Running a small business isn’t easy. That task comes with many challenges.

One of the most important ones is managing the finances. It requires attention to detail, the ability to adapt to ever-changing circumstances, and recognizing and employing best practices for managing small business finances.

You’ll find those practices in this article. By using them, handling the finances of your small business will be a much less daunting task. Let’s dive in!

- Manage Your Cash Flow Well

- Take Control of Your Budget

- Have a Good Billing Strategy

- Educate Yourself on Bookkeeping

- Do Financial Forecasting More Regularly

- Conclusion

Manage Your Cash Flow Well

Keeping on top of your finances is crucial for managing a small business. Cash flow is one of the best indicators of your financial stability, and you can considerably benefit from holding the reins of it.

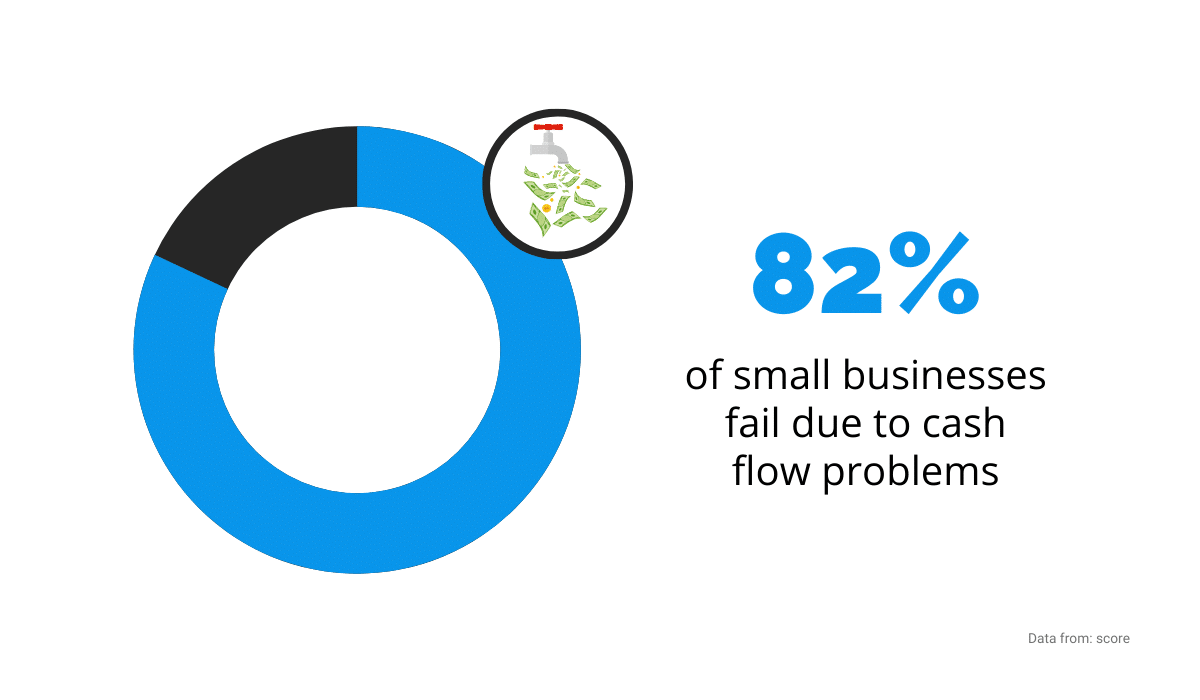

Many small businesses learn the importance of cash flow the hard way. According to research conducted by US Bank, 82% of small businesses fail because of poor cash flow management and the lack of understanding of it.

Source: Regpack

In addition to business survival, managing your cash flow is essential for planning and making sound decisions.

Simply put, without knowing the exact amount of money that flows in and out of your business, you can’t make business plans or decisions that are grounded in reality.

For example, without having an accurate grasp on cash flow, how can a company plan to pay the wages or operating costs, keep up with debt, or know how much money they have on hand for other expenses? You probably already know the answer—they can’t.

