Invoicing is a crucial part of any B2B (business-to-business) transaction. When done well, it fosters positive client relationships and continued business growth.

But complex payments and billing requirements make B2B invoicing challenging. That’s why it’s important to streamline the process through electronic invoicing.

In this article, we’ll explain the benefits e-invoicing offers for your business. We’ll also walk you through creating and sending B2B invoices.

- What Is B2B Invoicing?

- Is Electronic Invoicing Mandatory for B2B?

- Why Should You Send B2B Invoices Electronically?

- How Should You Structure Your B2B Invoices?

- When Should You Send B2B Invoices?

- How Can You Avoid Chasing Invoice Payments?

- The Future of B2B Invoicing

What Is B2B Invoicing?

B2B invoicing involves one business sending an invoice to another business to request payment for a product or service.

The business sending the invoice is known as the supplier, while the business receiving it is known as the client or buyer.

The supplier provides a product or service to the client, who then uses what they have purchased to provide a different product or service to consumers.

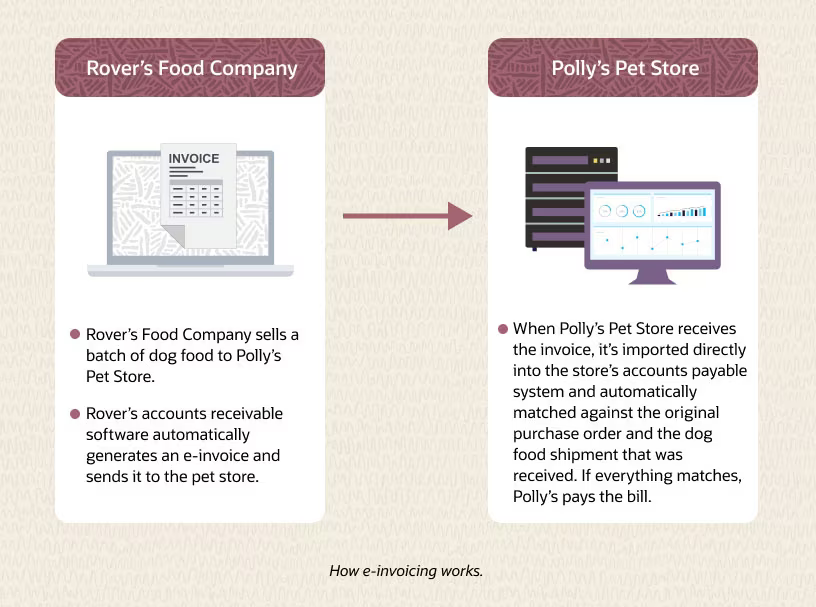

Here’s an example of how the process works:

Source: NetSuite

In this example, Rover’s Food Company is the supplier and Polly’s Pet Store is the client or buyer. Rover’s sends an invoice to Polly’s for a batch of dog food. Then, Polly’s pays the bill.

B2B transactions are often high-value and recurring. It’s important for invoices to be correct because both money and long-term client relationships are on the line.

Is Electronic Invoicing Mandatory for B2B?

Before the internet, businesses used expensive and time-consuming paper invoicing systems. They mailed or hand-delivered invoices, and clients paid with cash or check.

The current B2B payment trend is to use electronic invoicing (or e-invoicing) which is cheaper, faster, and easier for everyone.

Electronic invoicing also helps ensure accurate records for tax purposes.

For example, since Mexico made e-invoicing mandatory, the country has seen a 48% increase in tax revenue.

That’s why electronic invoicing in B2B transactions is mandatory in many countries, including Australia, the United Kingdom, and several other European countries.

