A subscription-based business’s financial health depends on its ability to successfully and efficiently collect recurring payments from its customers.

When they have a handle on this, the business is receiving the right amount at the right time, without having to spend too much time chasing down and reminding customers.

Plus, they experience fewer cash flow shortages, which can seriously hurt small businesses.

In this article, we’ll show you some steps you can take to improve your recurring billing service, from enabling automated payment retries to accepting multiple payment methods, so that you can ensure it’s operating at its highest potential.

- Ensure Updated Card Information

- Accept a Range of Different Payments

- Automatically Retry Failed Payments

- Send Reminders for Upcoming Invoices

- Use Data to Analyze Performance

- Have Transparent Policies

- Conclusion

Ensure Updated Card Information

One of the most common causes of a failed recurring payment is incorrect card information.

If a customer changed cards and canceled the one you have on file, it would be declined, and you’d have to reach out to the customer and then receive a late payment.

To stop declined payments, you must consistently ensure that your customer base’s card information is up to date.

The easiest way to do this is by using an account updater function, which is common in most payment gateways, like BlueSnap.

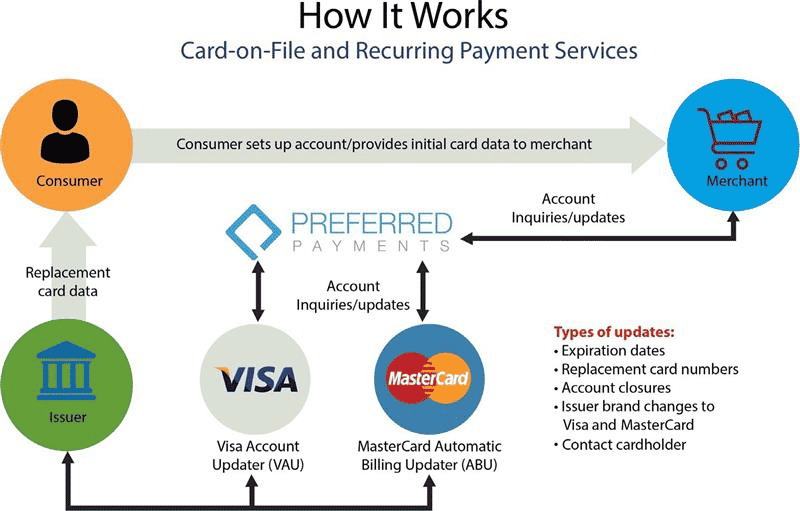

Here’s how the account updater feature works:

Source: Preferred Payments

An account updater feature automatically searches for new card information before the billing date and then updates accounts with any findings.

The tool also proactively queries the card issuer—Visa, Mastercard, Discover, American Express (all supported by Bluesnap)—for the new card numbers if a customer’s card expires, closes, or changes.

Because this is all done automatically on the back end, neither you nor your customer is involved in the card updating process.

They won’t be bothered, and you won’t have to handle this manually, which frees up your time to focus on your core objectives.

Furthermore, throughout the billing cycle, you’ll have peace of mind knowing that your system is scouting for and fixing incorrect card information and that you’ll receive your money on time.

Accept a Range of Different Payments

Accepting credit and debit cards is an important step for small, subscription-based businesses that are trying to modernize their approach to payments.

But, in terms of customer expectations, it’s becoming the bare minimum.

Customers want to pay however they please, and they’ll become annoyed with businesses that don’t allow for this.

In fact, around 42% of US customers say that they would leave a service if their preferred payment method wasn’t available.

Offering a large number of different payment methods beyond cards and cash enables you to reach a larger segment of the market and satisfy each individual customer’s payment preferences.

When you offer multiple options, you also lower the likelihood of a customer choosing to go to another business because payments will or have already become too difficult for them to manage.

Some types of payments companies commonly accept are cards, bank transfers, electronic checks, and mobile wallets, which are growing in popularity, especially amongst generation Z.

And if you’re selling globally, it’s also essential to allow customers to pay using international payment methods that they already use.

