Failed payments are a part of today’s business reality. There are many reasons a payment can fail, but the aftermath is the same; you aren’t getting paid, and you have to do something about it.

Therefore, you have to get in touch with your customer to rectify the situation, and the easiest way to do so is via email.

Failed payment emails, or dunning emails, serve two vital functions for your business. They help you get compensated and retain customers in the long run.

Writing a good failed payment email can be a challenge. That’s why we’ll give you six great email templates that have been tried and tested by real-world companies, as well as dissect the what, why, and how of a great dunning email. Let’s get to work!

Jump to section:

What Are Failed Payment Emails?

Why Should You Send Failed Payment Emails?

Failed Payment Email Templates

What Are Failed Payment Emails?

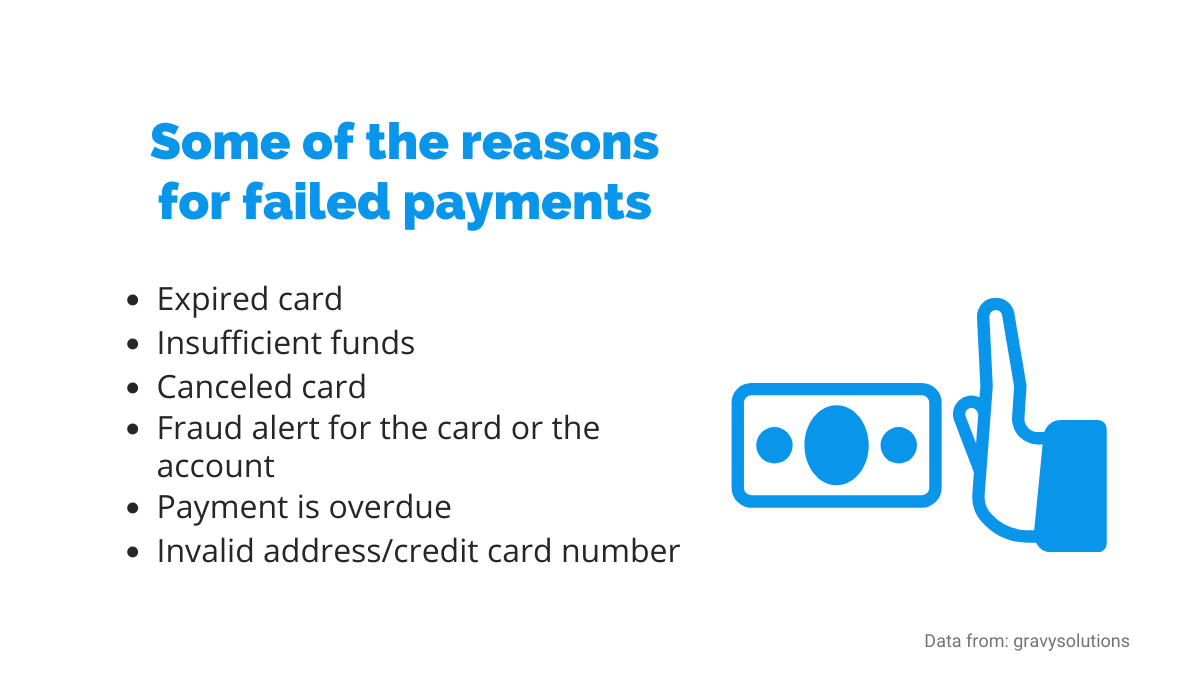

As we said, from time to time, the payment from your customer may fail. The reasons can be numerous, but your next step for you should always be the same—get in touch with a customer by means of a failed payment email.

Known as dunning emails, these types of messages have the purpose of alerting your customer that there has been some issue with their payment.

The issues can range from expired credit cards to overdue payments and a lot in between.

Whatever it might be, dunning emails are here to notify the customer of the unmet obligation, get them up to speed on their status, and provide them with options to make the payment, as well as update their information.

Source: Regpack

Failed payment emails are a way to contact the customer and communicate something that isn’t pleasant for you or them. Because of that, it’s crucial to explain what exactly happened and how to fix the situation.

More on how to do that in the later sections, but remember that the goal is to inform, not accuse.

There are many ways to compose a dunning email, which we’ll examine using some common templates of failed payment emails. As you’ll soon see, each of them can be useful for your business.

Why Should You Send Failed Payment Emails?

Although it is an inevitable part of doing business, payment failure can seriously jeopardize your cash flow, putting your entire business on a course toward financial ruin.

In fact, according to a US Bank study, 82% of small businesses fail because of poor cash flow management.

Source: Regpack

Sending timely dunning emails is a simple, yet effective way to prevent loss of revenue and help retain your customers.

While it’s true that sending failed payment emails is far from being the sole factor in maintaining a healthy cash flow, it certainly can influence it a great deal. For example, it can prevent involuntary churn, which we’ll discuss in the following subsection.

Prevent Involuntary Churn

What do we mean by involuntary churn? To answer that question, let’s first take a look at what types of churn exist.

Voluntary churn occurs when the customer intentionally leaves the business for various reasons, either because they’re unhappy with the service or simply because they cannot afford it anymore.

