Thinking about opening a merchant account so that you can accept credit cards and debit cards from customers online or in person?

If so, there are some best practices, like documentation prep or vendor research, that you should learn how to do before you start evaluating vendors and filling out any application.

Working knowledge of these best practices will make the merchant account evaluation and application processes go smoothly.

Being aware of them will also enable you to choose a vendor that fulfills your payment processing needs, thereby setting your business up for success.

- Open a Business Bank Account First

- Research Merchant Account Providers

- Determine Your Payment Processing Needs

- Prepare the Necessary Documentation

- Abide by PCI Compliance Standards

- Take Merchant Solution Fees Into Account

- Conclusion

Open a Business Bank Account First

Before you open a merchant account, you have to have a business bank account.

This is true even if you’re the sole proprietor, since a business bank account will be the destination for funds transacted by your business as well as the account from which transaction fees will be debited.

Fortunately, opening up a business account is usually a quick and easy process. First, choose a preferred bank.

This is probably the most important and time-consuming step. To get it right, there are some questions to ask to ensure you pick the right bank.

First off, you want to know their fees. Banks usually charge a maintenance fee, although some might waive them.

Some also have a transaction fee if you go over a certain number per month.

You should also make sure they offer the features you need to handle your finances efficiently.

For example, someone who uses their phone a lot might prefer a business bank account that offers a mobile app that allows them to access account information and make transactions on the go.

After you’ve chosen the right bank for you, go online or to a local branch and ask to open a business bank account.

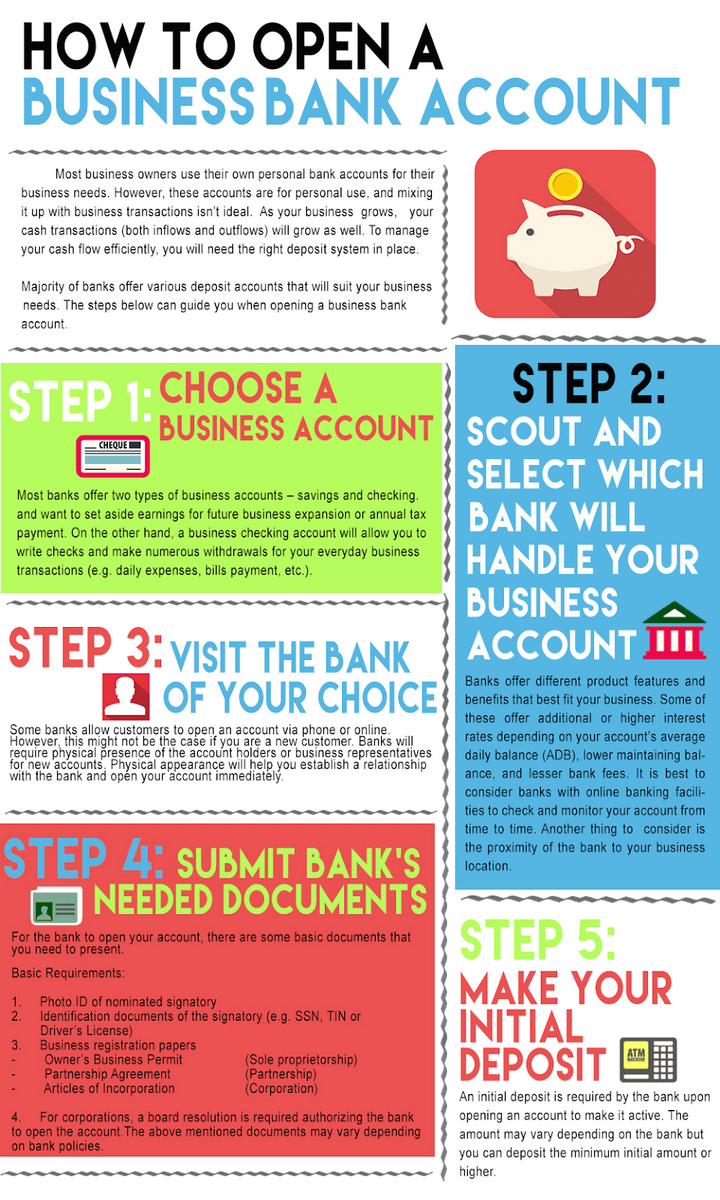

Founders Guide created a helpful infographic detailing the step-by-step process of opening a business bank account:

Source: Founder’s Guide

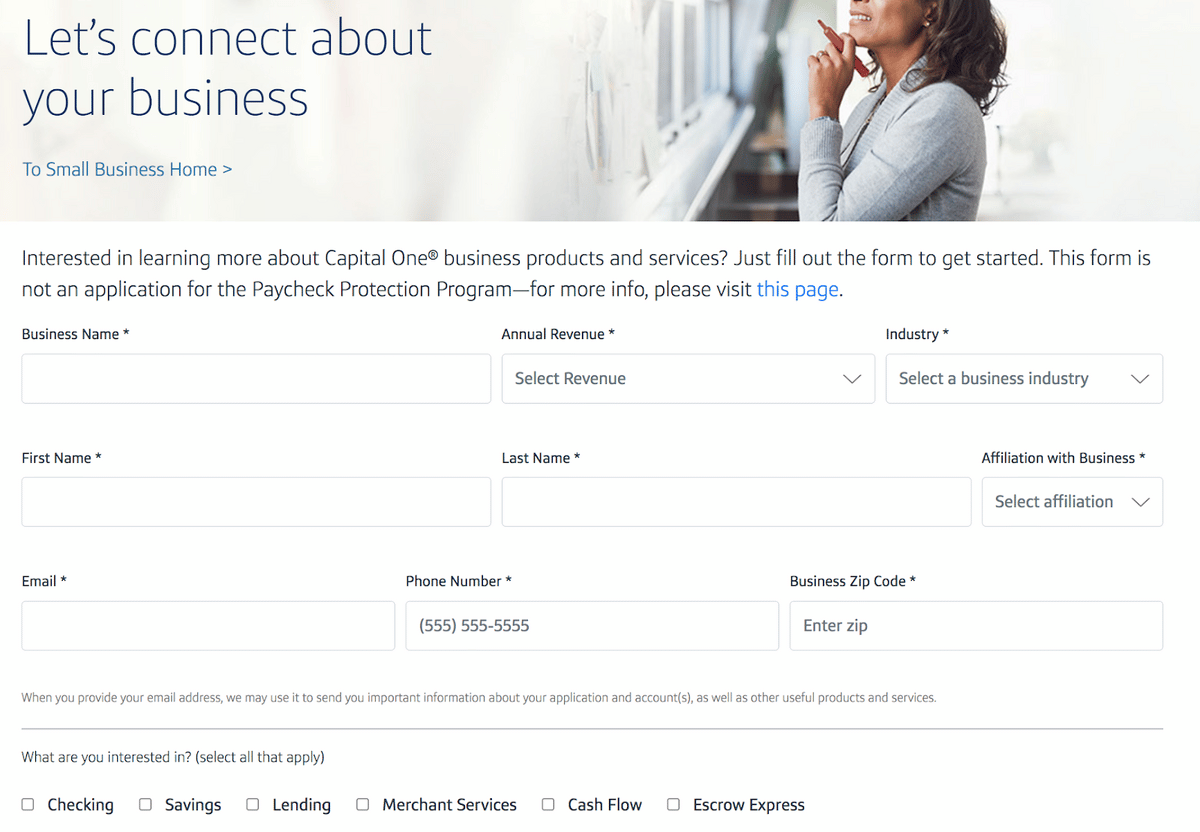

Sometimes, if you sign up online, the bank will first have you fill out a form to qualify you and make sure they can attend to your needs, as Capital One does in the form below:

Source: Capital One

Usually, the bank will ask you for your business license and your employer identification number (EIN), which can be your social security number if you’re a sole proprietor.

In some cases, they’ll also ask for your business formation documents and ownership agreements as well.

After you’ve submitted the documentation, you’ll make an initial deposit and make sure everything went through correctly.

As a final note, it’s critical that you keep enough funds in there to cover any processing fees or other costs associated with accepting credit cards.

Some banks have minimum monthly balance requirements, and they’ll charge a fee if you go under them.

Plus, you don’t want to fail to pay a processing fee you owe your merchant account provider.

Research Merchant Account Providers

It’s important that you take some time to do your due diligence and research various merchant account providers, as some might be better fits for your needs than others.

Some will also have higher fees than others.

