Online payments make everyone’s life easier. Students and parents can pay at their convenience using the wide range of payment methods that online payments open up.

That’s sure to make them happy.

And private school directors and administrators experience faster payment collection, fewer late payments, increased security, and many other benefits that lead to improved cash flow and saved time.

In this article, you’ll learn how accepting online payments can improve your private school’s payment collection process and make your life easier.

- Effortless Payment Collection

- Fewer Late Payments

- Increased Payment Security

- Paperless Payment Processing

- Improved Record Keeping

- Conclusion

Effortless Payment Collection

Gone are the days of counting cash, manually initiating transfers, hitting the post office, or waiting for a customer to meet you in person to make their payment.

All of this just takes too much of your time.

Accepting online payments streamlines the payment collection process for private school directors.

Once you have a customer’s payment information, you can easily send a request with instructions on how to pay, or you can even set up automated recurring charges.

Plus, it makes paying much more convenient for students and parents. They can pay from anywhere as long as they have an internet connection.

There’s no need for them to drive to your school and hand you the check or swipe their credit card in the terminal.

Furthermore, offering multiple payment options, from credit cards to ACH debit transfers, allows students and parents to pay in the way that is most convenient to them.

On your end, there’s no need to meet up with your customers to receive payments.

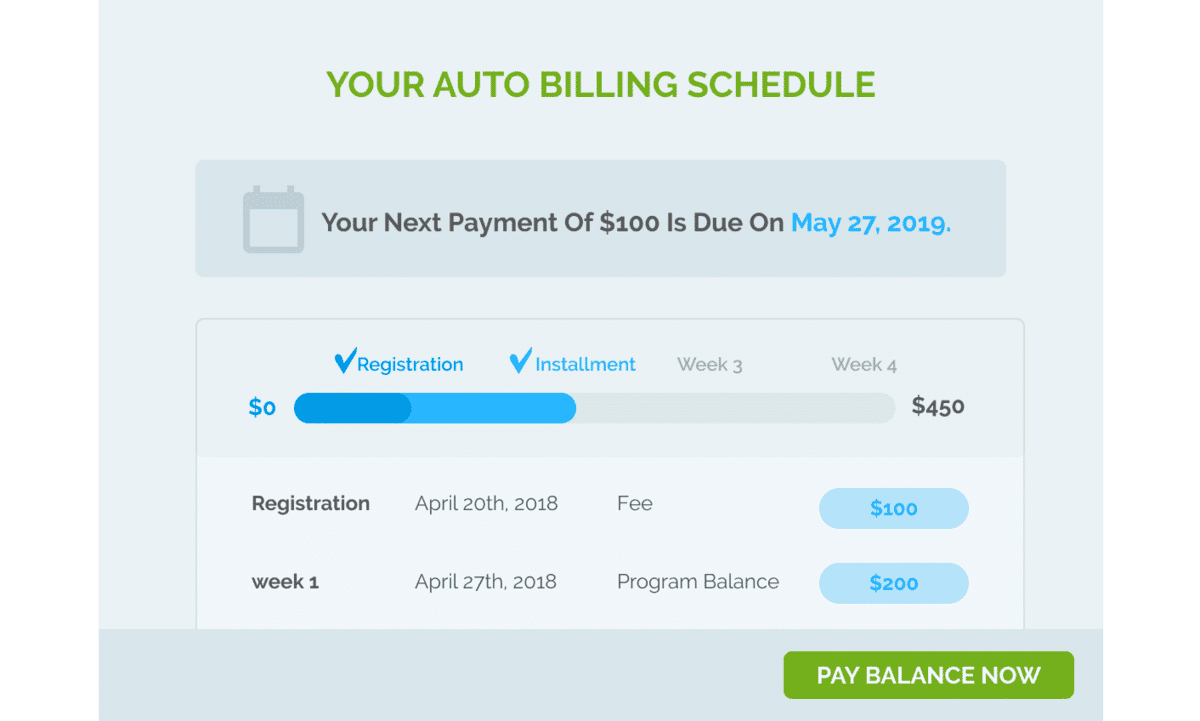

If you’re using an online payments software with automated billing, like Regpack, there’s no action required on your part at all.

All you need to do is set up the parameters and automations and Regpack will do the billing for you automatically from then on.

Meanwhile, you can focus on doing the tasks only you can do and watch the payments roll in.

Your clients will be able to sign into their online portal to pay their bills, and you can set up automated emails to remind them about upcoming due dates.

