So you’ve heard that B2B ACH payments are convenient, secure, and cost-effective—and now want to set them up?

Well, you’ve come to the right place.

Today we’ll give you a quick and straightforward tutorial on how to set up ACH payments for your business using payment processing software.

You’ll learn about choosing the right payment software, agreeing to the terms, setting up your merchant account, and onboarding clients.

Let’s get to it.

- Select a Payment Processing Software

- Agree to the Terms and Conditions

- Set Up Your Merchant Account

- Begin Onboarding Your Clients

- Conclusion

Select a Payment Processing Software

First, find a payment processing software that will help you securely collect ACH payments from customers on your website.

These platforms walk you through the process of setting up ACH payments, and give you the necessary tools and accounts to do so.

Below are some of the 8 key features to look for in a payment processing tool:

| Secure payment processing | The tool should be PCI-compliant and use security practices like tokenization or two-factor authentication to keep financial data safe. |

| Multi-currency processing | This allows customers to pay using their local currency while you receive it in yours, without hidden fees. |

| Mobile payments | Many B2B buyers use their phones to make payments, so you should offer this ability through mobile-adaptive payment forms and checkout. |

| Auto-billing | Enables customers to sign up for recurring payments and to be automatically charged at agreed-upon due dates. |

Regpack is a B2B payment processing software that comes with the above features and others designed to make accepting ACH payments—as well as other payment methods like credit cards—extremely simple for your business.

The platform also allows you to do things like create and offer personalized payment plans to your customers, which can help you close more sales.

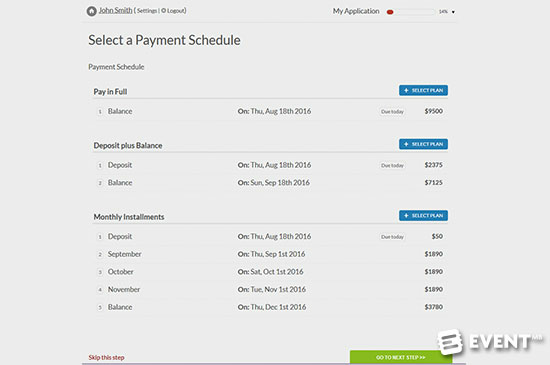

For example, below, you can see three different ways to pay at check out:

Source: Regpack

Regpack also offers a lot of automation features, like automated electronic invoicing, which will automatically create and send an invoice to a customer after they’ve made their payment.

This way, your team can focus on more interesting projects that impact the bottom line, instead of drafting invoices.

Do your due diligence before committing. Attend demos and ask questions. This is a decision you want to get correct.

The right payment processing software will help you avoid payment risk, simplify payment collection, and enhance the buying experience.

The wrong one will mostly just cause headaches.

To become more educated on the payments landscape, consider reading our guide on B2B payment companies and trends.

Agree to the Terms and Conditions

Once you’ve chosen the software, you’ll input a lot of business details, like your bank’s routing number and account number, to set up your account.