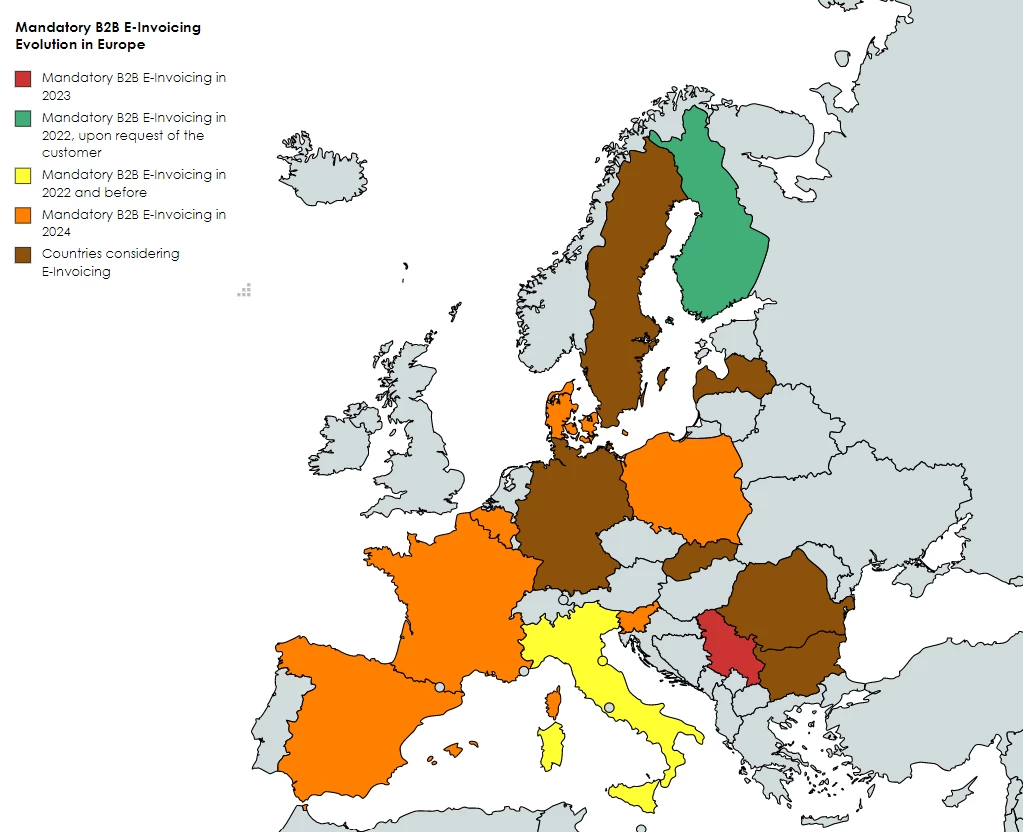

For a more comprehensive list, take a look at this map of the history of mandatory B2B e-invoicing in Europe:

Source: VAT Update

As you can see, the list of countries with mandatory e-invoicing grows every year.

However, B2B electronic invoicing is not yet mandatory at the federal or state level in the United States.

Why Should You Send B2B Invoices Electronically?

There are several reasons to use e-invoicing instead of paper bills. We’ll take a look at a few below.

Faster payments

Electronic invoicing is smooth and efficient. E-invoicing software creates invoices automatically and sends them to clients in a matter of seconds. Clients then pay electronically.

Market Business News explains how different this process is for businesses that rely on paper invoicing:

Sending paper-based B2B invoices requires you to manually create invoices, send them out, and then wait at least 30 days for the check to arrive. Additionally, you’ll need to deposit the check and wait for the money to show in your account. That is a slow cycle for payments!

Manual invoicing is a clunky system—while e-invoicing is simple and streamlined.

Enhanced accuracy

As we’ve mentioned, B2B transactions are complex—and so are their invoices. There’s a lot of room for human error in a complex system.

On the other hand, e-invoicing software totals the amount clients owe, tracks the status of payments, and keeps transaction records automatically.

The fewer papers and numbers you have to juggle manually, the more accurate and reliable your invoices will be.

Fewer unsuccessful payments

Electronic invoicing software also verifies clients’ payment information and warns them if their bank declines their payment.

That means you as the seller face fewer unsuccessful payments. Instead, clients fix payment problems on their end without your involvement.

Less back and forth with the client frees you up to spend your time on more important tasks.

Client convenience

Last, electronic invoicing is more convenient for clients because it lets them use the payment method they prefer.

They can also access invoices and payment receipts online. Clients appreciate having less paperwork to juggle just as much as you do!

Because B2B transactions often occur repeatedly between the same businesses, providing convenience to your clients is important.

Ensuring their satisfaction helps ensure your future growth as a company.

Sum Up adds to this idea:

When you’re operating with B2B sales, the relationship that is established between your business and another is an important one that should be fostered, even if the sale will be a one-off. This interaction can have an impact on the success of a particular sale, but also on the reputation of your business in the industry.

By giving your clients what they want, you’re helping both them and yourself.

How Should You Structure Your B2B Invoices?

Having the correct invoice structure ensures accurate and timely client payments. Invoices are also legal documents, so it’s important to get them right.

