It’s crucial in today’s online world that small businesses have the ability to accept payments online and bill clients from their website.

This is crucial not just to keep up with other businesses, but to streamline your processes and automate when you can to save time.

Reasons why you should be collecting payments on your website

- You’ll get paid efficiently

- Boost sales by offering a variety of different payment methods to customers

- Make it easy for your customers to pay you on time!

- Offering online payment methods will increase your cash flow

- Offering payments on your website creates a positive customer experience

- Provide flexibility to clients with scheduled payments and payment plans, including deposits

- Manage refunds electronically, including for cancellations

Jump to a Section

Why does my small business need to accept online credit card payments?

Which payment method is right for my small business?

Accepting credit card payments online

How These Businesses Are Using Regpack to Accept Credit Cards Online

Accepting Payments Online with Regpack

How do small businesses accept payments?

There are a number of ways to accept payments for your business online:

- Credit cards

- Cash

- Check

- eCheck /ACH

- Pay apps like Apple Pay, etc

Where you will save time and increase sales is by allowing customers to complete their own transactions. This is crucial to support your business in scaling.

Automating payment collection will free you and your team up for other business tasks.

If you require in-person credit card processing, you’ll want to ask if a card reader is available so you can collect payments in person when you need.

Mobile credit card payments are also crucial, so you’ll want to ensure your software is mobile friendly to make collecting payments easy. This should be a basic functionality of any online payment software.

How to accept credit card payments

The first step is finding a software and/or a payment processor. Oftentimes you will have other needs beyond just the straight payment processing, in which case you’ll want to find an online payments software that provides reporting, data collection, and email tools for the full package.

All of your payment software options will integrate the payment processor directly, to make it easy!

You’ll set up a merchant account, and then utilize the software to allow customers to view options to order on your website, and then checkout using your software’s interface to process the payment.

Ideally, and based on the programs or services you are selling, you’ll be able to include payment plans, offer deposits, and have comprehensive payment reporting.

Why does my small business need to accept online credit card payments?

Improve client experience through self-service payments and Scale up

In order to scale, you need to automate your processes, starting with collecting payments online and from your website.

24 hour storefront

The ability to be open 24/7 helps to facilitate your growth. It’s not only key to be open 24/7 but to make the process to pay easy, from any device.

No longer limited to local customers

When you allow for payments from your website, you can work with anyone, anywhere.

Especially in todays virtual event world, you are now marketing to a greater audience, so the ability to collect payments online is really the only way to do business with your new market.