You can even design personalized billing schedules for your customers so that they pay in a timeframe that works for them.

Source: Regpack

From their user portal, customers can make payments directly from their laptop or mobile device, just as you might do when paying your monthly credit card bill on your bank’s website.

If you’re billing on a recurring basis, you can also allow your student and parents to sign up for automatic payments so each month their card or payment method is charged, without any work on their end.

Offering online payments is an excellent way to automate your payment collection process and ensure customers are satisfied and paying on time.

Fewer Late Payments

Offering online payments to your private school’s students and parents decreases the chances of late payments, for a couple of reasons.

First, online payments are much more convenient than physical payments, especially when you offer personalized billing schedules and various payment methods like e-wallets and credit cards.

No longer will customers pay late because of a hiccup in the mailing process or a lack of motivation to head to the school and make a payment.

And no more parents will complain that you don’t offer their preferred method and that they have to move some money around before paying the bill.

They won’t be able to make as many justifiable late payment excuses that you have to spend time handling.

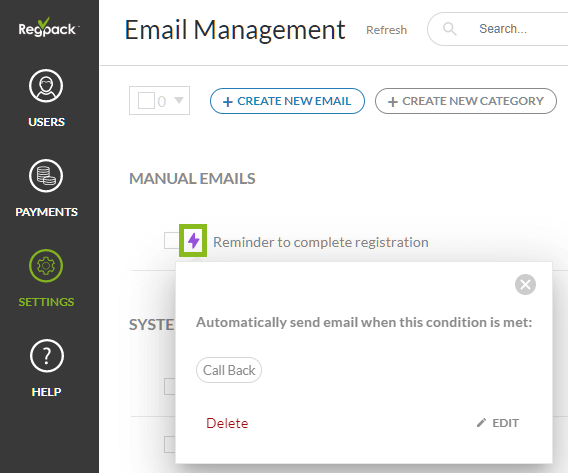

The second reason for fewer late payments is that online payment software often comes with email communication features that allow private school administrators to send payment reminders to students and parents automatically.

For example, Regpack users can schedule automated payment reminder emails to go out at certain times in relation to the payment due date.

That might be a combo of three emails, one a week before the deadline, another a day before, and the last on the day.

Life gets busy, and sometimes all people need is a little reminder to make the payment on time.

After configuring the automations, there’s no additional work on your end.

Customers receive personalized emails reminding them to pay, and this increases the chances they do so on time.

You can even choose certain conditions that will trigger the sending of an email:

Source: Regpack

For example, a condition might be that the due date has passed and no payment has been made.

When this condition is met, the system will automatically send a late payment email to the late customers, thus ensuring that the payments aren’t so late that they mess with your cash flow.

In sum, offering online payments at your private school results in fewer late payments because students and parents can pay effortlessly and you can use your online payments software to schedule automatic payment reminders.

Increased Payment Security

Online payments are extremely secure because they’re cashless and transferred through a secure network, provided that the online payment platform is following best practices.

For example, they should be using some sort of encryption technology that turns financial data into a code that’s impossible to access without the key.

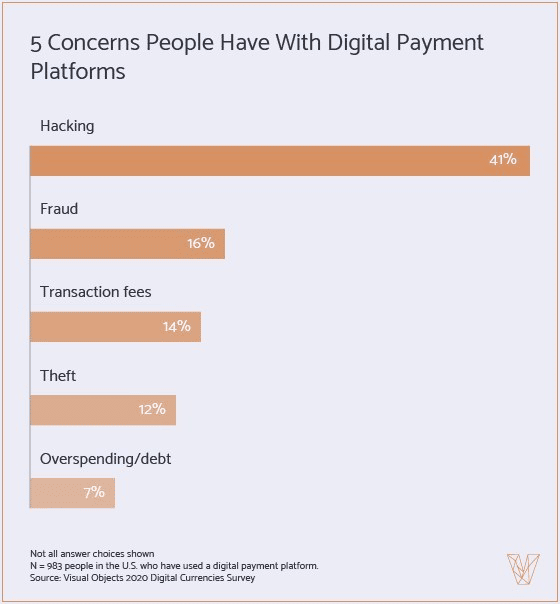

Unfortunately, many parents and students still worry about the safety of these transactions. They don’t want their financial data, like credit card numbers, ending up in the wrong hands.

A survey of around 1,000 people who have made digital payments found that 41% of respondents viewed hacking as their largest concern about digital payments.

