Business owners are presented with many payment choices in a technology-oriented market. As customers slowly move away from cash, there are now many new ways to collect payments from customers. These payment options offer both challenges and opportunities for large and small business owners.

Not having convenient payment options can result in customers not paying at all, causing unpaid invoices, overdue payments, and decreased cash flow. To prevent these issues, it is important to implement clear and simple ways to collect payments from customers.

This article will guide you through the most commonly used online payment collection methods and show that, while important, the most secure options aren’t the only thing you should focus on — ease of use should be a determining factor as well.

Jump to Section:

Credit and Debit Card

Payment Gateway

Mobile Wallets

ACH Payments

Email Invoicing

Why a Good Billing Solution Matters

Credit and Debit Card

Whether you’re experimenting with accepting payments in cryptocurrencies or sticking to more traditional payment methods, one thing’s for sure: you should always set up a way to collect payments with credit and debit cards.

Despite all the novel online payment options, debit and credit card payments remain the most popular choice. According to a global CIGI-Ipsos survey, 42% of those who shop for goods and services online prefer paying with credit cards.

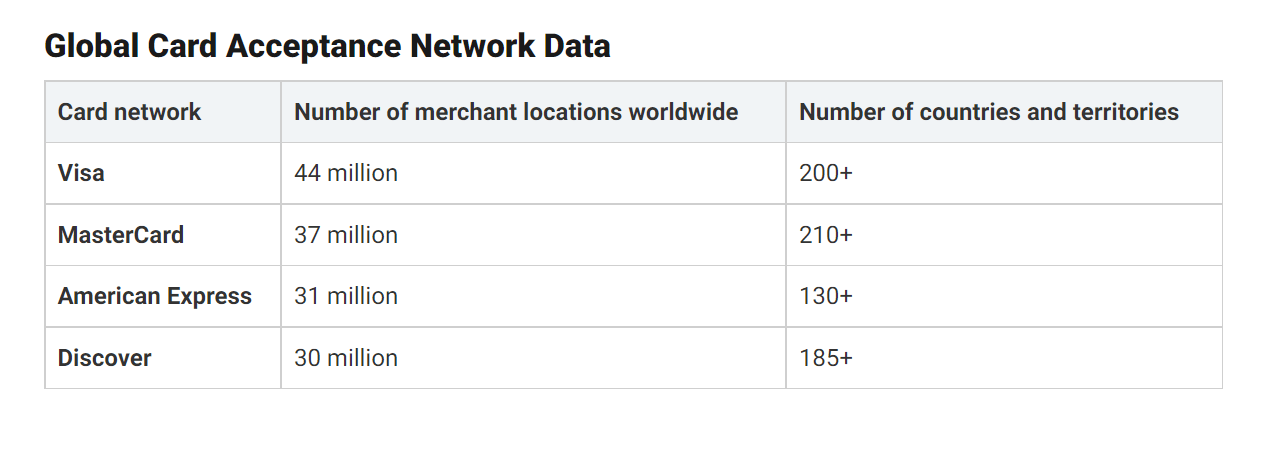

However, not all cards are accepted everywhere. MyBankTracker analyzed the data from different networks and found that most merchants accept cards issued by Visa, MasterCard, American Express, and Discover.

Source: MyBankTracker

So, if you’re looking to implement credit and debit card payment on your website, research the most commonly used card networks in your demographic to ensure broad compatibility.