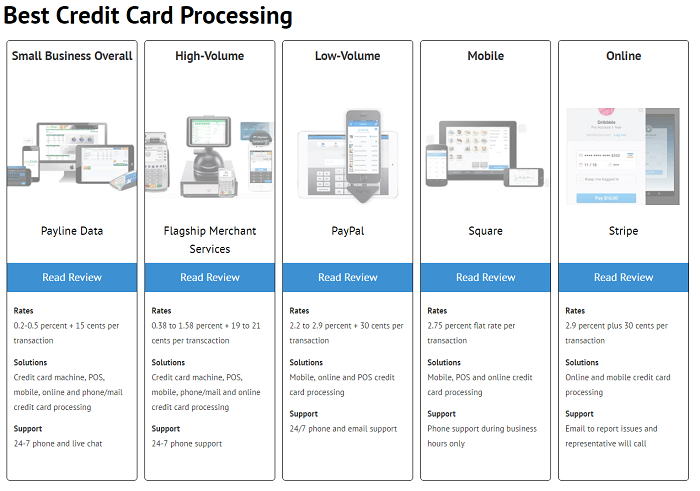

Here are five of the top merchant account providers:

Source: BankQuality

But just because a merchant account service is popular and offers low prices doesn’t mean that it is going to be the best fit for your business.

Some are generalists while others specialize in one industry or company type.

Below are some factors small business owners should consider when assessing merchant account providers:

| Customer Reviews | Look up Best Lists on google. Type in a phrase such as “best merchant accounts for small businesses” (or “for event managers”.) Also, read online reviews of the provider. |

| The Provider’s Industry | Ensure that the provider works with businesses similar to yours in size and industry. |

| Per-Transaction Fees | Most fees are between 1.5% and 2%. Anything higher likely is not worth it, and anything lower might have a catch. Keep in mind that companies that charge higher setup fees often charge lower transaction fees and vice versa. |

| Hidden Fees | Beware of customer service fees, minimum monthly volume fees, cancellation fees, and others that aren’t made apparent anywhere besides the contract’s fine print. |

| Customer Service | When something goes wrong you want the ability to reach out to your provider for help ASAP so that you don’t have to suspend credit card transactions for too long. |

| Your Financial History | Your credit history may influence a merchant account provider’s decision when reviewing your application. Look for one that will accept your financial history. |

| Integrations | Make sure the vendor’s system is compatible with your related business software and hardware. This allows for automated and accurate recordkeeping. |

It’s also essential that you find a provider who will satisfy your payment processing needs. Take inventory of the features you want before you go out searching for a provider.

Will you need to accept payments online or can you rent a machine to process payments in-person, or are you an omnichannel business that needs to do both?

The answers to questions like these will guide your search.

For more, check out our step-by-step guide detailing how to pick a merchant account provider that’s perfect for your business.

Determine Your Payment Processing Needs

Determining your payment process needs before searching for a vendor is important for two reasons.

1) You’ll narrow down your search and find the perfect vendor more quickly.

2) Once you choose a vendor you’ll know which documents to collect, as your payment processing needs affect the requirements for the application.

Below are some questions to ask yourself to determine your payment processing needs:

| Are you selling goods and services online? | You might need features like credit card storage, a virtual terminal, and a payment gateway. |

| Do you have a brick-and-mortar store? | Do you need to lease a card scanner from the vendor, or do you want to accept payments on phones and tablets, something Square allows you to do for free? |

| Through which channels do you accept payments? | Make sure the provider can help you process payments over whatever channels you use: phone, email, text, website, point-of-sale (POS) systems, etc. |

| What payment methods do you need to receive? | The provider’s documentation requirements vary based on the kinds of cashless payment methods you want your customers to be able to use. |

| What Cards Would You Like to Accept? | Do you want to accept cards from all the major networks or only a few of the ones your customers use most often? |

| What’s Your Projected Monthly Credit Card Volume? | Many merchant accounts have credit card monthly volume limits to protect themselves from fraud. Others have monthly minimums, typically 10-25 dollars per month. Seasonal businesses might want to look for one with no minimum. |

As a final note, think about how you’re planning to grow your business and how that will change your payment processing needs.

Make sure the provider is a good match for your future business as well as your current one. They should be flexible.

It’s always less of a headache to upgrade your plan than switch providers, which often requires paperwork and sometimes even downtime.

