To effectively assess performance and create data-driven strategies that grow their business, subscription-based companies should track some key metrics to set themselves up for success.

In this article, we’ll share the eight most important subscription billing metrics to track and explain why you should monitor them, as well as how to calculate them, while also giving some examples of how businesses can use these metrics to make intelligent decisions.

- Monthly Recurring Revenue (MRR)

- Annual Recurring Revenue (ARR)

- Average Revenue per Customer (ARPC)

- Trial Conversion Rate

- Renewal Rate

- Days Sales Outstanding (DSO)

- Customer Acquisition Cost (CAC)

- Customer Lifetime Value (CLV)

- Conclusion

Monthly Recurring Revenue (MRR)

MRR is the total monthly revenue from all active subscriptions.

Tracking your monthly recurring revenue (MRR) helps you understand, among other things, the financial health of your company.

Plus, if you record it every month, you can use the month-to-month fluctuations and overall trend in MRR to assess business performance and predict future growth.

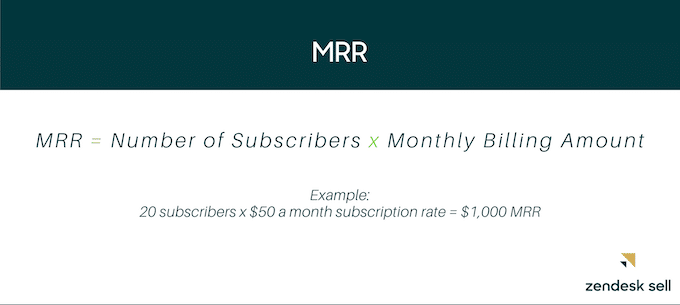

Below is the formula for calculating MRR:

Source: ZenDesk

You can also split MRR into different categories to learn more about your business and get more insights into who’s paying you what, and why.

For example, you could compare the MRR for customers who’ve been with you for 5 or more years with those who’ve been with you for less than 5 years to gain insight into how well your upsell and cross-sell strategy is working.

Tracking this metric is a great starting point for subscription-based businesses.

It will help you calculate other related metrics like MRR churn, which tells you how much revenue you lose from customers leaving each month.

Both are important for calculating the next metric, ARR.

Annual Recurring Revenue (ARR)

Annual recurring revenue is your total contractually obligated revenue over the course of a year. It’s the annual revenue your company expects to repeatedly bring in.

Subscription-based companies track this metric to form an even broader view of their company’s financial health and future revenue growth than would be possible with just MRR.

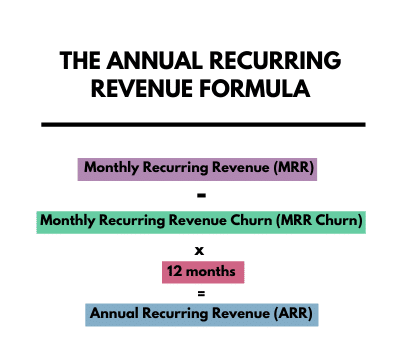

To calculate your ARR using MRR, follow the formula below:

Source: LATKA

For example, let’s say your MRR equals $20,000 and your MRR churn equals $2,000. In this case, your ARR would be $216,000.

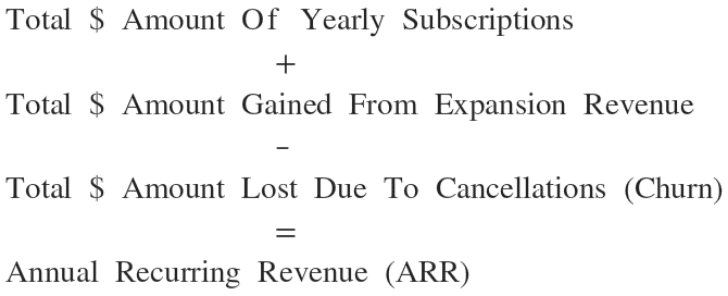

You could also calculate it this way if you don’t want to calculate MRR:

Source: Price Intelligently

Aside from telling you how much you can expect your business to earn per year, there are some other benefits of tracking ARR.

For one, investors tend to care more about ARR than MRR, so you’ll win them over more easily in meetings if you have been tracking your ARR.

Also, if you’re consistently tracking ARR, you can easily see the year-over-year revenue progression and measure the growth of your company.

Knowing the past will help you see your trajectory, allowing you to forecast future revenue more accurately and create a plan that aligns with the amount you expect to bring in.

Average Revenue per Customer (ARPC)

ARPC is the average revenue a company generates per customer each month, or year, depending on which you choose to use.

You may also see it represented as ARPU, where the U stands for users rather than customers, or ARPA, where the A represents accounts, which are regarded as individual customers.

This is common for SaaS companies.

Companies often calculate this metric for their multiple different products, services, or customer types for deeper insights.

For example, they may break their customers into groups based on their subscription tier and then calculate the ARPC for each group.

To calculate ARPC, follow this simple formula:

ARPC = Total Revenue / Number of Customers

Let’s go over an example to see how a company might split up their customers into groups for which they’ll calculate ARPC, and why this is a useful mathematical exercise for billing teams.

