selecting the right online payment software becomes paramount to harnessing this opportunity.

And if you opt for a solution that supports payments in multiple currencies, offering your customers a sense of security and trust, you will attract even more customers, which means better cash flow for your business.

In summary, embracing online payments is the gateway to unlocking a global customer base and expanding your revenue streams.

By doing so, you nurture a healthier cash flow, which is a crucial aspect of sustaining and growing your business.

Makes It Easy for Customers to Pay

As we already pointed out, providing an effortless payment experience for your customers is a necessity.

By seamlessly integrating online payment systems into your business, you unlock a world of convenience for your customers.

No longer will they endure the hassle of traditional payment methods. Instead, they can easily make purchases, ensuring a smooth and frictionless transaction process.

When paying becomes a breeze, customers have no qualms about returning to your business and making repeat purchases.

It’s the perfect recipe for boosting cash flow and nurturing a thriving customer base.

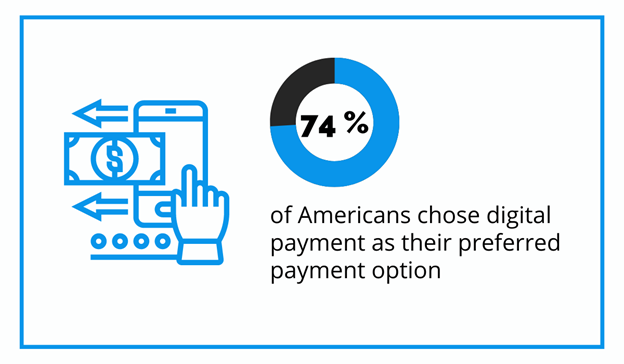

The importance of online payment is undeniable, with a staggering 74% of Americans preferring this modern approach over traditional methods.

Illustration: Regpack / Data: Onbe

This statistic, backed by a survey conducted by Onbe, highlights a seismic shift in consumer behavior.

Why have online payments gained such widespread popularity?

Apart from their time-saving nature, which we touched upon briefly in the earlier section, the appeal of online payments also stems from the wide variety of options available to customers.