Doing your due diligence will help you avoid becoming one of the 1/5 small businesses that switch merchant account providers.

Source: Regpack

Knowing your payment processing needs allows you to focus on finding the exact features that satisfy those needs.

This reduces the evaluation period and saves you from pitfalls down the line.

Prepare the Necessary Documentation

Like a good stir-fry chef chops and organizes the vegetables before the oil in the wok is sizzling, you should prepare all required documentation before filling out their application.

Preparation makes the process go smoothly.

It’s stressful and frustrating to scramble for paperwork in the middle of the process, especially if some of that paperwork takes some time and effort to get.

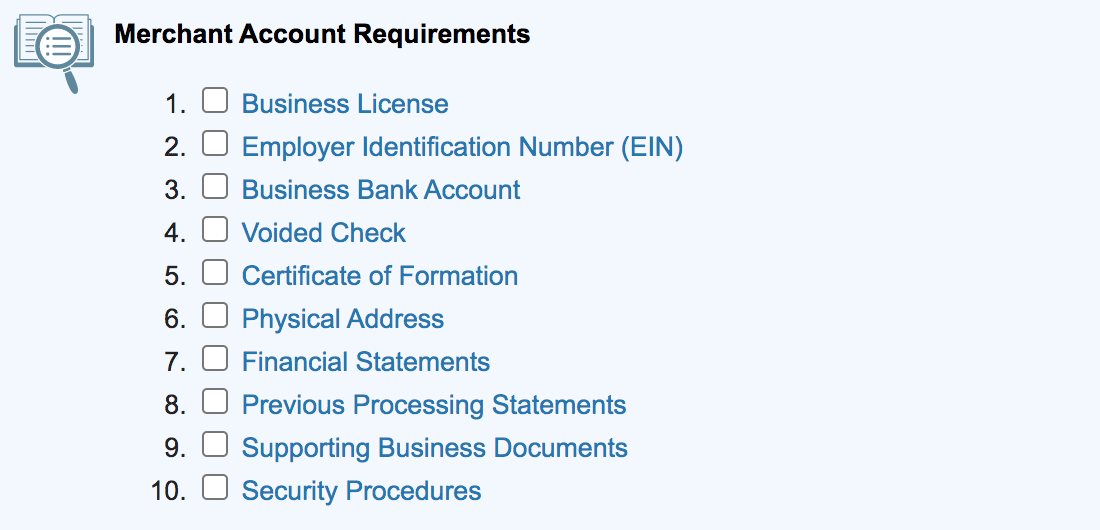

Apart from general business information like your address and certificate of formation, the provider is also likely to ask for further documentation that proves the business’ financial competence, such as banking statements and tax returns.

All of this is important for the underwriting process as well. Essentially, the provider wants this information to check how risky you are to them.

CreditDonkey wrote a great article that covers the 10 essential merchant account requirements:

Source: CreditDonkey

Although the above is a good benchmark, be sure to check your merchant account provider’s application guidelines for the exact details you’ll need to collect for your application.

Abide by PCI Compliance Standards

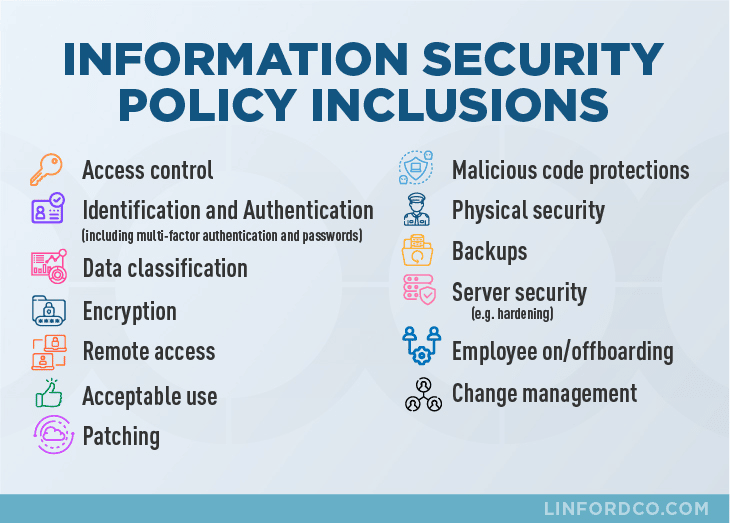

Abiding by PCI compliance standards is essential when you’re opening a merchant account.