That being said, there isn’t one right way to structure an electronic B2B invoice. What’s important is that they have a few key pieces of information:

- Your company’s name and mailing address

- Your client’s name and contact information

- A unique invoice number

- Invoice generation date

- Payment due date

- Tax on the payment

- List of products or services provided

- Total cost

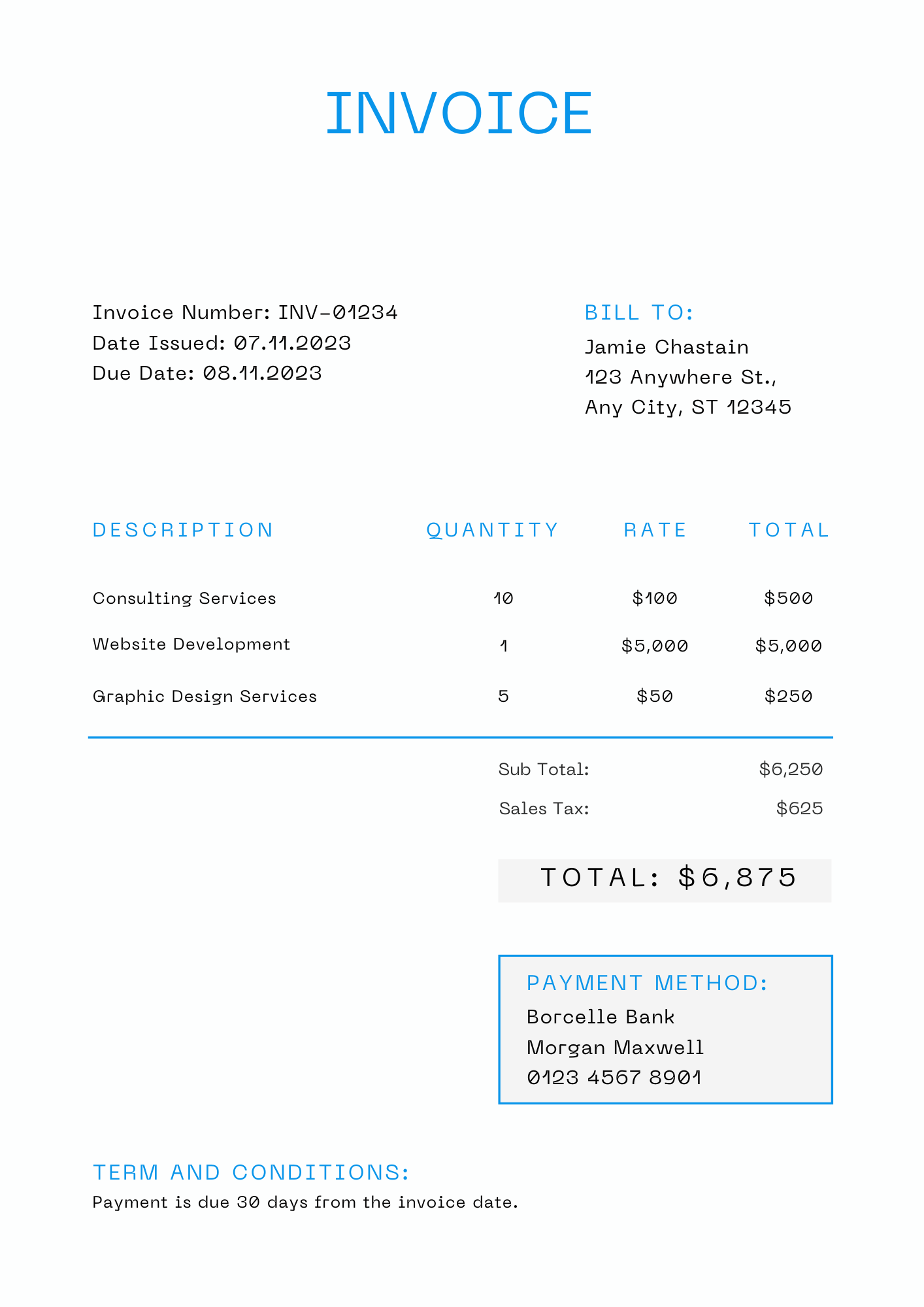

Don’t try to reinvent the wheel here; instead, use an invoice template like this one:

Source: Regpack

This template has an itemized list of services rendered and amounts owed. It also includes the payment due date and a payment method.

A well-structured B2B invoice is the first step toward consistent, timely client payments.

Clear, unambiguous invoices that contain the necessary information to facilitate prompt payment greatly reduce the risk of late or missed payments.

Your SMEs can benefit from this by protecting their margins and preventing cash flow issues.

You can’t control what your clients do—but you can do your part to make payments effortless for them.

When Should You Send B2B Invoices?

The sooner you send the invoice, the more likely it is that clients will pay you on time.

Ideally, invoices should be sent immediately after a sale is made. Doing so gives the client an opportunity to pay you as soon as they receive the invoice.

If you postpone sending the invoice for a few days or even weeks, any delay on the client’s side is likely to result in receiving a late payment.

Of course, a delayed client payment doesn’t necessarily mean the client is dragging their feet.

The complexity of B2B transactions means clients often need time to funnel the invoice through their billing department.

It’s important to leave yourself plenty of buffer room between when you send an invoice and when you actually need the money.

How Can You Avoid Chasing Invoice Payments?

