When a customer disputes their credit or debit card charge for a subscription—be it for a gym, streaming service, SaaS product, or, nowadays, almost any other service—for whatever reason, this can result in a chargeback.

As the number of your customers grows, your business will inevitably have to deal with a lot of these disputed subscription payments, regardless of whether they’re legitimate or not.

This can take a toll on your business in the form of revenue loss, increased processing fees, increased risk of fraud, and even account termination by the payment processor.

The best way to prevent recurring billing chargebacks?

Preemptive action.

In this article, we’ll explore seven simple yet effective ways how you can prevent recurring billing chargebacks and protect the revenue and reputation of your business.

- Ensure Customers Understand Your Free Trial Terms

- Provide Customers With a Detailed Order Summary

- Make Sure Customers Recognize the Billing Descriptor

- Notify Customers Prior to Each Recurring Billing

- Encourage Customers to Contact You Directly

- Make It Easy for Customers to Cancel the Subscription

- Offer Refunds to Your Customers if Necessary

- Conclusion

Ensure Customers Understand Your Free Trial Terms

When suitable for your service or product (or both in any combination), offering a free trial is an excellent way to attract potential customers and showcase the value proposition of your business.

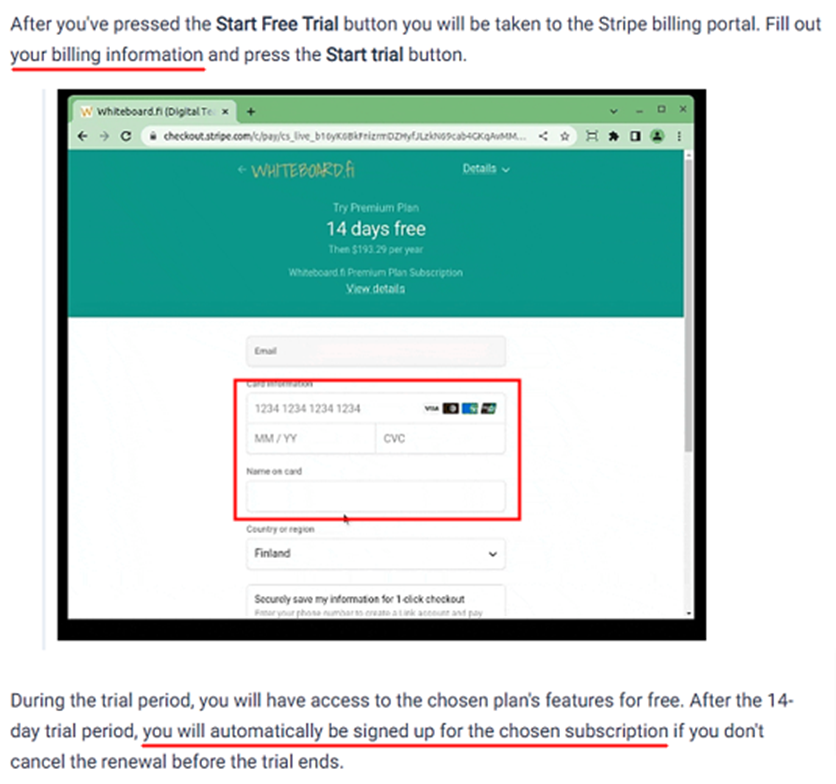

Equally, ensuring customers understand your free trial terms is a great way to prevent chargebacks, particularly if your policy is to take a customer’s credit card information at the trial sign-up and automatically upgrade them to a paid plan at the end of the trial.

Here’s an example.

Source: whiteboard.fi

As you can see, in such cases, customers must be made aware of this—the automatic start of billing after trial expiry—otherwise, they might file a chargeback.

Moreover, the Consumer Financial Protection Bureau (CFPB) recently issued a statement warning that:

Companies risk violating the law if they do not clearly and conspicuously disclose the terms of their subscription services and obtain consumers’ informed consent, or if they make it unreasonably difficult for consumers to cancel.

Therefore:

Source: whiteboard.fi

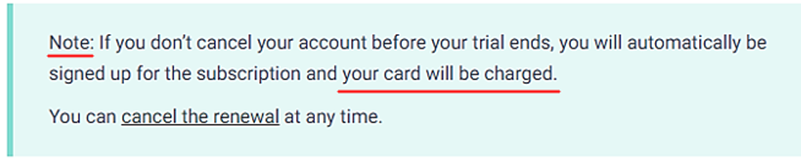

Better yet, you should reconsider whether requesting the customer’s credit card information at trial sign-up is really necessary, as it significantly increases the risk of chargebacks.