Now, the first step to enabling a tolerant payments plan is finding recurring billing software that supports the payment types that you want to offer.

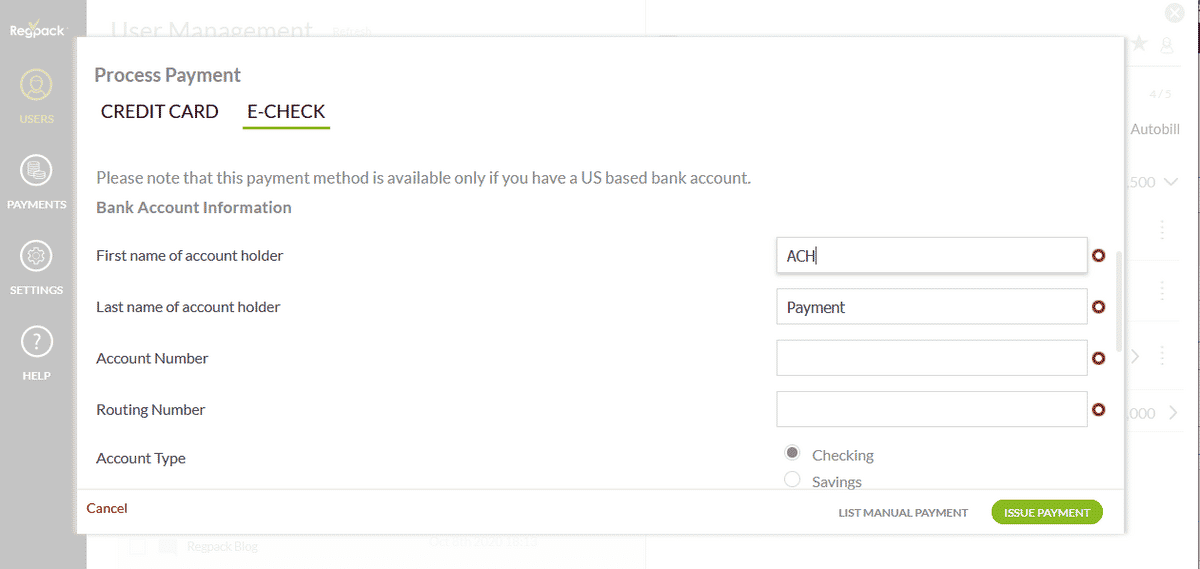

One such solution is Regpack, which is geared towards companies that offer trips, educational programs, and activities and that want to accept payments in credit card, debit card, and ACH (bank-to-bank) transfers.

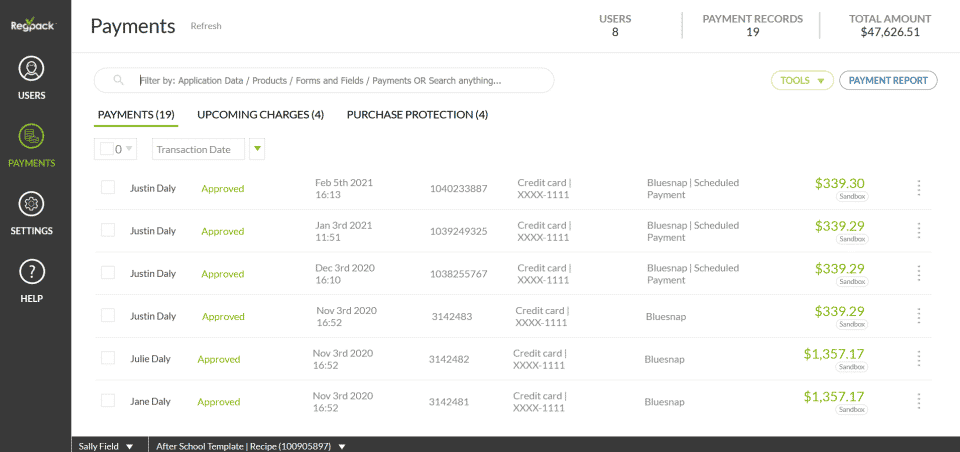

Source: Regpack

Regardless of your provider, the next step is to enable these payments in the system, so that your customers see these options on their monthly bills. Most third-party providers make this setup simple.

