Late payers can negatively affect your cash flow and have you scraping the bottom of the barrel to find a way to maintain liquidity while you wait for them to pay.

Sadly, this type of customer is a normal occurrence in any business. You may expect people to pay as soon as you invoice them since you have already kept your part of the bargain, but some people simply won’t feel obligated to pay right away, or they will forget.

Here are 15 tips on how to handle the customers that don’t pay on time and save yourself some trouble!

Create a Contract Beforehand

The whole process of purchase and payment should start with a bulletproof, detailed contract.

This type of document allows you to state precisely what you expect from the client, including how much they owe you, how much time they have to pay, and all the available payment methods they can choose.

In other words, the contract serves as your proof that you informed the customer of the payment terms beforehand.

That way, you can avoid all the excuses they may have for not being aware of your expectations, especially if you decide to take the legal route later down the road.

Without a contract, it will be hard to prove that the client is late with their payment.

After all, there’s no real record that they agreed to your proposed due date. Contracts allow you to avoid this hassle and get paid promptly.

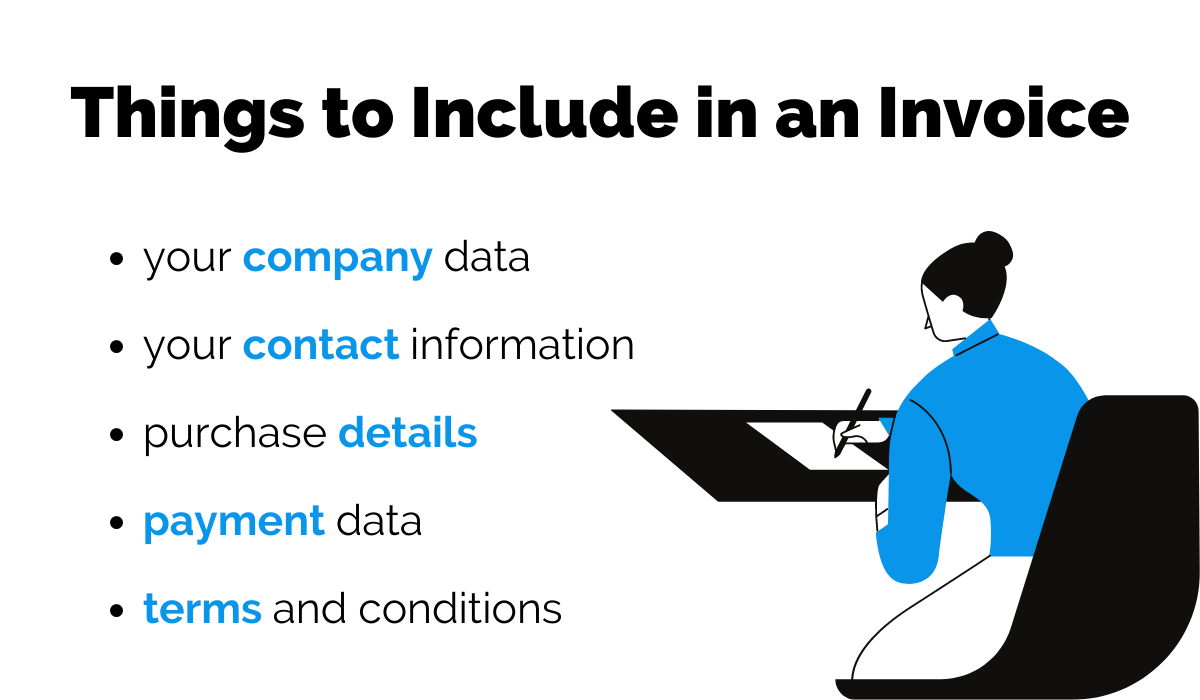

Always Ask What Data You Need to Include

An incomplete invoice will delay the payment, so it’s in your best interest to know exactly what data you should include.

Of course, your invoices should always include basic information, such as your company’s data, purchase and billing information, and payment terms.

Source: Regpack

All of these points will help you get paid faster. However, some customers might have special requirements, like including their PO number when listing their information.

Others might ask you for line item descriptions because of the specific needs of their Accounts Payable department.

Whatever the requirements are, you should be aware of them before creating and sending the invoice. With most invoicing software, you get the option of using a template and editing it as you see fit, which will help you adjust the invoice to the specific customer.

