There’s no disputing that the subscription-based business model is more popular than ever.

Subscription plans are now available everywhere, be it in media and entertainment, with services like Netflix and Spotify, or in different software-as-a-service (SaaS) products, including online shopping, education, publishing, and food delivery.

Although there are many reasons behind the popularity of the subscription billing model, they can be boiled down to the fact it provides stability and convenience for both businesses and consumers.

Naturally, this may give the impression that offering subscription plans is simple, but setting up, billing, and processing subscription-based recurring payments while providing customers with a seamless user experience comes with many hidden complexities and challenges.

Against this backdrop, we’ll look at seven challenges subscription businesses face and suggest how to overcome them.

- Offering Enough Payment Methods

- Providing Appropriate Billing Models

- Accommodating Users Who Change Subscription Plans

- Collecting Payments on a Regular Basis

- Keeping Revenue Leakage at a Minimum

- Providing a Seamless User Experience

- Remaining Compliant With Different Regulations

- Conclusion

Offering Enough Payment Methods

One of the challenges that any business faces is failing to offer enough convenient payment methods to ensure customers can easily pay for their products or services.

When a customer decides to buy something, they should be offered a range of payment methods wide enough to satisfy their purchasing preferences and ensure they enjoy maximum flexibility, and security while going through the payment process.

For instance, if you want to sell something worldwide, you should offer global payment methods preferred by users from different regions/countries using foreign currencies.

In general, this would include international bank transfers, credit and debit cards, online payment services like PayPal, and mobile payment apps like Apple Pay, including a growing number of regional/local digital payment methods.

Hence, when considering which payment options to offer, it’s wise to think about your target consumers, who they are, where they live, and what their preferred payment methods might be.

Source: Braintree

For example, although some might think that credit and debit cards are sufficient for international sales, they would be ignoring the fact that younger generations across the world often prefer different mobile payment apps/e-wallets.

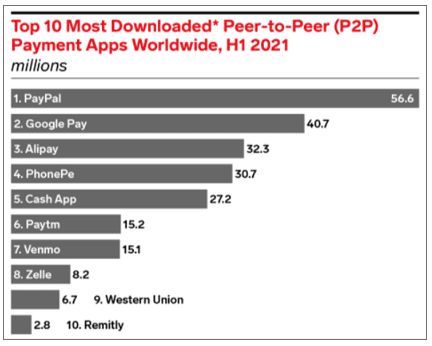

So, if your subscription product or service is intended for a younger global audience, then accepting payments via apps popular in different parts of the world could go a long way in boosting your international business, as this graph of the most downloaded payment apps worldwide shows.

Source: Insider Intelligence

For example, Google Pay and PhonePe are widely used in India, while AliPay and WeChat Pay dominate the Chinese market.

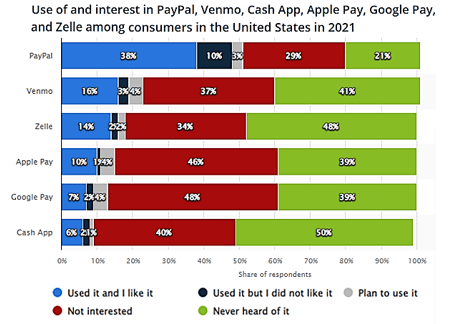

As for the US, you can see below how many consumers used the most popular mobile payment apps in 2021, courtesy of Statista.

Source: Statista

The point we’re trying to make is that your potential customers—young or mature, local or international—should be offered a wide range of payment methods so they can choose the one that gives them maximum payment flexibility, convenience, and security.

That’s because today’s customers expect their payment options to range beyond usual credit cards, bank transfers, or even PayPal.

If their favorite payment method isn’t available, they may decide to leave despite previously being ready to buy, as 42% of US consumers will do.

So, considering how your target audience would prefer to pay will enable you to select the right combination of payment methods for your subscription business, and consequently help you acquire and retain customers.

Providing Appropriate Billing Models

Another challenge subscription businesses have to tackle is deciding the most appropriate subscription billing models they should offer their users.

