Setting your prices is always a challenging process.

You need to consider many different factors, from your value offer to the customers’ interest and market trends. The better you can match your customer’s needs and expectations, the quicker you can overtake your competition and increase profits.

However, juggling all these considerations might lead to some common pricing mistakes. Let’s look at them more closely so you can avoid making them in the future.

Jump to section:

Failing to Establish a Pricing Strategy

Not Aligning Prices With Customer-Perceived Value

Pricing All Products With the Same Profit Margin in Mind

Miscalculating Your Competitors’ Pricing Strategy

Poorly Segmenting the Target Audience

Failing to Review Prices Regularly

Failing to Establish a Pricing Strategy

Pricing is often the last item on a company’s agenda when creating a new product or service.

Often, the decision is made based on the sales team’s suggestions, which is derived from calculating the overall cost, or even the competitors’ price lists.

While this approach could work as a temporary solution, if you want to create a sustainable business that will outlast the competition and draw in loyal customers, you need a more thorough pricing strategy.

Ask yourself, how does the pricing align with your business goals? What do you want to achieve? What are your marketing and sales targets?

So, it’s evident that a good pricing strategy can’t be established without thorough research, continuous communication between departments, and looking at hard data.

The pricing strategy should be tactical and take the following into account:

- Customer needs

- Competition

- Costs

- Profitability

Uncovering how your prices will affect the market should only help you stay on track with your business objectives, which you can’t do effectively without focused research.

© Jirapong Manustrong via Canva.com

Here’s how J. C. Penney, the fashion retailer, failed with its pricing strategy. They used to hype up their customers with discounts and coupons.

Then, after Ron Johnson took over the company, he thought that lowering prices permanently, instead of relying on coupons, would drive more sales.

In reality, their sales actually dropped by 20%, leading to a loss of $550 million in Q4 2012, and the company has been struggling for the past five years. But why did that happen?

Johnson failed to understand the mindset of the company’s customers when it came to pricing. The customers wanted to feel smart, thrifty, and excited about the sales and discounts while shopping. Permanently low prices weren’t what they wanted.

Also, J. C. Penney’s products aren’t unique. In fact, similar items can be found with many other competitors, so the company needed an exciting lure to bring customers to their stores. This is why discounts worked on their customers in the first place.

When a customer sees a $20 shirt, it’s not perceived as a bargain. But when the same customer sees a sticker with 30% off attached, that same $20 shirt starts looking more appealing.

If Johnson had made his pricing decision based on market research and interviews with buyers rather than gut instinct, his relaunch of J. C. Penney would’ve been more successful.

What you can learn from this is that creating a pricing strategy takes time, resources, and continuous research to be effective in the long term.

Deciding on the optimal amount to charge your customers should be done with utmost care. Otherwise, it can break your company with even the slightest market change.

Not Aligning Prices With Customer-Perceived Value

Despite what you may think, it’s not the cost of providing a service or product that should ultimately determine the price of your products. It’s the customers.

Covering your expenses should determine only the lowest possible price of your product, but if you want to maximize your profit, then you need to set your prices according to the perceived value.

Consumers love a good bargain, but they are also willing to pay top dollar for products that make their life easier or embody a desirable lifestyle.

