Once your customer has reached the checkout page, there’s nothing more to worry about, right? After all, they’ve decided to buy from you. You’re in the clear… right?

Not so fast.

In reality, online merchants often make some common (and avoidable) missteps when accepting online payments that can drastically affect their sales and bottom line.

In this article, you’ll learn the six most common mistakes to avoid making in your own business.

Jump to section:

Redirecting Customers to External Payment Websites

Forcing Users to Create an Account

Neglecting Data Security

Not Offering Proper Customer Support

Offering Limited Payment Options

Poor UI/UX Design

Redirecting Customers to External Payment Websites

Some ecommerce websites find it easiest to display the item or service for sale on their own website, and then, once the customer is ready to check out, redirect them to a third-party website (usually a payment processor) to finish the payment.

Being sent to another website, one that they weren’t expecting and that isn’t part of your website, can throw the customer off.

They may be understandably wary of inputting their payment information—like credit card or bank account numbers—into a third-party site that they don’t know or trust.

And by extension, being redirected to another website can lead the customer to lose their trust in you.

It’s better to keep customers on your own website rather than risk losing their trust—and their business.

When you allow customers to complete purchases on your own website, you also retain control over things like the checkout page or the confirmation email.

Many third-party payment processors let you make small customizations to the checkout page, such as choosing the color scheme—but if the overall checkout page is designed poorly, you have no real control over changing it.

That negative experience with the design will likely be the last impression your customer has of you.

Source: Regpack

And if the customer receives an email from the payment processor rather than you, you lose the chance to customize or personalize that last attempt at communication.

Finally, redirecting to a third-party website means you lose the ability to confirm whether a payment was actually made.

Because the checkout page isn’t fully integrated into your website, you won’t be able to do in-depth data analytics or include upsells for other offers.

Instead, you’ll have to trust the limited data analytics provided to you by your payment processor.

To avoid that, find a payment platform that lets you accept payments on your own site.

Embedding a payment form into your website not only allows customers to feel safer while doing business with you, it lets you see payments in real time so that you can detect and fix payment errors quickly and efficiently.

Source: Regpack

Our online payment software, Regpack, offers safe and secure payments through a customizable payment form where you own the code, so you have complete control over the look and customization of your checkout page.

No redirect pages or combinations of online and downloadable forms in sight!

Forcing Users to Create an Account

While we’re on the subject of customer trust, let’s discuss another way to make them suspicious of you immediately: asking for more information than absolutely necessary.

