For any subscription business dealing with recurring billing payments—whether it’s a streaming service, SaaS service, or a subscription box business—chargebacks are a common issue.

Simply put, it’s when customers request refunds without first talking to you, opting to dispute the charge with their bank.

If this happens often, chargebacks can hurt your business by reducing your profits, increasing the fees you pay, and even risking your account getting closed by the payment processor.

Chargebacks happen for various reasons that usually fall into three categories.

These are: merchant errors, external factors like criminal fraud when it’s neither the merchant’s nor the customer’s fault, or, third, when customers want their money back because they didn’t like the customer service or the product.

Understanding the reasons behind chargebacks can help you handle them effectively, as the cause often determines if they are valid or not.

So, keep reading to learn the most common reasons for recurring payment chargebacks.

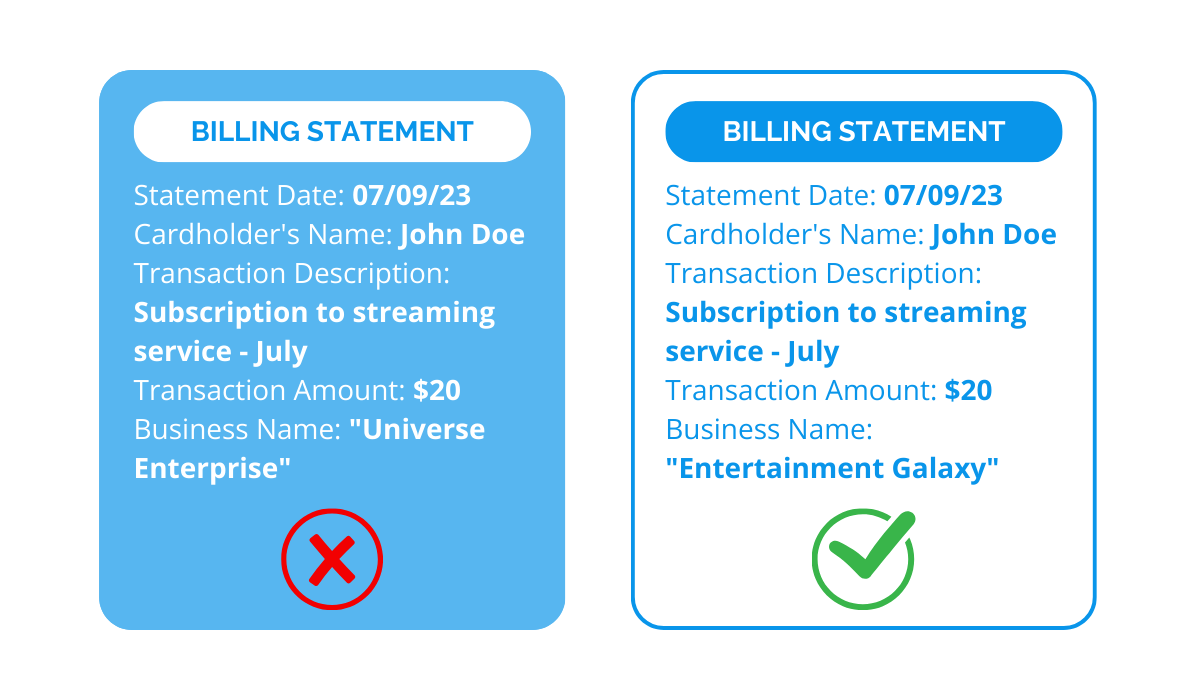

Unrecognizable Business Name

An unrecognizable business name can often be a significant factor behind chargebacks. Let’s explore why this is the case.

Imagine a customer subscribes to a monthly streaming service called Entertainment Galaxy. However, when they receive their credit card statement, the charge for this subscription appears under the name Universe Enterprise instead of the expected Entertainment Galaxy.

In such a scenario, it’s highly likely that the customer won’t immediately recognize the charge on their statement because it doesn’t match the business they subscribed to. This situation naturally leads to confusion and concern.

The customer might even mistake it for a fraudulent charge or simply forget that they made this subscription. And, if your business’s real name isn’t visible on their statement, they may not even attempt to contact you because they won’t know it’s your charge.

In turn, they will dispute the charge with their bank.

So, to avoid this happening in your business, you should make sure your billing descriptors or names on customers’ statements are clear and recognizable—they should match the name the customers associate with the service or product they purchased.

