Accepting card payments from customers requires a lot of setting up behind the scenes. For starters, you’ll need a payment processor and a merchant account. And you’ll need to pay merchant account fees to keep things running smoothly.

But what exactly are merchant account fees? And how do the pricing models and fee types differ across cards and processors?

Read on to learn everything you need to know about merchant account fees, including what kinds of charges to expect, and how to keep them at a minimum so that more of each customer payment stays in your pocket.

- What Are Merchant Account Fees?

- Different Fee Pricing Models

- Types of Merchant Account Fees

- How to Lower Your Merchant Account Fees

- Partner With the Right Merchant Account Provider

What Are Merchant Account Fees?

Merchant account fees are the price business owners pay to keep their merchant accounts in good standing and accept non-cash payments from customers.

These fees, sometimes also referred to as merchant services fees, are usually a combination of recurring monthly or annual payments, per-transaction fees, and fees incurred by specific events (like a refund or chargeback).

The complicated nature of merchant account fees stems mostly from the wide variety of pricing models and fee processes across different merchant service providers.

Some fees are set and collected by the processors themselves, while others are charged by third parties—like credit card companies—while the processor simply acts as a middleman.

Different Fee Pricing Models

When a customer makes a credit card payment with you, your merchant provider will charge you a fee. But each provider uses its own system for determining those fees—and most use one of three standard pricing models.

The most common pricing models in use today are flat-rate, interchange, and tiered pricing. Let’s look at each in more detail below.

Flat-Rate Pricing Model

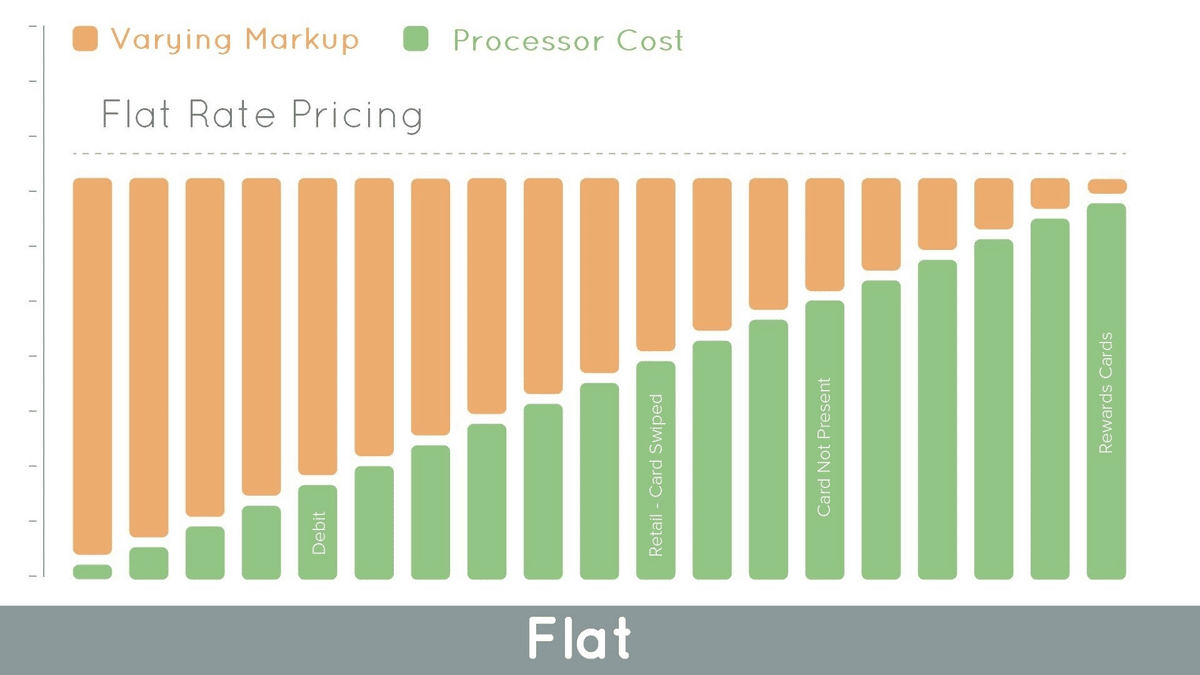

In the flat-rate pricing model, the merchant pays one flat fee or one fixed percentage for each transaction—or a combination of the two.

Source: Merchant Card Services Pro

This fee model doesn’t change based on the card type or transaction. Instead, you’ll know the rate at which you’ll be charged for every customer purchase.

For example, a common flat rate fee is 2.9% + $0.20 on every card transaction.

This model is recommended for small businesses because it is the most transparent—and it keeps your costs predictable. But if you process a high volume of credit card transactions, this model may be more costly—the higher the number of transactions, the higher the fee.

