When selling products or services online under a subscription-based or payment-in-installments model, recurring credit or debit card transactions are a great source of steady cash flow and predictable income.

But when a customer disputes one of these charges with their card issuer instead of contacting your business, then you’re dealing with the issue of recurring billing chargebacks.

In this guide, we’ll explore these chargebacks, why they happen, the process involved, and most importantly, how to prevent them and what to do if a customer initiates one.

What Are Recurring Billing Chargebacks

To better understand recurring billing chargebacks, let’s look at how a subscription or installment-based business model works online.

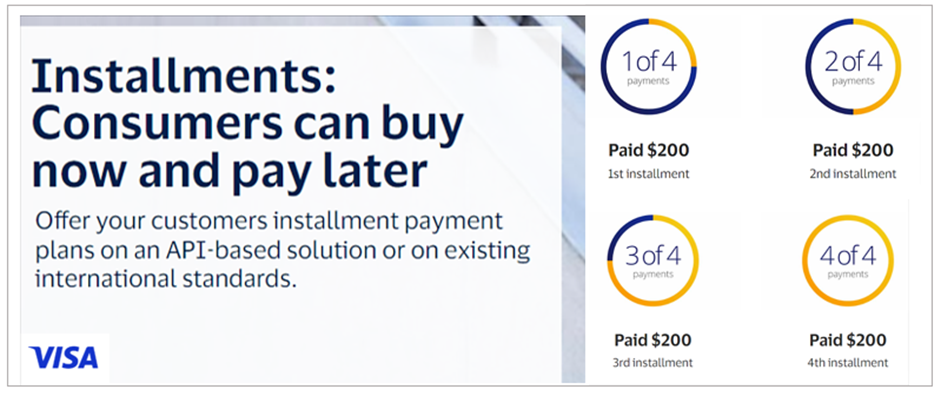

For starters, customers usually purchase a subscription (for streaming services, SaaS products, etc.) or agree to pay in installments (for events, courses, higher-value purchases, etc.) by providing their credit or debit card information during the initial transaction.

In doing so, they accept that their card will be automatically charged regularly (e.g., monthly, quarterly, annually) for an indefinite time (for a subscription) or a limited number of times (for installment payments).

This gives the customer the ultimate convenience of not paying the total amount for a service or product at once and not thinking about upcoming payments.

In turn, this provides your business with a reliable and predictable revenue stream.

However, this automated card-charging process is not without its flaws.

As said, when a customer—for whatever reason—decides to dispute the charge they see on their card statement with their issuing bank instead of addressing it with your business, they initiate a recurring billing chargeback you have to deal with.

Let’s first explore why they happen.

