If you’re running a small business with customers who purchase the same service or goods month after month, recurring payments are the ideal billing system for you.

Customers enjoy the convenience of recurring payments, while business owners like all the time and money they can save by automatizing invoicing.

To get the most out of recurring payments collected from credit cards, you have to choose your solution well and set it up carefully. This post will tell you how to select the best solution for your business and make the payment process easy for your customers.

Let’s get to it!

Jump to section:

What Are Recurring Payments?

What Kinds of Businesses Use Recurring Credit Card Payments?

Why Is It Important to Get Recurring Payments Right?

How to Set Up Recurring Card Payments

What Are Recurring Payments?

Recurring payments are a payment model where customers authorize the merchant to automatically pull funds from their bank accounts at regular intervals.

We sometimes also refer to this model as:

- subscription payments

- automatic payments

- recurring billing

- continuous payment authorities (CPA).

Whatever you call it, this payment model is here to stay. The total volume of processed recurring credit and debit card transactions in the U.S. was estimated at $473 billion in 2021, which tells us the market is burgeoning.

Source: Regpack

So, what makes recurring payments so great?

Customers see them as an easy way to continue using services for a prolonged amount of time without worrying about forgetting payments.

For instance, avid gym-goers will appreciate not having to renew their memberships month after month manually. With recurring payments, they can authorize the merchant to pull the price of the monthly membership from their cards so they can keep returning to the gym.

Business owners also benefit from recurring payments.

Such payments help you reduce the number of late payments or non-payments. Additionally, setting up a system that automatically collects payments means fewer invoices to issue, which cuts down on administrative costs.

Since 74% of consumers expect that people will subscribe to more services in the future, it’s safe to assume that more companies will start adopting this payment model.

Does this mean you can implement recurring payments into your business as well? It’s highly likely, with a few caveats.

Keep reading to see some examples from different industries that could help you see if this model is the right fit for you.

What Kinds of Businesses Use Recurring Credit Card Payments?

Adaptability is the quality of a competent business owner. With some creativity in the way you offer your services, you too can reap the benefits of recurring payments.

Recurring payments are often implemented in businesses that offer some of the following:

- On-demand services (such as Netflix or Apple TV Plus)

- Memberships (gyms, coworking spaces, bike shares)

- Subscriptions (magazines, language learning materials)

- Subscription boxes (beauty products, pet kibble)

- Software (such as Google Workspace)

Let’s start with some of the most recognizable subscription-based businesses. Netflix offers three different plans to their 209.18 million subscribers. Viewers allow Netflix to deduct a price from their bank account each month and enjoy hassle-free watching.