If this isn’t possible, it would be wise to inform your customers in advance that different business names may appear on their statements.

This will help you reduce the risk of chargebacks due to a customer’s failure to recognize your business name.

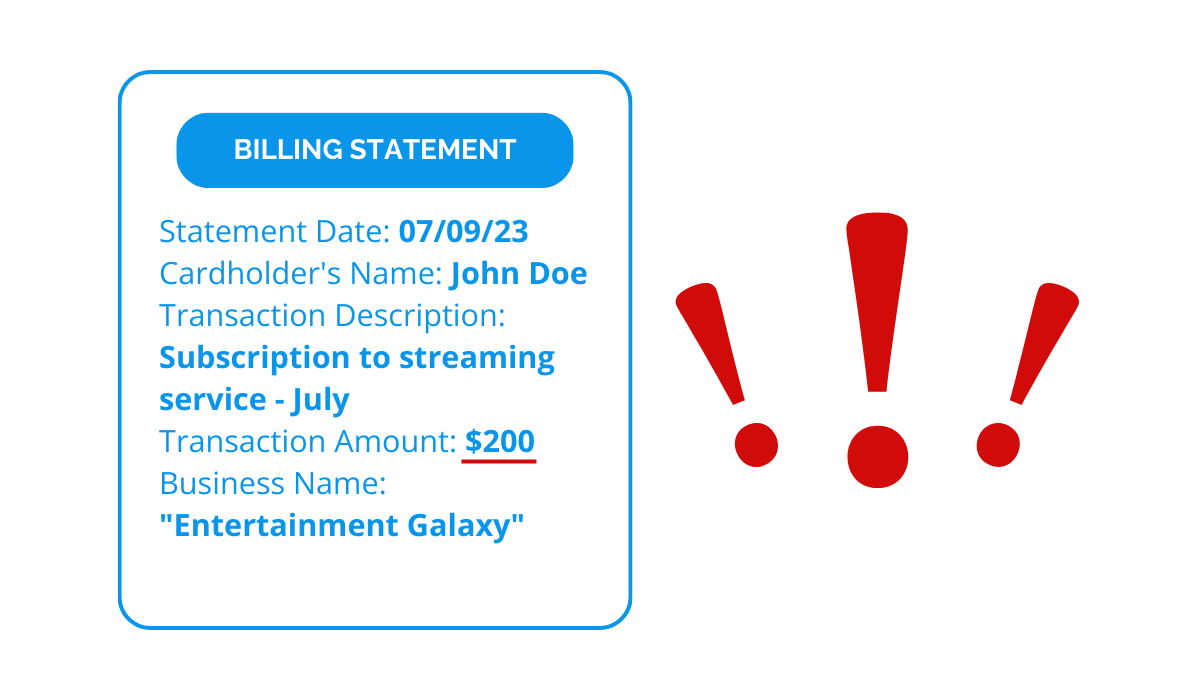

Incorrect Charge

This reason falls under the first category we mentioned in the introduction—merchant’s mistakes.

Although you would think that with recurring billing, where customers agree to pay the same amount monthly, incorrect charges don’t happen that often, that is far from the truth.

Mistakes happen. Especially when people are busy and in a rush, it’s not difficult to imagine accidentally adding an extra zero to the amount.

Incorrect charges are even more common when subscriptions are processed over the phone. When you manually set up recurring billing for your customers, errors can happen.

This might involve setting the wrong amount or accidentally charging customers twice for the same month’s subscription.

Even though it wasn’t your intention, these mistakes can give your customers a reason to request a chargeback. Why they don’t first contact you about it varies from person to person.

To prevent your customers from involving their bank before contacting you to resolve the issue, it would be wise to now and then remind your customers that they should contact you immediately whenever they encounter a payment problem.

Another thing you can do is put your contact information across all the channels you use—your website, social media profiles, and the email notifications you send when charging customers.

With these measures in place, you will increase the chance of your customers calling you first before involving their bank and asking for a chargeback.