Why Do Recurring Billing Chargebacks Happen

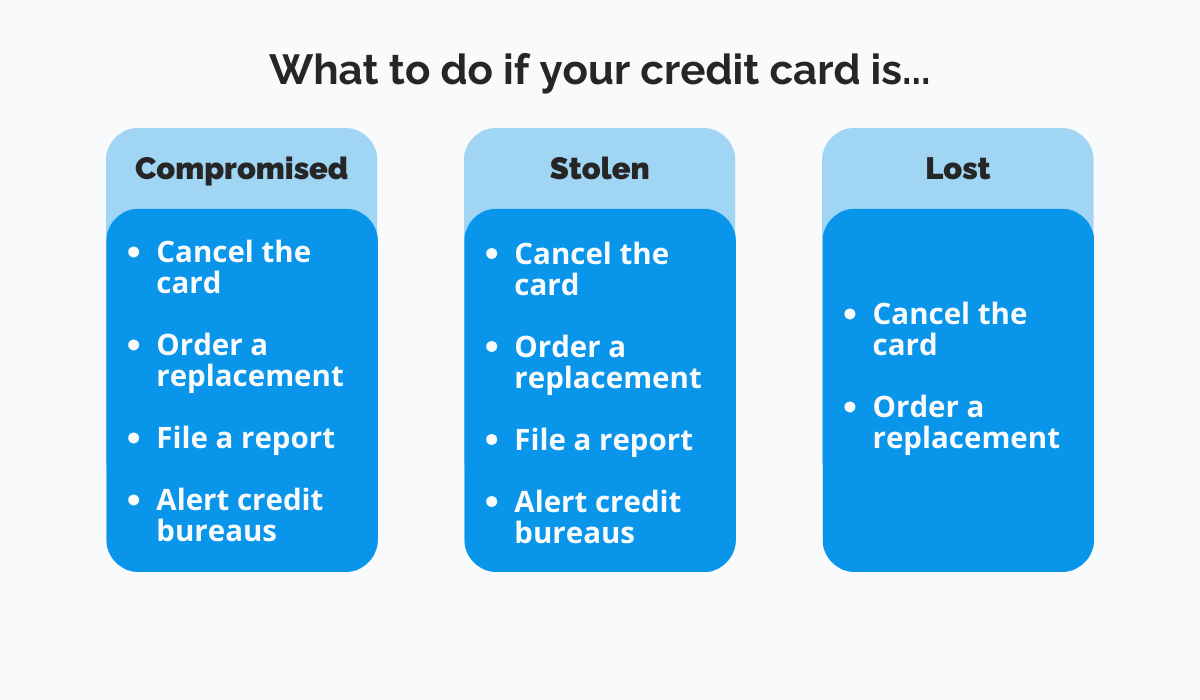

When talking about chargebacks in general, it’s important to remember that the process was initially designed by credit card companies with consumer protection in mind.

In other words, if someone stole your credit card (or its number and other data) and started charging your account with things you didn’t buy, you would contact your card provider, report unauthorized purchases, cancel the card, and initiate a chargeback.

Such cases and required actions are shown below, courtesy of Scored Credit:

However, these cases, whether or not card fraud is involved, are the only time a customer should contact the credit card issuer first instead of getting in touch with your customer support service.

In all other cases where consumers are entitled to dispute a card charge, they would be better advised to talk directly with your business and resolve the issue.

For example, a customer can—but doesn’t need to—request a chargeback if they report to the card provider that:

- they didn’t get what they ordered

- the product or service is defective in some way

- they were overcharged

While protecting consumers from substandard and fraudulent merchant practices, these and other justified card chargebacks also give rise to many instances where customers find it easier (or more profitable) to file a chargeback.

Simply put, the chargeback system is stacked against the merchant, and people, unintentionally or otherwise, take advantage of that fact.

That said, let’s look at more specific causes of chargebacks for businesses using the recurring billing model.

Why Is Recurring Billing Susceptible to Chargebacks

When a customer manually makes only the initial transaction and automates their subscription or installment plan, they can forget about it—and they often do.

This is the primary reason for most chargebacks, especially when long billing periods are involved, such as an annual subscription plan for various services and products.

Customers will see a charge on their statement, won’t recognize it, and will contact the card issuer to request a chargeback.

Again, with a little email search or googling, they would’ve probably seen that YES, they did buy that subscription, and NO, they didn’t cancel it (although they may have intended to).

However, human nature takes over, and, whether because of ignorance, convenience, or personal benefit, many customers will avoid talking to you, the merchant, and rather dispute the charge with the card issuer.

Of course, they also may have contacted your customer support, asked for a refund, and were denied or ignored for some reason.

As for real-life examples, let’s look at one where your business’s (essentially unintentional) actions and your customer’s choice of action can lead to a recurring billing chargeback.

Let’s say your customer canceled their subscription.

However, when they did it, it was too late for your automated billing system to recognize that fact and stop the scheduled charge.

As a result, the customer could have been charged in spite of canceling, giving them a justified reason to file a chargeback.

Of course, there’s less chance they’ll do so if your payment software flagged the “late” cancellation and the automated charge that followed, and your staff contacted the customer with the promise of a quick refund.

Another relevant example with more dishonest intentions involves a customer initiating a chargeback because they forgot to cancel their subscription on time.

Instead of owning up to that fact and canceling before the end of the next cycle, they would rather get back the money for the last billing period. They could call upon any of the reasons we discussed, forcing you to deal with the chargeback process and its consequences.

So, let’s see how this process works and what steps are involved.

