Using a merchant account is a popular and efficient way for small businesses to accept and process cashless forms of payment from their customers, such as credit and debit cards.

If you’ve ever researched merchant accounts to find one for your business, you might have felt a bit overwhelmed. After all, there are many different types of merchant accounts, each one geared towards a different type of business.

In this article, we’ll help you understand the 5 major types of merchant accounts, how they differ, and which type fits your business needs.

That way, you can save time by narrowing down your search and evaluating only the merchant account providers that best match your needs.

- Retail Merchant Accounts

- E-Commerce Merchant Accounts

- Mobile Merchant Accounts

- Telephone Order Merchant Accounts

- Mail-Order Merchant Accounts

Retail Merchant Accounts

Retail merchant accounts are for businesses with brick-and-mortar stores that want to process cashless payments in-person with customers.

Owners of retail merchant accounts use a payment terminal, also known as a point-of-sale (POS) system, to digitally process card payments through a physically wired network.

That means the terminal is confined to that location. Therefore, businesses with multiple points of sale will require more than one card terminal. It would be inefficient for two clerks to share a credit card machine, as shown below:

Source: Merchant Maverick

Customers swipe, tap, or insert their card into the terminal to initiate the processing, and then the terminal takes in and handles the card information securely, protecting the customer’s financial data via the latest security technology.

Many companies opt to get their card terminal(s) and retail merchant account through the same provider because it makes things more convenient.

There’s only one contract and one point of contact, which comes in handy if something goes wrong. Also, the implementation is a breeze, as there’s no need to integrate the POS system and merchant account.

Sometimes, merchant service providers include card terminals in the package, but it depends on the provider. That said, most merchant services are up for negotiation.

Because you represent long-term business for the provider, it’s recommended that you press your advantage and try to negotiate the terms of the agreement to get lower fees or a free card terminal thrown in. The worst that happens is they say they can’t budge.

Regardless, compared to other types of merchant accounts, a retail merchant account’s fees tend to be rather low.

This low cost is partly because card-in-hand purchases are less risky than phone or online transactions, but it’s mostly because sales volume tends to be high at retail locations.

But the low cost comes at a price — there are certain quotas and conditions users have to meet to ensure they don’t rack up other, often less advertised fees.

For example, most retail merchant account services state in their contract that a certain percentage of your store’s sales must be processed through the terminal. Therefore, if you’re mostly a cash business, you might get hit with additional fees that drive up expenses.

On the brighter side, another unique aspect of retail merchant account card terminals is that they can be programmed to accept pre-paid cards or your store’s gift cards.

Source: Money

In sum, if you run a business that needs to routinely accept card payments at physical locations through a card terminal, a retail merchant account is the right choice for you.

E-Commerce Merchant Accounts

An e-commerce, or internet, merchant account is designed for businesses with online stores that need to accept cashless payments online, often through a website or mobile app.

