Payment automation is a well-established practice in today’s business world. Big and small companies use it to streamline their payment process, reduce their employees’ workload, and increase efficiency and punctuality.

However, certain payment automation myths still float around, making some companies second-guess the entire practice.

Practically every business can benefit from payment automation. That’s why in this article, we’ll bust some common myths about it that still deter some businesses from reaping the benefits of automating payments.

Myth #1: Automation Is Not That Efficient

Businesses can sometimes be dismissive of automation because they feel a certain loyalty towards their employees—after all, how much more efficient can software be compared to a well-trained group of people?

Well, that’s a payment automation myth that’s easily busted with some data. It turns out that payment software can be considerably more efficient at processing payments than your accounting and finance team.

And it’s not your team’s fault; they can be incredibly quick and precise in manually processing invoices, but they’ll never be as efficient as automated software can be.

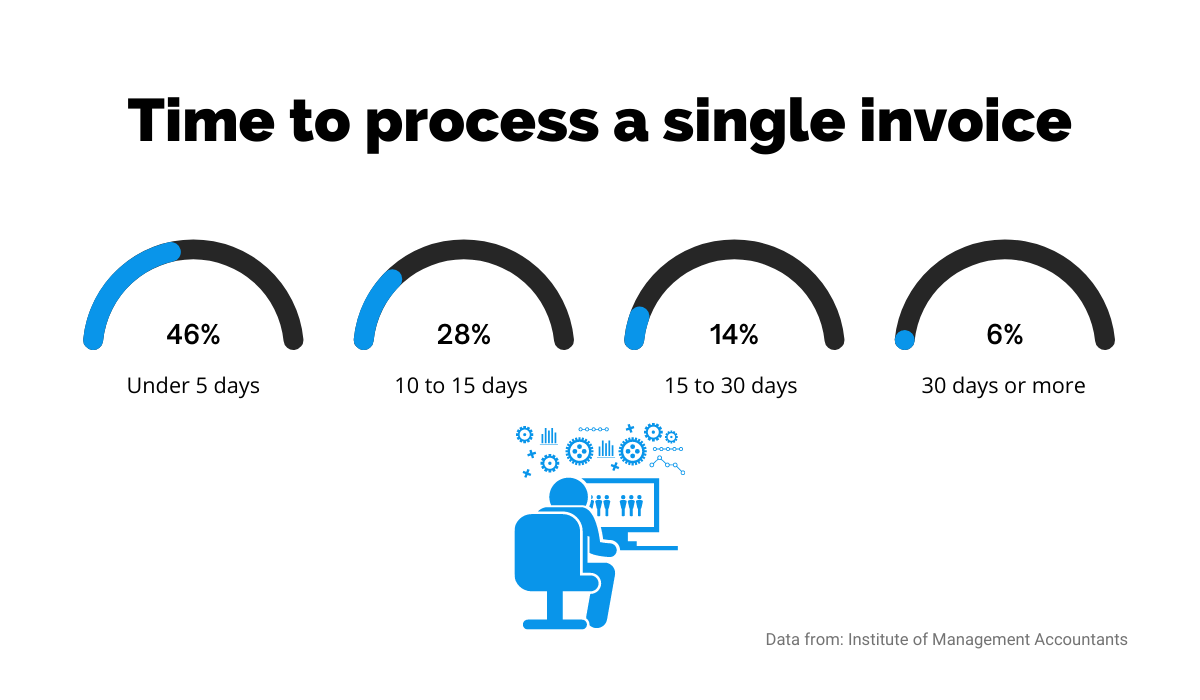

For instance, according to data from the Institute of Management Accountants, less than half of companies manage to process a single invoice in five days or less, as you can see in the graph below.

Source: Regpack

On the other hand, most automated solutions for payment processing will significantly reduce that time—departments that use automation will process most of the invoices in three to five days.

And since the process is more efficient, the cycle times are faster. In that sense, time literally is money—more processed payments in less time equals more money for your business.