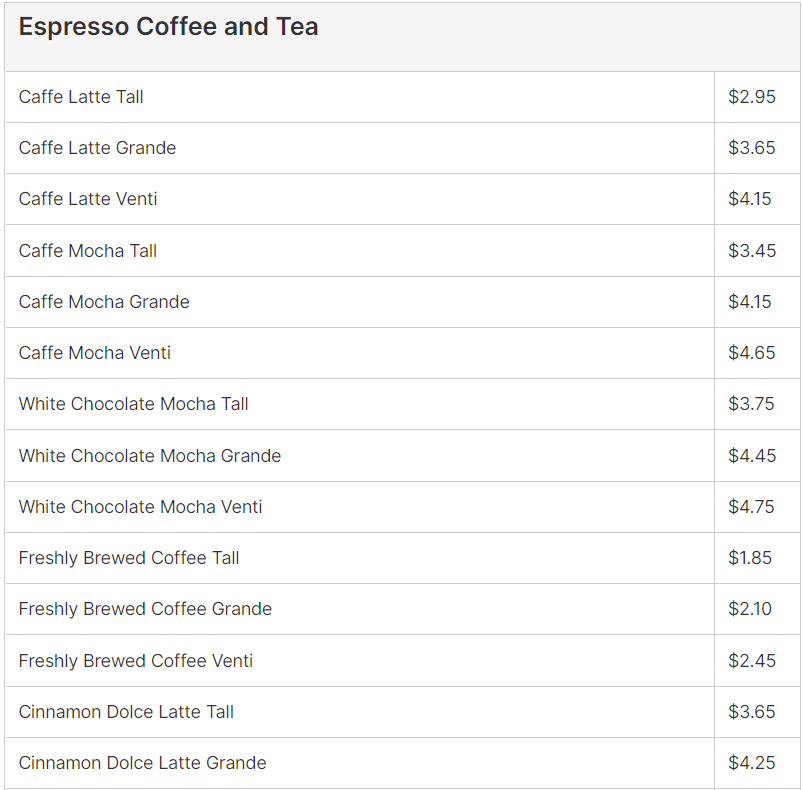

Starbucks is the perfect example. Why would anyone pay $4 for a cup of coffee when they can get the same in a grocery store for much less? It’s all about how customers perceive its value.

The company can set high prices for the coffee because it relies on the unique value proposition and experience it provides its customers.

They encourage social interactions, allow customers to stay in their shops as long as they want, and they’ve introduced seasonal drinks to additionally appeal to consumers by being trendy.

But most importantly, as one writer has noted, going to a Starbucks coffee shop is not about buying coffee anymore. It’s about meeting people and partaking in cafe culture. It’s basically become a lifestyle experience.

© SolStock via Canva.com

Starbucks has slowly built this brand image and is now successfully profiting off the perceived value of its products.

They’ve put a lot of effort into providing a great and unique experience for their customers, from the interior design of their shops to the types of products they sell. That is why Starbucks coffee is treated as an “affordable luxury” by consumers.

Keep in mind that customers will balance their financial investment with the outcome they wish to achieve, so some products are more highly valued than others.

It all comes down to adjusting your prices, so they match the image the customers have of your product.

Pricing All Products With the Same Profit Margin in Mind

The customers’ perceived value is also an important factor when calculating your profit margin. Even though the production costs might be similar across different products, their perceived value can differ.

Sometimes, companies will set identical profit margins for different value products and price them accordingly to make their financial decisions easier.

But that might be detrimental if you want to grow your company, as it will mean that you will always earn more for products that are more expensive, while selling the cheaper products will consistently be less profitable.

So, let’s turn to Starbucks again to see how you can avoid that rigidity by setting variable profit margins.

We’ve established that their customers value their products a lot, so they’re willing to spend more for a cup of coffee.

Source: Food

While an average cup of coffee costs Starbucks $1 to make (not including overhead costs and rent), their profit margins actually vary from product to product.

For one type of coffee, they have a profit margin of 45%, while for another, that can rise up to 71%.

That way, the company can actually garner a lot of profit across different products they offer, especially if their more expensive drinks are more popular among their customers.

If they stuck to the same profit margin of 45% across all their products, that would drive the price of their expensive drinks down and affect their profitability.

