Small business owners should always attempt to improve the financial strength and stability of their companies.

The stronger the business is financially, the more likely it is to attract and secure investments, weather hard economic and financial times, and grow sustainably over the long term.

However, before coming up with new ideas to implement, you must measure your current financial situation and spot areas where the business could benefit most from a change.

You must diagnose before you prescribe.

In this article, we’ll teach you how to analyze financial statements to form a solid understanding of the financial health of your small business.

- Study Your Balance Sheet

- Measure Liquidity

- Evaluate Your Cash Flow

- Keep Track of Accounts Payable

- Stay On Top of Accounts Receivable

- Conclusion

Study Your Balance Sheet

The balance sheet is a financial statement that shows a company’s financial position by listing its assets, liabilities, and shareholder equity.

The statement is split into two parts, both equal to each other, so that the following equation holds:

Assets = Liabilities + Shareholder Equity

But, simply creating a balance sheet statement isn’t enough to gain insights that will help you accurately assess the financial health of your business.

You first have to learn how to read it correctly.

You have to understand the definitions of assets, liabilities, and equity, as well as the relationship between the terms.

| Assets | What a company uses to operate. Examples include non-current (long term) assets like buildings, land, and long-term receivables, and current (short-term) assets like cash and inventory. |

| Liabilities | Money borrowed from other sources that will have to be repaid. Examples include non-current liabilities like deferred tax liabilities and current ones like accounts payable. |

| Shareholder Equity | How much owners have invested into a business by investing in it or by retaining earnings. |

As for the relationship between the terms, there are some financial ratios you can calculate and then compare to recommended ratios to evaluate the financial health of your business. For instance, the current ratio and the quick ratio are two of the most telling when it comes to analyzing a balance sheet.

The current ratio compares your current assets to your current liabilities.

It tells you how effectively you’ll be able to cover your short-term obligations and other payments due in the next year.

Businesses should aim for a 2:1 current ratio, meaning their assets are double their liabilities.

Another ratio to calculate is the quick ratio, which is used to assess whether your business will have enough assets to meet financial obligations even in the worst-case scenarios.

Quick Ratio = (Total Current Assets – Total Current Inventory) / Total Current Liabilities

Use the above equation to calculate your quick ratio, then compare it to the recommended quick ratio of 1.0. Any quick ratio greater than 1 is considered healthy.