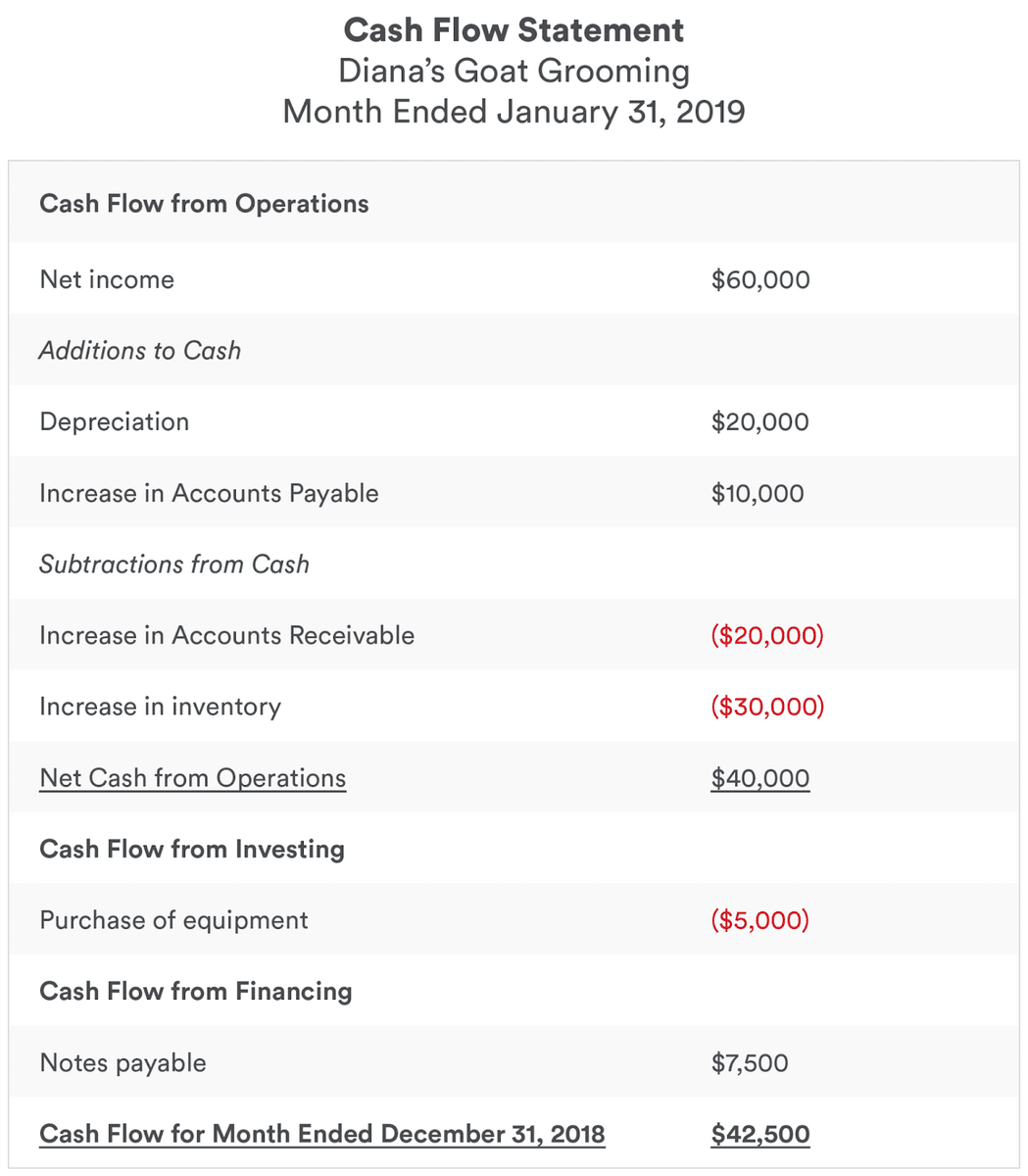

The cash flow statement is a great tool for planning your finances, making money-related decisions, having accurate insight into spending activities, and managing your cash flow overall.

It’s a financial document that shows you how the money goes in and out of your business. Below is an example of a cash flow statement.

Source: Bench

As you can see above, a cash flow statement breaks down the cash flow into three categories—operating, investing, and financing activities. That way, you can easily track the main business activities, long-term investments, and the financing activities such as stock purchases, dividends, notes payable, debt, and more.

A cash flow statement is vital for managing assets because it contains information that other financial documents like profit and loss statements may not have, such as loan or credit card payments.

Keep in mind that excellent cash flow management entails managing your expenses as well as your income, as efficiently as possible.

That’s why you should consider employing a careful strategy while paying your bills because not all of them are equally important.

For example, consider sorting your bills according to importance and billing date. Paying the electricity and the wages should always come before purchasing water jugs for your watercooler.

By prioritizing like that, you avoid putting your whole business at risk by not paying for the essentials.

There are plenty of solutions for tracking bills for small businesses. You can choose one according to your budget and needs. The important thing is that all of them are faster, more convenient, and more accurate than tracking expenses manually.

Take Intuit QuickBooks, for example.

Source: Intuit QuickBooks

This handy app allows you to track expenses and income in real-time. It also has reporting capabilities that will help you manage your cash flow and maximize tax deductions, making it a powerful tool for unlocking your money.

Becoming the master of your cash flow management can take time and careful planning. Still, the benefits are considerable—short and long-term financial security and increasing the chances of your business not only staying afloat but improving as well.

Take Control of Your Budget

Running a business without a budget is like driving a bike blindfolded—you may stay on track for a little while, but things eventually won’t end up well for you.

A detailed, properly made budget is a great way to understand how your business performs.

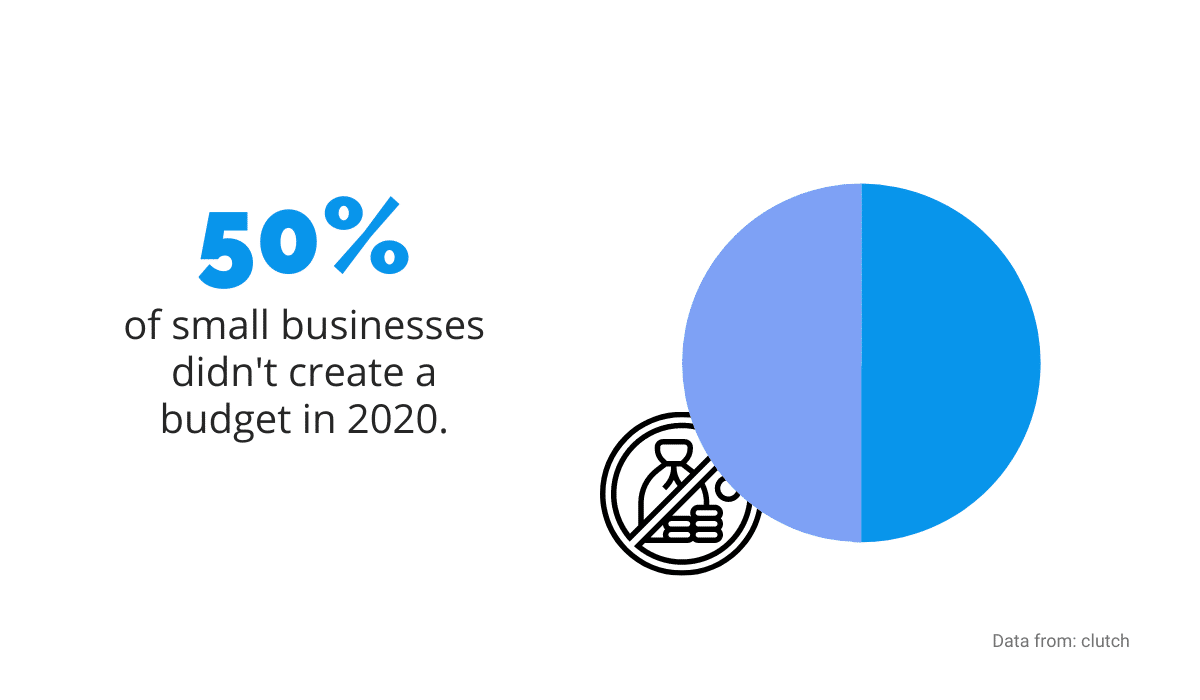

According to a survey done by Clutch, 50% of small businesses didn’t create a formal budget in 2020. In light of that, it’s understandable that many small businesses struggle with finances. When you control your budget, you control your business.

Source: Regpack

A budget is a helpful tool for planning your finances and analyzing past performance.

For example, you can see how your business performed over the previous fiscal year. That way, if you had fewer expenses in a particular department, you could adjust the next budget accordingly.

