It seems like e-invoicing is all the rage these days.

Businesses are switching to sending and processing bills electronically, and customers have come to expect that type of service from all companies.

If you operate online, you should be looking into switching your operations to digital, which includes invoicing.

After all, e-invoicing is the way of the future. Brodmin predicts its market will be worth an astounding $24,726 million by 2027.

So, what’s in it for you?

- Faster Client Payments

- Easier Account Reconciliation

- Reduced Costs

- Greater Customer Satisfaction

- Greater Security

- Increased Productivity

- Conclusion

Faster Client Payments

The first thing you get from switching to digital modes of invoicing is faster payments.

Some customers are chronic late payers, but most people will want to pay you when they get the invoice.

The majority of customers don’t want to be late with their payments. So, the faster you deliver the invoice, the quicker you’ll get paid.

The best thing about e-invoicing?

The invoice is usually ready almost immediately, which means the customer can download and pay instantly, speeding up the entire process and ensuring you have a good cash flow.

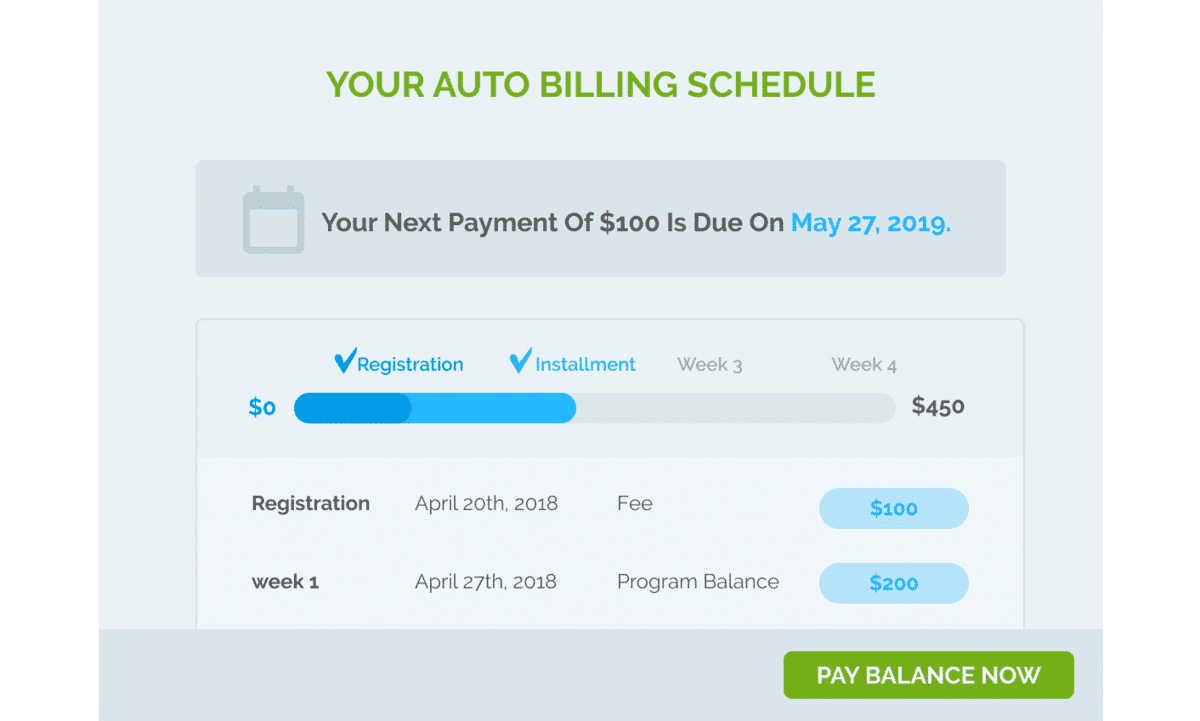

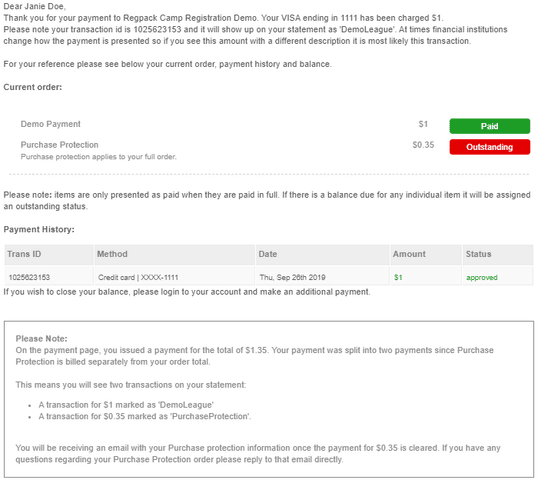

Source: Regpack

Compare the e-invoicing process to the old-fashioned mail invoices. The customer orders something from you, and you deliver their bill.