Suppose a company has two services, A and B. Service A has 100 customers and earns $100,000 in annual revenue. Their ARPC, therefore, equals $1,000.

Now, let’s Service B has 50 customers and earns $20,000 in annual revenue. Their ARPC sits at just $400, less than half of Service A’s ARPC.

Let’s pretend the sales team has some funds available, and they are trying to figure out which service to prioritize and train their new reps on how to sell.

All else equal, they should choose to focus on selling Service A, since the customers in that category are, on average, worth more.

Attempting to grow that customer base should give a higher return.

But that’s not all you can figure out from ARPC. You can calculate it for different intervals of time, allowing you to see how it’s progressed.

Perhaps you calculate last year’s ARPC and compare it to this year’s.

If the ARPC has dropped, you have some detective work to do. Perhaps you had a problem with your top-tier service this year and customers downgraded.

Tracking ARPC before and after big events like this helps you see how your customers reacted, which will help you perform better in the future.

Trial Conversion Rate

Trial conversion rate is the percentage of customers that have converted from a trial period to a paid subscription.

In most cases, this refers to customers who have switched from a free trial to a paid version of your SaaS, product, or service subscription.

It takes into account people who convert both during and after the trial period.

To calculate your trial conversion rate over a given period, divide the number of trial users who converted to paid users by the number of trial users.

Trial Conversion Rate = Trial to Paid Users / Trial Users

For an illustration, let’s say a company wants to know its trial conversion rate over the last month.

If over that month it had 100 trial users and 30 converted to paying customers, the trial conversion rate is 30%.

66% of SaaS companies report trial conversion rates of 25%, a good benchmark against which to assess your rate.

This metric mainly tells you if offering a trial period to potential buyers is paying off. If lots of people are converting into paying customers, then the freemium or free trial strategy is working.

If they’re just dropping out after it ends, you have to improve the free trial experience, reduce the functionality available for free, or reconsider the strategy altogether.

Renewal Rate

Customer renewal rate is the percentage of customers who renew their subscription at the end of a subscription period.

It basically tells you the likelihood an average customer will re-sign the contract.

Anything above 80% shows you have above-average customer renewal, which indicates that you are effectively bonding with customers and delivering long-term value.

If you weren’t, they wouldn’t stick around so often.

Here’s how to calculate your renewal rate:

Source: CSM Practice

For example, if you had 100 customers up for renewal over the course of a year and 81 of them renewed, your customer renewal rate for that year would be 81%.

This metric, like MRR and ARR, helps you forecast your future revenue numbers and design business strategies accordingly.

Having sound estimates for future revenue numbers will help you create effective yet realistic budgets for your departments.

And when you monitor the renewal rate over time, you can easily spot drastic changes and dig to find the underlying cause for a sharp rise or decline in customer renewal rate.

Lastly, by tracking your renewal rate, a proxy for customer satisfaction, you’ll know when preventative action is necessary.

Say, for instance, your renewal rate has been dipping over recent months in a certain segment of your customer base.

In that case, you might send out surveys or hold calls to figure out any problems that a segment of customers is experiencing.

And then you could remedy the issue and hopefully reduce future drops in renewal rates.

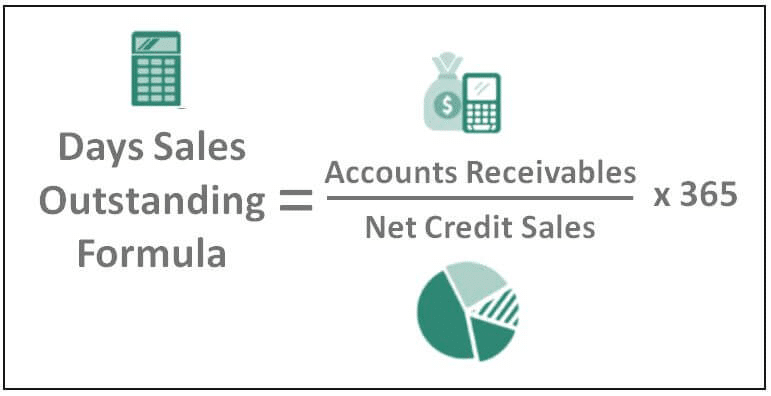

Days Sales Outstanding (DSO)

Days sales outstanding is extremely important for subscription billing teams, as it tells them the average number of days it takes their business to receive payment for a credit sale, and this can shed light on the effectiveness of their invoicing, billing, and payment practices.

To calculate DSO, use this formula:

Source: Wall Street Mojo

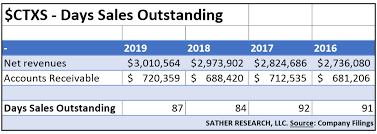

Calculating your DSO over time will clue you in to whether or not your invoicing and billing methods are improving in their effectiveness.

For example, check out four years of DSO compared to one another:

Source: Einvesting For Beginners

In this example, the company has done a good job lowering its DSO over the last four years, meaning they’ve learned how to collect payments faster.

And faster payment collection leads to fewer cash flow shortages on average.