However you look at it, the payment automation myth of not being more efficient than manual labor doesn’t hold ground, and it certainly doesn’t pay to abide by it.

Myth #2: We’d Lose Control Over Our Process

The myth of losing control over the payment process is common among the skeptics of payment automation. Interestingly enough, the opposite is true—you have more control over the payment process with automation than without it.

Using payment automation isn’t like handing the reins of that process over to some sinister, self-aware AI.

Automated solutions are meant to assist you in your business and make your life easier by streamlining some of the more tedious, potentially error-laden administrative tasks.

For example, you control how your automated software will handle payments.

By setting up system rules and patterns, you decide what the “correct” payment looks like and what data it should contain, so the payment automation software can scan it and process it if everything’s in order.

If it’s not, the payment is flagged as an exception, and then, again, you or your team are in control; you get insight into the anomaly and are able to process it manually.

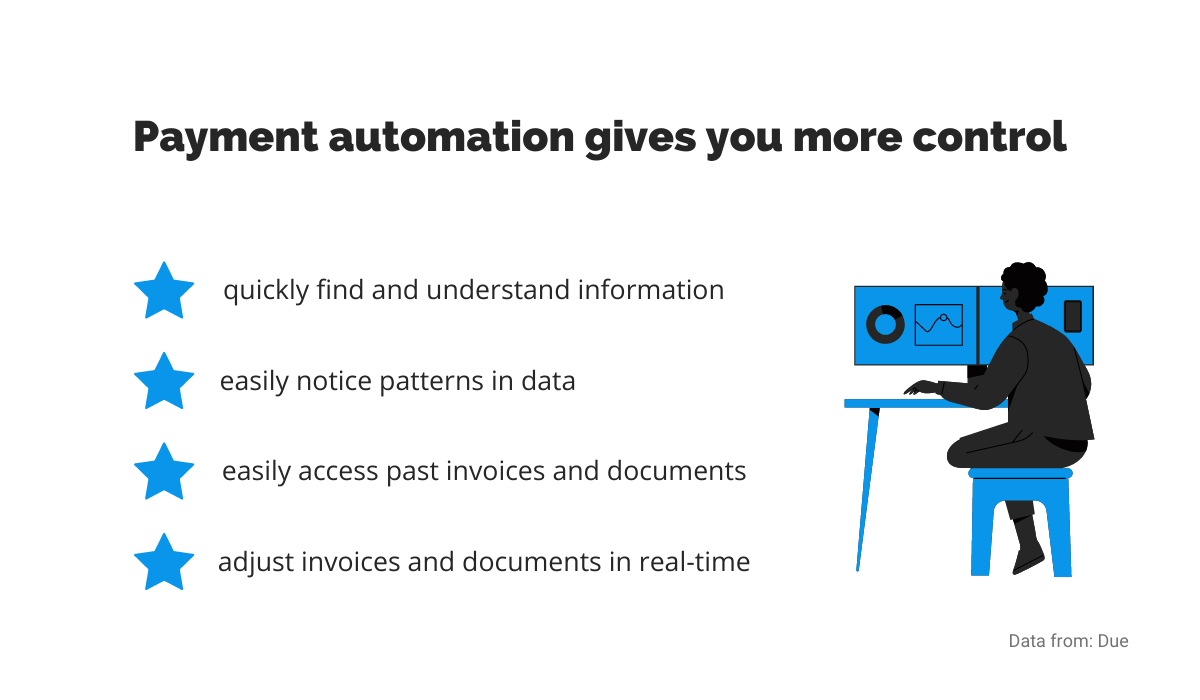

In addition to that, automated software gives you the chance to access past documents and invoices easily, filter them, and look for patterns, giving you a bird’s eye view of your finances.

Source: Regpack

As you can see above, you and your team have detailed insights at your fingertips in one centralized place. That means no more digging through piles of paper for that one receipt that someone forgot to file correctly.

