Recurring payment is a foolproof way to get paid quickly, easily, and consistently.

As with all things, recurring billing has its pros and cons.

It’s convenient for merchants because it improves their cash flow, just as it is for clients because it gives them regular access to a service without the hassle of entering card information over and over again.

Most importantly, it’s as versatile as it is simple, so there are multiple ways to adjust it to work best for your situation.

We’ve rounded up five best practices for businesses that want to maximize the benefits of accepting recurring payments.

- Prioritize Customer Data Security

- Streamline Failed Payment Retries

- Have Clear Payment Policies

- Offer Multiple Payment Methods

- Allow Customers to Choose the Billing Frequency

- Conclusion

Prioritize Customer Data Security

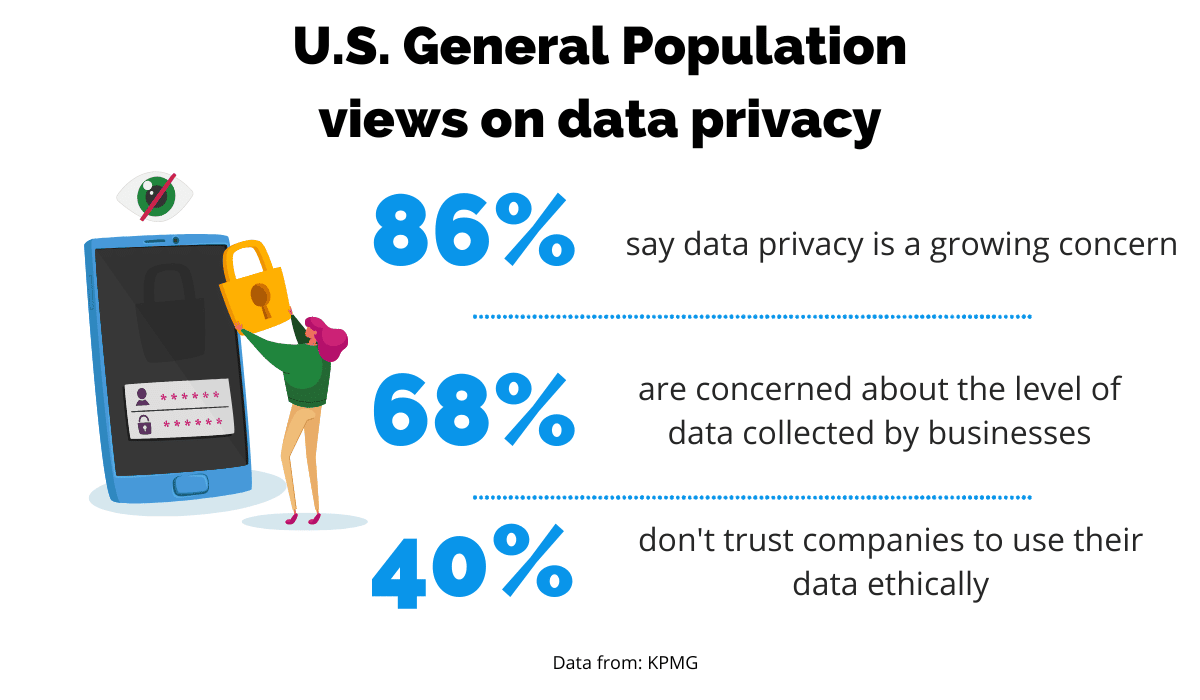

Citizens are more and more worried about the security of their data.

When KPMG surveyed 2,000 adults in the USA for their report “Corporate data responsibility: Bridging the consumer trust gap”, they found that data privacy is a growing concern for 86% of them, while 40% don’t trust companies to use their data ethically.

Source: Regpack

Furthermore, a whopping 30% aren’t willing to share their data for any reason.

Their concerns are not unwarranted either.