There are many ways to reduce your DSO and collect payments faster, like creating strict payment terms or allowing multiple payment options for customers.

Also, consider implementing the measures outlined in our article on customer billing best practices.

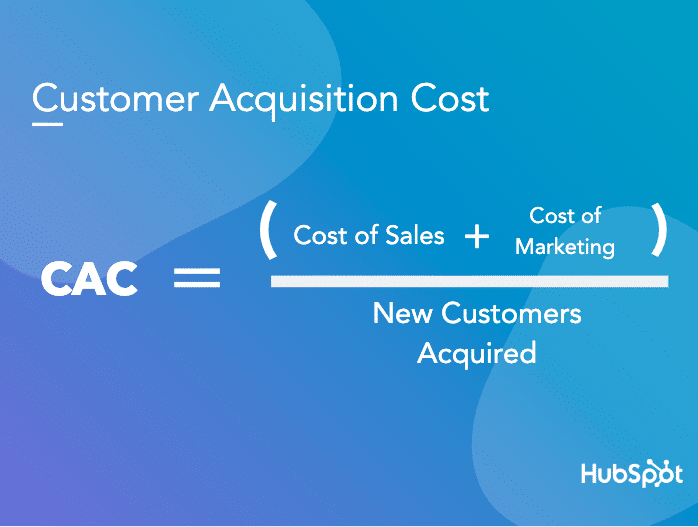

Customer Acquisition Cost (CAC)

Customer acquisition cost represents the average monetary cost of attracting a new customer.

In other words, it’s how much money you spend on marketing and sales in a period divided by the new customers generated in that period.

To calculate CAC, follow this formula:

Source: HubSpot

For example, if your cost of sales is 10k and your cost of marketing is 20k in a month, and you acquire 100 new customers that month, your CAC equals $300.

Whether that’s good or bad depends on the customer’s lifetime value, which we’ll discuss next.

If your customer is likely to spend $1,000 over their lifetime, then that $300 cost to acquire them is a good investment.

The most important reason for tracking your CAC is that it enables you to put a cost to your sales and marketing efforts.

And knowing the cost, you can work to reduce the cost, and see if your strategies to lower it are, in fact, working. Without the numbers, you’re working in the dark.

For example, imagine acquiring a new software meant to cost your sales team $300 per month.

How do you know if it was a good investment? One way to tell if the investment was worth it is to calculate your CAC before and after the implementation.

If CAC is lower after, the tool is likely doing its job.

The trickiest part of calculating CAC is probably figuring out what costs should be included in sales and marketing costs.

You have to take into account ad spending, employee salaries, publishing costs, and other expenditures, many of which are listed and explained in HubSpot’s article on customer acquisition cost.

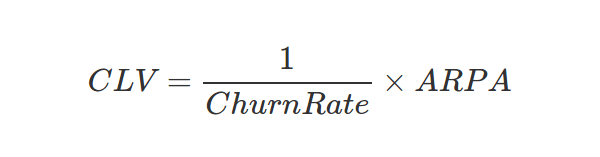

Customer Lifetime Value (CLV)

Customer lifetime value is the average amount of revenue a customer gives your business over the course of their relationship with your company.

It’s a key subscription metric to monitor and attempt to improve.

Because of the complexity of the metric, there are a couple of ways to calculate CLV.

To ensure an accurate estimate, some will use multiple formulas and then take the average of the calculated CLVs.

To calculate CLV as a subscription-based company, use the formula below:

Source: Inner Trends

These are the elements of the formula:

| Churn rate | The percentage of customers who cancel their subscriptions over a given period of time. |

| ARPA | Average revenue per account, which is the same thing as ARPC, a metric we’ve covered earlier in the article |

Here’s another popular way of calculating CLV.

Take ARPC for a year and multiply it by the expected customer lifetime (how long the average customer is with you).

For example, if your ARPC is $3,000 per year and the average customer stays with you for 1.7 years, then your CLV is $5,100 (3,000 x 1.7).

One of the most informative ways of using the CLV metric is comparing it to CAC. Your goal is to keep your CLV:CAC ratio rather high, with CLV rising and CAC decreasing.

When this is the general trend, it means your investment in sales and marketing is generating a higher return for your business.

If your ratio is on the low-end, say 1:1, that would mean you’re receiving no value from new customer acquisition. They’re just paying you back what you spent on getting them.

However, you don’t want your CLV:CAC ratio too high, either.

That indicates you aren’t spending enough on courting your customers.

And if these customers are worth a lot to you (high CLV), they’re also likely worth a lot to your competition, who will catch on and start spending more on acquiring them.

Incentify’s Marketing Director, Caroline Kratofil, suggests aiming for a 3:1 CLV to CAC ratio.

Anything higher than 7:1 can cause you to start missing out on profitable customers, who are likely going to the competition.

Conclusion

As the adage goes, you can’t improve what you don’t track.

Monitoring subscription billing metrics like MRR, CAC, and the others we’ve covered in this article will give you insight into your past performance, a glimpse into your company’s current financial health, and the data you need to increase subscription conversion rates and grow your business.