In other words, once you decide on the price of your product or service, you should decide how to package that price into billing/pricing models that best suit your customers’ needs, and those of your business.

Clearly, there is no one-size-fits-all billing model. Instead, each business should consider multiple subscription billing models.

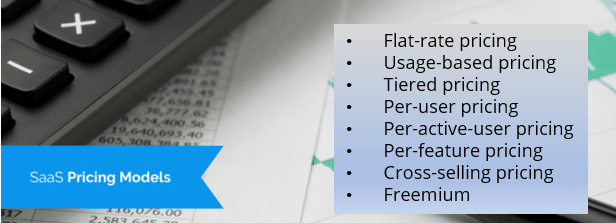

For instance, if your business is providing software as a service (SaaS) to other companies, these would be the main billing/pricing models to consider:

Source: Regpack

You can read more about each model in our article on SaaS pricing models, and we’ll look at a few of the most pertinent ones here.

For instance, the per-user billing model refers to charging a company that subscribed to your service based on the number of employees using it.

Thus, that company knows how much its subscription will cost monthly/annually per user, which in turn enables it to plan its future spending and add users when it wants.

This allows you to increase revenue as the adoption rate of your software within that company grows.

However, a company may overestimate the initial number of users and end up paying for something that’s not as widely used as expected, so they stop doing business with you.

To prevent this, you can consider the per-active-user billing model, where customers will pay only for active users, which can facilitate company-wide adoption and prevent your client from turning elsewhere.

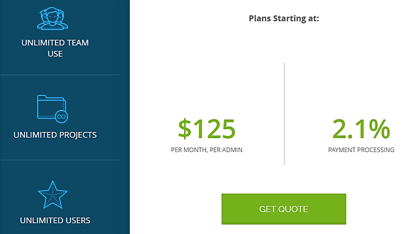

For instance, Regpack allows an unlimited number of users and projects while charging a per-admin fee, thus solving the problem of inactive users.

Source: Regpack

Finally, let’s consider the “freemium” billing model, which, although widely used, is not suitable for everyone.

This model has more variations, but it’s based on offering a free version of your software/app with basic features and charging users for advanced (premium) features.

In essence, freemium relies on users getting used to the free version enough to convert them into paying subscribers, which usually happens with only 2-5% of free users.

Given all of the above, the goal of any subscription business should be to review and then select the appropriate billing models that will ensure their long-term profitability and steady cash flow, while providing the utmost convenience and flexibility for your target customers.

Accommodating Users Who Change Subscription Plans

The next thing subscription businesses might find challenging is accommodating users who want to change subscription plans.

For instance, a customer may have opted for a “basic user” plan with limited features but soon realized they wanted to upgrade it.

As the billing cycle of their basic subscription plan is already underway, this creates billing issues for the provider.

However, in today’s market, the customer shouldn’t be expected to wait until the end of the billing cycle to make such a change but should be allowed to do it at any time.

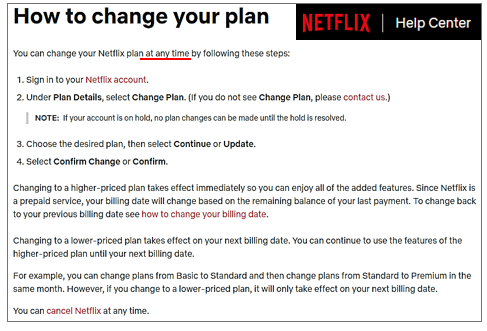

Here’s how Netflix accommodates its users.

Source: Netflix

In other words, subscription businesses must be flexible enough to allow real-time changes whenever their users want to upgrade, downgrade, cancel, renew, and make other modifications to their subscription plans.

Although that provides the expected flexibility and convenience for customers, it also makes it complex for businesses to track and properly bill these changes, which can lead to billing mistakes and disgruntled customers.

