When you’re a business with paying customers, the invoice payment process might be one of the most important ones for your survival. After all, poor invoicing practices can lead to non-payments and payment delays, which will slowly but surely bankrupt you.

To avoid this consequence, you should strive to improve every aspect of invoicing and ensure that it runs smoothly from creation, sending, and receipt to payment and archiving.

We’ll go through each step and see what they all entail before figuring out how to improve them.

You should already be using invoice payment processing software that allows you to create and send invoices seamlessly in this day and age. If you’re not, consider it!

Raising an Invoice

The first step of invoicing is the creation of the invoice.

As the seller, you should create the invoice when the customer makes the purchase. By doing that, you’ll deliver the invoices faster, increasing your chances of getting paid. Postponing invoice generation can make you seem irresponsible and unorganized, which is not the impression you want your company to make.

However, if your business is doing great and you have more orders than you can count, this step might be complicated, especially if you’re doing it all manually. Generating invoices by hand takes a lot of work when you don’t use templates.

Even if you do, but you fill them out manually, it will take you a while to complete an invoice.

What is more, you always have to double-check manually created invoices, as human error is prevalent in this type of work. In fact, correcting a paper invoice mistake costs companies $53.50.

Source: Regpack

It’s important to note that your invoices will look the same every time if you create them using software, giving off a more polished, professional look, which is a good business practice.

Plus, automation will bring invoice errors down to a minimum, thus helping you avoid costly disputes and corrections. After all, a customer is not obligated to settle an incorrect invoice, so if you keep sending flawed invoices, you might not get paid at all.

Sellers who have turned to technology for invoice creation allow billing software to bear the brunt of their work.

The software generates an invoice automatically using the purchase order (PO) and predetermined settings, such as your company logo, contact information, and payment data. It also matches the PO to the customer’s data, after which the invoice is good to go.

Sending the Invoice

Once you have your automated invoice ready, it’s time to deliver it to your customers.

Usually, the mode of invoice delivery is something you will discuss with the client before the purchase. That way, your customers will know when and where to expect the invoice.

This also makes it easier for you to choose your billing delivery method in the payment software.

The fastest way to send an invoice is to do it electronically—by emailing it as a pdf attachment, which is faster than sending it by mail.

Besides, electronic invoices are much easier to pay, especially since most people nowadays know how to use online payments and actually prefer them to more traditional ones.

Source: Regpack

If you send the information to the clients by email, they can scan the QR code on the invoice (if applicable) or copy and paste the payment information to their payment solution of choice.

Either way, the payment terms are simplified, which means the chances of you getting your money fast are higher.

However, studies show that people receive over a hundred business emails daily, which means yours might get lost in the crowd.

To prevent that, you can implement some of the following best practices:

- Send the invoice as an attachment instead of pasting it into the email text

- Come up with an eye-catching subject

- Put enough effort into the text of the email

- Personalize the email for that extra punch

If you do not get paid on time, you should send a reminder email to notify your customer of their outstanding payment. Doing this increases your chances of getting paid, so make this your standard practice.

The same best practices we’ve listed earlier apply to sending reminder emails, so try them out and you should be good to go.

Don’t Limit Your Customer Pool!

Offer Multiple Payment Options Seamlessly

Receiving the Invoice

The next stage of the invoice process is the invoice getting to the intended recipient.

It is usually the buyer who receives the invoice you’ve sent. Of course, if you’ve sold items/services to a company, their accounting department is going to receive and process your invoice. Usually, accountants have to enter the invoice into a centralized accounts payable (AP) system before the following process stage can begin.

Nowadays, tools such as the electronic data interchange (EDI) system allow companies to bypass this step and simply share the invoice data between systems.