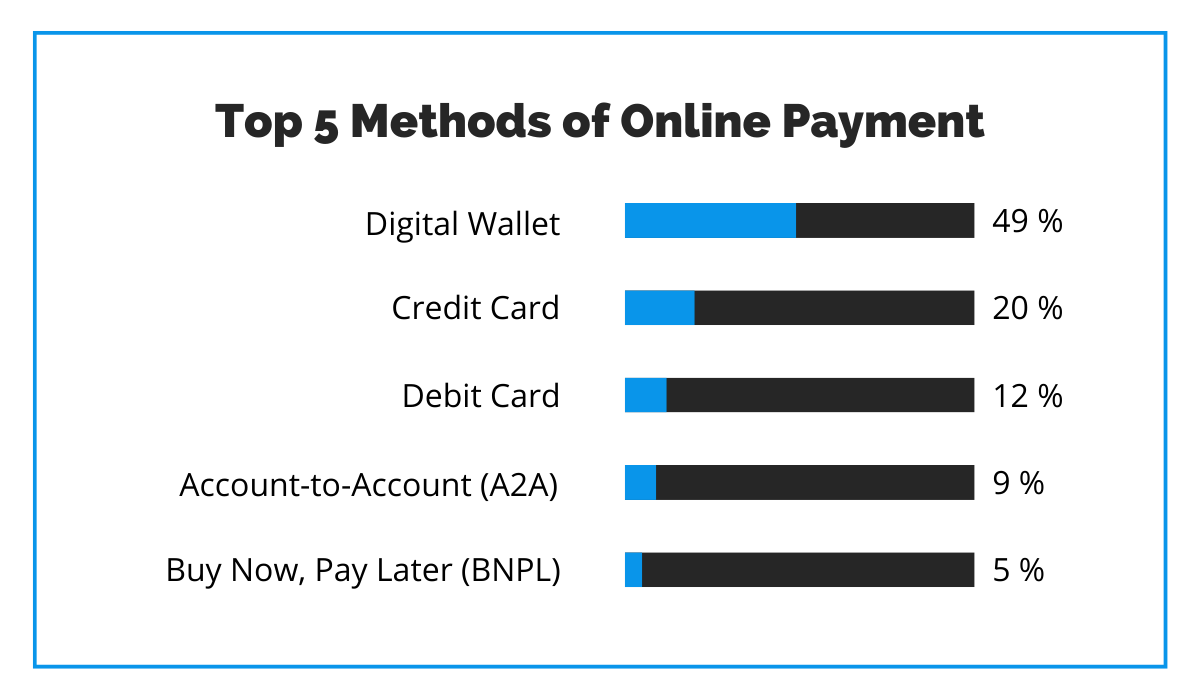

Providing multiple payment options is essential when transitioning to online payments. It ensures your customers have the flexibility they desire and the ease of use they deserve.

The photo below gives insight into which online payment options were preferred among global consumers in 2022.

Illustration: Regpack / Data: Worldpay

Expanding your payment options should also extend to accepting multiple currencies.

If you aspire to tap into international markets and maximize your cash flow, embracing global transactions is a must.

Make it easy for customers worldwide to engage with your business by embracing online payment software like Regpack.

Source: Regpack

With Regpack, you gain access to a wide array of payment options, including credit and debit cards, and ACH payments.

Plus, the flexibility to accept payments in any currency ensures a seamless experience for your international customers.

To recap, when paying becomes effortless, customers are more likely to make purchases without hesitation.

No longer will they need to seek alternative payment methods or grapple with currency conversions.

The result? A surge of customers eagerly buying your products or services, propelling your sales and fueling your cash flow.

Quicker Payment Processing

If you want to enhance your cash flow and accelerate your payment processes, accepting online payments can be a game-changer for your business.

Here are two compelling reasons why.

First, by embracing online payments, you can bid farewell to the tedious hassle of physical checks and manual processing and say hello to lightning-fast transaction times.

According to PayStand, a B2B payment solution, businesses that accept online payments experience a whopping 62% decrease in the average time it takes to collect payments.

Imagine receiving funds within hours or even minutes, rather than anxiously waiting for checks to clear or for customers to visit your office to settle their dues in person.

This accelerated payment cycle empowers you to access funds sooner, charging your cash flow and allowing you to allocate resources more efficiently.

But there is more.

