Managing accounts receivable can be a daunting task, but that doesn’t make it any less important.

If you keep your accounts receivable in check, you can expect good results—clients pay their dues on time, your revenue is steady, relationships with customers remain positive, and your team is productive and happy.

However, none of those things just happen on their own. In this article, we’ll show you how to track your accounts receivable so that they become a propeller of your business and not the anchor holding it down.

Jump to section:

Switch to an Automated Billing Solution

Establish Efficient Billing Procedures

Be Proactive About Payment Collection

Regularly Review Your Accounts Receivable

Switch to an Automated Billing Solution

There really isn’t any contest when you’re comparing automated billing solutions with manual billing practices.

However you look at it, when it comes to efficiency, automation knocks out manual labor in every round.

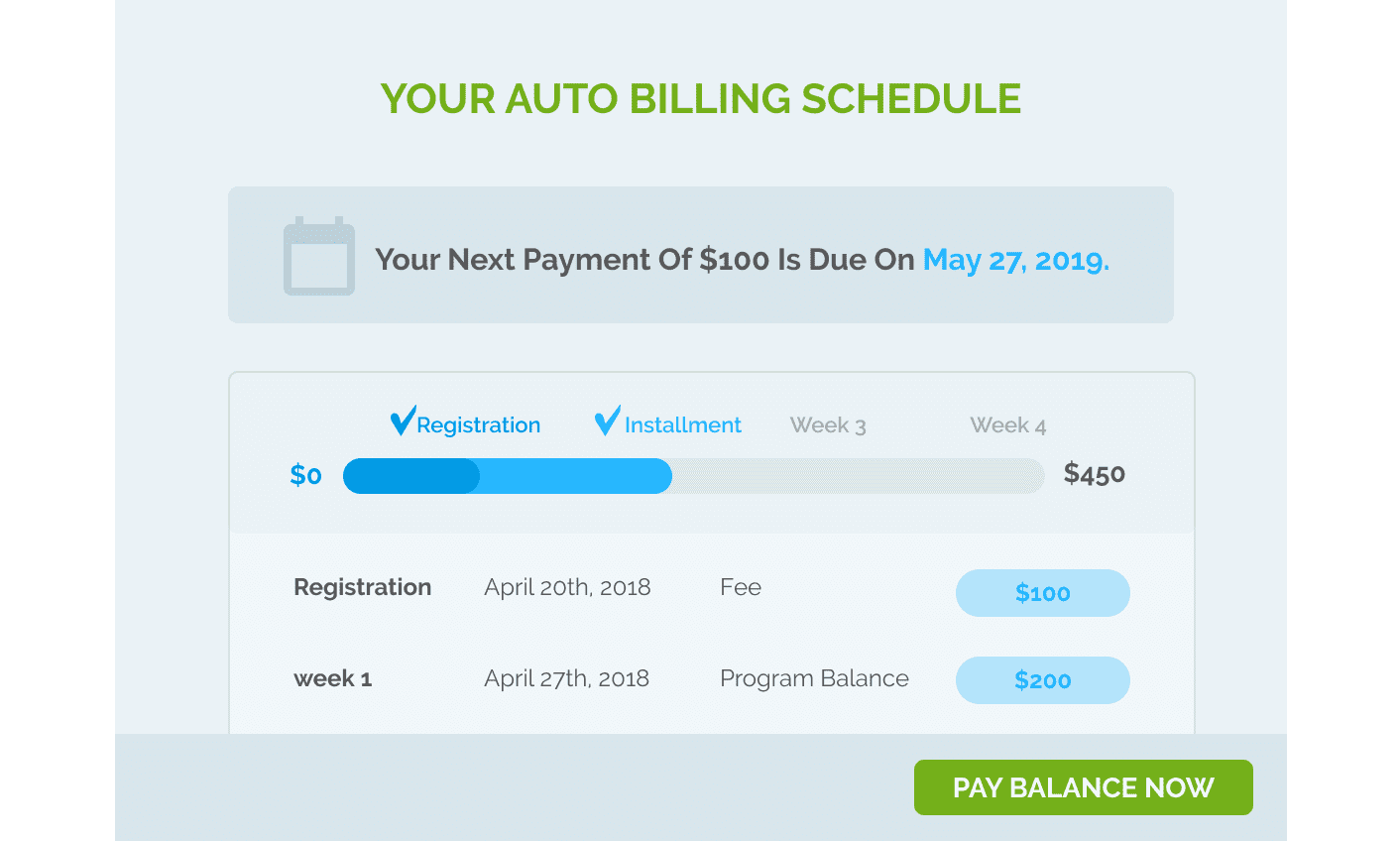

As you probably already know, an automated billing solution is a type of software designed to assist with the whole payment process, from creating and sending invoices to collecting data, tracking payments, and everything in between.