Access to more relevant data and a chance to focus on those payments that genuinely require your attention gives you more control over your payments than any manual process you might use.

Myth #3: Payment Automation Is Too Expensive

Like any other software, a payment automation solution requires an initial investment. However, the claims that it’s too expensive compared to manual payment processing are often exaggerated.

For example, payment automation solutions that come as software-as-a-service (SaaS) and use cloud storage require no investment in a specific piece of equipment.

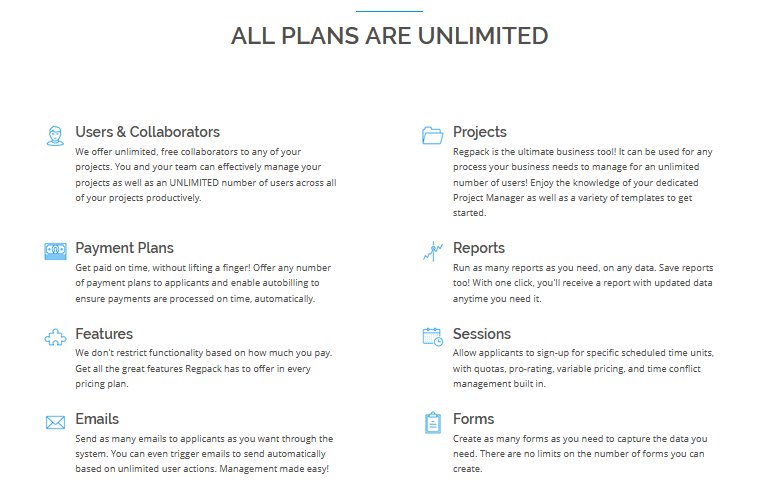

Automated solutions often offer many unlimited features for a fixed price.

For instance, Regpack provides access for an unlimited number of users across all your projects, all the features in any pricing plan, creating as many reports and forms as you need, and much more.

Source: Regpack

Also, using payment automation software can save you money in the long run. As we mentioned earlier, manually processing payments can lead to errors, which can be very costly for your business.

There isn’t a human being that won’t eventually make a mistake. In fact, according to the Bloomberg survey, human error is a leading factor in accounting mistakes.

More than a quarter of professionals (27.5%) said that there was incorrect data manually entered into their systems.

Those kinds of errors can delay payment processing and lead to penalties for your business, not to mention they can get you in trouble if you don’t notice them before the auditors come or before you file your taxes.

Believing in the myth of too expensive payment automation can prove very costly for your business. The fact of the matter is that, after the initial investment, automated solutions can quickly prove their worth and prevent any unwanted financial mistakes.

Myth #4: We’re Too Small for Automation

The size of your business has nothing to do with payment automation. The belief that some businesses are simply too small to benefit from automation solutions is another myth that doesn’t hold up.

Smaller businesses have fewer resources than large companies; that much is common sense.

However, as we mentioned earlier, automated payment software is worth the initial investment.

Businesses of any size can benefit from the absence of mistakes that manual payment processing can produce.

Also, small businesses have fewer employees.

Do you want to burden your handful of employees with grunt work like manually checking data on invoices and receipts, sending payment reminders, and calculating late payment fees—when you could let a software solution take care of that instead?

A payment automation solution that takes care of tasks like that means more time for your employees to tackle more important and engaging work that requires their full attention.

Moreover, global trends confirm that payment automation isn’t only for big companies. According to research by PYMNTS, 34% of small businesses in the B2B sector intend to prioritize investment in automated solutions in the next three years.

Source: Regpack

Thinking your company is too small to use payment automation can hurt your business and have you struggling to keep up. The benefits of payment automation we mentioned earlier apply the same to businesses of every size, so don’t be afraid to use them to their fullest.

Myth #5: We’re Too Big for Payment Automation

Just like no business is too small for payment automation, no business is too big for it either. Hesitating to implement an automated payment system because you think your business is too big can hinder your success, and there’s no merit to that assumption.