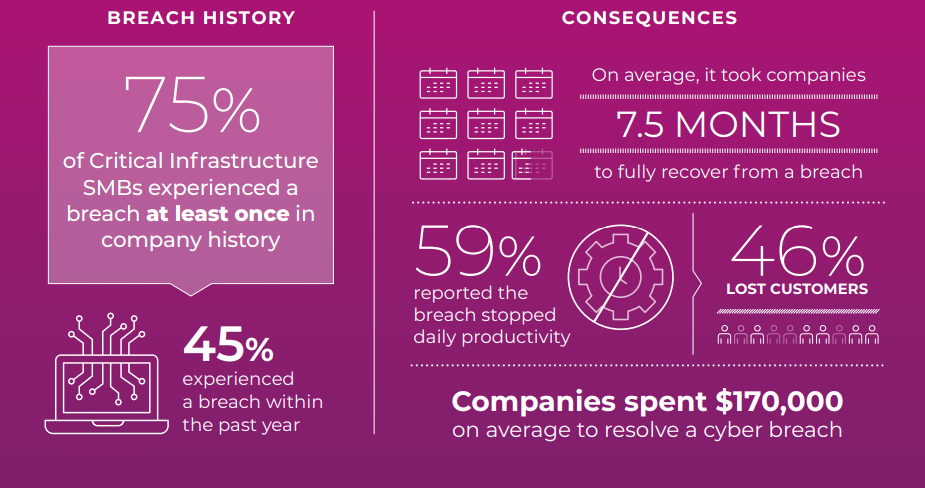

According to USTelecom’s 2021 Cybersecurity Survey of Critical Infrastructure Small and Medium-Sized Businesses (SMBs), 75% of SMBs experienced a breach at least once in company history, and 46% lost customers because of it.

Source: USTelecom

With such widespread distrust, companies need to be extra careful when handling their customers’ private information and ensure that customers know they’re doing everything they can to store credit card information securely.

That’s why meeting security standards should be a top priority for companies.

Luckily, major credit card companies have come up with a set of requirements called PCI standards to help you ensure that the card information provided by customers is stored, processed, and transmitted securely.

Even though PCI standards require significant engagement from companies that use them, they truly cover security concerns at all levels, from prevention by building secure systems to regular monitoring and testing to make sure everything works on a regular basis.

Here they are at a glance.

Source: PCI Security Standards

As recurring payments rely on stored data, #3 and #4 are particularly important for businesses that accept recurring payments.

We live in a digital world, so you’re probably already storing your data digitally. This is the most secure way to do it, especially if you use end-to-end encryption.

When information is encrypted, the only people able to access it are the sender and the receiver, who typically have a decryption key.

That way, even if someone attempts to hack your data, it is unintelligible without a key.

An additional layer of security can be added with tokenization.

In tokenization, the primary account number (PAN) is replaced with a randomly generated number (called a token) that cannot be traced back to your account.

Only that token is transmitted to the payment gateway during payment.

Unlike encrypted information, tokens are not reversible, making them extra secure and nearly impossible to hack.

Don’t worry—you don’t have to handle these complicated processes alone.

Good billing software will have at least one of the processes mentioned above in place and take care of the security aspect for you.

Streamline Failed Payment Retries

Unsuccessful payments are bound to happen, so having multiple policies for when, not if, they arise is the key to addressing them efficiently.

This is especially true for recurring payments because they are automatic, so people tend to forget about them.

They don’t remember to update their credit card information or have insufficient funds, and the payment fails without them realizing it.