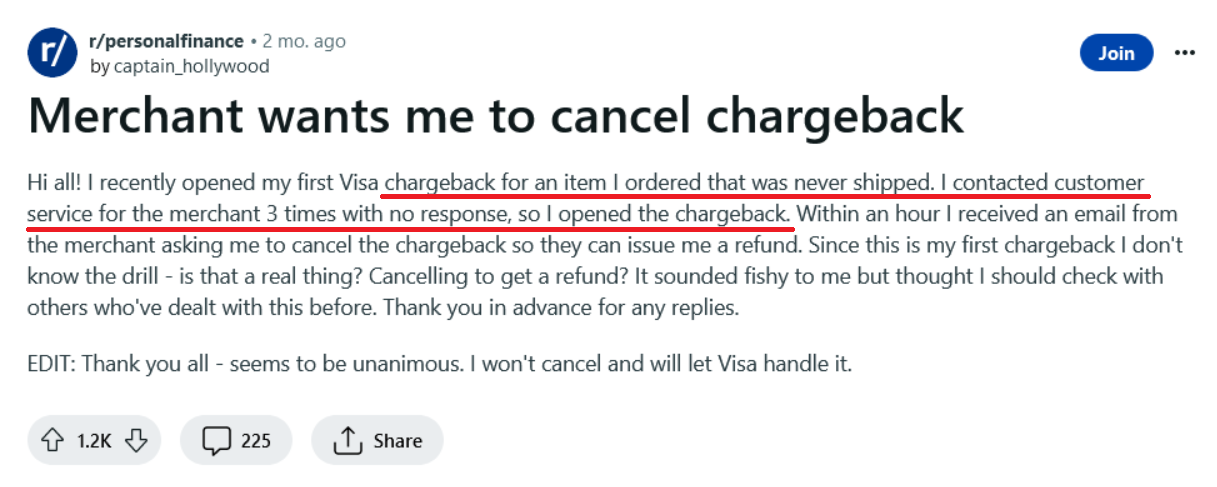

Order Fulfillment Issues

Another reason for chargebacks that falls into the merchant’s mistakes category is when customers face difficulties with order fulfillment.

This may involve paying for a service or product but not receiving it within the timeframe outlined in the terms and conditions.

For instance, suppose you offer a subscription for access to workout videos, and a customer subscribes and pays for it.

However, they can’t access the videos because they haven’t received the necessary access code. If you haven’t communicated when to expect the code or failed to deliver it within the specified time, the customer has a valid reason to initiate a chargeback.

Even if they eventually receive the code after some delay, it still counts as a chargeback-worthy situation because the order was not fulfilled as promised.

The same principle applies to the delivery of physical products.

So, what should you do in such situations?

Ideally, prevent them by keeping communication with your customers regarding their delivery status. And at any cost, avoid behaving like the merchant in this Reddit user’s story.

In this Reddit user’s case, the customer tried to contact the merchant three times about the undelivered product without receiving a response. Frustrated, the customer initiated a chargeback.

Only when the merchant was notified about the impending chargeback from the bank did they reach out to the customer and ask them to cancel the chargeback to facilitate a refund.

However, the customer, understandably, chose not to cancel it. Consequently, the merchant will likely incur processing fees and end up losing more money than if they had responded to the customer’s initial attempts to contact them.

This situation shows that chargebacks caused by unfulfilled orders are very much valid. So, try to avoid it by communicating timely with your customers. You can prevent bigger financial losses.

Dissatisfaction With Product or Service

The next common reason for chargebacks is when customers aren’t happy with the products or services they bought.

This dissatisfaction can come from two main sources.

First, there could be real problems with the product. Perhaps it arrived damaged, doesn’t work right, or is in bad shape. In such cases, the customer has a good reason to be dissatisfied.

Second, customer dissatisfaction can be more about personal expectations. This is subjective, so it can be much harder to decide if there is a valid reason for a chargeback.

However, you probably wonder why an unhappy customer doesn’t just contact the seller and see what can be done in such situations.

And if it’s a subscription service they’re no longer satisfied with, why don’t dissatisfied customers simply cancel it instead of asking for a chargeback?

Well, in fact, many do. About one-third of the people who subscribe to a service cancel it in less than three months, and over half cancel in less than six months.