It’s not pleasant for a business owner because part of the revenue also goes with the customer.

Therefore, every responsible business person should look into the reasons why a voluntary churn has occurred, and do their best to manage it.

However, involuntary churn isn’t a potential sign that your business is doing something wrong, but merely a result of a set of unfortunate circumstances.

It occurs when the customer unintentionally stops paying for a service or product, and it’s one of the most frustrating things to encounter in business.

After all, with involuntary churn, you’re losing a customer who actually wants to keep using your services and all you need to do is try to find a way to allow them to do that.

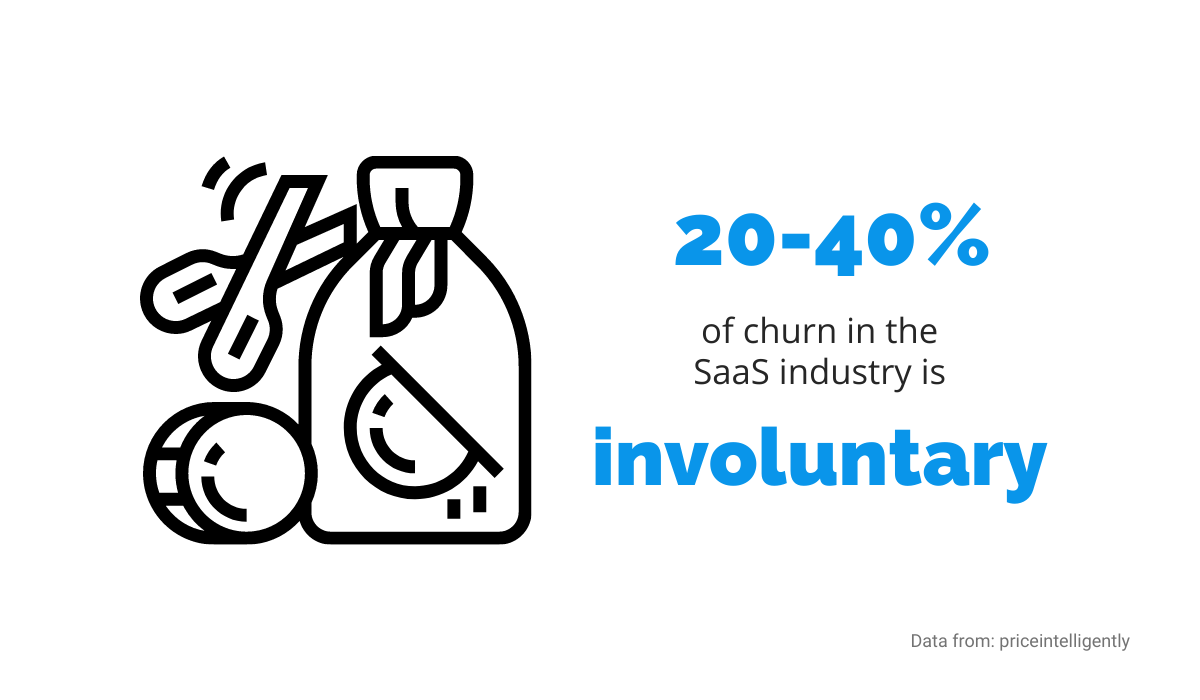

The real danger of involuntary churn is that it can add up significantly. According to a ProfitWell study, 20-40% of all churn in the SaaS industry is involuntary.

Source: Regpack

Luckily, it’s preventable.

Involuntary churn usually occurs because of technical difficulties with the payment, such as an expired credit card, insufficient funds, or the bank declining payment for some other reason.

Therefore, you can prevent most of those issues from affecting you by keeping a close eye on the customer’s credit card information and status.

Most customers aren’t even aware that there’s a problem with their payment.

This is where sending failed payment emails comes to the rescue, and you’re actually helping the customer by getting in touch.