The client clicks on a link and gets the invoice if you do it electronically. If you do it through the mail, you have to print the invoice, mail it to the customer, and wait for them to get it.

Depending on how many invoices you print and mail, that’s already a day or two of delay.

With invoicing software like Regpack, the process becomes a breeze.

There are no worries about manually creating each invoice or ensuring the details are correct and that you haven’t missed a number or two.

You also don’t have to print the invoice or go to the post office to mail it.

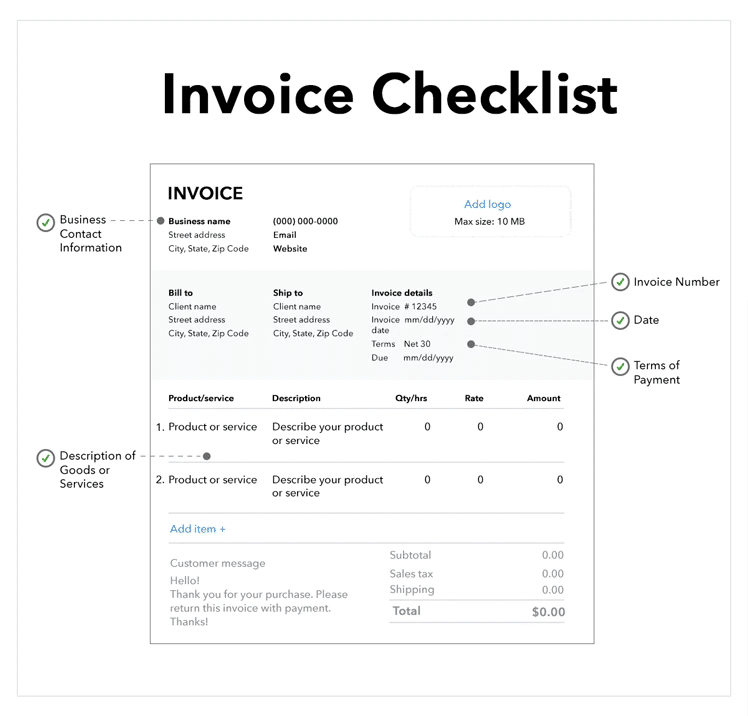

Instead, the software uses your invoice template and fills it with invoice information, including customer details.

In seconds, you’ll get a clean-looking invoice with correct data, ready to be sent via email to your customer, which the software does on its own.

Lost invoices are often a problem when you send them by traditional mail or even email.

The customer could accidentally delete the email, or it can end up in the spam folder, which further delays payment.

Your letter could get lost or damaged during travel, which leads to late payments.

Source: Regpack

You can quickly check any clients with outstanding payments with invoicing software and send them a payment reminder.

On top of that, your customers can always download the invoice through your portal.

So, even if they accidentally delete the email with the invoice, they can get it in a click or two without any delays.

Therefore, if you’re trying to get paid faster, look into invoicing software that creates and delivers invoices quickly.

Easier Account Reconciliation

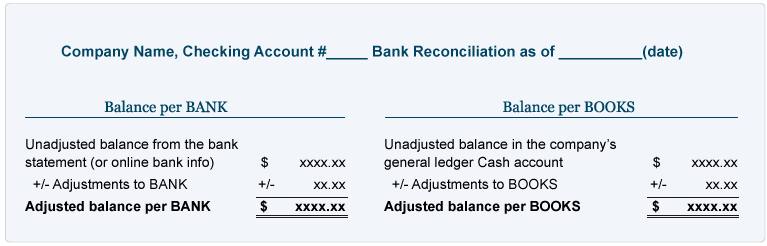

Going digital with your invoices simplifies the entire payment process, including reconciliation and balancing your bank account with business records to check if they match.

If they do not, you will have to make adjustments until they do.

Businesses usually use invoices as a reference when they inspect their bank account.

Companies have to compare their books with their bank statements to determine whether everything matches. However, this process can be a hassle, primarily if you issue many of them.

Source: Accounting Coach

After all, it’s easy to figure out who paid their invoice and mark it in the system when you get a couple of payments a day.

However, what if your business grows and you start getting tens of payments daily? You won’t be able to keep up with everything, which could get you in trouble with the law.

To avoid having to pay hefty fines and overdrafting your account, figure out a way to reconcile your accounts and stay on track.