How Does the Chargeback Process Work

Naturally, every major card issuer has its own chargeback procedures, but the steps in this process are generally similar.

Unsurprisingly, the chargeback process involves a lot of actors and separate claim review and investigation procedures. As a result, it may take a while before you, the merchant, are even aware that one of your customers filed a chargeback.

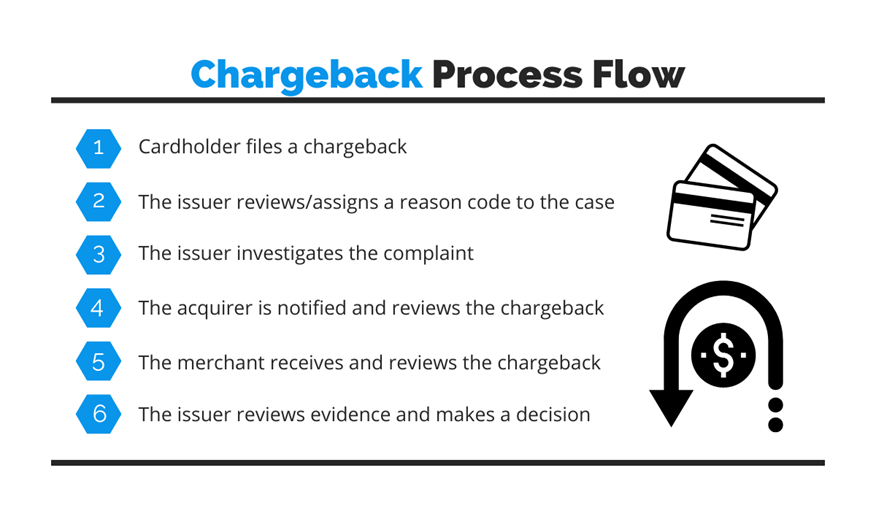

Although the number of steps can vary, here’s a simplified chargeback process flow:

As you can see, it all starts when a customer (cardholder) wants to dispute a charge on their card statement and contacts the card-issuing bank.

Based on the cardholder’s initial claim, the issuer will assign a reason code, which serves as a standardized way to categorize the basis of the dispute.

This doesn’t mean the issuing bank has made a final determination on the validity of the cardholder’s claim, which occurs when the issuer investigates the complaint.

During the investigation, if the bank decides the claim is void, no chargeback will occur, and the cardholder will be notified.

However, if the issuing bank considers the cardholder’s case valid, in most cases, it will first execute the chargeback—giving the customer the benefit of the doubt—and then notify the acquirer (your bank).

In this case, the issuer removes the funds from your merchant account (where they wait for card transactions to be approved) and transfers them back to the cardholder as provisional credit.

This is also where the issuer’s chargeback fees and administrative costs come into play, as well as potential penalties and credit card use restrictions when your business repeatedly gets high numbers of chargebacks.

At this point, your acquiring bank will be notified and provide the card issuer with any evidence it has in your favor that would reverse the chargeback.

During or after this process, the acquiring bank will finally inform you, the merchant, of the chargeback.

As we’ll see in the last section, at this stage, you can either accept the chargeback-generated loss or appeal it with the card issuer and provide evidence to the contrary.

However, before we cover what to do when faced with recurring billing chargebacks, let’s see what you can do to prevent them.

How to Prevent Recurring Billing Chargebacks

First, it’s important to note that not every chargeback can be prevented.

Some will be a result of actual fraudulent activity, and some will be your business’s fault due to internal procedural errors and oversights.

However, you can do plenty to significantly reduce the number of recurring billing chargebacks, so let’s quickly cover some key tips.

Ensure That the Information You Provide Is Correct

To avoid misunderstandings that could lead to a chargeback, ensure that your customers have the correct information before purchasing and when they’re charged.

