We’ve come a long way from relying solely on cash and paper checks when it comes to payment.

The modern customer has greater demands regarding payment methods, and you have to meet them before your competition does. Recognizing your customers’ payment preferences on time, and accommodating them, opens the door to your company’s growth.

Keep in mind that, no matter the payment method, customers value the security of their data, as well as the ease of use.

Also, each payment method comes with its limitations, as well as advantages, and to help you navigate through them, we compiled a quick guide to the most frequently used payment options.

So, which options should you choose?

This post will show you which payment options customers prefer, along with the factors to consider when implementing them into your business.

Jump to section:

Accepting Credit and Debit Cards

Allowing Mobile Payments

Offering ACH Transactions and eChecks

Click-To-Pay Email Invoicing

Setting up an Online Storefront

Enabling Recurring Payments

Offering Payment Plans

Accepting Credit and Debit Cards

Regardless of whether you’re building a business oriented towards a niche market or wide audiences, you should be able to accept credit and debit card payments.

They are the most common payment method out there—almost everyone uses cards to pay for their purchases.

More precisely, seventy percent of the United States population carries credit cards, and more than a third of Americans have three or more cards.

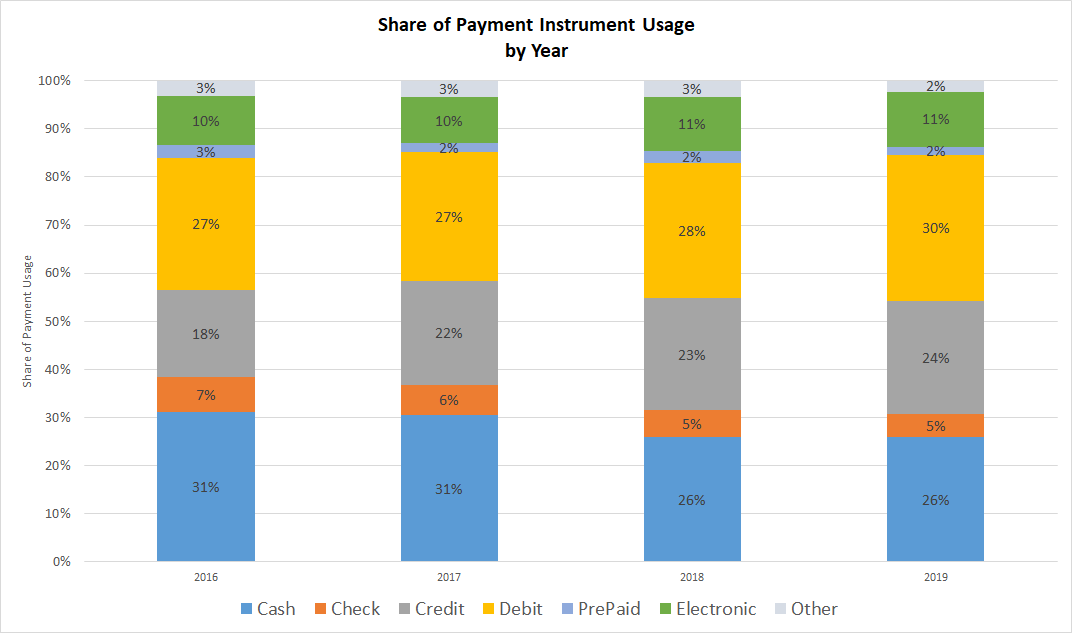

According to the Federal Reserve System findings, credit and debit cards together accounted for 54% of payments in 2019. That is more than all other payment methods combined.

Source: Federal Reserve System

For small businesses, this means two things.

First, if you’re just starting out and still don’t know your customers’ payment preferences, your safest bet is to set up a system for accepting card payments.

If more than half of all payments are transferred via cards, the average customer will also opt for that method.

Let’s see what else you need to consider when it comes to cards.

Keeping track of financial operations is a crucial element of running a business, so you have to approach it wisely. Not all card payment processing methods are made equal; you’ll have to do some research to find the one that best fits your needs.

Before you settle on a payment processor, make sure to ask them about:

- Fees for setting up the account

- Transaction fees

- Security of customer data

Since credit and debit cards account for such a significant portion of the transactions, you have to choose a reputable payment processor to keep your customers’ money safe.