Setting Up Merchant Accounts

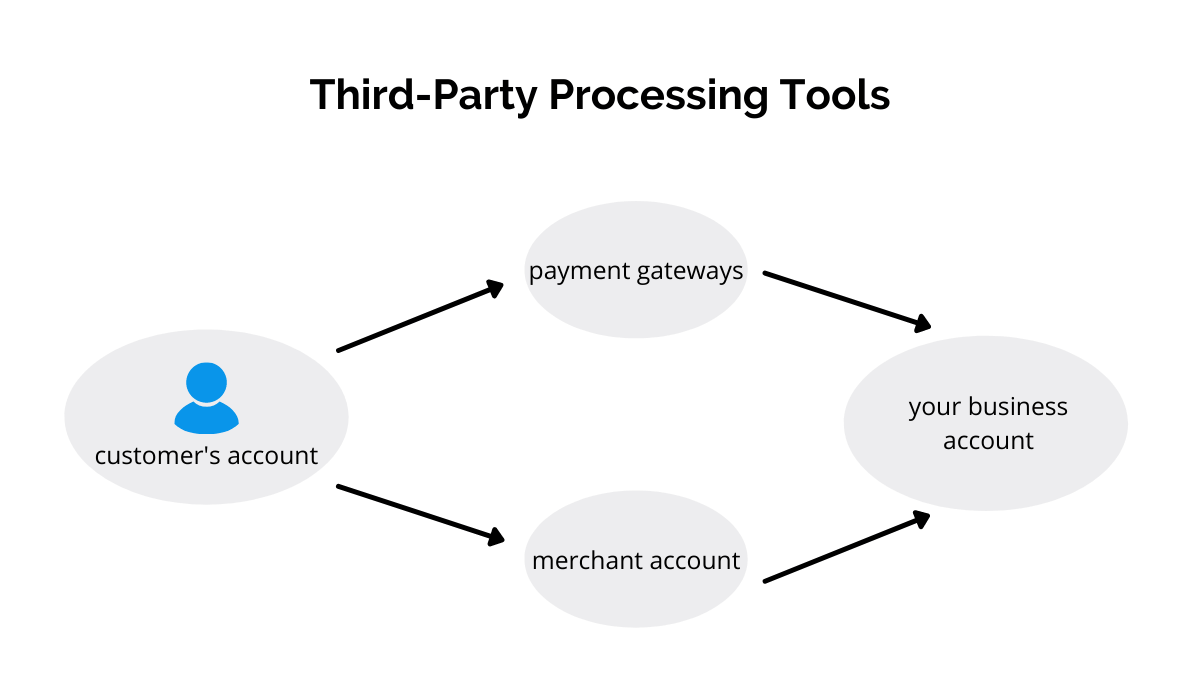

For online businesses, setting up a merchant account is a necessity for facilitating credit and debit card payments. These payment providers act as intermediaries, ensuring funds are securely transferred from the customer to your business bank account following verification.

Source: Regpack

Opening a merchant account can require underwriting, and you may be required to have a business license. Unfortunately, for some enterprises, especially smaller or newer ones, the costs associated with these processes are not viable.

Don’t worry; there are still ways you can receive credit and debit card payments from customers.

One of the solutions is to create an aggregated merchant account or a payment gateway service.

Payment Gateway

Integrating a payment gateway into your website is an excellent solution if you’re trying to automate the payment process. A payment gateway gives your customers an easy checkout and allows you to receive payments around the clock – what’s not to love?

Rather than each business owner registering their own account, some services provide aggregate merchant accounts to their retailers. These are called payment gateway service providers.

You’ve probably heard of and used the most well-known example of gateway services; PayPal’s Payflow.

A payment gateway is a secure element that connects your customer and their issuing bank to you and your acquiring bank.

During the process, it encrypts sensitive card information, ensuring information is passed on securely.

How to Choose the Right Payment Gateway

When choosing a gateway for your business, one of the crucial factors to consider is the implementation process.

Even though Regpack was primarily designed as a registration tool, you can use the software to sell goods and services. Relying on the same software for several services ensures easy implementation into your website.

Here’s what that looks like in practice:

Source: Regpack

The GIF shows how you can select a plan, make a payment, and confirm it in a matter of seconds. There are no redirect pages to complicate the process; the only thing your customers see is your customized, user-friendly payment form.

By selecting a payment gateway as your way to collect online payments, you’re making things easier for your customers and your business.

This process eliminates the need for manual transfer confirmations, reducing administrative tasks and allowing business owners to receive payments from all over the world at all times.

Mobile Wallets

To attract modern customers, incorporating mobile wallet options is a must.

Customers rely on mobile technology in their day-to-day activities, so it’s no surprise that they are ditching cash and cards for smartphones they already use.