Source: RegPack

Such a system can significantly improve your tracking and managing your accounts receivable. The fact that it makes invoicing, billing, and handling data easier gives you a firmer grip on the state of your revenue and cash flow.

And there are several ways in which automation makes invoicing and billing easier. For one, it reduces your team’s workload, and when you are no longer swamped with administrative tasks, there’s a smaller chance of making errors that can cost you time and money.

For example, one typo made while filling out an email address or an account number can make your invoice unusable. When you finally track down the mistake, the payment could already be late, thus impacting your revenue.

With an automated billing solution, you can save the necessary billing data, which is then automatically filled out every time you do business with the same client.

This drastically reduces, even eliminates, the chances of a human error.

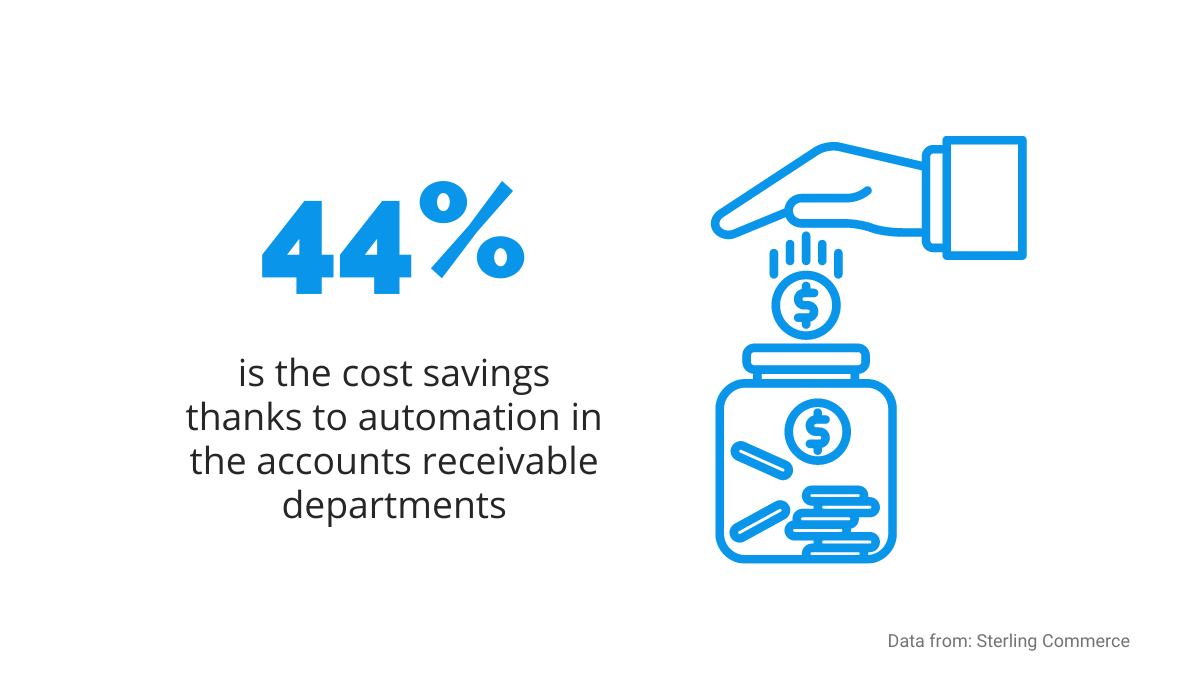

In addition to saving you time, an automated billing solution saves you money, too.