On the screen, they’ll typically prompt you to select your payment methods, and then ask you to fill in specific details for the selected method, whether that’s your bank information or your PayPal email address.

You can choose to enable as many or as few types as you’d like.

The software should notify you if any of the information you typed in was incorrect, and generally help guide you throughout the process.

After it’s up and running, your customers will see these payment options on their invoices or in the portal.

Automatically Retry Failed Payments

Managing failed payments is one of the biggest recurring billing challenges businesses face.

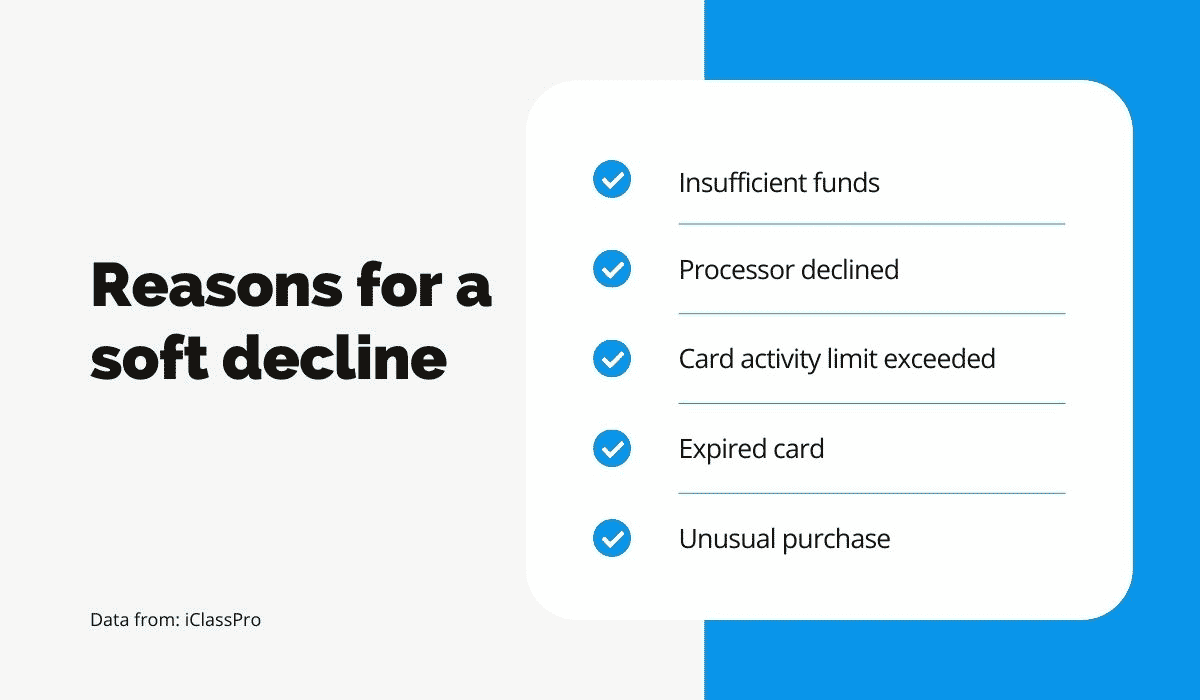

There are many reasons a card might fail to process other than fraud, card losses, and card theft, and they are known as soft declines.

Some examples of reasons for a soft decline are insufficient funds, a generic error, or a temporary hold on the account or card.

Source: Regpack

Many payment gateways will automatically retry subscription payments that suffered from these soft declines, and this increases the likelihood that you’ll collect the amount you’re owed without having to get the customer involved.

For example, say a customer’s card failed because they accidentally let their debit account get too low on funds to afford the subscription, and then they transferred $200 into it two days later after the decline.