The most common form of offering mobile payments are digital wallets, such as Apple Pay, Google Pay, Samsung Pay, or others.

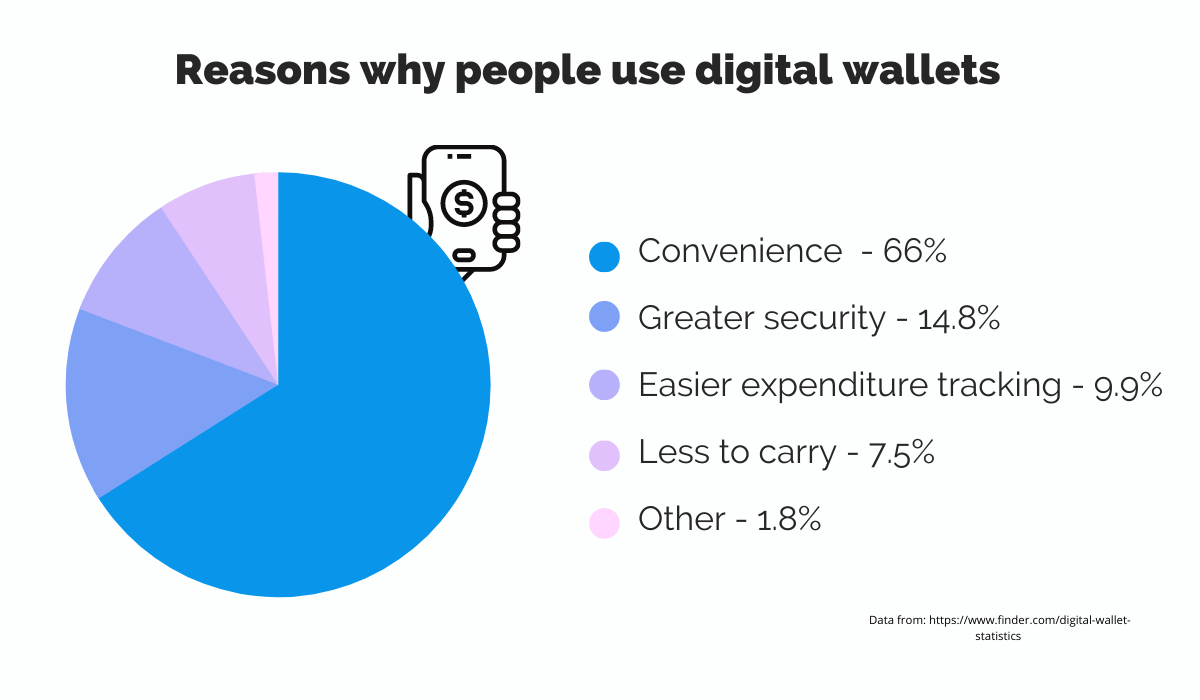

More than half of the consumers who use digital wallets for their transactions report that the most prominent reason they use a digital wallet is the convenience of payment. Convenience is followed by greater security, a feature important to 14% of consumers.

Source: Regpack

Consumers find mobile wallets convenient because they automatically fill in credit card details like card numbers and CVV codes. This eliminates customers’ need to manually enter this information for each purchase.

Most popular e-commerce platforms support mobile wallet payments, making integration straightforward for business owners.

However, custom-built websites may require professional development services to implement these options securely. If your customers don’t feel their sensitive financial data is safe with your website, they won’t continue purchasing there.

But, always remember to elegantly hide these complex configurations behind a user-friendly interface so your customers can shop with ease.

ACH Payments

For businesses looking to reduce operating costs and transaction fees, ACH payments present an efficient solution.

Short for Automated Clearing House, this payment collection method is primarily used for facilitating low-cost transfers between banks, making them a practical choice for both small and large transactions.

ACH is a U.S. financial network run by Nacha and has been around since the 1970s. It remains a dominant force in the online payment market, with 7.70 billion transactions facilitating the transfer of nearly $4 trillion via ACH in 2020. And we’re talking about internet payments only!

