Late payment is a small business owner’s nightmare.

It disrupts cash flow and affects their ability to pay others, not to mention the time wasted on chasing clients and the uncomfortable conversations that ensue.

Unfortunately, it’s become a global phenomenon, and businesses have to develop more and more creative ways to make clients pay while remaining polite and professional.

That’s why we’ve decided to help and give some valuable tips on addressing this issue.

Read on to find out the best ways to deal with five common types of late-paying clients.

- Clients That Need More Time to Pay

- Clients That Always Forget to Pay

- Clients That Just Disappear

- Unsatisfied Clients

- Large Corporations as Late Paying Clients

- Conclusion

Clients That Need More Time to Pay

The era of uncertainty that we are in has had an impact on all parts of the supply chain, and your clients are no exception.

The Atradius Payment Practices Barometer 2021 found that 50% of all B2B invoices issued in the US in the first half of 2021 were paid late.

Source: Regpack

It’s no surprise then that your clients are also struggling to settle their invoices.

When making your decision, bear in mind that not all clients are the same.

If a reliable client requests to extend a payment that’s past due, it’s best to approve it, especially if they’ve never done it before.

The client will appreciate it because it shows good faith on your part, so your relationship with them will remain friendly, hopefully for a long time.

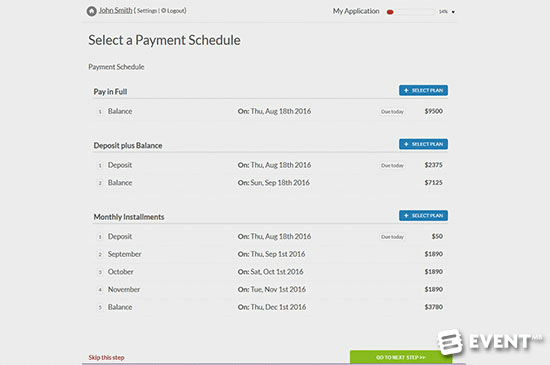

If they need longer to pay, you can set up a payment plan. Paying in installments will alleviate the financial burden for them, and you will still get paid.

Moreover, you get to keep a good client and a healthy cash flow.

You can use a software solution such as Regpack to help you work out a payment schedule that works for both of you.

Source: Regpack

It’s a simple and effective way to stay on top of your accounts receivable.

Regrettably, despite your best efforts to accommodate your clients, some people will only be looking for excuses not to pay.

If you think this might be the case, look at the client’s payment history—extending grace to a chronically late payer is probably not a good idea.

A better approach would be to negotiate for them to pay the largest amount they can as soon as possible and then pay for the rest later.

They will probably feel relieved that you’re not pursuing legal action and accept it, and even if they don’t pay the rest, at least you got some of the money.

Sadly, things like these happen. Just make sure to blacklist these clients so it doesn’t happen more than once.

Clients That Always Forget to Pay

Sometimes, a client is the chief cook and bottle washer at a small business, so it’s perfectly understandable that an invoice slips by them.

Other clients are simply disorganized and forget about an unpaid bill sitting in their inbox.

Whatever the reason, an ounce of prevention is worth a pound of cure, so the best thing to do is to make invoices as easy to pay as possible.

Sending invoices by snail mail costs money and is not environmentally friendly.

Email invoicing is a much better option, but you shouldn’t stop there.

Instead of sending a non-editable PDF file (which you should always add in a separate attachment to make it easier for clients to print invoices), use invoicing software to generate a QR code or add a direct payment link.

This will make payment seamless and minimize your client’s chances of postponing it.

If your proactive approach fails to deliver results and the client still forgets to pay the invoice, you should send a polite reminder.

Even better, software like Regpack can do it for you automatically.