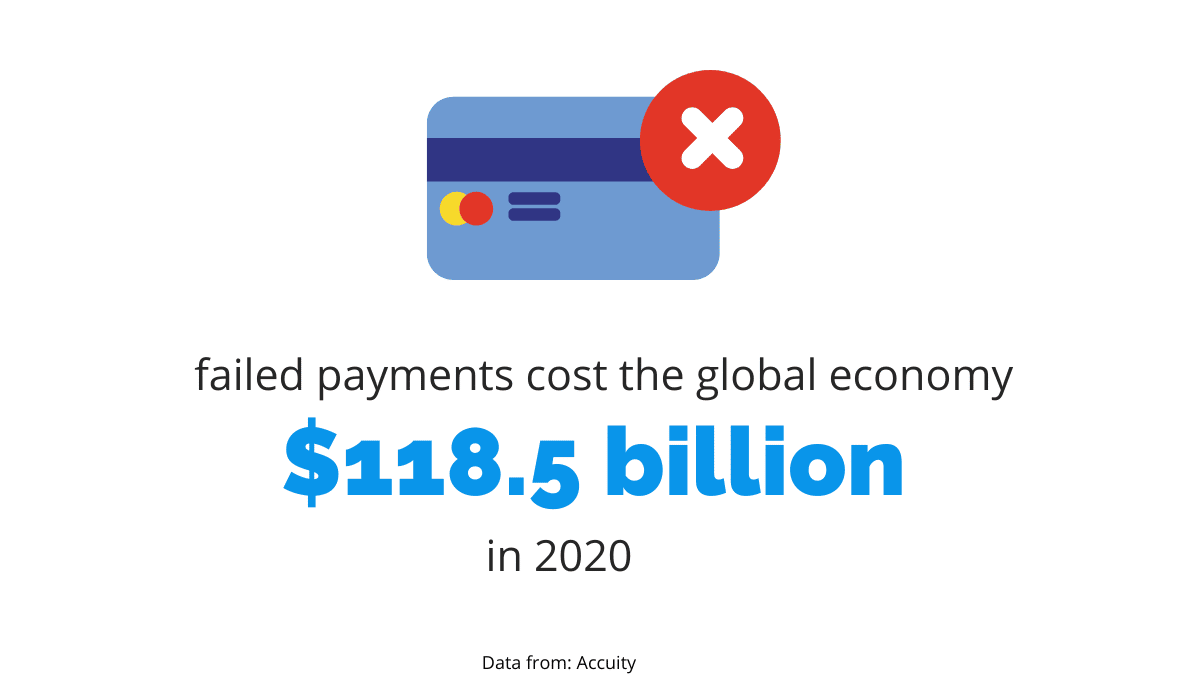

Failed payments happen more often than you think. According to Accuity, they cost the global economy $118.5 billion in 2020.

Source: Regpack

Naturally, failed payments aren’t good for companies because they don’t get paid, which is why they use various methods to prevent them, retry and notify the client.

This process is known as dunning.

Dunning is a lengthy process, but luckily, your billing software takes care of it for you automatically, so there’s no need for a person to go through each payment or send emails to notify clients about them.

First, we should warn you about a dunning practice you should avoid because it’s becoming obsolete: sending emails before a client’s card expires.

Clients opt for recurring payment because they want a hassle-free experience, and constantly getting emails is actually hassle-full.

Nowadays, you can find payment platforms (e.g., Stripe) with an automatic card updater.

The system contacts the issuing bank directly and updates your client’s card information when the expiration date approaches.

It’s an advanced feature that will make your and your clients’ lives easier by decreasing the need to contact them about boring technical issues.

When a payment fails, the first thing to do is try the same card again.

Churnbuster suggests that 21% of failed payments will be resolved in the first couple of days by retrying the same card.

Glitches on either end aren’t uncommon, so retrying is not a bad avenue to pursue.

Zoho recommends trying at least three times over five days.

For instance, a temporary malfunction or network issue can be resolved simply by retrying in an hour, or the next day.

However, for the sake of transparency, notify the client of your retrying attempts.

You don’t necessarily have to do it on the first or second attempt, especially if it ends up being successful, but definitely do it if you need to retry three or more times.

This way, they won’t be spammed if there’s just a simple malfunction on one occasion.

On the other hand, if the problem persists, they will know what’s happening with their account without being unnecessarily alarmed or suspicious that you’re trying to charge them without their knowledge.

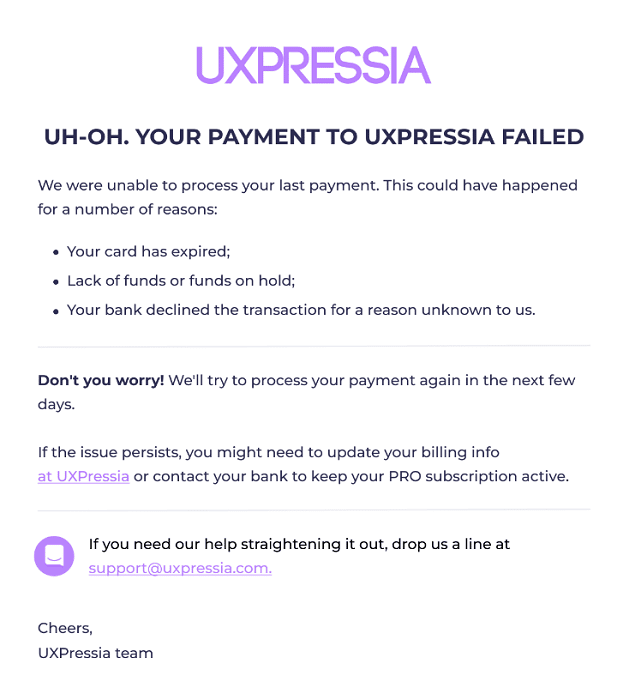

When sending dunning emails, it is best to be friendly and explain the issue and the steps you’ve taken to resolve them.

Below is an example of an excellent dunning email from UXPressia.

Source: Baremetrics

It’s friendly, reassuring, and lets clients know these things happen. Furthermore, it explains the possible reasons, showing the client that there’s nothing to worry about.

In the context of timing, it’s not a bad idea to have your billing cycle start later in a month, for instance, in the second week of a month, or on the 15th.

This ensures your client has sufficient funds ready on the day you try to collect.

Most billing cycles begin on the 1st or the 5th, so your clients have to settle several bills in a short period while waiting for their clients to pay them.