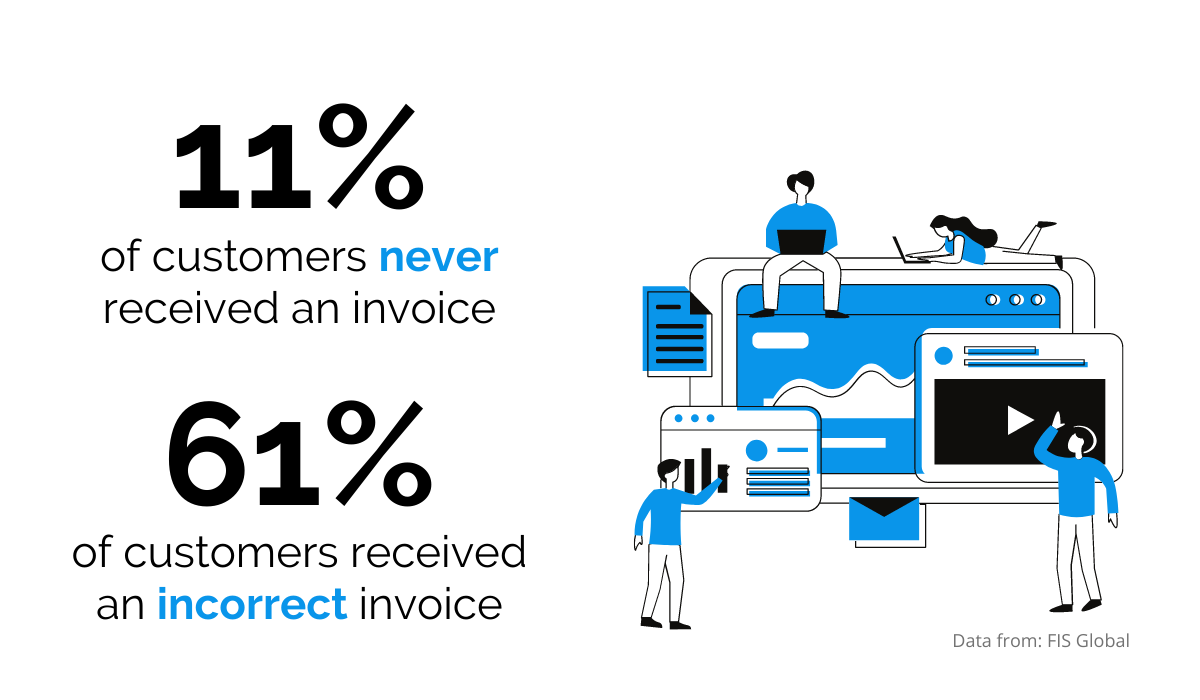

Sadly, 11% of all customers never even receive their invoices. Such issues arise from mistakes with the email address or similar problems that stem from manual entry.

Source: Regpack

Moreover, more than half of those who received an invoice reported getting an incorrect one, prolonging the payment process and increasing frustration. So, you should ensure that the data is correct before sending your invoice.

If you do that electronically, you’re making the process cheaper for the other party as well.

A Zycus survey mentions that this type of invoicing reduces invoice processing costs, as the company you’re billing doesn’t have to process it manually.

The invoice-to-pay process is also a lot faster in the case of e-billing. However, only 47% of businesses receive digital invoices.

Because of the time and money savings, many companies nowadays already use software that helps them charge and process payments online. Therefore, you’ll get paid faster if you send an e-invoice to such companies because they already have a working system in place.

Invoice Approval

Once your customer receives your invoice, they must check whether it is accurate. Only then can they move on to paying you.

The first step your customer will probably do in the approval process is inspect the services/items in question. If the invoice information matches the purchase details in the system, the person in charge of this step will approve the invoice and forward it to the payment department.

However, if your client is a business that doesn’t use software to perform this action, don’t expect it to happen so quickly. On average, it takes a whopping 16 days for an invoice to get additional approval for payment, which doesn’t come as a surprise if you know that an accounting clerk can process around 20 invoices daily.

Source: Regpack

Therefore, it’s no wonder that almost 40% of companies think their top priority should be invoice automation of invoice approval and exception handling. In other words, more than half of companies understand that this process takes way too long to complete.

