One of the fastest ways to balloon the revenue of your service business is to offer autopay to your customers.

This small tweak in payment strategy leads to more predictable cash flow, fewer late payments, and better opportunities to upsell current customers.

Let’s go over the five major reasons why autopay helps service businesses increase revenue.

Hopefully, this roundup of benefits will help you determine how important switching to autopay is for your particular service business.

- Ensures a More Predictable Cash Flow

- Minimizes the Number of Late Payments

- Boosts the Number of Initial Sales

- Increases the Customer Lifetime Value

- Provides Opportunities for Upselling

- Conclusion

Ensures a More Predictable Cash Flow

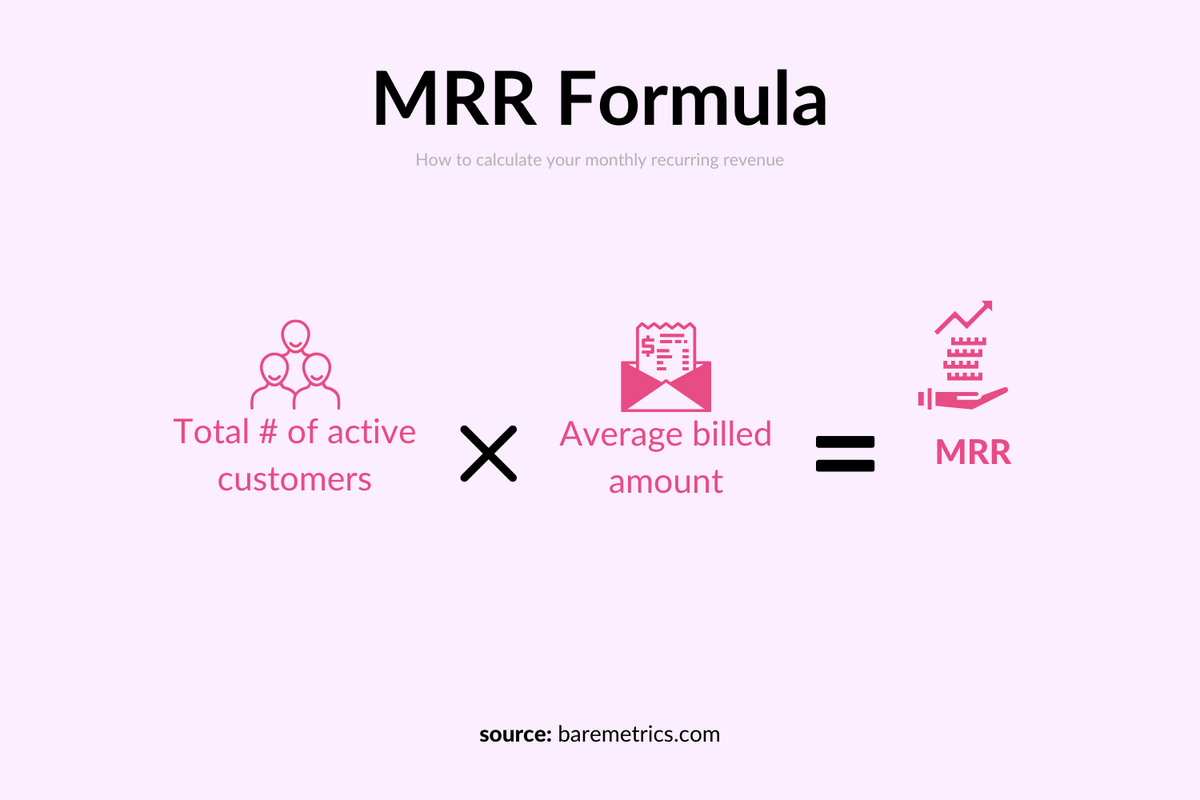

When you collect payments on a recurring basis using autopay, it becomes easier to forecast your business’s cash flow.