Similarly, if you made more money from one source, you can invest more in the lacking areas. With a proper budget, you can have complete control over your assets at any time.

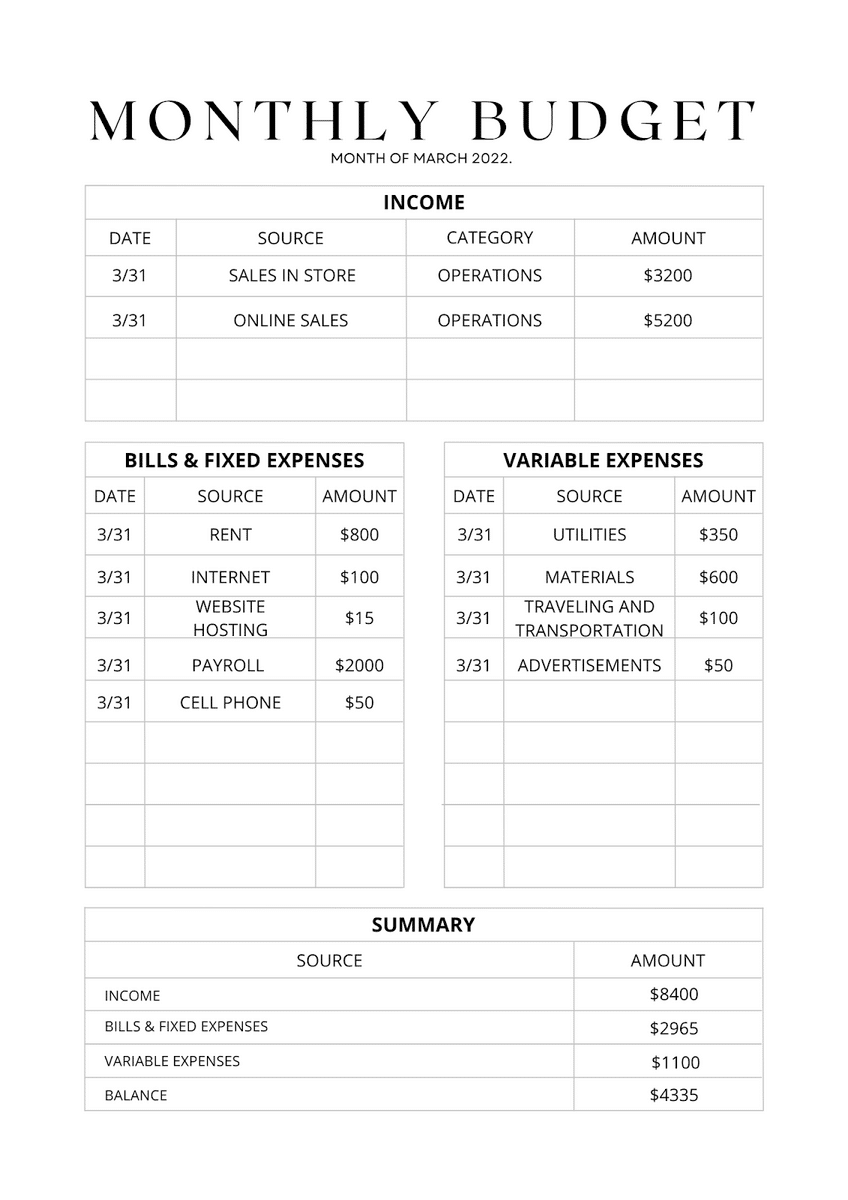

To illustrate the point, here’s an example of a budget for a small business that designs jewelry.

Source: Regpack

As you can see, for taking control of the budget, first, you should tally all your income sources. In this case, the sources of income are sales in the store and online sales.

Furthermore, it’s important to determine the expenses.

Besides fixed ones, every business has variable expenses, too.

They vary from month to month, and they’re the ones you can cut if the profit is smaller than expected or increase if the profit is bigger than you anticipated. As you can see in the example, variables can be utilities, jewelry materials, traveling and transportation, and advertisements.

There are also one-time expenses, like, for example, a new computer. Taking control of your budget can help you plan for these expenses and save money in time for them, so they don’t make a big dent in your finances.

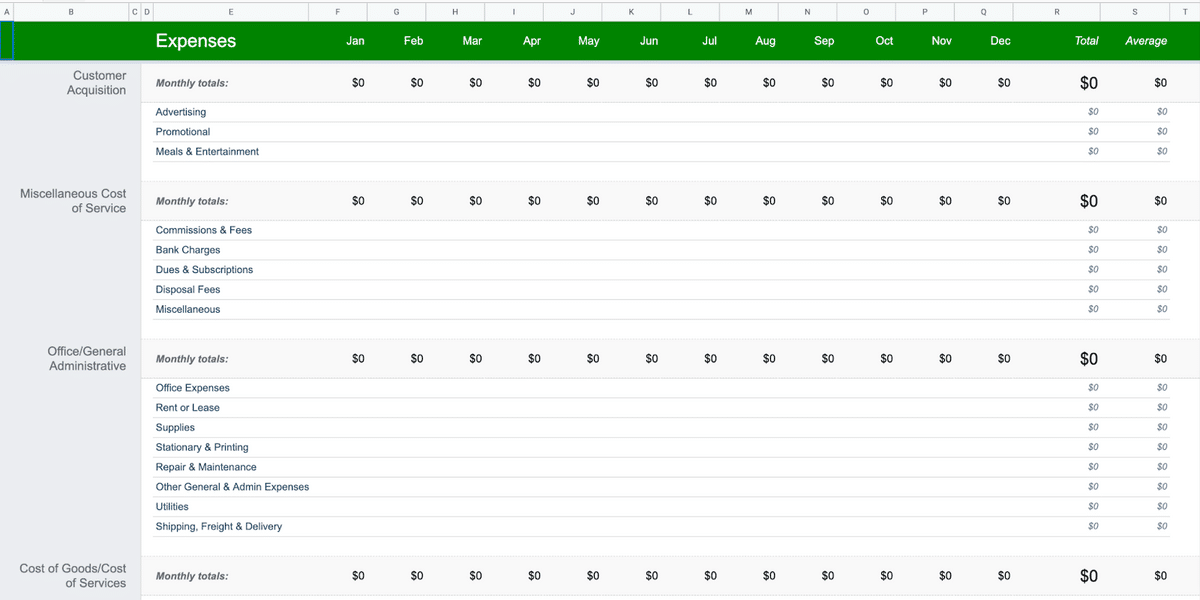

Of course, you can do all that planning, calculating, and analyzing on paper or in spreadsheets.