Allowing Mobile Payments

The modern customer is always looking for on-the-go solutions and won’t wait too long for you to adapt. One of the trends you should embrace if you want to grow your business is allowing mobile payments.

Consumers are now accustomed to having access to advanced technology to facilitate payments.

There has been a shift towards payment methods where customers pay using their smartphones or smartwatches, with no cash or cards needed, particularly contactless payments.

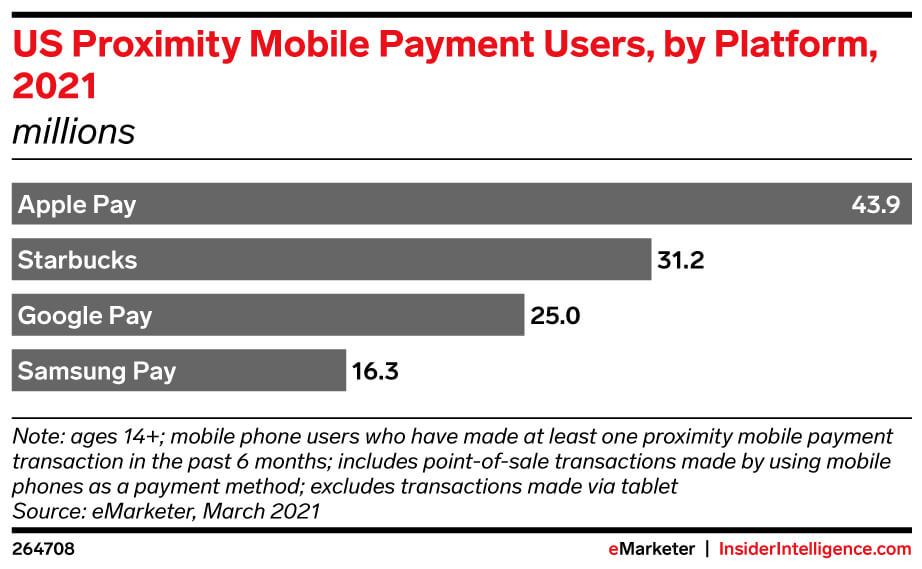

The following graph shows how many users there are at each of the most popular mobile payment providers.

Source: eMarketer

Combined, Apple Pay, Starbucks, Google Pay, and Samsung Pay have 116 million users in the U.S. Experts predict that number will continue to grow in the future, surpassing 50% of all smartphone users by 2025.

Forward-thinking businesses try to anticipate their customers’ needs and act accordingly. Since adapting business websites or apps to the mobile interface is transitioning from a trend to a requirement, it’s a good idea for small businesses to allow mobile payments.

Knowing why customers use their smartphones to make their payments can help you determine how to implement this option best.

A recent Finder survey has shown that 66% of surveyed mobile payment users choose this method because of convenience. The second most common reason is greater security.

This means that you have to prioritize user experience while making sure your customers’ financial and personal data remain secure.

After choosing a reliable processing company and a payment device for your customers, ensure that the device is secure by locking it with a password and always keeping all software you use updated.

Offering ACH Transactions and eChecks

If the majority of your customers are U.S.-based, offering ACH transactions and eChecks might be a good idea to reduce transaction costs.