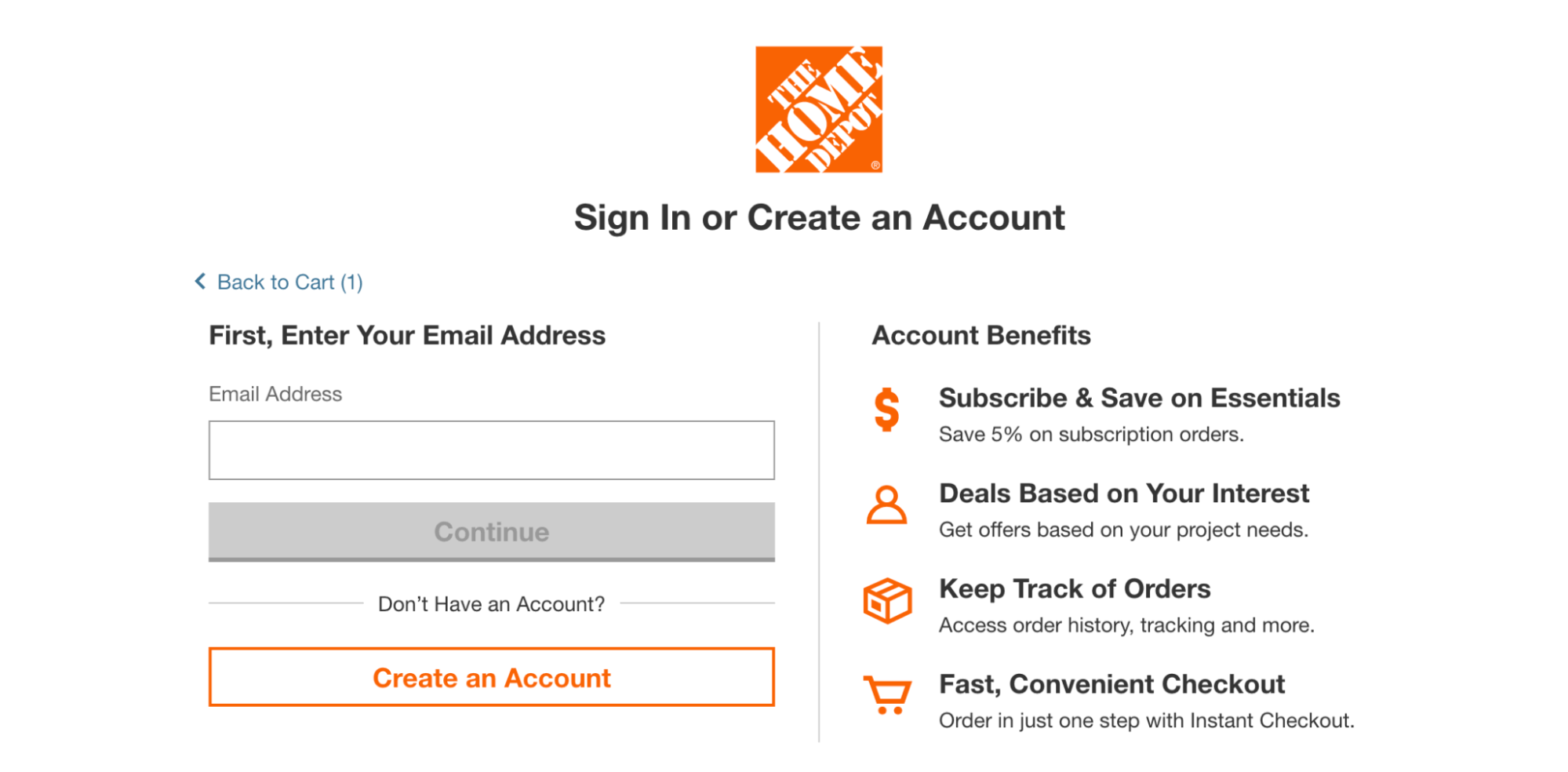

Many online businesses force users to create an account or sign in before proceeding with a purchase. One of them is Home Depot:

Source: HomeDepot

From the business’s perspective, this function is nothing but beneficial. It helps you provide a personalized experience and lets customers track their orders. But customers don’t appreciate being forced to create an account.

If you don’t offer a “checkout as guest” option, you risk losing business.

If you’re an experienced business manager, you’re probably familiar with the concept of lead generation.

It essentially means asking prospects for their email addresses in exchange for providing them with useful items like a regular newsletter, a free download, or a purchased product.

Once you have their name and email address, you can use that data to communicate with them further and place them into your sales funnel.

Many companies use that concept and take it a step further: by forcing users to create an account, companies gather all kinds of useful data such as names, addresses, contact information, and even interests.

This information can either be used to send more targeted marketing communications or—much more nefariously—even sell that data to the highest bidder.

After all, privacy is the new currency—and modern consumers know it. Businesses sell our data to data mining companies that can use that information to find patterns and target customers for their own clients.

As New York Times critic Amanda Hess writes:

“We’ve come to understand that privacy is the currency of our online lives, paying for petty conveniences with bits of personal information. But we are blissfully ignorant of what that means. We don’t know what data is being bought and sold, because, well, that’s private.”