According to a global survey done by Sterling Commerce, automation can result in 44% cost savings in the accounts receivable departments—the average cost for a manually processed invoice is $4. In contrast, the automated invoice costs $2.25 to process.

Source: Regpack

The point is that an automated billing solution is a centralized system that collects all the data about your billing process and automates your record-keeping.

Having access to one hub which holds data about payments made, late payments, due dates, and every other relevant piece of information is like a dream come true for tracking your accounts.

When you’re choosing an automated billing solution to make tracking your accounts receivable easier, consider your accounting needs and look for features accordingly.

There are plenty of billing software solutions available, offering a wide range of options.

The minimum you should look for is the ability to create, send and track invoices, store customer data with some sort of encryption protocol, and record payments in a straightforward and manageable way.

Source: Regpack

As you can see above, there are more useful features that can help with tracking accounts receivable, so it’s a good idea to shop around and decide on a solution according to the needs of your business.

Switching to an automated billing solution is a sturdy foundation for building an efficient and streamlined practice of tracking accounts receivable. Without it, establishing efficient billing procedures, which we’ll examine in the next section, would be much harder.

Establish Efficient Billing Procedures

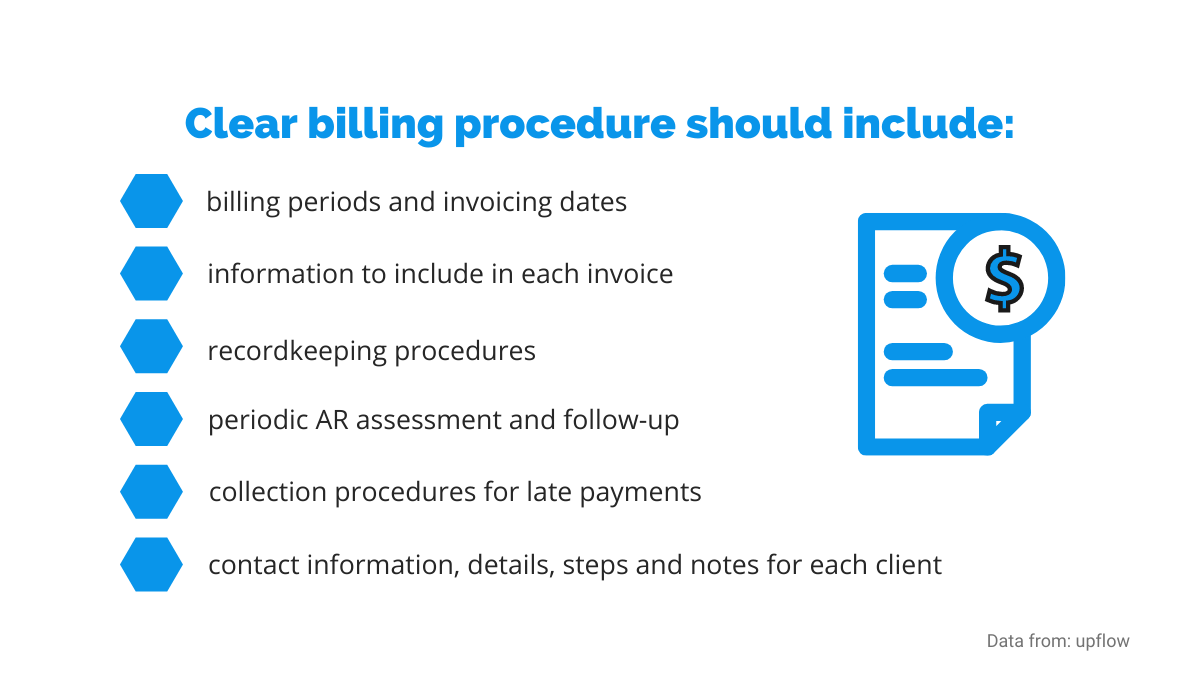

Your billing procedure should be precise and consistent, with every step clearly outlined. That way, you improve efficiency and stop tracking your accounts receivable from becoming a chore.

Approaching your billing process that way can minimize errors and save you time.

If you have your billing procedure clearly documented and available to every team member who deals with clients, you ensure that everyone is on the same page and follows the same guidelines.

Furthermore, by having everyone aware of the billing procedure, you avoid the mistakes and delays that occur when different departments, or even different teams within the same department, don’t communicate efficiently.

That’s a phenomenon known as an information silo, and in addition to holding back efficiency, it can also be very costly for the business.

According to a survey by Planview cited by the HCM Technology Report, relying on poorly integrated tools that aren’t centralized throughout the company results in about 20 hours of lost time a month.

These are 20 hours that could have been spent on productive and meaningful tasks for the business.

Source: Regpack

In terms of billing procedures, that means that team members don’t need to spend their time and energy on figuring out, for example, if the client paid on time, whether anyone sent a reminder to them, or what’s the number of their invoice.

The whole billing procedure is clear to everyone, which makes tracking accounts receivable more efficient.