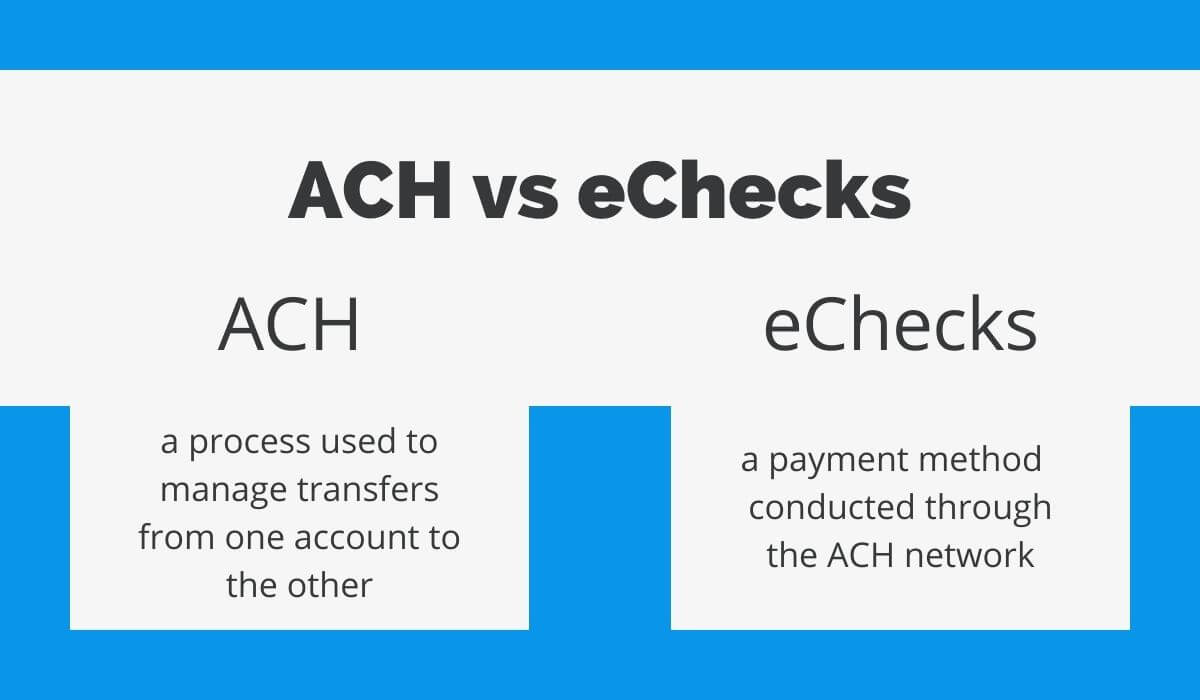

People sometimes use the terms ACH and eCheck interchangeably. They indeed share many similarities, the most obvious one being that both imply transactions from one bank account to another.

However, to understand the process behind your small business payment options, you should be aware of the difference between ACH (Automated Clearing House) and eChecks.

Source: Regpack

To put it simply, ACH is a process in which the information related to your online bank account, usually the account number or the routing number of your bank, is used to manage transfers from one account to the other.

The process entails making a payment request, authorizing that request with the relevant information, and processing it through a virtual terminal or gateway before the funds are transferred.

On the other hand, an eCheck can be regarded as more of a payment in this environment. It’s just like a regular check–only moved to the digital sphere.

Now, these two terms are connected because eChecks use the ACH network.

In other words, when your customer pays you with an eCheck, their money is electronically withdrawn from their account, transferred over the ACH network, and then deposited into your business account.