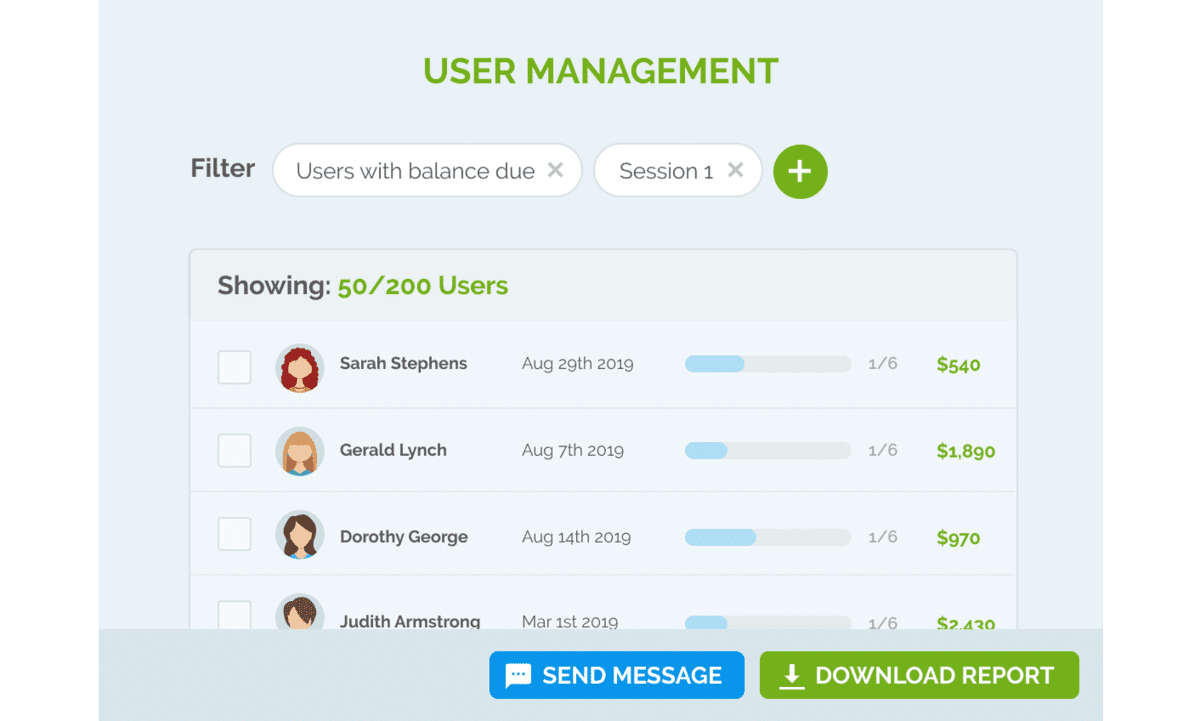

If you’re already issuing more invoices than you can keep track of, think about getting software that gives you a clear overview of all invoices.

For example, Regpack lets you create reports, filtering the data you need for account reconciliation.

You’ll be able to get an overview of your users, determine who owes you, and see which of your customers have already paid.

With these reports in hand, you’ll have an easier job matching the invoices to account payments and spotting potential problems.

The Balance recommends reconciling your accounts once a month after receiving your bank statements.

Otherwise, the bank statements and invoices could pile up and take a long time to go through.

With billing software, you can generate the reports the same day you receive the necessary bank information and ensure you get it done faster than you would manually.

After that, all you have to do is figure out how much money you have. Do this by checking your outgoing and incoming funds and any outstanding payments.

If you use billing software, generating reports on incoming funds and unpaid invoices will take you a minute or two, which will help you save time and energy, thus simplifying reconciliation.

Reduced Costs

Instead of cutting corners wherever you can to save some money, turn to e-invoicing to significantly reduce your invoice costs.

Companies that invoice the old-fashioned way pay $11.57 for a bill that takes more than eight days to process.

The price might seem high, but remember that businesses have to invest in creating, printing, filing, storing, and delivering invoices.

The billing process includes holding onto invoices for at least three years.

Source: Regpack

In some cases, you might have to keep a bill for seven years, depending on the circumstances.

The Internal Revenue Service (IRS) gives detailed information about the invoice-keeping timeline, so check it if you want to stay out of legal trouble with your invoicing.

It’s easy to see why invoicing can get expensive. However, businesses that use invoicing software can save a lot of money through digitalization.

The only expense they incur is the cost of the software, which is minimal compared to all the savings such a solution brings.