For starters, customers often forget about trial subscriptions and get charged for a service they might not want or no longer use.

This can lead to them filing a chargeback request with their bank or credit card issuer, which can be a costly and time-consuming process for your business to handle.

Additionally, as quoted above, this practice can also hurt your business reputation as it’s increasingly considered unethical and—in some cases when free trial terms are not explicit—even illegal.

Conversely—when credit card information is not required upfront—customers are more likely to take advantage of the free trial when they aren’t feeling pressured to continue to use the service or cancel it before being charged.

Here’s an example.

Source: GoCodes

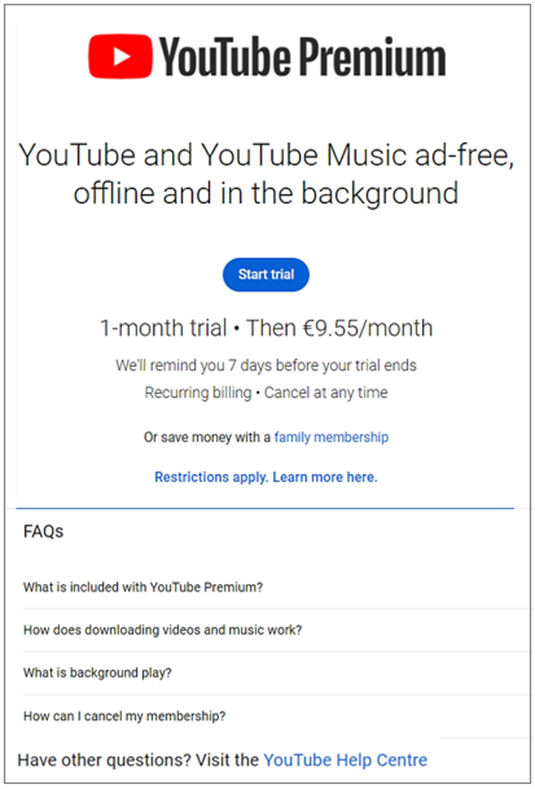

To ensure that customers understand your free trial terms before signing up, it’s also a good idea to have FAQs on the same page as the free trial sign-up.

FAQs should clearly outline the trial terms and what happens at the end of the trial period.

This way, customers are aware of what they’re signing up for and can avoid any misunderstandings that could prompt a chargeback.

YouTube Premium is a good example, with their FAQs at the end of their free trial webpage.

Source: YouTube

Last but not least, it’s not only advisable to inform customers when the end of their trial is coming up, but it was also prescribed as a rule by many credit card companies, such as Mastercard in 2019 and Visa in 2020.

Therefore, it’s important to comply with their rules and regulations to avoid chargebacks and their consequences like lost revenue, increased processing fees, or merchant account suspension.

Overall, ensuring your customers understand your free trial terms—along with not having to give credit card info upon trial sign-up, having FAQs nearby, and being informed when the trial period is coming up—are crucial for preventing recurring billing chargebacks.

Provide Customers With a Detailed Order Summary

When customers sign up for a subscription, it’s crucial to provide them with a detailed order summary before finalizing their purchase.

Simply put, an order summary allows the customer to review and confirm their agreement with the terms and conditions of the subscription before clicking “Subscribe” or “Checkout”.

This has a double effect—it makes it less likely that customers will file a chargeback out of ignorance and protects your business if a chargeback is filed.

Therefore, let’s explore what information a detailed order summary for a subscription should include.