So while our society is becoming used to giving up bits of privacy in exchange for the convenience of a free gift or a faster checkout, that doesn’t mean your customers will be happy about it.

The more information you demand of them, the more likely they’ll be to simply look elsewhere.

If your competitor lets them buy a similar product without offering up private information about themselves, who do you think they’ll choose?

Neglecting Data Security

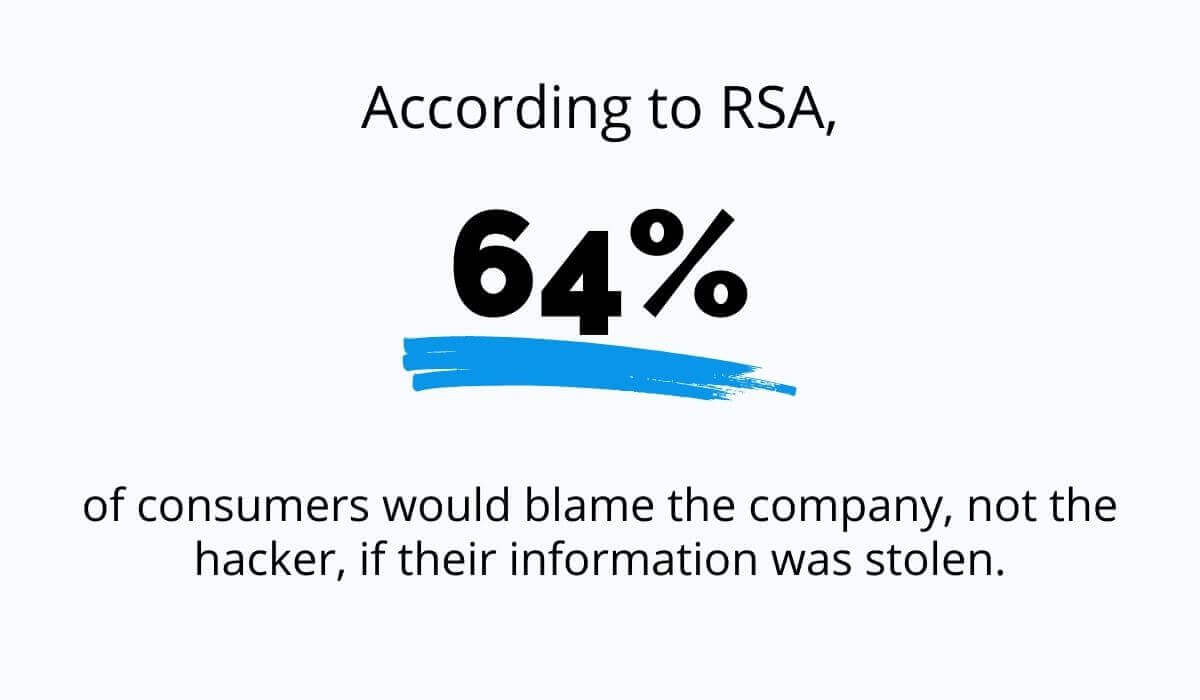

Another common mistake businesses make when accepting online payments is to miss out on the opportunity to secure customer data.

While making online payments—whether it’s via credit card or ACH payment—can be much more convenient than traditional forms of payment, they do come with their own risks.

Most customers entering their payment information will be doing so from their home network or mobile device, which are both likely unsecured.

So if your website gives the impression of being equally unprotected, the customer may rightly choose to take their business elsewhere.

Source: Regpack

Understandably, data security is extremely important to consumers, and your customers expect you to be proactive about protecting their security.

According to research on data breaches, 64% of consumers would blame the company, not the hacker, if their information was stolen.