Source: PR Newswire

Therefore, it’s important to use an online payment platform that is compliant with the Payment Card Industry Data Security Standard (PCI DSS) and to inform your payees about it.

This will reduce their level of concern.

PCI DSS is a set of standards that must be met to ensure online payment transaction information is safe from unauthorized access by people like hackers.

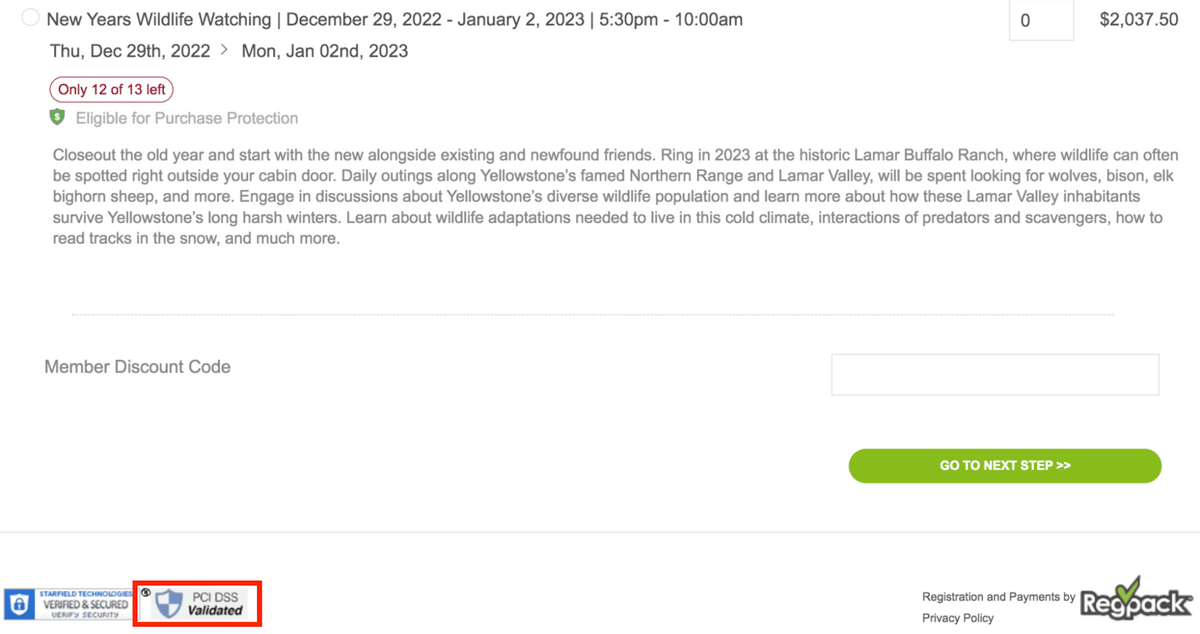

Regpack, an online payment platform, is PCI DSS compliant. Businesses that use it to process their digital payments are able to cite this compliance on their checkout page.

Yellowstone Forever does this below in the bottom left-hand corner of their registration page:

Source: Yellowstone Forever

Customers who see this validation certificate will be more likely to go through with the transaction without any hesitation, and you’ll therefore have an easier time convincing students and parents in favor of online payment methods.

If you have concerns about your payment platform’s security, be sure to hop on the phone with them to learn about the precautions they’re taking to protect sensitive data.

In sum, by accepting online payments through a PCI DSS-compliant payment platform, you ensure the safety of your customers’ financial data, and eliminate the risk of stolen checks or envelopes of cash.

Paperless Payment Processing

The average school spends roughly $100 per day on paper. That adds up to $16,000 spent on paper per year.

A great way to reduce the costs of paper is to introduce online payment processing, as it’s completely paperless.