There are several things you can do to avoid chasing down client payments, including:

Give clients more payment options

First, let clients use their preferred payment method—such as electronic check, credit, debit, etc.

The easiest way to do that is by using payment processing software, which handles the logistics of online payments so you don’t have to.

For example, Regpack’s payment processing and invoicing software lets clients use ACH, credit, debit, and more.

Clients can pay directly on your website, which is preferable to paying on a third-party site.

Regpack is also PCI-compliant, so neither you nor your clients need to worry about security during the payment process.

Clients are more likely to pay invoices on time when they can safely do it their way.

Set up recurring billing

Another way to encourage clients to pay on time is to set up automatic recurring billing. If you sell regularly to the same clients, it makes sense to automate their payments.

Clients will be charged automatically according to a payment schedule that’s convenient for everyone. Once you set up the billing, your payment processing software takes it from there.

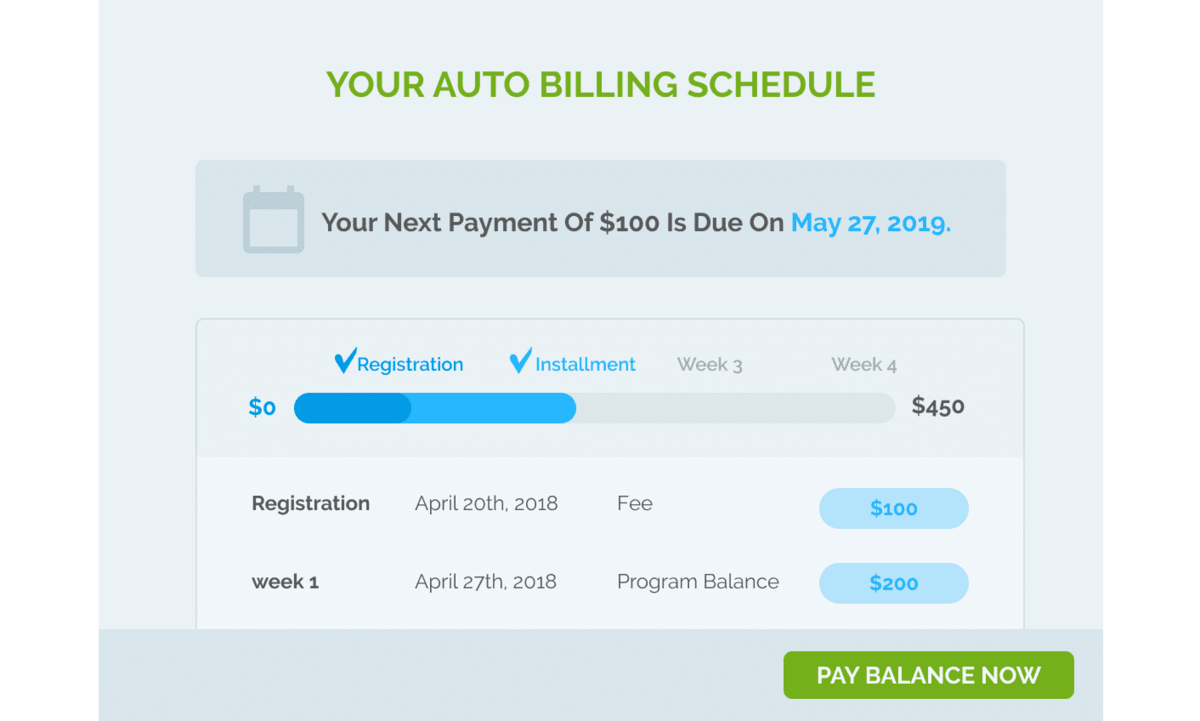

Here’s an example of automatic billing from Regpack:

Source: Regpack

This client dashboard shows the payment deadline and amount due. It also notes where the client is in the payment process.

Automatically retry failed payments

There are two main reasons you may need to hunt down client payments: they’re dragging their feet or their payment didn’t go through. It can be hard enough to get clients to pay as it is, so you want to make sure their payment works.

One way to do that is by using software that automatically retries failed payments.

For example, Regpack retries failed payments after 5, 10, and 14 days. If the client didn’t have the necessary funds in their account the first time, they may after a few days.

It’s an easy way to get your money with no action on the part of you or the client.

The Future of B2B Invoicing

Without the right tools, B2B invoicing can be tedious and time-consuming.

You have to properly structure your invoices, make sure they don’t contain any errors, find the time in your busy schedule to send them, and deal with late or failed client payments.

And because your income and reputation depend on how clients perceive you, it’s important to do everything correctly.

Electronic invoicing makes the whole process much less of a headache.

Invoicing and payment processing software gives both you and your clients everything you need out of the B2B payment process. It’s simple, fast, and secure.

For B2B transactions, e-invoicing is the way of the future.