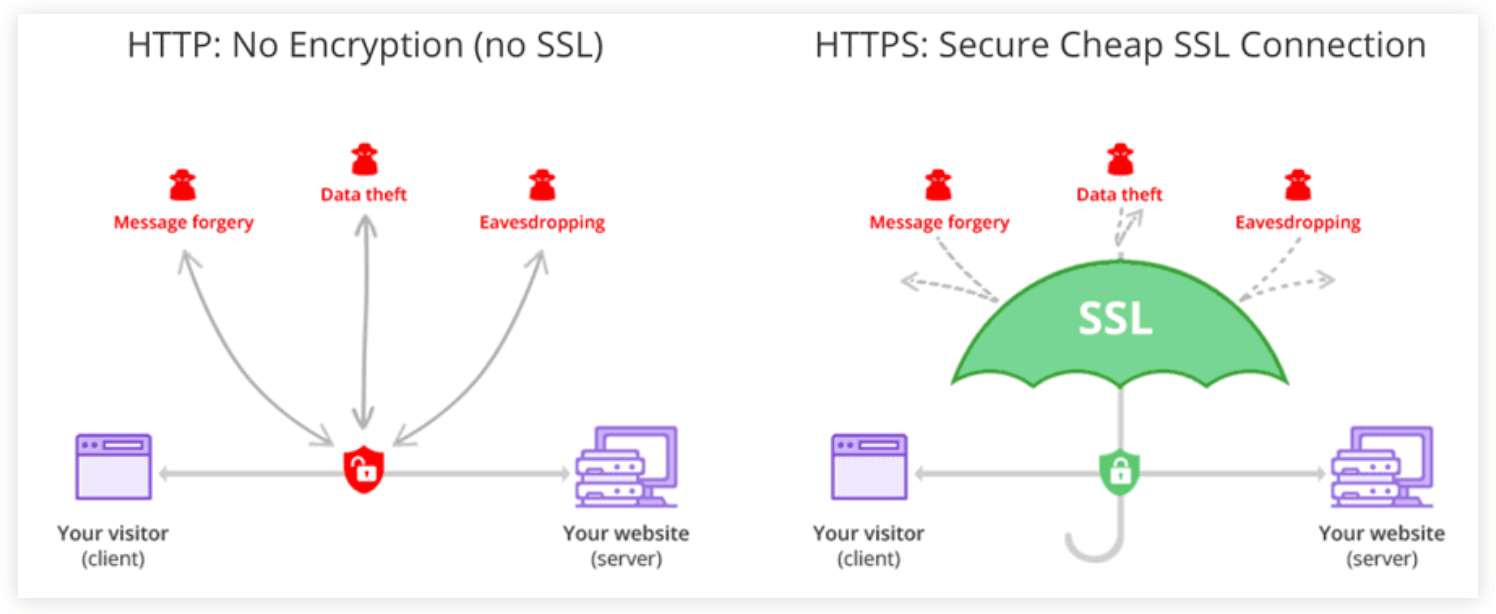

In order to ensure customer confidence in your data security (not to mention remain PCI compliant), you’ll need to use SSL/TLS in your online payments.

TLS (or “Transport Layer Security”) is used interchangeably with its older equivalent, SSL (“Secure Sockets Layer”). Both terms refer to standard security technology that encrypts customer data through a secure link.

Source: Hostinger

SSL/TLS functions by giving both ends of the communication chain a secure connection that’s unique to that experience.

When a customer navigates to an SSL-secured page, public and private keys are used to create a session key to encrypt all data being transferred during that connection.

The purpose of SSL/TLS protection is to ensure that the intended recipient of the transferred information is the only person who can access it.

No matter how many devices and networks it is transferred to, the data is kept secure.

When a customer sees an HTTPS address in the URL bar and a green lock icon, they can feel confident that your website is authentic, secure, and protected from malicious attacks.

Not Offering Proper Customer Support

Customer service shouldn’t be reserved for post-purchase issues.

Just like your customers want the ability to call your company’s support line if they have a problem or a question about your product, they also may need to get in touch with you concerning payment issues.