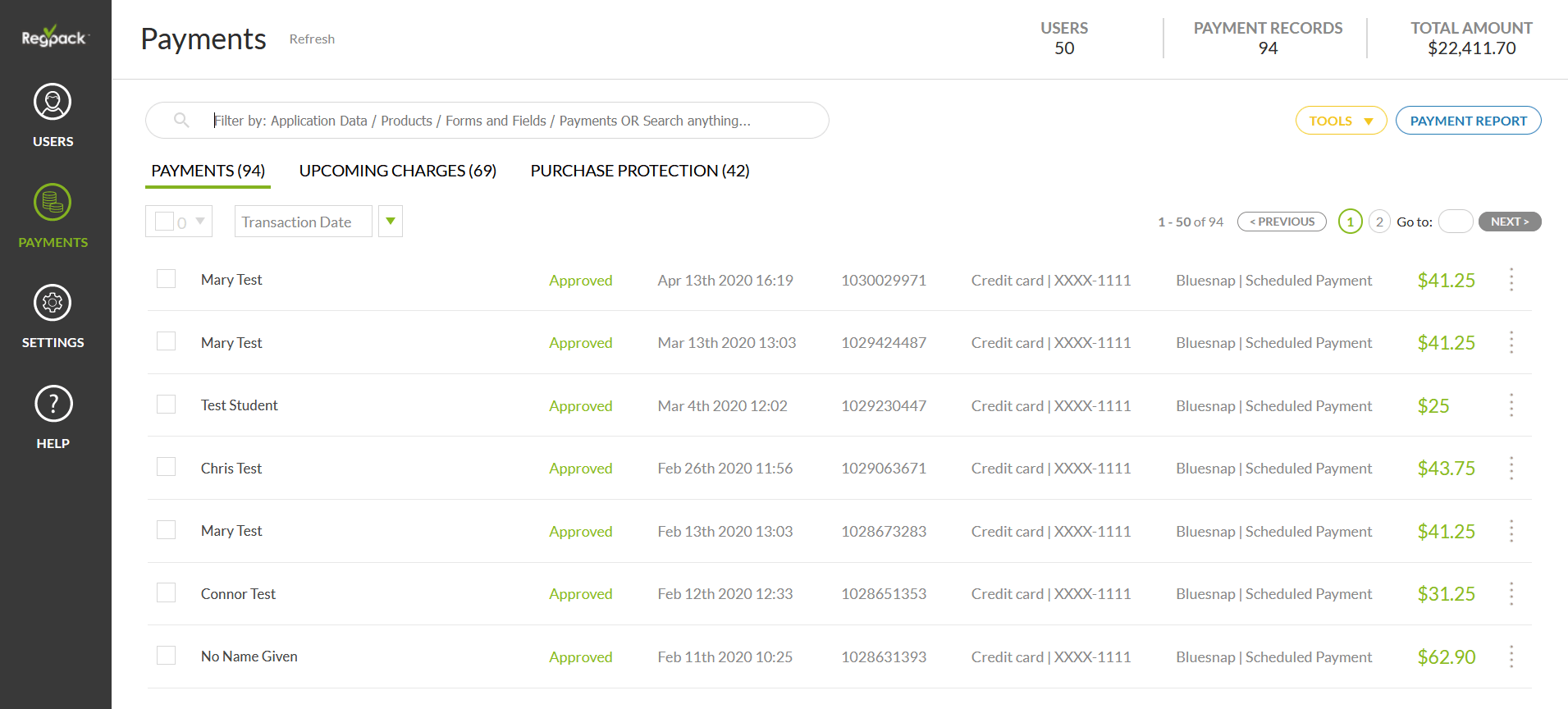

Smarter Payment Reporting

The software you use for online payments should offer robust sales reports.

These reports should show you transaction details that include:

- Date of transaction

- Payment status

- Processor transaction ID

- Fees paid to processor

- Product Allocation

- Client details like name, email, zip of payee

- Check details like bank, date, and check number

This information is crucial to pass through to your accounting app to reconcile accounts receivables and have a clear picture of where your income is coming from – which services have the highest revenue, etc.

A good data filtering tool will make generating these statistics and insights easy.

Improve security

Ensure the software you use is PCI compliant and clearly states their payment and data security.

One huge benefit to using a software that bridges the gap between the processor themselves and the interface you will use to collect payments, is that the security concerns are covered by the company – meaning you don’t have to do anything to amp up security on your website or go through the hoops to become PCI compliant.

PCI compliance is crucial to process payments securely on your website and provides security and peace of mind to your customers paying you.

Which payment method is right for my small business?

You should ask yourself the following questions when deciding how to accept payment

What are different types of payment methods?

When looking for a good payment processor, keep in mind the following things:

- You’ll want a processor that will process a variety of payment methods including eChecks/ACH, credit cards, debit cards, rewards cards

- You want to have the clarity of fees to process each payment type, as some are more expensive than others – a flat processing fee can often lead to you over paying on processing fees when you don’t have to

- Have transparent fees as well as options on how to structure your fees to match your business needs. So if you know you receive mostly debit cards or mostly ACH transfers, you can structure your rates to be optimal for these transaction types

How many transactions do I expect to do a month?

You won’t always know the answer to this question but can form a baseline from past sales.

It’s CRUCIAL to understand the payment types you expect to receive and/or would like to accept.

You can accept:

- ACH / eChecks (Electronic Checks)

- Credit Cards

- Reward Credit Cards / Amex

- Debit Cards

All of these payment types have different processing fees (rewards cards being the most expensive and ACH being the least expensive).

If you’re looking for an all around software, consider Regpack as an option. We offer a comprehensive database to manage customer information, offering selections, payment plans, and payment reporting.

Find a company that provides different fees, or a blended rate, for all or some of these payment options. A software that can also default to your preferred payment method, functionality to pass some or all of those fees to your customers, and can calculate the best pricing based on your individual business, is key.