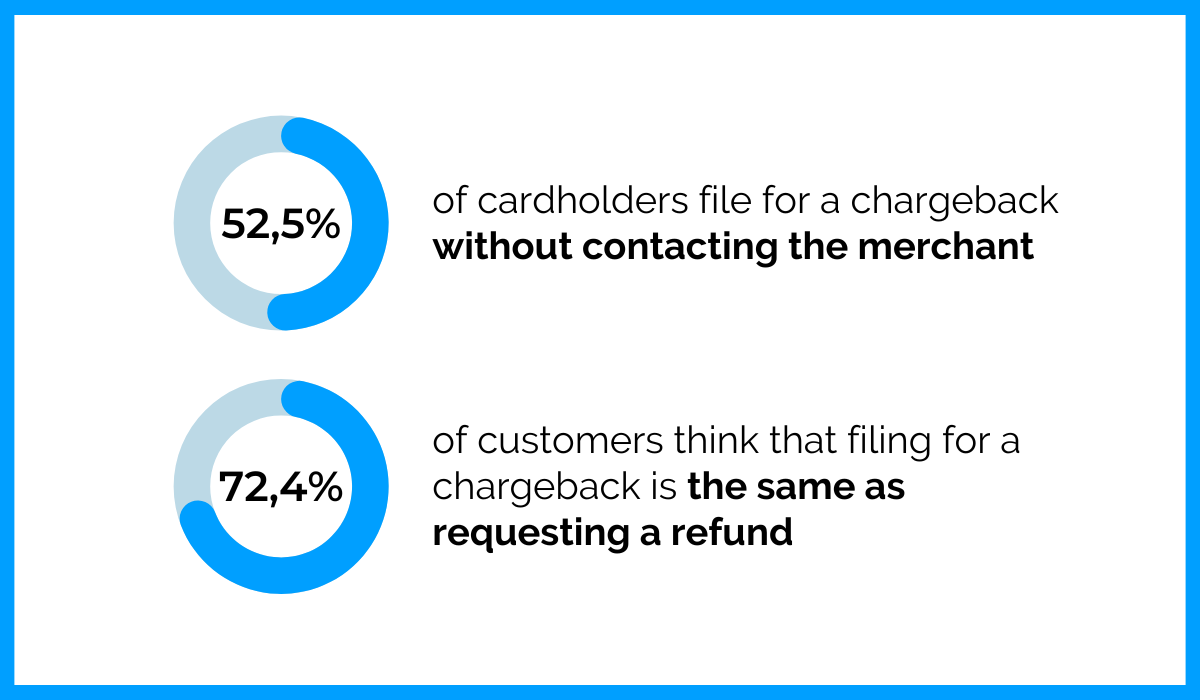

But surprisingly, more than half of unhappy customers (52.5%) choose to ask for a chargeback without contacting the seller, according to a survey by Chargebacks911.

However, the same survey found that over 70% of consumers think asking for a chargeback is the same as asking for a refund.

In other words, it seems that many people ask for chargebacks unintentionally because they might not know better. On the other hand, some do it intentionally to get a product or service without paying—a practice known as cyber-shoplifting.

Both of these scenarios fall under the term “friendly fraud”—when customers, either intentionally or by mistake, try to get their money back through the bank before contacting the seller directly.

To avoid the chargebacks that stem from customer dissatisfaction, keep these two in mind: pack products well if you ship them, and be very clear when describing how your products or services look so your customers know exactly what to expect.

Credit Not Processed

Did you know that customers who file a chargeback with a positive outcome are nine times more likely to do it again?

And they might do it again sooner than you’d expect—around 40% of those who commit friendly fraud may attempt it again within just 60 days.

We share these statistics to highlight how important it is to prevent chargebacks.

Now, another significant reason behind chargebacks is unprocessed credits. This is what occurs when a customer is entitled to a refund for a purchase or payment, but the refund has not been issued or processed by the merchant or service provider.

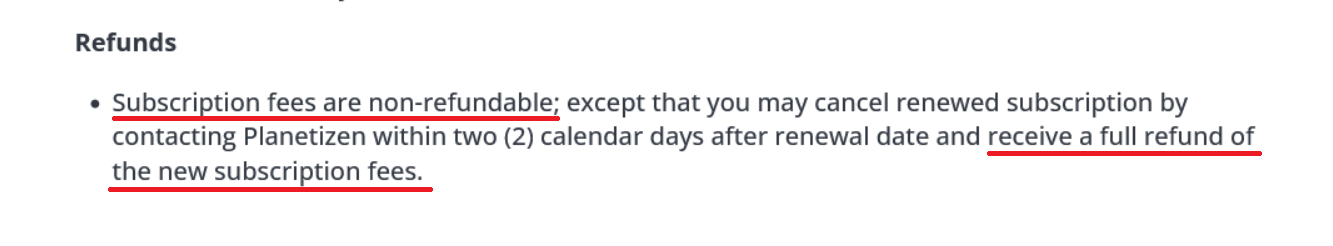

Let’s break it down using an example from Planetizen, an e-learning platform that offers subscriptions to get access to courses.