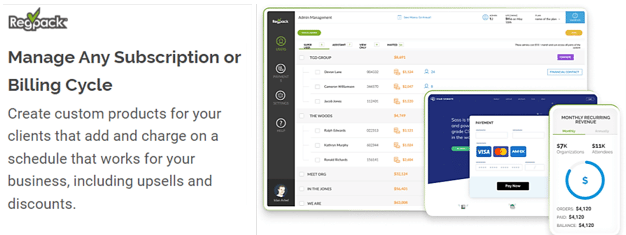

The answer to this and most other challenges presented here is to find and adopt the right subscription management software that will allow you to manage all changes to subscription plans and their billing cycles, such as Regpack.

Source: Regpack

Since most subscription-based businesses want to acquire new customers over time while catering to their existing subscribers, that’s hard to achieve without the help of one or more software solutions that will streamline the management of subscription plans, recurring invoices, and payments.

So, although accommodating users who change subscription plans in the middle of a billing cycle does present some challenges, they’re best addressed by using billing software

that fits the specific needs of your subscription business and your customers.

Collecting Payments on a Regular Basis

Collecting payments on a regular basis is the lifeline of any subscription business, but that may prove to be challenging for a number of reasons.

For instance, some of your customers will simply forget that they subscribed to a service and consequently that they should pay their subscription every month/year/etc.

This means you will need to send out timely payment reminders, as well as manage late and failed payments.

Another example is when your customer initially buys a subscription plan and provides their payment details during the checkout process, and then the recurring billing process relies on that information for correct future billing.

When some of those details change, i.e., their credit card expires, you won’t be able to bill that user until they update their information.

When handled manually, these and other payment issues can quickly pile up or lead to billing mistakes, misunderstandings, and unhappy customers.

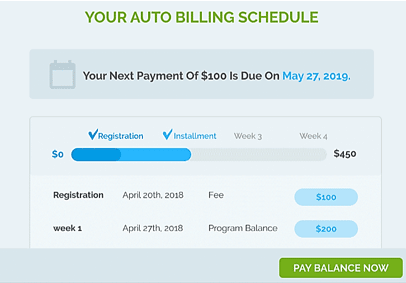

The answer is again in automating the recurring billing process with the help of a software feature that allows users to pick how and when they will be charged for the product in advance. In other words, you’ll want to set up auto-billing.

Source: Regpack

In a nutshell, this feature enables you to create custom payment plans and offer them to your customers who, after selecting their preferred option, are charged automatically on a regular basis, thus making sure your subscriptions are paid on time.

However, even when everything is automated, tracked, and managed, you can still expect some missed, failed, or overdue payments, so it’s in your interest to maintain good communication with your users to help solve such issues.

In summary, collecting payments on a regular basis is critical for subscription businesses, and that process is best managed with the help of recurring billing software.

Keeping Revenue Leakage at a Minimum

When users change plans, or use discounts and other marketing offers, it gets easier to charge them incorrectly to your detriment, which leads to revenue leakage.

For instance, when users are allowed (as they should be) to change their subscription plans at any time, this creates many opportunities to undercharge them mistakenly.

Then there are other marketing schemes your business will probably use, such as free trials, discounted prices for x months, limited-time offers, etc., all of which just increase the likelihood of billing mistakes and lost revenue.

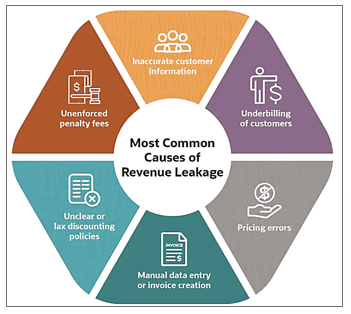

Here are the most common causes of revenue leakage, including underbilling and pricing errors.

Source: Oracle

As you can see, revenue leakage is often the result of human error, incorrect information, and flawed processes.

The solution? Same as before.

In other words, you need a centralized system (software) that will keep track of all these different billing options and allow you to easily manage them, thus keeping revenue leakage at a minimum.

Providing a Seamless User Experience

As subscription businesses depend on user loyalty and ongoing payments, providing a seamless user experience (UX) is absolutely essential for their long-term survival, sustainable cash flow, and profitability.

At the same time, ensuring that the entire customer experience is free of mistakes and delays, as well as smooth and enjoyable, is the most wide-ranging challenge that includes all those aspects we have covered so far, together with some additional ones.