If you’re PCI-compliant, it means that your business takes the necessary precautions to ensure the security of sensitive customer data.

For small businesses, that means, for instance, using encryption and a firewall to protect cardholder data, consistently updating antivirus software, and having a written information security policy that summarizes and enforces the following procedures:

Source: linford & co

You won’t have to achieve full PCI compliance when opening up the account, but you will soon after, so it’s smart to get a head start.

Stripe, a popular merchant services provider, recommends that their potential customers validate their PCI compliance by using a self-assessment questionnaire provided by the PCI security standards council.

Keep in mind that the merchant account provider will also likely have their own PCI-compliance requirements on top of the one by the Payment Card Industry.

Therefore, you should look over your provider’s PCI requirements before submitting and ensure you meet them before submitting your application.

For more on how to ensure that you’re PCI compliant, here’s a helpful article by NerdWallet on the 12 requirements for PCI compliance.

Take Merchant Solution Fees Into Account

It’s important to know that there are going to be fees that you’re going to have to pay when opening a merchant account.

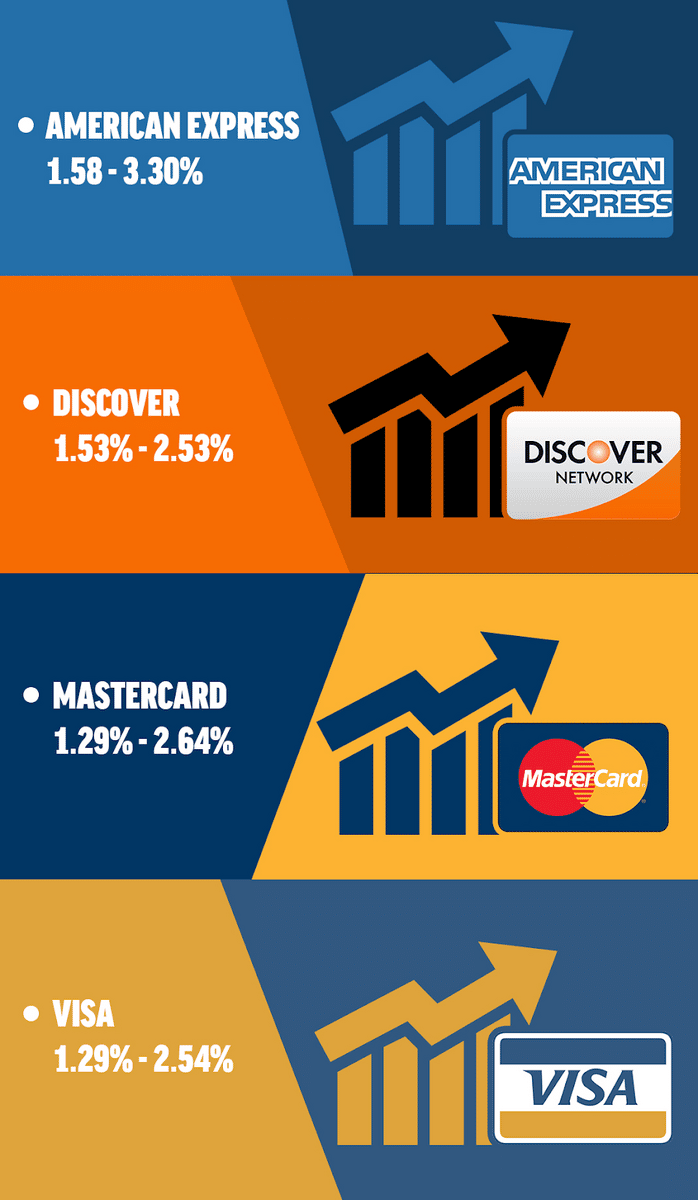

The most expensive fee for you will be the card processing fee, which, according to NerdWallet, usually ranges from 1.5 to 3% of each transaction’s total purchase.

However, the processing fee depends on the provider, payment structure, processing type, annual business sales, the credit card networks you’ll accept, and other factors.

Here’s Payment Depot’s summary of the average processing fees at four major networks:

Source: Payment Depot

Tacked onto the processing fee will typically be a transaction fee, a flat charge of around 10 cents per transaction.