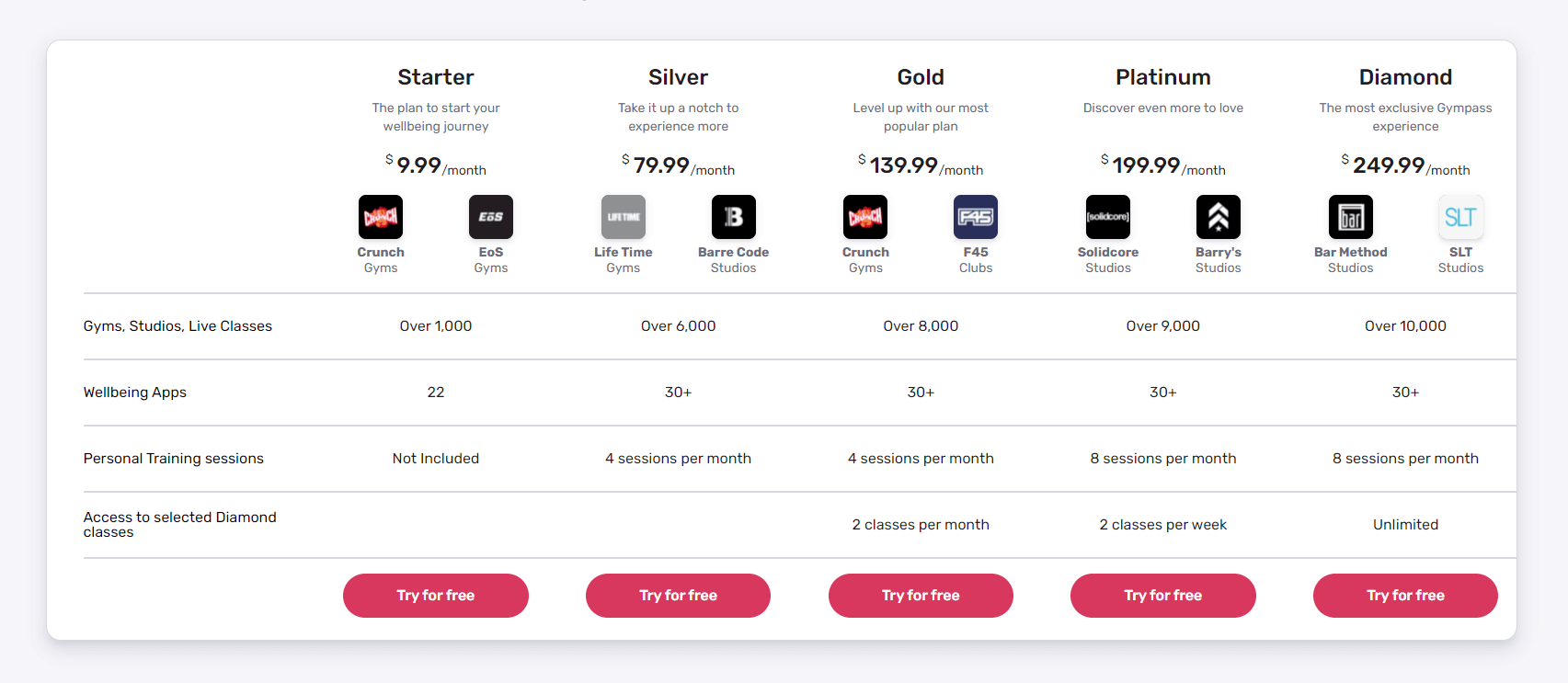

Depending on the type of service, some companies offer more plans.

For example, Gympass is a wellness platform that offers one membership for multiple fitness locations. The following picture shows their pricing tiers, with the price increasing along with the number of amenities customers can use.

Source: Gympass

However, big corporations with large numbers of subscribers are not the only ones benefiting from this model. Classic businesses like satellite tv packages apply this model consistently.

Even local gyms or health clubs can use it to make billing easier for their customers. In other words, you don’t need many subscribers for recurring payments to work; you need regular customers.

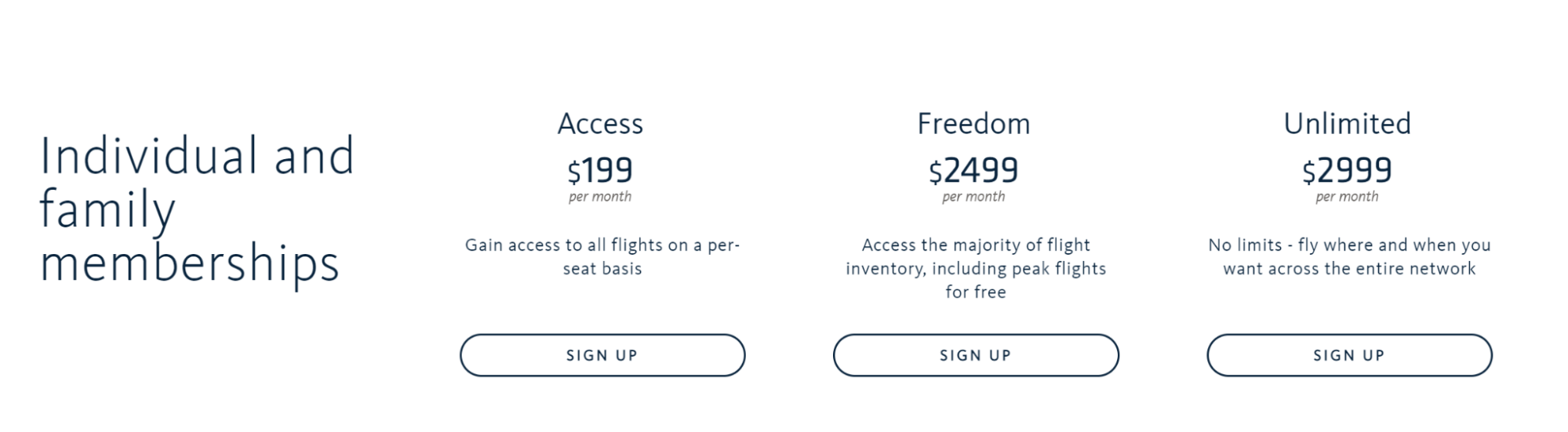

There are some unconventional examples of companies using the recurring payment models out there, too, such as Surf Air. This company offers flight memberships.