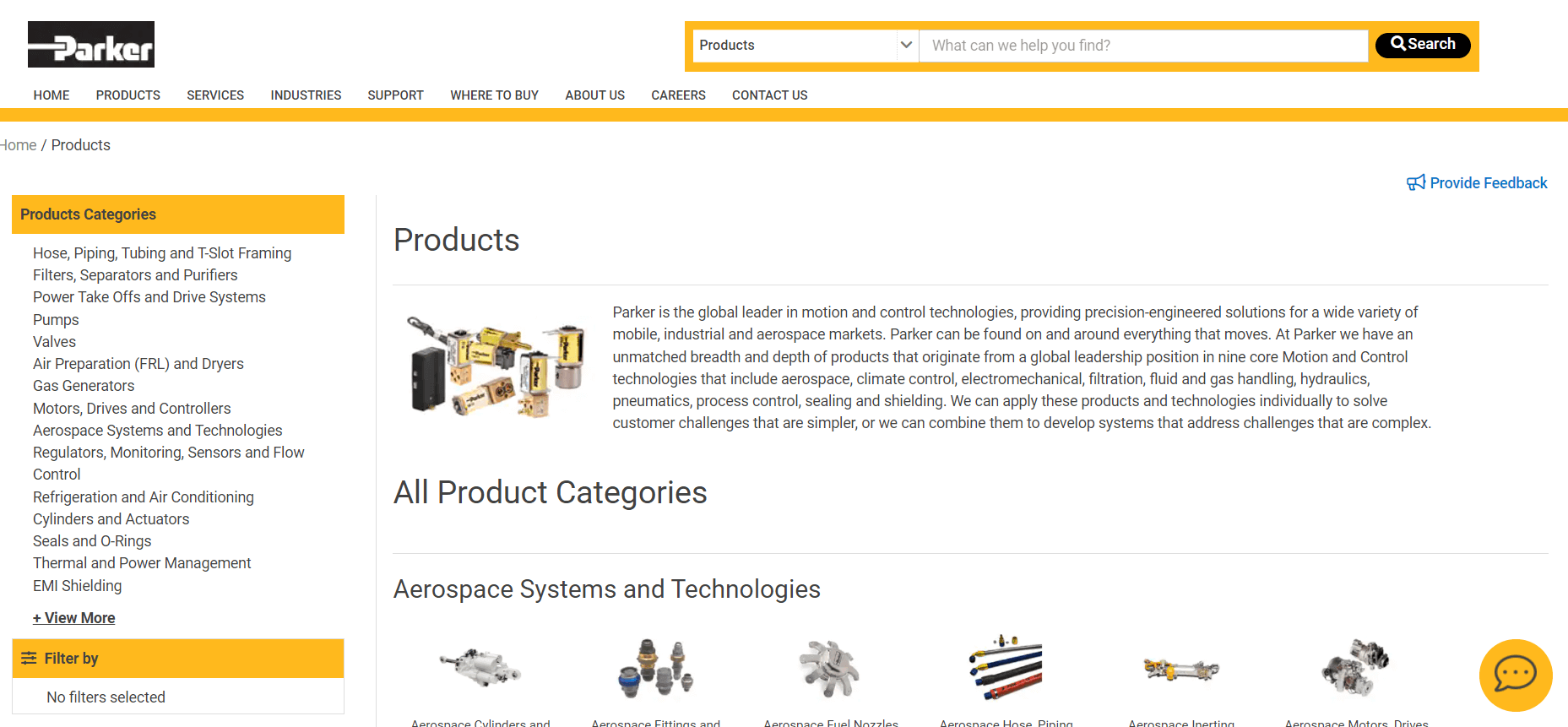

Here’s another example from Parker, a motion and control technologies company that had a 35% profit margin policy for 800 000 products.

They were at a standstill until a new pricing scheme was introduced. As a result, the company garnered over $800 million over seven years from improving its pricing strategy.

Source: Parker

So establishing the same profit margin for products of higher perceived value can bring down the market price and reduce your profits.

If you sell many products with different perceived values, it makes more sense to diversify your profit margin for various products.

Miscalculating Your Competitors’ Pricing Strategy

Keeping an eye on your competition when it comes to pricing is a great strategy. But you shouldn’t just copy what they’re doing.

Their business objectives, strategies, and resources may be completely different from yours, and you have no idea which factors they took into account when setting their price.

They might even be trying to undermine you and other competitors with their low prices, so by trying to match them, you’d be falling right into their trap.

Keep in mind that any change in pricing will cause a reaction in the market.

Sometimes your competitors will react aggressively and match your prices, but sometimes they’ll simply ignore you and put you at a disadvantage.