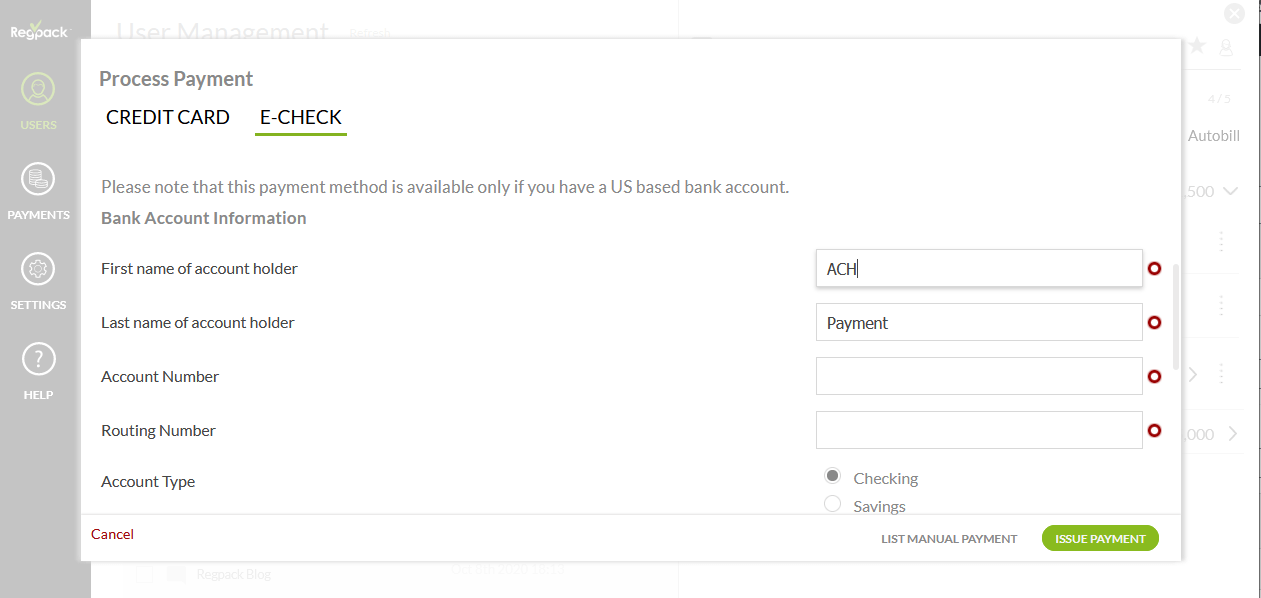

Payment processing solutions usually feature eCheck and ACH transfers. Here’s what that looks like on Regpack:

Source: Regpack

Still, there’s a small limitation to ACH that may or may not apply to your business. We’ve mentioned that this payment method was a good solution if you primarily work with customers who have U.S-based bank accounts.

That’s because ACH serves financial institutions in the U.S., and it’s intended for domestic transfer only.

There are ways to transfer funds abroad, but the so-called remittance transfers can get complicated, so you would be better off choosing a different payment method for transfers outside of the U.S.

Nonetheless, disregarding ACH because of that limitation would be a mistake. With lower fees than those for wire transfers and credit or debit card payments, using the ACH network can be a more cost-effective option.

Click-To-Pay Email Invoicing

If you’re looking for a completely automated solution for accepting payments, you should consider email invoicing.

As a small business owner, you know that every minute of your workday counts. Spending a lot of time on invoice organization is neither effective nor productive, so if you had a chance to automate invoicing, why wouldn’t you?

By setting up an email-based payment system, you no longer have to deal with examining a customer’s payment history and balances.

A well-designed payment software, such as the Regpack one, allows you to fill in the form you’ve previously set, as well as include any applicable discounts, and that’s all you have to do–the software takes care of the rest.

Once you click the submit button, the system creates an invoice and sends it to the customer via email. The invoice should include the info on the outstanding amount, the description of the product or services, and the due date.

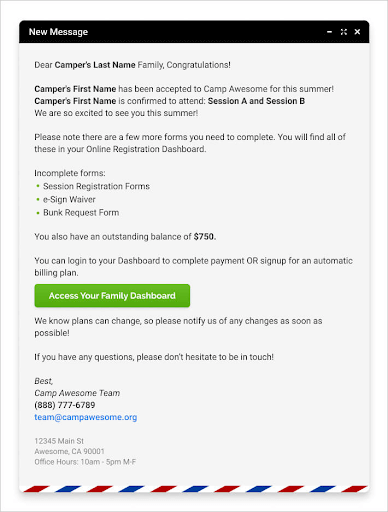

Below, you can find an example of an email invoice.

If you choose an integrated email invoicing solution, your customers will be able to click the payment button inside the email and make the payment.

One of the benefits of using Regpack is that its invoicing system allows you to set up a trigger that notifies you when a payment has been made.

That way, by collecting info on all payments via one software, you have a clear overview of how payments are allocated. There’s no better way to understand how your business creates revenue than having all financial reports in one location.

Setting up an Online Storefront

Just like with brick-and-mortar locations, your online storefront tells customers a lot about your business. This is why it has to be well-designed on every level.

Online storefront means more than a pretty website listing your services. In addition to displaying goods and services you’re selling, your storefront should include a billing and online payment system. The way you present these sections matters as well.