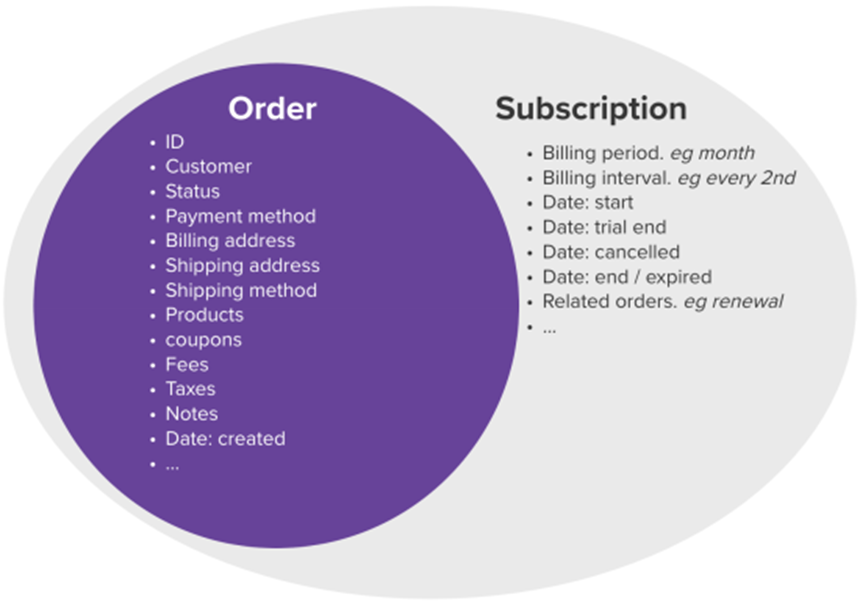

According to WooCommerce, here’s what typical orders and their extension—subscriptions—should cover:

Source: WooCommerce

Therefore, a subscription order summary should include all the information that a standard order would, along with additional data referring exclusively to the subscription.

According to Microsoft, this should include information such as the start date and (optionally) end date for recurring billing, the frequency of recurring billing, and the maximum billing amount (if required).

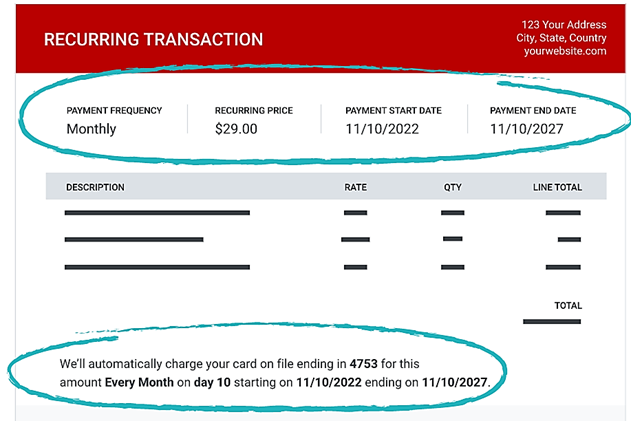

According to Chargebacks911, the initial sales receipt should include the phrase “recurring transaction” and other details highlighted here.

Source: Chargebacks911

It’s also advisable to include a separate checkbox that the customer needs to check to indicate their agreement with your business terms and conditions before finalizing their purchase.

This helps protect your business in a chargeback dispute, as the checkbox indicates that the customer agreed to your subscription terms.

Therefore, it’s clear why providing customers with a detailed order summary, clear subscription terms and cancellation policies (discussed below) and a check box to confirm their agreement is crucial for preventing chargebacks and protecting your business.

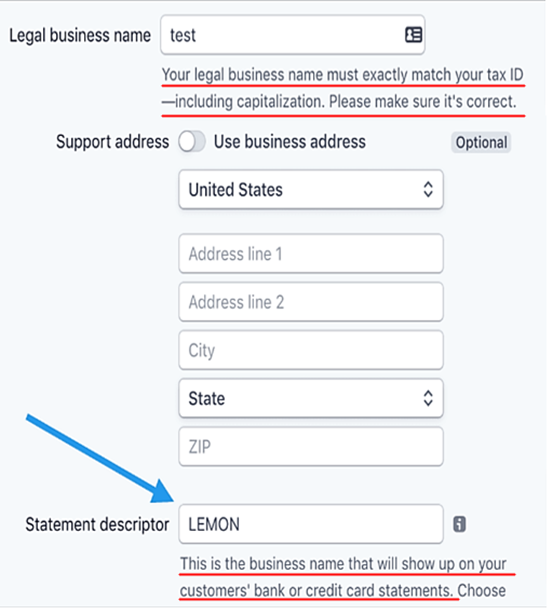

Make Sure Customers Recognize the Billing Descriptor

The billing descriptor is the name that appears on your customer’s bank or credit card statement after they make a purchase (subscribe), and—if they fail to recognize it—they might file a chargeback.