Ask For Their Preferred Invoice Delivery Method

Checking your customer’s preferences regarding invoice delivery can greatly increase your chances of getting paid.

After all, if your client doesn’t use email or, on the contrary, has too many of them to even read, you won’t have any luck trying to reach them that way.

On the other hand, some might prefer email over the post, especially since it takes longer, comes in paper format, and might not be as easy to pay as an online invoice.

Nowadays, you have a plethora of invoice delivery methods, including:

- a .pdf email attachment

- eInvoice

- link to the invoice in the portal

- mailing the invoice the old-fashioned way

Whatever option you choose, make sure it suits the customers by checking with them first. If you bill customers electronically, you can still print the invoice and send it by post for the customers who prefer to receive an invoice that way, helping them pay you faster.

Check If They Outsource Accounting

Companies often outsource their accounting, letting another person or company take over these services.

In that case, you need to know who is doing the accounting. That way, you’ll understand where to send the invoice directly. If you send it to the company only to have them forward it to a third party, the process takes more time, which means you won’t get paid as fast.

Another aspect to consider is their approval process. Does the payment need to be approved manually, or is the process automated?

Once you find that out, you can format the invoice in a way that makes approval smoother and quicker and send it directly to the person responsible for payments.

Cutting out the middleman is a surefire way to reduce the time needed for the client to process and pay your invoice, making it much less likely they’re going to be late with their payment.

Send the Invoice As Soon as Possible

Clearly, the sooner you invoice someone, the faster you’ll get paid.

Depending on the total amount, you might even be able to do so before you deliver the finished product or service.

On other occasions, you won’t be able to charge someone before giving them the final product, but you can send them the invoice as soon as that happens and avoid wasting time.

Source: Regpack

A good practice to follow here is to prepare the invoice while working on the product or service delivery. That way, you will have it ready to go the second you deliver your service.

The more you put off invoice creation and sending, the less of a rush your clients will be in to pay. After all, if you don’t seem to be in a hurry, why should they be?

An excellent way to stay on top of this task is to use invoicing software that does most of the work for you, thus ensuring every customer gets their invoice as soon as possible.

Highlight the Due Date on the Invoice

Always ensure that the due date is clear and visible on the invoice.

Don’t leave anything to chance. In other words, don’t print the due date using the same font size, styling, or color as the rest of the invoice. That way, it could easily get looked over and go unnoticed, especially if your invoices are long and contain a lot of details.

Source: Regpack

Instead, make the due date stand out with different styles (bolded, underlined, etc.), different colors, or maybe even another font. Some companies choose to place the due date in a little box that instantly catches the reader’s eyes.

Instead of using business terms such as NET 15 or NET 30, opt for a simple phrase like 15 or 30 days, which helps everyone understand when you expect to receive the payment.

The less ambiguous you are about the payment terms, the easier it is for the customers to pay you.

Inform Customers of Late Fees

One of the most effective ways of preventing outstanding invoices is introducing late payment fees.

You can add late charges for each day, week, or month the payment is overdue, thus prompting the customer to pay before the due date to avoid extra costs.

For many, this is incentive enough to check the due date and make sure to pay before it, as most people can’t afford to accumulate additional charges.

Source: Regpack

The best time to let the customers know about such fees is before you do business with them. You’ll then be confident that they are aware of the consequences of late payment, so there can’t be any misunderstandings down the line.

If you do charge late fees, mention them in the terms and conditions section of your invoice, as well.

Offer Incentives for Paying on Time

What do customers like more than not having to pay extra? Having to pay less!

That’s precisely what you can offer your customers if they pay ahead of time. Many businesses have reaped the benefits of providing a 1 or 2% discount on the total purchase amount, depending on how high it is.

After all, someone who has the money to pay would rather pay early and spend less than wait a couple of weeks and pay more. However, if there is no incentive to pay early, the customer might as well settle their debt on the due date itself.

Source: Regpack

Incentives like these don’t hurt your company in any way, but your cash flow will be healthier the more early payers you manage to get.

Because of this, early payment discounts or similar rewards offered to those who pay well before the due date are the way to go.

If you don’t think discounts for that purchase would work for you, you can offer a coupon or a discount for the next purchase with your company, thus enticing the customer to do further business with you.

Send Reminders Immediately After the Due Date

Don’t wait for days or weeks to send your late payment reminder.