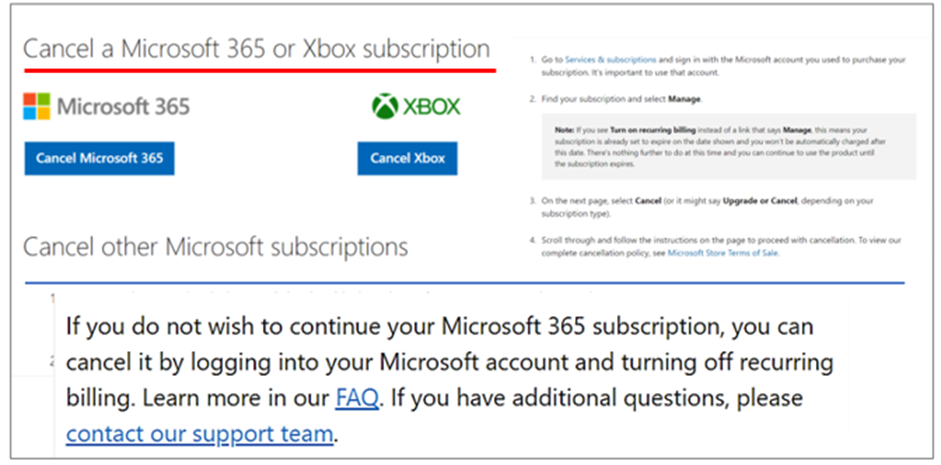

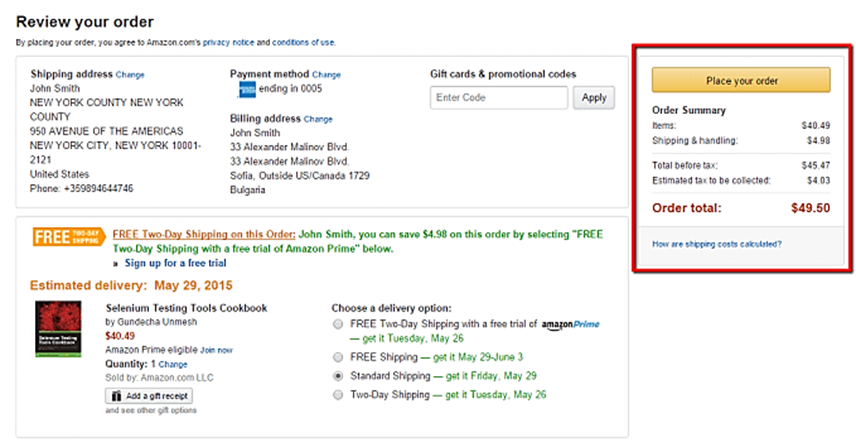

One surefire way to ensure customers are clear on what they’re buying and confirm they agree to your terms and conditions is to provide a detailed order summary before clicking “Subscribe” or “Checkout.”

This automated feature of your recurring billing software reduces the likelihood of customers reporting incorrect charges to the card issuer.

It also provides your business with necessary evidence should you choose to dispute their chargeback claim.

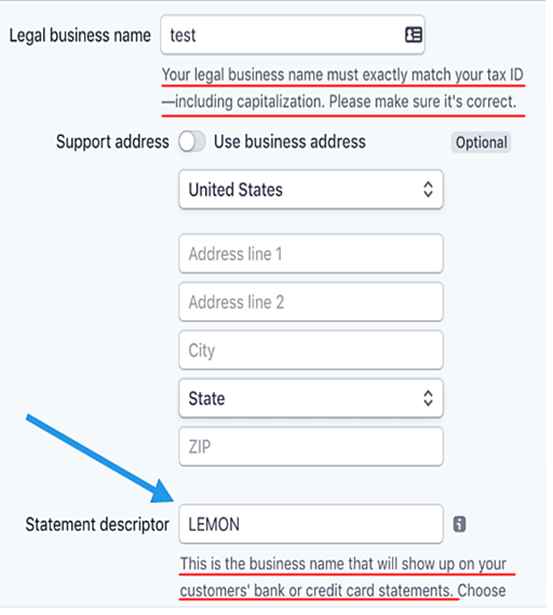

Another tip related to providing correct information is more technical but can help you avoid chargebacks caused by confusion and seemingly conflicting information.

This can happen when the customer does not realize that the charge on their bank or card statement is actually for something they purchased because they didn’t recognize the billing descriptor.