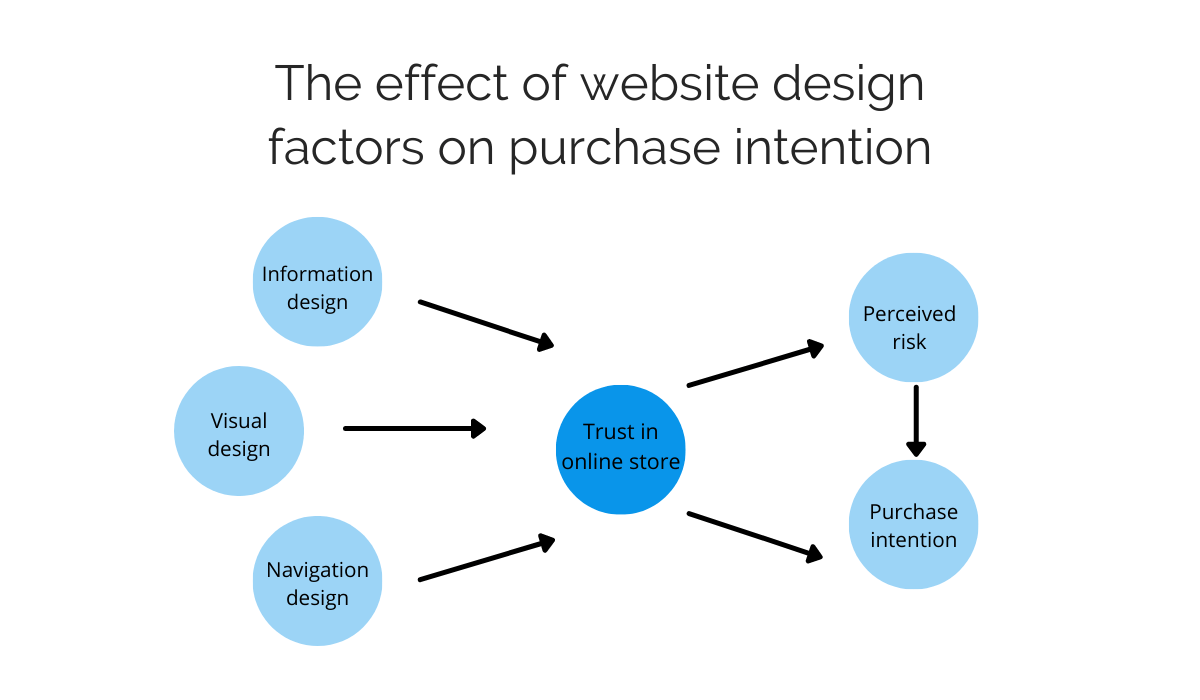

A group of scientists has studied the effects of website design on purchase intention in online shopping. They suggest that all visual elements you use to present your products should work together to inspire a feeling of trust in customers.

Source: Regpack

After the customer considers the possible risks and deems you trustworthy, they are ready to make a purchase.

The way you present credible payment options plays a role in establishing trust as well. Customers are protective of their data and don’t want to purchase from sites they think might compromise their security.

All in all, you have to create a pleasant experience for your customers from the moment they enter your website to the moment they complete the purchase.

The whole process has to be perfect—67% of customers won’t hesitate to stop mid-shopping if something arouses their suspicion.

There can never be too much caution when it comes to payment security. If you decide on a DIY approach to implementing payment options on your website, you may be risking some security issues.

Here at Regpack, we specialize in accepting online payments securely. We can help you set up an online storefront where you can manage your orders and registrations and collect payments with ease.

Leave security protocols to us while you focus on developing your business.

Enabling Recurring Payments

Recurring payments can bring many benefits to small businesses: getting a steady cash flow, a more reliable revenue forecast, and reduced administrative costs, to name a few.