Let’s say their customer subscribes to the service and uses it for some time but then has a change of heart and decides to unsubscribe.

Planetizen’s refund policy clearly states that subscription fees are non-refundable. However, it also mentions that subscribers can cancel the subscription if they contact them within two days after the renewal date.

The customer follows this rule and unsubscribes within the specified timeframe, but they don’t see the fee returned. And since nothing has changed for quite some time, frustrated by the lack of action, they decide to initiate a chargeback.

This scenario is a common trigger for chargebacks. However, you can prevent it by having a dependable payment system that handles refunds quickly.

Additionally, make sure that your refund policy is clearly explained, including the expected timeframe for money to be returned.

Poor Customer Service

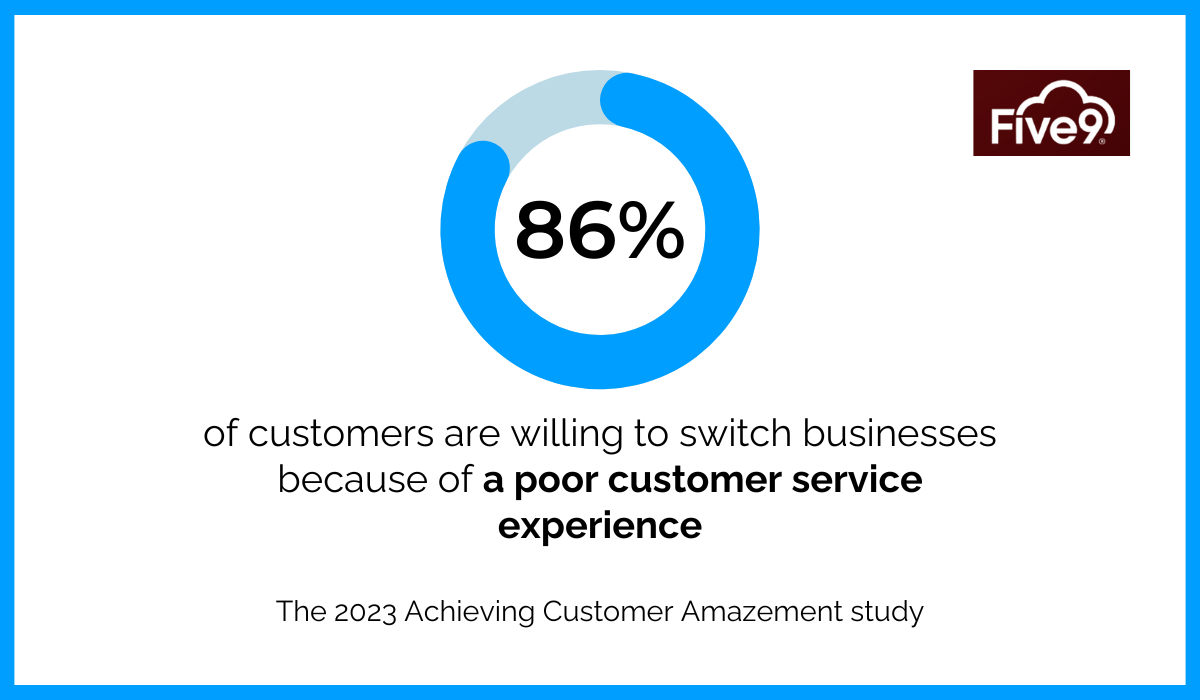

A recent study of customer preferences by Shep Hyken and Five9 showed that almost 90% of customers are willing to switch to another business due to poor customer service. This means your customer service can make or break your business.

So, it’s not surprising that poor customer service can also trigger customers to resort to chargebacks.

Initially, your customers may have tried to resolve issues such as receiving damaged products, missing deliveries, streaming service troubles, or not getting the expected content with a subscription with you directly.

However, their experience with your customer service might have taken a negative turn. Perhaps they:

- Made multiple calls with no response

- Had to be put on hold for extended periods

- Were bounced between different service representatives

- Found the customer service representative unhelpful or impolite

Unfortunately, these situations do happen, and if customers face them, they may seek an alternative way to obtain what they believe they are owed. In that case, they will likely proceed to request a chargeback.