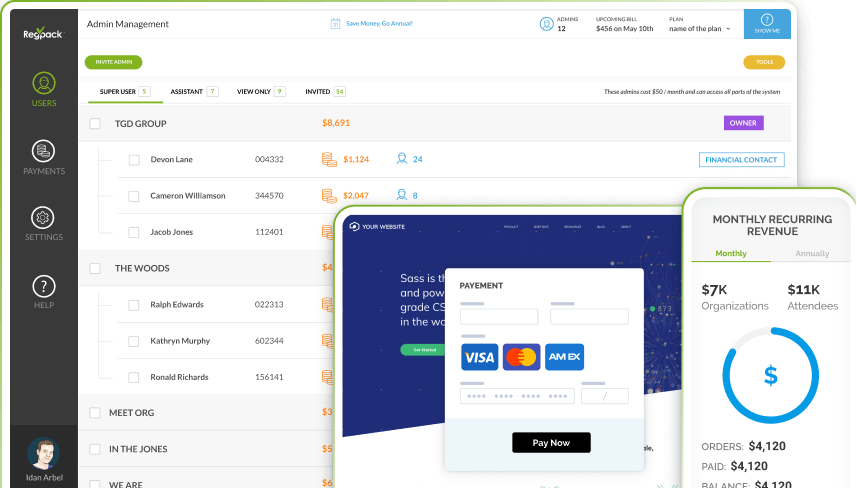

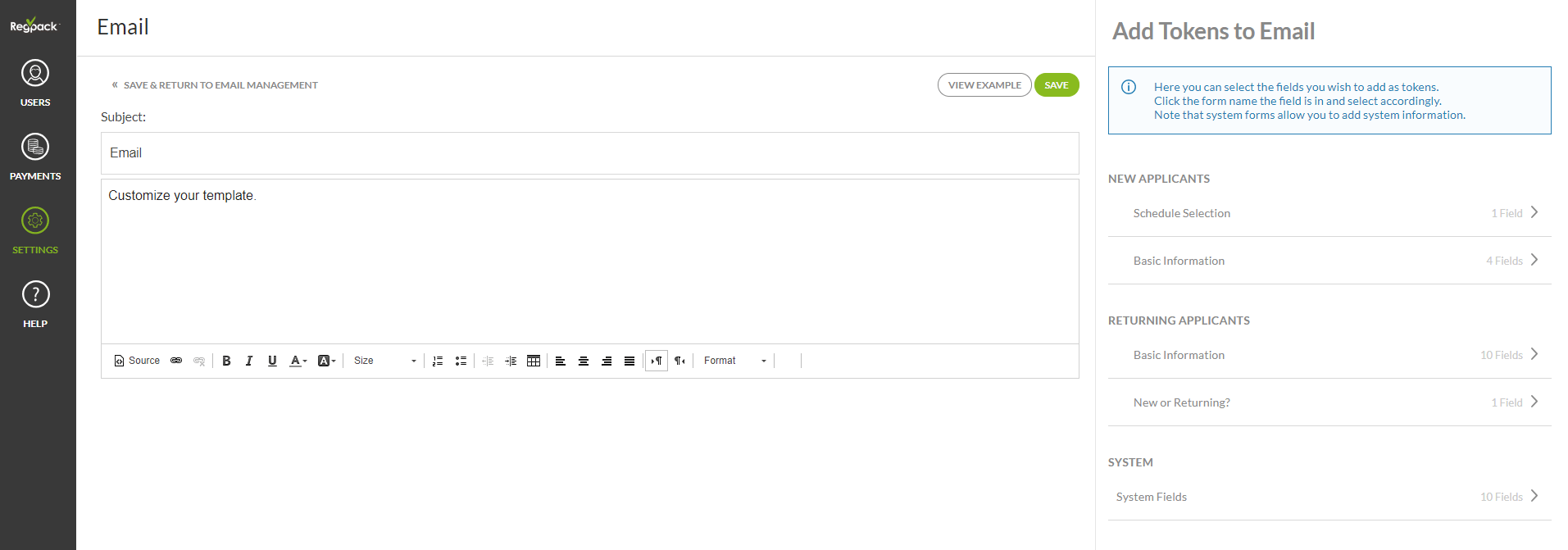

What is more, you don’t have to waste time by sending out those emails manually, since there are software solutions, such as Regpack, which have an automated system in place to do that for you, allowing you to devote your time to more significant tasks.

Regpack also has features that can help you with keeping track of your customers’ payments, processing their invoices, and a lot more.

Source: Regpack

Preventing involuntary churn is one of the easiest and most effective ways to keep your revenue and cash flow steady. With the help of some practical automatic solutions, you can get great results with just a little effort.

Recover Lost Revenue

The loss of revenue that potentially stems from a failed payment is an excellent reason to notify your customer of the problem; by doing that, you increase your chances of recovering your money in a timely manner.

Losing revenue is never good for any kind of business.

If we return for a second to the aforementioned statistic of 82% of small businesses failing because of problems with cash flow, it becomes clear that failing to deal with lost revenue can even be the beginning of the end for a company.