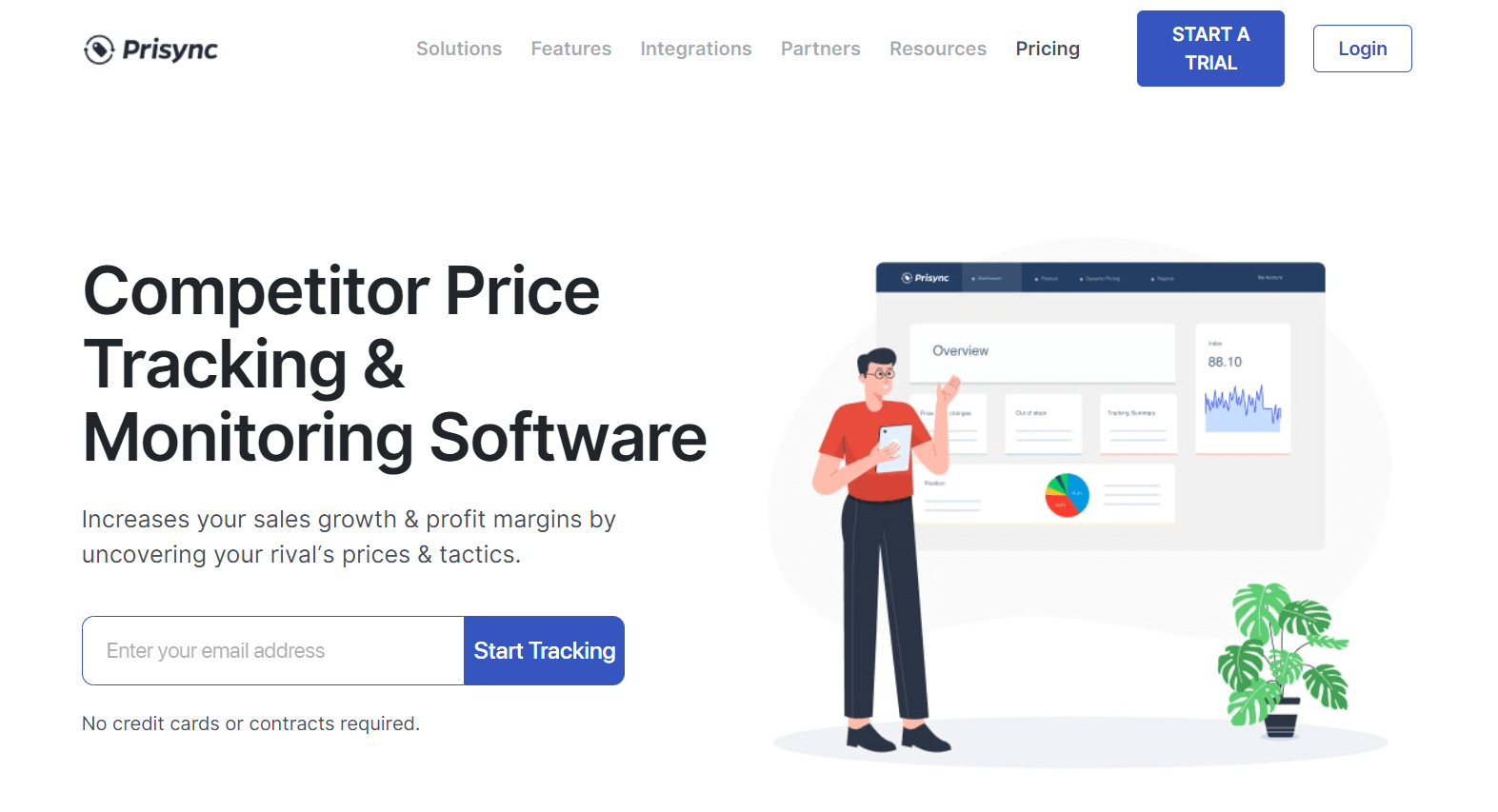

One practical solution that can help you in this journey is to use automated competitor price tracking software.

If you’re doing business in the online space, you’re competing against thousands of other companies across the globe. Hence, it’s difficult to keep track of them manually, even with a dedicated team.

Source: Prisync

Digital solutions will help you identify your direct competitors, their pricing, and the frequency of their price changes.

Then when the time comes to review your prices, you’ll have real-time data on what other businesses are doing and what you can do to be one step ahead.

Basically, you’ll stop being just another name in the sea of similar products with similar prices, but you’ll get to focus on what you’re offering and what differentiates you from others. That way, you can lead more customers to your products.

It’s important to know what your competitors are doing and how they’re responding to market changes in their pricing, but it should not ultimately dictate how you determine yours.

Poorly Segmenting the Target Audience

Different customers have varying needs and preferences when it comes to products.

Following that, when you have a product costing $20, some of your customers might find that too expensive, while others might think it’s perfectly priced.