Simply put, a billing descriptor is the name that will be listed on their credit card statement, along with a short description of the transaction.

Since that name (typically the merchant’s legal business name) sometimes differs from their trade name, this can confuse some cardholders.

All things considered, you should ensure that your billing descriptor is recognizable and consistent across different purchases and over time.

Additionally, consider adding contact information in the second part of the descriptor to encourage users to contact your customer service instead of their card issuer.

Overall, ensuring that the information you provide (in an order summary and your billing descriptor) is correct is a great way to prevent recurring billing chargebacks, which works even better with our next tip.

Keep Your Customers in the Loop at All Times

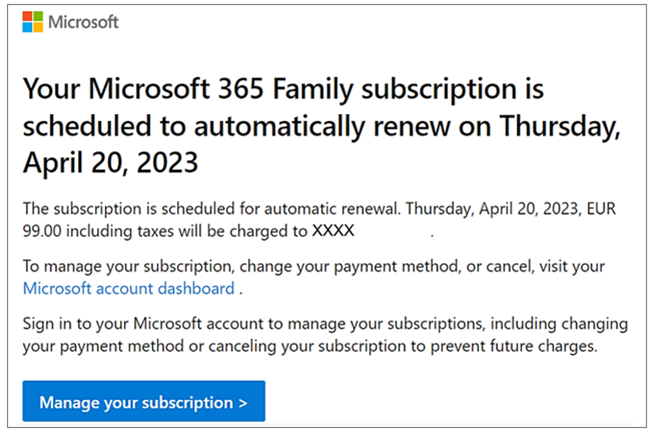

To prevent your subscribers or installment plan holders from filing chargebacks, you should always keep them in the loop. For instance, you could notify them before and after each recurring charge using automated emails.

Moreover, for businesses using some type of free trial to attract customers, credit card companies have mandated they inform the customer that the end of their free trial is coming up.

The exact best practice, although not regulated, applies to sending automated notifications before each recurring billing.

This has a double effect of ensuring the customer is aware that a corresponding charge will appear on their card statement and that they implicitly agree to it by not canceling their subscription.

Other best practices include sending automated payment confirmation emails and informing the subscriber or customer that your prices (and their billing amount) have changed.

Naturally, all these email notifications need to be automatically sent at the right time, i.e., when triggered by an event (transaction performed, payment failed) or a specific date (before each recurring billing or in case of price/terms changes).

The best way to handle this complexity is with an all-in-one payment platform.

Such a platform allows you to automate all billing workflows (registration, payment processing, and email communication) within one integrated solution.

One such solution is Regpack, our recurring billing software with integrated payment processing embedded right on your website.

In a nutshell, Regpack will provide your team with the necessary automation needed for customers to be always informed on time via email notifications that contain the correct billing information and the agreed billing amount.

At the same time, integrated payment processing ensures customers will be automatically charged according to a payment schedule you set (and they select), thus avoiding incorrect or double charging caused by human error.

Naturally, these and other features can help reduce card chargebacks, and the data provided by your payment processing platform and its provider can help fight a chargeback.

However, before that, you should do everything possible to encourage disgruntled or confused customers to contact your user support service.