Payment automation solutions are easily scalable. That means they can take on more and more tasks as your business grows without a hitch.

First of all, handling large amounts of money, mountains of paperwork, international payments, and everything else that’s a part of the big business day-to-day accounting can put enormous pressure on your employees.

But automated systems can take on this complex workload with ease.

Furthermore, payment automation can handle 1000 invoices a day with the same precision as it can ten. It doesn’t get fatigued, demotivated, or distracted, and it doesn’t lose documents, or make typos.

Source: Regpack

Besides, other big companies in your industry certainly don’t believe this myth and reap the benefits automation can provide. Failing to keep up with new technology and using your resources on outdated manual processes will make you lag behind your big competitors.

Overall, the larger the company is, the more it relies on payment automation. With today’s payment automation solutions, even the largest enterprises can put their faith in their efficiency and reliability.

Myth #6: It Takes Too Long to Implement

Payment automation software may seem like a complex system that requires extensive technical knowledge and a lot of time to implement; after all, something that has that many features must be time-consuming to set up, right? Luckily, that’s a myth.

Most payment automation solutions are quick and easy to install and integrate into a company’s systems.

Of course, as with any new technology, you’ll have to get it up and running, but it takes no more time to do so than it did for any other vital solution that considerably benefits your business.

While time to implementation can be a short-term drawback, the long-term benefits we’ve outlined so far outweigh it by far.

That being said, keep in mind that you don’t have to implement this new system alone and unsupported. Most solutions offer a team that can help you implement it properly.

For example, Regpack offers a full support team and a project manager who can help you set up your system, assist you along the way and answer any questions.

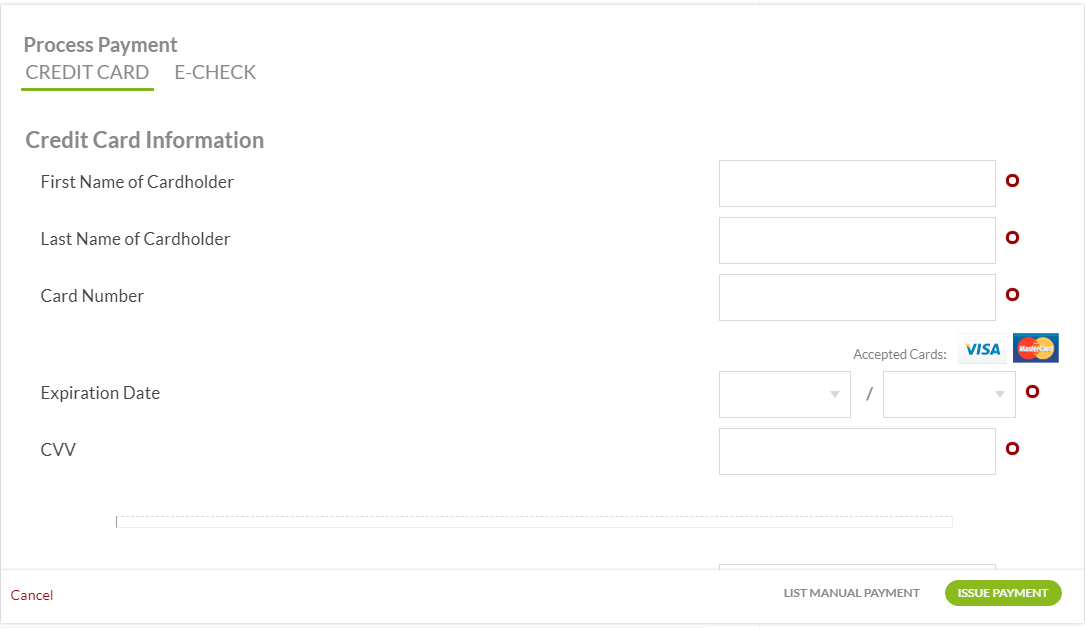

Source: Regpack

The time that implementation of payment automation takes is relative; even if you spend some of it, the benefits of those solutions make the effort worthwhile.