If you’re using a subscription model, you’ll be able to calculate MRR, monthly recurring revenue, which will tell you how much your service business will earn each month:

Source: Baremetrics

Regardless of your specific payment model, if you offer autopay and recurring payments, you’ll know exactly when you’ll receive funds from your customers.

For example, let’s say you have 100 customers signed up to pay on the 25th of every month, and that your service costs $50 per month.

If bank transfer time takes around two days, you can predict with a high level of certainty that you’ll have $5,000 entering your account on the 27th of every month.

This predictable cash flow then enables you to better manage your current finances and make more informed decisions about your future growth initiatives.

For example, you’ll be able to foresee and prepare for cash shortages.

If three months down the line is going to be a low-cash month, you can start planning for it early by perhaps cutting current expenses, holding off on technology purchases, and considering financing options.

By preparing for the cash flow shortage before it hits, you prevent it from doing major damage to your business.

You avoid bad situations like lacking the cash to cover payroll or the electricity bill, which can seriously take out small businesses.

In fact, 82% of small businesses fail due to cash flow mismanagement.

Of course, making these predictions is easier with software that tracks your payments.

For a tool that’ll help you predict cash flow, and set up autopay, check out Regpack’s automated billing software.

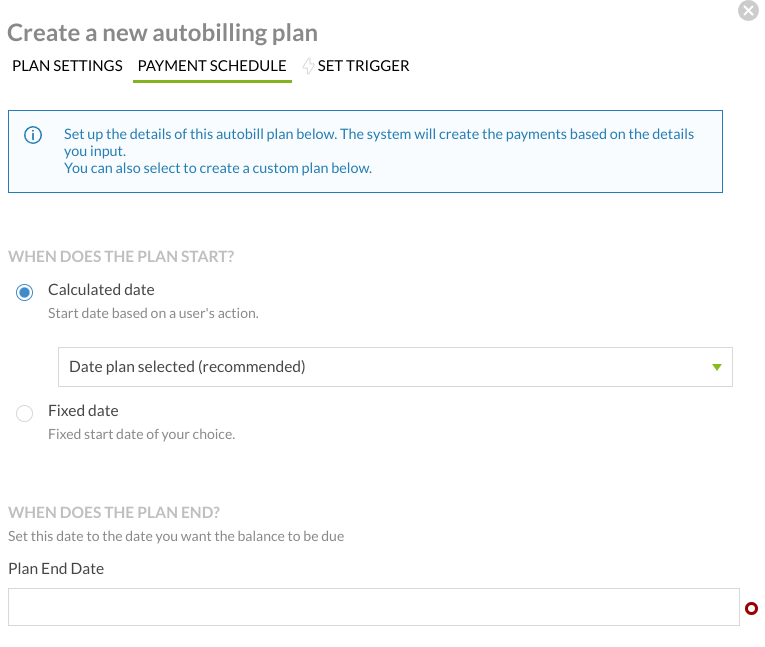

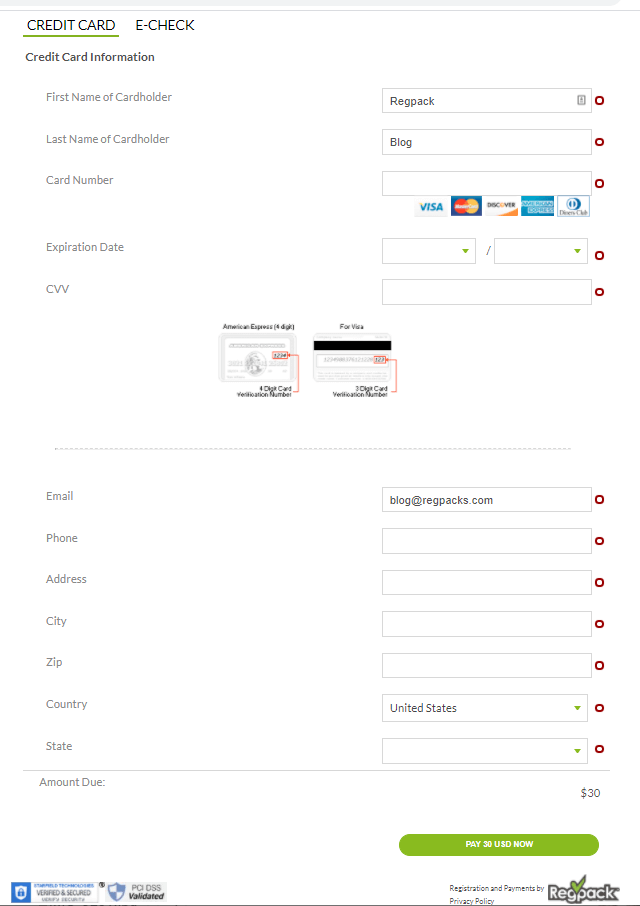

Regpack makes it easy to create and offer auto-billing plans:

Source: Regpack

Regpack also allows you to offer your customers custom payment schedules and multiple online payment methods, from credit card to ACH. Your customers will love this flexibility.

Further, the platform comes with numerous automation features that save you time, such as automated invoices, which will build and email invoices to customers after they’ve been charged.

When you have a tool like this on your side, it becomes easy to manage autopay, predict cash flow, and streamline all the work that goes into payment collection.

Minimizes the Number of Late Payments

If late payments become commonplace, they can seriously hinder the cash flow of your business and your ability to operate effectively.

Moreover, reaching out to a customer about a late payment can be frustrating and time-consuming, especially if they’re hard to reach.

Unfortunately, late payments are all too prevalent in business.

According to The 2022 Late Payments Report, 87% of business leaders state that late payments hurt business growth due to the strain and uncertainty they put on cash flow.