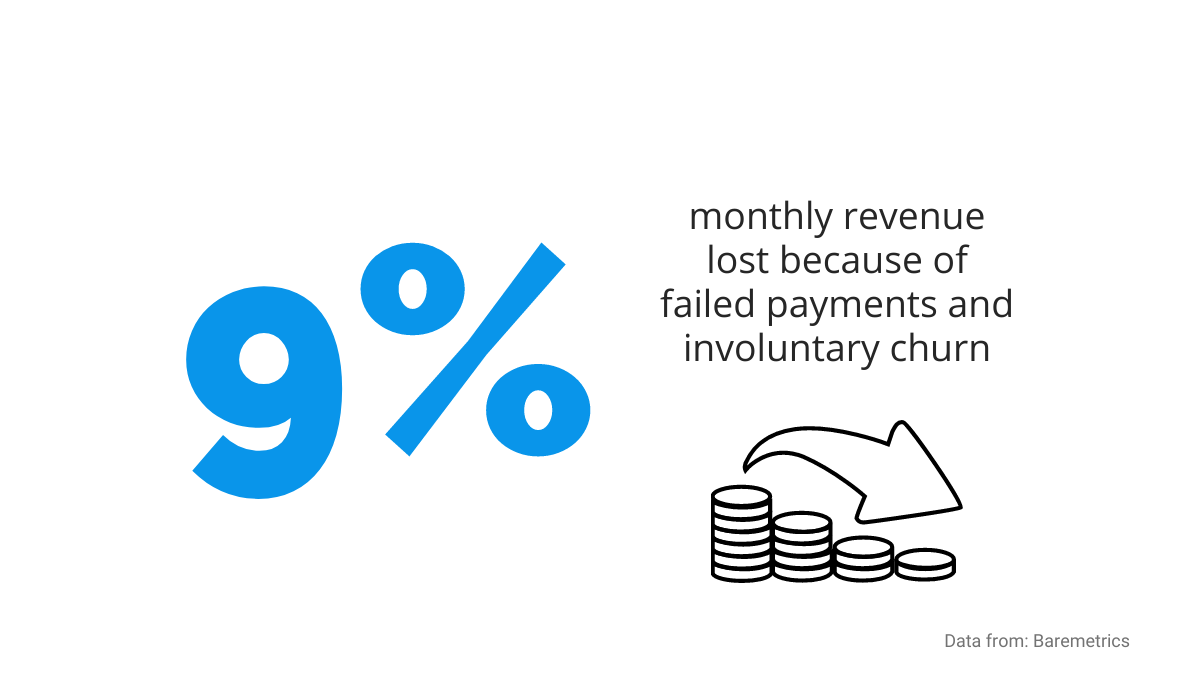

One more number that can put things into perspective is from a study done by Baremetrics. They found that SaaS companies lose 9% of their monthly recurring revenue due to failed payments and involuntary churn.

Source: Regpack

That’s why you should send failed payment emails.

A simple message to your customer about a problem with their payment can keep your relationship with them functional and simultaneously preserve your revenue and undisrupted cash flow.

Of course, how you write the email, your tone, wording, the information that you include, and many other elements definitely matter and have a great impact on your chances of recovering that lost revenue.

For example, personalization is a great way to improve the effectiveness of your failed payment emails.

According to Instapage, personalized emails have a six times higher transaction rate. And when you’re trying to recover your lost revenue, that’s a significant number.

Solutions like Regpack can make that process much less time-consuming and more manageable.

Instead of manually personalizing every failed payment email, you can automate the process by creating templates and inserting tokens with user information directly into your email.

Source: Regpack

Combining those features with triggers that can automatically send emails when the payment fails creates a very efficient and helpful automated process for recovering your lost revenue.

Improve the Customer Experience

Sending failed payment emails helps you retain customers and recover revenue, but it also helps your customers.

That’s because alerting the customer of an issue with their payment enables them to keep using your service or product and prevents possible service disruptions, delays in product delivery, account suspension, and other annoyances.

In other words, by notifying them of an issue, you’re providing a smooth and seamless experience for your customer.

And with great customer experience come increased trust and loyalty to your brand.

How much the customers value a good customer experience is evident from the PWC research that shows that almost a third of them would leave a service after just one bad experience.

Source: Regpack

Simply put, a well-written failed payment email shows your customers that you care about them and their loyalty, thus improving their customer experience as a whole.

Writing a good dunning email boils down to threading a fine line between being friendly and alerting them that something went wrong (i.e., a payment failure).

You want to communicate clearly and respectfully to minimize the chance of friction and service disruption.

If you do so, dunning emails will be a way to improve the customer experience and strengthen your relationship with them.

Next, let’s go into more detail about what makes a well-written dunning email.

Failed Payment Email Templates

As mentioned earlier, dunning emails can be very efficient in preventing involuntary churn, keeping steady revenue and strengthening the relationships with your customers—but only when done correctly.

There are many ways to approach composing the failed payment email. In the following sections, we’ll be presenting you with six templates that real companies use. If you model your own after them, you’re sure to see some good results.

Detailed Failed Payment Email

Failed payment email should contain the information necessary for the customer to understand what happened and how to fix the problem. If you opt for the detailed approach to failed payment emails, you’ll provide your customer with even more than that.