All the data, like product/service description, quantity, and the total should check out. In that case, the customer will proceed with the payment request, so the “approval” stage of a business-to-consumer (B2C) transaction is fairly quick.

In that case, you must add as much descriptive data as possible when stating what products or services you’ve offered. This way, there will be no misunderstanding between you and the customer.

For example, if you’re a service provider that organizes trips, instead of listing your service as “trip,” which can be pretty ambiguous, opt for something more detailed, like “a 10-person team-building trip to [destination]”.

That way, you’re leaving no room for confusion and ensuring the customer pays you upon receiving the invoice.

Invoice Payment

Once your supplier invoice is checked and cleared, it’s time for your customers to make their payment.

Before selling the product or service, you should discuss the transaction details with the customers, including the available payment options and the invoice date. These details explain how and when the customer can pay, which means they won’t be surprised when they see the terms and invoice amount.

The best payable process for your business is the automated one since you can easily accept and process it.

Of course, cash is also an option, but it may not always be the best possible solution for the type of business you do.

When you get paid cash, you have to manually enter the payment data into the system, which takes time.

If you run your business online, it’s more feasible to offer online payment as your default payment method to speed things up. According to Zycus, the length of the typical invoice-to-payment cycle for services is 20.9 days, while for simple invoices, it is only slightly faster at 18.6 days.

Source: Regpack

That might not seem that bad, but if you wait 20 days for each customer to pay you, your cash flow will suffer. After all, that’s a far cry from what every business would really like—getting paid on the same day the invoice was sent. It seems that most companies settle their dues as late as possible because of cash flow problems, timing the payment for when they have an influx of cash.

Those who use automated software will adjust the settings to send payment within a week of receiving the invoice. Others will time the payment on the invoice due date.

Even if your end-customer is not a company, they might be more inclined to postpone payment until their next paycheck or after they have paid all their other bills. While this is not something you can change, you can offer them as many payment options as possible in hopes of providing their preferred one and empowering them to pay you right away.

Decrease Non-Payment By 75%

With Flexible Payment Plans!

Receiving Payment

Once you receive the payment, don’t forget to examine it to ensure everything is accurate. If any part of the invoice process was manual, the chances of an error are highly likely.

Mistakes become a bigger risk when the payment isn’t digital or if the company you were charging doesn’t use software to process payments.

In fact, the margin of error for manual invoicing is 10%, which isn’t exactly low, especially if you get paid less than you are supposed to.

Source: Regpack

Once you check the payment and ensure that the amount and payment details are accurate, you should enter it into your system and match the payment with the corresponding invoice and customer.

You must do this step correctly and find corresponding payments, matching them with the correct invoices and products.

Only then will your books be accurate at the end of the fiscal year, and it will be a lot easier to do an inventory when you have a clear picture of how much you’ve sold and how much you’ve earned.