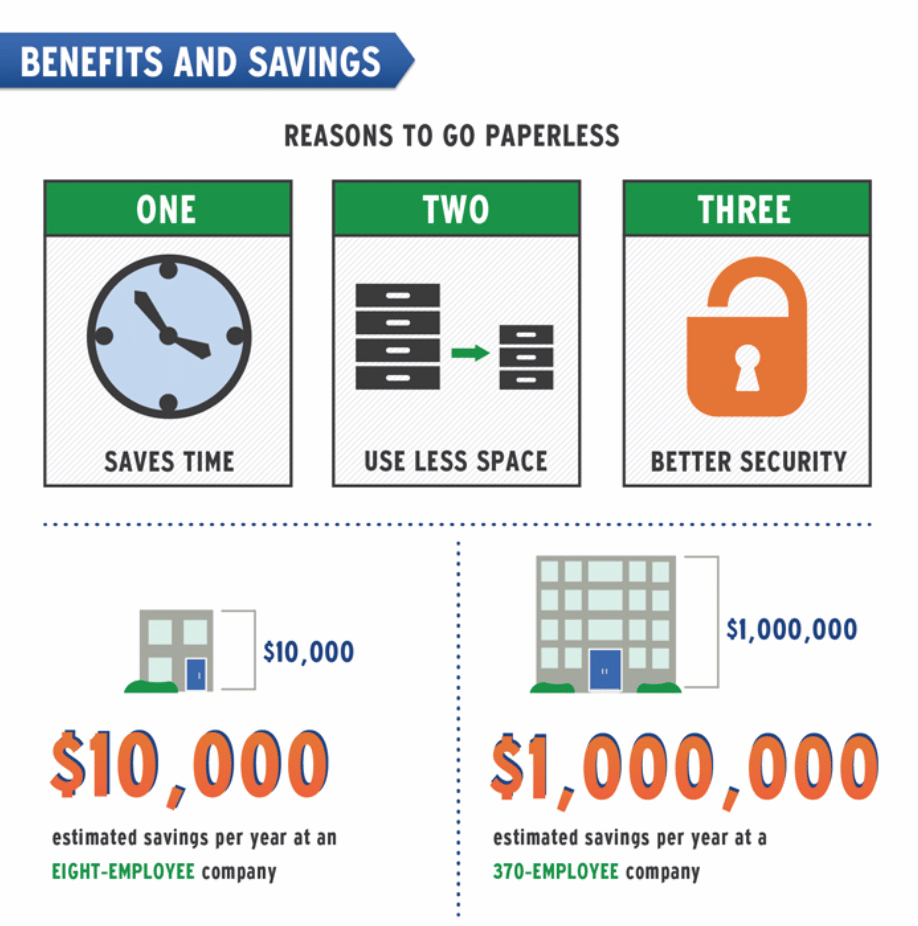

Just look at these benefits of going paperless in general:

Source: BizTech Magazine

Even if you’re still using paper for exams, handouts, and other in-class documents, going paperless for payment processing can still provide you with spectacular savings.

Without needing hundreds of reams of paper for record-keeping, schools can streamline their payment processing and save money.

They don’t have to print out bills or receipts, as all of it is stored online and sent via email or software to the paying student or parent.

You’ll no longer have to spend money on paper-based financial documents like fee cards, registers, and ledgers, or on printer ink and other supplies.

That money can be put elsewhere, like into teacher salaries or improved facilities and supplies for your students.

Furthermore, when you process payments online, you reduce any transportation costs associated with moving paper from one place to another, and all the stamps and mailing costs associated with that.

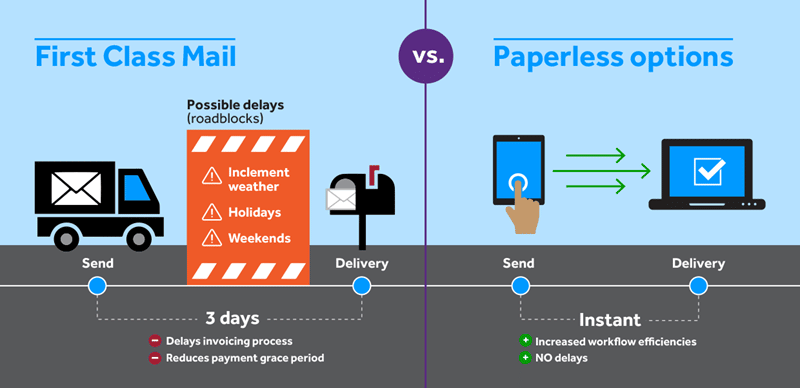

This also reduces delays, which are so common in traditional paper payment processing:

Source: DLL

Additionally, processing invoices and other payment documents by hand can be a strain.

It’s so much easier to do online, especially when you have automations handling the non-skill tasks for you.

Paperless payment processing is not only cost-effective. It’s also eco-friendly.

And being known as an environmentally sustainable school can improve your private school’s reputation and even attract parents and students who hold nature dear to their hearts.

To spread the word about your environmentally conscious school, consider highlighting your mission to go paperless on your school’s social media profiles and other marketing channels.

Ultimately, accepting online payments allows you to move your private school away from paper-based processing, and this shift leads to cost savings and a more elevated brand image.