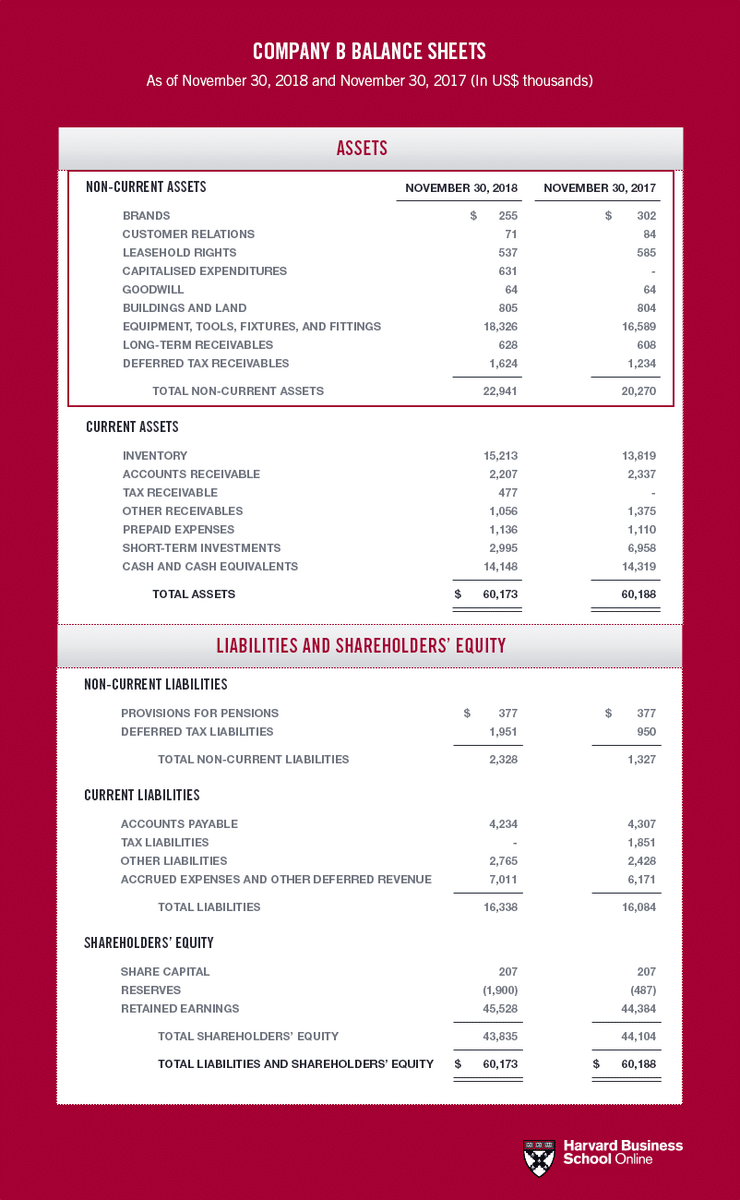

Now, let’s take a look at an example balance sheet and try to assess the company’s financial health using the two ratios we just discussed.

Source: Harvard Business School

With a few calculations, we can quickly find that the current ratio is about $37,000 (current assets) to around $14,000, making the ratio 37:14, well above the recommended 2:1 ratio, which would look like 28:14.

Therefore, this fictitious business has a healthy amount of assets compared to its liabilities.

Now, its quick ratio is [$37,000 (current assets) – $15,000 (total inventory)] / $14,000 (current liabilities), or $22,000 / $14,000 = 1.57, which is above one and therefore considered healthy.

Calculating these two ratios for your business and comparing them to ideal ratios is a great way to use the balance sheet to gain insight into your business’s financial health.

Measure Liquidity

Liquidity represents your small business’s ability to convert assets into cash.

The more liquid an asset, the faster it can become cash. It also sells you your ability to cover liabilities with assets.

As a rule, the better a business’s liquidity, the easier it is to overcome cash flow challenges or other financial hurdles, secure loans, and capitalize on opportunities, like a once-in-a-lifetime deal on a piece of equipment that will triple your operating efficiency.

Therefore, liquidity is a great indicator of a business’s financial health, and small business owners should know how to calculate it.