Interchange Pricing Model

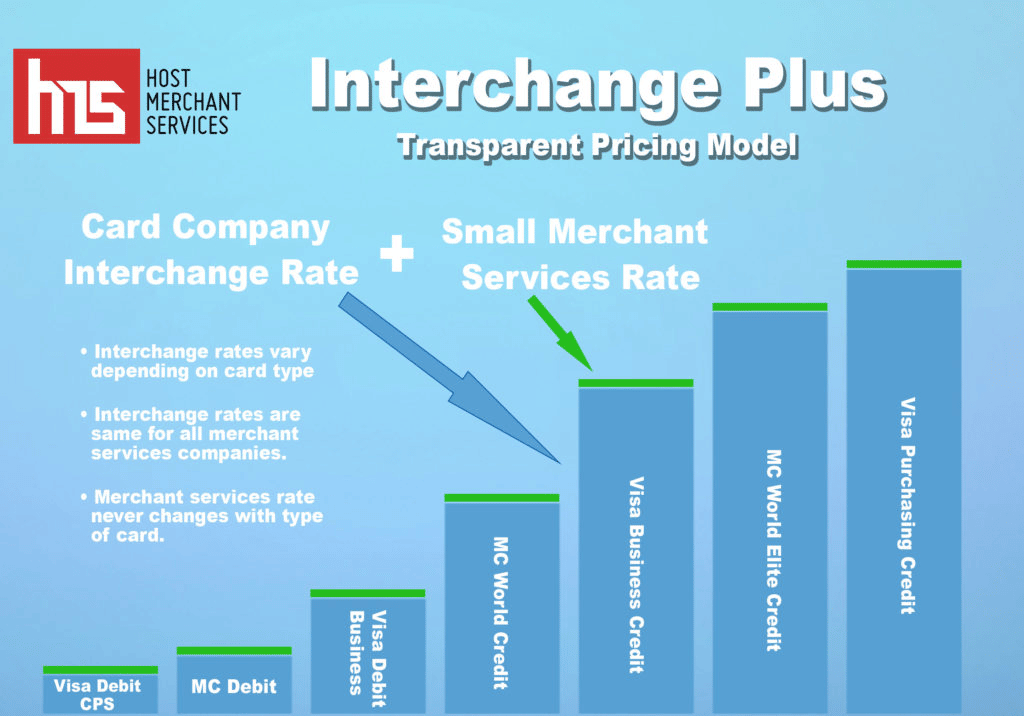

Also called Interchange Plus or Cost Plus, this pricing model is based on credit card companies’ per-transaction processing fees. The processing fee these card member associations charge is called the rate of interchange.

As Tidal Commerce explains in their blog post:

“There are three entities that need to be satisfied during a credit card transaction process: the merchant, the issuing bank, and the credit card association (Visa, Mastercard, etc.). The idea is to set a rate that pays the issuing bank enough to compensate for the risks it incurs during the direct transfer of funds while also giving enough incentive to the card associations to sign up more people for credit cards—all while providing that “convenience” at a rate that doesn’t make merchants decide it’s not worth it.”

The interchange model is based on the rate that the financial institutions that are involved will charge for each transaction.

Source: Host Merchant Services

Interchange fees are standardized—meaning that they are non-negotiable. In this system, your merchant provider will simply mark the rate up slightly to make a profit.