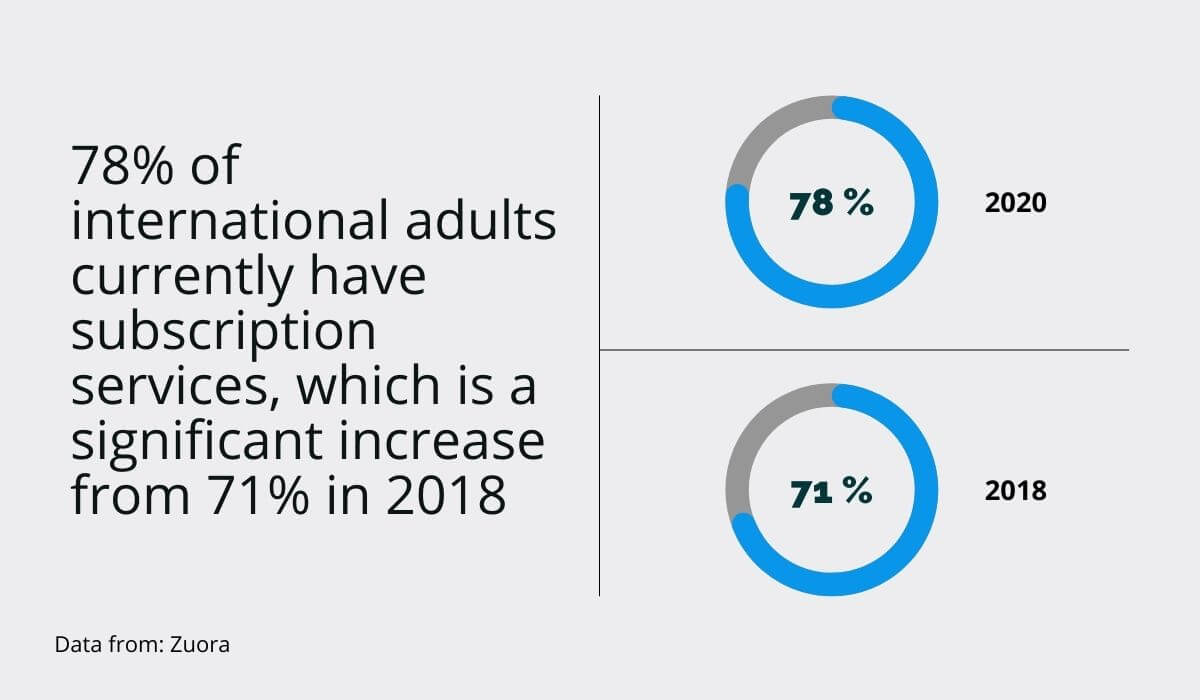

The subscription economy is burgeoning, leaving no industry unaffected. In 2020, 78% of American adults subscribed to at least one service. These services entail everything from access to gyms, grocery delivery, video on demand, even pet kibble delivery.

Source: Regpack

Challenged with a new business model, business owners had to come up with a method that would allow them to collect what’s owed them in an organized manner, and the answer was recurring billing.

Just like many people set automatic payments for cable or utility bills, recurring payments are a widely accepted method of payment for service-based businesses.

A marketing expert Neil Patel says that almost every product and service can shift to recurring payments. Customers appreciate the option of only setting up their payment details once instead of having to enter the same information every month.

Business owners can benefit from recurring payments because they have fewer invoices to issue. The stability of payments means a steady cash flow, which can help you predict future revenue more correctly.

Recurring payments also eliminate the chance of a customer forgetting a monthly payment. Regpack clients who have been using our automated billing system have seen a 75% decrease in non-payment.

However, recurring payments don’t eliminate all administrative tasks. Cards can expire, consumers can reach their monthly limit, or a card issuer can decline an attempted recurring charge. This is why you have to choose a recurring payment solution wisely.

Your recurring payment solution should include the option of sales and payment reports (which ours does). When you have a clear overview of your payments, you can easily correct any billing errors.

Offering Payment Plans

Offering different payment plans brings flexibility to your business, making your products and services available to a wider audience and driving sales in the process.

According to a FINRA study, 53% of Americans deal with financial anxiety. People are becoming more aware of financial literacy, and they don’t want to dent their rainy day funds. Luckily, with payment plans, they don’t have to.

The option to pay in installments enables customers to access a broader range of products, even those on the pricier side.

Installments allow customers to stretch the cost of the purchase over a manageable period of time, depending on their needs.

If you offer payment plans, customers will take them. Almost half of Americans have used such services to purchase items.

Seventy-five percent of those have done so at least twice, meaning they were satisfied enough with the experience the first time to be willing to repeat it.