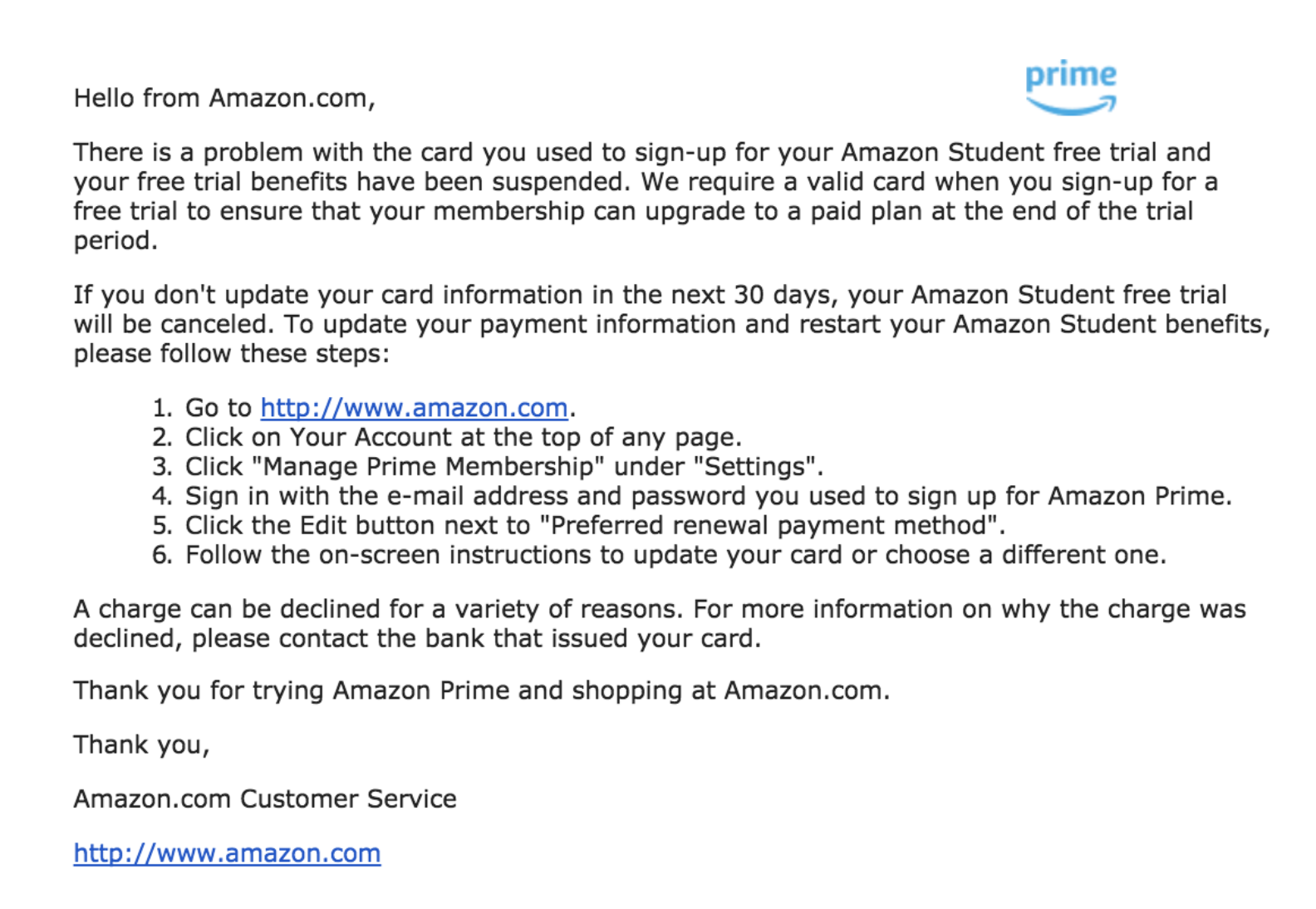

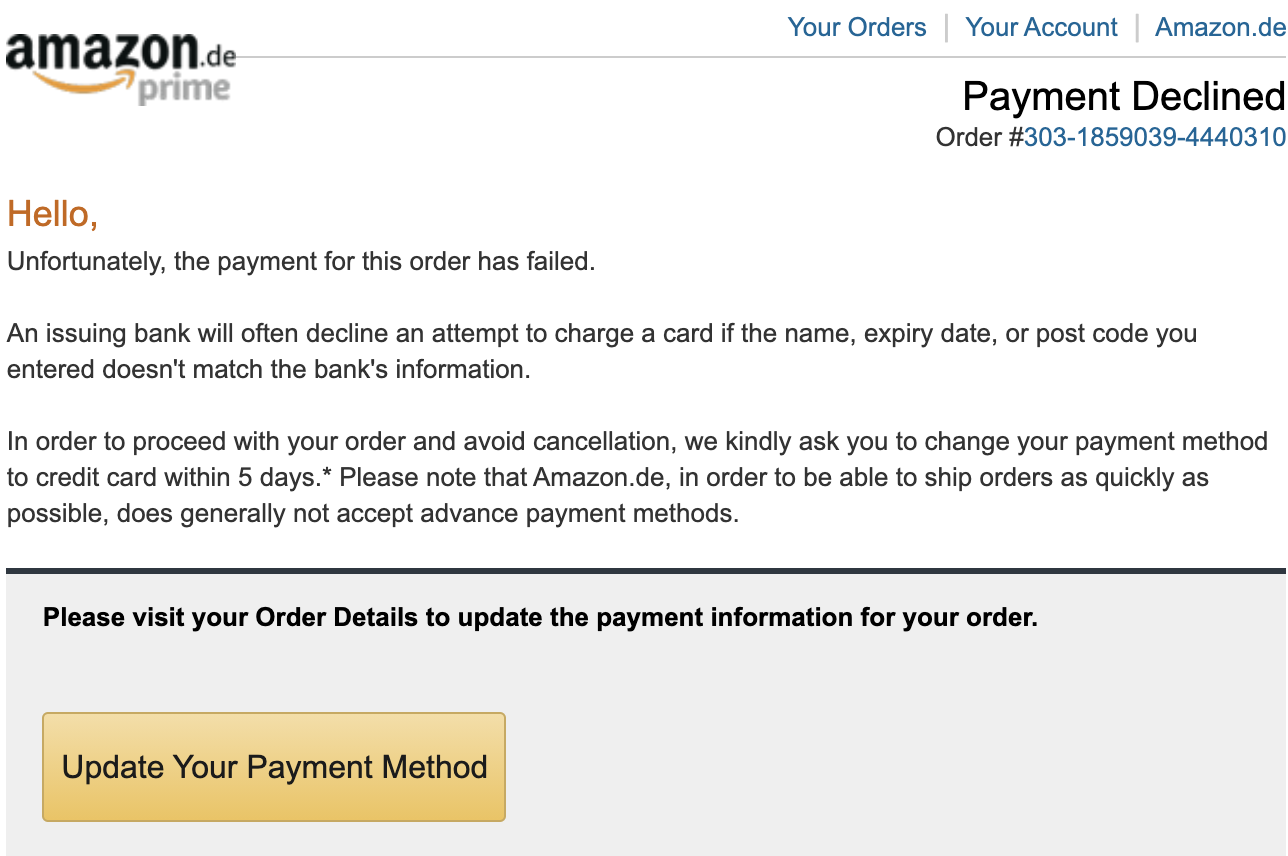

For example, Amazon uses this style and sends a very detailed email.

Source: Customer.io

As you can see, there’s a lot of text in the email, but every sentence has its purpose. The customer is now aware that:

- there was a problem with the card

- what the consequences are

- why a valid card is required

- how long they have to update their information

- how to update the information in six steps

- how to find out why the problem occurred

Even though it isn’t immediately apparent what kind of message this is upon opening it, unlike some templates that’ll follow, the instructions are very clear and easy to follow, which is crucial for a quick and easy solution to the problem.

Short Failed Payment Email

This type of failed payment email still provides all the necessary information but in fewer words. That can be even more challenging than detailing everything.

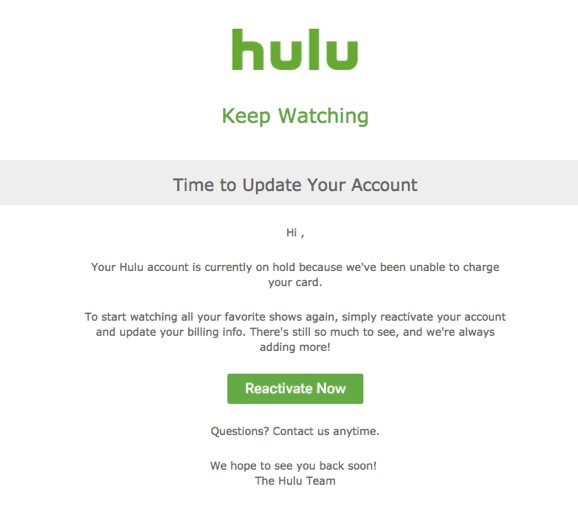

Take a look at the dunning email Hulu sends after a failed payment at collecting a payment.

Source: LiveAgent

Let’s break it down. As soon as you open it, at the top you see the words “Time to Update Your Account”—a simple sentence that lets the customer know what the email is about.

It’s followed by an explanation of the problem, the value statement with the reminder to the customer what they’ll lose if they don’t update, and the big, clear call to action button. For good measure, after that, there’s an invitation to contact them if something is unclear.

If you opt for this template, make sure that you include the necessary information for your customer, because the short email won’t do you any good if it doesn’t convey clearly which steps need to be taken.

Card Declined Email

As we previously mentioned, most failed payments happen because of a problem with the credit or debit card, whether it’s the expiration date, incorrect information input, or some other issue.

Amazon has a template for those instances that you might want to borrow.

Source: SimpleTexting

With this email, the customer doesn’t have to wonder why the payment failed—the company lists some common reasons why the bank might have declined their card so they can narrow it down.

One more helpful element of this email is the big, yellow button on the bottom with a clearly stated purpose. Even if the customer casually skims the email, they’ll notice that and immediately know that they have to address a particular issue.