Perhaps their credit card didn’t go through, or they’re not sure if the payment was made. Maybe they need to cancel the order or change their billing address.

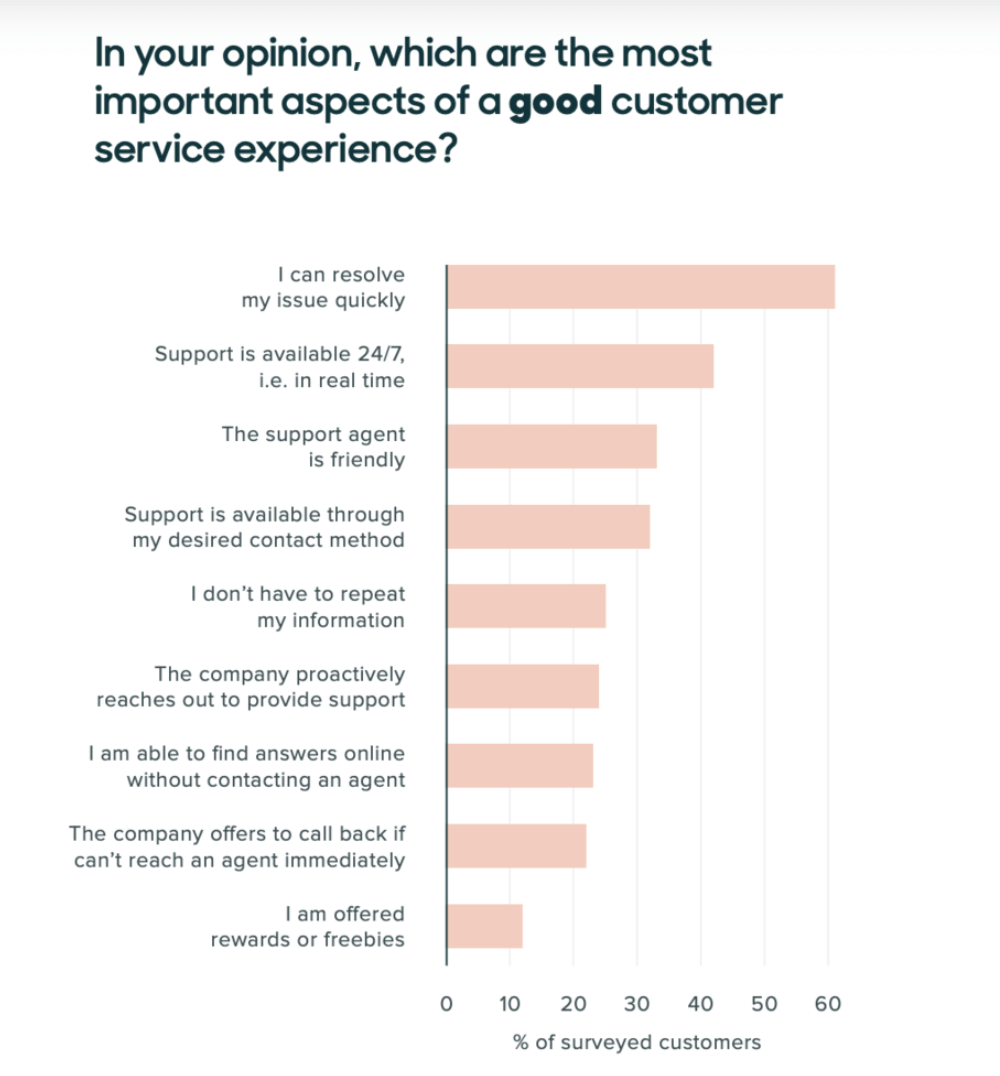

Whatever the issue, your customers expect to receive a prompt and helpful response.

According to a Zendesk survey, the most important component of excellent customer service is that the customer’s issue is resolved quickly.

Next on the list is, relatedly, that support is available around the clock.