However, the most effective way is to use one of the software solutions for budgeting.

They usually have many useful features, but the least you should look for is creating budgets by departments, providing access to multiple users, and pulling up reports and comparisons for convenient budget analysis.

Taking control of your budget is a sure way to keep your business successful. Knowing at any moment how your business is performing, what are the strengths and weaknesses of your finances, and what lies ahead is crucial for the financial prosperity of any small business.

Have a Good Billing Strategy

Money is vital for every business, of course, but small businesses are especially dependent on a steady revenue stream. A good billing strategy can make or break a small business—quite literally.

For example, if your customers often pay late, that can be a considerable problem. Not many small businesses have a significant buffer fund for mitigating those circumstances.

Furthermore, late payments cause an inability to predict and control your finances and can even cause problems with paying a business’s fixed and variable expenses.

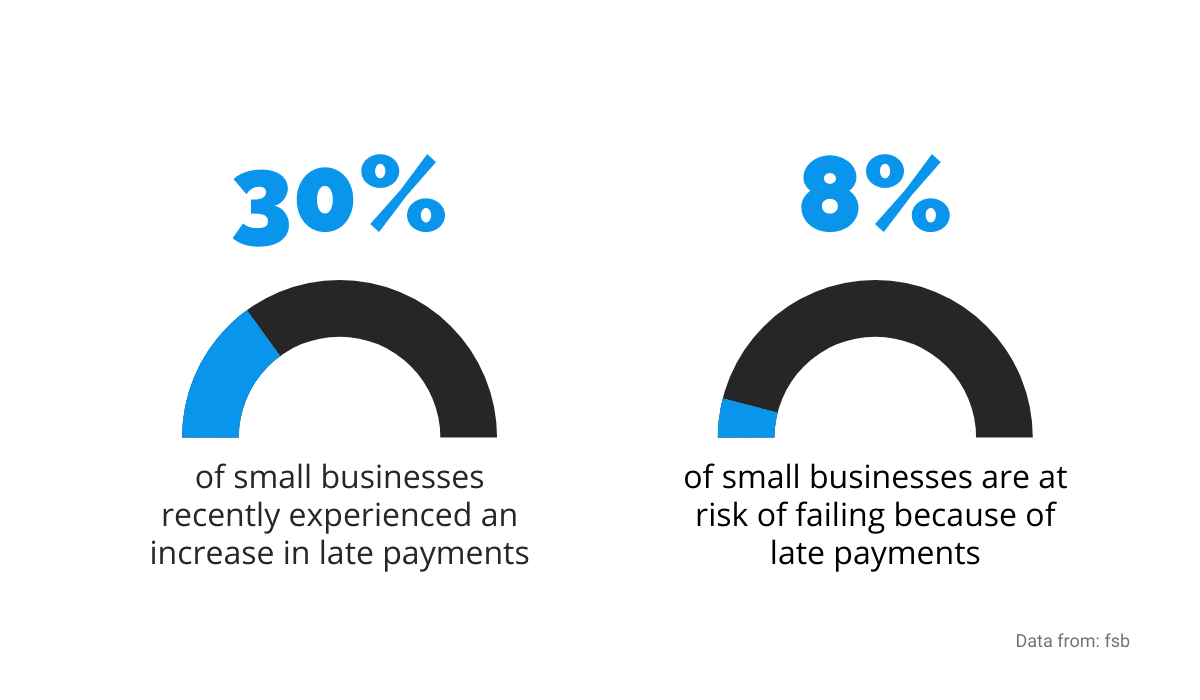

And they happen often enough to raise concerns for any responsible small business owner.

For example, according to one 2022 study conducted on more than 1200 small businesses in the UK, a third of them experienced a recent increase in late payments.

Source: Regpack

Besides that, as you can see above, for 8% of businesses, late payments are a serious threat.

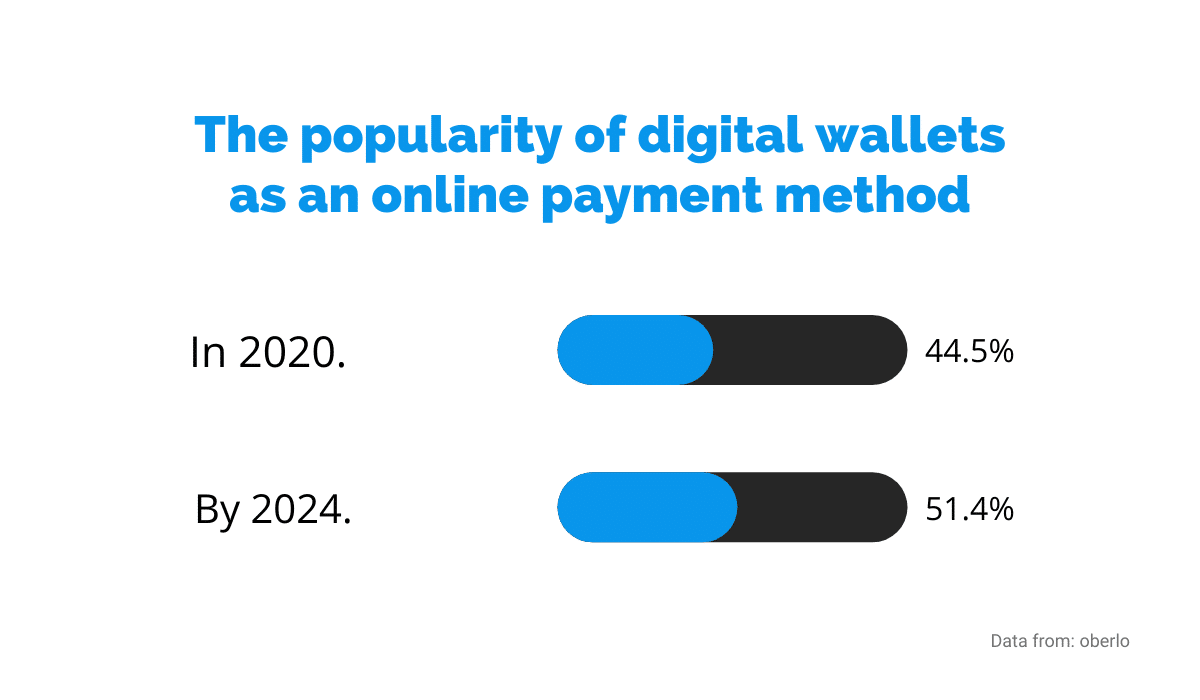

A good billing strategy can significantly reduce the chances of late payments simply by offering customers convenient and fast payment methods. For example, if you’re accepting online payments, that can speed up the payment process and make things easier for you and your customers.