Myth #7: Our Clients Won’t Use It

Skeptics often claim that it’s their clients who would be reluctant to use automated payment systems, despite their many benefits.

Payment automation has been around for years now, and many industries got comfortable with it. There’s no solid reason why clients would refuse to accept it.

After all, payment automation makes their lives easier, too; it isn’t just a great solution for businesses. The benefits of automation can improve the whole process, from the business end to the client’s end.

For example, payment automation means faster payment cycles, which means less time spent waiting for payment processing. For clients, that means more control over their finances; it’s easier for them to assess their spending and budgeting.

Source: Regpack

In addition to that, payment automation can lead to better relationships with the clients—the more transparent and visible the process is, the more satisfaction and loyalty it can engender with your clients.

Also, payment automation and e-invoicing are a regular occurrence in many industries and countries. For example, in China, one of the leading economies in the world, around 80% of B2B transactions are done by e-invoicing.

Payment automation solutions are a well-established practice in various industries across the world. The myth that your clients won’t use them is better left to the past.

Myth #8: Payment Automation Cuts Jobs

The claim that the payment automation software will take someone’s job is a myth; simply put, a payment automation solution isn’t designed to replace humans but rather assist them.

As we mentioned earlier, payment automation solutions take care of repetitive and dull tasks like data extraction from the invoice or, for example, general ledger coding.

These are time-consuming tasks that, when automated, make space for more important, and challenging work.

The fact that payment automation frees up your and your employees’ time means that you can invest that time more efficiently.

It’s certainly better for a business long-term if, instead of menial data entry, employees work on developing strategies, making analyses, or other valuable tasks.

In other words, you can use the benefits of payment automation technology to develop your team members’ skills as well as your own, diversify them, and therefore improve your productivity and business as a whole.

That can also lead to a higher level of satisfaction in the company and better employee retention; according to SHRM research, the top factor of satisfaction in the workplace is the opportunity to use skills and abilities.

And it’s safe to assume that data entry tasks aren’t using the full potential of your employees’ skills.

Source: Regpack

So, no, payment automation doesn’t eliminate jobs; it changes and diversifies them. One software can’t replace the whole finance department, but it can give them a chance to be more productive and invested in their work.

Myth #9: There Are Too Many Security Risks Involved

When technology, computers, software, and automated systems come into play, some people will always fear data breaches and security risks. Luckily, with todays’ payment automation solutions, those risks are not as grave as you may believe.

In fact, it is far more likely for a data breach to occur during manual payment processing than in an automated one. In other words, it takes just one human error to do some significant damage.

For example, if one person in your business is responsible for client data, all it takes for a data breach to happen is one misplaced payment document or one email sent to the wrong address.

And the chances of human error are far greater than the chances of some lone hacker forcing themselves into your automated payment system.

That’s even less likely with the complex security protocols, encryptions, and password protections that payment automation solutions regularly use.

For instance, Regpack secures all payments with the SSL 256bit enabled servers. In less technical terms, all information is processed through the SSL protocol, which ensures that someone unauthorized can’t view the transferred data.

Source: Regpack

In addition to that, the credit card information isn’t saved with the other user information, and it’s kept under even more layers of security. And that’s just a part of the protocols that many payment automation solutions offer.

Maximum security is one of the top priorities for payment automation solutions. Companies offering these solutions invest heavily in it because their reputation would be ruined if there’s just one slip-up. That’s why their security risks are nothing more than a myth.

Conclusion

Payment automation solutions can be a big factor in transforming the payment practice of any business.

The myths we’ve discussed in this article are those seeds of doubt that can hinder the implementation of payment automation in your business and therefore halt your growth.

The payment process is one of the most important parts of your business – it impacts your revenue, productivity, and relationships with your clients. Don’t let the myths we busted in this article prevent you from taking the next step in your business.