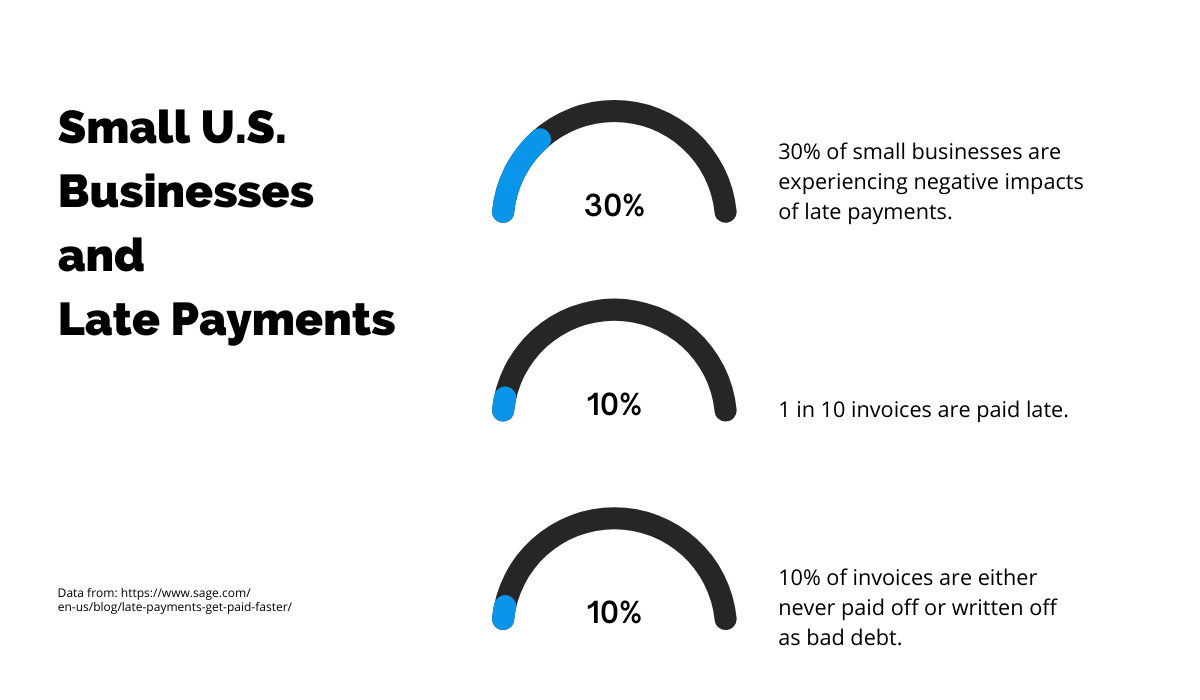

Plus, about 30% of small businesses experience negative impacts of late payments:

Source: Regpack

On the bright side, there’s a simple way to dramatically reduce late payments, and that’s instituting an autopay payment model.

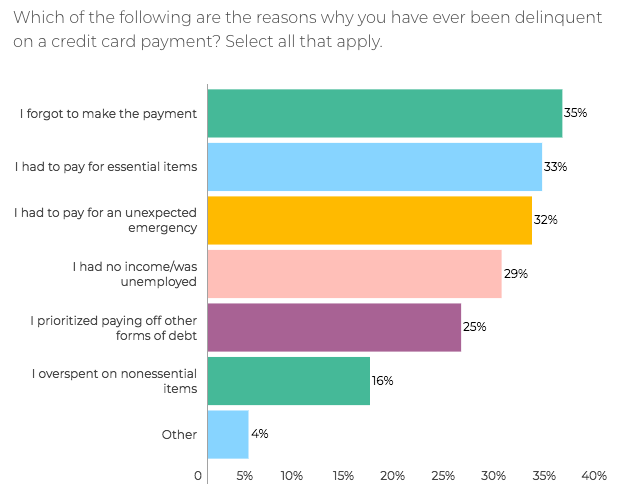

That’s because autopay eliminates the most common cause of late payments—forgetting to make the payment:

Source: NGPF

With autopay, customers only have to submit their payment information once.

From then on, your system will automatically charge them according to a predetermined schedule.

Customers don’t have to lift a finger, or fire a brain neuron, to make their payments.

There may still be late payments that occur due to failed payment methods, like an out-of-use credit card number that the customer forgot to change.

But most automated billing software tools offer features like automatic retries and late payment emails to help reduce the damage of these late payments.

For example, if a customer’s card fails, the system will alert the customer of the issue via email, and automatically retry the card a few days later.

This gives the customer ample time to fix the issue. Usually, that just means switching their card information in your system to reflect their new credit card or bank account info.

Source: Regpack

Another way that these tools prevent late payments is through their email automation feature.

You can create and schedule emails to go out a few days before a card charge or account debit occurs.

This gives customers a heads-up in case they need to make any changes they need to in your system for the transaction to go through.

It’s also just a friendly way to let customers know that you’re going to withdraw money from them.

Overall, autopay is a great way to significantly reduce the number of late payments your business experiences, and lessen the lifetimes of any outstanding late payments.

And this will help you improve cash flow, operations, and revenue.

Boosts the Number of Initial Sales

Charging using recurring billing and autopay can increase sales by lowering the barrier to entry to access your service.

It’s a lot easier to get someone to sign up for a small monthly payment than to fork over a big chunk of cash.

People often have budgets, and a big expense like $5,000 will break it, a financial no-no that many people avoid like the plague.

Managing smaller monthly payments is also typically more manageable for salaried individuals.

For example, if you were trying to sell a summer camp service to a parent, $5,000 spread over five installments is going to be a lot easier for parents to manage.

The reality is that most of these buyers who can’t find a payment option that fits their financial needs will just choose one of your competitors who is more flexible.