Firstly, you no longer have to print and send the invoice through mail.

Instead, the customer receives the invoice electronically, and you don’t have to invest in printers, paper, and mailing costs.

Source: Regpack

The filing and storing process becomes obsolete since your invoices stay in your system until you decide to delete them.

As a result, you’ll save on the time needed to store invoices and the space dedicated to it, which will grow with time and customer volume.

Furthermore, you will have unlimited space in the cloud, which allows you to keep all invoices you’ve issued.

With physical storage space, keeping year-old invoices is impractical unless you want to keep investing in more and more storage room.

Whenever you have to check the details of an invoice or provide them for an IRS check, you’ll be able to download them straight from the software, saving yourself time and ensuring you always find exactly what you need.

If you don’t, the IRS might fine you.

Therefore, switching to e-invoicing allows you to save on invoice creation, printing, sending, and storing costs. All you have to do is pick an invoicing software, and you’ll start saving right away.

Greater Customer Satisfaction

Companies that create accurate invoices and send them on time have more satisfied customers.

If you were to purchase something online, would you be happier if you could pay it instantly or if you had to wait for at least a couple of days until the invoice got there via the post?

Chances are, the faster you get the invoice, the happier you will be.

After all, studies show that billing is the second or third most important factor to customers, who think of quick invoicing as good service.

Other businesses that invoice customers seem to be on the same page, agreeing that e-invoicing reflects your investment in customer satisfaction.

Source: Twitter

With this type of billing, you can include different payment methods, including online payments.

As a result, your customers will pay from their phone or desktop in a couple of seconds, positively affecting their happiness with your brand and invoicing.

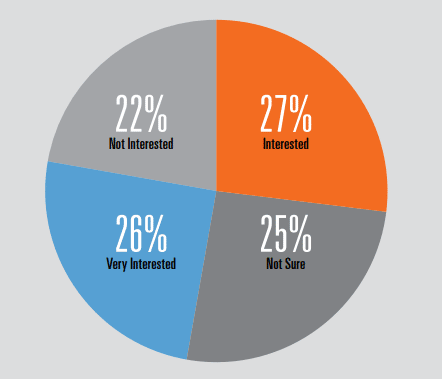

Moreover, e-invoicing is what customers want. Fiserv found that most US bill payers are interested in switching from paper to electronic invoicing.

Source: Fiserv

So, implementing e-invoicing will show your customers you care about what they want.

After all, with it, your customers don’t have to dig through their inbox to find the email with an attached invoice.

If they don’t locate the email, your customers don’t have to contact your customer service. Instead, they can just log in to your portal and seamlessly download it.

While keeping your customers happy, you’ll also unburden your customer service team, who will have more time to deal with complaints that you can’t fix with billing software.

Your clients could also be upset if they come across invoice errors. Imagine waiting for an invoice for a week just to be unable to pay it because of a miscalculated total.

You’d probably be on the phone with CS in no time, and you’d be unhappy with the turn of events.

With invoicing software, you can rest assured that the bills you send are correct and contain all the data your customers need to pay.

Therefore, you’re eliminating the risk of human error and the resulting dissatisfaction.

Greater Security

Since e-invoicing is more secure than paper billing, it helps you eliminate many risks.