Source: Surf Air

Despite not having as many customers as Netflix or Kindle Unlimited, Surf Air have identified their niche, i.e., frequent fliers, and offered a solution for simple payments.

On the other end of the spectrum, there’s Kindle Unlimited, Amazon’s subscription program, where customers pay a monthly fee and enjoy reading books, magazines, or audiobooks.

As you can see, almost any type of business can implement and benefit from recurring payments.

Although you will have to analyze the viability of this model for your specific needs before implementing it, just because you haven’t offered recurring payments before doesn’t mean you wouldn’t find them advantageous.

Also, if you’re still on the fence, remember that almost 80% of adults pay for at least one subscription service. That’s too large of a market to ignore, so consider adapting your small business to meet the needs of a modern customer.

Why Is It Important to Get Recurring Payments Right?

Recurring payments are beneficial as long as you implement them right. If you make the payment process seamless, you will be able to retain more customers and improve your cash flow.

After all, there are several differences between running a Netflix-sized business and a small business. One of them is that Netflix can afford to lose 100 customers, but small businesses usually can’t.

As you’re probably aware, it costs significantly less to retain users than to acquire new ones. Because of this, whichever actions you take in running your business, make sure to consider how they will affect your existing customers.

For instance, if you’ve had loyal customers at your gym for years and you decide to implement recurring payments, you’ll have to ensure a smooth transition.

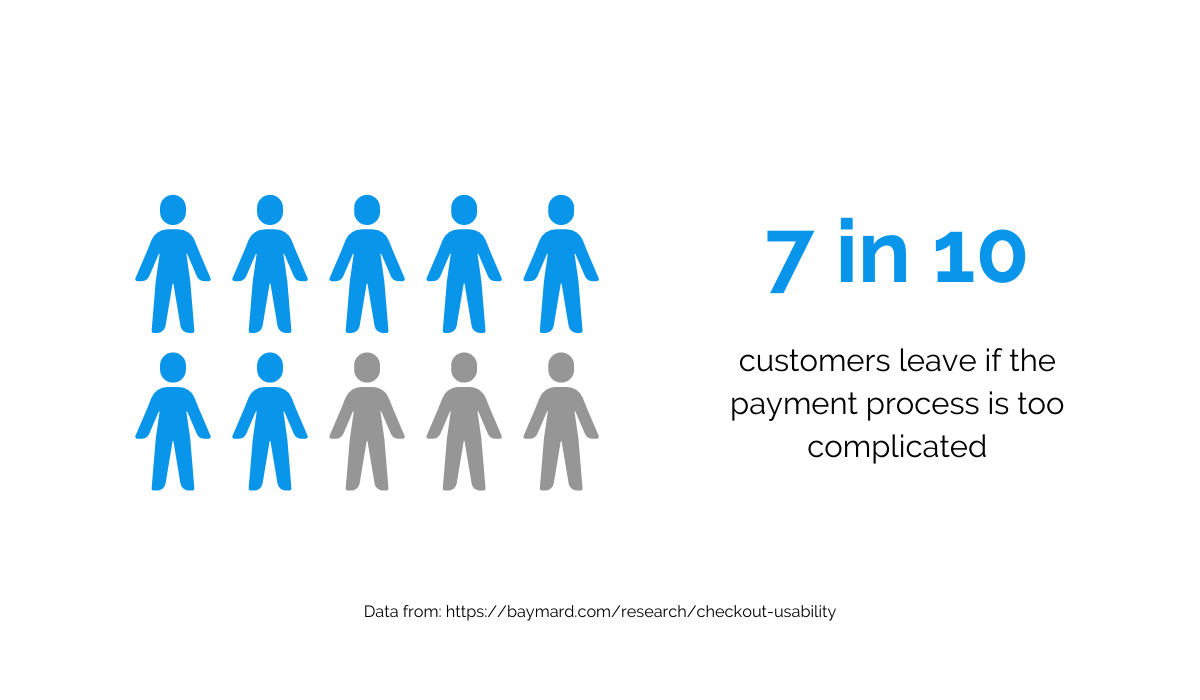

Keep in mind that the payment process and the checkout experience are crucial factors in customer satisfaction. If your customers don’t like how your payment process works, they will likely leave your business.