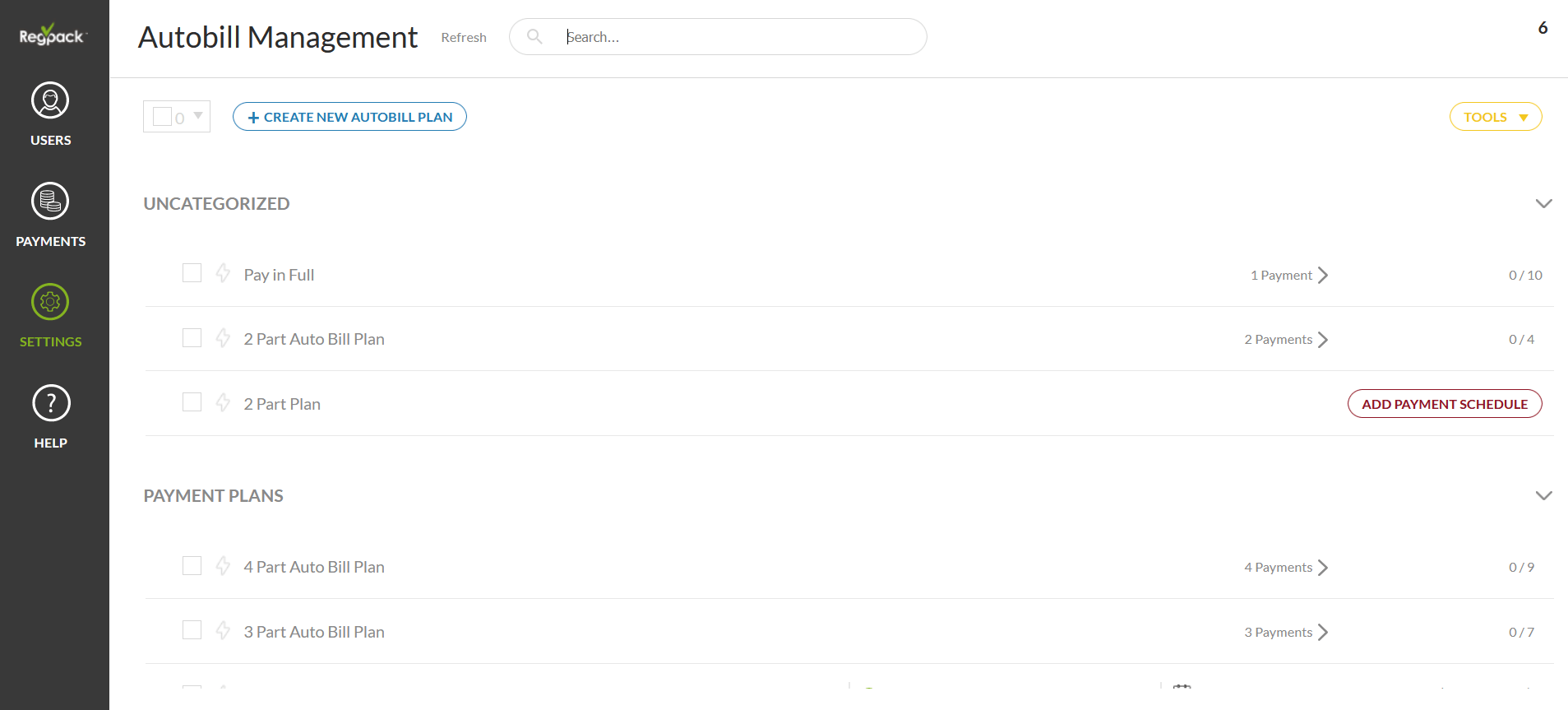

Do I need recurring or monthly billing options?

Not always, but customizing payment plans for customers will increase your payment rate and provides additional options for clients.

Custom billing plans will break up the total payment owed in equal payments on a schedule you set – weekly, monthly, in 6 payments – whatever you want! A good software will offer the flexibility for you to set these parameters.

What fee structure makes the most sense for me?

Processing fees can be paid by either you or you can pass on that expense to your customer, either through a price increase or a line item when they check out. Learn more in this in-depth article about whether to pass on fees to your customers and what best practice is for your industry.

How much customer support will I need?

Hopefully not so much! Software is meant to automate your process and save you time, not replace the time you spent collecting payments manually sitting on the phone troubleshooting payment issues with the Support team.

You do want a company that offers support and the ability to help resolve issues if they arise quickly.

Accepting credit card payments online

Accepting credit cards will be, likely, THE most important way that you accept payments online.

What do you need to keep in mind? For one thing, credit card processing for small businesses can seem expensive. However when you take into consideration the amount of time and salary you pay someone to manually collect and record manual payments (like checks, etc), it’s worth the increase cost of processing fees.

How do I get started accepting payments online?

Simple…

You set up a merchant account and when customers pay, you are charged a processing fee and the net amount is deposited into your bank account on a schedule you decide on (daily, weekly, monthly).

That’s it!

It can take anywhere from a few hours to a few business days to get your merchant account up and running.

Ensure whatever software you choose provides reporting on your transaction fees so you can account properly.

Choosing an online payments platform

You’ll get more bang for your buck using a payment platform that integrates with a payment processor.

A platform will do all the heavy lifting in terms of PCI compliance, a nice interface to collect customer information and the tools you need to create payment plans, invoice emails, etc.