Instead, send it the day after the due date, notifying the customer that you still can’t see their payment in the system. You can always add a line to the email asking them to contact you in case they have already paid you, as system errors are always possible.

If the customer hasn’t paid yet, mention once again how they can pay you and what possible consequences they could face if they don’t.

Source: Regpack

Obviously, the more you wait to contact the customer about their late payment, the more they will put it off. If someone has forgotten about the invoice and purchase in question, a reminder email or text will jog their memory.

However, if you show them you did not forget and are keeping track of all invoices, the customer won’t have options other than to pay you. If you use billing software, such as Regpack, you can automate reminder emails and have the app do it for you.

Find Out Why They Don’t Pay on Time

The best way to figure out why someone’s neglecting to pay you is to get in touch with them.

You can do this by calling the customer or sending them a personalized email.

If you go into the late payment resolution process thinking people just don’t want to pay, you might be damaging your relationship with the customer, which will cost you more than you know.

After all, most companies admit that retaining a customer is cheaper than acquiring a new one.

Source: Regpack

A simple call can help you understand your customer and discern whether they’re dragging the process out for no reason or if they’re having trouble finding the money to settle the bill.

In the latter case, you can always allow them to pay in installments or find another type of solution that works for both of you.

Doing this will show empathy and understanding, which will also help you retain the customer.