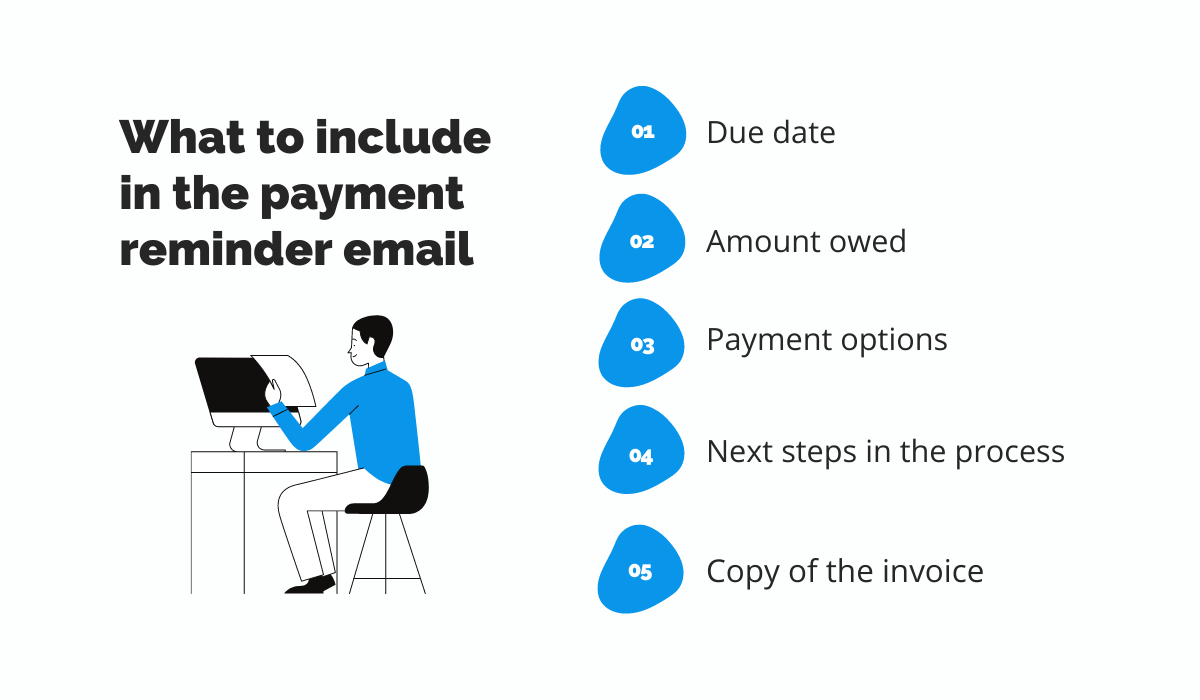

Source: Regpack

In addition to including the essential details, such as the due date, amount owed, and payment options in the reminder, it’s helpful to attach a copy of the invoice in the payment reminder email.

This way, the client doesn’t have to search their inbox to find it.

When it comes to wording, always be polite and professional, so the clients don’t feel as if they’re being threatened.

A good idea is to include a power word—anything from “important” to “urgent”—in the subject line. It will grab the reader’s attention and move them to action, but it won’t sound too harsh.

An effortless and time-saving way to ask for overdue payments is by using a template. It’s pre-made, so you only need to add a few details.

It’s convenient for you, and the client will appreciate the fact that they know what to expect and where to look for the essential payment information.

As we’ve seen, people who need constant reminding are a nuisance, but our next category is much worse.

Clients That Just Disappear

Have you ever had a client pull a disappearing act on you?

It’s terrible.

Sage’s survey of 300 small SMEs in the USA found that 34% of clients who pay late actually have no reason for doing so.

Source: Regpack

What’s worse, some clients take things to extremes and try to get out of paying altogether simply because they think they can get away with it.

As it turns out, this isn’t just wishful thinking—sometimes they can. The same survey found that 10% of late payments are written off as bad debt, which means that it never gets paid.

Small businesses and freelancers often have no time or resources to sue, so it’s easier just to let it go and not work with that client again.

If a client disappears, consider sending a letter of intent to sue before you involve other parties.

You don’t need a lawyer for this step because it’s purely informative, but it’s a powerful tool to get the client to take things seriously.

The letter should clearly state how much is owed and have a timeframe for settling the debt outside of court.

Below is an example of a Letter of Intent to Sue from eForms:

Source: eForms

Other than the standard elements, it’s also good to include a list (or even better, copies) of your attempts to contact the client, making it clear that this is your last warning, after which you will be left with no choice but to sue.

Another option that doesn’t include the court but does include a third party is hiring a debt collection agency.

It saves time because someone else will contact the client for you, but it won’t come cheap.

Agencies usually charge by contingency (15–50% of the amount collected) or a flat fee (15% paid upfront).

The first group typically has a “no win, no pay” policy, so you won’t have to pay anything if they don’t manage to get your money back.

Even though their fees are higher, they will be more motivated to collect because they don’t get paid otherwise, so it’s best to go with them.

In addition, they often work on sliding scale commissions, which means their commission is lower as time goes by, incentivizing them to get your money (and theirs) fast.

If you feel like giving up when clients disappear because you don’t want to waste your own time or feel uncomfortable hiring an agency that will chase them, just think of all the hard work you’ve done.

Remember that you’re not in the wrong for trying to get what you deserve by any means necessary; the client is, for making you have to resort to it.

This brings us to our next category.

Unsatisfied Clients

Clients are sometimes simply not happy with your work, which is a standard part of every job.