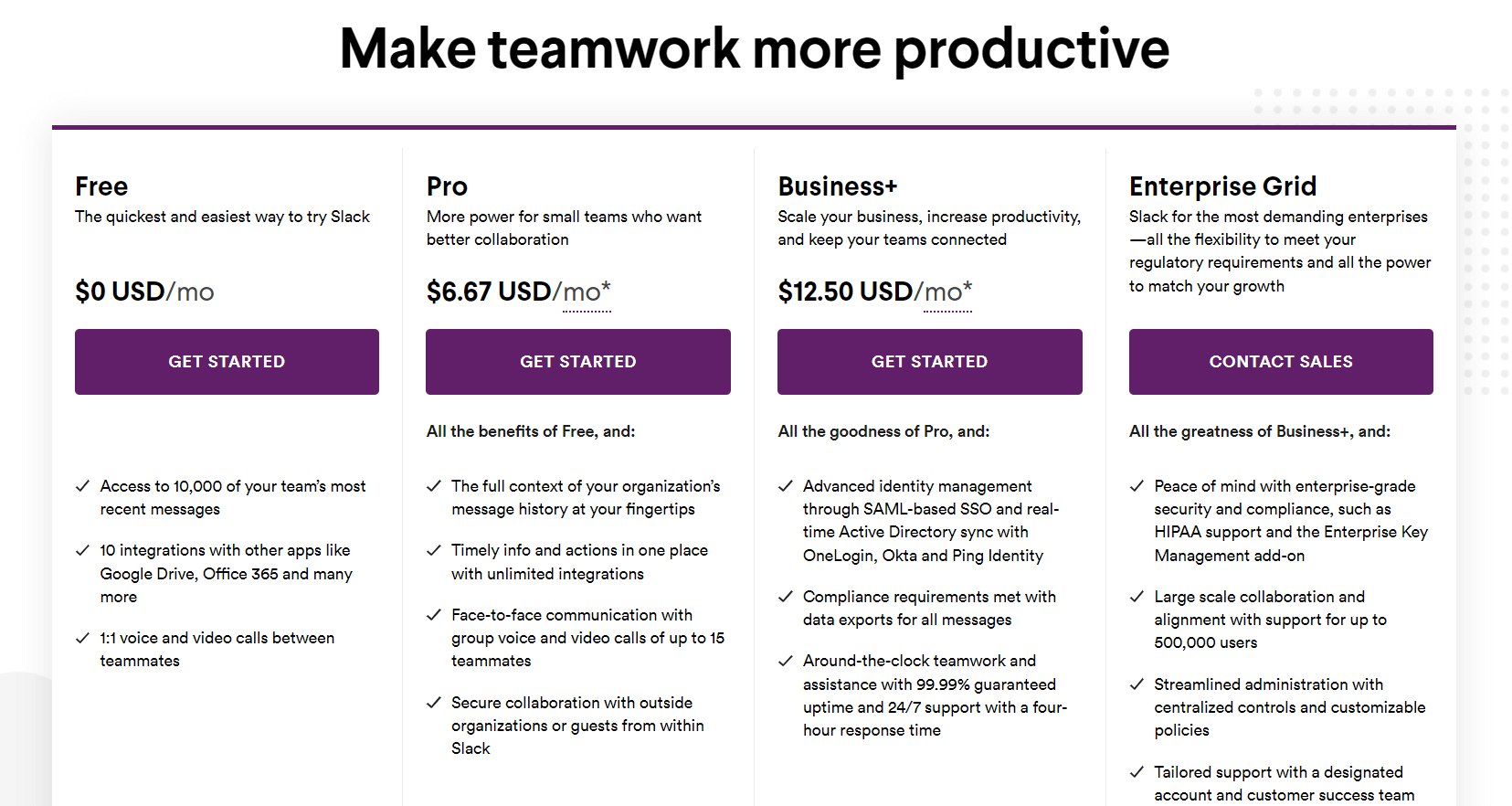

So, you might resort to charging $15, $20, and $30 for the same product, to appeal to different segments of your customer base.

Source: Slack

This is commonly known as customer segmentation. When applied in the right context, it can help you cater to less demanding customers who want cheaper products, as well as those who are willing to pay more.

The basis of this strategy is taking different buyer personas in your target market into account.

By closely researching who they are, what they’re frequently buying, and how they’re buying them, you can better understand how to price your product according to each segment.

Or, to put it simply, the amount of money you ask for a product targeted at a student is different from that you would ask for one intended for business professionals, as they don’t have the same purchasing power.

So, let’s look at two tech companies that needed to segment their customer base to increase sales.

The first one developed an innovative software product priced at $79 per seat. They kept the price for a while, but their sales didn’t increase as they expected.

After the company researched their customer base, they identified two segments: consumers and professionals. The fixed price was too high for the average consumer, whereas the professionals didn’t take the product too seriously due to its low price.

The company ultimately decided to focus on marketing its product to professionals and raised the price to $129. After that, their sales increased, too.

In another example, a tech company initially only offered one price for their product, $50 per user. They stuck to the price for several years before introducing an additional offer they charged 2x more for.