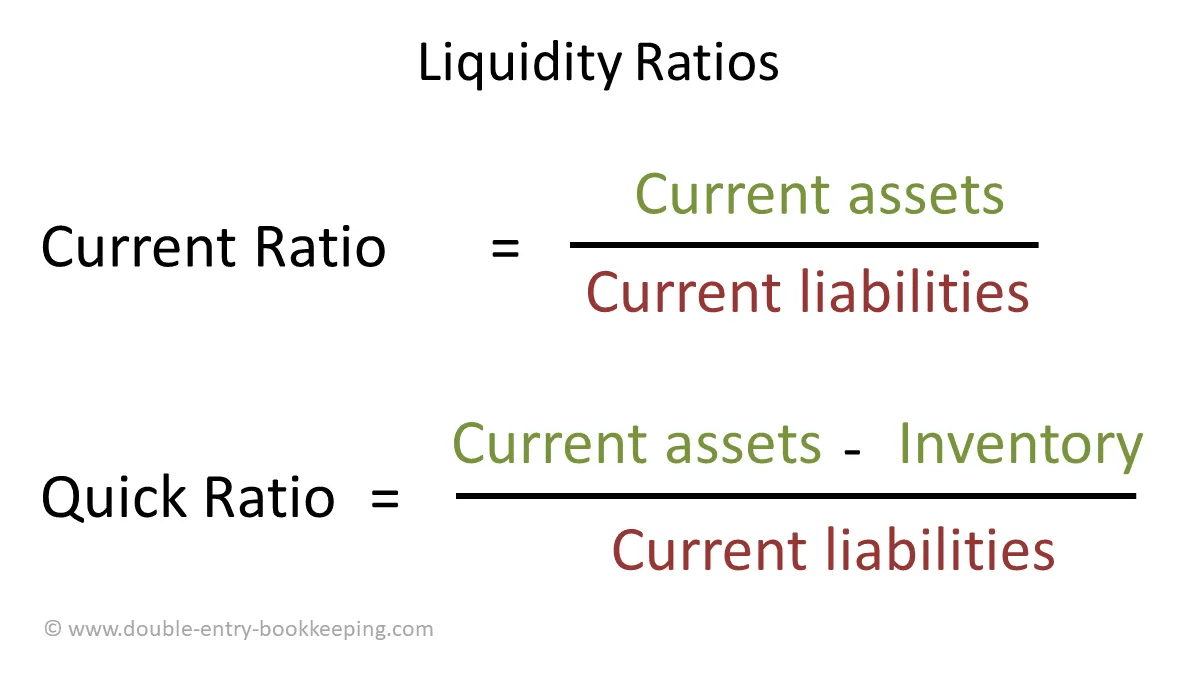

In the previous section, we gave you the two balance sheet ratios that deal with liquidity, namely, the quick ratio and the current ratio.

Having healthy quick and current ratios means you should be able to cover your short-term financial demands.

Source: Double Entry Bookkeeping

To gain a wider understanding of your business’s liquidity, however, you need to also assess solvency, which tells you if your business will cover its financial obligations on an ongoing basis over the long term.

The fastest way to calculate your business’s solvency is by subtracting liabilities from assets, which gives you your shareholder equity.

Typically, high shareholder equity suggests that your company will have more stability and flexibility when it faces economic recessions.

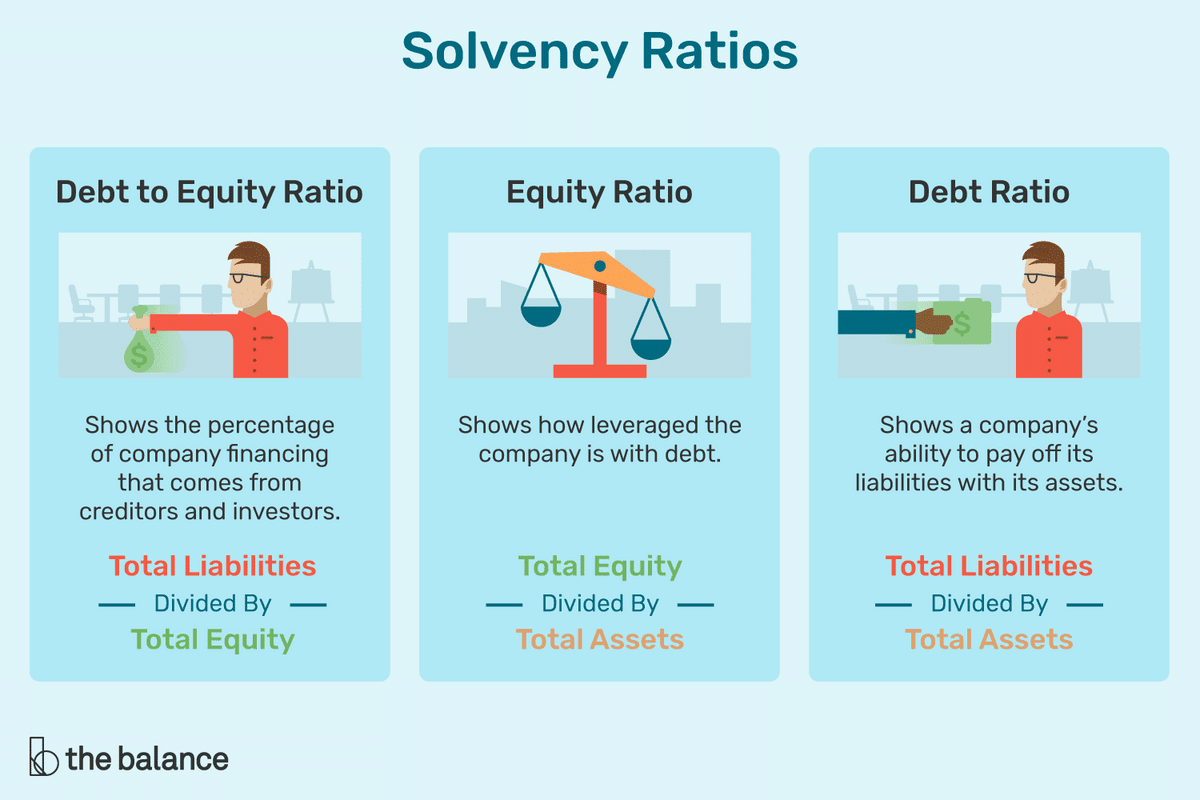

There are some other specific solvency ratios you can use to shed more light on particular aspects of your company’s solvency, such as the debt-to-equity ratio, equity ratio, and debt ratio.