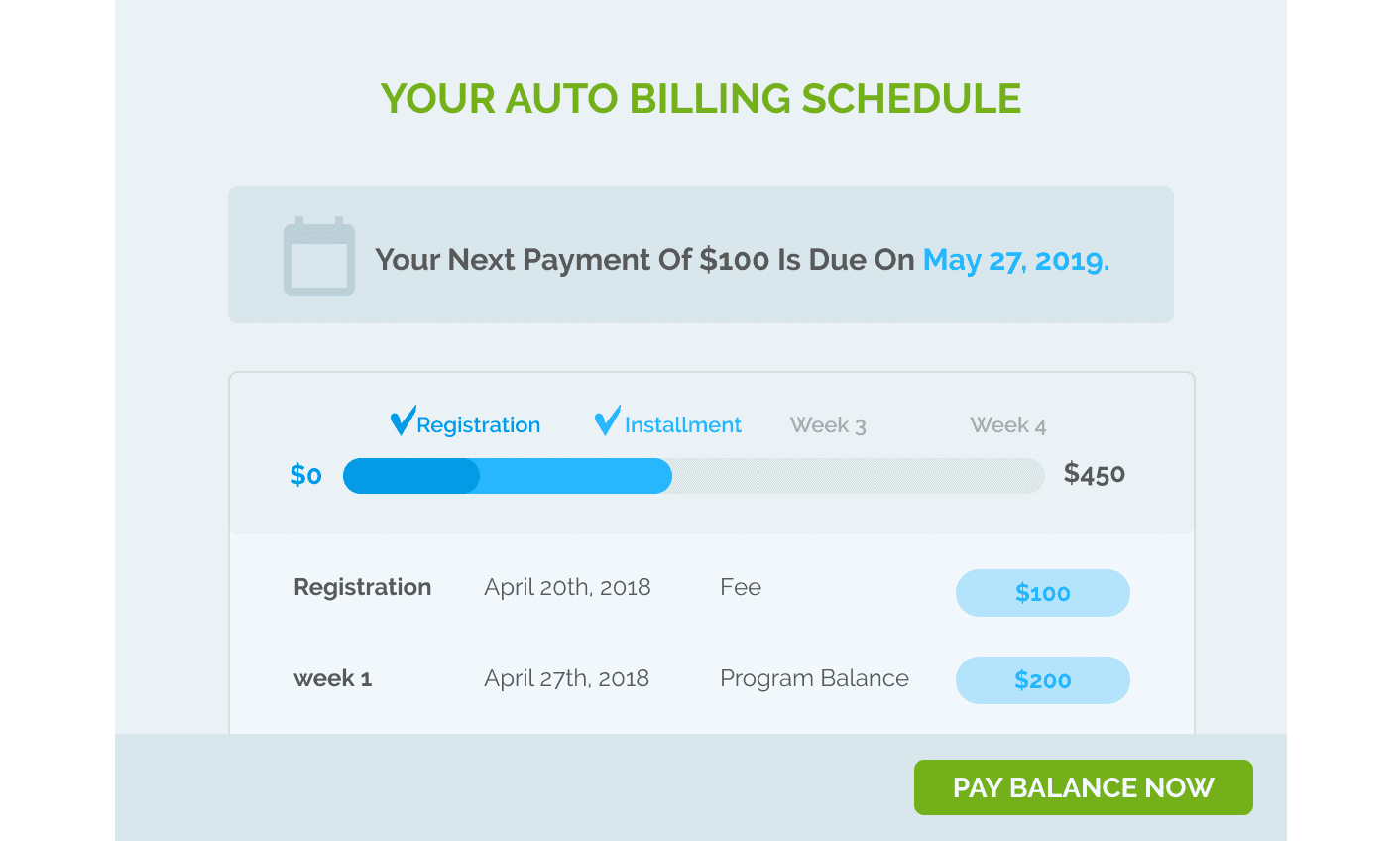

Now, you also want a smooth transfer of funds on your side without having to remind customers of their outstanding payments. Regpack’s automated billing software can help you with that.

Source: Regpack

This billing system is completely adjustable; you’re in charge of what kind of payment plans you’ll offer. You can control the payoff timeline without any hassle because the system generates dates and charges based on the parameters you’ve set.

It’s as convenient for your customers, too. The clean interface makes payment easier and provides an overview of their payments.

Just like all our other features, auto-billing is entirely secure for you and your customers. The software calculates and charges them exactly what they owe, with no hidden fees.

Automating the payment plans saves our clients an average of 60 hours a month. They’ve also reported a 25% improvement in cash flow, together with a 35% increase in payment rate. It seems that automating all tasks you can truly is the future of running a business.

Conclusion

Excellent products or services should be paramount for your business. However, convenient payment options can also contribute to your success.

To grow your business, you should stay on top of the current payment methods. Some are timeless, such as eChecks, ACH transactions, and paying with credit and debit cards.

On the other hand, email invoicing and mobile payments may be new to you, but the number of mobile payment users is on the rise, so you should adapt to the market.

Recurring payments and payment plans are also popular with customers. With a good software solution, you can automate the process of accepting such payments and watch your cash flow improve.