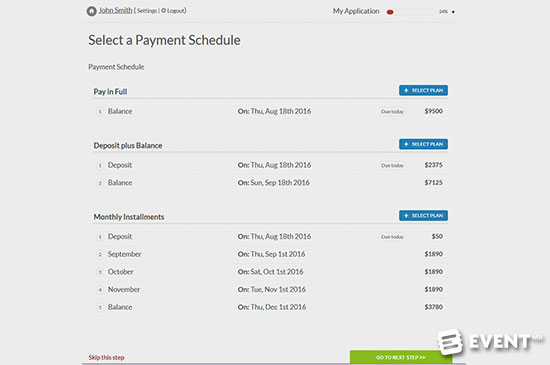

To improve your pricing flexibility and win more customers, consider using billing software that allows you to offer a variety of autoplay plans.

Buyers can select the schedule that most aligns with their needs.

For example, Regpack enables you to extend multiple auto-billing schedules to buyers:

Source: Regpack

In this case, customers can choose between paying in full, paying a large deposit then a smaller balance, or paying monthly installments.

If the customer doesn’t like any of the payment schedules you’ve set up in the system, the two of you could collaborate to come up with a new custom schedule that works for both of you.

Alongside winning new customers with ease, offering multiple autopay options also helps you keep customers for the long term.

That’s because they’ll never think of your business as a burden to their financial or mental health. They’ll remain satisfied with your service.

In sum, using autopay and monthly billing makes your service more accessible to your potential buyers, and this indirectly improves your revenue numbers via increasing sales.

Increases the Customer Lifetime Value

Customers want convenience. They want to be able to pay online for their services, or, better yet, not have to worry about paying at all.

Convenience is a big factor in many people’s purchasing decisions.

Source: Smart Insights

And this convenience is exactly what autopay gives your customers.

Aside from the initial submission of payment details, which is a breeze with online forms, customers don’t have to do any work to pay for your ongoing service.

Their preferred payment method is automatically charged on a recurring basis, and they’re only called into action in the rare case that the payment fails.

Autopay also alleviates any stress regarding paying on time. Customers never have to worry about being late on a payment and losing their service.

They never have to imagine how angry their family is going to be with them for forgetting to pay for the services they rely on.

Customers also don’t have to spend precarious time creating reminders or marking their calendars with payment due dates.

Who wants to look at a calendar on their kitchen wall that’s covered with service payment deadlines? It’d be a bit depressing.

As a result of this increased convenience, customers become more loyal to your service. They feel no agitation with your payment model, and are more likely to stick around.

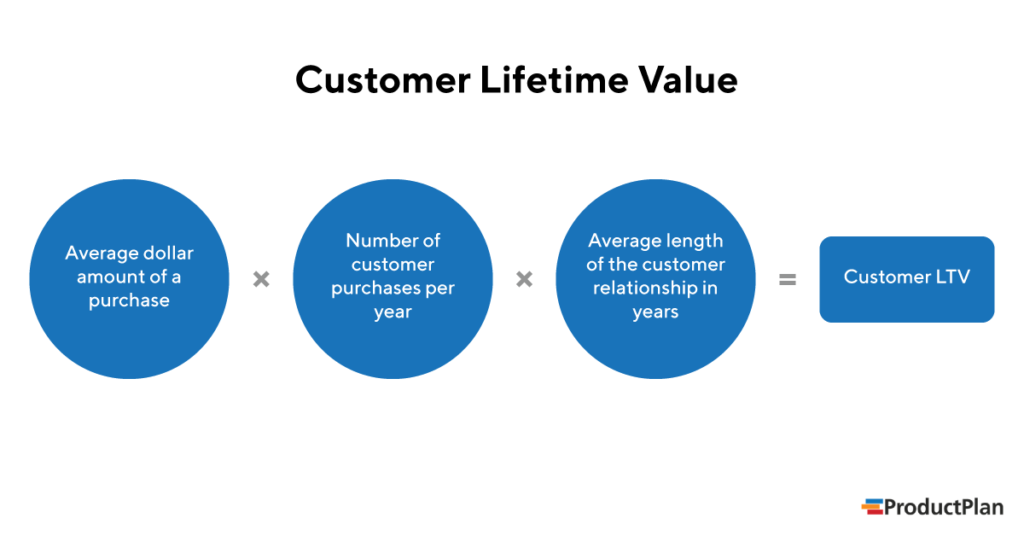

And, as a result, your customer lifetime value (CLV) will increase:

Source: Product Plan

CLV is the amount of money you expect to earn from the average customer over the course of their relationship with your business. If this metric goes up, so does your overall revenue.