Source: The Balance SMB

Calculating these can give you some real insights. For instance, if a business’s equity ratio is relatively high, it means a small amount of debt is required for asset acquisition.

In sum, studying your small business’s liquidity and solvency are important steps in determining just how healthy your small business is financially speaking.

Evaluate Your Cash Flow

Understanding your small business’s cash flow is an essential step in assessing its overall financial health.

Typically, the stronger the cash flow, the healthier the business is, financially speaking. Poor cash flow, on the other hand, can spell doom, especially for small businesses.

To understand your cash flow, start by preparing a cash flow statement.

This will tell you the relationship between cash outflows and cash inflows, or, in other words, how much money is coming in and going out of your business over a certain period of time (typically a month or a year).

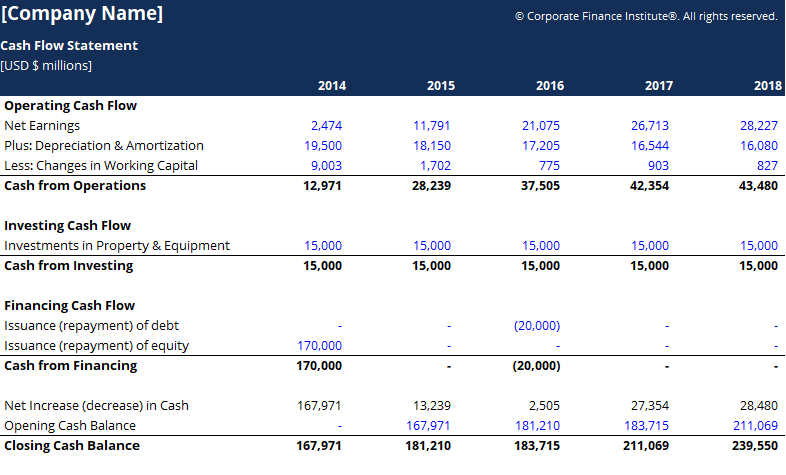

Source: Corporate Finance Institute

In the above case, the company has operated at a positive cash flow for the past five years—generally a good sign.

In fact, 2016 is the closest they came to operating in the negative.

Negative cash flow means more has left than entered, and positive means the opposite.

Typically, you want positive cash flow, especially over the long-term, as it indicates you can cover expenses, grow the business, and survive difficult times.

The occasional negative flow is okay if it is due to investment activity and as long as it doesn’t become the norm, as it is generally unsustainable for a small business.

There may come a point where you can no longer cover expenses. In fact, nine out of ten small businesses, according to a D&B study, fail because of cash flow issues.

When analyzing your cash flow statement, there are some important ratios to calculate as you’re trying to assess your company’s financial health, as shown below:

| Operating cash flow / net sales | Informs you of your ability to create cash flow in proportion to your business’s sales volume. Divide operating cash flow by net sales. The higher the better. |

| Free cash flow | Tells you how efficiently your business generates cash. Subtract net operating cash flow from capital expenditures. Positive free cash flow is best. |

| Operating cash flow ratio | Helps you assess if you can cover your short-term debt liabilities. Divide net cash flow from operations (cash flow) by average current liabilities (balance sheet). Generally, healthy is anything over one. |

As you’ll note, the operating cash flow ratio requires you to get information from your balance sheet as well.

That is why it’s best practice to first create your balance sheet, cash flow statement, and income statement—the three most important financial reports—before you start financial ratio analysis to determine your business’s financial health.

Keep Track of Accounts Payable

Monitoring your accounts payable (AP), the money your business owes to vendors, is another great way to keep track of your company’s financial health.

A clue that your company is in good financial standing is that you have enough money to pay your vendors on time.