Therefore, to improve the efficiency of your billing, it’s a good idea to document the procedure precisely so everyone in every department can follow it.

This includes keeping track of information like billing periods and invoicing dates, the necessary data and procedure for creating an invoice, the guidelines for bookkeeping and debt collection, and other information you can see below.

Source: Regpack

For example, it should be clear if the client should be invoiced on the day your work is done or if you send invoices on the first day of the month. Furthermore, an efficient procedure should specify if the billing period is 15 or 30 days from sending an invoice.

The less time and effort team members spend on figuring out details like that, the more efficient the procedure is and the easier tracking accounts receivable gets.

To further increase the efficiency of your billing procedures, consider eliciting contributions from every department and team that’s dealing with clients.

For example, the accounts receivable team should obviously be involved in the billing procedure. Still, the sales department and contact center could also benefit from being on the same page with them.

That can positively impact the communication inside your organization, reduce mistakes and redundancies, as well as prevent different teams from being stuck in their own information silos, with little awareness of the rest of the organization.

In other words, your company’s overall efficiency can be significantly improved.

An efficient billing procedure is the backbone of tracking your accounts receivable. Having a clear and consistent way to handle payments and knowing every moment of the billing procedure is vital for controlling your business.

Be Proactive About Payment Collection

Your goal is to successfully collect payments from your clients and enjoy all the benefits which go along with it. To achieve it, you should be proactive—being idle and waiting to see if your clients will pay on time might put you in an unenviable position.

There are few universal truths in the world, but one of them is that there’s no business that wants late payments—they negatively impact revenue, prevent the business from growing and make cash flow inconsistent.

The latter can be especially problematic, particularly for small businesses. Being able to rely on a steady cash flow and predict payments is crucial. Moreover, late and irregular payments can make tracking accounts receivable a challenging task.

Even if you think that you can depend on your clients to make regular payments, things can turn around in just a month or two.

That’s especially true these days; according to data from Brodmin, more than half of businesses struggle with late payments due to the COVID-19 pandemic.

Source: Regpack

Settling the terms of payment with your customers early on is a great starting point for a proactive approach.

Communicating about payment collection shouldn’t be limited only to a time when the payment is already late. Don’t be afraid to openly discuss your payment terms, due dates, and payment cycles with your clients, as well as get that in writing.