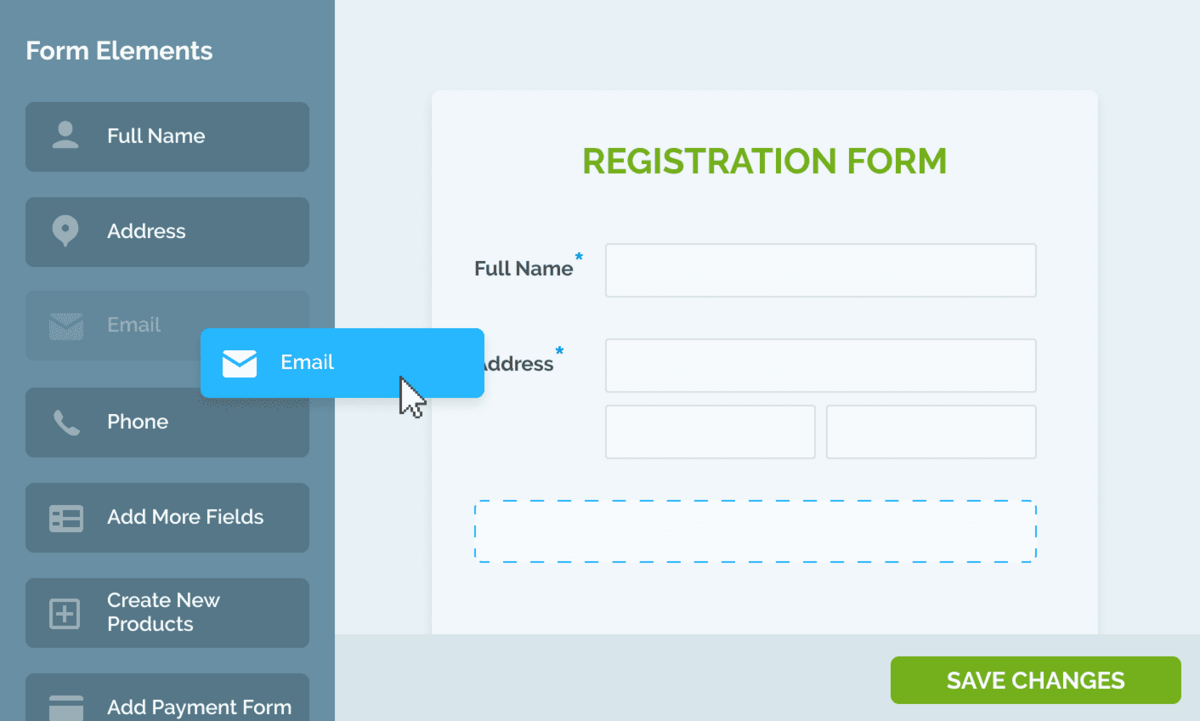

There are other ways to increase your CLV that relate to autopay.

For example, one method is to make onboarding painless. In most cases, autopay software comes with features that you streamline onboarding for your buyers.

For example, many of these autopay tools empower you to build and embed online payment forms that make payment set up a short 2-minute procedure:

Source: Regpack

Further, recurring billing tools offer other features that help you please and build relationships with customers, like user portals or automated payment alert emails.

In sum, autopay results in greater convenience for your customers, which makes them more likely to stick with your service for the long haul.

Provides Opportunities for Upselling

Autopay allows you to build long-lasting relationships with your customers. Buyers come to see your service as an essential part of their lives, one they can’t live without.

And when your customers view your service in this favorable light, they’re more receptive to upsells.