What makes ACH payments so practical for business owners are low transaction fees. Just like with credit cards, there are no set prices for ACH transfers. Fees depend on the provider, but are generally much lower than with credit cards, rarely exceeding $1 for business transactions.

Plaid, a financial services company, has compared the cost of fees between Stripe ACH transfers and Stripe credit card fees. Here’s what they found.

For a $500 transaction, the ACH fee was $108 cheaper than a credit card fee.

This works for smaller transactions as well, where for a $10 payment, the ACH fee amounts to $0.08, compared to the credit card fee at $0.59.

Regardless of the price of goods you’re selling on your website, ACH payments are more cost-effective than other methods. However, they can take one to three business days to process. Before implementing an ACH solution, make sure to examine your cash-flow needs and plan your business activities with a potential delay in mind.

Email Invoicing

There’s another fully automated method for businesses to accept online payments from customers: email invoicing. Generating and sending invoices by email provides a clear overview of purchases to both customers and business owners, enabling payments through a familiar and secure method.

By setting up an email invoicing system, you can allow customers to pay however they wish. There’s no need to send each invoice manually. Integrating your customer database and a payment form in an email invoice system can eliminate human error and save tons of time.

To make payment expectations and processes clear, your email invoice should contain the following payment information:

- The invoice number

- The due date

- The due amount

- An overview of the products sold

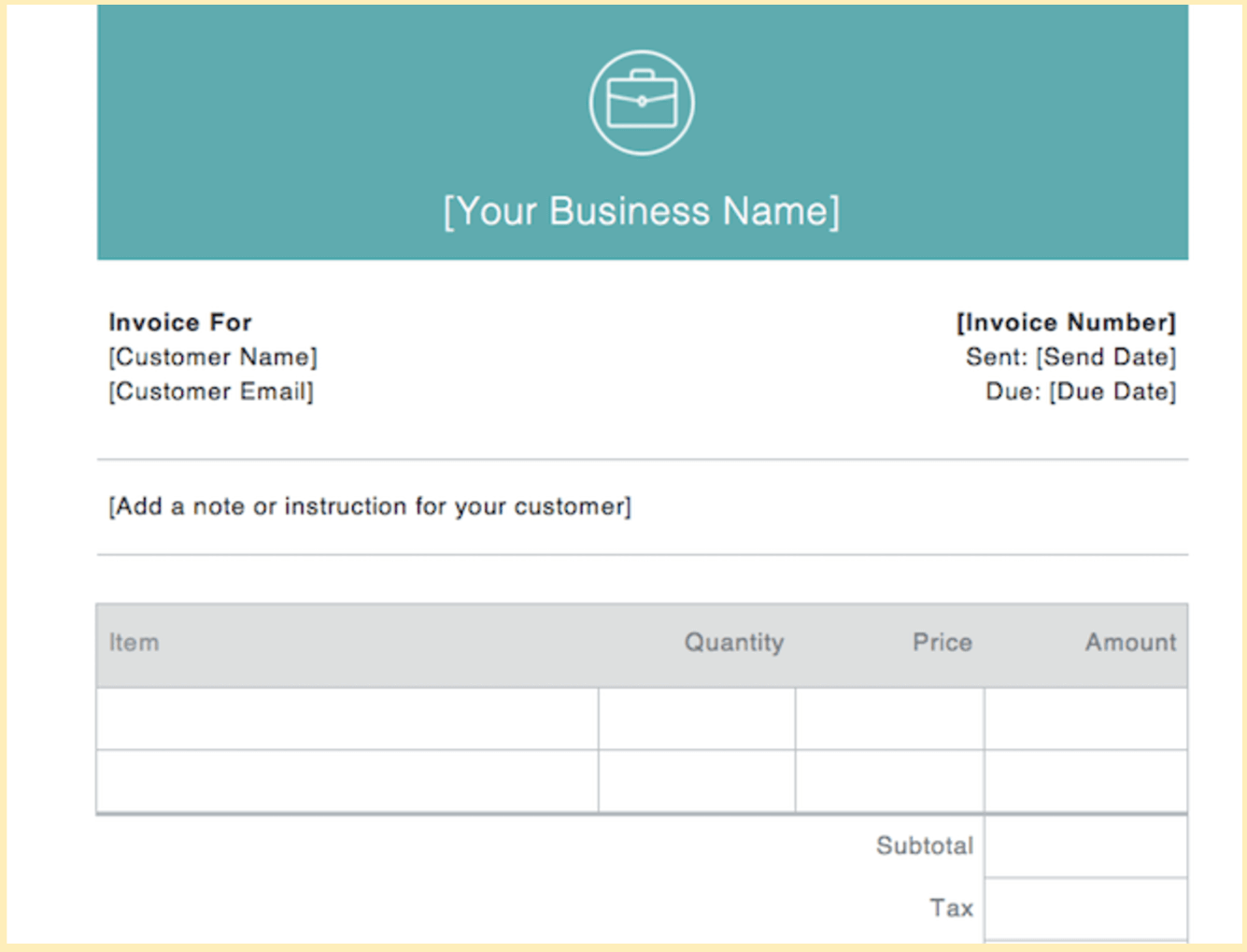

The following picture illustrates what an email template for invoicing could look like.

Source: Square

You could go the extra mile and provide a link to a web payment form, so those customers who want to complete the payment upfront can do so.

An additional benefit of a click-to-pay email invoicing system is coordination with your data.

When a customer clicks and completes an online payment, the system automatically marks the invoice as paid. That gives you an overview of the completed purchases without waiting for a transaction confirmation from the bank.

How to Avoid Late Payments from Customers

As a business owner, managing cash flow is crucial, and a key part of this is ensuring you collect payments from customers in a timely manner. Late payments can disrupt cash flow and affect your ability to operate and grow.

Fortunately, there are strategies you can implement to minimize late payments and encourage timely payment from your customers.

- Implement Payment Reminders: Consider setting up an automated email or messaging system that sends out reminders at set intervals— a few days before the due date, on the due date, and if necessary, following up after the due date.