That can be even more efficient if you offer multiple payment options and focus on the most popular ones. According to Oberlo, digital wallets like PayPal, Google Pay, or Venmo are the most popular payment methods today, and their popularity will only increase.

Source: Regpack

In addition to digital wallets, offering credit and debit cards, bank transfers, and cash should cover the vast majority of your customers’ needs and provide them with a quick and easy way to compensate you for your work.

However, offering multiple payment options and calling it a day isn’t enough to make a good billing strategy.

You should consider keeping an accurate account of your customers’ information, quickly generating and sending invoices, securely storing every piece of billing information, etc.

Luckily, you don’t have to juggle a dozen spreadsheets and notebooks for that. The more efficient way is to use billing software.

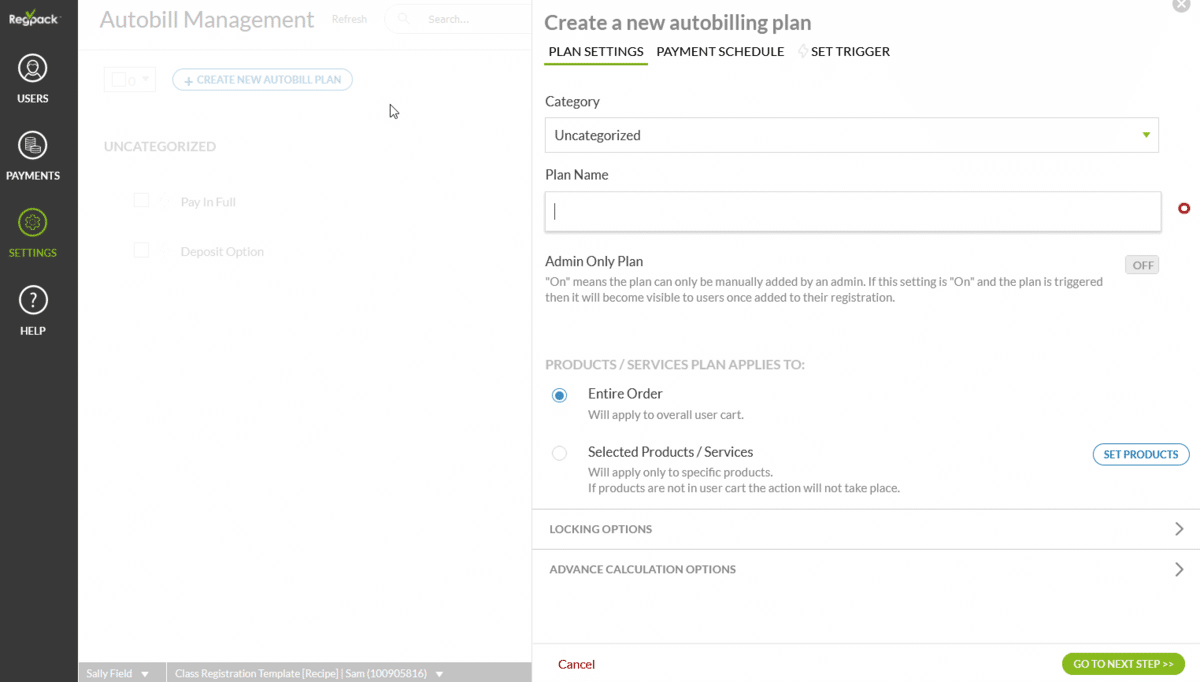

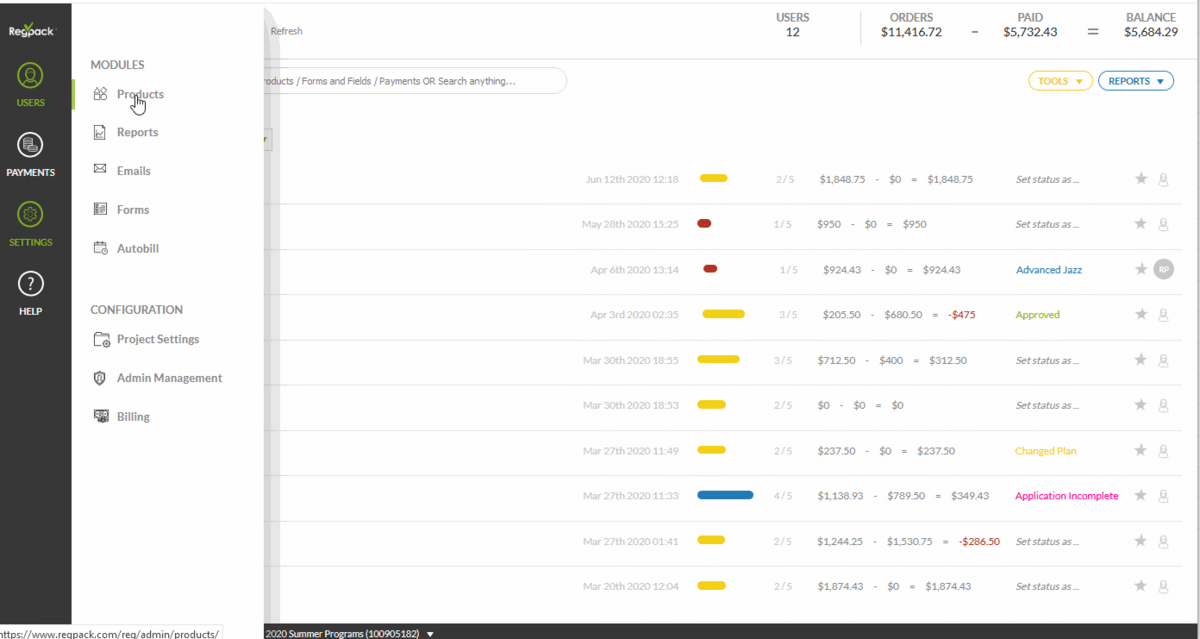

For instance, with Regpack, you can set up your entire billing strategy and make your small business finances much more manageable.