That way, both sides can ensure that everything is transparent, and if a payment is late, everyone knows who is responsible and what the next steps are.

Another way to be proactive about collecting payments is to make it as easy as possible for your clients to compensate you for your work.

Convenience is a powerful factor in the payment procedure. Going out of your way to provide your clients with their preferred payment method can lead to earlier payments and, by extension, easier tracking of accounts receivable.

If the payment is still late despite all your efforts, ensure that you have an efficient dunning process in place. As you probably know, dunning is a process of communicating with your clients to ensure the collection of payments.

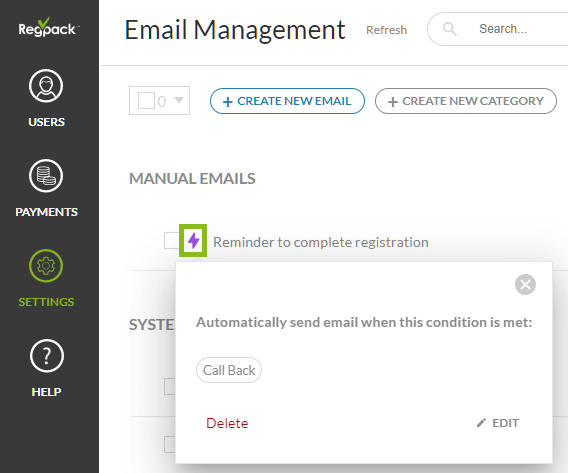

A proactive approach to dunning can be to automate a series of dunning emails.

A solution like Regpack can be very helpful here; you can draft your emails and send them automatically on a particular day or trigger.

Source: Regpack

For example, it’s a good idea to send the first dunning email on the day the payment is due to serve as a reminder to the customer before the payment is late. Then, you can follow up after 2-3 days, a week, two weeks, and a month after the payment is late.

Having a consistent dunning procedure in place can help track accounts receivable; even if the payment is late, it’s important to track the due amount, calculate the debt, charge late fees and interests, or, in the worst-case scenario, write the debt off.

Tracking your accounts receivable is much easier when you’re proactive about payment collection.

That way, you’re in control of your revenue and do what you can to keep your cash flow steady, which is a significantly better option than the unpredictable “wait and see” approach.

Regularly Review Your Accounts Receivable

To efficiently keep track of your accounts receivable, sticking to a habit of reviewing them in regular intervals can be very beneficial. That way, you can prevent unpleasant surprises or errors that manage to slip by.

By reviewing your accounts receivable regularly, for instance, once a month or at the end of a quarter, you can ensure that the procedures and processes for billing are functioning properly.

For example, you can get ahead of potential problems with late payments.

If you notice during the reviews that the number of late payments isn’t reducing despite the dunning emails you’ve been sending, you may want to revisit the wording of your messages or schedule them more frequently.

Furthermore, if you notice a rise in the number of revised invoices, it might be time to take a look at your billing policies.

Blunders like these can occur to anyone, but you can deal with them easily if you notice them on time, while regularly reviewing accounts receivable.