- Offer Early Payment Discounts: Incentivize your customers to pay their invoices ahead of time by offering discounts for early payments. Even a small discount can be a significant motivator for early payments.

- Enforce Late Fees: By clearly outlining in your original contract the consequences of late payments, including incurred late fees, and being transparent about these policies from the start, you establish financial repercussions for delayed payment.

- Provide Payment Links: Payment links remove barriers by directing customers straight to a payment portal, where they can make payments quickly and without hassle.

By taking proactive steps, you can significantly reduce the occurrence of late payments from customers, ensuring a healthier cash flow for your business.

Why a Good Billing Solution Matters

Good service is the foundation of any successful business, and a simple way to collect customer payments is an important part. To retain your customers, you have to make the payment process straightforward enough that they can complete their transactions with no fuss.

When a customer sees a complicated payment process, they see a lack of organization, which then reflects on your business as a whole.

Even more seriously, they can become concerned about the security of their financial information and decide against the purchase. So, whichever online payment options you choose, you must keep them polished.

Despite the variety of ways to accept customer payments online, accommodating different customer preferences doesn’t have to be complicated.

Regpack can help you create an amazing online storefront, together with solutions for collecting payments.

An integrated online payment processing solution helps you manage all payment data in one place and eliminates the need to log each payment manually.

Its reporting tools make tracking payments easy so you can get an insight into your sales and manage your business accordingly.

Regpack allows for custom payment plans and works with various payment processors to meet your needs. It’s flexible, fitting both new businesses needing merchant account setup and established ones looking to integrate payment solutions into their websites.

Ultimately, the checkout process can make or break the user experience. Providing your customers with simple payment solutions enables them to quickly and securely complete transactions, purchase after purchase.

Conclusion

The world is moving towards more online and contactless payment solutions, leaving cash behind. In embracing online payment systems, businesses must select options that align with customer preferences and operational needs.

From traditional credit and debit card payments to innovative mobile wallets and ACH transfers, the choice of payment methods should facilitate easy and secure transactions for both customers and businesses alike.

With solutions like Regpack, collecting payments from customers has never been easier. Integrating diverse payment options becomes simple, enhancing the overall customer experience and ensuring prompt payments from customers.