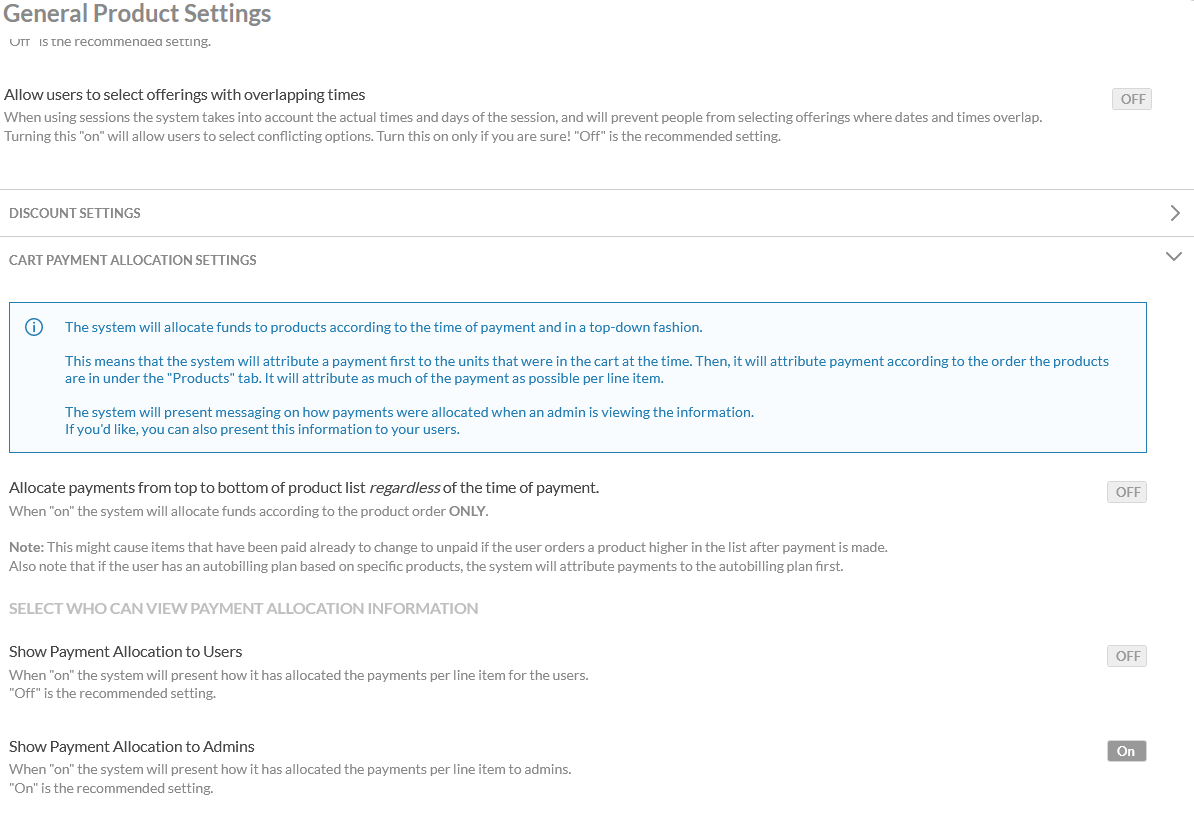

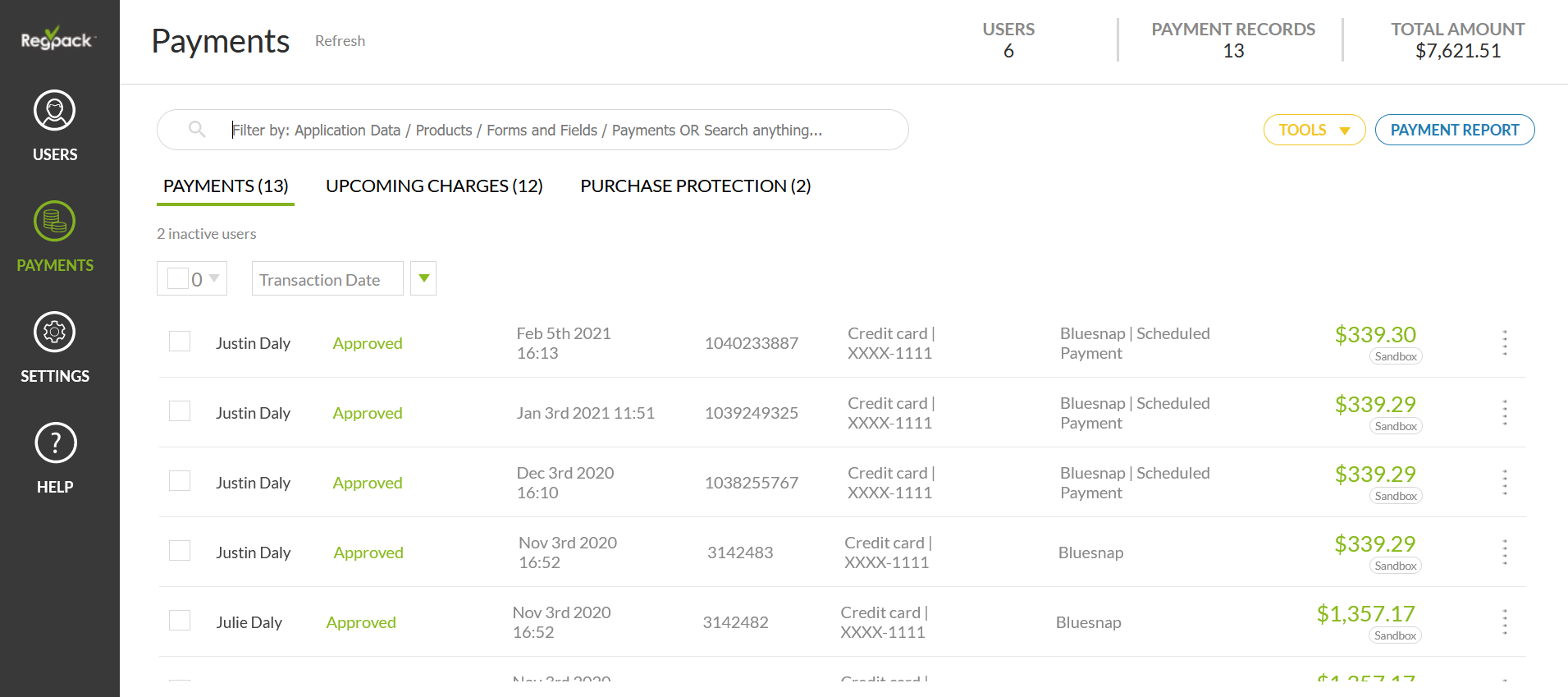

With payment processing software, you can choose how to allocate the funds among all the products/services on the invoice.

Let’s take a closer look at how.

Source: Regpack

Most digital tools distribute the funds evenly, paying off each invoice item at the same rate. However, you might find some products or services more vital than others.

Through software like Regpack, you can mark certain products as a priority, which means the system will direct the resources towards them and count them off as “paid off” first.

Archiving Invoices

The invoice process doesn’t end the moment you receive the payment. Instead, you should focus on invoice archiving.

After you deliver the product or service and receive payment, you have to ensure that the sale and payment are visible in your system. That way, you have your database of all sales and compensations you’ve ever received, which makes audits a lot easier, in case the U.S. Internal Revenue Service (IRS) subjects you to one.

In fact, you must hold onto invoices for three to seven years, depending on the circumstances. For additional information on this, check out this IRS guide.

This type of invoice archiving also helps you when tax season rolls around, so it’s a good idea to start saving bills if you haven’t already.

Source: Regpack

If they’re a company, your buyer should also archive their invoice as something they’ve paid since it can serve as proof of payment in case of a later dispute. Moreover, having such an archive comes in handy when you’re being audited or when you have to do regular inventory. Knowing what you sold and got paid for makes it easy to check how many products you’re supposed to have left.

When archiving your bills, make sure they are easily accessible and legible. There is no particular rule on whether they have to be paper-based or digital, but storing your data in the cloud definitely seems like the easier option.

Source: Regpack

After all, you can access this database anywhere you have an internet connection. The chances of it getting deleted are minimal compared to those of a hard copy getting misplaced, torn, or damaged somehow. After a while, you’ll simply have too many paper invoices to hold onto, which will make it difficult to go through them when you have to locate a specific one.

Accept Payments Online, Right On Your Website!

Streamline your checkout process, offer payment plans, and more!

Conclusion

The invoice process starts with the purchase. You record the purchase with the invoice and save it in your system when someone buys something from you.

Once you send the invoice, preferably electronically, the customer will receive, approve, and pay for it. These stages are out of your control, but making a clear and straightforward invoice definitely helps. After that, you’ll receive payment, but don’t forget to archive your invoice and hold onto it for three to even years, depending on IRS instructions.

The easiest way to do all of this seamlessly is to use software that lets you invoice and bill your customers while holding on to and saving all the necessary data.