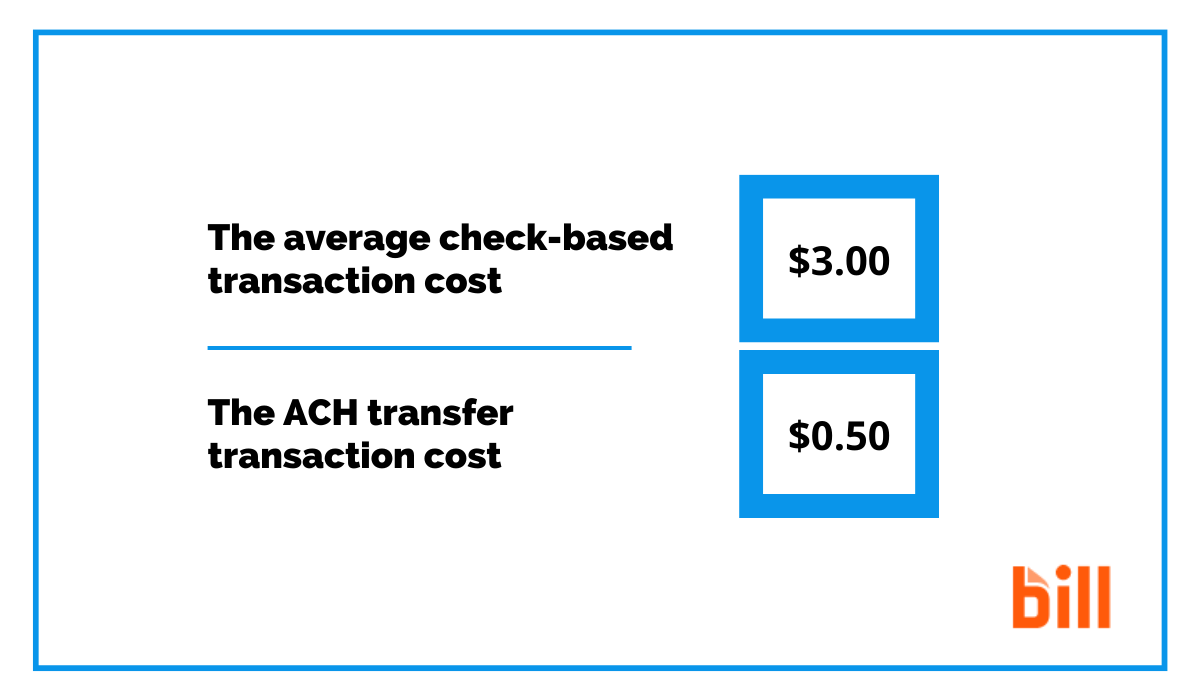

Online payment methods often come with lower processing costs compared to traditional options.

Check the difference in the transaction costs in the image below.

Illustration: Regpack / Data: bill

When you accept credit card payments online, you can access competitive merchant rates negotiated by savvy payment processors.

These rates are typically more favorable than the fees associated with processing paper checks or handling cash transactions.

By harnessing the power of online payment solutions, you can unlock cost savings and redirect those resources to fuel other areas of your operations.

In summary, faster processing times and reduced transaction costs will empower you to access funds quickly and optimize your financial operations, improving your profitability and cash flow.

Ability to Accept Automatic Recurring Payments

Automatic recurring payments are the last on our list of ways in which accepting online payments helps boost your cash flow.

With online payment software, like our solution Regpack, you have not only the power to accept one-time online payments but also the ability to embrace the advantages of automatic recurring payments.

With this feature, your customers can easily subscribe to your products or services, and like clockwork, you charge them automatically at regular intervals—whether weekly, monthly, or annually.

But why is this a game-changer for your cash flow?

Automatic recurring payments provide a reliable and predictable source of income, which can significantly improve your cash flow.

Instead of relying on infrequent or one-time payments, you have the assurance that regular payments will be coming in at predefined intervals.

©MarsBars via Canva

Let’s say you run an online subscription business.

By offering automatic recurring payments, you ensure that your customers are billed automatically on a monthly basis.

This means that if you have 100 subscribers, each paying $50 per month, you can rely on $5,000 of guaranteed monthly revenue.

This consistency lets you confidently plan your expenses, investments, and business growth.

Moreover, automatic recurring payments make it convenient for customers to continue using your products or services, leading to higher customer retention rates.

Satisfied customers are more likely to stick around, resulting in a continuous revenue stream and reduced customer churn.

Suppose you operate a membership-based fitness studio.

By implementing automatic recurring payments, your members can easily set up monthly subscriptions for their gym access.

This frictionless payment process encourages them to maintain their membership without the hassle of manual renewals or making separate payments each month.

As a result, you experience improved customer retention, reducing the need to acquire new customers to sustain your cash flow constantly.

Combining these two factors allows you to establish a reliable income stream and reduce revenue fluctuations.

This will enable you to better plan and allocate resources, invest in business growth, and provide enhanced products or services to your customers, further strengthening their loyalty and improving retention.

Conclusion

We hope this article has provided a better understanding of how accepting online payments can increase your cash flow.

In conclusion, if you embrace online payments, you will significantly enhance your cash flow by attracting more customers and making the whole purchasing process more straightforward for them—and yourself.

Save time, and find the best online payment software as soon as possible to enjoy a smoother and healthier financial journey.