If your system did an automatic retry a few days later, the payment would successfully go through.

In general, different payment gateways have different retry frequencies, but most will make at least two reattempts.

BlueSnap does three retries 5, 10, and 14 days after the first failed attempt. Sometimes, the payment succeeds on one of the attempts, and then you get your money.

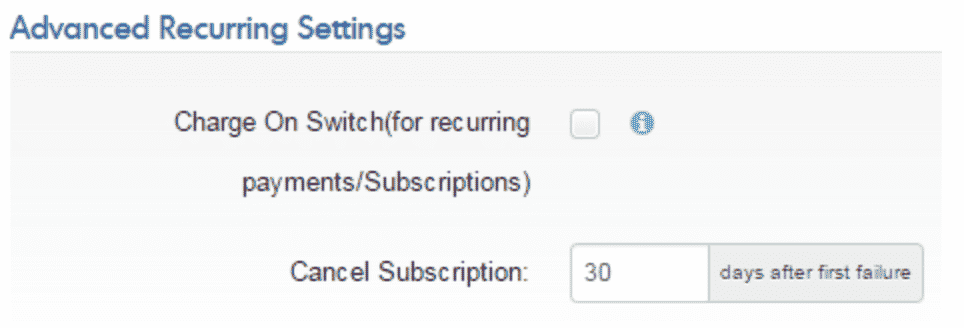

Below, you’ll see the business chose to have the tool cancel the subscription 30 days after the first failed attempt:

Source: BlueSnap

This is because it allows them to suspend the subscription if all the attempts at collecting payments.

The subscription is then canceled after a grace period that you choose during configuration.

Send Reminders for Upcoming Invoices

To avoid surprising the client, send reminders for upcoming invoices. This can be in the form of an email, text, or notification on their app.

If a client receives a reminder, they will be more likely to pay the invoice when it comes, and they’ll appreciate the heads up.

This reminder might give them some time to make the necessary financial moves they need to make to pay the invoice.

For example, if they’re paying with a debit card, perhaps they need to switch some funds over to the bank account they’re using.

As for the content and style of your reminder, it should be specific, friendly, and succinct. Here are some things to include in the reminder notice:

| A greeting | “Hi {Name}, I hope you’ve been well!” |

| A thank you | “First off, thank you for your continued business!” |

| Amount due / date | “I’m reaching out to send over a quick note to remind you about an upcoming invoice of {amount due} due on {date}.” |

| Request for confirmation | “We would be very grateful if you could please confirm that everything is on track for this payment.” |

Best practice is to send an invoice reminder notice around 3 or more days before the invoice is due.

This, of course, can be hard to keep track of when you have a bunch of invoices all due at different times.

Luckily, most billing software tools have automation features that enable you to set up invoice reminder emails to send automatically to customers a certain number of days before the due date.

They also come with email templates that auto-populate fields like the customer’s specific name, the amount due, and due date, so that the whole reminder process is completely hands-off.

Use Data to Analyze Performance

Using the reporting functionality on your billing software, you can analyze payment data to find issues with your payments process, policies, or gateways.

Once you spot the issues, you can implement fixes and then test if the changes have improved your overall payments process performance via more reporting, which will show you how certain metrics are rising or falling.

The three main payment metrics to track are the following:

| Payment conversion rate | This metric tells you what percentage of payment transactions are successful. Aim to increase it. The following metrics will help you figure out what’s causing a low conversion rate. |

| Conversion rate by bank | Sometimes you may have a lot of your declines associated with a certain bank. This can often be due to a bank changing its fraud rules. |

| Conversion rate by payment method | This will tell you which payment methods lead to successful transactions most often, and which don’t. You can then promote effective payment methods and remove ineffective ones. |

Not using data analytics and reporting to your advantage is one of the most common and limiting recurring billing mistakes.

It can be almost impossible to pin down exactly what’s holding your payments process back from reaching its full potential without it.

Source: Regpack

Fortunately, tools like Regpack make it easy to run reports on payments data so that anyone can investigate and improve their process.