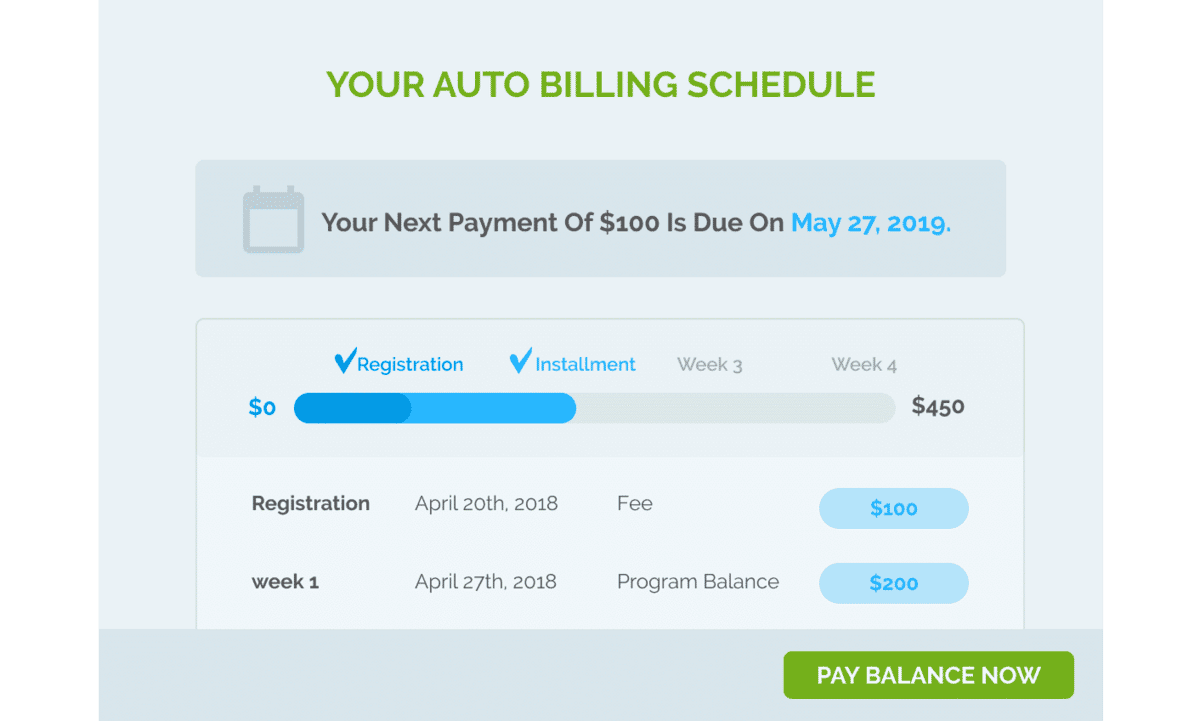

Service-based businesses might also let customers pay through a payment portal:

Source: Regpack

These e-commerce merchant accounts securely process all transactions through a digitally connected network online and in real-time, thereby allowing e-commerce businesses to collect credit, debit, and ACH payments from customers who are shopping on their phone, tablet, or computer.

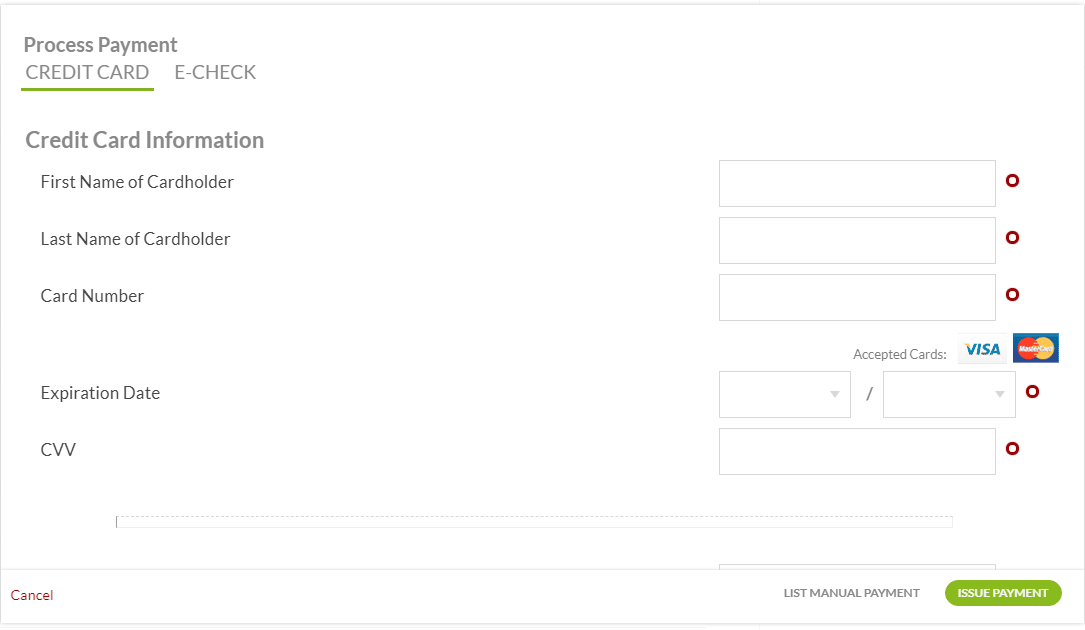

Through a payment gateway on your website, customers can manually type in their card information and initiate the payment by clicking purchase or something similar.

Below is an example of a payment gateway provided by Regpack:

Source: Regpack

After the card information has been submitted, the merchant account plays a vital role in processing the electronic payment. In short, it facilitates communication between various parties involved in the transaction.

The payment gateway sends customer information to the bank, confirming that the customer has enough funds in their account to complete the transaction. It then contacts the branded card processor, which sends the details to the customer’s card issuer (Chase, Citi, Discover, and other banks). All of this happens behind the scenes, and in a matter of seconds.

If authenticated, approval is sent to the acquiring merchant bank through the network processor. After the final approval, the bank moves the funds into the business’s merchant account.

Of course, there are costs involved with all this backend work, the highest of which will be the transaction fee. Every merchant account has credit card transaction fees, which range on average from 1.3 to 3.5% of the total purchase—debit transaction fees are typically lower.

E-commerce merchant accounts tend to have higher transaction fees than other types of merchant accounts because they can’t make money off of you through card terminal leasing and fees.