For example, Square, a popular merchant account provider, charges 2.6% + 10 cents per transaction for its contactless payments service.

But, in addition to these per-transaction fees, there are also one-time, monthly, and annual fees to look out for when evaluating a merchant account provider.

| Setup Fee | This one-time fee is paid after the deal is closed and can range from hundreds to thousands of dollars, depending on a host of factors. |

| Annual Fee | Sometimes you’ll pay an annual fee for continued access to the provider’s software platform. |

| Monthly Minimum Fee | This stands for the minimum amount you have to pay in processing fees per month. If you fail to reach it, you must pay the difference. |

| Statement Fee | Some providers make you pay for paper statement delivery costs. |

| Penalties | You may have to pay penalty fees for chargebacks, disputed charges, or failure to keep up your PCI compliance. |

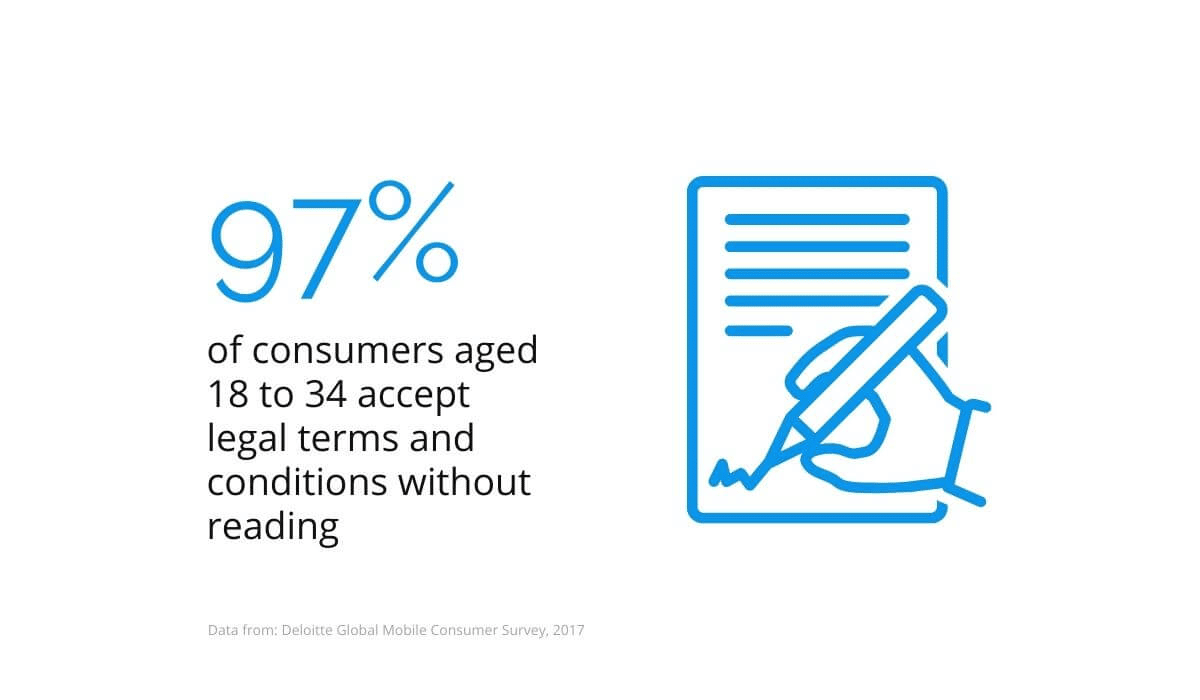

Some of the above fees might only be listed in the fine print of the contract.

So read the merchant agreement carefully before signing it so that you know what fees you’ll be responsible for paying.

Source: Regpack

And, as a rule, avoid companies that are being shady or in any way untransparent about their fees.

For a complete outline of the fees you may encounter when evaluating merchant account services, check out Payment Cloud’s article on average credit card processing fees.

Conclusion

Before selecting a merchant account provider and filling out an application, there are some things you should do.

Among other things, that includes opening a business bank account, determining your payment processing needs, and knowing what fees to expect.

Taking these precautionary steps will ensure you find the right merchant account for your specific needs and avoid locking yourself into a deal that makes you feel taken advantage of or unsatisfied.