Payment Failure Email for B2B Customers

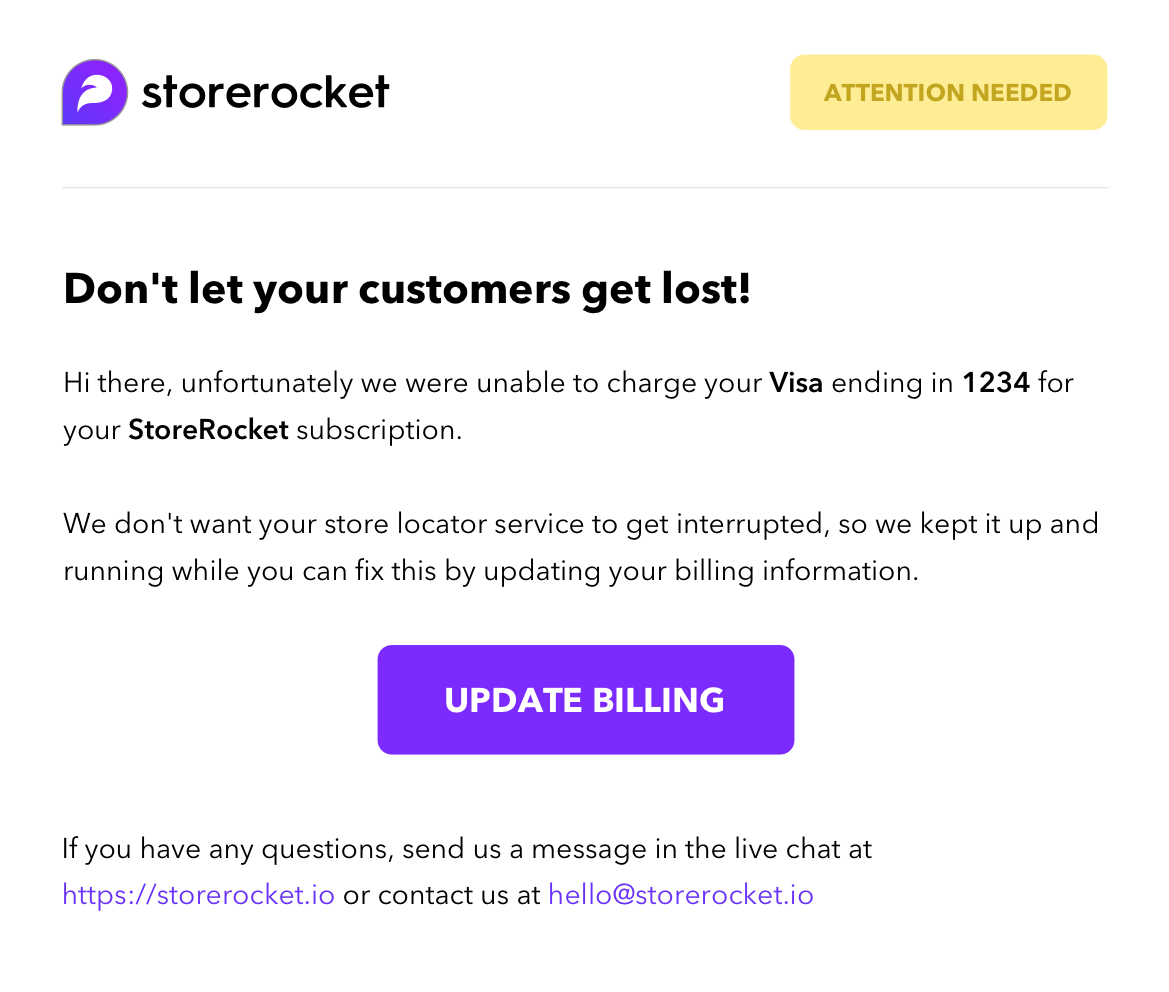

If you run a B2B company, you might want to shift the focus of your failed payment email to something that your client certainly values the most—their own customers.

For example, StoreRocket explains how the issue with the payment will impact their client’s business.

Source: SimpleTexting

As you can see, they emphasize that from the first bolded sentence. Also, they point out that they’ve kept the service running to avoid interruptions.

Showing some understanding and making it clear that it isn’t just money you’re after, but that you take a genuine interest in your customers’ well-being can improve loyalty and strengthen their relationship with you.

Retry Payment Email

A good idea to consider is retrying the payment a day or two after the failed payment. As the data from Churnbuster suggests, 21% of failed payments are resolved by retrying the same card a couple of times.