Source: Regpack

Recurring payments may sound intimidating to the customers because they imply a commitment.

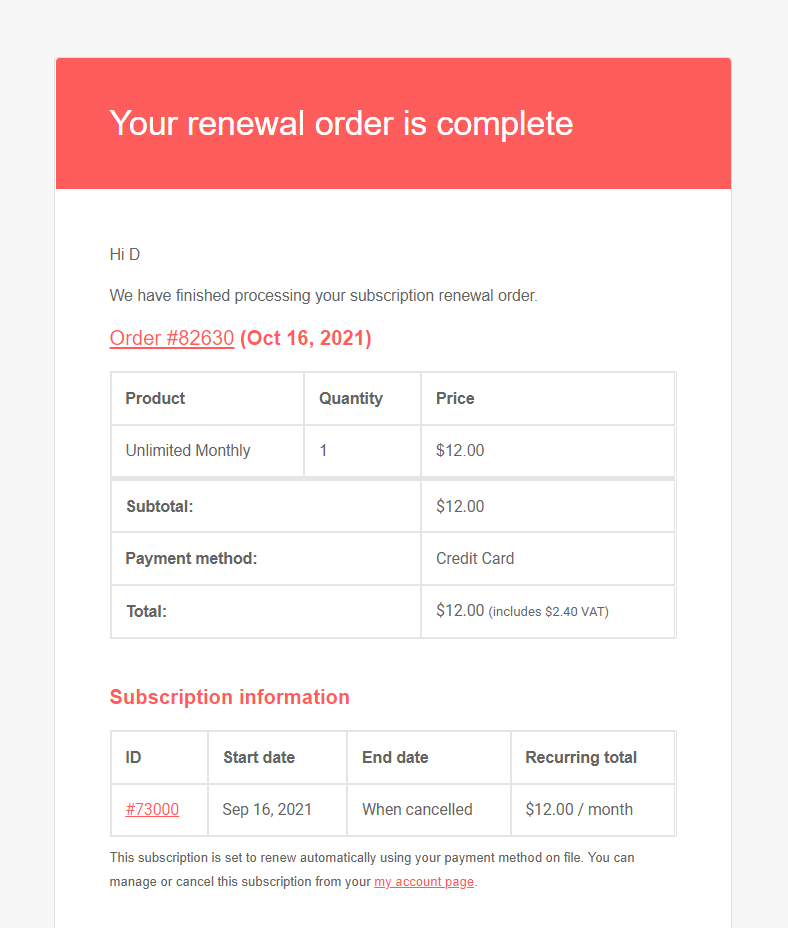

To keep things transparent, you should send an email to the customer each time a recurring payment is made. The following picture shows a subscription renewal confirmation from a language-learning website.

Source: Regpack

Like the one in the picture, the email you send after collecting payments should include the details of the purchased product and the price.

That way, your customers will always know what they paid for, when, and how much.

Your small business can gain loyal customers if you keep delivering excellent products or services combined with a smooth and straightforward payment process.

Once you build a base of customers who choose recurring payments, you will notice an improvement in your cash flow. On top of that, operating with such payments helps with more accurate financial forecasting.

However, recurring payments have certain downsides, mostly due to customer errors.

A customer can lose their card and forget to update card information when they get a new one, or the card can expire, or they may not have enough funds.

Regardless of the reason, you should have an overview of payments that fail to go through. Recurring payments can only improve your cash flow if the transactions are successful.

So, when choosing a recurring billing solution, make sure to check its functionalities regarding outstanding balances and dunning.

Now that you know why you should get recurring payments right, we’ll tell you exactly how to handle them.

How to Set Up Recurring Card Payments

You can accept credit and debit card recurring payments with different types of solutions.

Merchant Maverick lists the following categories:

- Payment gateways

- All-in-one payment processors

- Accounting software

- Subscription management platform

But why bother selecting one of these—or even more complicated, combining them—when you can find an integrated solution? Our registration and billing solution Regpack offers everything you need for recurring billing, and then some.

Still, we’ll leave the choice to you and tell you what features to look for in your solution.

1. Find a Good Recurring Billing Solution

Your billing solution should be fully automated, customizable, and secure in order to keep recurring payments easy for you and your customers.

Since the whole point of recurring billing is to accept payments without manual work, you should look for a reliable solution you can set up once and then continue to receive future payments.

If you aim to automate the payment process and reduce time spent communicating with customers about payments, you also need a solution that works well on the users’ end.