One of the many features Regpack offers is creating invoices that you can personalize and send according to the payment schedule. Also, you can keep track of payments and see which customers pay on time and which are late.

Source: Regpack

Dealing with late payments is also much less time-consuming and more manageable. You can automate reminder emails for your late-paying customers and avoid revenue slipping through the cracks.

An automated billing solution is crucial in a good billing strategy. Automating processes like invoicing, late-payment reminders, billing, and storing customer data saves a lot of time and resources for small businesses.

Educate Yourself on Bookkeeping

Bookkeeping doesn’t have to be an incomprehensible and complicated process. Educating yourself even on its basics can significantly help you manage your small business finances.

If you’re familiar with bookkeeping, you can understand where your business stands at any time. For instance, when you have a balance sheet in front of you, you know how to read it and what to look for to have an overview of your business.

Tracking your financial information through bookkeeping allows you to be more accurate in managing your finances.

However, finance management requires the knowledge of some basic bookkeeping terms; there’s no use in trying to go through your books if it all looks like a foreign language to you.

Some of the terms you may want to learn are gross revenue, expenses, net profit, cash flow, and break-even point. These are relatively simple but can help you grasp essential financial documents.

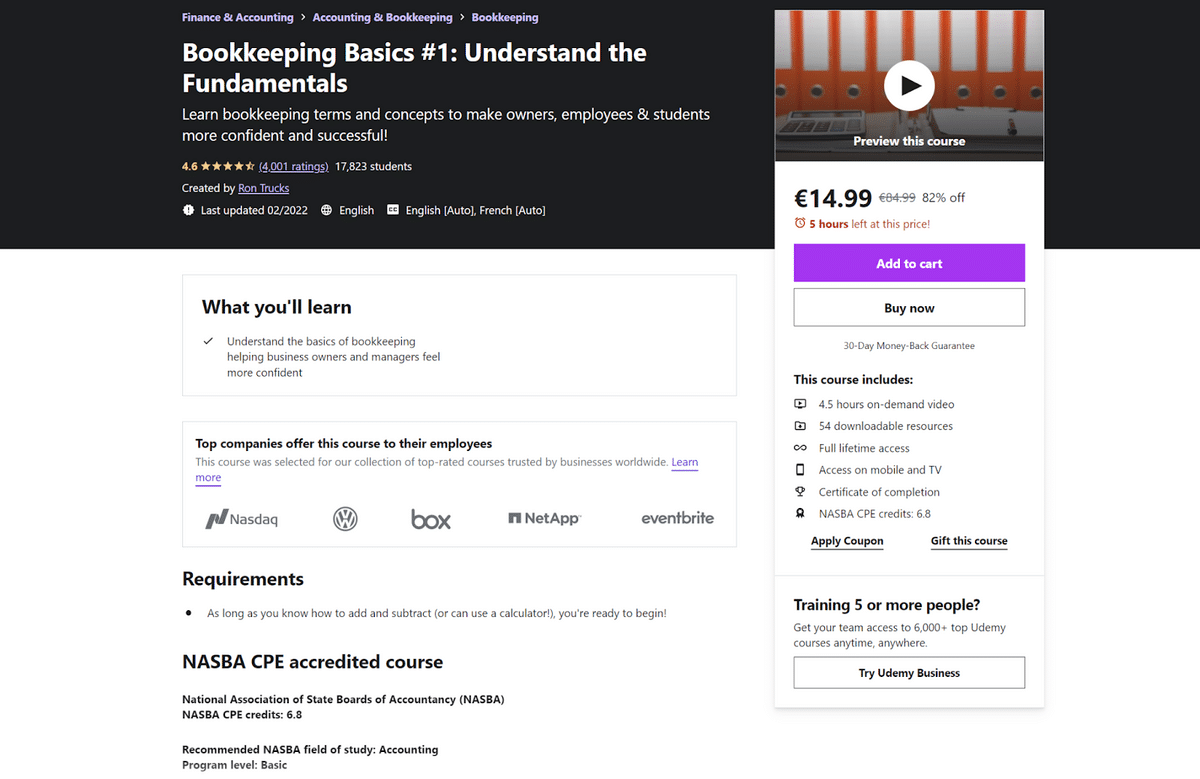

A great help to you in that sense might come from taking a short course on bookkeeping essentials. These come in the form of in-person classes or an online course, such as those offered by Udemy.

Source: Udemy

Taking a class like the one above comes at a small cost (just look at that price!) but it can advance your business in a big way and help you keep a better grasp on things.

Yes, bookkeeping involves a lot of paperwork, which can be overwhelming. However, to better understand your finances, it should be enough to familiarize yourself with the most important documents and basic practices.

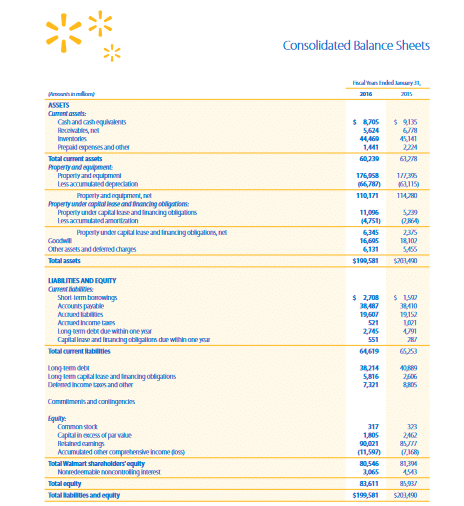

One of them is a balance sheet. It lists the assets, liabilities, and equity, and you can use it to see the net worth of your business at any moment.

Below, you can see an example of a balance sheet from Walmart.

Source: Walmart

You can see the aforementioned elements; the assets are on top, and the liabilities and equity are in the bottom half.

Notice how the total value of assets is the same as the total value of liabilities and equity, which is the underlying thing you should look for when checking a balance sheet.