Have Transparent Policies

Hiding payment policies that you think might be disliked by customers to get them to sign up hurts you in the long run.

When the invoice arrives, and the subscribers find out about any such policy, they may feel like they’ve been swindled.

Often, this surprise, be it about late or hidden fees, can lead to a customer churning, as well as asking you for their money back.

As a rule of thumb, the more transparent your payment policies, the more likely your customers are to trust you as a vendor.

Additionally, this transparency should also enable you to charge more.

According to Sprout Social’s research, 73% of buyers are willing to pay more for products that guarantee total transparency.

It’s therefore critical to clearly articulate the payment terms of the subscription agreement.

Write out your policies about late fees, refunds, the subscription, the payment schedule, cancellations, and anything else your customer needs to know.

But just having them in some file in your drawer for when customers ask isn’t enough. Customers need to find them easily online.

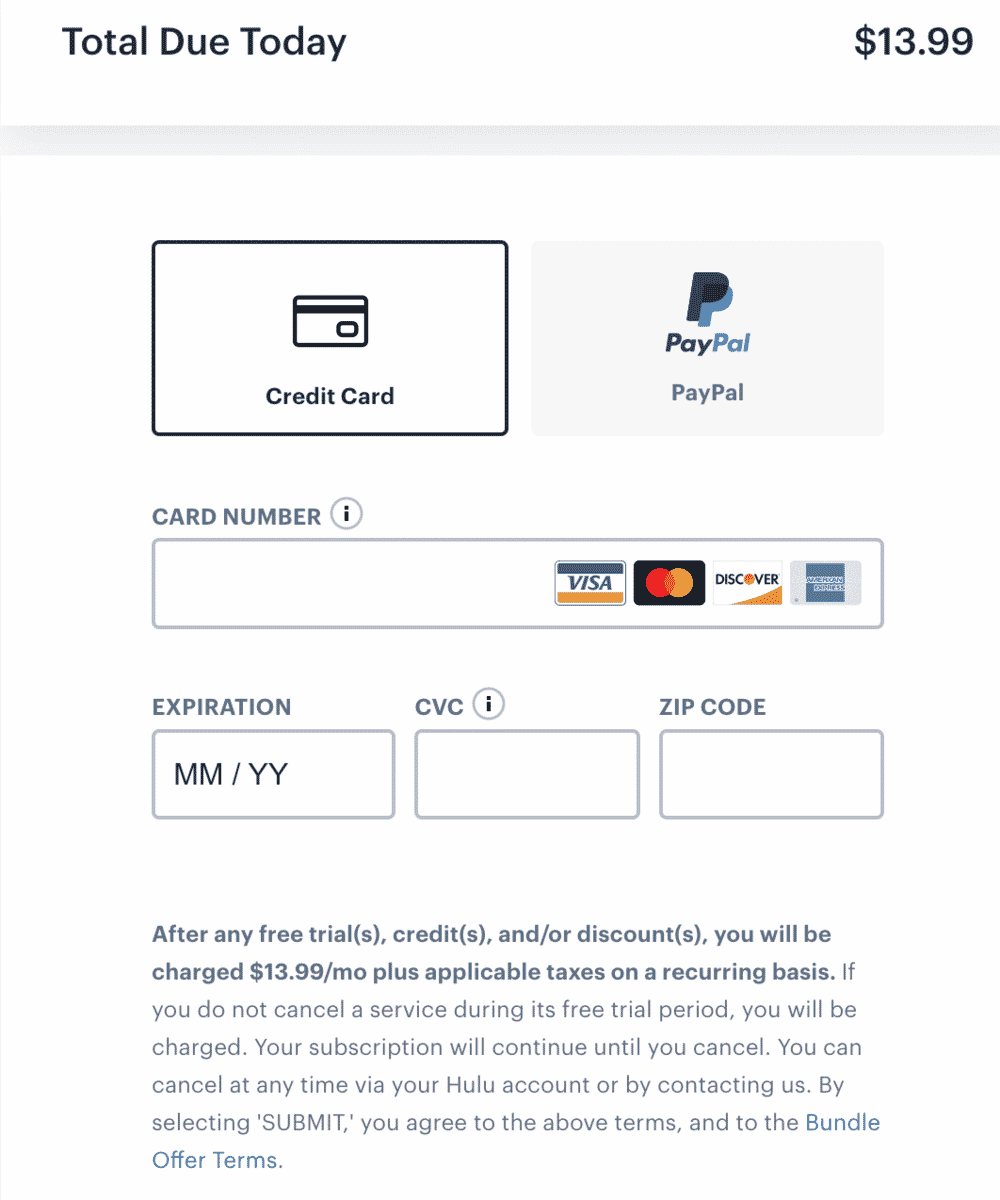

Better yet, customers should be reminded of the payment policies before they checkout.

Ideally, you want to put these policies in writing somewhere within the subscription or checkout form.

This ensures they don’t buy something they regret and then become a problem customer who takes up a bunch of your time.