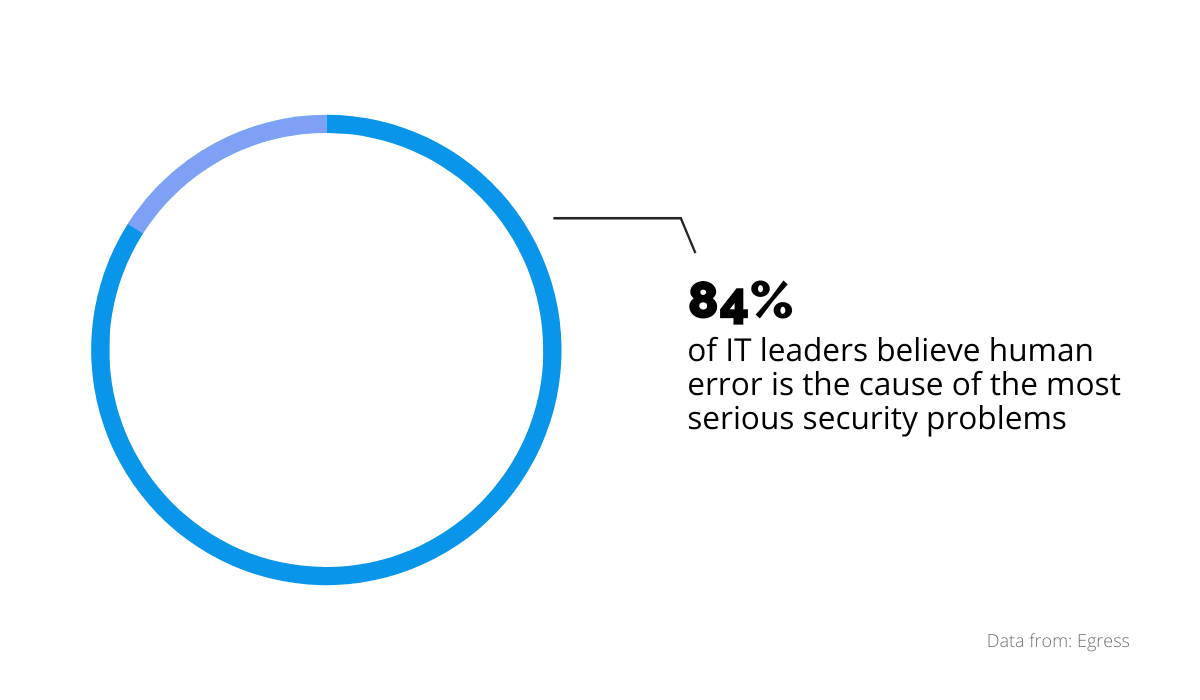

Research shows that the cause of the most severe security incidents is human error, which means that these problems are easily avoidable in most cases.

Source: Regpack

If you create, print, and send invoices manually, you can always count on someone getting something wrong. Sometimes, you can easily fix this mistake.

Other times, it may cost you a lot of money and a tarnished reputation, especially if personal information is involved.

When you entrust software with creating, sending, and processing your invoices, you eliminate the human element almost entirely.

As a result, you also remove the cause of the most serious security breaches.

Moreover, e-invoicing allows clients to download the invoice from your customer portal. As a result, no one can intercept and edit the invoice like they can through emails.

Such incidents can cost both you and customers a lot of money, depending on who gets scammed.

For example, Evaldas Rimasauskas swindled more than $120 million from Google and Facebook through a phishing and invoice scheme.

The man got his hand on an invoice Quanta Computer sent to these two businesses. Then, he registered a company under the same name in his country.

After that, he could copy the invoice and mail it to the businesses, effectively pretending he was the real Quanta Computer’s representative—and he got paid.

Clearly, if the invoices you send or receive end up in the wrong hands, someone with the right skillset can copy them and pretend they are you or someone invoicing you.

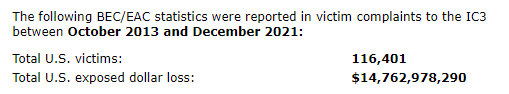

This type of fraud, also known as a Business email compromise (BEC), cost US victims over $14 billion, which means it’s a real threat.

Source: IC3

Globally, businesses and victims lost $43 billion to business email compromises.

However, by using software like Regpack and uploading your invoices online for customers to download, you’re getting rid of the possibility of altered invoices and payment fraud.

Increased Productivity

After implementing e-invoicing, you’ll have more time to focus on other, non-automated tasks.

Here’s the thing—invoice processing takes a long time when done manually. Studies show that the processing of a traditional invoice can take up to 25 days.

You have to create the invoice, fill it out with customer information, add order details and the total amount, and then double-check every part of the bill to ensure everything is correct.

Source: QuickBooks

Then, you have to print the invoice, check if the printing compromised the quality, and get the invoice ready for shipping.

After double-checking the recipient’s address, you need to take the letter to the nearest post office and send it.

Of course, you’ll have to file the invoice and store it safely since you need to hold onto such documentation for a certain time.

Clearly, these steps take a long time. But, this isn’t something you just have to accept since there is a way to cut down on time.

The same research shows that invoicing software processes an invoice within 3-5 days.

So, why even waste time on doing any of this manually when you can have technology do it for you?

Think of every other task your business could do if your employees no longer had to spend that much time billing customers.

You’d have more time to offer good customer service, handle requests, and fix issues that software just can’t do on its own.

Since you can automate billing, you will no longer worry about doing this manually.

You’ll have more time for other business activities with invoicing software, thus increasing your productivity.

Conclusion

After reading this article, you should clearly understand what e-invoicing can do for your company.

The implementation process shouldn’t take long since many e-invoicing software options are available.

Get familiar with the tool you choose, set up an invoicing template, and watch the software do all the work for you while you focus on other business tasks.

Who wouldn’t want to get paid faster, have happier customers, and be more time and cost-effective?