In other words, to quote Midigator’s glossary:

A billing descriptor describes a payment and helps the cardholder identify the transaction on his or her bank statement. If the cardholder doesn’t easily understand the billing descriptor and recognize the transaction, a chargeback might be initiated.

Most payment processors use the merchant company’s legal business name as the default in the billing descriptor.

However, when the company’s trade name is different from its registered name, and the registered name is the one that appears in the billing descriptor, customers may not recognize who is charging them.

To illustrate:

Source: GitHub

Therefore—to prevent chargebacks—you should ensure that your company’s billing descriptor is clear and recognizable to the customers, as well as consistent across all transactions.

This consistency will help customers easily recognize your business and thus further reduce the likelihood of chargebacks.

It’s also advisable to include—in the second part of the billing descriptor—the contact information of your business (website, email address, or phone number) so that customers can contact support if they’re confused about the charge.

Hence, by ensuring your billing descriptor is recognizable and consistent, you can reduce the chances of confused customers filing chargebacks because they don’t recognize your company’s name.

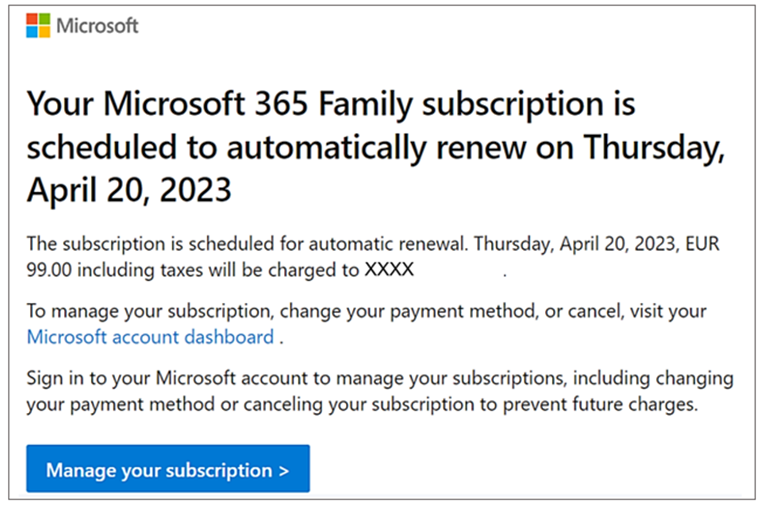

Notify Customers Prior to Each Recurring Billing

Although they’ve agreed to being billed for your service/product on a recurring basis (e.g., weekly, monthly, annually), you should still notify your customers before each recurring billing.

This step ensures that the customer is aware of the upcoming charge on their credit card or bank statement and they still want to continue with the subscription, thereby protecting your business from chargebacks.

Therefore, you should—as a best practice—notify your customers about a week prior to each recurring billing.

Mind you, this period will vary depending on many business-specific factors.

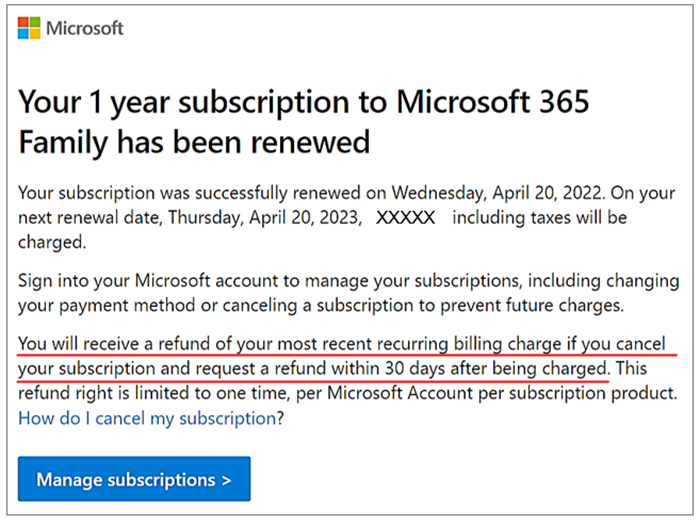

Source: Microsoft

Moreover, if the amount a customer/subscriber will be billed exceeds the previously agreed upon recurring billing amount, you should—as a rule—notify the customer in advance.

This notification gives customers enough time to review their subscription and payment information and allows them to take necessary steps if there are any discrepancies.