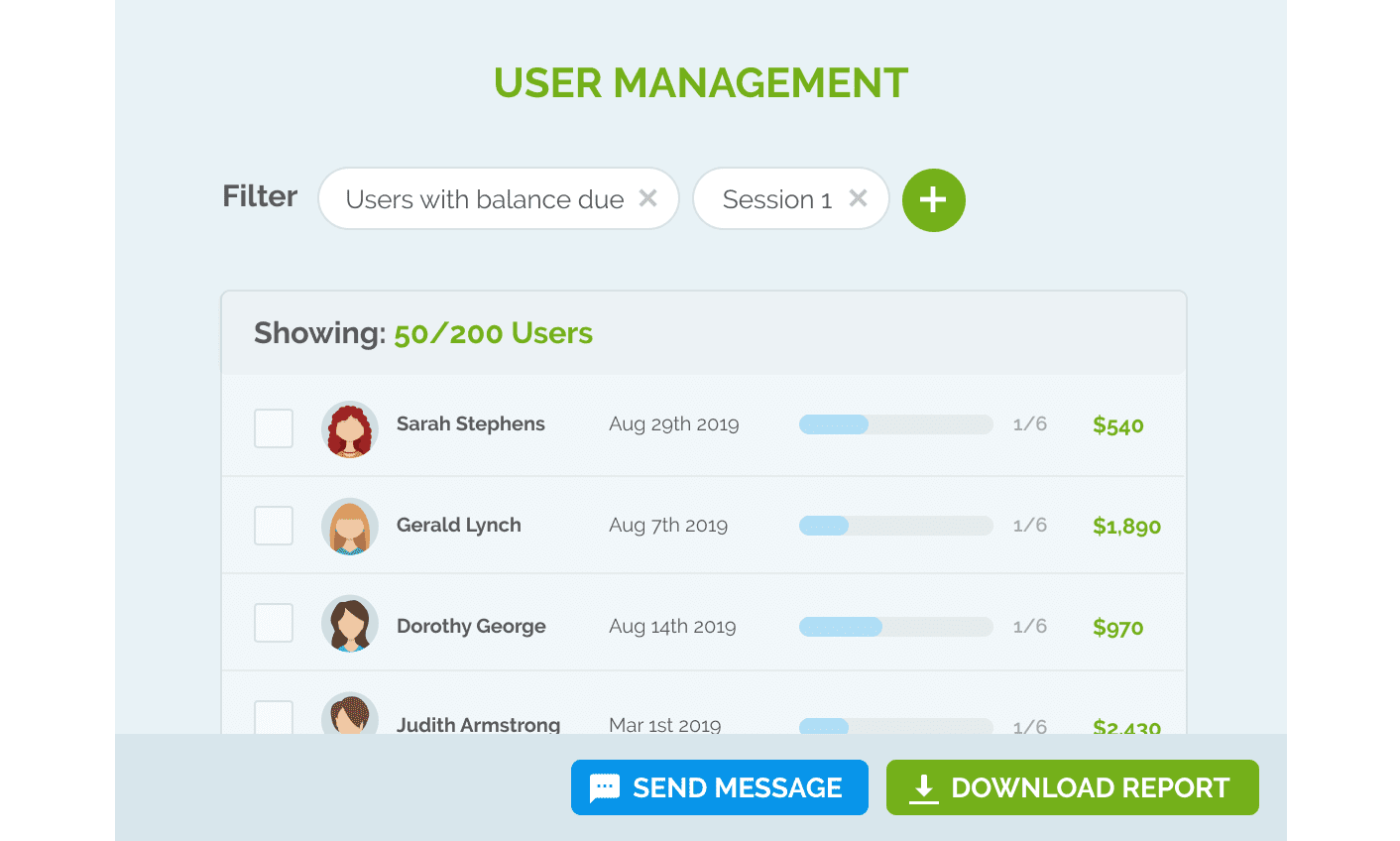

Keep Track of Chronically Late Payers

Before deciding to be a good samaritan and letting overdue payments slip, look into the customer’s purchase and payment history.

Is the customer a chronically late payer? If so, chances are they are hoping to get away with it.

Research shows that 10% of late payments get written off as bad debt, meaning that some customers are possibly counting on you simply forgiving their debt. It doesn’t always work, but a certain percentage of clients manage to pull it off.

Source: Regpack

Because of this, it’s essential to have insight into the client’s previous payment history. You can then understand whether to anticipate late payments from this specific customer.

It is likely that you will have to personally contact customers with a history of outstanding invoices, as a simple email won’t do.