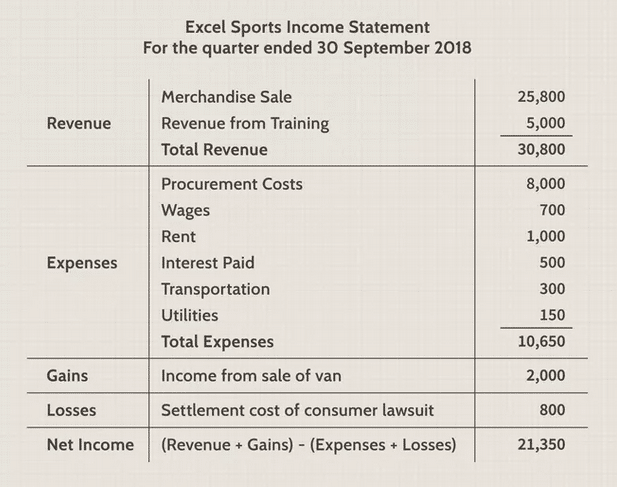

Another important document is an income statement, or a profit and loss statement. It contains revenue and expenses and allows you to calculate the net profit or loss for a particular period.

Source: Investopedia

The example above is a simple income statement known as a single-step income statement, which many small businesses use. You can see the revenue, the expenses, gains and losses, and in the end, there’s the net income for that quarter.

Whether you educate yourself only on the terms and documents we mentioned or go even further, bookkeeping knowledge can help you get the most out of managing your small business finances.

Do Financial Forecasting More Regularly

Wouldn’t it be great to have a crystal ball that shows you the business predictions, upcoming trends, and the best strategies to improve your business and avoid losses? Actually, while it admittedly isn’t shaped like a ball, financial forecasting can do all of that.

Regular financial forecasting can help you set realistic goals and plans for your business. When you can make data-based decisions, you can see what’s ahead for your business more clearly, which means that you can set achievable business goals.

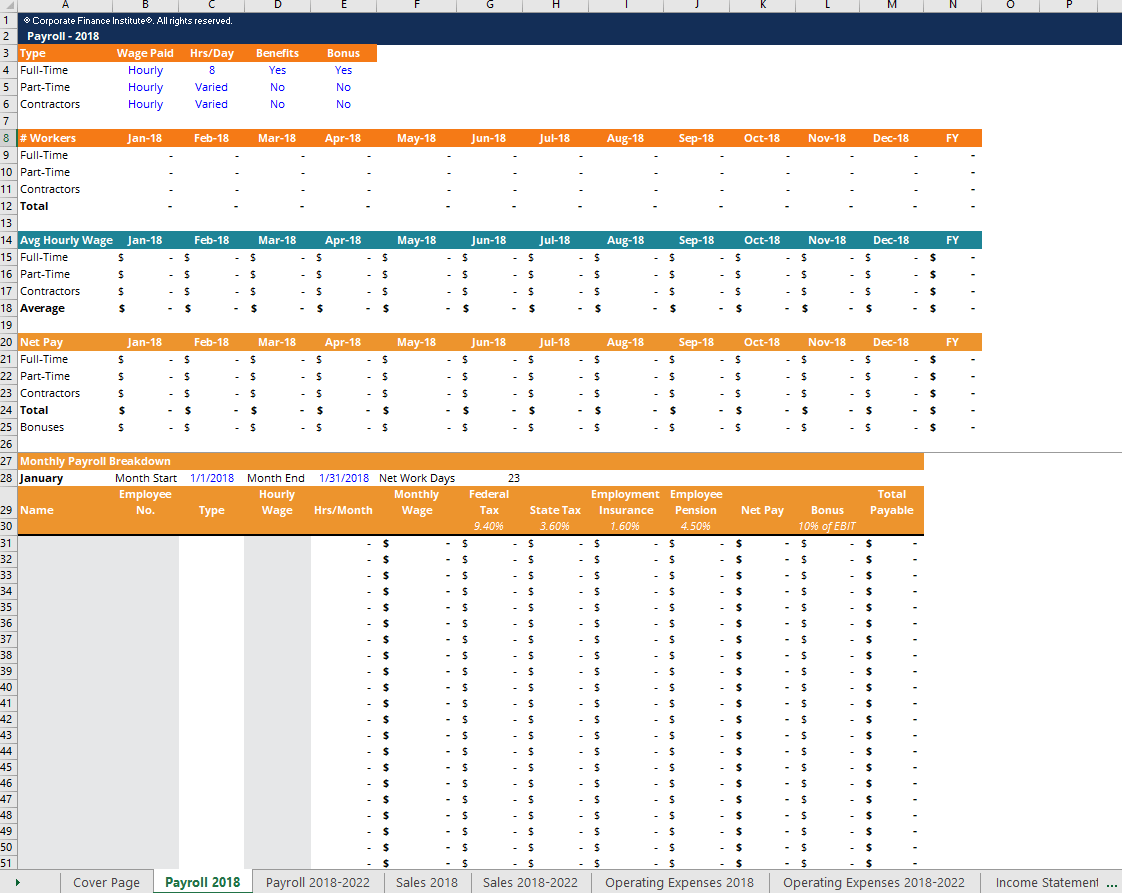

Financial projections template from Excel that you can download from Corporatefinanceinstitute

Also, financial forecasting helps with accurate budgeting. Knowing the trends in your market can help you identify possible challenges and business opportunities. Therefore, with the help of forecasting, you can make a budget adjusted to predictions.

And financial forecasting can shift your focus from being reactive to being active in your business. Projections of future events and trends may encourage you to adjust your business strategy to be in line with the predictions and reap the benefits of upcoming opportunities.

To regularly do efficient financial forecasting, you should use the method most suitable for your business.

Sales reports like the ones from Regpack can help you with financial planning and forecasting.

If your business is new and you don’t have years’ worth of past data, the qualitative method is appropriate. Despite the lack of past performance data for analysis, it still relies on research and investigation to form predictions for the future.

For example, one of the qualitative methods is a survey. A subscription service can send a survey to their customers to predict the impact of increasing prices of their packages on the revenue.

On the other hand, the quantitative method bases its predictions on the existing data from previous periods. For example, by collecting sales data from the past ten years, you can assess the current sales performance and predict the rise or fall in the upcoming period.

The method you choose will depend on many factors, like the following:

- context;

- historical data;

- desired accuracy;

- short-term or long-term forecasting;

- cost vs. benefit;

- time available for forecasting.

We already established that financial forecasting doesn’t include gazing into a crystal ball; instead, there are many business intelligence (BI) solutions to assist you with that.

BI software can turn data into actionable information and help you make decisions and predictions easier.