It’s also advisable to send payment confirmation emails, which provide customers with complete transparency and increase their trust in your business—while serving as proof in case of chargebacks and payment disputes.

Of course, these emails should be sent automatically.

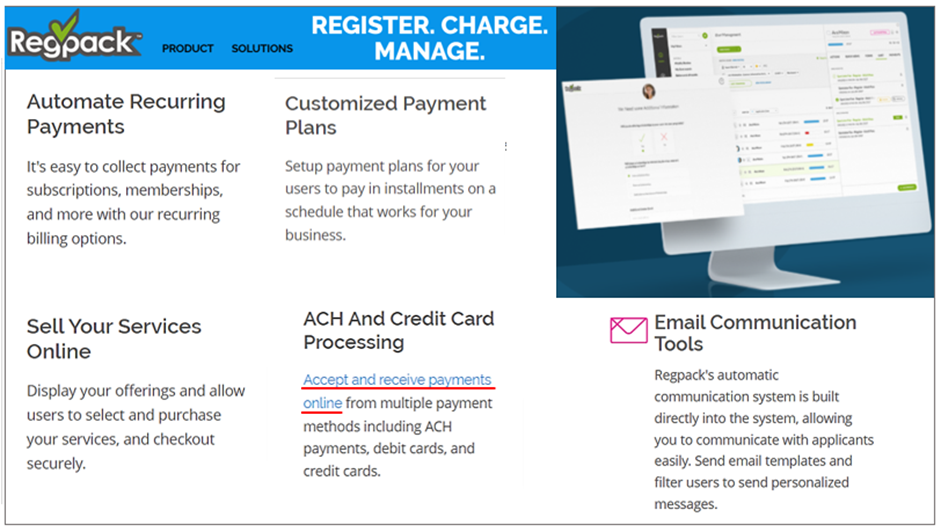

And email management is just one of many features provided by recurring billing software with integrated payment processing like Regpack.

Source: Regpack

As for email management, Regpack offers email automatization and email customization features, with which you can easily create and automate sending of notifications before and after each recurring charge for a subscription.

As for secure payment processing, Regpack automates the payment process from start to finish—as some of the above-shown features explain—all of which can help prevent chargebacks.

Overall, notifying your customers before and after each recurring billing using automated emails can minimize the risk of chargebacks and build trust with your customers.

Encourage Customers to Contact You Directly

This one is simple—if dissatisfied or confused customers contact your business for help with resolving their issue, it helps keep them from filing chargebacks to credit card companies or banks.

In other words, whenever customers have questions, concerns, or complaints, they should be encouraged to contact customer support.

That way, your business gets an opportunity to resolve recurring billing problems that would otherwise result in the customer filing a chargeback.

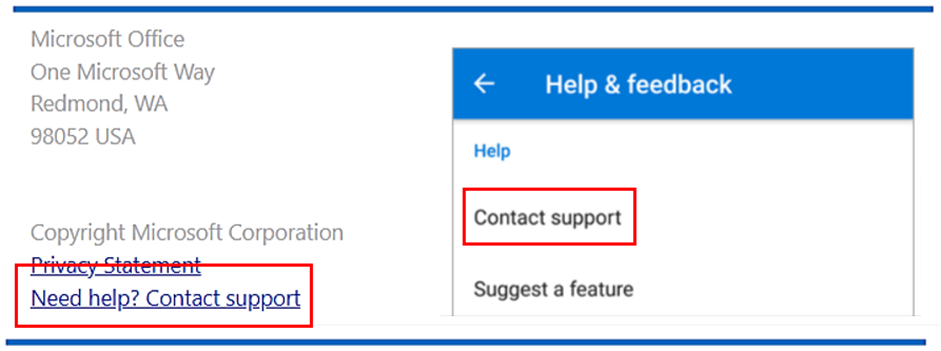

Therefore, make sure your business prominently displays contact information on your website, and that contact information is included in every email sent to customers.

Moreover, consider adding in-app support for your customers’ convenience.

Below, you can see the end of a Microsoft Office email (left) and in-app Outlook help for iOS and Android (right).

Source: Microsoft

This way, customers can quickly reach out to your business, ask questions, and have their concerns addressed in a timely manner.

Simply put, encouraging customers to contact you directly gives you an opportunity to resolve issues and prevent chargebacks.