However, their refusal to pay for your service should not be. After all, they’re paying for the objective aspect (your time and outcome), not the subjective one (quality).

As in most cases, it would be best to prevent this by setting realistic expectations from the beginning, preferably in writing.

That way, everyone is on the same page, and there won’t be any misunderstanding, especially if you continue communicating clearly throughout the process.

But what happens if no such agreement was made and your service fails to meet clients’ realistic expectations?

The best course of action is to offer a sincere apology and, if possible, to fix the problem.

It’s essential not to take it personally and over-explain yourself and your services, but be kind and apologize.

If you show humility and admit your mistake, the client will probably not get defensive.

Clients want to feel heard and be part of the process, so if you ask for their input on addressing the situation, they are likely to provide payment once you fix the problem.

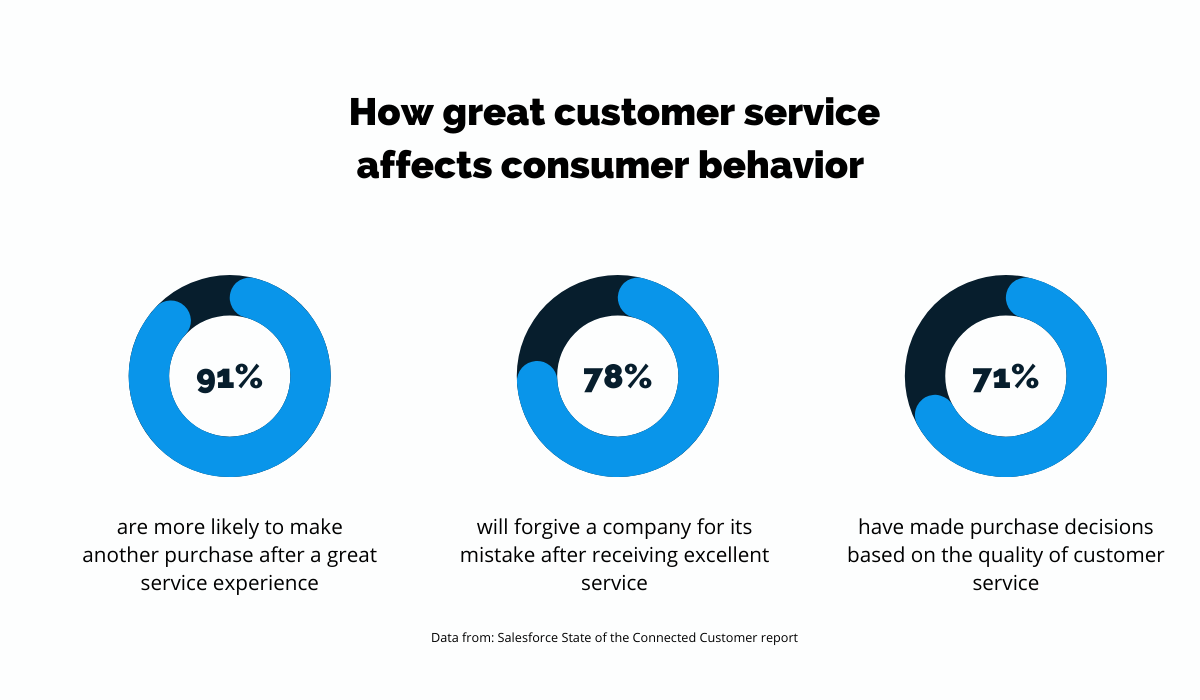

This is backed by data from the Salesforce State of the Connected Customer report, in which 91% of customers said they’re more likely to make another purchase after a great service experience.

Source: Regpack

Moreover, the same report shows that 78% are willing to forgive a company for its mistake if they provide excellent customer service, and 71% will make purchase decisions based on that quality.

It shows that excellent customer service can make up for most mistakes.

Another thing you can do is offer a discount or a free temporary upgrade. The deal will diffuse the situation and calm down the potentially angry customer.

Offering a free upgrade is even better.

Giving your customer a sneak peek into additional features and showing them how their experience can be improved means they are more likely to pay for it once the free period runs out.

Your mistakes do not define your relationship with a customer, but the way you handle them does, so always remember to show empathy and try to fix the problem.

Large Corporations as Late Paying Clients

Getting a seat at the big table is exciting when you’re a freelancer or a small company.

It’s your chance to establish connections, and if it has the potential to turn into a steady gig, it seems like a great opportunity.

Until it’s invoicing time.

The truth is that big businesses tend to move small companies or freelancers they work with to the bottom of the list simply because they can.

Extended payment terms (60, 90, or even 120-day billing cycles) seem to be a long-term trend for big companies because it improves their cash flow, even though it’s devastating for small businesses.