To prevent this, your business should have responsive customer service.

It would be wise to put effort into training your customer service representatives to approach customers politely and calmly and do everything they can to resolve issues instead of letting them escalate into chargebacks.

Additionally, having a clear refund policy in place can be a smart move, as refunds are typically more cost-effective than chargebacks.

Failure to Cancel Subscription

As we mentioned earlier, around one-third of subscribers cancel their subscriptions within the first three months. But what about those who simply forget they signed up?

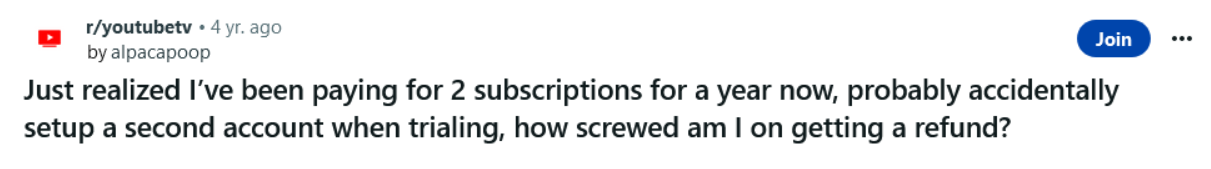

Not everyone keeps a close eye on their spending. Take, for instance, this Reddit user who ended up paying for two subscriptions for a whole year without realizing it.

Source: Reddit

Source: Reddit

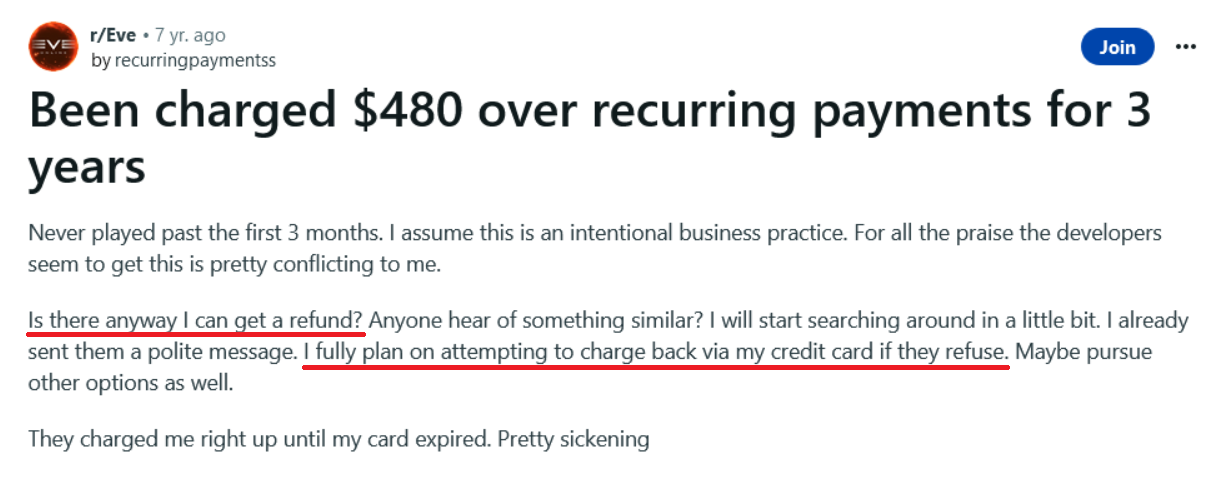

But an even more striking example comes from this Reddit user who subscribed, used the service for the initial three months, and then seemingly forgot about making a subscription.

For those of us who carefully track our expenses, it’s hard to understand how this can happen.

This individual was charged $480 over recurring payments for three years until their credit card expired. And instead of accepting the mistake, they now fully intend to initiate a chargeback via their credit card if the business denies them a refund.

Sadly, this is not an isolated case, and such situations are more common than businesses would like. This often leads to subscription businesses facing numerous, and often very much unnecessary, chargebacks.

To prevent this, consider the following:

- Send an email reminder well before the subscription renews

- In the same email, include clear instructions on how subscribers can cancel if they don’t want to renew subscriptions

- Before the customers commit to subscriptions, explain billing cycles, dates, fees, and refunds in detail

Unfortunately, forgetful people will always exist. Still, by taking these steps, you can help reduce chargebacks caused by your subscribers forgetting to cancel their subscriptions.