Source: Oberlo

Because you’ve provided them with value for so long, they have faith in your business and are willing to take the risk of buying a higher-priced service or package from you.

For a simplistic example, imagine a marketing agency that has been creating four social media posts per month for a client for a year.

After a successful year, they could host a call with that client and ask them if they’d be interested in increasing the number to eight per month.

Many software companies also use upselling as a major part of their sales strategy.

They divide their subscription service into a few tiers, each costing a different price, and attempt to get customers to gradually move up the tiers until they’re paying for the most comprehensive one.

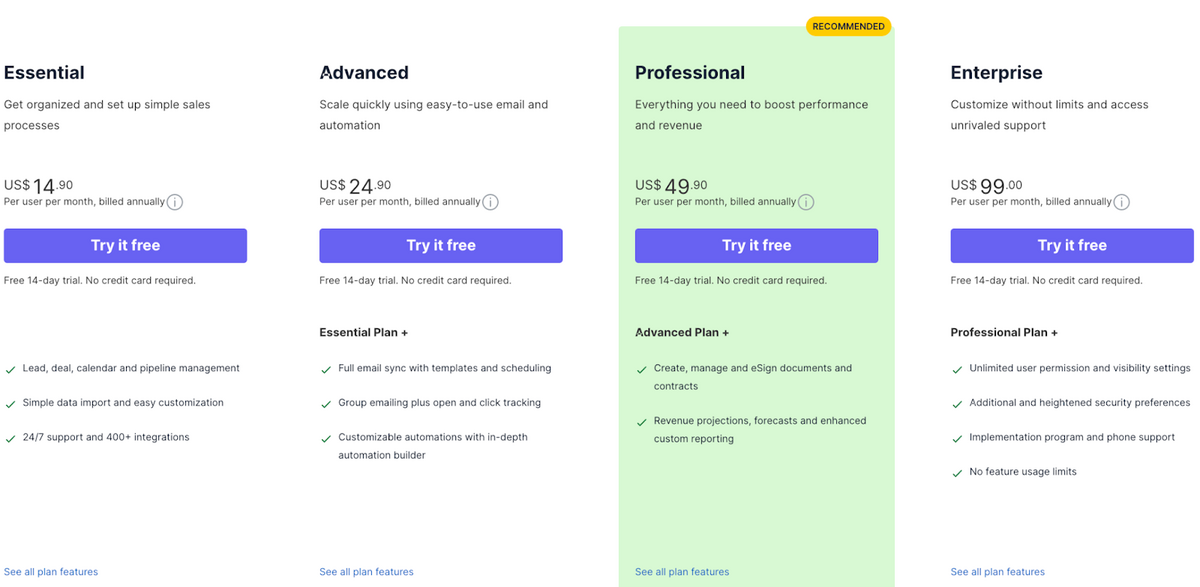

For example, here are Pipdrive’s four different plans:

Source: Pipedrive

One of the best ways to ensure that your long-term customers are warmed up for upsells is to consistently interact with them through email marketing campaigns.

In most of the emails, you can share helpful tips relating to the area of life or work that your business focuses on.

For example, a wine bottle subscription service might send emails that teach customers about wine tasting.

Then, every once in a while, send an email that highlights a feature of the higher-tier service. This will get them thinking about upgrading.

They might even initiate the conversation on their own. If not, when you ask them, they’ll be more likely to entertain the idea if they’ve already seen how great some of its features are.

Even if you aren’t sending emails to your customers, just the act of charging them and providing them with service over the long run will instill in them trust for your brand.

And with that trust comes a higher chance that they’ll pay for more of your services.

Conclusion

Autopay boosts service business revenue in many ways.

It gives you more opportunities to upsell, reduces late payments, and increases your sales numbers and lifetime customer value.

If you’re looking to learn more about recurring payments before making the switch, check out our article on the pros and cons of recurring payments, where we help you judge whether it’s the right option for your business.