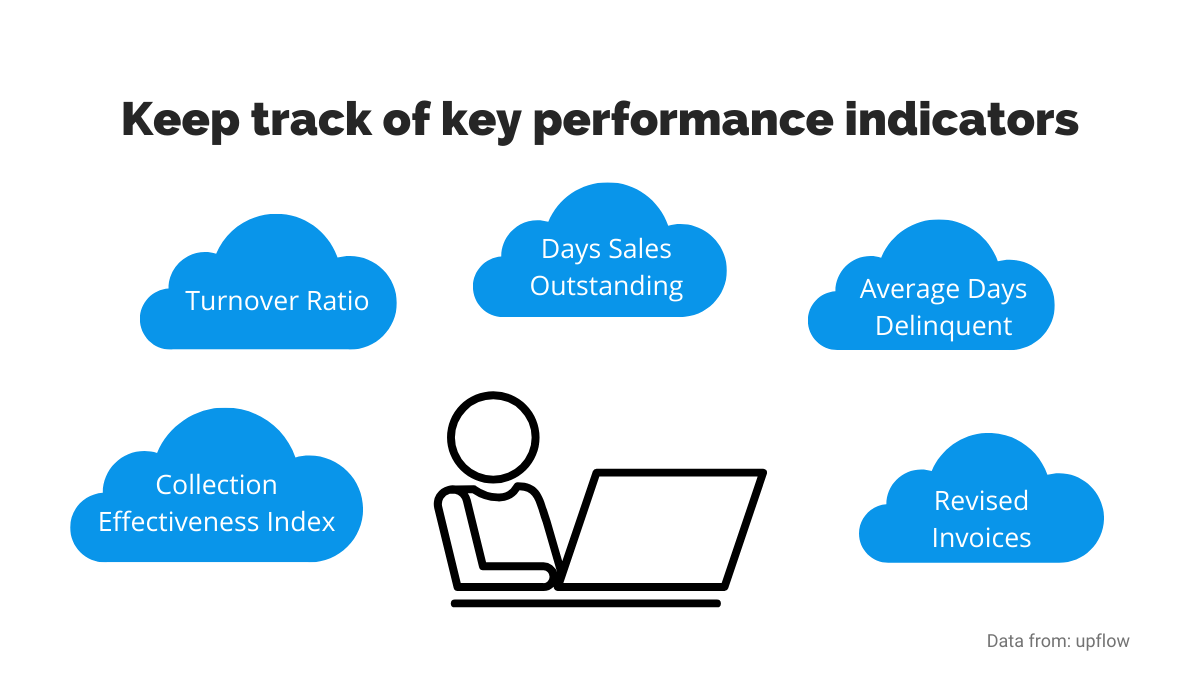

Below you can see some of the key performance indicators (KPI) that it would be wise to track and keep an eye on.

Source: Regpack

Let’s examine them a little closer.

The Days Sales Outstanding (DSO) indicates the average number of days a company takes to collect payment. That’s one of the most important metrics to keep track of because it can indicate problems with cash flow if it’s high.

According to Investopedia, it’s considered low if it’s below 45 days.

Source: IntelliChief

Average Days Delinquent (ADD) shows how many days on average invoices are overdue. It’s a good idea to track this metric because if it rises, you should check for any problems in your billing process.

Receivables Turnover Ratio in Days measures how effectively you’re collecting debts. If the number is high, it means that it takes you more days to collect debts, which can be detrimental to your cash flow.

Another valuable metric to keep track of is the Collection Effectiveness Index (CEI). That’s the percentage of accounts receivables collected—ideally, it should be 100, meaning that you’ve collected revenue from all of your clients.

Keeping track of metrics like those mentioned above can provide you with lots of valuable insights for managing your accounts receivable. However, you may need a system that can turn that data into actionable information that is easy to analyze.

An automated billing solution like Regpack can be very useful in that regard.