Platforms will generally also help you to facilitate the onboarding process for your merchant account and provide more customized payment reporting.

Do you have a merchant account, or do you need to set one up?

Setting up a merchant account is easy, especially when your payment platform does the hard work for you.

It generally takes 2 hours – 5 business days to setup a merchant account, depending on the processor and the information you need to provide (time on your end to compile the information).

Can I use PayPal for my small business?

Definitely! The downside to PayPal is it is JUST payments. So you would have to build out the functionality on your website to offer, display, and redirect to PayPal for payments.

You will also have to reconcile payments coming in through PayPal with your orders, which can be time consuming and takes some of the automation out of things.

For example, if you have a student register for an online course you are running, they would be directed to PayPal to make payment. Now you have a registration from your website + a line item for a specific amount from an email address on PayPal you have to tie together.

This is the same challenge when using Google Forms and a separate payment solution.

What is the best online payment system for a small business?

If you’re looking for an all around software, check out this option. They offer a comprehensive database to manage customer information, offering selections, payment plans, and payment reporting.

Online payments through your website

The process to get to your checkout form should be customizable and easy!

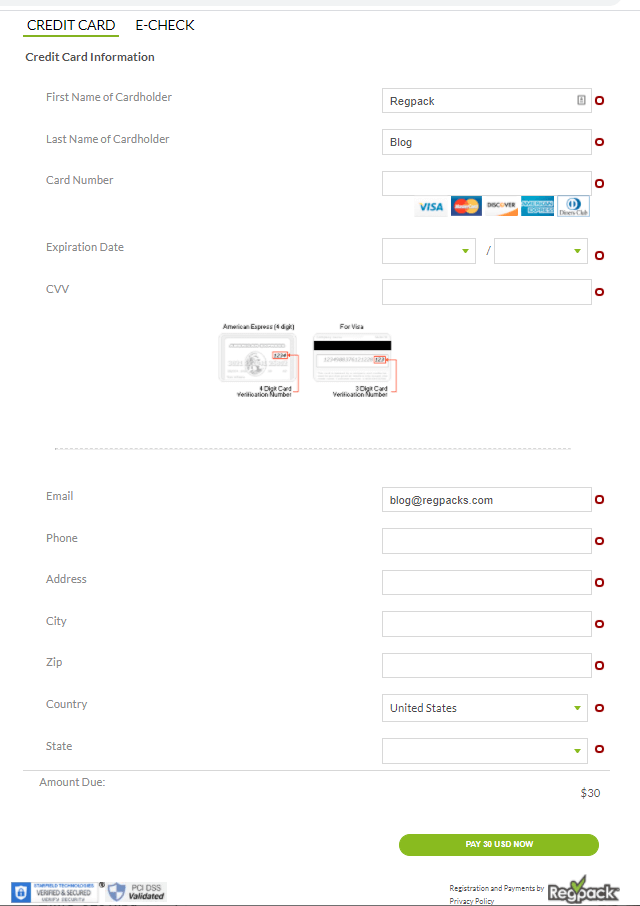

You can see in the example below, options include multiple credit cards, as well as E-Check.

The form is easy to understand and complete, shows the security and PCI compliance at the bottom to assure shoppers it’s safe to pay, and will auto generate a payment invoice once processed.

All of that information will be available in the software to view and manage.

Customized buying processes based on customer needs

The real key behind accepting payments online efficiently is creating customized pathways for customers to pay that take the manual work off your plate.

This includes automated discounts based on the customer’s selections and/or codes entered, automatic payment plans that charge the saved payment method on file according to the schedule they select, and presenting the right products, services, and offerings that match their search and/or parameters (like age, location, etc)

Ensure your payment platform can create this customization for you.