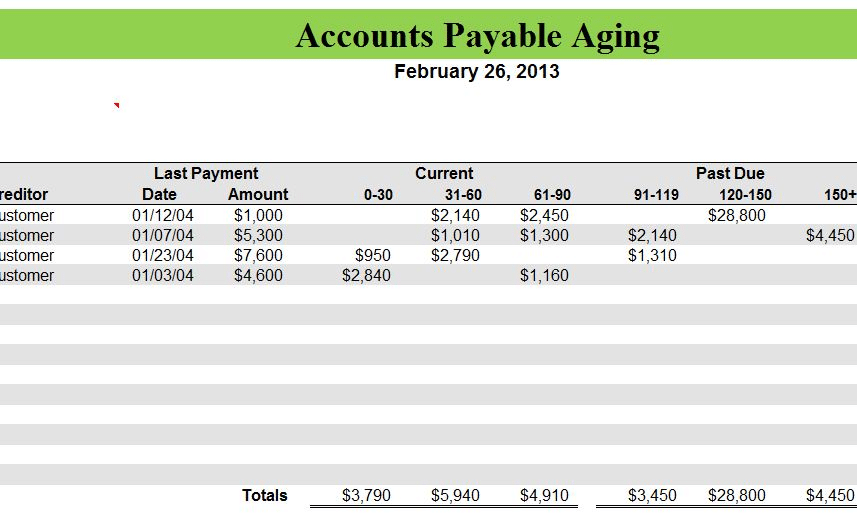

One specific financial report that will help you assess this ability is the accounts payable aging report, which shows you how much your business owes to its vendors in thirty-day blocks, enabling you to quickly see if you have enough cash to cover these unpaid invoices.

Source: My Excel Templates

As you’ll see in the example above, at a glance the business manager knows who they owe, what they owe, and when it’s due, all of which enables them to plan their purchases and investments with respect to the payments they must make.

They’ll see, for example, that in 31-60 days, they’ll have to pay $5,940 to their vendors, meaning they better not purchase something in the meantime that puts them in a tricky financial situation when payment comes due.

Furthermore, taking just a quick look at your accounts payable can save you from making unnecessary budgeting mistakes that negatively impact your business down the line.

In the end, it’s crucial that you consistently check in on your accounts payable if you want to truly understand the financial stability of your small business.

Stay On Top of Accounts Receivable

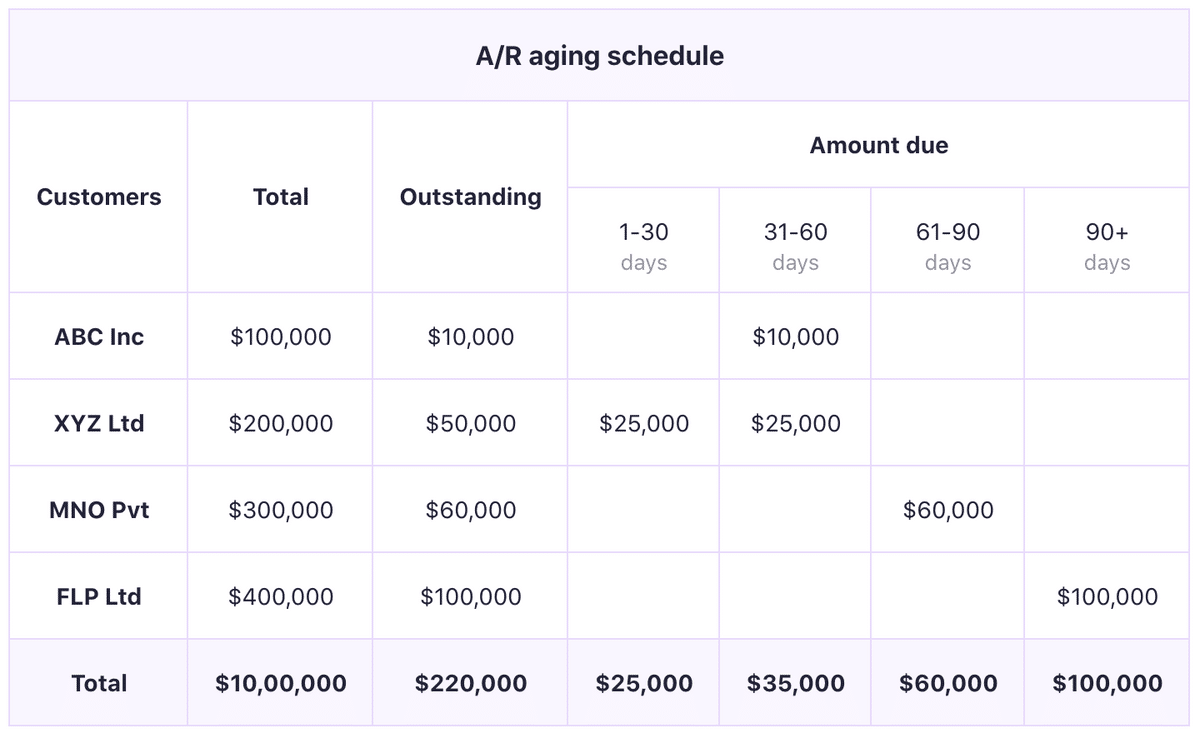

Tracking your accounts receivable (AR), the money you’re owed, is, just like tracking AP—another practice that gives you a clearer picture of the financial health of your small business.