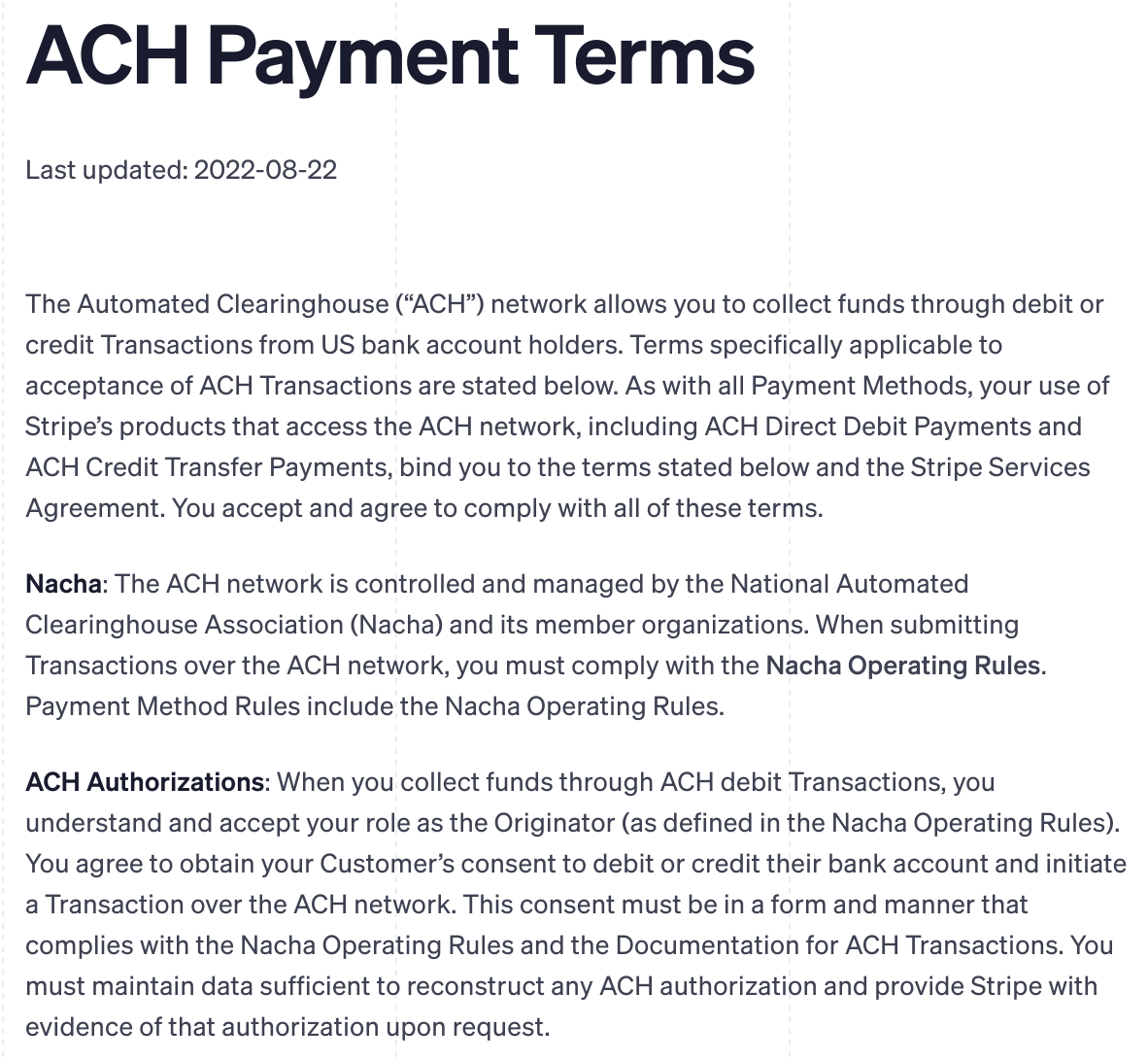

Regardless of which software you choose, during the setup process, you’ll encounter ACH terms and conditions that you should read and, if you see no issues with them, agree to by checking the related box.

Terms may cover the finer details of bank account verification, ACH returns, ACH authorizations, and more.

For example, here are some of Stripe’s terms for using their ACH payments:

Source: Stripe

Have your legal and billing team read over these terms before you agree so that you know exactly what you’re signing up for.

Usually, it’ll be pretty standard stuff, but one should always be safe when it comes to signing agreements with companies.

Set Up Your Merchant Account

A merchant account is necessary to process credit card and other online payments. It’s essentially a holding place for payment funds.

After the customer makes a deposit, the money is held there before going to your business bank account.

Setting one up is easy with the right payment processing tool. The software will prompt the application process during onboarding.

It’ll walk you through each step and tell you what information you need to provide in its online merchant account application.

Commonly required information for a merchant account includes social security number, bank account details, company address and website, contact details, and necessary supporting documentation.

If you already have an account, the software will help you connect the two so that payments flow seamlessly between them.

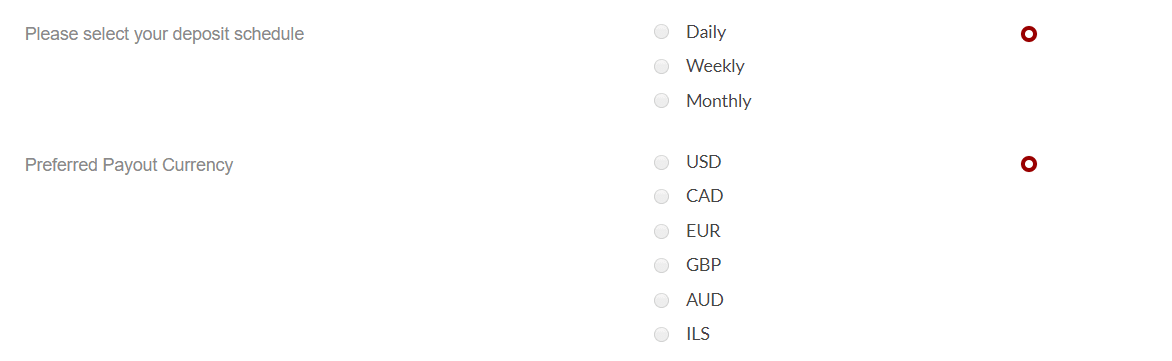

During the setup process, most tools will ask you to select your preferred deposit schedule and payout currency:

Source: Regpack

Once your merchant account is approved, you’ll receive a notification telling you that you can now start collecting online payments through the payment processing software.

If it’s rejected, the software company should tell you why. And it should specify which supporting documents are necessary to move it into the green.

Begin Onboarding Your Clients

Now that you’re all set up, start telling your clients about the option to pay with ACH.

For starters, include messaging about ACH payments at checkout so that they know it’s an option, even if they haven’t spoken with you directly about payments.

If you want a majority of your customers to use this method over others, call your buyers individually and ask them if they’d be open to paying with this method.

Be sure to explain the benefits of it, like how it’s fast, secure, and convenient for everyone involved.

Also, if a customer ever reaches out to you about a payment error, use that as an opportunity to pitch ACH payments as a more reliable option.

When customers agree to use ACH—which will happen often since it’s so convenient—you’ll need to give them instructions on how to do it. Make these clear and exact, and put them on the invoice.

Your payment processing software might also offer automated customer onboarding, which will walk them through the process of setting up ACH payments with your business.

Conclusion

ACH payments are one of many online B2B payment methods to offer to your customers. With the proper payment software, they’re quick, secure, and easy for your buyers.

That said, businesses should aim for a diversified approach to payments.

While some buyers might like ACH transfers, others might want to pay using a credit card or PayPal. Giving flexibility will help you win and retain customers.

To learn about the different payment options you might want to offer, check out this article on the major B2B payment methods.