Improved Record Keeping

Managing paper documents is a huge time sink for most schools.

Digging through files to find the right financial information is a big hassle, as is searching through email chains to find a payment receipt.

When you use an online payments solution, all of your payment transaction data is saved automatically within a searchable, filterable database.

Whether it’s a payment receipt or a customer’s payment history, private school directors can easily find the payment details they’re looking for.

In a single click, you can even view the entire payment history of a specific customer, a segment of customers, or your entire customer base.

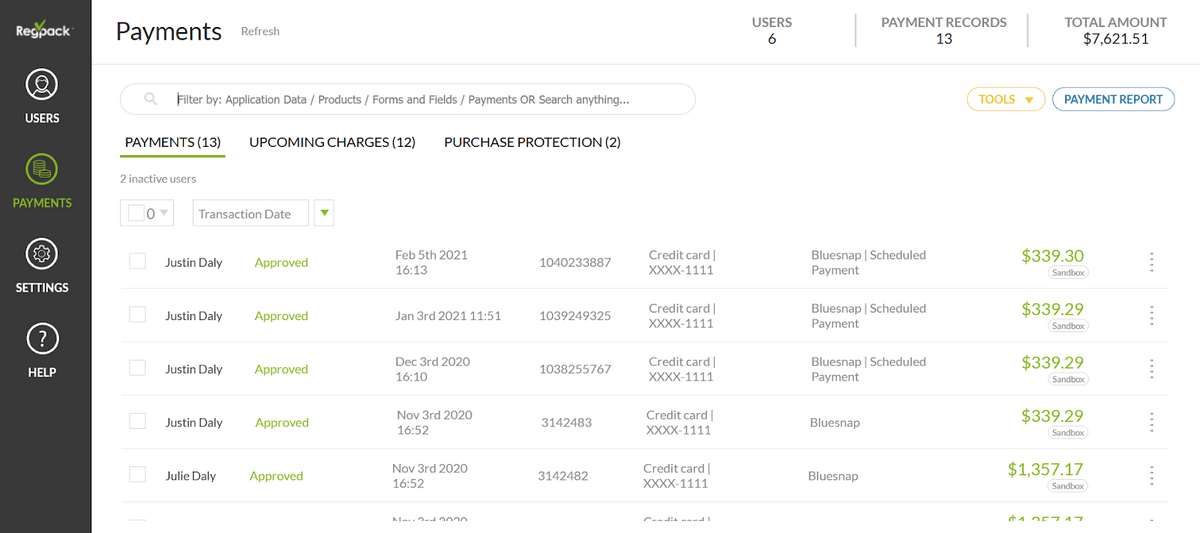

For example, here’s a picture of Regpack’s payment database:

Source: Regpack

It makes it super simple for you to track which payments have successfully gone through, which are pending, and which have failed, along with other crucial information like the payment amount and method.

The visibility you get with an online payment platform is so much clearer than what you’d get with paper-based documentation.

Not to mention, your co-workers will be able to access the data they need to do their job from anywhere in the world as long as they have an internet connection.

If you’re working from home, you’ll never run into a situation where you have to drive back to the school to pick up payment documents to finish a project, thereby wasting precious time.

And using an online payment solution doesn’t just let you find important data.

It also helps you analyze it to uncover payment insights that you can use to improve your payment process.

For example, you could drill down into the payment data using the reporting features to figure out which payment methods (card, ACH, etc.), or which customers, are resulting in the greatest number of late payments and why this is occurring.

If you found that a few of your customers are responsible for a huge chunk of your late payments, you could perhaps start sending more automated payment reminders to those parents or students.

Here are some other questions you could answer with data analysis on your online payments software:

| Which payment methods fail most often, and how can we fix that? |

| Which customers are always on time, and why might that be? |

| Who is behind on their payments, and how can we help them catch up? |

| Did our process change lead to faster payment collection? |

| Which programs have the highest number of late payments? |

By digitizing your payments record keeping with online payments software you provide yourself with an environment where you can quickly find what you’re looking for.

Plus, you can run payments reports to reveal insights that allow for data-driven decision-making.

Conclusion

By introducing online payments, you can take advantage of digital payment technology and give your customers the convenience they crave while also streamlining your recordkeeping and analysis, decreasing late payments, and improving your overall customer billing process.

If you need help getting started, reach out to Regpack, an online payments software that specializes in helping schools and education facilities accept payments via cashless, online methods.