Often, reviewing your AR aging report will lift up your current estimation of your company’s financial health because it will remind you that your customers, who are hopefully reliable, owe you money.

As you’ll see below, the report will also show you when to expect that money, allowing you to plan your investments and operations accordingly:

Source: Chargebee

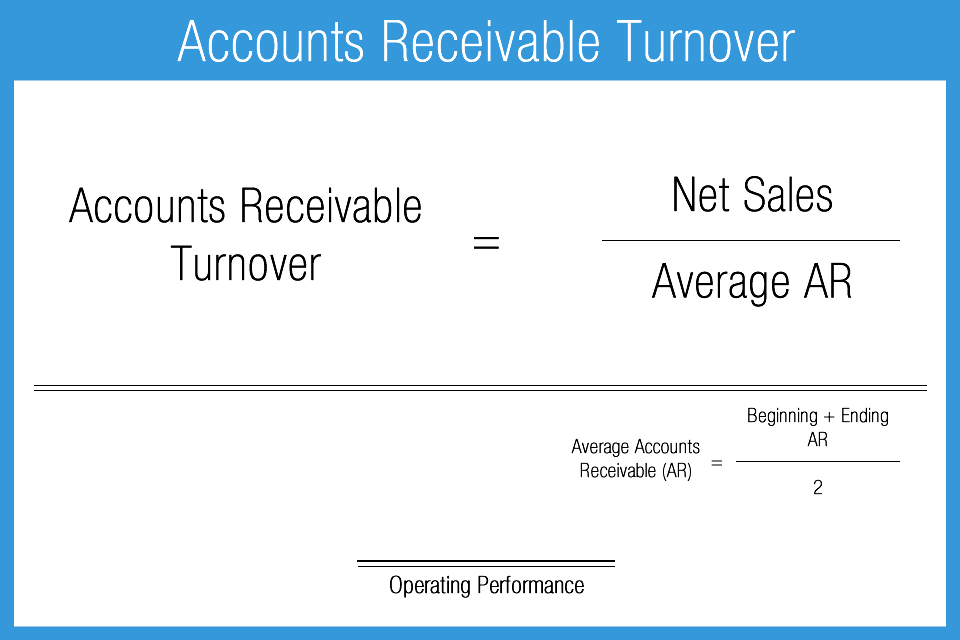

When using AR information to assess your business’s financial health, you should also pay attention to metrics like the AR turnover ratio, which tells you how effective you are at extending credit and collecting the cash owed to you by your customers.

Source: Accounting Play

A high AR turnover ratio, above, indicates that your small business has a healthy billing system. Customer credit turns to cash quickly.

A high ratio is also correlated with quality customers and conservative credit policies.

To see if yours is high, compare it to your industry’s average. In general, though, you want to be somewhere between 5 and 10.

If your AR turnover ratio is low for your industry, it’s important to improve your billing process, or you risk being unable to pay your vendors.

An Atradius survey found that from 2019 to 2020, there was a 32% increase in the number of businesses that couldn’t pay vendors because of late customer payments.

As for how to keep track of your small business’s accounts receivable, many service-based businesses use Regpack, a software solution built for registration and payments that gives users a central, online location where they can easily generate sales and income reports to gain insight into their business’s financial health.

Having a tool that makes it easy to reveal billing data and information enables you to spend more time coming up with data-driven ideas for improving financial stability and executing them instead of handling administrative billing work you would otherwise do in excel.

Conclusion

Measuring the health of your small business requires a bit of financial know-how, but any small business owner or financial manager can pretty quickly learn these basics with a bit of reading and some real-life practice analyzing their financial reports.

Once you’ve measured your financial stability, it’s important that you take steps to improve it.

For some simple-to-implement methods, check out our article on small business finance best practices. Inside you’ll learn how to manage cash flow, budget effectively, and more.