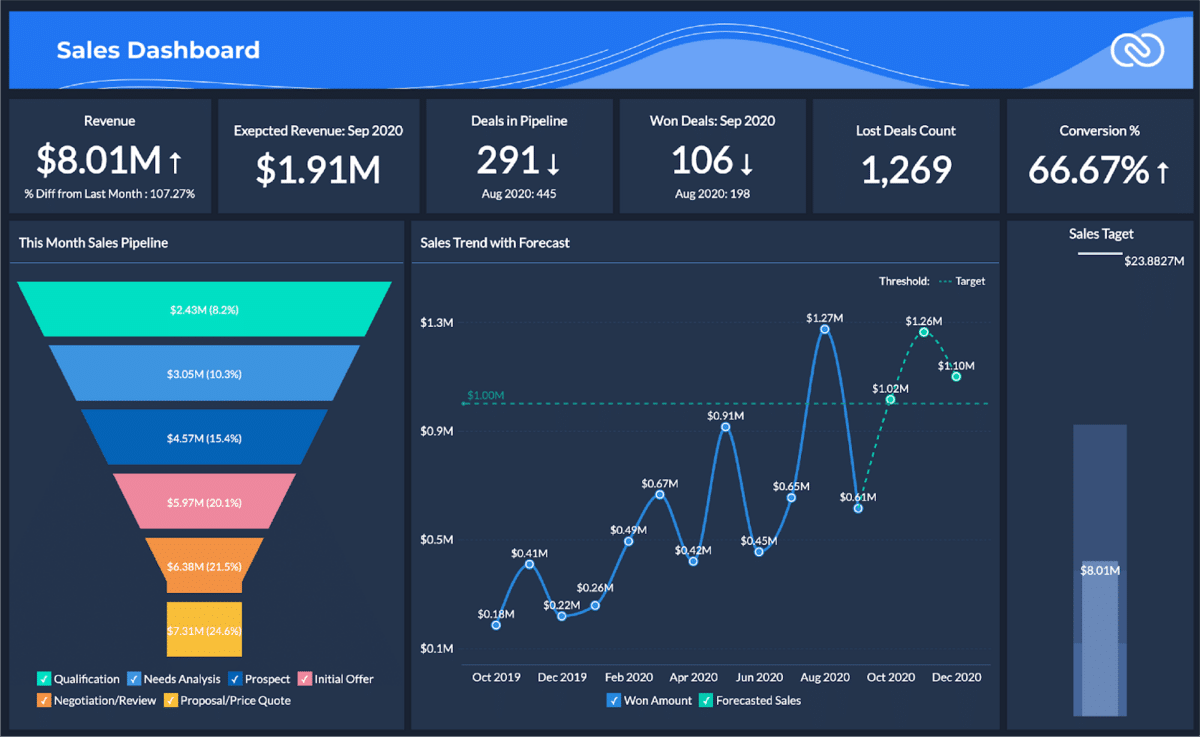

These solutions often use visualization to create detailed insights into business processes. For example, one of the most popular is Zoho Analytics.

Source: Zoho

As you can see, they prioritize visual depictions of information, which is easy to follow even if you’re not tech-savvy. In addition to offering in-depth analytics and many available tools, their software can make informed predictions using the available data.

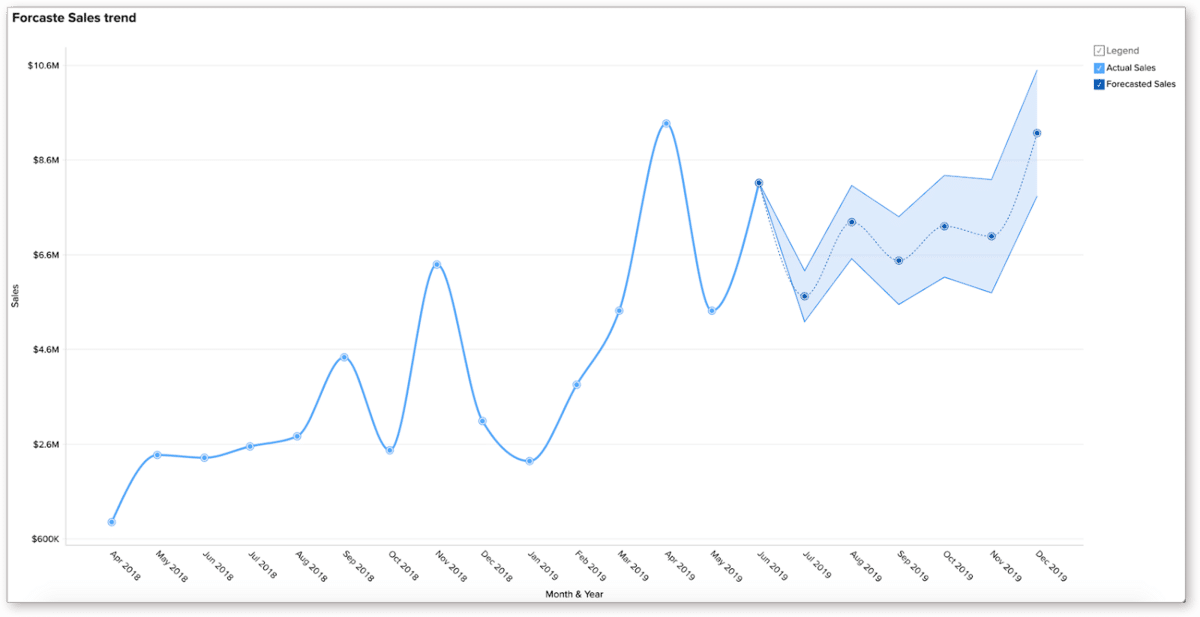

For example, below is a sales prediction in the form of a graph that the software creates after analyzing the data in the forecast engine.

Source: Zoho

There are many available BI tools on the market. Choosing one according to your needs and capacities can help you make financial forecasts regularly and accurately.

Conclusion

If you have a small business, you already know how much time and dedication it takes to ensure that everything runs smoothly, including the finances.

Managing your small business finances is an area where you shouldn’t cut corners. That doesn’t necessarily mean employing a dozen finance professionals; luckily, just practicing what we’ve described in this article can go a long way.

By managing your cash flow, controlling your budget, developing a good billing strategy, educating yourself on bookkeeping basics, and doing financial forecasting, you can take your finances to the next level.