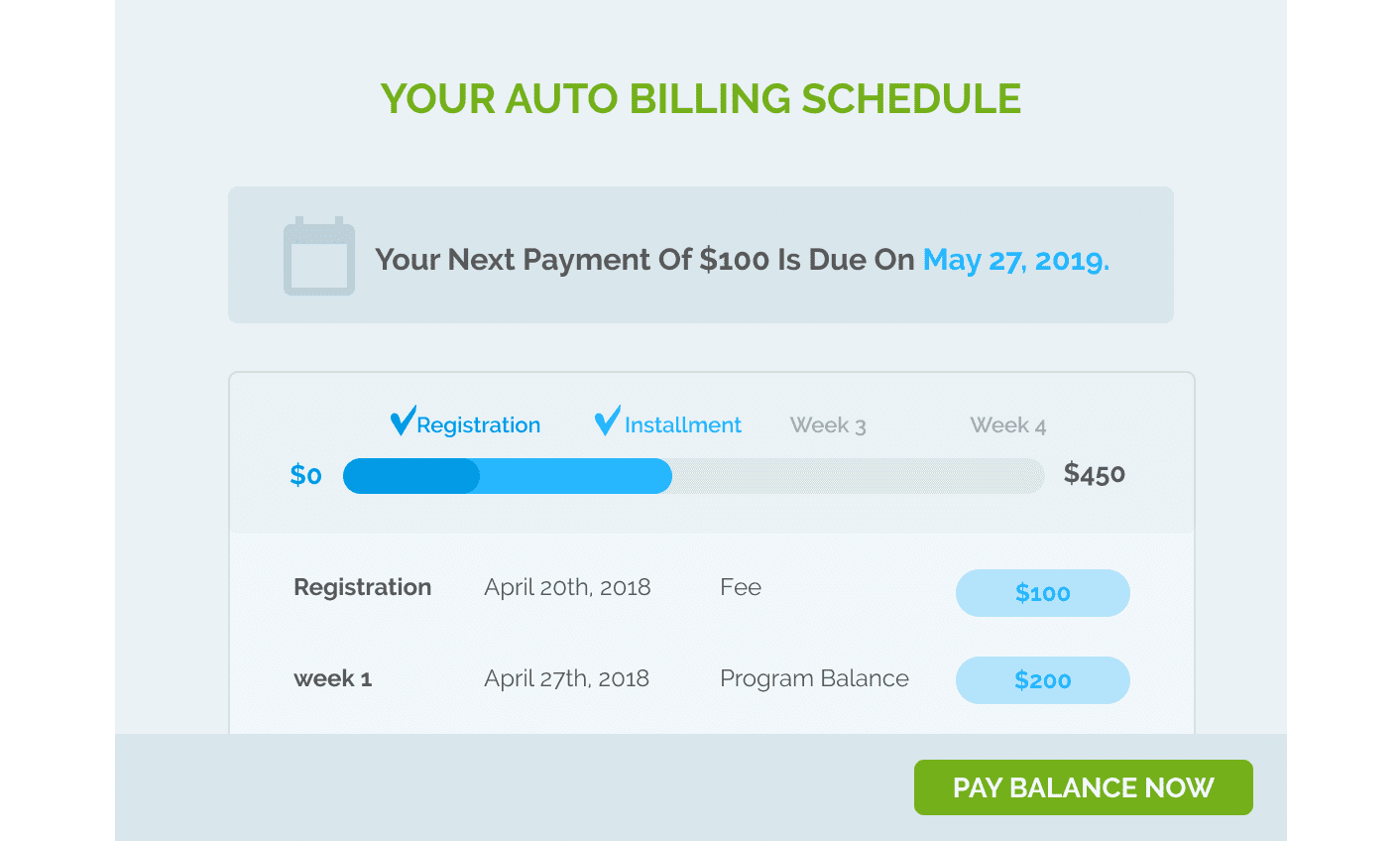

Start Requiring Partial Upfront Payment

The best way to ensure you get at least some of the money you’re owed is to ask the customer to pay a percentage of the total amount before delivering the product or service.

That way, you still don’t have a guarantee that the customer will pay the remaining amount on time or at all, but you’ll at least get something. In other words, this option is better than being left empty-handed, without the product or service and the money.

Of course, you can’t do this with every purchase or customer.

Once you look into the client’s payment history, you will determine whether they’re in the habit of paying late.

If so, ask for a portion of the total cost upfront instead of making peace with the fact that you’ll get paid late.

Have Your Lawyer Reach Out to The Customer

Sometimes the only way to get your money is to hire a lawyer who will contact the client on your behalf.

This way, you get to show the customer that you are not letting them off the hook and that you are ready to take legal action if they don’t pay.

Of course, you don’t necessarily have to enter into legal proceedings. Your lawyer’s letter is just meant to remind the customer they are legally obligated to pay you, and it does carry a little more weight than a reminder email.

As Basha Rubin, CEO of Priori Legal, said for BPlans, a company doesn’t have to spend a fortune to do this, and it can make a world of difference.

Source: Regpack

In fact, if you invest just a little bit into getting a lawyer to write a letter, it could prompt the customer to pay as soon as possible.

After all, litigation isn’t cheap, so they will probably decide it’s easier to settle their debt with you than get in trouble with the law and increase their debt even more.

Enlist a Collection Agency

If the lawyer letter doesn’t work, think about transferring the debt to a collection agency.

Such agencies won’t stop contacting the customer until they pay off the debt, so most customers will give in sooner or later. On top of that, having a debt with a collection agency can ruin someone’s credit score, as well.

However, these agencies take hefty fees, which means you won’t get the full amount you’re owed. BPlans also talked to Ryan Wilson, the founder and CEO of FiveFifty, who explained:

“Collections companies can take up to 30 percent of the money collected (not owed). If you are owed $1000 and collect $700 of that through an agency, you will only end up with $490.”

Giving 30% of the total amount might seem excessive to some. If that’s the case for you, why not offer the customer 15 or 20% off directly? That way, you’ll get more money than you would if a collection agency collected the debt.

Cut Your Losses Once and For All

If all the options we’ve described thus far fail, or you decide that a long process is simply not worth it, write the debt off.

It’s a loss, of course, but frequently, it’s less of a loss than if you fought tooth and nail for months just to end up right where you started.

Sometimes, it’s cheaper for you to accept that you won’t get the money than to go into legal battles and waste time and energy trying to get your money.

Even contacting the customer takes away the time you could spend on marketing or customer care, so it might not be worth it. This is especially true if the unpaid invoice isn’t that high.

Once you’ve forgiven the debt, don’t forget to blacklist the customer. After all, why should you allow them to shop with you again for free?

Conclusion

Late-paying customers are a thorn in the side of many small businesses. These clients take your product or use your service but simply put off paying as long as they can.

Most of the time, the company doesn’t do enough to get the invoice paid, which is why customers think they can get away with it.

In this article, we’ve listed 15 ideas that should help you get back what you are owed, starting even before there is a late payment. Implementing changes to the invoicing process itself can work wonders for your on-time payment rates.

Which method will you try out first?