When it comes to customizability, we at Regpack know that the needs and preferences in small businesses can vary. Your customers can make recurring payments with credit cards, mobile wallets, or ACH payments using our solution.

Source: Regpack

You can also customize all documentation and emails related to recurring payments you send to your customers.

Security is another quality you have to take seriously. Make sure to offer a solution that implements multiple safety practices, such as data encryption, SSL protocols, tokenization, or PCI compliance.

With Regpack, your data is secure. In addition to using encryption, our servers sit behind a physical firewall managed by an external security team. Our developers’ code is subject to regular code audits to keep all elements of our software secure.

We are also Level 2 PCI compliant, which means that all credit card transactions done via our system are processed in a secure environment.

Remember, all the time you put into selecting the right recurring billing solution for your business will pay off in easy billing management.

2. Set Up the Payment Frequency and Amount

Recurring payments offer you flexibility in creating payment plans. Before you set up the payment frequency and amount, you should calculate which options would be the most profitable for your small business, while taking your customers’ needs into account.

The frequency will depend on the type of your business.

Do you offer educational programs, or maybe landscaping services? If you teach classes every week, it makes sense to charge as often. But if you provide leaf removal once a month, there’s no place for pulling payments more often than that.

It is also good to keep in mind what practices are customary in your niche.

For instance, even if people visit the gym you manage every day, they are still accustomed to paying memberships once a month. Charge more often than that, and you’re likely to meet resistance.

Whichever option you choose, a good recurring billing solution should enable you to set up the payment frequency however you want.

For instance, Regpack allows you to choose between daily, weekly, monthly, or annual recurring payments. If none of these options fit, you can even select a custom number of days between payments.

Take a look:

Source: Regpack

The GIF shows how easy it is to set the frequency and the amount.

Although the amount you charge naturally corresponds to the price of services you usually provide, you can also offer a small discount to encourage customers to use recurring payments.

Additionally, you can combine recurring payments with up-front payments.