Source: Zendesk

If you sell products and services online, odds are that you’ll have a global customer base. And those customers may make purchases from your website at any time of the day or night, in any time zone.

It’s not good enough to respond to customer support issues only during certain time windows or after a long delay; for optimal customer satisfaction, you need a customer support system that gets back to the user promptly and effectively.

Choose a payment provider that comes with a responsive and robust support system so that you and your customers can find each payment process equally reliable.

And you’ll also want a payment processor that gives you access to the checkout page’s code, for instance, with an embedded form on your own website. That way, you can control the little things that help prevent customer error in the first place.

When customers fill out payment forms, it’s normal for them to make a few typos. Include error message indicators that stop customers from making obvious errors and show them how to fix mistakes.

Offering Limited Payment Options

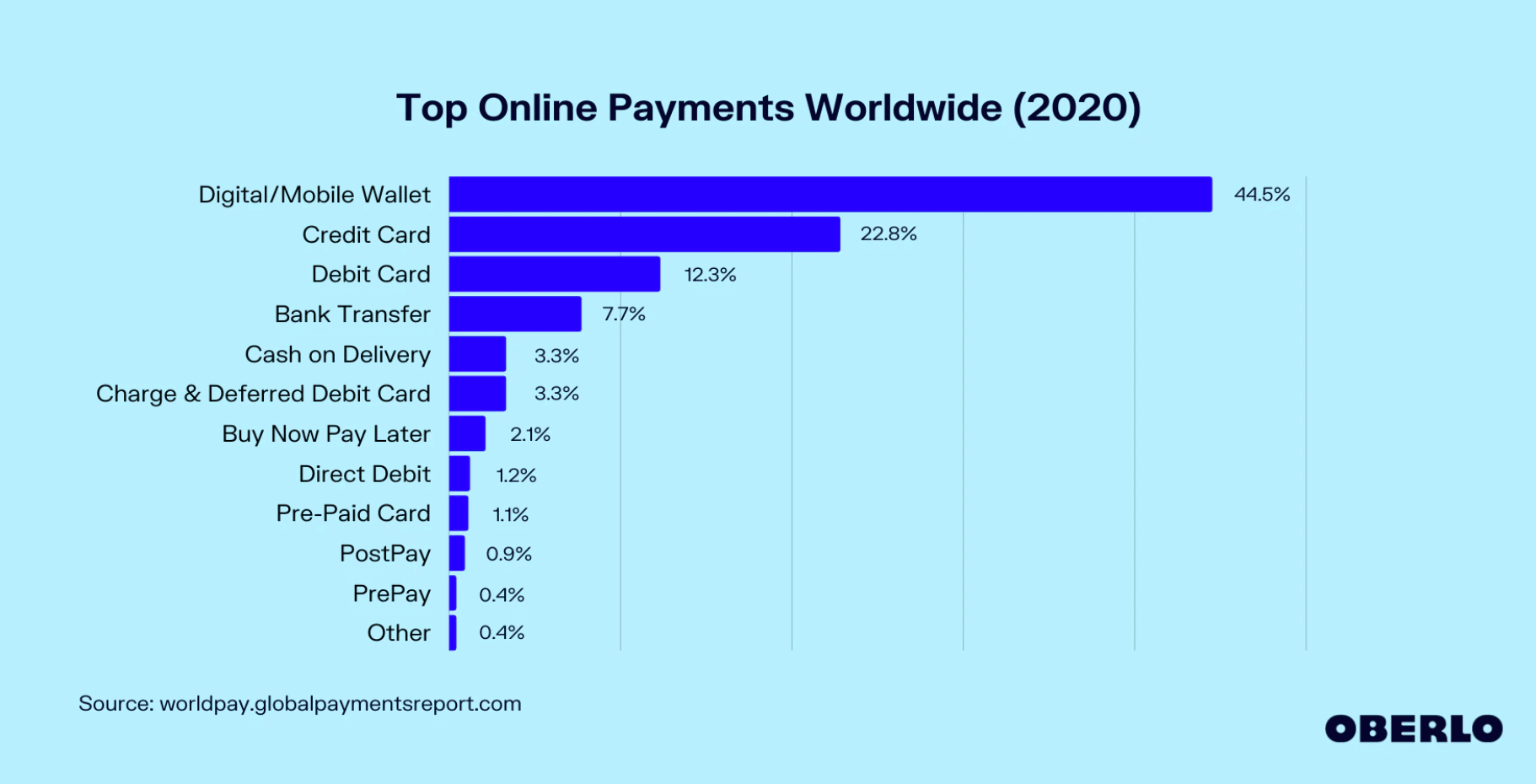

Aside from security and customer support concerns, another mistake that’s often made by online businesses is offering too few ways to pay.

In 2020, the most popular payment type worldwide was digital/mobile wallet, followed by credit and debit cards, then bank transfers.

Source: Oberlo

Your U.S. customers are likely to want to pay by credit/debit card or a bank account transfer /eCheck, so it’s a good idea to choose a payment processor that accepts these options.

And what about international customers?

If you sell products or services globally, you’ll want to choose a payment processor that accepts as many payment methods and currencies as possible.

For instance, in many European countries, credit cards aren’t as popular as bank transfers, so if you only accept card payments, some of your European customers will likely think twice before doing business with you.

Poor UI/UX Design

Finally, don’t forget about the overall checkout experience.

If the design of your checkout page is clunky or difficult to navigate, that factors into your customer’s overall impression of your brand. And the checkout experience is the final step in their first interaction with you, so it’ll be the lingering impression they have of your business.

You want it to be a positive one, right?