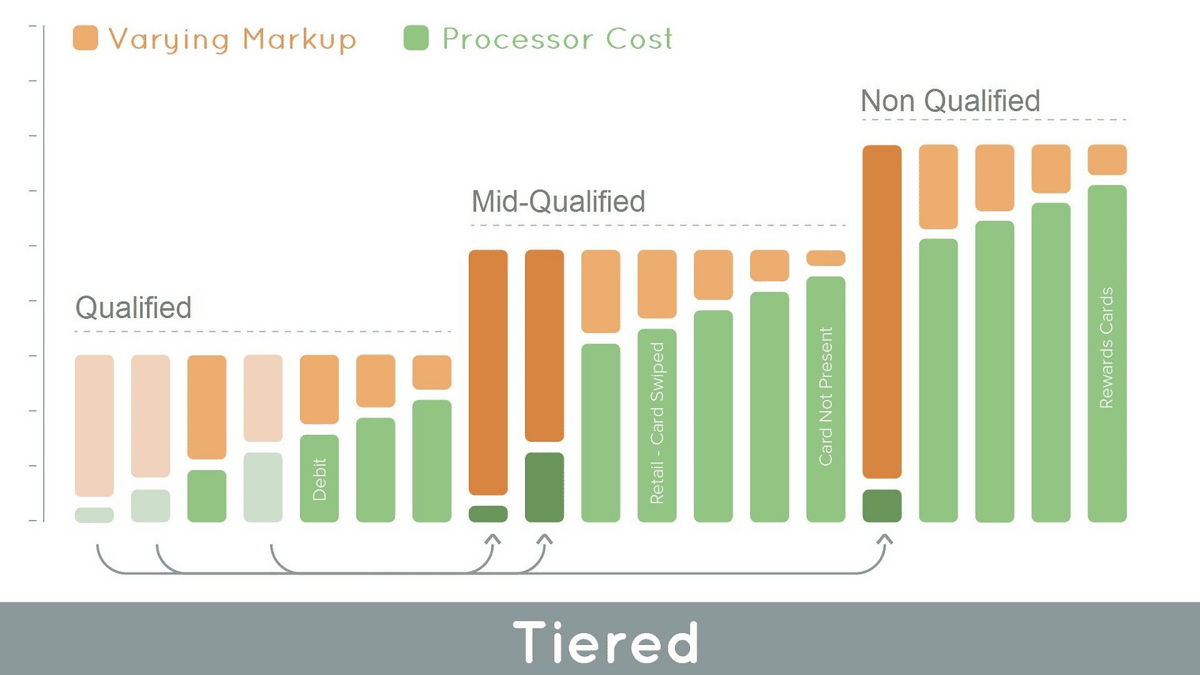

Tiered Pricing Model

Finally, the tiered pricing system groups interchange fees into more complex tiers of the merchant account provider’s choice.

Source: Merchant Card Services Pro

In other words, you’ll be charged a fee depending not only on which card provider is involved, but on what type of card (like credit card, debit card, or prepaid) the customer is using. The fee amount also depends on how the card was processed—like if it was present at the transaction and whether it was swiped, keyed in, or placed in a chip reader.

This model is considered to be the least transparent because it comes with various costs that may not show up on your merchant statements.

Types of Merchant Account Fees

Merchant account providers use the pricing models above to determine how you’ll be charged per transaction—but there are several categories of account fees to be aware of.

Universal account fees are usually charged per transaction, while scheduled fees are charged on a recurring basis regardless of how many secure transactions you’ve processed.

And incidental fees are charged only when an incident triggers them.

Let’s look at each type of fee below.

Universal Merchant Account Fees

Universal merchant account fees refer to the fees that a merchant must always pay, regardless of the fee pricing model.

These fees are charged by the merchant services provider, card member associations, and the merchant’s credit card processor.

Here are some of the fees that fall under this category:

- Transaction fees are charged per card transaction. The amount is determined by the merchant’s pricing model of choice (see above).

- Authorization fees are charged to cover the information exchange between the card issuer’s bank and your business account whenever a customer’s card is swiped.

- Assessment fees are charged by the credit card association to cover network services and operating expenses.

To learn more about credit card processing fees, check out our in-depth guide to payment processors.

Scheduled Merchant Account Fees

Also known as recurring fees, these monthly fees are charged regularly by the merchant services provider to maintain your merchant account.

These fees are most likely to stack up if you’re not careful about reading your service contract and learning the costs before signing up with a merchant provider.

Some of the most common scheduled merchant account fees include:

- Monthly minimum fee — The minimum payment required, it’s usually between $5-$25.

- Processing commitment fee — If you do not process a minimum number of transactions in a month, you may be charged a processing commitment fee instead.

- PIN Debit network fee — A charge for the use of PIN debit networks if your business accepts debit payments.

- Payment gateway fee — A subscription payment for the payment gateway used to accept point-of-sale transactions. This fee is usually paid to a third party and may include per-transaction fees as well.

- PCI compliance fee — Fees paid to cover security services for the merchant remaining in compliance with industry security standards.

- Monthly and annual fees — Regular charges to maintain the service of your account.

Many merchant services providers display a merchant fee schedule on their websites, but others choose not to disclose their fee policies. So after signing up for a service, make sure to check the terms of your contract to be aware of when and how you will be charged.

Incidental Merchant Account Fees

Incidental merchant account fees are situational, which means they’re charged only if a specific triggering event occurs.

Some of the most common incidental merchant account fees include:

- Chargeback fees — If a customer disputes a purchase, resulting in a refund of the funds to their card, your provider may charge you a fee between $15-$100.

- Retrieval request fees — If a customer reports a transaction as fraudulent, the issuing bank will charge a small fee to collect evidence to determine whether the transaction was legitimate.

- PCI non-compliance fees — If your business is not in compliance with Payment Card Industry security standards, you’ll be charged a penalty.

- Address verification service fees — An AVS helps prevent fraud by verifying that the customer’s billing address matches the one they provided at checkout. These fees typically cost $0.10 per transaction.