For instance, after you decide on appropriate subscription billing models and select convenient payment methods, you will also want to ensure a simple and clear online sign-up process, so users can easily subscribe.

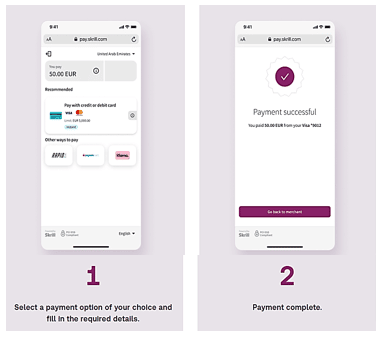

Of course, the next step is ensuring users can easily pay you after selecting a subscription plan.

So, sign-up should be followed by a transparent and concise payment process, which must include secure capture of payment details (e.g., credit card data) and other sensitive user information.

Furthermore, the secure checkout process should be streamlined to minimize potential data breaches and provide a smoother user experience, like in this example.

Source: Skrill

Continuing with examples of a frictionless user experience, your customers will, once they have paid and subscribed, expect some level of self-service where they can easily change subscription plans.

So, that needs to be set up and managed, as we discussed before.

Then, a seamless customer experience also involves high-quality user support, training (if required), correct billing, timely notifications, clear communication with users in all interactions, including late payments and other issues, and so on.

And there’s still a lot to do on the business side of things, like configuring and automating customer emails or ensuring a simple cancelation process, etc., all of which serves to make the entire customer experience smoother.

As you can see, creating a seamless user experience requires a multi-faceted approach, but if done right, it can be extremely beneficial for your business.

Remaining Compliant With Different Regulations

Remaining compliant with different regulations is crucial for protecting your users and your business from cyberattacks, data breaches, payment fraud, identity theft, and other online and offline risks.

As such, it’s also integral to providing a seamless user experience.

Of course, ensuring secure payment processing and protecting user data privacy can be challenging for many subscription businesses, especially when they’re operating internationally.

After all, it’s easy to get lost in different compliance regulations such as globally recognized PCI DSS, Californian CCPA, or European SCA and GDPR, so we’ll briefly touch upon each.

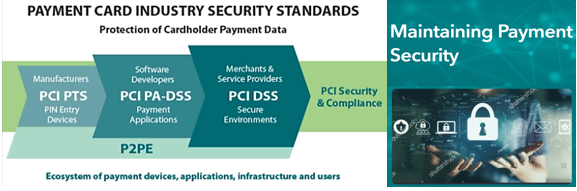

In essence, your subscription business starts with being compliant with PCI DSS (Payment Card Industry Data Security Standard) regulations.

Source: PCI Security Standards Council

Simply put, PCI DSS is a set of guidelines developed by major credit card companies to ensure that businesses processing credit card data do so in a secure environment.

You can read more about what businesses should do to achieve PCI DSS compliance here.

We should also mention Strong Customer Authentication (SCA), a regulation that should be complied with in transactions with European users.

This is a security standard already adopted across Europe, which basically requires payment service providers, such as banks, to authenticate customers before approving online and offline contactless payments using at least two of these three factors:

Source: Stripe

As many other countries are rolling out their own SCA versions, compliance with this security standard will soon be expected worldwide.

There are also numerous data privacy protection regulations that could affect how you collect, process, and store the private data of your users.

Two of the most well-known ones are the California Consumer Privacy Act (CCPA) in the US and the General Data Protection Regulation (GDPR) in the EU.

Of course, keeping track and remaining compliant with these and many other regulations, whether national or international, wouldn’t be possible without a set of different software tools and service providers that automate all these processes.

In other words, you should do some research, select appropriate solutions, and automate and/or outsource compliance issues, thus addressing this challenge.

Conclusion

Having covered seven challenges subscription businesses face, it’s clear that each can be successfully tackled with careful planning, good preparation, and suitable software and service solutions.

When combined with the quality product or service your business provides, this can ensure a safe and enjoyable experience for your customers and a steady stream of income for your subscription business.