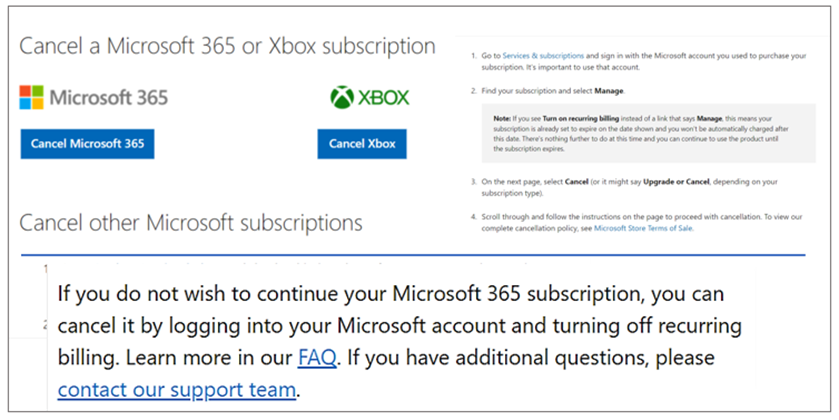

Make It Easy for Customers to Cancel the Subscription

From all the above, it’s already clear that many chargebacks can be avoided by making it easy for customers to cancel their subscription.

Put simply, when the process of canceling the subscription is long and complicated, customers may conclude it’s more convenient to request a chargeback instead.

Moreover—as quoted in the first section—if your business makes it “unreasonably difficult for consumers to cancel,” you’re risking legal consequences.

Therefore, your cancellation policy should be clear, easy to understand, and included in the terms and conditions of the subscription.

Additionally, the option to cancel their subscription should be prominently displayed on your company’s website, the customer’s account, and email notifications sent to them.

Below, you can see Microsoft’s support page for canceling subscriptions and a standard part of their email notifications.

Source: Microsoft

This way, you avoid customers being charged for something they no longer want and filing a chargeback, whether out of frustration, confusion, or convenience.

Finally, you should also consider providing customers with the option to speak to someone—even a chatbot—from customer support when canceling their subscription, giving your business an opportunity to address the reasons related to the customer’s decision to cancel.

Moreover, this provides you with valuable info about the reasons for cancellation, which can be used to improve your company’s products or services.

In any case, making subscription cancellation easy—with a clear policy and prominently displayed canceling options—helps divert customers from filing chargebacks and strengthens the relationship with your customers.

Offer Refunds to Your Customers if Necessary

Last but not least, offering refunds to your customers prevents chargebacks, fosters long-term customer relationships, and enhances the reputation of your business.

Or you can look at it this way—if the customer is going to get their money back one way or another, it’s better to offer them a refund and prevent them from filing a chargeback.

Why?

Because the consequences of a high chargeback rate are—especially in the long-term—far more damaging and costly for your business than a generous refund policy.

As a reminder, these consequences can include loss of revenue, higher processing fees, fines, and penalties, as well as merchant account restrictions or termination.

And things get even worse when chargebacks result from poor customer service, unclear policies, or friendly fraud, as both your revenue and reputation take a hit.

That’s why your refund policy should be clear, easy to understand, and included in the terms and conditions of the subscription.

Moreover, the right to refund should be clearly stated in your subscription notifications, as highlighted below.

Source: Microsoft

When approving refunds, it’s also advisable to review the customer’s history and pay special attention to the signs of a problematic customer, such as:

- frequent refund requests

- a high number of chargebacks

- suspicious or fraudulent activity on their account

However, remember that—when chargebacks are concerned—you’ll be dealing with a credit card company or bank whose decisions can override your own.

Therefore, it’s important to have a solid case with evidence supporting your decision not to give a refund.

In summary, having a clear refund policy, providing simple ways to ask for refunds, and documenting your subscription payment and notification processes—using recurring billing software—will put a stop to many chargebacks.

Conclusion

All things considered—although chargebacks are inevitable in almost any business, let alone those involving recurring billing—it’s clear there’s a lot you can do to protect your business and reduce these disputed charges to a minimum.

As a reminder, this includes providing customers with clear free trial terms, a detailed order summary, easy subscription cancellation, and refund options, timely recurring billing notifications, a recognizable billing descriptor, and great service support.

With the help of the right tools and methods, your business can ensure chargebacks either do not happen or—when they do—are quickly and amicably resolved with payment processors and customers, thus protecting your company’s bottom-line.