By charging them later, you increase your chances of payments being successful.

That way, your clients won’t see your payment as yet another thing they have to spend money on but as paying for a high-quality service at a convenient time.

Have Clear Payment Policies

We mentioned that clients need to know what’s going on with their accounts during the recurring payment process.

Being completely transparent about your policies beforehand is just as important, if not more so.

Before signing up for a service, customers need to know exactly what they’ll be paying for and all the actions that will be taken if something fails.

There’s nothing worse than a customer doing guesswork regarding important matters.

If you make it impossible to find the information on cancellations and other things they as a customer are entitled to, they might take it personally and refuse to do business with you.

Furthermore, offering complete transparency will increase customer loyalty.

When customers see that you’re not trying to hide anything or trick them, they will feel confident about giving you information.

This is why all the data on cancellations, refund policies, late fees, and terms and conditions for your service, in general, should be clearly displayed on your website.

You should write everything down in a transparent way for customers to be able to consult at all times.

First and foremost, include the phrase “recurring payment/transaction” so there’s no confusion that this transaction is not a one-time thing.

Next, add all the essential information related to the recurring payment, such as frequency, start date, expiration date (if any), and the amount that will be charged.

This will eliminate confusion and help customers enjoy your service without worrying about hidden fees.

If you’re worried nobody will want to read it, you can also display the information in a way you think will be interesting to your target audience.

Take Tumblr, for example. Their Terms & Conditions make it clear that you have to be of a certain age to use it in a friendly and amusing way.

Source: Tumblr

Of course, it doesn’t have to be this informal if teenagers don’t make up your target audience, nor do you have to jump through hoops to make all of your policies a fun read.

Still, you can spice up some appropriate sections with a touch of humor to make customers feel like you’re their friend, not a corporate robot—just make sure they fully understand everything.

Offer Multiple Payment Methods

Recurring payments are a great source of steady income for your company, which is why you should be as flexible as possible with accepting them.

That means giving your clients plenty of payment methods to choose from, and this decreases the chances of cart abandonment.

Say a client likes your recurring service and wants to commit to it long-term.

They enter all the necessary details and reach the checkout window only to find that their preferred payment method, for example, mobile payment, isn’t available.

Even if you offer outstanding services they like, they won’t think twice about leaving and finding another merchant who provides similar services and accepts mobile payment.

This is a common occurrence.

Research by PPRO has found that nearly half of consumers in the USA would stop a purchase if they found themselves unable to use the payment method they planned to.

Source: Regpack

Humans are simply creatures of habit and like to stick to what they’re used to.

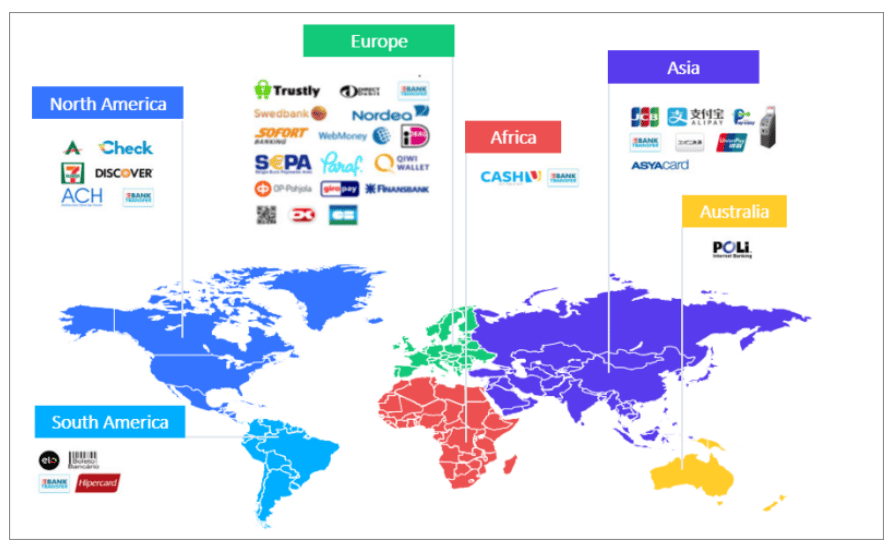

In addition to payment methods, you can consider offering different payment gateways.

A payment gateway is a software solution that enables you to accept payment from clients and securely deposit it into your account.

Having multiple payment gateways means that you can offer your services internationally because it gives you the option to accept various currencies.

Many people prefer to pay in their local currency, and allowing them to do so will provide you with a competitive edge.

Preferences vary greatly across continents and regions, as you can see below.