That said, if you make all your sales online, and never through a physical store, this type of merchant account is for you. Without one, you cannot accept cashless payments through an online store.

Mobile Merchant Accounts

Mobile merchant accounts allow card transactions to be made on-site, with the payment processed through a mobile device or a portable POS system. Unlike a card terminal, which needs to stay wired in one place to work, these payment terminals are wireless.

Clover Mini is one commonly offered by mobile merchant account service providers:

Source: Leaders Merchant Services

Businesses that move around frequently will find this type of merchant account to be ideal, as it allows them to easily and securely collect card payments from customers from wherever they’ve set up shop for the day.

Examples of mobile businesses that could benefit from mobile merchant accounts include food trucks, pop-up coffee shops, lawyers, consultants, tradespeople, catering services, tour guide services, and photographers.

In terms of setup, mobile merchant accounts are extremely convenient. The card processor integrates directly with your smartphone or tablet, and account approval and card terminal setup together usually take no more than 48 hours.

Source: Sociable

However, the transaction costs for mobile merchant accounts do typically fall on the higher end of the spectrum because the sales volume tends to be low for mobile businesses, compared to the volume at retail or online stores.

Rates also depend on the business’s level of risk, which merchant account providers evaluate by analyzing your financial history, credit score, and other information.

In sum, on-the-go businesses will benefit from this type of merchant account and the wireless payment terminals it offers. They’ll stop losing those would-be customers who just don’t carry cash on them and want to pay with a debit or credit card.

Telephone Order Merchant Accounts

A telephone order merchant account allows a business to accept payments over the telephone. During a call, an employee can manually enter the customer’s payment information into a terminal or computer software provided by the merchant services provider.

This type of merchant account is commonly found in businesses that advertise through infomercials and therefore receive a lot of telephone orders from people watching the television show.

For example, home shopping channels like QVC use this type of account:

Source: Vox

Phone order merchant accounts used to be quite common for restaurants that take orders for pick up or delivery over the phone. Customers would call, give the order, and pay over the phone so that the pickup or food retrieval process would be fast and easy.

Source: Merchant Card Advisor

However, over the years, customer preferences have shifted to online ordering on the restaurant’s website, which doesn’t require talking to an employee. As a result, many restaurants have switched over to e-commerce merchant accounts to offer online payment.

Some online or retail businesses might still want to take phone orders alongside online or in-person purchases, so it’s not uncommon for e-commerce or retail merchant accounts to give users the option to add phone order merchant account services to your package.

Compared to retail merchant accounts, telephone order accounts charge high transaction fees because the transaction is slightly riskier. The merchant cannot actually see the card in the person’s hand, so there is a greater chance of fraud.

For reference, with Square, the cost of accepting credit card payments over the phone is 3.5% + 15 cents per transaction, while the in-person, card-present fee is around 2.6% + 10 cents per transaction.

You might be able to reduce the merchant account provider’s risk concerns, and the price, by proving you have a strategy for preventing such fraud.

At Durango merchant services, they recommend the following as a way to reduce fraud:

“Requiring the CVV2 number on the back of a card, and address verification, are security measures that are helping many businesses reduce fraud.”

Also, according to their article, if your merchant account performs well over the course of three years, you should be able to negotiate down your rates, if they haven’t already fallen on their own.

Regardless, if your business’s revenue benefits from accepting card payments over the phone, a telephone order merchant account is likely the right choice for you, either as a standalone account or as an add-on to another one.

Mail-Order Merchant Accounts

A mail-order merchant account enables businesses to accept card payments over mail, making it a good choice for companies that advertise their products through a catalog.

Customers can send their card information through the mail and, once it arrives, a business employee can enter the information into a terminal or dedicated software solution provided by the merchant account provider. Any software they offer can easily be installed into your personal computer.

This type of merchant account is common amongst companies selling beauty products, clothing, home goods, and other products commonly found in magazines or catalogs.