Encourage Customers to Contact Customer Support

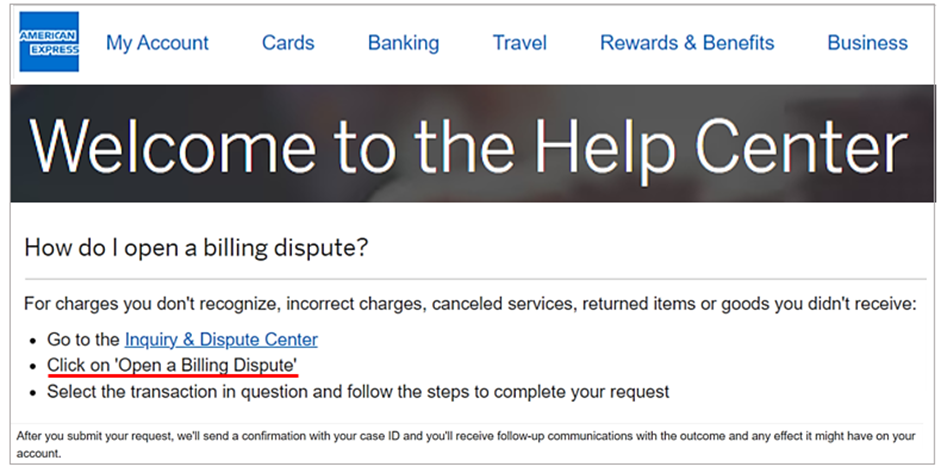

It’s simple—to avoid chargebacks, customers should be encouraged to contact your customer support service when faced with a confusing charge or a faulty product or service.

Therefore, you should give them plenty of opportunity to voice their complaints and concerns or ask questions.

In other words, you should ensure your business’s website and email communication prominently display your contact information and a link to the help center and/or live customer support.

Remember, even a partially justified refund (and a pleased complainant) is always better than handling chargebacks (once they reach you) generated by inaccessible, slow, and sloppy customer service.

All in all, when customers voice their grievances with you instead of disputing the charge with their issuer, this allows you to minimize the number of chargebacks.

Having looked at how to avoid chargebacks, let’s see what you should do when a customer initiates one.

What to Do if a Customer Initiates a Chargeback

When the chargeback process reaches a point where your business is notified, you have to decide whether you’ll accept that loss (plus additional fees) or not.

Considering all the complexities we discussed, many businesses will rather accept the loss, especially for smaller amounts, than deal with the dispute process.

This is not surprising, particularly when you consider that additional chargeback costs are typically not refunded even when a business “wins” a chargeback dispute and gets the originally charged funds back.

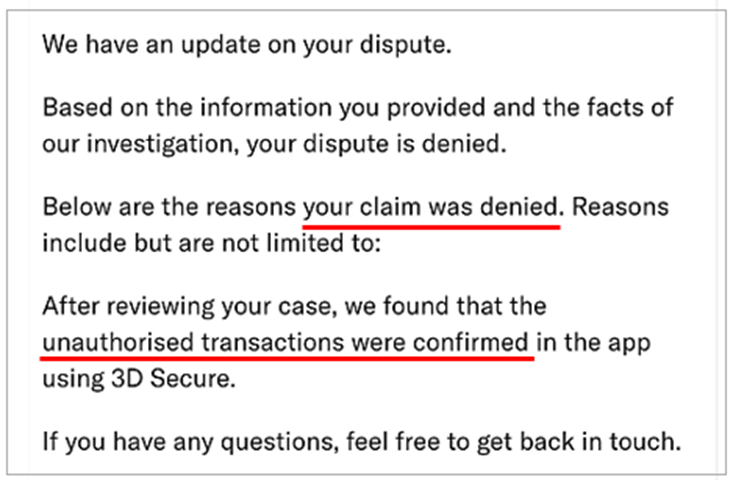

However, if a business believes the claim is false and can prove that, it can choose to fight the chargeback.

This process starts with gathering the necessary evidence (agreements, receipts, invoices, confirmation emails, and other correspondence) to present to the card issuer.

You can learn more about what constitutes compelling evidence in chargeback disputes in this article.

Again, your payment processing/recurring billing platform and its provider can be a valuable resource when challenging a chargeback.

In other words, the data collected in the software’s database makes it easy to gather evidence, and your software provider’s team can help you prepare the chargeback-contesting package and communicate with the card issuer.

To recap, when faced with a chargeback you can prove is wrong, you can fight it with the help of evidence provided by your payment platform and support provided by your provider’s team.

Ultimately, the card issuer will review the evidence and make a final decision.

Conclusion

In closing, we hope this guide has helped you better understand what recurring billing chargebacks are, what causes them, and how you can prevent them or—when a customer initiates a chargeback—facilitate its quick and amicable resolution.

Remember, with the help of the right software tools and support, you can ensure your customers are correctly and timely informed about their recurring billing transactions.

Most importantly, they can be made aware that they can resolve any issue directly with your business instead of their card issuer.

This will help you protect your business from all the additional costs and hassle that chargebacks can cause while improving your customer experience and your profitability.