Source: Verifone

By catering to the needs of users from various countries, you grow your pool of potential customers and therefore increase the chances of someone opting for your recurring services.

One final thing to consider introducing as an option for recurring payments is bank debit, which generally refers to Direct Debit in the UK, SEPA Direct Debit in the EU, and an Automated Clearing House (ACH) transfer in the USA.

It’s a direct transfer from one bank to another, which means it’s much less likely to fail than other methods.

According to GoCardless, their churn rate as direct debit providers in the UK is only 0.5%, which is impressive, especially compared to the churn rate when using a credit card, which is 5–10%.

Even if payments fail, SmartDebit states that the chances of a successful retry with direct debit are significantly higher (52%) than with credit card retries (25%).

In any case, there’s no such thing as having too many payment methods.

A big pool of potential customers only increases your chances of conversions, so the more options you offer, the better.

Allow Customers to Choose the Billing Frequency

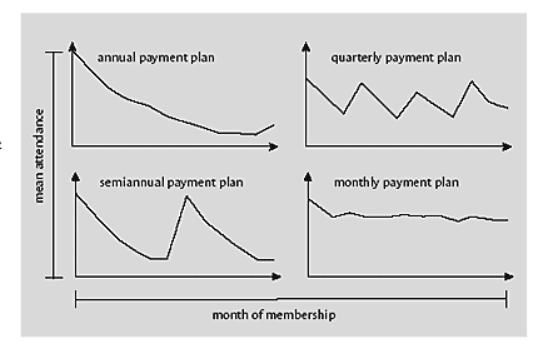

The two most frequent billing frequencies are monthly and annual.

Monthly billing is the most convenient for the customer because it doesn’t require a significant upfront cost.

This is also a great option if they’re not ready to make the long-term commitment that annual billing would require.

Merchants can also benefit from a steady income every month.

Furthermore, this type of billing makes it easier for them to increase prices as customers are more likely to agree to pay a few extra dollars every month than tens of dollars each year.

On the other hand, annual billing usually includes some kind of a discount to attract customers, so they can save money by choosing a yearly plan.

The benefit for the merchant is that they get a larger sum and don’t have as many fees as the payment is made only once.

Statistically speaking, the monthly option seems to lead to the highest number of renewals.

Harvard Business Review’s research on how timing affects consumption found that people who had a monthly gym membership used it most consistently, and a monthly plan generated the most membership renewals.

Source: Harvard Business Review

Modifications can also be made, so you can charge customers bi-annually, quarterly, or even weekly—it all depends on their preferences and the type of service offered.

The best thing you can do is let your customers choose their own billing frequency.

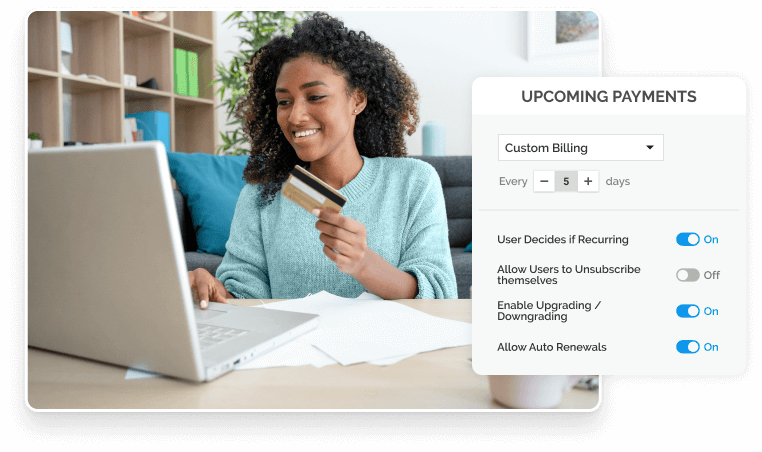

Regpack allows you to create a custom billing schedule depending on what works best for your client.

Source: Regpack

The Subscription product in Regpack allows you to determine the settings for a subscription, such as upgrades and downgrades, and when the billing cycle starts and ends.

The best thing is that you can also enable users to decide these settings themselves when ordering.

Letting users manage the subscription process will give them a sense of control and show flexibility on your part, which is something they will undoubtedly appreciate.

Conclusion

Subscription-based business models are here to stay and to keep up, so companies need to streamline their recurring payment processes.

This is true especially for small businesses, as recurring payments play a vital role in their cash flow.

The key aspects to focus on should be security, transparency, and flexibility.

By being clear about your policies in recurring payments, flexible in payment options and billing cycles, and prioritizing data security, your small business will be able to attract a range of customers and get steady revenue streams that come with regular payments.