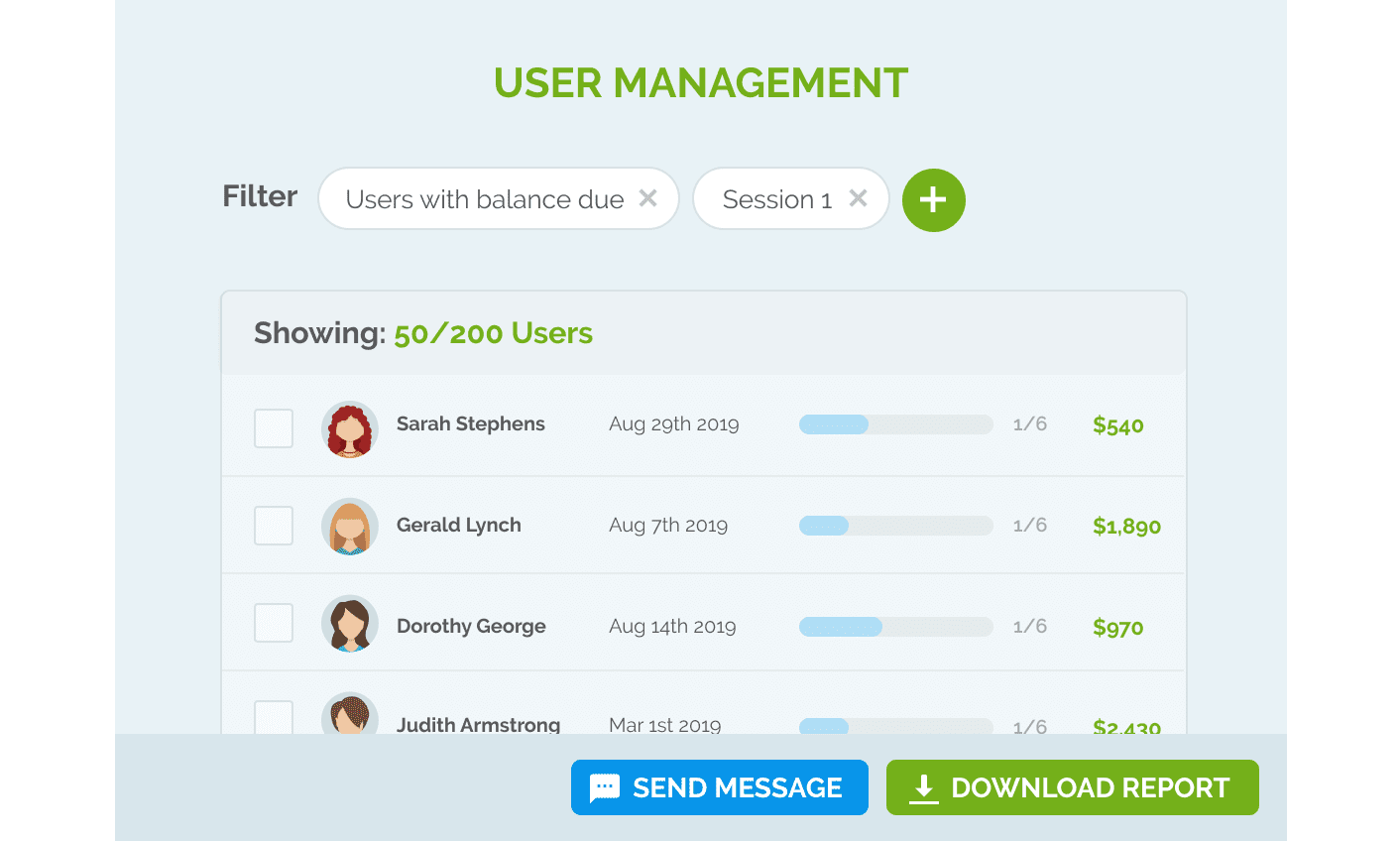

Besides the features we mentioned earlier, with Regpack, you can also run reports, compile data, filter it by various criteria—in other words, you can efficiently track and review your accounts receivable.

Source: Regpack

For example, Regpack enables you to filter clients by payments; that way, you can easily see who paid on time, who’s late with their payments, who requested a refund, and other helpful information.

Making time to regularly review your accounts receivable should be an integral part of your business routine. It prevents errors from slipping through the cracks, and it can be a considerable help with keeping tabs on your finances.

Conclusion

You can’t control everything when it comes to your accounts receivable.

However, putting efficient and well-organized systems in place can help you track them, significantly improving your cash flow and relationships with your customers while minimizing the amount of time, resources, and energy that gets wasted.

If you follow the practices explained in this article and embrace automation, you will be able to set up an efficient billing procedure, proactively collect your payments, and regularly review your accounts receivable.

As a result, your business will run like a well-oiled machine.