After that, they also decided to offer a premium version that was 3-4x more expensive.

The reason why they implemented these changes was that their customer base had grown and they saw the need to expand on their product offer.

They realized they could reach more customers with a wide variety of pricing options and steadily grow their company.

In short, the customers’ demands represent another significant factor in pricing your product.

After thorough research, you can identify their requirements and decide whether you want to focus on one segment of your customer base or diversify your product and cater to many different customers.

In the end, identifying different customer segments through research can help you effectively promote the right value of your product and increase sales.

Failing to Review Prices Regularly

Obviously, your market is constantly changing. New trends are always emerging, customers are frequently changing their preferences, and new competitors are invading your niche.

With new challenges always shaping the business landscape, adjusting your prices is necessary.

Yet, many companies are afraid to do that, thinking that changing their prices will drive their customers away. However, they’re likely operating without hard data, and the market challenges are eating into their profits.

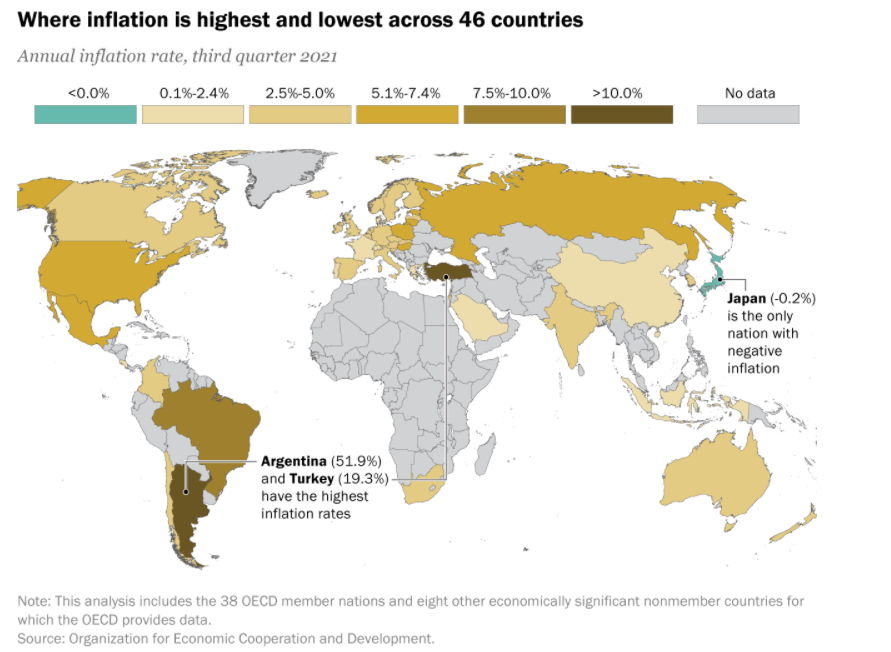

Let’s put it this way. At the end of 2021, the inflation rate in the US was 7%, the highest since the 1980s. This spike was due to supply chain problems, rising energy costs, and labor shortages.

Experts believe it will continue rising well into the middle of 2022.

Source: PEW Research

Even a famous furniture brand like IKEA felt the pressure of increasing costs and supply demands, so they decided to increase their prices by 9% in its stores worldwide.

It’s also worth mentioning that regularly reviewing your prices can significantly improve your bottom line.

According to ProfitWell, by changing your prices by 1%, you can increase your profit up to 12.7%. This change can enhance every aspect of your business, but most importantly, you can better respond to unfavorable challenges such as inflation.

So, how often should you adjust your prices?

Generally, you should rethink your pricing strategy every 6-9 months to address various market changes.

The price changes don’t have to be drastic. In fact, if you do it right, often most customers won’t even notice them.

Customers will be more receptive to steady and fair price changes than short-sighted pricing decisions based on fear and ignoring market dynamics.

Keeping your customers informed about price changes can be a part of good customer service and positively impact your relationship with the consumers.

Source: Regpack

Remember that if you keep your prices the same with ongoing market problems and changes, you can negatively affect your bottom line in the long run.

Conclusion

Prices shape a company’s profitability and long-term growth.

So, if you dedicate time and resources to properly investigating the market, then make sure to cater to your customer’s specific needs and align your prices with your business goals, you’ll be way ahead of your competitors.

This process is not easy, but if you manage to avoid the top pricing mistakes we’ve described, you’ll be better equipped to withstand numerous challenges and uncover untapped business potential.