Source: Equity Payment

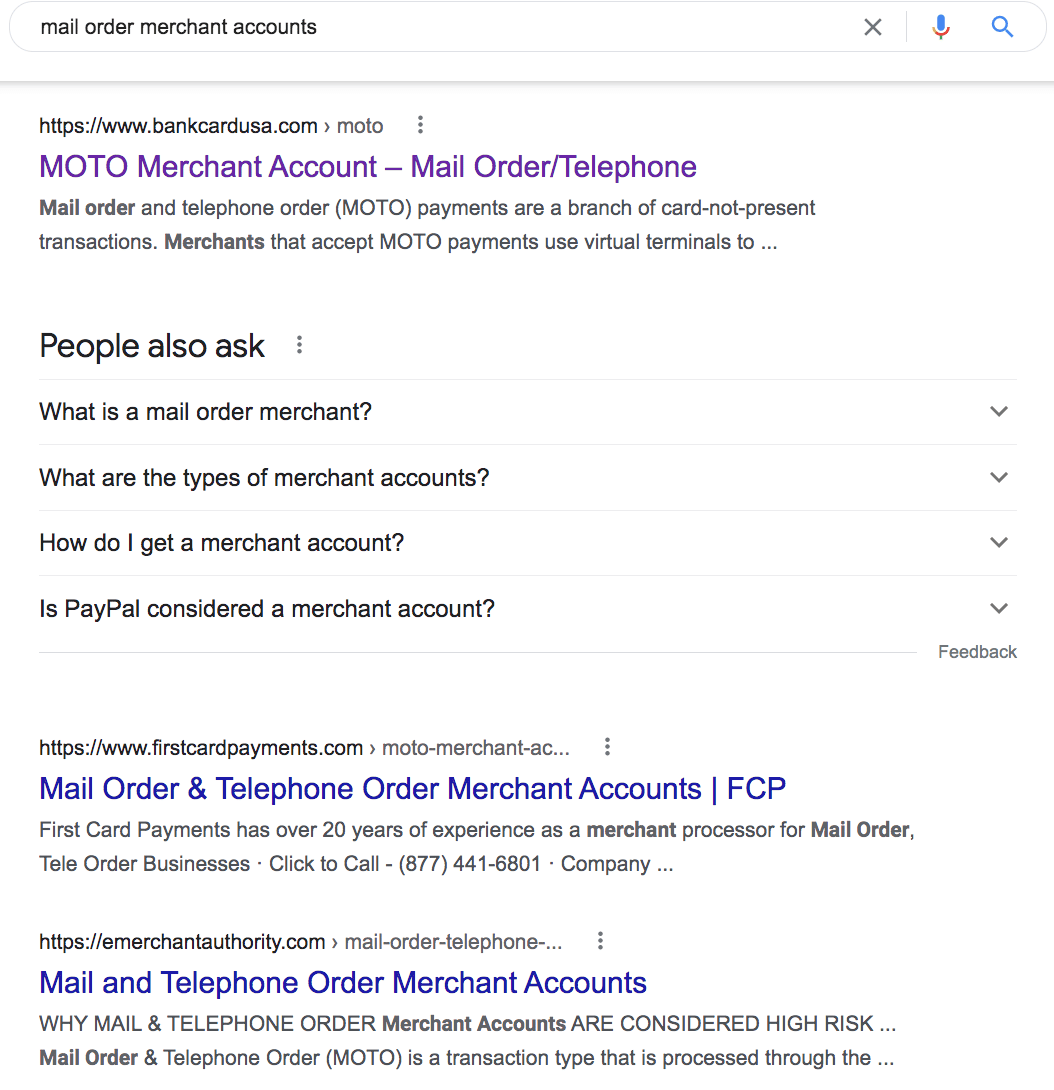

Often, merchant account services will package mail order and telephone order merchant accounts together into a MOTO account so that businesses can accept both forms of payment. This is becoming more popular because catalog-based companies want to offer customers multiple ways to pay.

In fact, when you google mail order merchant account, it’s mostly MOTO accounts that come up in the search results, indicating that many businesses like to have the option to charge over phone and mail:

Source: Google

Since offering a variety of payment methods is essential for customer satisfaction, many businesses also add mail-order merchant services to an e-commerce or retail merchant account for an additional fee. Whether or not you can do this depends on your service provider, but many are used to these types of requests.

Like a telephone merchant account, rates for credit and debit card transactions tend to be high because the seller cannot physically check to make sure that the customer actually has a card and is not instead stealing someone else’s information.

To combat this potential for fraud, most mail-order merchant account services offer fraud protection services, are PCI DSS certified, and offer 24/7 support.

In sum, if your business advertises through catalogs and wants to accept a customer’s credit card information through the mail, then a mail-order merchant account is built for you.

Conclusion

There are five main types of merchant accounts: retail, e-commerce, mobile, telephone order, and mail order. Each one is designed for a specific type of business.

Therefore, small business owners need to pick which merchant account type will best align with their sales strategy.

Often, service-based businesses find that the most efficient way to charge their customers is through an online store, where customers can pay for themselves and on their own time, without involving any of the business’s staff.

If that’s the case with you, it would be a good idea to choose an e-commerce merchant account and also find an online payments software platform that provides you with the other tools you need, like a payment gateway, to start processing cashless transactions from customers.