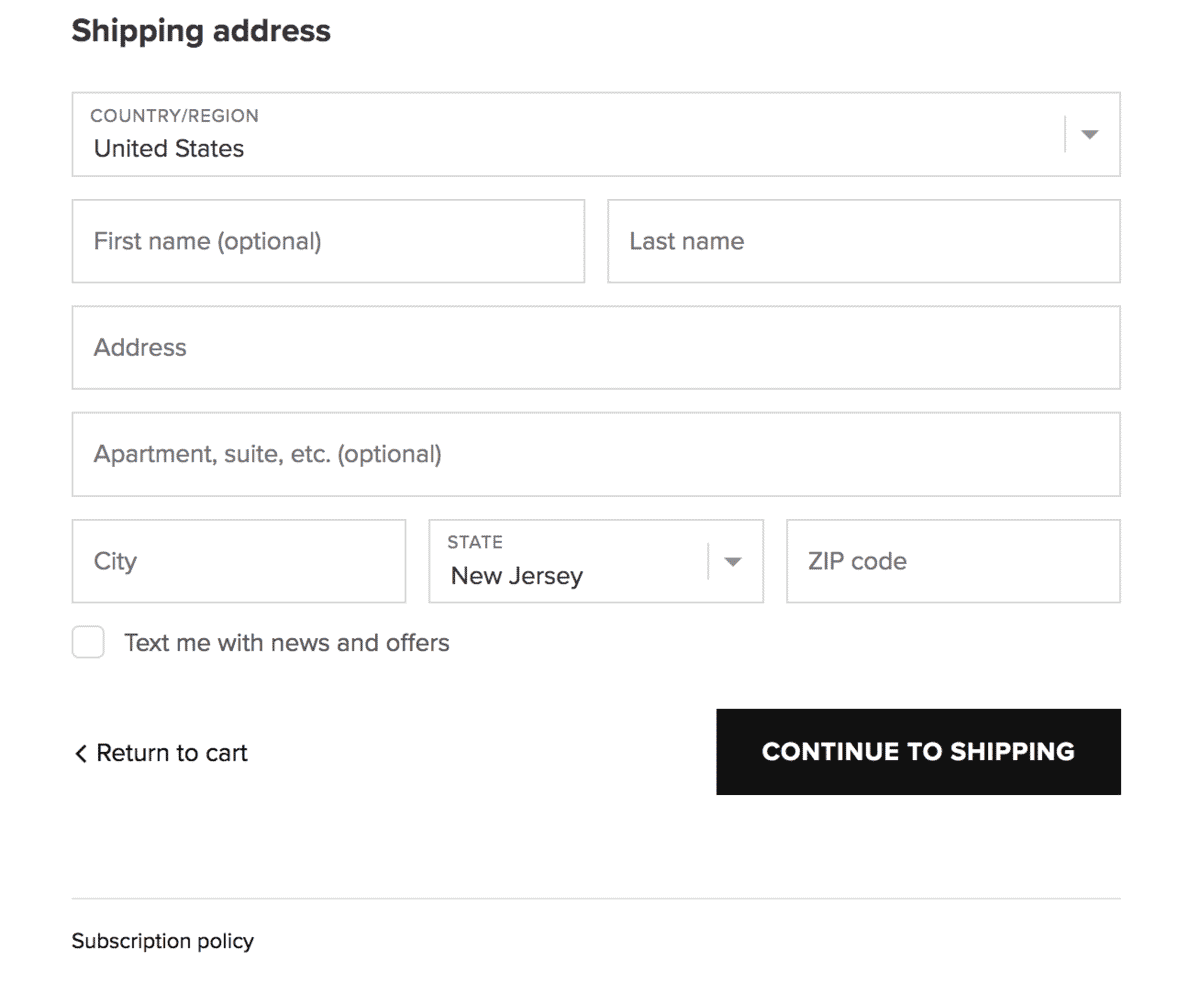

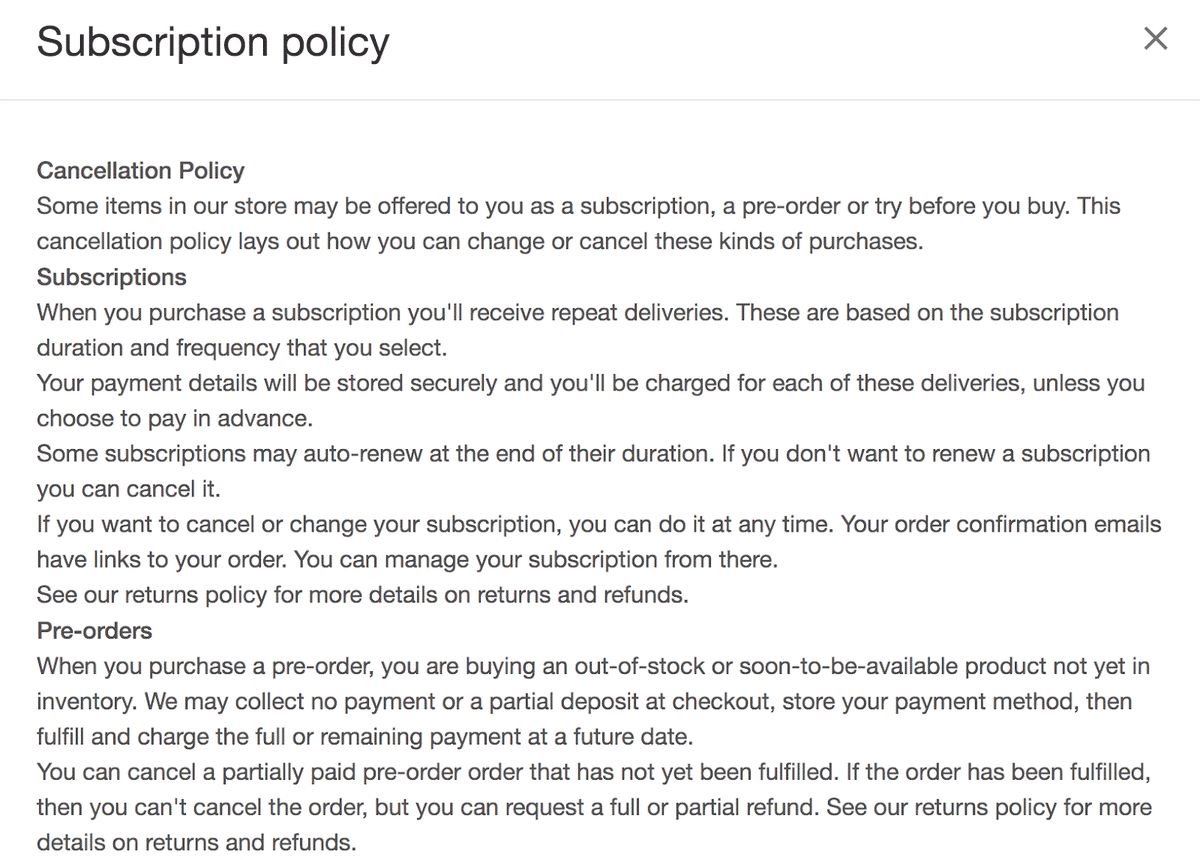

For example, Ascent Protein has a subscription policy button at the bottom of their form:

Source: Ascent

When shoppers click on it, it expands into a popup box where the customer can read policies regarding cancellation, pre-orders, subscription, and generally, try before they buy:

Source: Ascent

This is a great way to save space on your form while also giving your customers the ability to easily view your payment policies.

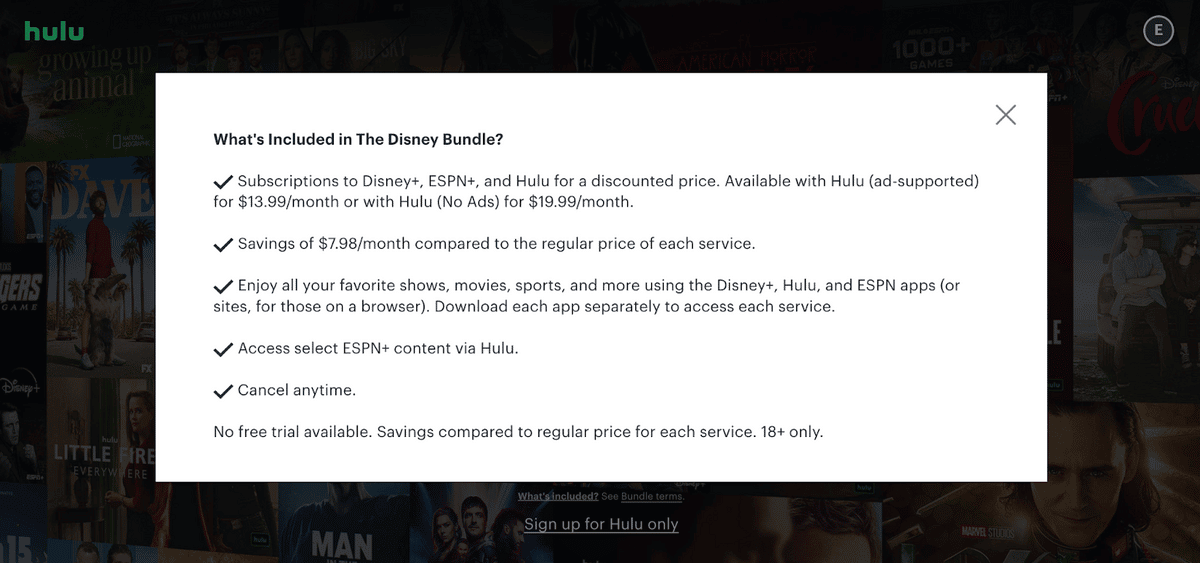

Other companies, like Hulu, share the most important policy information, like free cancellation and price per month, on their homepage:

Source: Hulu

And then, as customers progress through the subscription process and get closer to checkout, they will see a summary of the policy and then an option to read the specifics of the policy:

Source: Hulu

Even though it sometimes might seem like your customers will be driven away by some of your policies, the opposite is often true.

Customers who clearly understand what they’re signing up for and expected to pay are going to be more likely to finish the subscription.

Feelings of confusion are more likely to drive them away than a slight annoyance with a little cancellation term.

Conclusion

There are some serious benefits to gain by using a recurring billing service, such as reducing churn, improving customer loyalty, and saving your team time that otherwise would be spent doing mundane administrative work like typing and sending out invoices and reminders.

Some ways to ensure your recurring billing service is providing you with the maximum benefits are using automated account updaters and retries, sending invoices reminders a few days before the due date, and other tactics we’ve covered in this article.

Most of these tactics are easy to roll out quickly as long as you have recurring billing software, like Regpack.