- Refund fees — Charged when you issue a refund to a customer who paid via credit card.

- Early termination fees — Charged when you close your account with the merchant account provider before the contract term ends.

Most of these fees are only charged once per triggering event, with the exception of the PCI non-compliance fee.

If your merchant account is not PCI-compliant, you’ll be charged an incidental fee once a month until your account is brought back into compliance.

How to Lower Your Merchant Account Fees

If you’re looking for a way to minimize your processing fees for accepting electronic payments, we recommend doing your research, negotiating with merchant account processors, and doing everything you can to prevent additional fees.

Do Your Research

First, look for a provider that not only is transparent about the fees it charges, but doesn’t tack on unnecessary annual maintenance fees to your bill.

Some providers charge large annual fees to maintain your account—but this large fee is often unnecessary and considered a “junk” fee.

In the same vein, some providers charge application and account setup fees. These charges are usually a one-time fee to process your application and create your merchant account. This practice is becoming less common, so you can easily reduce your overall expenditures by looking for a provider that doesn’t charge these types of fees.

Negotiate

Once you’ve settled on a merchant service provider with transparent fee schedules and practices, negotiate for the lowest fees you can.

While some pricing models and fees are non-negotiable, you may be able to bring some costs down simply by asking for a better rate.

Prevent Incidental Fees

Once you’ve entered into a contract with a merchant account provider, do everything you can to prevent triggering incidental fees.

For instance, make sure you’re aware of any early termination fees that might go into effect if you end your long-term contract before the agreed-upon end date. These fees can easily cost hundreds of dollars, which is no laughing matter for a small business.

Several other common incidental fees are caused by fraudulent activities, returns, and chargebacks.

Investing in fraud prevention tools is one way to reduce the amount of time and money you would waste on recovery.

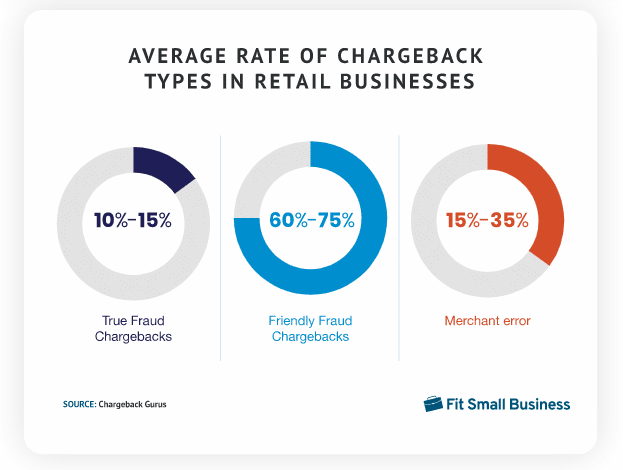

A chargeback takes place when a customer requests a refund or otherwise reverses a transaction.

While some chargebacks happen due to fraud or logistical errors, up to 75% of chargebacks are so-called friendly fraud.

Source: Fit Small Business

Friendly fraud happens when a customer disputes a real purchase they made.

As explained in a blog post by Chargeback Gurus:

“[Customers] might want their product for free, be unhappy with their purchase or service, or simply not want to go through a difficult refund process. Verifying the cardholder’s identity during your checkout process can help prevent these types of fraud—or at least give you the evidence you need to fight a chargeback should one be filed.”

These types of chargebacks can often be prevented by:

- Writing clear product descriptions to prevent buyer’s remorse and returns

- Using clear out-of-stock messages for sold-out items that are still listed online

- Sending itemized receipts so customers can clearly see what they did and didn’t buy

- Being upfront about shipping and delivery times

- Using contracts (that outline the terms of service and how to cancel) for recurring billing

By taking these steps, you’ll protect yourself and your business from unnecessary hassle.

Partner With the Right Merchant Account Provider

Merchant account fees are simply a part of doing business in 2022.

Accepting cashless or online payments is essential for maximizing customer purchases—but it means paying the necessary fees to providers, credit card associations, and financial institutions.

When researching merchant account providers, be sure to consider how their fees are structured.

Small businesses may prefer a flat-rate pricing model, while larger companies may find that an interchange model works better for their transaction types.

And beyond per-transaction fees, there are several other fees involved in merchant accounts that you should be aware of.

Knowing all the costs associated with maintaining a merchant account helps you budget accurately—not to mention devise strategies to avoid some incidental fees like the ones for chargebacks and fraud.

The best merchant account provider for you will clearly define their fee schedule and contract terms.

They’ll also provide great value for money and suit your business needs so that you can maximize your revenue (and spend as little time as possible worrying about the technicalities of payment processing).

To learn more about what to look for in a merchant account provider and find the right payment solution for your business, check out our article on payment solutions.