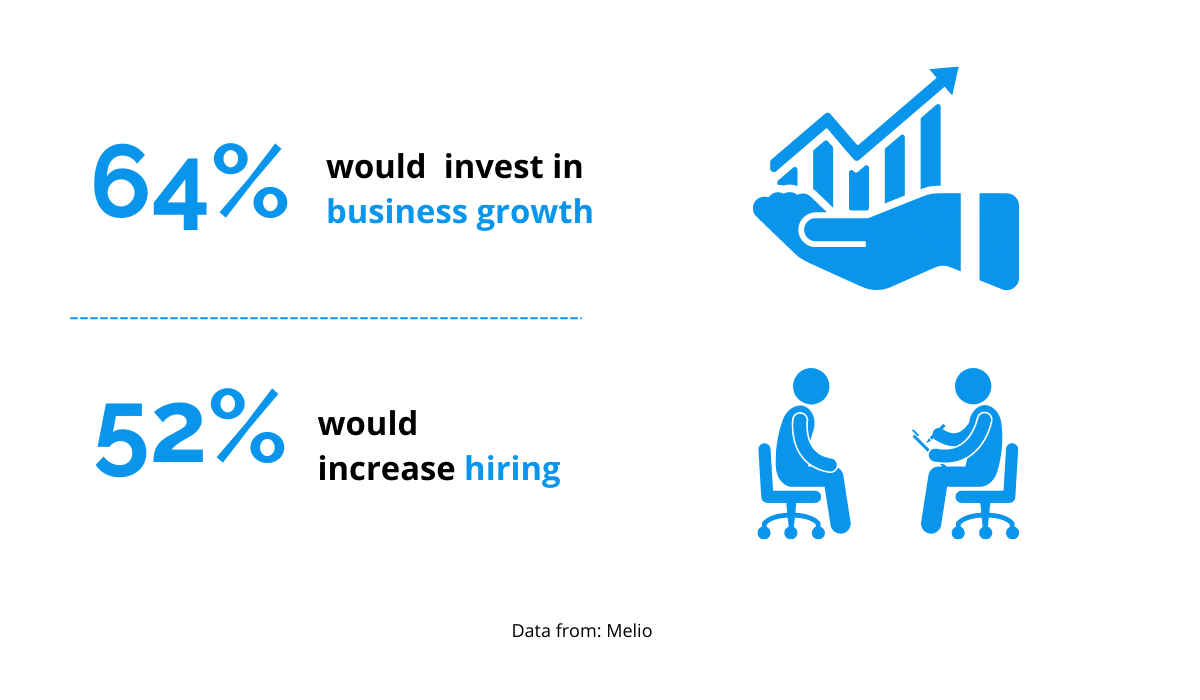

According to Melio’s research on the impact of late payments on small and medium-sized businesses (SMBs), 63% would benefit from being paid on time.

64% of those would invest in business growth, while 52% would hire more people.

Source: Regpack

In a nutshell, everyone would be better off if big companies paid their invoices on time.

However, because they are more powerful, big companies dictate payment terms. Their accountants will probably tell you that there isn’t much they can do as it’s their policy.

Nevertheless, you can try to work around them by using a few simple tricks.

First of all, try to outsmart them beforehand. If they propose to pay you in 60 days instead of 30, you can explain that your price is calculated on a 30-day basis, so if they insist on paying in 60, you would be left with no choice but to increase your price by 15%.

Big companies are also eager to save money as much as possible, so this can prompt them to agree to your terms.

Second of all, you can reward customers who pay early. Positive reinforcement works much better than instituting late fees, and it won’t harm your relationship.

Consider offering one (or both) of these options:

- Discount for paying early

This is a widely used method that works. Be careful, though, because it can be tricky to find a balance between a discount that’s interesting enough to pique your client’s interest but not too big to undersell your services and cost you money.

- Discount for future services

This is a powerful tool to inspire clients to work with you again. It works even better if you keep a list of clients that haven’t used their discount and occasionally send out email reminders that there’s a deal waiting for them.

The big leagues play by their own rules, but sometimes they just do it because they know most people won’t complain. Be firm, don’t let it intimidate you, and always negotiate.

Conclusion

Not all clients intend to leave their bills unpaid; some simply forget. In other cases, they need more time, and in the worst-case scenario, they simply disappear.

Businesses go through hard times. You aim to show compassion and understanding, but the thankless job of having to ask for payment isn’t any easier because of this.

You know how much effort went into your work, so use our tips to get what you deserve for it. Be polite, but stand your ground.

After all, not paying someone definitely doesn’t fall under the “the customer’s always right” category.