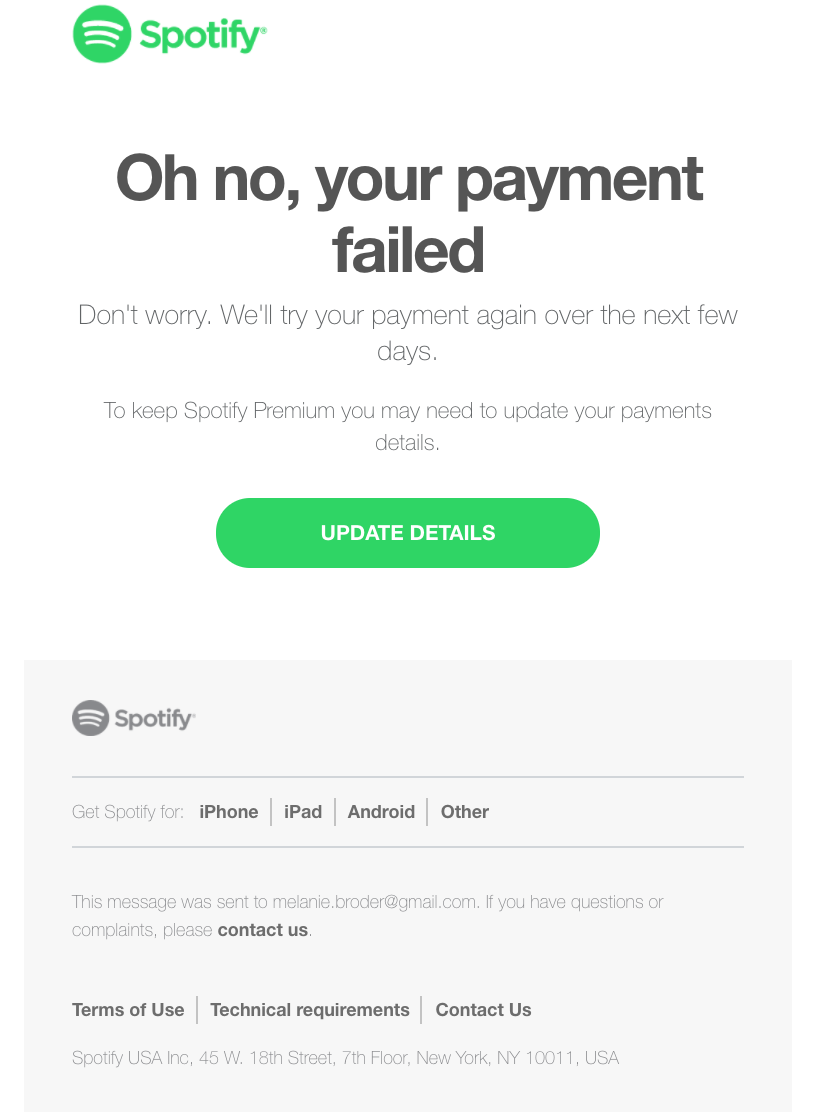

If you decide to do so, you should still inform your customer of the failed attempt. Here’s a template from Spotify showing how to do that.

Source: Customer.io

Notice that the message is very brief; just playfully constructed information about the failed payment, an update on what happens next, and a CTA button if the customer still decides to check the payment details themselves.

Even though it might seem bare-bones, this template has all the necessary elements, and you might as well borrow it for your failed payment email.

Service Suspension Email

When the payment doesn’t go through, your first step is to decide what to do with the service you provide to your customer—do you allow them to continue using it for the time being, or do you immediately suspend it?

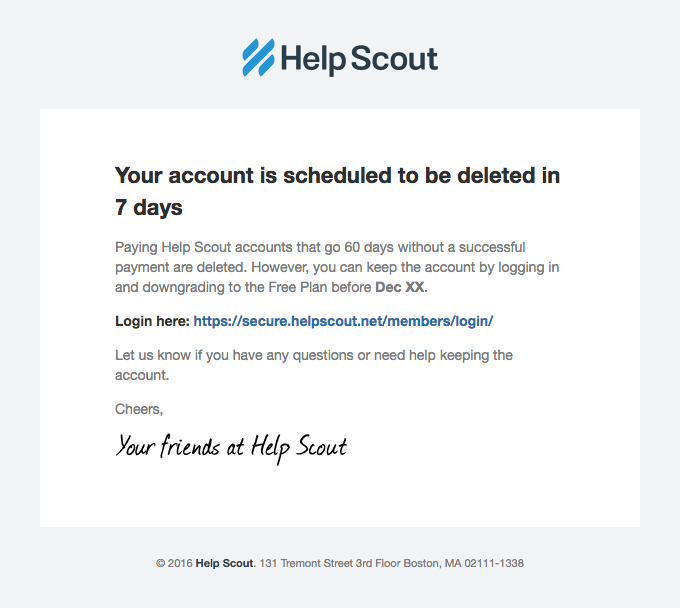

Whatever you decide, you can include that information in your failed payment email. For example, Help Scout offers a grace period before terminating their service.

Source: Customer.io

As you can see, they warn the customer from the first line that they will delete the account in a week if the payment isn’t successful and they offer a downgrade to the free plan.

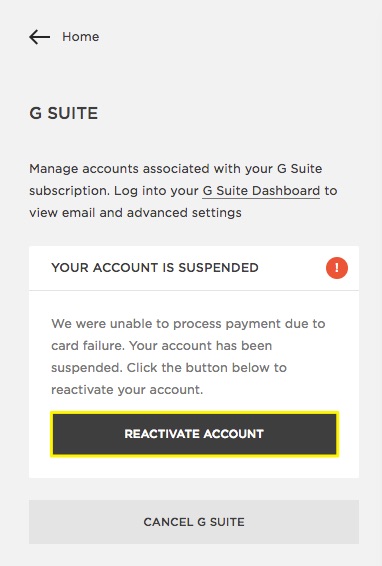

On the other hand, G Suite isn’t that generous.

Source: Customer.io

Their dunning email informs the customer that the account is suspended and provides the option to reactivate it.

What both of those examples have in common is the clear call to action and wording that communicates urgency to the customer, despite their different policies. Therefore, both templates can be useful, depending on your preference and customer policies.

Conclusion

When you send a failed payment email, its purpose shouldn’t be to scold your customer for depriving you of your hard-earned money.

In fact, there are many layers to that one simple message. A good dunning email should inform your customer and give them options to proceed, prevent them from leaving your business, nudge them to pay what they owe, and strengthen the bond you have.

That’s a lot for one email. Luckily, all of the templates we’ve provided in this article can do precisely that. Use them and take your dunning emails to the next level.