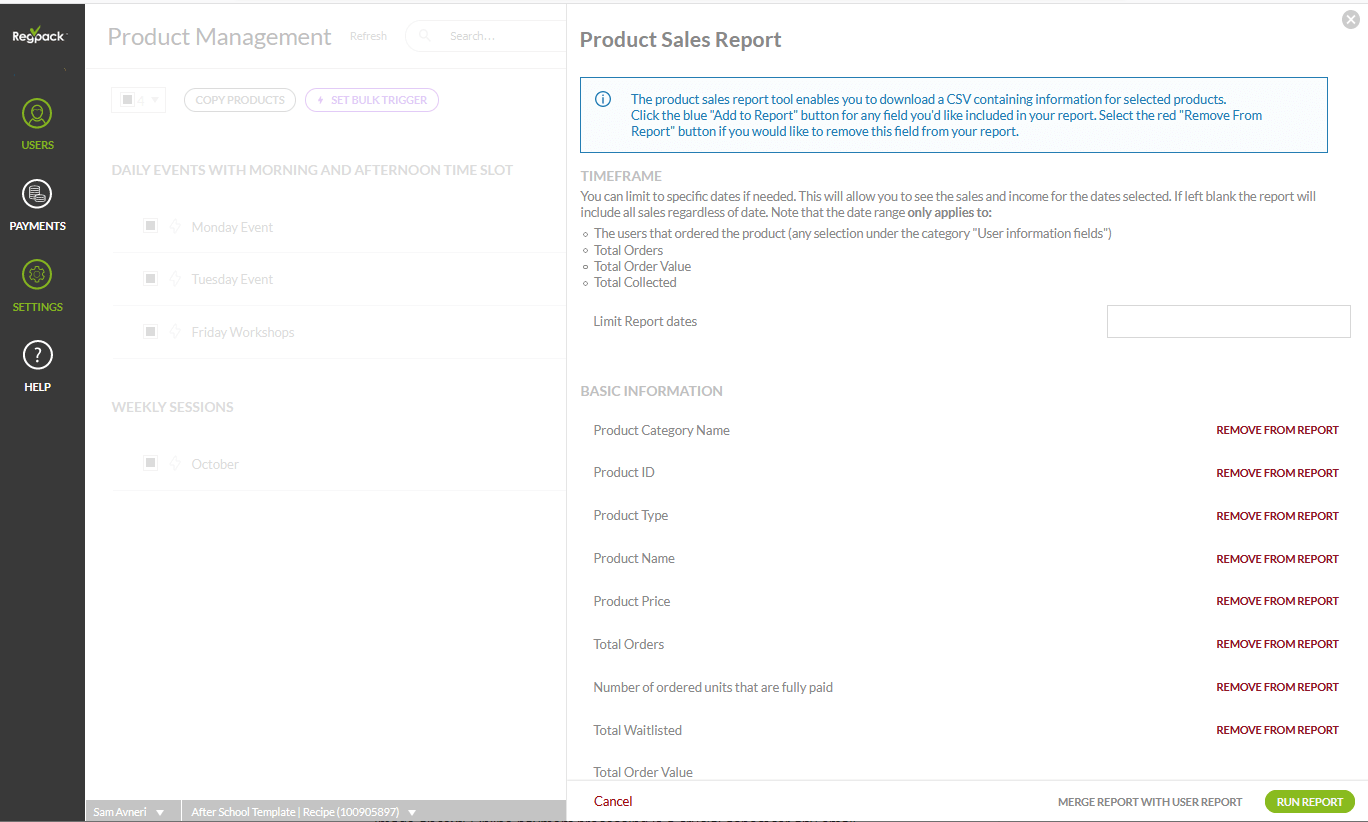

Custom reporting on your online sales

It’s important for your accounting team to have an accurate reporting of payments and sales.

Reports should include transaction data that is useful, payment types, and other reporting by dates that makes reconciling your sales and profits easier.

Payment reporting should also provide data pushed in that gives you a full picture of your business, including product specific payments data, and the option to merge with user data to gain valuable insights you might otherwise miss with 2 separate systems (data and payments).

How These Businesses Are Using Regpack to Accept Credit Cards Online

Many small businesses are using Regpack, an online registration software, to register, charge, and manage their customers. Regpack embeds on your website, so you can easily and quickly collect payments on your own website.

Goodwill

Goodwill uses Regpack for their internal training programs, including their Senior Leadership, Executive Development and Manager Development programs as well as manage payments for their event and conferences. Read more here.

Harvard Medical School

They have been using Regpack for their high school program registration for 4+ years!

The annual program is a weekly long intensive program for high school students. The students become CPR certified and are able to participate in medical simulations, learn clinical skills and meet medical practitioners and more!

They use Regpack both to register students as well as manage the teacher recommendations that come in. We link their two projects with an API so every student’s file is complete! Read more here.

Accepting Payments Online with Regpack

Regpack helps to automate the process of collecting payments online.

Regpack provides all the tools you need to securely collect and manage payments for your business, on your website.

Features include:

- Custom Payment Plans

- Payment Reporting

- Data filtering

- Payment forms

- Embeddable on your website

- Payment method controls and prioritization

- Taxes and Service Fee Settings

- Blended and fixed rate options

- Custom form builder

- Data and customer management tools

- Payment invoices via email

- Email marketing and communication tools

Online Payment Resources for Small Businesses

Should you pass on processing fees to your customers?

5 Reasons to Automate Online Payments

Why you should offer eChecks as a Payment Method