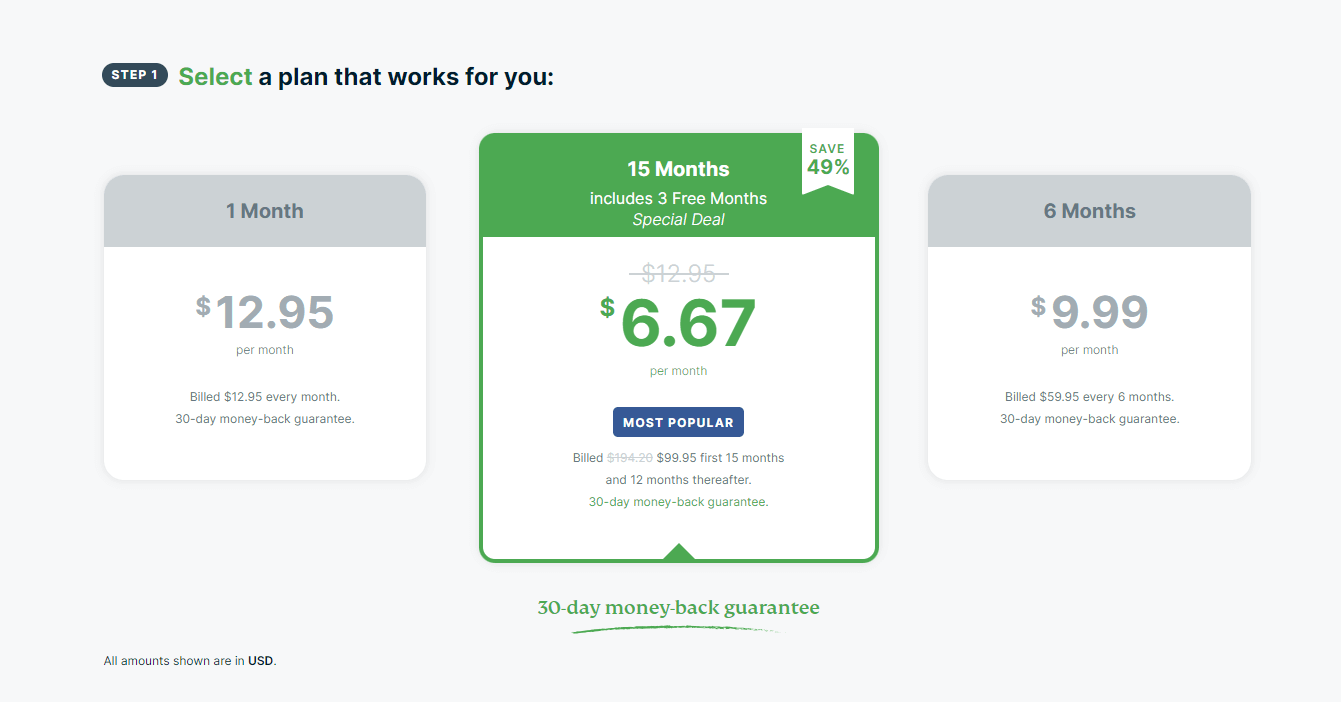

Here’s how ExpressVPN does it:

Source: ExpressVPN

Besides paying on a monthly basis, they also offer the option of paying for 12 months in advance and saving 49%. After that period is over, recurring payment automatically bills the customer for another year.

Of course, you want to run a profitable business, but keep in mind that recurring payments save you money that would otherwise be spent on administration and invoicing. You can use that money to cover the discounts.

3. Inform Your Customers About the Possibility of Recurring Payments

Once you choose your solution and implement it, it’s time to get customers on board with recurring payments. Therefore, if you want your customers to use this function, you should consider advertising it.

As we’ve already mentioned, recurring payments, i.e., the idea of paying for something multiple times can sound intimidating.

To let your customers know they are in charge of their money, you should highlight that they can cancel the payments at any time.

When you first enable recurring payments, a step that will encourage your customers to choose this option is educating them on the benefits they get. Remind them that recurring payments are convenient, easy, and safe, saving them time to boot.

Use the power of email, social media, and your website to make it known that you now accept recurring payments.

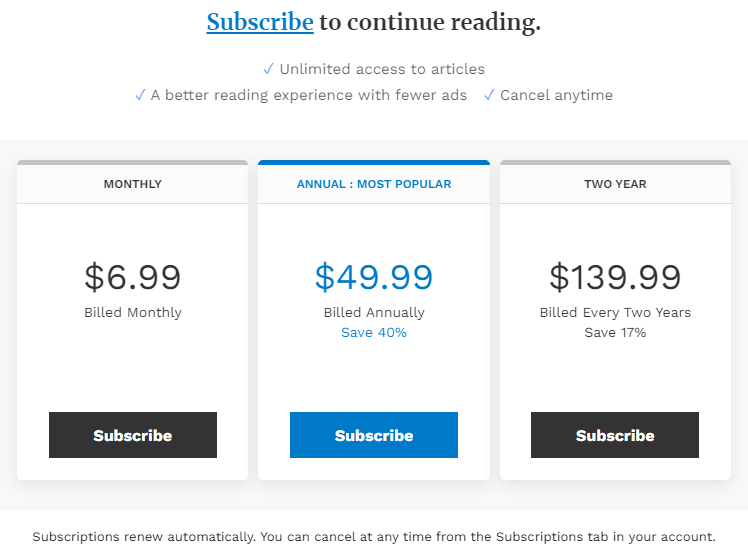

Another way to entice customers to use recurring payments is to emphasize how much they can save this way. For instance, you can offer a discount for paying annually instead of monthly. Here is how Forbes did it with their online articles:

Source: Forbes

You don’t have to offer a discount as big as Forbes’s with their 40%; customers welcome all opportunities to save money.

Besides advertising the introduction of recurring payments, you should also keep your customers informed of any changes you choose to implement.

Seeing that 86% of customers say transparency from businesses is more important than ever, you should let them know if you change anything in the way you operate recurring payments.

Here are some elements that can be considered a subscription change:

- an upgrade

- a downgrade

- a price change

- a tier change

- a quantity change

- a Terms & Conditions change

Recurring payments may take some trial and error until you find the perfect solution for your customers. You are allowed to make changes, but your customers have to be aware of them.

Don’t forget that recurring payments rely on customers authorizing you to pull funds from their bank account. So, whether you increase or decrease the prices you charge, any price changes mean you have to request authorization again.

Conclusion

Recurring payments can streamline your billing process. If you already bill customers on a regular basis, you have an opportunity to automate the process with this method.

Choosing the right solution is half the battle, so find one easy to set up and manage. Customizability and security protocols are also a must-have.

When you decide on payment frequency and amount, don’t forget to promote recurring payments to your customers. You want as many customers to use this method because it’s more efficient than issuing individual invoices each time.