Fraudulent Transaction

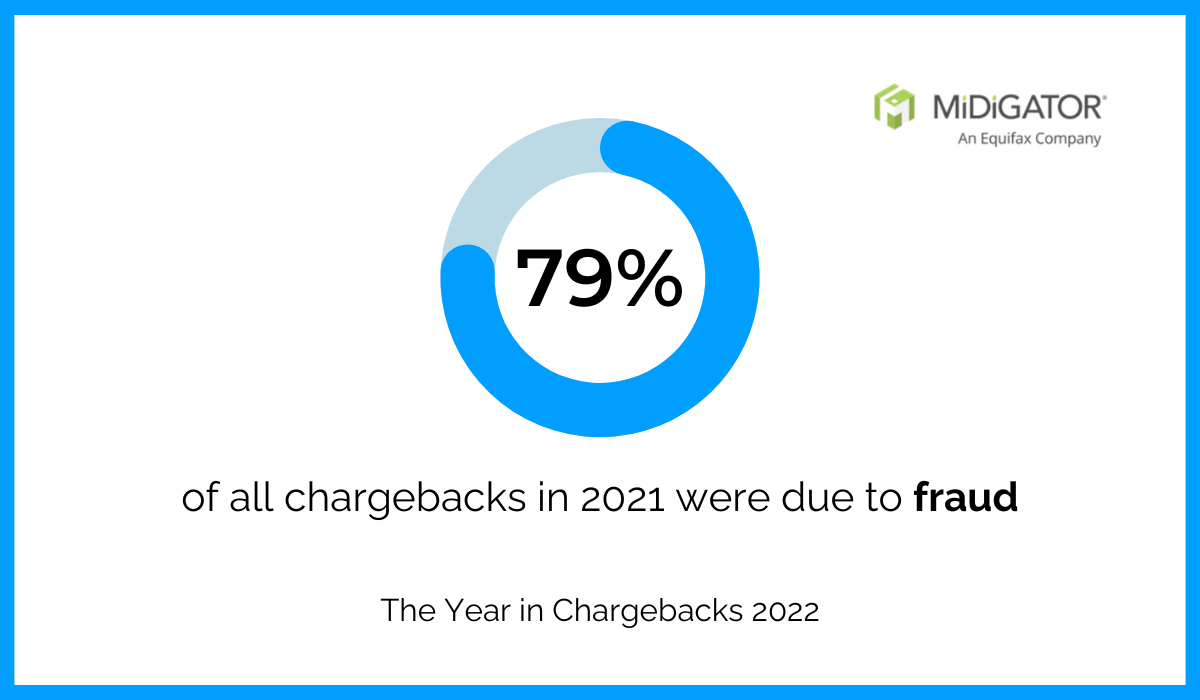

The last reason for chargebacks we will mention today, and the most common one of all, is due to fraud.

According to Midigator’s 2022 Year in Chargebacks report, the reason behind almost 80% of chargebacks was fraud.

Fraudulent transactions can take different forms.

Some customers intentionally try to get products or services without paying—cyber-shoplifting, as we mentioned earlier.

Another scenario is what we call “buyer’s remorse”. This happens when a buyer makes a purchase but later regrets it, leading to a chargeback as a way to get their money back.

These customers usually worry that their refund request will be denied, so they opt for chargebacks.

But things become even more complex when a third party is involved—for instance, when someone steals a customer’s credit card and uses it for unauthorized purchases.

In such cases, it’s neither the customer’s nor the merchant’s fault. However, it’s typically the merchant who bears the responsibility for these fraudulent transactions.

So, what can you do to tackle this widespread problem?

One practical step is to ask customers to provide complete card details during transactions, including the expiration date and security code.

This added layer of security can help deter fraudsters and reduce the impact of chargebacks on your business.

Conclusion

In conclusion, chargebacks can happen for various reasons, including customers not recognizing the business on their card statements, incorrect charges, dissatisfaction with services, or even fraud.

Understanding why customers turn to chargebacks instead of contacting you directly can provide insights into their behavior and assist you in better chargeback management.

Now that you know the eight most common reasons for chargebacks, we invite you to explore our article on preventing recurring billing chargebacks in your business.