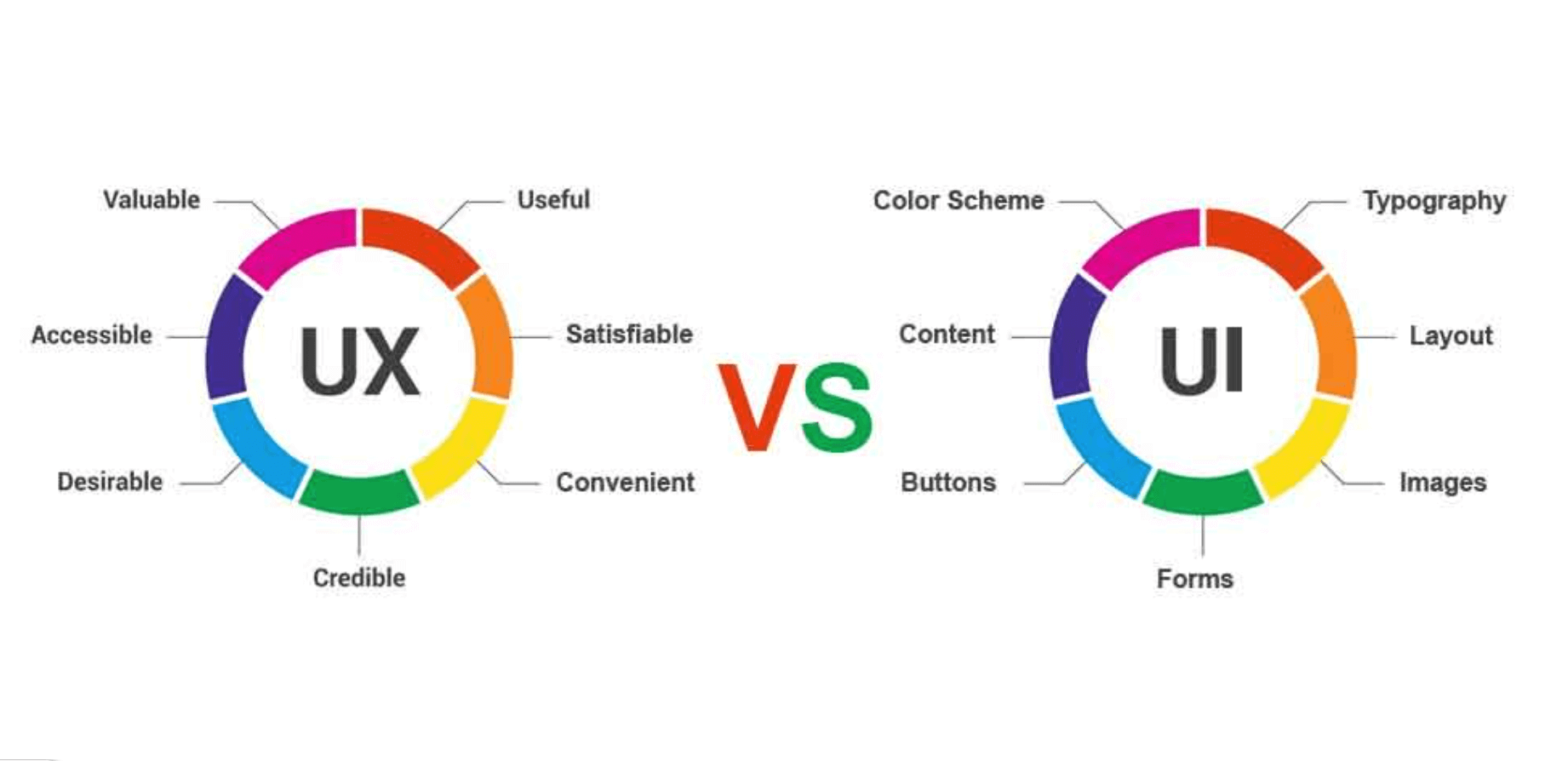

That’s why you should focus on the UI/UX design of your payment process.

User interface (UI) refers to the graphic design elements, such as the layout, buttons, images, and animation.

User experience (UX), on the other hand, refers to the experience of interacting with the web page, such as the ease of navigation and how smooth the interaction feels.

Source: WebTricksHome

As one UX Planet contributor explains it:

“User experience is determined by how easy or difficult it is to interact with the user interface elements that the UI designers have created.”

Therefore, avoid common UI/UX design mistakes, such as:

- Limited device compatibility—Is your checkout process mobile-responsive?

- Having no “guest checkout” option or making it too difficult to find

- Inaccessible fields—Thoroughly test all fields to make sure they function properly

- Not clearly displaying important information on the checkout page—Show the customer the final price (including all taxes and fees) along with shipping options and estimated delivery date(s)

- Unattractive and cluttered design—Keep your form short and sweet, and limit the page to a single column to help your customers avoid accidentally skipping fields. Remove any distractions from your form, such as social sharing buttons, graphic elements, and irrelevant links

When designing your checkout page(s), keep the design and the user’s experience interacting with that design at front of mind.

Avoid These Mistakes When Accepting Online Payments

How many of these mistakes is your business making right now?

Fortunately, most of the common online payment mistakes are easy to fix.

Simply put yourself in your customers’ shoes and think about what the checkout experience is like for them. Are they being redirected to a third-party website? Are they being asked to give up more information about themselves than really necessary?

When it comes to the security of the transaction, ask yourself if your website using basic encryption technology is enough to ensure customers can trust you with their sensitive information?

And, of course, consider how much support you’re giving your customers. Be available around the clock to help rectify mistakes (and do your best to avoid letting them happen in the first place).

Use your overall checkout page design to enhance the customer’s experience and make their last interaction with you an impressive one.

Most of these issues can be corrected by working with a payment processor like Regpack that lets you build a custom payment form and checkout page directly on your website.

You’ll have granular control over most aspects of the customer’s checkout process, ensuring you retain their trust and increasing the chances that they’ll be a returning customer in the future.